Document role

The value of a payslip cannot be overestimated - it allows an enterprise employee to understand exactly what his salary is formed from, and also, in some cases, to see in a timely manner the inconsistencies between the calculation of wages and the terms of a specific employment contract or legal requirements. If such facts are identified, an employee can turn to the company’s accounting department for clarification of controversial or unclear issues, and if it comes to a conflict, then go to the labor inspectorate or court to restore justice.

Payslip form

There is no unified form of pay slip. It must be developed independently or a suitable template used by other enterprises must be found. If your accounting program allows for the printing of payslips, you can use it, just check that this payslip contains all the indicators provided for in Article 136 of the Labor Code of the Russian Federation.

As mentioned above, when considering Article 136 of the Labor Code of the Russian Federation, the pay slip must be approved by the local regulatory act of the employer.

When should you create a document?

The payslip must be made several days before salary payments, but it can also be issued in advance or on the day the salary is paid. At the same time, it should be remembered that usually the payment of salaries is divided into two stages, two weeks apart - so the pay slip should be provided to employees on the day they receive their “graduation”, when all the necessary amounts have already been calculated.

It must be said that the payslip concerns only wages, so there is no need to create it for issuing, for example, vacation pay.

When resigning, it is mandatory to provide a payslip (it is given to the resigning person on his last working day along with his salary).

Responsibility

If the procedure for paying wages is violated, the manager may be held administratively liable. This also applies to notifying employees about the amount and parts of their salary using a payslip. If there is no notice, then the manager and the enterprise may be punished on the basis of Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Article 5.27. Violation of labor legislation and other regulatory legal acts containing labor law norms

| Officials | Entrepreneurs who are not legal entities | Legal entities | Repeated violation by an official |

| A fine of 1,000 – 5,000 rubles |

|

| Disqualification for one to three years |

Who prepares the payslip

The payslip is prepared by a specialist from the accounting department, i.e. an employee who has complete data on all payments due to a particular employee. Typically, it is not necessary to certify the sheet with the signature of the head of the company or even the accountant himself, nor is it necessary to affix a stamp on it.

This is due to the fact that the sheet is purely informational in nature, in other words, it does not in any way confirm the fact of receiving exactly the amount of wages that was indicated for payment on it.

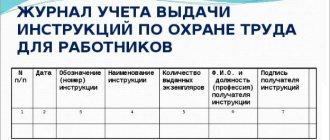

But as for the employee of the organization, he must sign for the receipt of the pay slip. To do this, an accountant or cashier can provide him with a special form called a “sheet for issuing pay slips.”

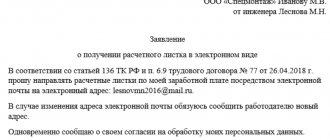

Pay slip in electronic form

According to Art. 312.1 of the Labor Code of the Russian Federation, a payslip in electronic form can only be sent to a remote worker. But the Ministry of Labor and Social Protection of the Russian Federation, in its letter dated February 21, 2021 N 14-1 / OOG-1560 “On notifying the employee about the components of the salary (pay slip) via email,” reports the possibility of transmitting the pay slip electronically to employee email:

... if an employment contract, collective agreement, or local regulatory act provides for a procedure for notifying an employee about the components of wages (pay slip) via email, then this procedure, in our opinion, does not violate the provisions of Article 136 of the Labor Code of the Russian Federation.

Now a payslip in electronic form can be sent not only to remote workers, as mentioned above, but also to all other employees, only this must be specified in one of the documents listed above.

Sample pay slip

Since 2013, standard unified forms for most primary accounting documents have been abolished, as has the obligation to use them. Now representatives of enterprises and organizations have the right to develop their own document forms approved in their accounting policies, or use previously commonly used templates.

Regardless of which option the employer chooses, the document’s structure must comply with office work standards, and its text must comply with the rules of the Russian language.

Registration procedure

- At the beginning of the sheet write:

- company name,

- job title,

- Full name of the employee,

- the period for which the document is drawn up (usually one month),

- the department in which the employee works,

- his personnel number.

- Next comes the main part, which looks like a table with several sections.

- The first includes all types of accruals for the period (salary, bonus, compensation, interest, etc.). All data is entered here indicating the number of days and hours subject to payment for one or another type of accrual.

- The second section includes everything related to tax withholdings.

- The third contains information about contributions to extra-budgetary funds.

- Next, indicate the amount of the advance payment and information about additional insurance premiums.

- After all the calculations, at the end of the document the total amount of deductions and the salary to be paid are written. If the company has a debt to the employee, or vice versa, the employee owes the employer, information about this must also be included in the payslip.

If necessary, the form can be supplemented with other information, for example, information about the statement on which the payment will be made, the date of payment of wages, etc.

Let's sum it up

- Issuing a pay slip is the direct responsibility of the employer.

- The form of the payslip is approved by local regulations.

- The payslip must be issued in writing or sent electronically if the employment contract, collective agreement, or local regulatory act provides for a procedure for notifying the employee about the components of wages via e-mail.

- A payslip must be issued to all employees, including those who receive wages by bank transfer.

- It is not necessary to put a signature or seal on the pay slip, since this is not clearly indicated in the regulatory documents.

- Payslips can be issued to employees in writing or sent electronically once a month when the final portion of wages is paid.

There is an opinion that it is better to issue pay slips in written form against signature in a specially kept book (magazine). Or, in the pay slip itself, provide a tear-off part with the employee’s signature, which will remain with the employer. This will be confirmation for the labor inspectorate that pay slips were issued, if suddenly the employee for some reason forgets about it.

According to the results of a survey conducted on the Klerk.ru portal, more than half of employers do not issue pay slips to employees, despite the fact that administrative liability is provided for this.

What is it needed for?

The main purpose of issuing pay slips is to inform employees about accrued salaries and deductions made from them.

When receiving a dismissal paycheck in hand, a person does not always understand what it consists of.

The payslip contains all the accrual and deduction items; you can always check the correctness of the accrual.

Sometimes employers do not issue payslips to avoid unnecessary questions from employees. After all, after studying the components of the salary, the employee may begin to wonder, for example, why the bonus has become smaller.

In fact, it is not beneficial for the employer to ignore the obligation to issue this document.

After all, if errors in payments and accruals are identified, it will be easier to understand and prove the case if the obligation to provide staff with detailed information about the components of their salary on paper is fulfilled.

In this case, the direct calculation of the due amounts upon dismissal is made in a special unified form of document - calculation note T-61.

Are they required to issue?

A specific obligation to issue a pay slip upon dismissal to an employee cannot be found in any legislative act.

However, if you compare some provisions of the law, you can come to the conclusion that this is mandatory.

The employer must provide the employee with a work book and salary upon dismissal. Accordingly, the pay slip is also issued on the day of dismissal. Failure to comply with this rule may result in complaints.

An employee may claim to the labor inspectorate that they forgot to inform him of how his salary and compensation upon dismissal were calculated.

In order to avoid possible problems with regulatory authorities, it is recommended that the employer must issue a pay slip when dismissing an employee.

What does it look like?

If we rely on Article 136 of the Labor Code of the Russian Federation, we can highlight the mandatory points of this form:

- components of wages for the past period (salary, bonus, rate, etc.);

- all types of accruals, including compensation, financial assistance, severance pay, etc.;

- deductions (for example, personal income tax or alimony);

- total amount to be paid.

The document header contains the following data:

- Company name;

- position and full name employee;

- billing period;

- the employee's department and personnel number.

The main part contains information in table form:

- on the left side all accruals are listed;

- On the right side, deductions and payments made are displayed.

The final part contains the amounts due for payment to an employed citizen.

If an employee has a salary debt, for example, an overpayment has occurred, this is displayed in a separate part of the table.

It is allowed to supplement the pay slip form with other necessary information.

For example, the date of issuing the salary in person or transferring it to the salary account.

Failure to complete the form in full may result in punishment for the employer, as this will be a violation of labor laws.

The payslip is always printed in one copy and given to employees against signature.

Only documentary evidence of the issuance of a document can help the employer avoid liability.

In this case, organizations use various methods of issuance: logbook, tear-off coupons, mailing, etc.

Some companies additionally print sheets for themselves and store them in the archive in case of inspection.

The form of the payslip at the enterprise is approved using a special order.

The document received by the employee with detailed information about the calculation will make it possible to detect errors made by the accountant. For example, he forgot to calculate compensation for dismissal.

If corrections are made immediately on the settlement day, there will be no consequences. And if the omission is discovered the next day, the company can be held accountable.

Therefore, the issuance of such a document is beneficial not only to the employee, but also to the employer himself.

Sample

pay slip upon dismissal – word.

The need to issue a payslip

The employer is obliged to provide the employee not only with wages, but also with information about what it consists of . This requirement is established by Article 136 of the Labor Code. In particular, the employee must be provided with information:

- about the parts that make up its RFP;

- about other amounts that must be paid to him (compensations, vacation pay, dismissal payments, etc.);

- about deductions made from the salary amount, as well as the grounds for these deductions.

All this information is contained in the pay slip. By neglecting to issue it, the employer violates labor law standards . This may result in the employee contacting the Labor Inspectorate, which will come with an unscheduled inspection.

Responsibility

If inspectors reveal violations of labor laws, including failure to issue a pay slip, then liability will follow for the organization and its officials. In accordance with paragraph 5.27 of the Code of Administrative Offenses of the Russian Federation, a legal entity will be fined 30-50 thousand rubles , an official will pay 1-5 thousand rubles . For repeated violations, the fines are higher, and the official may receive disqualification for a period of one to three years .

Pay slip as confirmation of salary payment

Court decisions also speak about the need to draw up pay slips. For example, the Appeal ruling of the Moscow City Court dated June 30, 2021 in case No. 33-8525/2017. It says that the facts of accrual of wages are confirmed by pay slips.

Rules for registration and issuance of pay slips for wages Pay slip for each employee

As required by labor legislation, each employer is obliged to establish the procedure for issuing pay slips in its local regulations. Namely, in:

- employment contracts with employees;

- in a collective agreement;

- in accounting policies.

After this, employers and individual entrepreneurs are required to comply with this procedure. In particular, a payslip can be issued not on paper, but in electronic form, if this is secured by an order from the organization. The collective agreement should also stipulate the possibility of sending an e-mail with a pay slip to each employee, in this case there will be no violation of Labor Code norms, and the State Labor Inspectorate will not be able to bring the head of the company, as well as the employer company itself, to administrative responsibility.

The form of the payslip is not approved by any centralized regulations, so an organization or individual entrepreneur can develop it independently, approve it by order and include it in the accounting policy. Usually in this document, in order not to receive a fine, they indicate:

- How much is accrued according to salary or rate;

- How much was accrued for various allowances (indicate each on a separate line);

- How much vacation pay is accrued;

- How much accrued on sick leave;

- Withholding personal income tax;

- Other deductions, for example on writs of execution;

- Advance paid.

You can generate payslips using special accounting programs at the time of payroll. You should give to employees without waiting for individual demands from them.