In modern Russia, there are many different laws regulating the activities of employees and employers in the legal field. Often, the management of an organization takes advantage of the lack of knowledge of the nuances of the Labor Code by its wards, benefiting itself.

Travel expenses are a complex and integral aspect of the life of every employee aimed at long-term work. This article will help you avoid unforeseen situations and disagreements with administrative staff by clarifying the nuances of document preparation and the work of current bills.

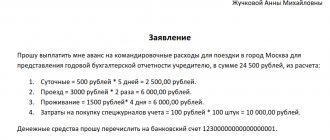

An application for reimbursement of travel expenses, a sample of which can be found in the public domain, is drawn up in accordance with the regulatory guidelines that will be presented below.

Application for reimbursement of travel expenses through the court

HomeDocument Statement of claim for recovery Application for reimbursement of travel expenses. When sent on a business trip, the employer is obliged to maintain the employee’s place of work (position) and average earnings, as well as reimburse expenses associated with the business trip (Article 167 of the Labor Code of the Russian Federation). The specified guarantees must be provided in full to part-time workers (Part 2 of Article 287 of the Labor Code of the Russian Federation).

The procedure and amount of reimbursement of expenses related to business trips are determined by a collective agreement or a local regulatory act (for example, regulations on business trips), unless otherwise established by the Labor Code of the Russian Federation, other federal laws, and other regulatory legal acts (Part.

4 tbsp. 168 Labor Code of the Russian Federation). The employer, based on financial capabilities, has the right to provide in a local regulatory act for a differentiated amount of reimbursement of such expenses for different categories of employees (workers holding various positions) (Letters of Rostrud dated 03/04/2013 N 164-6-1 and the Ministry of Labor of Russia dated 02/14/2013 N 14-2-291). The procedure and amount of reimbursement of travel expenses to employees of federal government bodies, state extra-budgetary funds and federal government agencies are determined by regulatory legal acts of the Government of the Russian Federation (Part 2 of Article 168 of the Labor Code of the Russian Federation)

Today there is a promotion - consultation of lawyers and advocates 0 - rubles.

hurry to get an answer for free→

This Personal Data Privacy Policy (hereinafter referred to as the Privacy Policy) applies to all information that the website https://online-sovetnik.ru, (hereinafter referred to as Online Advisor) located on the domain name https://online-sovetnik.ru (and also its subdomains), can obtain information about the User while using the site https://online-sovetnik.ru (as well as its subdomains), its programs and its products.1. Definition of Terms 1.1 The following terms are used in this Privacy Policy: 1.1.1. “Site Administration” (hereinafter referred to as the Administration) - authorized employees to manage the site https://online-sovetnik.ru, who organize and (or) carry out the processing of personal data, and also determine the purposes of processing personal data, the composition of personal data to be processed , actions (operations) performed with personal data.1.1.2.

“Personal data” - any information relating to a directly or indirectly identified or identifiable individual (subject of personal data). 1.1.3.

“Processing of personal data” - any action (operation) or set of actions (operations) performed using automation tools or without the use of such means with personal data, including collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution, provision, access), depersonalization, blocking, deletion, destruction of personal data.1.1.4.

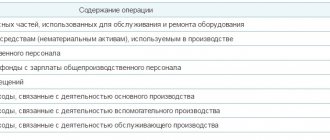

Accountant's Directory

07/10/2018 Contents It is necessary to attach the appropriate receipts, travel tickets, housing receipts and other documents indicating that the employee paid for these services.

- Clearly record the date of departure of the employee on a business trip and the date of his arrival.

- In addition to the main points accepted for all notes, in the text of the document indicate the exact time, minutely, and the city from which the employee departed, as well as the city of arrival.

- Then list in detail all the services for which compensation is required, describing them as informatively as possible, but at the same time concisely.

- Then indicate the minute-by-minute time of arrival and indicate the list of documents that you will attach as a basis for receiving money.

For financial assistance, Russian legislation provides for the possibility of employees receiving one-time payments.

Info

However, in order to ensure the correctness of drawing up a document aimed specifically at receiving a sum of money, it is necessary to contact the person who is authorized to manage the organization’s sums of money. In some cases, you will need to indicate the laws, citing which you express a desire to receive funds.

Important

For entertainment expenses Almost any organization carries out

How much do they pay for military business trips?

Military personnel sent on a business trip are paid for travel expenses (costs for booking and renting housing, arrival at the place of military duty and back to the place of duty, plus daily expenses are reimbursed).

According to current standards, the costs of arriving at the place of military assignment and back to the place of permanent deployment of the unit (including payment for services for obtaining travel tickets, the cost of using bed linen in cars) are reimbursed in the amount of actual costs, confirmed by accompanying papers, but not higher than the price of travel :

– by rail – in a compartment carriage of a fast express train;

- by water communication - in the cabin of the 5th group of a water vessel of periodic transport directions and directions with comprehensive services for citizens, in the cabin of the 2nd category of a river vessel of all directions of communication, in the cabin of the 1st category of a ferry vessel;

– by air – flight in an economy class cabin;

– by road – in public transport, with the exception of taxi services;

– in the absence of accompanying documents confirming the costs incurred – in the amount of the minimum fare:

– by rail – in a reserved seat car;

- by water communication - in the cabin of the 10th category of a sea vessel of periodic transport directions and directions with comprehensive services for citizens, in the cabin of the 3rd group of a river vessel of all directions of communication;

– by road – on a standard bus.

The provisions of Order No. 2700 provide that in addition to the costs of arriving at the place of military assignment and back to the place of service, including the use of public transport (except taxis) to the railway station, river pier, airfield or bus station, the following are included :

– insurance payments for the provided personal insurance of citizens in transport;

– costs of issuing travel tickets;

– costs of using bed linen for railway communications.

The day of departure for a business trip is the day of departure of a train, plane, bus or other vehicle from the place where the seconded military man is serving on a permanent basis, and the day of arrival is the day the transport arrives in the specified area. When transport departs before 24.00, the day of departure is considered the current day, and from 00.00 onwards - the next day.

When the departure station of the vehicle is located in another area, the time spent traveling to this station is also taken into account. The day of arrival of a military personnel sent to the place of permanent deployment of the military unit where he is serving is calculated in the same order. Departure and return days are calculated according to local time.

Sample application for reimbursement of travel expenses

Accounting documents Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > July 11, 2021 Application for travel expenses - you can find a sample of it in our article - necessary for making payments to an employee who incurred travel expenses at his own expense.

Let's look at how it is formatted.

In accordance with Art. 168 of the Labor Code of the Russian Federation, an employee has the right to reimbursement of travel expenses. The amounts that he spent on the trip from his personal funds will not be included in the accountable funds. To be reimbursed, the employee must submit a petition requesting compensation for actual costs.

The application drawn up and supported by documents is endorsed by the general director, indicating the amount and period of compensation. After this, the accounting department processes the document and issues funds to the employee.

Read about payment for one-day trips in the material. There are no maximum terms for payments under such a document. IMPORTANT! Costs must be documented.

If this condition is met, they are recognized in the simplified tax system after payment (Article 346.17 of the Tax Code of the Russian Federation), and in the OSNO - on the date of approval of the application (subclause 5, clause 7, article 272 of the Tax Code of the Russian Federation). The application is being drawn up

Application for reimbursement of money spent

Contents Based on these documents, the employee will be able to make objective decisions regarding acceptable limits for overspending.

The justification for the fact that the overexpenditure on the advance report must be paid is the following factors:

- approval of the JSC by the manager.

- justification of expenses;

- documentary evidence of each expense;

- compliance of the joint stock company with the form accepted by the employer;

For questions that arise when reimbursing overexpenditures on travel expenses, read the material “What is the procedure for reimbursement on an advance report?”

Payment of overexpenditures is carried out after the JSC has been checked by the accounting department and approved by its management. The basis for payment is the advance report itself. Payment can be made either in cash from the company’s cash desk or by transfer of funds to the employee’s card.

Please tell me whether I need to write an application for overspending on the advance report?

An employee went on a business trip and after returning he submitted an advance report. Do I need to write an application for the issuance of overspending? We inform you the following: No, it is not necessary. The legislation does not contain requirements for filling out an Application for the issuance of overexpenditure for a joint stock company. When checking the JSC, it may be revealed that the employee spent more money than was given to him in advance.

Based on the approved AO, the amount that the employee spent in excess of what was received on the report, give him from the cash register or transfer to a salary card.

Within three working days after the expiration of the deadline, the Contractor undertakes to provide the Customer with an advance report and documents confirming expenses.

Application for reimbursement of personal funds spent on company needs

0 An application for reimbursement of funds that were spent on the needs of the organization, as a rule, is submitted by accountable persons who have spent more money than they were given. After all, no one is immune from unexpected expenses. If the expenses were really necessary and the accountant provided documents confirming them, then the organization will have to pay him compensation.

A sample application for refund is given below. Let us remind you that an accountable person can be either an ordinary employee or a manager, as well as a contractor with whom the company has entered into a civil contract (). Accordingly, any of them can write an application for reimbursement of personal funds.

As you remember, money is issued to the employee on the basis of his visa, which must contain the visa of the head of the organization, or the order (order) of the head (). You can give the employee cash, or you can make a non-cash transfer to his bank card, incl.

salary (). In the latter case, the card details must be indicated in the accountant’s application or management order. When transferring funds in a payment order, in the “Purpose of payment” field, you must indicate that the employee was given an advance for business needs (for travel expenses or other purposes).

In order to report for the funds spent, the employee must draw up an advance report in a form approved by the organization or unified (approved.

Resolution of the State Statistics Committee of the Russian Federation dated 01.08.2001 N 55).

Original documents confirming expenses must be attached to the report.

In what cases is an application required?

An application for reimbursement of travel expenses must be submitted personally by the returning employee. The HR specialist must be sure that the document was drawn up by him.

Despite the proliferation of fax signatures and electronic media, the presence of handwritten confirmation still plays a significant role. Therefore, a statement must be drawn up and signed in all cases where the established budget is exceeded.

What should the application contain?

The application is written according to the general rules.

There is no generally accepted application form for travel reimbursement in the government system. In most cases, it is compiled in electronic form or in handwritten form.

In the latter case, the applicant is recommended to leave his signature and the date of submission of the document. The form must include the following elements:

- Content. The essence of the application is described;

- Title. Contains the initials and position of the recipient;

- Bottom line. The date and time the document was written is indicated. By signing it, the applicant agrees with the stated requirements.

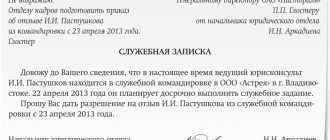

Memo for refund of funds: sample

Home — Business organization — Personnel — Documents — The enterprise budget, as a rule, includes the main expenses for various areas of activity.

However, sometimes situations arise when an employee pays for goods and services for the employer from his own funds.

This article will explore the main ones. The process of reimbursement of expenses to an employee by the manager and the documents required for this will also be considered. Contents: 1. The concept of reimbursement of expenses by an enterprise 2. Features of cost compensation: main types and grounds 3. Internal memo on reimbursement of funds The concept of reimbursement of expenses by an enterprise Current legislation does not prohibit the purchase of goods by an employee, as well as payment for services in the interests of the employer.

Moreover, Russian legislation provides for a number of circumstances obliging the administration of the organization to reimburse expenses associated with the expenses of a staff member for official activities.

The basis for such an operation will be an application or a motivated memo for reimbursement of funds.

By the way, a manager may encounter such a need as soon as he accepts a new employee onto his staff. The reason for this may be a person moving to work in a new area (Article 169 of the Labor Code of the Russian Federation). The main condition for the enterprise to reimburse the funds spent is the employee’s pre-agreed intention to use his income and property to achieve work goals.

Financial support for military business trips

The Financial Planning Department of the RF Ministry of Defense, before December 1 of a particular year, based on the received plans for business trips, develops a general plan for the distribution of budget injections for business trips among military districts, central bodies of military command and institutions subordinate to the RF Ministry of Defense.

This plan, upon presentation by the Deputy Minister of Defense working with financial support, is signed personally by the Minister of Defense.

Financial departments, upon receiving extracts from military travel plans, calculate the need for budgetary injections and request from the department the necessary LBO (limits) to cover the costs of business trips of military units, institutions and territorial organizations, the personnel of which are supported by cash.

The Department examines the submitted data for compliance of the procedures requiring the submission of LBO, the stipulated business travel plans, the appropriateness of determining the need for budgetary allocations, and communicates the LBO to financial institutions.

Additional LBOs may be sent on military trips (within approved limits) in the following situations:

– adoption by the RF Ministry of Defense of decisions to conduct special events that are not regulated by plans for implementation this year;

– development of legal norms providing for an increase in the amount of expenses, provided that these changes are not provided for when the relevant plans are adopted;

– increase in current prices for the transportation of citizens by all modes of transport.

In such situations, the decision is made by the First Deputy Minister of Defense, who is responsible for the financial support of the Armed Forces of the Russian Federation.

Sample application for reimbursement of travel expenses - all about taxes

Almost every fifth employee is sent on a business trip.

And this action must be correctly documented.

A person must submit a travel application that will allow him to be sent to a specific location for a specific time to perform his job duties. The application is submitted personally by the citizen who is sent on a business trip.

The application has a standard format.

The name of the management, the text of the document, the date and signature are written down. The text must contain information about the employee’s positive decision to travel.

When sending a standard category employee without children, consent to go on a business trip is not required. In accordance with Article 166 of the Labor Code of Russia, a business trip is a business trip on which an employee is sent to fulfill his obligations.

The employee is given a specific goal and deadline. If a person has a traveling nature of work, then this is not considered a business trip.

The issue of business trips is regulated by Regulation No. 749 of October 13, 2008.

An application for a business trip is submitted by the employee to the company management. Each person must slightly change the conditions of the trip, for example, change the departure date or ask for the payment of money. Each such process is accompanied by features and nuances in design.

Therefore, you need to first familiarize yourself with all the questions.

Postponement of a trip by the employer is possible both for a specific period and for an indefinite period.

Business trip concept

A business trip is the sending of a military man (or a civilian employee) by order of the commander (chief) of a unit for a certain time to another location in order to carry out a personal assignment outside the place of permanent deployment or temporary quartering of a military unit in which the military man is on permanent duty.

Military trips are not business trips:

- those who have departed as part of a military unit, with the exception of cases of military personnel leaving to carry out special topographical, topographic and geodetic research, aerial survey, hydrographic research or winter measurements on ice outside the location of their base, among regular military musical orchestras or theatrical production groups;

– at the time of departure, who are students or cadets, also undergoing permanent service under a contract, sent to become familiar with advanced types of weapons and special equipment;

– in case of departure for personal matters without calling the authorities;

Nuances of an application for reimbursement of travel expenses and a writing sample

In modern Russia, there are many different laws regulating the activities of employees and employers in the legal field.

Often, the management of an organization takes advantage of the lack of knowledge of the nuances of the Labor Code by its wards, benefiting itself. Travel expenses are a complex and integral aspect of the life of every employee aimed at long-term work. This article will help you avoid unforeseen situations and disagreements with administrative staff by clarifying the nuances of paperwork and the operation of current bills. An application for reimbursement of travel expenses, a sample of which can be found in the public domain, is drawn up in accordance with the regulatory guidelines that will be presented below. Contents

What are travel expenses? Travel expenses are expenses recorded by an employee that are necessary for the correct completion of a business trip.

Legislative norms and acts regulate the procedure for their accrual. According to Article 167 of the Labor Code of the Russian Federation, the employer undertakes to preserve the official position of the person under his charge and his average salary; it is also necessary to reimburse the money spent by him during a business trip. The above-described guarantees are subject to an equivalent amount for employees combining several positions and officially employed in the organization, as demonstrated by Part 2 of Article 287 of the Labor Code. Chronological

How to get an advance for travel expenses - a sample application for a business trip for reimbursement of expenses

» » » 09/10/2021 Sending an employee to perform a labor function due to a job assignment, away from his permanent place of work, is directly related to the expenses of the sending enterprise (organization). The presented expenses consist of payment to the posted employee of wages for the entire period of the official trip, travel expenses and accommodation at the destination, covering daily expenses, etc.

(compensation for overtime work, night shifts, etc.). The article describes typical situations.

To solve your problem - or call for free: - Moscow - - St. Petersburg - - Other regions - It's fast and free! All stipulated expenses are documented and confirmed by strict reporting documents, including applications for travel expenses. Regulatory regulation of this issue is carried out in accordance with the Labor and Tax Codes of Russia, as well as those approved by Decrees of the Government of the Russian Federation of December 24, 2007 and October 13, 2008 year, respectively. The law imposes an obligation on the employer to provide an advance payment for a business trip to an employee sent on a business trip (and the Russian Federation).

How an advance is issued. This payment is made by the accounting department of the sending enterprise (organization) on the basis of a corresponding order from management, as well as an application from the seconded employee himself and includes amounts to cover travel, accommodation, and daily expenses. Can be issued in cash or .To receive

Procedure for paying travel allowances

When paying travel allowances, all nuances are taken into account.

According to current laws and regulations, the employer undertakes to pay the ward money for the following periods:

- disability caused by being on a business trip;

- every day you are on a business trip, including:

- Days of forced interruption of a vehicle;

- Weekends and non-working days;

- Days spent on the road.

If a person is sent to a state entity located fairly close to his place of permanent residence, travel expenses are not reimbursed. The conditions of transport communications and the nature of the work tasks performed should allow for daily return without damage to them.

Sample application for a refund for a business trip

Jun 6, 2021 Order on reimbursement of expenses to an employee An order on reimbursement of expenses to an employee is an official order of the director.

Based on the document, the employee is reimbursed for all financial resources that he spent out of his own pocket for the needs of the company while on a business trip or in other circumstances. Contents of the article The header of the document should contain the following:

- full name of the organization; the date when the order was drawn up; registration number; title; wording: “Based on the reporting documents provided... (the full name of the employee is written here) I ORDER”; text; signature of the person responsible for the execution of the order and its transcript; director’s signature and its transcript; signature of the employee (who needs to reimburse the expenses) and its transcript in the familiarization column.

The text itself must contain the following information: Full name of the employee who needs to be reimbursed.

The structural unit in which the employee works, as well as his position, rank, class, qualifications. Wording: “Pay as reimbursement of expenses in excess of the advance received in connection with the stay in ... from... to... year ... rub....