Workwear is part of the employee's personal protective equipment (PPE). This is actually overalls, special-purpose shoes, various protective devices, for example, special glasses (Order No. 135n of the Ministry of Finance dated December 26, 2002, paragraph 7). Upon dismissal, the employee is obliged to hand over the protective clothing issued to him for use. The article discusses the nuances of this procedure, the actions of the employer, as well as problematic aspects of returning PPE to a resigning employee.

Do you always need to return workwear?

The law obliges the employer to provide employees with special clothing from the organization’s funds. There are cases when an employee purchases protective equipment on his own and then receives compensation for the cost of PPE. Workwear is the property of the employer, therefore, the employee is obliged to return it. An exception is the case when PPE is purchased by an employee at his own expense, but before the dismissal he did not have time to make any payments and register a set of protective clothing.

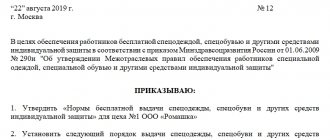

What are the standard standards for the free issuance of PPE , special clothing and special footwear to employees?

In accounting, returns are not always documented by postings. If the period of use of workwear is less than a year, it can be written off as expenses immediately after issuance to the employee (Project No. 135n, paragraph 21). BU postings are not made at the time of delivery of such workwear, since it is not registered. At the same time, when it is handed over by a resigning employee, by decision of the created commission, it is possible to post the rags - by an act, with the signatures of the responsible persons.

Working clothes upon dismissal of an employee, procedure for writing off and deduction from wages

Labor legislation places the responsibility for ensuring safe conditions and labor protection on the employer (Article 212 of the Labor Code of the Russian Federation).

The employer must ensure, in particular, the acquisition and issuance at his own expense of special clothing, special shoes and other personal protective equipment, flushing and neutralizing agents to employees engaged in work with harmful and (or) dangerous working conditions, as well as in work performed under special temperature conditions or those associated with contamination.

By virtue of Art. 221 of the Labor Code of the Russian Federation, in work with harmful and (or) dangerous working conditions, as well as in work performed in special temperature conditions or associated with pollution, workers are provided with free special clothing, special footwear and other personal protective equipment that have passed mandatory certification or declaration of conformity, as well as flushing and (or) neutralizing agents in accordance with standard standards, which are established in the manner determined by the Government of the Russian Federation.

The employer, at its own expense, is obliged, in accordance with established standards, to ensure the timely issuance of special clothing, special shoes and other personal protective equipment to employees, as well as their storage, washing, drying, repair and replacement.

If PPE is lost or damaged in the designated storage areas for reasons beyond the control of employees, the employer will issue them with other serviceable PPE. The employer provides replacement or repair of personal protective equipment that has become unusable before the end of the wearing period for reasons beyond the control of the employee (clause 25 of the Intersectoral Rules).

Let us remind you that, according to the Rules of financial support for preventive measures to reduce industrial injuries [1], expenses for the purchase of work clothes, safety shoes and other personal protective equipment can be counted against insurance premiums in accordance with standard standards or the results of a special assessment of working conditions.

For all sectors of the economy the following applies:

- Model norms for the free issuance of special clothing, special footwear and other personal protective equipment to employees of cross-cutting professions and positions of all types of economic activities engaged in work with harmful and (or) dangerous working conditions, as well as in work performed in special temperature conditions or related to pollution, approved by Order of the Ministry of Labor of the Russian Federation dated December 9, 2014 No. 997n;

- Standards for the free provision of warm special clothing and warm special shoes to employees according to climatic zones, uniform for all sectors of the economy, approved by Resolution of the Ministry of Labor of the Russian Federation of December 31, 1997 No. 70;

- Standard standards for the free issuance of certified special high-visibility signal clothing to workers in all sectors of the economy, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated April 20, 2006 No. 297.

In addition, certain types of economic activity have their own standard norms.

PPE must be domestic, and the materials from which the workwear is made must also be of Russian origin (Letter of the Federal Social Insurance Fund of the Russian Federation dated February 20, 2017 No. 02-09-11/16-05-3685). However, the Ministry of Labor has now prepared a draft order, according to which it will be possible to reimburse expenses from the Social Insurance Fund for personal protective equipment manufactured not only in the Russian Federation, but also in member states of the Eurasian Economic Union.

Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 No. 135n (effective as amended on December 24, 2010) approved the Guidelines for accounting of special tools, special devices, special equipment and special clothing (hereinafter referred to as the Guidelines).

| Contents of operation | Debit | Credit |

| The purchase of workwear is reflected | 10/10 | 60 |

| The amount of VAT presented by the seller of workwear is reflected | 19 | 68 |

| The debt to the workwear supplier was repaid | 60 | 51 |

| The amount of VAT presented by the seller is accepted for deduction | 68 | 19 |

If the workwear was purchased at the expense of the Social Insurance Fund, it is necessary to draw up correspondence accounts: Debit 69 Credit 10/10 - the cost of workwear is offset against the payment of insurance premiums.

However, in practice, reducing the amount of insurance premiums for the cost of purchasing workwear is possible only after submitting documents and approval from the Social Insurance Fund, which most often occurs not only after the purchase, but also after the transfer of workwear to employees.

In this case, you can make the following entries:

- Debit 20, 23, 25 Credit 10/10 – special clothing released for use (transferred to employees);

- Debit 69 Credit 20, 23, 25 – expenses were offset against the payment of insurance premiums (after approval by the Social Insurance Fund).

We suggest you read: Is additional leave for harmfulness subject to compensation upon dismissal

? When transferring workwear to employees, an entry is drawn up (in the case of a one-time write-off - on the date of issue to the employees): Debit 20, 23, 25 Credit 10/10 - workwear was put into operation.

The accountant needs to organize documentary control of the availability and safety of protective clothing issued to employees. To do this, you can provide an additional off-balance sheet account 12 “Special clothing transferred to operation.” Then, after the work clothes are issued to the employees, the following entry should be made: Debit 012 Credit – – the cost of the written-off work clothes is reflected on the balance sheet.

When writing off expenses for the purchase of workwear evenly, the following entries are made:

- Debit 10/11 Credit 10/10 – special clothing issued to employees (as of the date of issue);

- Debit 20, 23, 25 Credit 10/11 – reflects the repayment of part of the cost of workwear (in equal monthly installments during the wear period).

As for tax accounting, according to paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, an organization has the right to independently determine and establish in its accounting policies the procedure for recognizing material expenses in the form of the cost of workwear. Consequently, in order to bring accounting and tax accounting closer together, workwear can be recognized either as an asset (in tax accounting - a material expense), the value of which is gradually written off, or as an expense recognized in the full assessment of an immediately written off asset.

Expenses for the purchase of workwear can be recognized when calculating income tax, provided that the expenses comply with the norms of Art. 252 of the Tax Code of the Russian Federation and the provisions of labor legislation (letters of the Federal Tax Service of the Russian Federation dated September 22, 2017 No. SD-4-3/19054, Ministry of Finance of the Russian Federation dated August 19, 2016 No. 03-03-06/1/48743, dated April 8, 2016 No. 03-03- 06/1/20165).

According to the rules of Art. 272 of the Tax Code of the Russian Federation, when applying the accrual method, the date of material expenses is the date of transfer into production of raw materials and materials related to goods (work, services), that is, material expenses in tax accounting are recognized at a time.

According to para. 1 clause 13 of the Intersectoral Rules, the employer is obliged to organize proper accounting and control of the issuance of PPE to employees within the established time frame.

In the Guidelines, the section of the same name is devoted to the operational accounting of special clothing. VII.

- Ownership of workwear remains with the employer, so upon dismissal, the employee is obliged to return it to the warehouse.

- If the workwear is worn out before the established period, write off its cost in accounting as other expenses.

- At the same time, the inventory commission must determine the unsuitability of the workwear and make a decision on its write-off.

- Debit 94 Credit 10-11 – work clothes are written off from accounting at residual value;

- Debit 91-2 Credit 94 – written-off work clothes are reflected as other expenses.

- The rationale for this position is given below in the materials of the Glavbukh System version for commercial organizations

- 1. Recommendation: How to formalize and reflect in accounting the issuance of workwear to employees

- What to do with work clothes that have been returned

- Since ownership of the workwear remains with the employer, the employee is obliged to return it:

- upon dismissal;

- when transferred to another job for which the use of the special clothing issued to him is not provided.

- associated with pollution.

- in special temperature conditions,

- with harmful and (or) dangerous working conditions,

Procedure for returning workwear upon dismissal

IMPORTANT! Recommendations on the procedure for returning workwear upon dismissal of an employee from ConsultantPlus are available at the link

When resigning, the employee is required to receive an extract from the personal PPE issuance card, and then, according to the list, hand over the protective clothing to the responsible person: a warehouse worker or another employee with similar control functions. In the certificate-extract, it is advisable to indicate not only the number of units of workwear, but also its residual value, even if it has a zero value.

The receiving employee assesses the condition of the overalls. If it was received recently, but there are visible signs of substitution, damage, or the degree of wear does not correspond to its service life, it is advisable to create a competent commission to assess the condition of the PPE.

If the workwear has a normal appearance corresponding to the period of wear, it is returned to the warehouse and then issued again after dry cleaning. When accepting such goods and materials, the storekeeper makes a note in the documents about the service life, for example: “protective overalls, service life 5 months.” After delivery, the responsible person signs the worksheet for the employee, in which he makes the appropriate note.

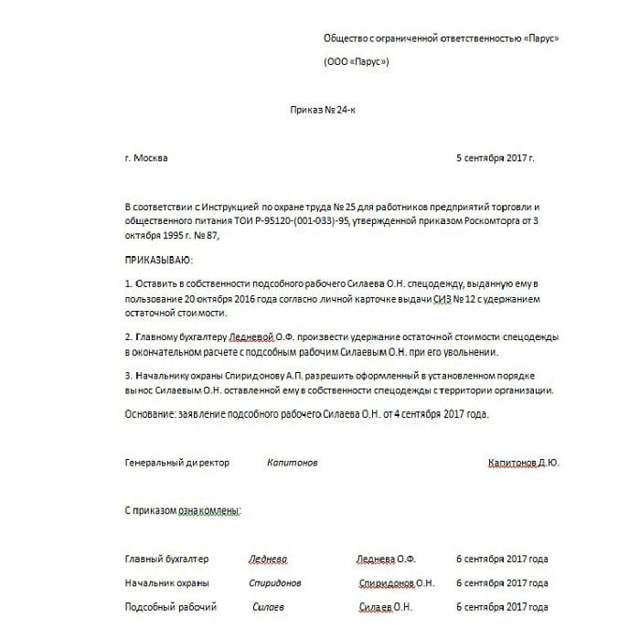

As a general rule, upon resigning, an employee can hand over the workwear in full, or in part, or reimburse its cost to the organization and keep it for personal use.

The reuse of discarded workwear as a cleaning material after handing it over by the employee must also be confirmed by an act signed by members of the commission.

Reference data on the cost of workwear can be used in the future:

- if a voluntary decision is made on the part of the employee to reimburse the cost of PPE;

- if an employee needs to be held accountable for damage, substitution, or loss of workwear;

- if the commission decided to write off previously not written off workwear due to its actual wear and tear;

- if the commission similarly decided to capitalize rags from written-off workwear.

The rules for returning workwear must be specified in the local regulations of the organization.

On a note! An employee who has expressed a desire to buy out workwear upon dismissal must write an application addressed to the head of the organization with payment of the cost. It indicates a list of personal protective equipment for which payment will be made, as well as the intention to purchase valuables for your needs. It is advisable to indicate the method of payment.

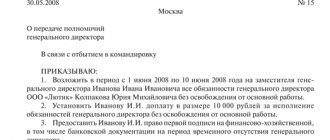

Actions upon dismissal of an employee

Individual protective clothing is required to be issued to each employee of the enterprise if his activities involve the possibility of harmful effects. A list of required PPE, uniforms and accessories is compiled in accordance with industry regulations governing the activity. Also, at the end of their service life, workwear is written off [download] in compliance with the necessary features. When purchasing and disposing of workwear, it is necessary to take into account that only certified sets are allowed to be used.

Assignment of special clothing by an employee

According to Art. 243 of the Labor Code of the Russian Federation, an employee is financially responsible for the inventory materials issued to him. This also applies to workwear. If a resigning citizen appropriated special clothing and did not return it in the prescribed manner to the organization’s warehouse, the cost of it may be deducted from the payments due upon dismissal. However, there are limitations. According to Art. 138 of the Labor Code of the Russian Federation, withholding more than 20% of payments (in some cases up to 50%) is illegal.

You cannot make deductions from amounts such as:

- compensation payments for unused vacation;

- benefits (“Chernobyl”, funeral benefits, etc.);

- bonuses paid not from the wages.

On a note! You cannot withhold an employee’s documents (work book, originals of other documents from the personal file) under the pretext of non-payment of amounts for work clothes. These actions are illegal and can be appealed in court.

If an employee completely refuses to pay the cost of workwear or compensate it from wages, it is advisable to obtain a written refusal from a citizen with his signature. The written refusal is accompanied by a certificate of the cost of the protective clothing and other documents indicating that the employee was provided with protective clothing and did not return it legally. Such actions are necessary in case of a conflict situation that can be resolved in court.

Most often, an employer, having received a refusal to hand over protective clothing or reimburse its cost, issues an order to write off the PPE. Also, an out-of-court solution to the problem may be possible if the employee quit without a bypass certificate: the moment of recovery from wages has been missed. In this case, it can be problematic to prove in court that he maliciously did not complete settlements with the organization.

On a note! The employee does not have the obligation to reimburse the cost of workwear, including upon dismissal, if it is damaged through no fault of his own, for example, in the event of an emergency, force majeure, or is used by him after the expiration date due to failure to issue a new set.

Why write off workwear?

Timely accounting and write-off of workwear allows you to:

- Transparent accounting and calculation of tax deductions. The correctness of tax calculations makes the company's activities transparent from the point of view of current legislation.

- Ensure the safety of your workers, make the production process more comfortable and maximally productive.

Ultimately, timely updating of workwear will have a positive impact on the company’s activities as a whole.

Accounting

Workwear is reflected in account 10. Usually subaccounts 10 and 11 are used, respectively, “Workwear and equipment in warehouse” and “Workwear and equipment in operation.”

If an employee, upon resigning, hands over PPE to a warehouse, this operation is reflected by internal wiring Dt10/10 Kt 10/11. In addition, the following wiring can be used:

- Dt94 Kt 10/11 – upon delivery to the warehouse, the commission declared the workwear unusable.

- Dt91/2 Kt 94 - its cost is included in other expenses.

- Dt73 Kt 94 (91/1) - the amount of work clothes not returned by the employee upon dismissal is recorded.

- Dt 70 Kt 73 – the amount of personal protective equipment is withheld from the employee’s salary.

- Dt 50 Kt 73 – the amount of personal protective equipment is paid by the employee to the cash desk.

- Dt 51 Kt 73 – the amount of personal protective equipment was transferred by the employee to the organization’s account.

- D 94 K 10/11 – the cost of unreturned workwear was written off.

- D 91/2 K 94 – shortage of workwear is reflected in expenses.

The last two entries are used if the employee has already quit, and the organization was unable to recover compensation for personal protective equipment.

Accounting for personal protective equipment is carried out on the basis of various primary documents, for example, a card for issuing personal protective equipment, a record sheet for issuing special clothing, etc.

Main

- Workwear is the property of the employer, and upon dismissal the employee is obliged to return it.

- If the employee refuses to return the workwear, its cost may be deducted from dismissal payments.

- The employer does not have the right to withhold more than 20% (in exceptional cases 50%) from payments to the employee.

- Similar amounts are not withheld from state benefits and compensation payments.

- The return of workwear is recorded by internal wiring according to count 10.

- If the clothes have become unusable and it was not possible to receive compensation for them from the dismissed employee, use account 94.

- Compensation for workwear is carried out on account 91/1 or 94, in correspondence with account 73, repayment of amounts from the employee is reflected on loan 73, in correspondence with accounts for cash payments or wage settlements.

Postings for workwear

Here are the main accounting entries for accounting for workwear.

| Operation | Account debit | Account credit |

| Workwear was purchased under an agreement with the supplier | 10-10 | 60 “Settlements with suppliers and contractors” |

| VAT on purchased workwear has been taken into account | 19 “VAT on purchased assets” | 60 |

| Workwear manufactured by the organization itself was capitalized | 10-10 | 20 “Main production”, 23 “Auxiliary production”, etc. |

| The cost of special clothing transferred into service with a useful life not exceeding 12 months has been written off. | 20, 23, 25 “General production expenses”, 44 “Sales expenses”, etc. | 10-10 |

| The special clothing was put into operation | 10-11 | 10-10 |

| Reflects linear write-off of the cost of workwear over its useful life | 20, 23, 25, 44, etc. | 10-11 |

Write-off in case of unsuitability

If the overalls were worn out ahead of time because the employee was negligent in using PPE, then the amount of damage caused to the enterprise due to the write-off of the clothing will be recovered from him. The funds will be collected from wages in the amount of monthly income.

In this case, clothing or shoes are written off as a result of revealing their unsuitability. This is done by the inventory commission.