Mandatory provisions of an open-ended employment contract

In accordance with Article 57 of the Labor Code of the Russian Federation, they are:

- employer details and full name employee;

- employer's TIN and employee's passport details;

- indication of the place of conclusion of the contract and the date, place of work;

- information about what specific work will be performed (name of position (profession) and job responsibilities);

- deadline for starting work;

- size and terms of salary payment (indicating specific dates and place of payments);

- work and rest schedule;

- information about social insurance;

- information on working conditions based on the results of a special assessment;

- additional conditions, if necessary (if working conditions are recognized as harmful or dangerous, appropriate compensation should be prescribed; if the nature of the work is specific, indicate what kind of work it is).

What cannot be included in an employment contract:

- You cannot enter into a fixed-term contract without good reason.

- You cannot combine your main job and part-time work in one contract (such part-time work is not prohibited, but there must be 2 different contracts for this).

- It is impossible to establish a labor regime that violates the provisions of the Labor Code (for example, oblige a minor to work 40 hours a week).

- You cannot include a condition for paying wages below the minimum wage (or not take into account “northern bonuses”).

- It is impossible to specify only one date per month in the terms of payment of wages.

Which small businesses have the right to enter into an employment contract?

Not all small businesses are designated by the Labor Code as employers entitled to enter into fixed-term employment contracts. According to Part 2 of Art. 59 of the Labor Code, by agreement of the parties, a fixed-term employment contract can be concluded with persons entering work for employers - small businesses, the number of employees of which does not exceed 35 people.

Even more stringent requirements are provided for small businesses in the field of retail trade and consumer services. They can enter into fixed-term employment contracts only if their number does not exceed 20 people.

Sample of a standard employment contract with an employee 2021 and the procedure for filling it out

The full form of a standard employer-employee agreement includes many different situations and wording. But the organization has an excellent opportunity to leave in the form only the information that is necessary to work with a specific employee. Anything unnecessary can be simply removed. This standard employment contract is unique in that officials have included correct wording in it that complies with the norms of the Labor Code of the Russian Federation for all possible situations. It even has sections that cover remote and home workers. The only thing that is not provided for by this document is the employment of foreign citizens. In fact, legislators have placed many types of employment contracts in one form.

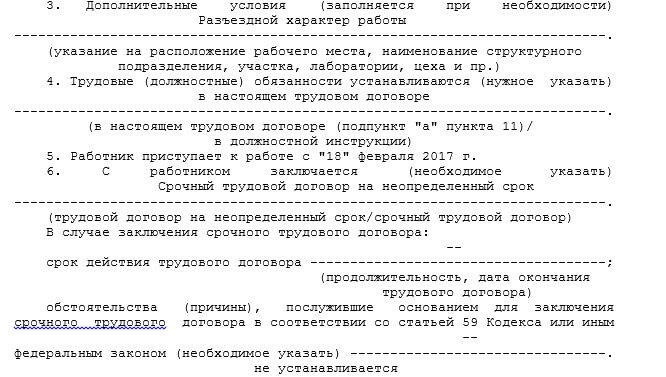

So, the decision to use the standard form has been made and now it must be filled out correctly. Let's take a closer look at this procedure, and then you can download a free sample employment contract 2021. The approved standard form contains as many as 38 points, combined into 11 chapters. We have already figured out above that in each specific case only some of them will be needed; let’s talk about filling out the most important parts of the standard form, applicable to most employees.

For example, let's look at how a micro-enterprise can draw up employment contracts in 2021: a sample will show an agreement with the manager of the sales department. The step-by-step instructions that we ended up with look like this:

Step 1. The “General Provisions” section is required to be completed in all cases. It should indicate the full name of the employer and its address, last name, first name, patronymic and position of the future employee.

In addition, if necessary, the test period established for the new specialist and the nature of his work: main or part-time, are also indicated here. In the same chapter, you should indicate the period for which the employment contract was concluded, if it is fixed-term. This information is additional and must be filled in if necessary. It is also necessary to indicate at what point the employee begins work, and note where his workplace is located, or note the traveling nature of the work. For example, in our case, a sales manager travels around the city to conclude sales transactions with clients. If the work does not have any special features, you can indicate that “the employee does not have a special nature of the work.”

When hiring a home worker, you will need to fill out clauses 9.1 or 9.2 in the “General Provisions” section. They provide a list of equipment that such an employee uses, and the procedure and timing for providing him with the necessary materials for work (if he needs them). You can provide for the payment of compensation for the use of personal property for business purposes and indicate its amount and terms of payment. In the case of remote employees, it is very important to indicate the length of work and rest time.

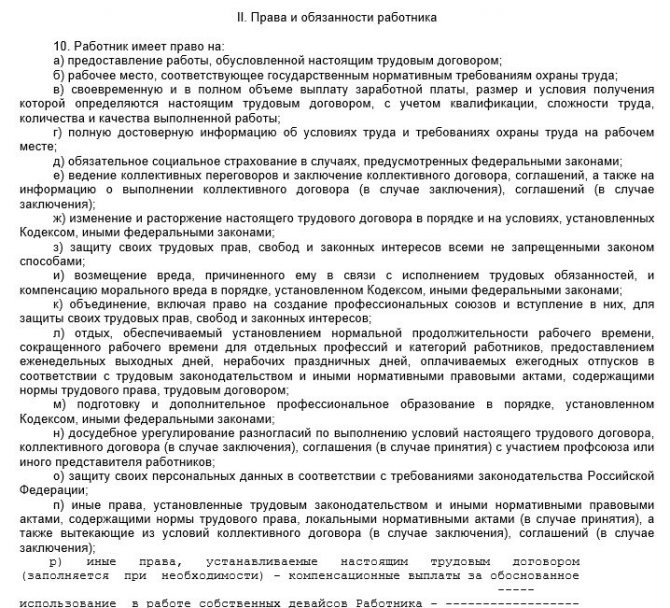

Step 2. The section “Employee Rights and Responsibilities” specifies what job functions the new specialist performs. Typically, this part of the form remains with the standard terms, but the employer may indicate specifics at the end of each subsection.

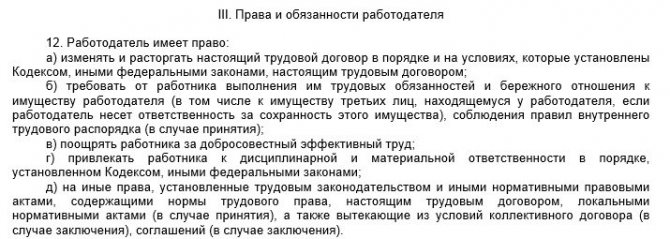

Step 3. Section “Rights and obligations of the employer.” Similarly, with the second section, you can leave all the points proposed by officials, and also, if necessary, add your own. For example, indicate what tools and equipment the employee is provided with.

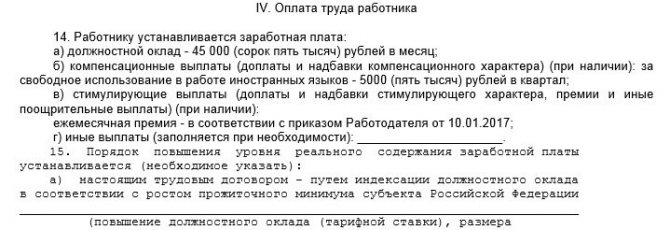

Step 4. Section “Employee remuneration”. This is a very important part of the document and special attention must be paid to it if the organization has refused to accept the wage provision. Here it is necessary to specify in detail what the salary consists of. A standard employment contract provides for several types of payments, next to each of which you must indicate the amount:

- official salary;

- compensation payments (for work in hazardous conditions, use of personal transport, etc.);

- incentive payments (bonuses and incentives);

- other payments.

In addition to the amount, you must indicate the conditions for receipt and frequency. The employment contract also specifies specific terms for payment of wages and methods for receiving them.

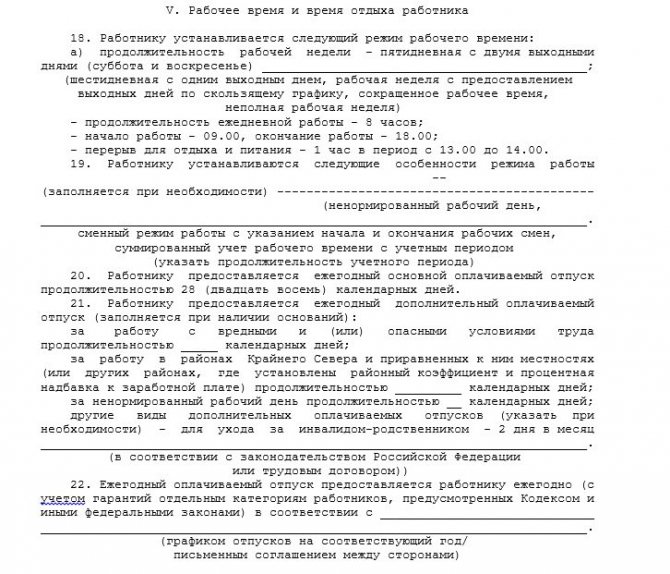

Step 5. Section “Working time and rest time of the employee.” Here you indicate the length of the working day, rest time, weekends and vacations. Only fill in the lines that are necessary.

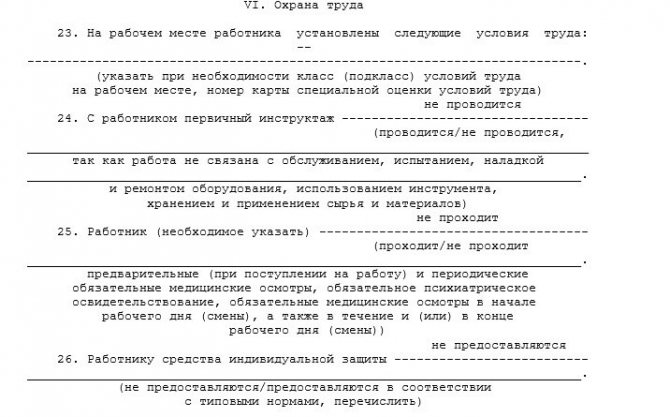

Step 6. Section “Occupational Safety and Health”. Here you should indicate the working conditions established for the employee, and note the mandatory and frequency of medical examination. If an employee is required to wear personal protective equipment, indicate which ones.

Step 7. Section “Social insurance and other guarantees.” The section is filled out when paying an employee for training, a voluntary health insurance policy, compensation for the cost of rental housing, vouchers to sanatoriums and other social guarantees.

Step 8. The section “Other terms of the employment contract” is very short. Most often, its completion is required when employing homeworkers or when concluding an agreement with an individual entrepreneur. Here the grounds for terminating the relationship between employee and employer are prescribed, different from those provided for by the Labor Code of the Russian Federation.

Step 9. The section “Changing the terms of an employment contract” usually contains general information that the terms can only be changed by agreement of the parties. Most often, nothing needs to be changed or added to it.

Step 10. The section “Responsibility of the parties to the employment contract” contains standard conditions suitable for most cases.

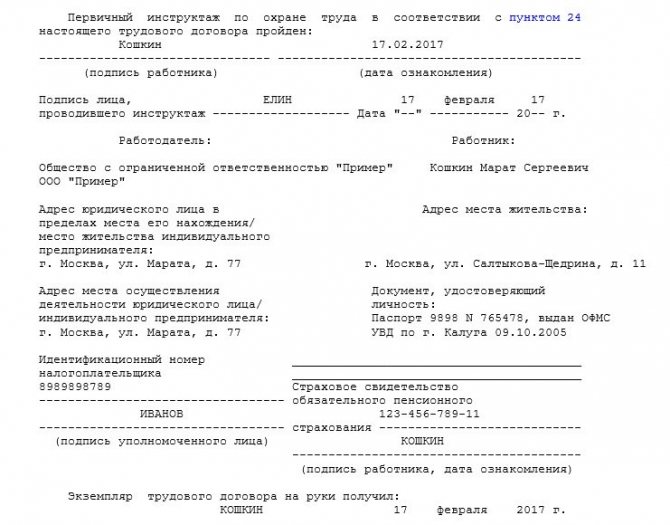

Step 11. Section 11 “Final Provisions”. Here the employee signs all the rules and regulations with which he is familiar. These include a collective agreement (if there is one), job responsibilities, initial briefing on labor protection and civil defense, various instructions and routines. At the end, the full details of the employer and employee must be indicated and the signatures of both parties to the contract must be indicated. The employee must sign that he has read the entire text of the contract and has received its second copy.

We talked about how to conclude an employment contract with an employee: the 2021 sample shows all the stages of working on the document step by step. A unified employment contract (form) will optimize the work of the HR department not only in micro-enterprises, but also in other organizations. The main thing is to monitor all changes in legislation in a timely manner and make the necessary adjustments to the document as needed when hiring new employees. A sample employment contract with an employee 2020 can help you with your work (variants of contracts with different specialists were prepared by PPT experts).

What local acts can be replaced by a standard form of an employment contract?

Having decided to implement a standard form of agreement in 2021, a micro-enterprise can refuse:

- Regulations on remuneration and bonuses . This document is replaced by section 4 of the agreement.

- Provisions on irregular working hours . You can specify the conditions in clause 9 of the first section of the standard form.

- Job descriptions , which are already optional for micro-enterprises, but are designed to help employers record in detail and distribute responsibilities among employees, and determine the degree of responsibility for non-compliance with conditions. The functionality can be specified in the contract in section 2.

- Shift schedule . All information is included in section 5, clause 19.

- Labor safety rules and relevant instructions , which can be described in section 6. If the work involves a danger to the life and health of workers, then it is advisable to keep the instructions as a separate document so as not to overload the contract with specific provisions and pay special attention to them.

Employer's liability

An employment contract is a basic document of labor legislation. It is designed to protect the rights of workers, and this is the very first “goal” of the inspection of the State Labor Inspectorate. Above we wrote about what must be included in it. Now let us briefly list the amount of fines that the director and the company will have to pay for violations in the execution of employment contracts. According to Article 5.27 of the Code of Administrative Offenses of the Russian Federation, for violations in the field of labor relations, the amounts of fines are:

- for the head of the enterprise - 10,000–20,000 rubles;

- for a legal entity - 50,000–100,000 rubles;

- for individual entrepreneurs - 5,000–10,000 rubles.

Standard form of an employment contract for micro-enterprises (form)

Employment contract with an employee (completed sample)

Employment contract of a micro-enterprise with an accountant

Legal documents

- Decree of the Government of the Russian Federation of August 27, 2016 N 858

- Federal Law of July 3, 2016 N 348-FZ

- Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Violation of labor legislation and other regulatory legal acts containing labor law norms

- Article 57 of the Labor Code of the Russian Federation. Contents of the employment contract

- Article 57 of the Labor Code of the Russian Federation. Contents of the employment contract

- Article 1 of the Labor Code of the Russian Federation. Goals and objectives of labor legislation

- Labor Code

- Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Violation of labor legislation and other regulatory legal acts containing labor law norms

Drawing up an employment agreement according to a standard form, as an alternative to maintaining personnel documentation

If a micro-enterprise formalizes labor relations with employees using this document, it has the right not to adopt other local acts (regarding labor law), including internal regulations, regulations on wages, bonuses, etc. This is very convenient, as it reduces the documentary and administrative burden.

Requirements for an employee for a certain position, rights, responsibilities and other essential conditions must be specified in the text of the contract. In order for the introduction of such personnel document flow to have a legal basis, the head of a business entity must record the use of a standard form of an employment contract in the relevant order.