Closed results

In 2021, every fifth business was closed, the largest number of liquidations occurred in individual entrepreneurs, the number of legal entities decreased less than in 2021 (according to Izvestia with reference to the Federal Tax Service report).

| More than 1.5 million legal entities were liquidated in 2020 | |

| 991 000 | individual entrepreneurs (36% more than in 2019) |

| 548 000 | companies (17% less than in 2021) |

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Liquidation: what is it, who is responsible for carrying it out?

During the liquidation of an enterprise, all activities cease. Managers are deprived of the rights and responsibilities associated with their work. After completing this procedure, even creditors do not have the right to make any additional demands. Therefore, all calculations must be completed before the liquidation comes to an end. This also applies to employees who have been laid off.

This procedure is carried out by a special commission. Its composition is appointed by legal entities or bodies that made decisions on the liquidation itself. The initial responsibility of the commission is to draw up a liquidation plan. The document must consist of several items:

- Order of dismissal.

- Reconciliation with counterparties and tax authorities.

- Inventory of property.

- Calculation of preliminary balance.

Notification of creditors about the liquidation of the organization

In the course of doing business, the need to close the company periodically arises. To ensure that regulatory authorities do not have questions for the founders and management, it is necessary to promptly inform about the abolition of the company.

Winding up a business is a lengthy and complex process with many exceptions. They are reflected both in the Federal Law “On Insolvency”, the Civil Code of the Russian Federation, and in other legislative acts.

The further bankruptcy procedure of a company is affected even by the method of its initiation: voluntary or forced. But, in any case, before completing the liquidation, you need to pay off your debts. Let's consider in detail how to do this.

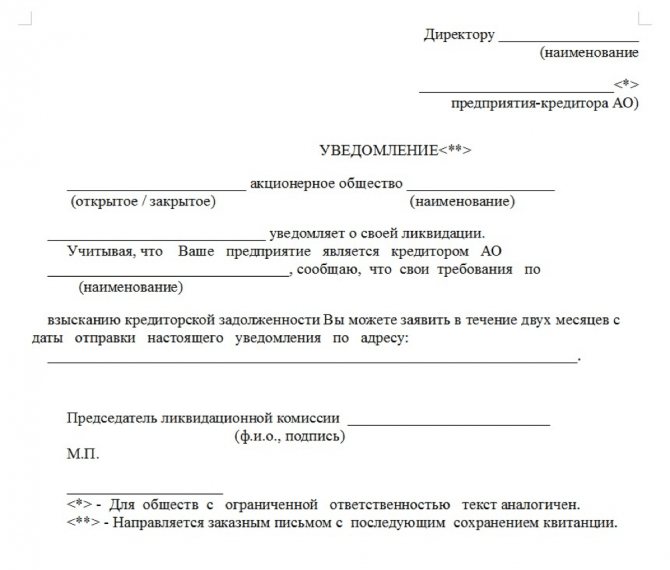

The legislation, namely the Civil Code, the Order of the Federal Tax Service, establishes a certain procedure for warning the party to whom the enterprise has a debt. In order to notify creditors of the liquidation, the insolvency administrator sends him information in writing.

This is done so that the party that once provided funds to the bankrupt enterprise can make claims for non-fulfillment of obligations. There must be documentary evidence, copies of which are attached to the response.

The arbitration manager makes inquiries and notifies the persons to whom the company has debts. This is done in order to obtain a complete picture of the financial condition of the enterprise. The manager needs to weigh the remaining options and compare them with the debts.

There are 2 optimal options for notifying creditors to whom the company has obligations. These can be both legal entities and individuals. The most common options for notice of liquidation are:

- written notification by mail;

- notification through the media.

It would concern why notification through the media is needed when it is enough to personally notify the creditor? It’s very simple: there are creditors who are not reflected in the documentation of the liquidated enterprise.

They remain unknown to the liquidation commission until they make themselves known by receiving information through the media. The letter must be sent via mail with notification in order to know the date when it reached the addressee.

Notice deadlines

The notice period for creditors is determined by law. In order to notify the debtor company of liquidation, you must try to use any suitable means for this. The lender's claims will be satisfied only if he is included in the so-called register of creditors.

The compilation of this register is very important to ensure that all claims are satisfied proportionately and in order. Creditors are not included in the register automatically, but upon application.

To do this, they must be notified of the bankruptcy of the enterprise in person or through the media. The media should announce both the liquidation and the timing of creditors presenting their claims. This period is indicated in Article 63 of the Civil Code of the Russian Federation. It is determined by the arbitration manager and by law cannot be less than 2 months.

If the notification occurs by sending a letter to the creditor, then the countdown begins from the moment when the letter came into hand and the lender signed for its receipt. That is why it is best to send a letter with a notification.

There are exceptional cases when the period for inclusion of a legal entity or individual is subject to restoration. For example, a new lender who appears after a 2-month period may be the tax service with some kind of fine. In this case, the creditor is included in the liquidation balance sheet.

Sample notification

To consider their requirements, a special PLB is formed - an interim liquidation balance sheet. A balance sheet is not considered valid if it does not take into account those who are not listed in the accounting records. Otherwise, the lender challenges the liquidation of the enterprise by filing a lawsuit.

The creditor may recover the debt from the liquidator in the following cases:

- not all creditors are taken into account and notified;

- violation of the notification procedure;

- non-inclusion in the PLB for unfounded reasons;

- unreliability of information when registering liquidation.

It is necessary to notify not only lenders, but also persons who are not creditors. For example, a bank whose client is a liquidated enterprise takes measures to prevent account fraud on the part of managers.

To find out how to fill out a letter template and become familiar with other features of the process, you need to use the information provided on the country’s federal websites (IMNS, Ministry of Justice). You can get advice from your Federal Tax Service inspector or contact a specialized law firm.

Specialists will not only be able to answer all your questions, but will also help in collecting and processing documents. Let’s try to understand the main nuances of the company’s cancellation procedure.

If the company comes into force on another day, the statutory body is required to prepare extraordinary financial statements, which consist of. If the statutory body fails to establish financial statements without undue delay, this obligation is transferred to the liquidator.

Compilation of opening balance sheet and asset inventory.

The liquidator's duty is to open the books and prepare an opening balance sheet and make an inventory of the assets of the entity as of the date the company enters liquidation, which is then issued against the creditor who claims it.

We invite you to familiarize yourself with: Order of the Ministry of Transport dated March 14, 2008 N AM-23-r || Order of fuel consumption standards sample RB

An asset reserve typically includes the following items: cash, bank deposits, trade receivables, real estate, movable assets and company liabilities.

Closing an organization is required when there is no income, which is why it cannot develop further. The process involves the termination of activities after entering information into the Unified State Register of Legal Entities. All the subtleties of the procedure are present in the Civil Code of the Russian Federation, on the basis of which such issues are resolved.

There are 2 types of liquidation of a company - forced and voluntary, but the procedures are approximately the same. In the first case, this happens by court decision, including in case of violations of registration of activities or in difficult financial situations. In the second case, the enterprise is canceled when its work did not meet the expectations of the owners. But in any situation, confirmation of the closure of the company is required.

Here, the regulator's job is to confirm the completeness and accuracy of the inventory and transfer the assets to the liquidator for liquidation. Registration of entry into liquidation in the Commercial Register.

Another duty of the liquidator is to wind up the company without undue delay after liquidation by registering the company registration and registering the liquidator's person in the Commercial Register without reservation.

The proposal may be submitted in paper form, where signatures on the paper form must be officially certified, or electronically, where the form must be provided with recognized electronic signatures or submitted via a data field.

The voluntary procedure is quite long and can last about 4-8 months. Only after this the company owners receive notice of closure. After this, the company is considered inactive.

To close a company you need to go through the following steps:

- First, the owners make a decision to complete the transaction, a commission is appointed, terms and procedures are determined;

From the moment of entering into liquidation and for the entire period of liquidation, the company uses. Announcement of the company entering into liquidation of known creditors and publication of the notice in the Commercial Bulletin. Liquidation should be replaced by other methods of termination.

However, the Commercial Companies Code does not regulate the procedure for every company. In particular, different rules apply to partnerships, partnerships and limited partnerships, as well as other limited partnerships, joint ventures and partnerships.

The information is sent to the tax office at the place of registration within 3 days;

Information is published in official newspapers, which is necessary for the presentation of claims by assignors.

Information can be posted only if there is an application form with a certified seal and signature of the chairman of the commission.

You also need a copy of the cancellation decision, a payment document, a covering letter, and a power of attorney. A letter sent to clients will resolve many current issues.

Employees should be notified of the procedure, a letter should be written to creditors and a letter to partners. All this will greatly simplify the closing procedure.

Liquidation procedures in partnerships, partnerships and limited liability partnerships are optional. In the event of any termination, the company must be wound up unless the shareholders agree otherwise.

An alternative method of winding up a company may be agreed upon before and after the reason for the winding up of the company.

According to him, in the event of a partnership agreement being terminated by a partner's creditor or a partner filing for bankruptcy, an agreement to terminate the company's activities due to its termination requires the consent of the creditor or recipient, respectively.

There are other methods of liquidation in which merger, acquisition and transformation of the company occurs. In this case, the privileges and obligations of the institution belong to the successor in title. When an LLC is closed or converted, the parties receive legal supporting documentation.

A merger involves the combination of companies, after which a new enterprise is opened. Merger involves the purchase of a legal entity by another institution. In this case, a new company does not appear, but the old one continues to develop, but with a new structure, management, and specialists.

The court did not agree with the position of the court of record that such proceedings may, among other things, violate the interests of creditors. He emphasized, however, that despite the cessation of the legal existence of a public company, its shareholders continue to be responsible for their obligations.

The doctrine as acceptable refers to a solution whereby partners already in agreement with the company establish another way to close the business. Commenters also recommend that they also regulate the possibility of subsequent additions or modifications to such a provision. This is due to the fact that it is impossible to predict all the circumstances that may arise during the dissolution of a company.

We notify the tax office

Filing an application to begin liquidation of a company is the most important step, without which it is impossible to carry out this procedure.

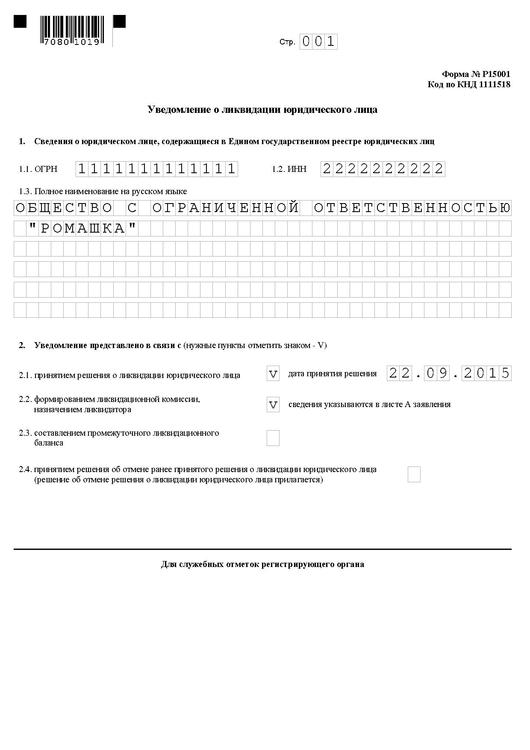

An application must be submitted to the tax service within three business days from the moment the manager decides to liquidate the enterprise. To transmit information, it is necessary to use a form specially approved by the government of the country. Notification of liquidation of a legal entity R15001 within 5 working days, the registration authority must make a corresponding entry in the Unified State Register of Legal Entities. It contains information about the beginning of the business closure procedure.

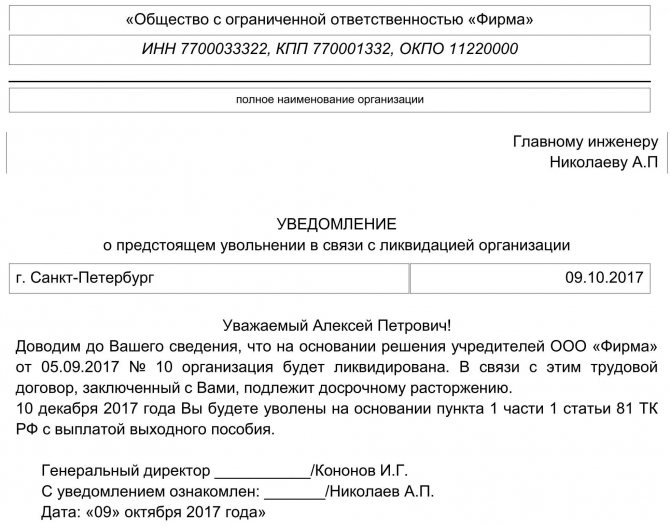

Proper formatting of notifications

The law does not establish strict requirements for such notifications for employees. But it is advisable to record the following information:

- The admissibility of dismissal during vacations and periods of incapacity for work.

- Listing of guarantees and compensation if the dismissal is related to the relevant grounds.

- Date of acquaintance with the document.

- A specific date or period during which the dismissal will take place.

The notification itself is drawn up in two copies - one is sent to the subordinate, the second is kept by the manager. If there is only one copy, a copy is given to the other party.

An act of refusal with familiarization is drawn up if the corresponding decision is made by subordinates. It is imperative to describe the compiler and invite at least two witnesses. You can read the contents of the document out loud, which is also recorded.

Notice to trade unions, authorities

The message must be sent not only to subordinates, but also to the authorities that are empowered to control this direction. The employment service is informed at least two months before the event. In this case, the document must contain:

- positions;

- professions;

- specialties;

- qualification requirements;

- wage conditions for everyone.

The legislation does not have clear requirements related to the sending of papers to trade union organizations. Three months before the event, a message is sent if the dismissal falls under the concept of “mass”.

There is no need to report the incident again if the tax office refused to register the notices. So the liquidation decision itself is enough for dismissals.

Who needs to be notified?

The following should be reported about the upcoming closure of a legal entity:

- tax authority;

- employees of the enterprise;

- creditors;

- Employment Center.

For any company, notification to the registration authority, creditors and personnel is mandatory. You should notify the central employment center about the upcoming closure only if you plan to dismiss 15 or more employees (subparagraph “a” of paragraph 1 of the “Regulations on the organization of work to promote employment in conditions of mass layoffs”, approved by Decree of the Government of the Russian Federation of 02/05/1993 No. 99).

Is it necessary to notify the Social Insurance Fund about the liquidation of an LLC, as well as the Pension Fund and the Compulsory Medical Insurance Fund? Such an obligation existed previously, but in 2021 the tax inspectorate, having received information about the upcoming closure of a legal entity, reports this to the funds independently.

There is no mandatory form for written notification of creditors (Part 1 of Article 63 of the Civil Code of the Russian Federation), but it is obvious that this should be done as soon as possible - creditors have two months to submit claims from the date of publication of the announcement of the beginning of liquidation in the State Registration Bulletin "(Clause 1, Article 61 of the Civil Code of the Russian Federation).

The list of letters sent will need to be submitted to the tax authority to complete the liquidation procedure of the company.

Failure to personally notify creditors may result in the tax authority refusing to register the closure of the company, as well as claims by creditors.

Prepare documents for registering an LLC in the Documentoved service

Notice of liquidation of a legal entity is sent primarily to four different entities. They are:

- tax service;

- personnel of the enterprise itself;

- creditors who provide money to the company, or a supplier;

- Employment Center.

Notification of the liquidation of an LLC must be provided to the registration authority, creditors and company employees. It is not always worth notifying the employment center about the closure of an enterprise. Notice of liquidation only needs to be given if more than 15 employees are unemployed after the cessation of the business.

Notice of liquidation of a legal entity before 2021 had to be submitted to two more important entities, such as:

- Pension Fund of the Russian Federation;

- Federal Compulsory Health Insurance Fund (MHIF).

Currently, in accordance with current legislation, the tax authority independently reports information about the closure of the business of the Pension Fund of the Russian Federation and the Compulsory Medical Insurance Fund.

When a decision on liquidation is made, all governing powers are transferred to the liquidation commission or to the sole liquidator. Their responsibilities include sending the required notices of liquidation of a legal entity:

- To the tax service - about the start of the liquidation procedure within 3 days after such a decision is made. The pension fund does not need to be notified of the closure.

- To creditors - about the upcoming closure with an indication of the possibility of filing claims regarding debt obligations to them.

- Employees - about the upcoming layoff due to liquidation at least 2 months before the termination of the employment contract.

The obligation to notify creditors is specified in paragraph 1 of Art. 63 Civil Code.

Creditors are all companies and individuals to whom the liquidated company has outstanding debt obligations. But the mere existence of an agreement on the existence of debts does not confirm them. The fact of debt can be confirmed by a reconciliation act, an acceptance certificate, etc. It is worth considering that the debt repayment period begins immediately after the decision to liquidate is made, regardless of the contractual terms.

Taking into account the fact that obligations to creditors come due ahead of schedule under clause 4 of Art. 61 of the Civil Code, as well as the fact that after liquidation all obligations of a legal entity are canceled, creditors are given a fairly long period to present their claims.

Based on the claims presented by creditors, the liquidation commission prepares an interim liquidation report

balance

. The company cannot be liquidated until it has paid off its creditors.

If its property is not enough to pay off debts to all creditors, the company initiates bankruptcy proceedings.

How to notify employees of upcoming dismissal?

The liquidation procedure proceeds as follows if the decision is made by management itself:

- Making the decision itself.

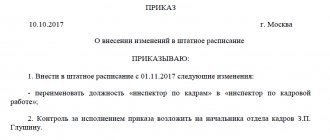

- Appointment of the liquidation commission and chairman, determination of the timing and procedure for liquidation.

- Transfer of powers to manage the affairs of a legal entity.

The chairman of the liquidation commission is responsible for any actions related to dismissed employees. The bankruptcy trustee appointed by the court interacts with the second interested party if the court previously made a decision on bankruptcy of the enterprise.