- home

- Reference

- Documentation

Employers are required to make numerous contributions for their employees. These include transfers to the Pension Fund and other funds.

Sometimes citizens decide to increase their future pension by increasing their funded pension, and the funds can be transferred at the expense of the employee or the owner of the company. When paying these funds, company managers are required to prepare a special report on a quarterly basis using the unified form DSV-3.

Filling procedure

The register contains the employer's details:

- registration number in the Fund;

- TIN/KPP;

- name of company;

- details of payment orders for payment of additional contributions.

The tabular part of the form includes:

- Full name of the insured person;

- SNILS;

- the amount of paid contributions - employees and employer (if paid).

Complete instructions for filling out DSV-3

Employers whose employees work in dangerous or harmful conditions are required to pay not only insurance premiums, but also contributions at an additional rate.

What are additional insurance premiums? What categories of persons have the right to receive such contributions to form their pension? How are such fees paid? We will answer these questions in this article.

What are additional insurance premiums?

Additional insurance contributions (ADI) are funds accrued to the funded part of the pension fund. According to paragraphs 3 and 5 of Article 2 of the Federal Law “On Additional Insurance Contributions” dated April 30, 2008 N 56-FZ, additional contributions may be paid:

- by the insured person at his own expense or by his employer at the request of the employee. In the latter case, the funds are calculated from the employee’s salary;

- by the employer for the benefit of the employee.

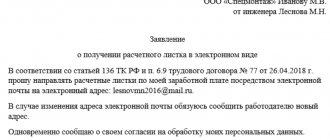

If additional contributions are paid directly by the employee, then he must apply to the territorial branch of the Pension Fund for voluntary payment of additional contributions to the funded pension fund. The corresponding application is submitted in form DBS-1; it can be sent through the official website of the Pension Fund of Russia, through the MFC, as well as through your employer. In this case, the application must indicate how much the employee will transfer to the Pension Fund each month. If the employer has received a corresponding application from the employee, then he is obliged to send it to the Pension Fund no later than 3 days later.

The procedure for payment of DSA by the employer in favor of the employee is regulated by Part 1 of Article 8 of the above-mentioned normative act. Employees of certain categories engaged in hazardous or heavy work have the right to such contributions.

Form DSV-1. State co-financing of pensions

Attention: the form is no longer available

Any insured person has the right to voluntarily enter into legal relations to pay additional insurance contributions to the funded part of his labor pension. To do this, you must fill out and submit form DSV-1, an application for voluntary entry into legal relations under compulsory pension insurance in order to pay additional insurance contributions for the funded part of the labor pension:

(doc, 38 Kb)

(doc, 46kb)

Form DSV-1 An application for voluntary entry into legal relations under compulsory pension insurance in order to pay additional insurance contributions for the funded part of a labor pension can be submitted:

- through your employer;

- in person to the territorial body of the Pension Fund of the Russian Federation at the place of residence;

- in another way, in which identification and verification of the authenticity of a citizen’s signature are carried out: by a notary; officials of consular offices of the Russian Federation in cases where the insured person is located outside the Russian Federation; an organization with which the Pension Fund of the Russian Federation has concluded an agreement on mutual certification of signatures.

Applications for payment of additional insurance contributions for the funded part of the labor pension have been accepted since October 1, 2008.

The procedure for paying additional insurance premium through the employer:

- in the application submitted to the employer, the insured person indicates the amount of the additional monthly insurance contribution paid, determined in a fixed amount or as a percentage of the base for calculating insurance contributions for compulsory pension insurance;

- the amount of the additional insurance contribution paid for the funded part of the labor pension is determined by the insured person independently and can be changed by submitting a new application;

- an employer who has received an application to pay or to change the amount of an additional insurance contribution to be paid for the funded part of a labor pension shall calculate, withhold and transfer additional insurance contributions starting from the 1st day of the month following the month the employer received the corresponding application. The termination or resumption of payment of additional insurance contributions for the funded part of the labor pension is also carried out from the 1st day of the month following the month of filing the corresponding application.

Payment of additional insurance contributions for the funded part of the labor pension is made from January 1, 2009.

The procedure for self-payment of additional insurance premium:

- carried out by the insured person by transferring funds to the budget of the Pension Fund of the Russian Federation through a credit institution;

- no later than 20 days from the end of the quarter, the insured person submits to the territorial body of the Pension Fund of the Russian Federation copies of payment documents for the past quarter with marks of execution by the credit organization personally or through an organization with which the Pension Fund of the Russian Federation has concluded an agreement on mutual certification of signatures.

Employer contributions

- the employer has the right to decide to pay contributions in favor of insured persons who pay additional insurance contributions for the funded part of the labor pension;

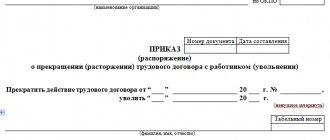

- this decision is formalized by a separate order or by including relevant provisions in a collective or labor agreement;

- in the event of termination of employment legal relations and (or) legal relations under relevant civil law contracts, payment of employer contributions in favor of the insured person is terminated from the date of termination of these legal relations;

- the amount of the employer's contributions is calculated (determined) by him monthly in relation to each insured person in whose favor these contributions are paid.

- An additional insurance contribution for a funded pension (hereinafter referred to as the ASP) is an individually compensated payment paid at the expense of the insured person’s own funds, calculated, withheld and transferred by the employer or paid by the insured person independently under the conditions and in the manner established by Federal Law No. 56-FZ.

In accordance with the law, an employee can pay DSA for a funded pension independently or entrust their payment to his employer by deduction from his salary. To do this, the employee submits an application to the employer’s accounting department, in which he indicates the amount of the daily allowance in a fixed amount of money or as a percentage of the base for calculating insurance contributions for compulsory pension insurance, which must be withheld from him monthly from his salary. These statements are kept in the accounting department. If an employee wishes to stop paying or change the amount of DSA paid by him, he again submits an application to the accounting department. An employer who has received an application from an employee to pay DSA shall calculate, withhold and transfer DSA starting from the 1st day of the month following the month of filing such an application. Also, from the 1st day of the month following the month the employee submitted an application to terminate or resume the payment of DSA, the employer accordingly stops or resumes the calculation, withholding and transfer of DSA.

IMPORTANT! The own funds of the insured person - a participant in the Co-financing Program, directed by him independently or through his employer to form pension savings are subject to state co-financing.

- The employer's contribution is the employer's funds paid by him in favor of the insured person under the conditions and in the manner established by Federal Law No. 56-FZ.

Employer contributions paid in favor of the insured persons are included in the pension savings of the insured persons and are reflected in a special part of the individual personal account of the insured person, just like DSA, which are independently paid by the insured persons (including participants in the State Co-financing Program) and funds (part of the funds) of maternal (family) capital aimed at forming a funded pension, as well as the results of their investment.

The employer may decide to make additional contributions from its own funds in favor of employees paying DSA (employer contributions), thereby increasing the level of future pension security for employees. The employer formalizes such a decision by a separate order or by including relevant provisions in a collective or employment agreement.

In the event of termination of employment legal relations and (or) legal relations under relevant civil law contracts with the insured person, payment of employer contributions in favor of this employee is terminated from the date of termination of these legal relations.

IMPORTANT! Employer contributions included in the pension savings of insured persons in whose favor such contributions are paid do not participate in the State Co-financing Program for the formation of pension savings (are not co-financed by the state)!

Today, employer contributions aimed at increasing the pension capital of their employees have become part of the social package for many enterprises and companies and serve as additional motivation.

At the same time, paying employer contributions in favor of employees and the employer himself provides a number of additional benefits:

- he is exempt from paying insurance premiums in the amount of the contribution he paid, but not more than 12,000 rubles per year per employee;

- The amounts of employer contributions are included in the employer's labor costs taken into account when taxing profits.

IMPORTANT! Employers must transfer to the budget of the Pension Fund of the Russian Federation in separate payments and issue separate payment orders in relation to:

- employer contributions (paid from the employer's funds) in favor of insured persons paying DWI, in this case it is necessary to indicate the budget classification code 392 1 0200 160;

- DSA (according to the application submitted by the employee to the employer’s accounting department for voluntary entry into legal relations for compulsory pension insurance for the purpose of paying DSA), it is necessary to indicate the budget classification code 392 1 02 02041 06 1100 160.

Information in the details of payment orders is filled out in accordance with the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

You can find out the details and generate a receipt for payment of insurance premiums on our electronic service.

Who is charged additional insurance premiums?

According to the current legislation, payments under DSV are transferred in favor of certain categories of employees. They were introduced to provide financial support for those citizens who are applying for early retirement, that is, before retirement age.

Tariffs for additional payments are indexed annually and in 2017 are:

- 8% - for workers whose work activity is related to underground work or employment in hot shops;

- 7-2% - for employees working in difficult working conditions.

Tariff 2-8% applies to:

- to women working as tractor drivers in the construction, agricultural, road and loading and unloading sectors;

- to women working in the textile industry with high intensity and hardship;

- to employees of locomotive crews, as well as workers involved in transportation or ensuring the safety of transportation on the railway and metro;

- to truck drivers working in mines, in mines involved in the removal of minerals;

- to prospectors engaged in topographic work, field geological exploration work, to geologists, to expedition participants;

- to employees whose work activities are related to convicted persons in prisons, etc.

The full list of employees to whose funded pension account an additional insurance contribution is charged is indicated in paragraphs 1 and 2 of Art. 30 of the Federal Law of December 28, 2013 No. 400-FZ. However, there is no maximum base for calculating additional contributions.

DSA in 2021 based on the results of a special labor assessment

The rate of additional insurance premiums depends on the results of a special assessment of working conditions, which not only establishes the level of working conditions, but also identifies shortcomings that the employer is obliged to eliminate and bring the workplace into compliance with established standards. They are regulated by the Federal Law “On Special Assessment of Working Conditions” dated December 28, 2013 No. 426-FZ, which, among other things, establishes the timing of such inspections - at least once every 5 years.

Tariffs for DSA are set depending on the level of harmfulness based on the results of such an assessment of working conditions. The higher the danger and harmfulness of the conditions, the higher the rate of additional insurance premiums. Based on the results of a special assessment of workplaces, tariffs for DSA may be as follows:

If, after a special assessment, optimal or acceptable working conditions are established, an additional insurance premium rate is not provided.

What documents do you need to have?

According to the new rules, along with the registers of insured persons, in general it is required to present:

- a document confirming the amount of insurance premiums paid by the employee or employer;

- identification document;

- for an organization - a copy of the order appointing an individual to the position of manager, according to which such an individual has the right to act on behalf of the organization without a power of attorney.

A representative when submitting registers must have:

- identification document of the representative;

- a valid power of attorney signed by the head of the employing organization.

Terms for calculating additional insurance premiums

According to Part 1 of Article 9 of Federal Law No. 56-FZ, additional contributions, regardless of who pays them, are transferred to the Pension Fund within the same time frame as contributions to pension insurance, i.e. for each month until the 15th of the following month. Contributions from employees and employers are transferred to different BCCs (budget classification code)

Each time DSV is accrued to the Pension Fund of the Russian Federation, the employer is obliged to create a register of insured persons to whose account the contributions were transferred. The registration of the register is carried out every month according to DSV-3 (the new form came into force on September 10, 2016).

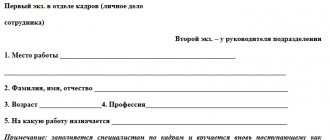

The register must indicate:

- information about the policyholder - registration number in the Pension Fund of Russia, checkpoint, tax identification number, name of the organization;

- date, number of the payment order on the basis of which contributions are transferred, execution date;

- contribution period;

- information about the employee - full name, SNILS;

- the amount of accrued additional contributions.

The deadline for submitting DSV-3 is set no later than the 20th day of the month following the quarter in which the DSV was translated. For example, if an employer paid contributions for March, April and May 2021, then he must send three DSV-3 registers to the territorial department of the Pension Fund no later than June 20, 2021.

It is worth considering that for those employees who work in conditions of high danger and harmfulness, when determining the right to early retirement, periods of work taken into account to determine preferential length of service are counted only if during this period additional insurance contributions were transferred in their favor.

Insured persons whose work activities are carried out in dangerous and harmful working conditions are entitled to additional insurance premiums. The rate of such contributions is determined after a commission checks working conditions at least once every 5 years and varies from 2% to 8%. If the employer does not carry out such checks, he is obliged to pay 9% of the DSA to the Pension Fund for employees from List No. 1 and 6% for employees from List No. 2.

We recommend reading: Funded pension in the Russian Federation in 2021 5/5 (1 votes)

What is reflected in DSV-3

The DSV-3 register must contain the following information:

— the total amount of transferred funds, including the amount of all transferred additional insurance contributions for a funded pension (the sum of all paid employer contributions);

— payment order number and execution date;

— insurance number of the individual personal account of each insured person;

- last name, first name and patronymic of each insured person;

- the amount of additional insurance contributions transferred to the funded pension of each insured person (the amount of employer contributions paid in favor of each insured person);

- payment period.

Is it mandatory to issue certificates to employees upon dismissal?

DSV-3 contains information about all insured persons in the company, and also provides the amount of the transferred contributions. Since the funds are transferred by the head of the organization, he has to report not only to the Pension Fund, but also to the direct insured persons.

Upon dismissal, the director is obliged to hand over to the employee a large package of documents, which includes an extract from DSV-3. It is issued exclusively to specialists for whom the employer paid insurance contributions for a funded pension. The basic rules for transferring this document are given in the provisions of Federal Law No. 56.

The statement contains information about all transferred funds for the entire period of work in the company. The head of the company must issue this documentation to the employee on the last day of employment. For this purpose, you cannot require any statement from a specialist. If an employer does not provide a citizen with the required documents, he may be subject to disciplinary or administrative liability.

The DSV-3 report is compiled by all employers who transfer voluntary payments towards funded pensions to the Pension Fund or non-state funds for their employees. It is submitted quarterly and also contains information not only about the insured persons, but also about the amount of funds transferred. An extract from this report is generated upon the dismissal of the person for whom the money was paid.

In what form should I submit it?

The method of submitting the DSV-3 form depends on the average number of employees for the previous calendar year, and for newly created organizations - on the number of employees: