What types of time tracking are there and how do they differ from systems?

Before considering what types of time tracking there are, it is necessary to understand what this concept means. Thus, quite often there are ambiguous interpretations regarding the issues of what time tracking systems are and what their types are.

Systems directly refer to technological and organizational solutions that ensure actual recording of employee working time. The types provide for complex organizational and legal features of keeping records of workers’ working time from the point of view of legislation and personnel affairs. And this article will directly examine the types of working time recording under the Labor Code. More details about existing time tracking systems, the procedure for their application and types can be found in a separate article.

Globally, we can divide the types of working time used by employers in the Russian Federation into the following categories:

- Daily accounting.

- Weekly accounting.

- Summarized accounting.

Each procedure for recording working time implies its own advantages and disadvantages for both employees and employers, and the effectiveness of the methods used will largely depend on the characteristics of work in a particular business entity or even in a specific position. That is why it is necessary to consider all the main types of working time recording in more detail.

Daily or daily work recording is the most common approach

Most employees in the Russian Federation work a standard five-day, eight-hour work week and are paid a fixed monthly salary, possibly with additional bonuses for achievements. And for the implementation of such tasks, daily working time recording is best suited, which is considered the “gold standard” both among employees and among employers.

This approach is also convenient not only with a salary system, but also in cases where employees receive piecework income at a tariff rate or a percentage of sales. In this case, the employer also does not actually need to track exactly the working time spent by employees, and he uses the most simple and convenient accounting system for each party to the relationship.

The main advantages of daily accounting include the following characteristic advantages:

Does not require any additional costs for providing systems for recording and monitoring working hours. It’s enough just to keep a time sheet - and this will be enough to pay your employees and carry out all the necessary personnel and accounting activities.- Reduces the burden on the employer. With this approach, the employer does not need to not only incur additional costs for organizing the accounting system and its technical support, but also to load the HR and accounting departments with additional work, because with other principles for calculating working hours, accountants and HR officers will have an order of magnitude more work.

- High transparency. The simplicity and clarity of this type of accounting is a good plus for both employers and employees. A person came to work at a clearly stated time, left - and that’s enough. Everything is extremely simple, which means there is much less opportunity for labor disputes to arise in this case.

However, this approach also has certain disadvantages, which include the following characteristic features:

- Inapplicability for organizing shift work. It is almost impossible to keep daily records of working hours at enterprises where a continuous work process is organized or simply involves shifts of non-standard duration and a rotating work schedule.

- Reduced level of employee responsibility. This disadvantage is typical mainly for workers who receive a salary - in the case of daily working hours and in the absence of control, it is far from a fact that employees will be engaged in their job responsibilities all working hours and, in principle, will be at the workplace.

- Less labor efficiency. The fact that hourly and minute-by-minute methods of recording working hours generally increase work efficiency, especially of lower-level personnel, has been proven by repeated statistical studies. At the same time, daily accounting does not allow the full potential of workers to be realized and, as a result, to maximize the benefits of the economic activity of a business entity.

- Difficulties with processing and additional costs. In situations where other methods of recording working time are used, calculating overtime and overtime hours will be a much simpler task - since there is already an entire legal framework for this. At the same time, if the enterprise keeps summarized records, then this technique also makes it possible to ensure that the employer does not overpay for overtime on one day, if it was compensated for by shorter work time on another.

- Not suitable for shift work. In the Russian Federation, shift work is quite common, but legislation directly prohibits the use of standard types of working time recording in relation to such labor relationships.

In addition to the above-mentioned shortcomings, one can also note the employer’s inability to organize an effective flexible work schedule and other organizational nuances. However, as already noted, for the majority of Russian business entities and the workers themselves, this type of working time recording is optimal.

Working time tracking. Time sheet

According to Article 91 of the Labor Code, “the employer is obliged to keep records of the time actually worked by each employee.”

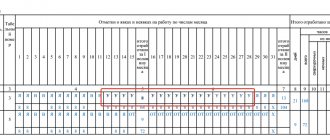

Before January 1, 2013, special forms were required for recording working hours. They are approved by the State Statistics Committee of Russia (). These are time sheets. After this date, the company has the right to either keep records in a form developed independently and approved by the head of the organization or, as before, use a unified form. At the same time, in our opinion, the second option is simpler and more convenient. The unified form contains all the lines and columns necessary for the correct organization of accounting. Let's take a closer look at the order of filling it out.

() approved fast. Goskomstat of Russia dated January 05, 2004 No. 1

Timesheet form No. T-12 is used for manual accounting, T-13 for automated accounting. Note that form No. T-12 consists of two sections: I “Accounting for working hours” and II “Settlements with personnel for wages”. The first section is intended directly to record the time worked by employees, the second - to reflect the calculation of their wages. At the same time, the company has the right to keep separate records of these data. In such a situation, section II of the report card is not filled out.

Both timesheets are drawn up in one copy. In this case, working time is taken into account in the timesheet in one of two ways: either by the method of continuous registration of appearances and absences from work, or by the method of recording only deviations (no-shows, lateness, overtime, etc.). When reflecting absences from work, which are recorded in days (vacation, days of temporary disability, business trips, leave in connection with training, time spent performing government duties, etc.), only symbol codes are entered in the top line of the timesheet in the columns , and the columns in the bottom line remain empty.

On the title page of report card No. T-12 there are symbols of worked and unworked time. They must also be used when filling out the time sheet in form No. T-13.

In most cases, the timesheet is submitted to the accounting department once a month upon completion. However, this is not entirely true. The fact is that wages must be issued to the employee at least every half month (advance payment and final payment) (). In this case, the advance is calculated based on the time actually worked by the employee, which is reflected in the time sheet. It turns out that for temporary employees, time sheets need to be issued every six months. Otherwise, the accounting department will not be able to correctly charge them an advance.

() Art. 136 Labor Code of the Russian Federation

Maintaining timesheets is the responsibility of the organization. Moreover, it is necessary even if the company uses a piece-rate form of remuneration. On the one hand, when using this system, an employee’s earnings do not depend on the amount of time he works. It is determined based on the established prices for the volume of work performed in physical quantities. However, regardless of the remuneration system established in the company, the duration of working hours is limited by labor legislation. Therefore, the employer is obliged to keep records of it. The Labor Code does not make any exceptions to this rule (). In addition, data on the working time spent by each employee of the company is needed to correctly calculate his average earnings and generate statistical reporting.

() art. 91 Labor Code of the Russian Federation

When dismissing an employee, the company, at his request, must issue an extract from the time sheet. The fact is that, according to labor law, the employer is obliged to issue the employee a work book and certified copies of other documents related to his work on the day of termination of the employment contract (). They are presented at the request of the employee. Moreover, the Labor Code does not establish a list of these documents. The timesheet is directly related to the employee’s work. Therefore, he has the right to demand a copy of it.

() Art. 84.1 Labor Code of the Russian Federation

However, the report card contains data not only on the person leaving, but also on other employees. Moreover, the information contained in the report card is their personal data. Therefore, they can only be transferred to other persons with their consent. Thus, in this situation, in order not to obtain the consent of other employees, the company has the right to issue an extract from the document in question, which will indicate information only about the resigning employee.

Based on materials from the reference book “Salaries and other payments to employees” edited by V. Vereshchaki

Weekly Time Tracking - When to Use It

In cases where the enterprise has a flexible work schedule, shift work schedule, or the duration of work on different days may differ, without reference to the days of the week, but according to other principles, employers can use recording of working hours during the week. In this case, the employer has the opportunity to more effectively distribute labor resources and use them with maximum efficiency.

Weekly recording of working hours has the following characteristic advantages:

- It makes it possible to ensure the efficient operation of an enterprise with a shift work schedule and at the same time comply with the requirements of labor legislation and the rights of workers.

- Allows you to maximize profits and not incur additional costs for overtime hours if during the week the total amount of time worked does not exceed the norms established by law.

- Easily allows you to make changes to the schedule and work routine if necessary to optimize work processes.

Often, weekly accounting can be used for workers in creative professions and in activities where labor efficiency may depend on various external factors. For example, when carrying out asphalt laying work, a situation may arise when it is canceled due to weather conditions.

The disadvantages of this type of working time recording include the fact that weekly accounting requires a more in-depth study of personnel documentation and daily recording of working hours in general, and not just hours worked by employees overtime.

Working time accounting, its types.

Recording of working time is necessary to assess and document the degree to which each employee, employer and his officials fulfill their labor duties; to apply disciplinary sanctions and material sanctions in case of failure to fulfill or improper performance of these duties; for payroll, guarantee and compensation payments and additional payments.

The actual working time is subject to accounting, which consists of worked and unworked time, included in working hours in accordance with the law. Actual working time is taken into account from the moment the employee appears at the place of work in accordance with the internal regulations, work schedule (shift) or special instructions of the employer until the moment of actual release from work on that day (shift).

The employer is obliged to organize a record of employees' attendance at work and departure from work (Part 1, Article 133). Recording of attendance and departure from work is carried out in work time sheets of the established form, in annual time cards and other documents and is organized according to one of the following systems: card (using control clocks); token (service tokens or stamps); pass (handing over and issuing passes); report-sheet (using reports or time sheets received from the heads of workshops and departments); access control devices. Combined and other systems are possible.

Accounting is maintained for the organization as a whole or for structural divisions. Depending on the period for which the established standard of hours is worked, daily, weekly and summarized recording of working time is used. In all cases, the time worked is taken into account (recorded) for each working day (shift).

With daily accounting, working hours are calculated for each day. Its actual duration must correspond to the established working day norm. This type of accounting is typically used for a six-day work week.

In cases where the daily standard of working hours cannot be met every working day, but can be fulfilled every calendar week, weekly recording of working hours is established. This type of accounting is used for a five-day working week.

Summarized recording of working time can be used in continuously operating organizations, and where, due to production (work) conditions, it is impossible or economically impractical to comply with the daily or weekly working hours established for a given category of workers (metallurgical, chemical production, communications, healthcare, trade) summarized recording of working time is introduced by the employer in agreement with the trade union.

The accounting period can be measured in calendar units (week, month, year...) or other periods of time (harvest period, rotational work, etc.).

With cumulative accounting, time worked is calculated for a certain period lasting more than a day or a week - three weeks, three months. As a result, the total working time for the accounting period should be equal to the standard hours for this period.

Use of working time.

Effective use of working time is the most important responsibility of workers and employers. The main responsibilities of employees and employers are established by Article 132 of the Labor Code:

— employees are obliged to come to work on time and fully use the working hours established by law to perform their duties. Failure by an employee to comply with his duties is considered a violation of labor discipline and may entail disciplinary liability;

- the employer must create conditions for the full and productive use of working time.

During working hours, it is prohibited to distract employees from their immediate duties and carry out activities not related to production activities, unless otherwise provided by law, a collective agreement, or an agreement.

Summarized working time recording

Summarized recording of working time is also effective and widely used in the Russian Federation. This special work regime allows the employer to establish a long period of up to one year during which the actual hours worked will be recorded. In this case, only those hours that go beyond the standard indicators specified in the production calendar for the accounting period can be considered overtime.

The maximum duration of the accounting period for cumulative accounting of working hours may differ depending on the category to which the employee belongs, as well as the nature of his work activity.

Summarized recording of working time requires mandatory calculation of at least the hourly work of employees. However, now there are organizational and technical solutions that implement minute-by-minute recording of working time. This approach allows the employer to maximize its profit from employee activities without actually paying for time spent outside of direct work tasks and responsibilities. In addition, summarized recording of working time is expressly provided as the only type of accounting applicable for shift work.

However, for effective organization of labor using such a system, additional material and technical support will most likely also be required - programs, access control systems and technological solutions that provide accounting automation. At the same time, the load on the personnel department and accounting department of the enterprise increases significantly due to more complex calculations of workers' wages.

Time tracking

According to Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the working time actually worked by each employee. In this case, working time refers to the time during which an employee must perform work duties.

Types of working hours:

1. Normal working hours

According to the Labor Code of the Russian Federation, normal working hours cannot exceed 40 hours per week and is the standard working time for all employees of the Russian Federation.

2. Reduced working hours

Shortened working hours are established for certain groups of workers:

- under the age of 16 - no more than 24 hours a week;

- at the age of 16 to 18 years - no more than 35 hours per week;

- for disabled people of group I or II - no more than 35 hours per week;

- for those employed in harmful or dangerous work - no more than 36 hours a week, etc.

3. Part-time work

Part-time working hours can be established by agreement between the employer and the employee (for example, with a pregnant woman or with an employee on maternity leave).

4. Summarized working time recording

If the specifics of the organization’s work do not allow it to comply with the established working hours, it is permissible to introduce summarized recording of working hours with an accounting period of no more than one year (Article 104 of the Labor Code of the Russian Federation). Typically, summarized accounting is used for shift work or flexible working hours. When introducing summarized accounting, the employer organizes the work process so that the standard working time is worked by the employee for the accounting period, for example, for a month.

Time sheet. Forms T-12, T-13

To keep track of working hours, unified forms of time sheets are provided: T-12 and T-13.

Form T-13 is recommended for use in organizations that have an electronic checkpoint.

Form T-12 - for all other organizations.

For budgetary organizations, the Ministry of Finance has approved a separate timesheet form (form code according to OKUD - 0504421).

Working hours can be displayed on the timesheet in two ways:

- The method of continuous registration of attendance and absence from work.

- By recording deviations (no-shows, overtime, etc.).

When summarizing accounting, the continuous registration method should be used. The report card form for public sector employees suggests a method for recording deviations.

Featured articles

- Entering information about donating blood

- Changing the work schedule of a pregnant employee

- Registration of transfer of days off in May

- Registration of transfer of January holidays

- Registration of transfer of days off in March

- Registration of transfer of days off in June

- Registration of overtime work