Home / Salary disputes / How to calculate interest for delayed payment of wages? Calculator and basis for calculation

The law establishes that in case of delay in payment of wages to employees, the enterprise is obliged to pay a penalty along with the debt. It is calculated using the special formula given below. Technically, it is not difficult to obtain, but in such disputes it is necessary to take into account other factors that may not work in favor of workers.

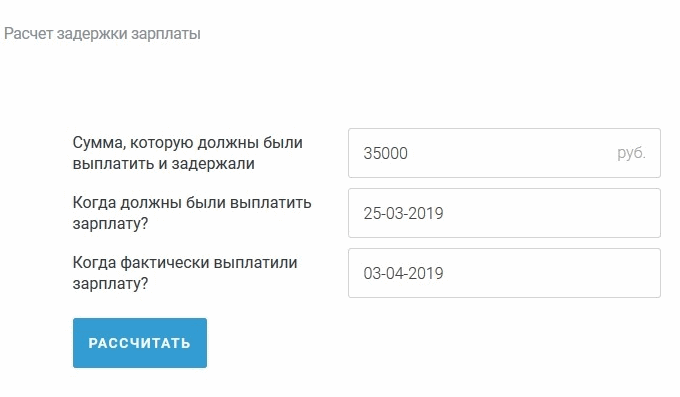

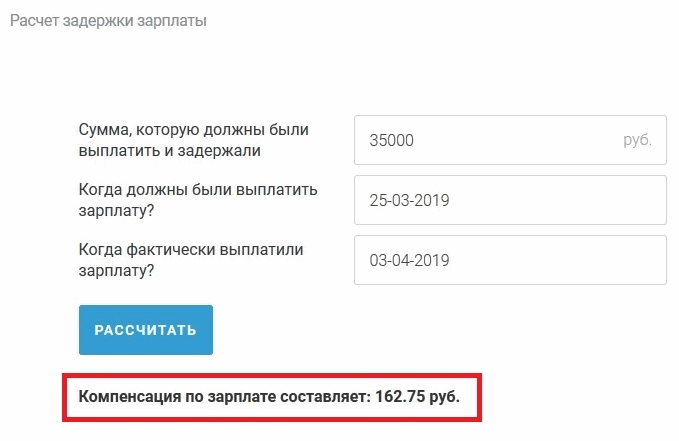

Compensation calculator for late wages

First, let's look at how to use the formula manually.

Let's determine how much the restaurant should pay him extra:

- the key rate today is 7.75 percent;

- number of days late - 9;

- accrued penalties - 1622.75 rubles.

To determine the number of days late, you need to start counting from the day following the day of non-payment (in our example - from March 26), and also include the day of payment (April 3) in the calculation. It turns out 9 days.

The calculator for calculating salary delays in 2021 allows you to avoid making these calculations manually. With its help, we will find out in a matter of seconds to what extent the boss will be held liable for violating the rights of a worker.

It is enough for us to know the due date, the date of actual receipt and the amount due for payment. This data must be entered into the calculator for calculating compensation for delayed wages.

The algorithm is as follows:

- We enter the salary amount manually in numbers.

- We select dates from the drop-down calendars.

- Click the “Calculate” button.

The result will appear in the bottom line. It is important that you can take into account not only the salary or rate itself, but also any other payment that the employer withholds (for example, maternity benefits).

So, you have found out the amount of penalties. Then you should present it in a written statement demanding compensation for the violation of rights. If management ignores it, the information can be transferred to the State Labor Inspectorate or the prosecutor's office.

A manager who does not want to voluntarily bear financial responsibility for his misconduct risks receiving administrative liability in the form of a fine under Article 5.27 of the Code of Administrative Offenses of the Russian Federation (up to 20,000 rubles for an official). And if he does this regularly and periods of non-payment last for months, there may be grounds for opening a criminal case under Article 145.1 of the Criminal Code of the Russian Federation.

Delay of wages from the deadlines established by law violates the employee’s right to timely and full remuneration, guaranteed by Article 37 of the Constitution and Article 21 of the Labor Code. The amount of compensation for delayed wages is usually established in a collective or employment agreement. For example, you can indicate that compensation is 0.06 percent of the amount owed for each day of delay in salary. If the amount of compensation is not established by an employment or collective agreement, then it is calculated based on 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay. Such rules are established in Article 236 of the Labor Code of the Russian Federation.

Attention:

The amount of compensation established by the organization for delayed wages cannot be less than 1/150 of the key refinancing rate. Otherwise, this condition of the collective (labor) agreement will be invalid (

Art. 8 Labor Code of the Russian Federation

).

The organization must set a specific date for payment of salaries. It is impossible to establish a period during which wages should be paid, rather than a specific day of payment. If the payment day coincides with a non-working day, the salary must be paid the day before.

Note:

Article 136

Labor Code of the Russian Federation, paragraph 3 of the letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242.

In this regard, the period of delayed wages is defined as the number of days by which the payment is overdue. The first day of delay is the day following the due date for payment of wages. The last day of delay is the date of actual payment of wages. This procedure is established in Article 236 of the Labor Code of the Russian Federation.

When calculating compensation, determine the duration of the delay in payment of wages in calendar days. Article 236 of the Labor Code of the Russian Federation states that compensation must be calculated for each day of delay. There is no reason to exclude weekends and holidays from this period.

Compensation for delayed wages

=

Salary arrears

X

1/150 of the key rate (or a greater percentage set by the organization)

X

Number of days of delay

• on the 20th – an advance in the amount of 40 percent of the salary;

• 5th – final payment.

According to the collective agreement, compensation for delayed wages is 0.06 percent for each day of delay.

The organization paid the final payment for December 2013, as well as the entire salary amount for January 2014, on February 16, 2014.

We suggest you read: Maximum percentage of alimony withholding from wages

• 300,000 rub. (final payment for December 2013) – 47 days (from January 1 to February 16, 2014 (January 1–8, 2014 are holidays, so wages for December must be paid on December 31, 2013));

• 250,000 rub. (advance payment for January 2014) – 27 days (from January 21 to February 16, 2014);

• 300,000 rub. (final calculation for January 2014) – 11 days (from February 6 to February 16, 2014).

Along with the arrears of wages, the organization paid compensation for the delay.

The amount of compensation for delayed wages was: RUB 300,000. × 47 days × 0.06% RUB 250,000 × 27 days × 0.06% RUB 300,000 × 11 days × 0.06% = 14,490 rub.

calculates the amount of debt of the organization to the employee for the use of his money in accordance with Article 236 of the Labor Code of the Russian Federation.

The “Compensation for delayed payment of wages” calculator calculates compensation for the use of an employee’s money in the event that the employer delays payment of wages to the employee.

So, to calculate compensation for delayed wages, fill out the “Salary Payments” table. When filling out the table, you should pay attention to a clear indication of the dates of the due salary and actual payments, since the amount of compensation depends on them. In the data given as an example, these dates coincide; in real life it may be different.

A parameter has been added to the Compensation for Delayed Salary Calculator that capitalizes interest when salary payments are delayed by more than a year. This is done because the Central Bank refinancing rate is the amount of interest on an ANNUAL basis payable to the country’s central bank for loans provided to credit institutions.

Thus, interest on bank loans is subject to capitalization once a year (as a rule). But, unfortunately, Article 236 of the Labor Code of the Russian Federation does not stipulate such subtlety. But, since the basis for calculating compensation is the Central Bank refinancing rate, it is necessary to correctly take into account its features, i.e. if payment terms are missed by more than 1 year, make appropriate capitalization of compensation amounts.

Example

The driver S. Ivanov’s salary is 25,000 rubles. On April 23, 2021, he was paid an advance in the amount of 10,000 rubles, and his salary was 11,750 rubles. (RUB 25,000 - RUB 10,000 - (RUB 25,000 x 13%))

Payment of wages was delayed by 14 days. The refinancing rate of the Bank of Russia on the payment date is 8.25% (instruction of the Bank of Russia dated September 13, 2012 No. 2873-U). Thus, compensation for delayed payment of wages will be 45.24 rubles. (RUB 11,750 x 8.25°%: 300 x 14 days) only - May 24, 2021.

We calculate penalties online

The above formula is incorporated into program algorithms that are displayed on specialized legal websites. They are known as the interest calculator for late wages and work online.

The following must be taken into account:

- Programs sometimes work with errors;

- The entered data may not be displayed correctly.

Therefore, it is recommended to additionally check the values produced by the program with independent calculations. This is easy to do if you use the above formula.

The penalty is calculated for each month separately, the resulting values are summed up.

If a company owes wages for several months, the formula is applied separately for each payment . For example, the first debt arose on April 16, but the company did not pay the staff in both May and June. As of June 20, the number of days for calculating the penalty is:

- For April – 66 days;

- For May – 36 days;

- For June – 5 days.

These values are substituted into the formula. The result is three values of the penalty, which are summed up to give the total amount of the penalty.

Established rates for penalties

Another variable in the formula is the Central Bank's key refinancing rate . You need to check its value for the entire period of delayed wages. If it changes, calculations are carried out for each value separately.

For example, in the above case, the key rate in April and May was 8.5%, and in June – 9%. This means that the calculation of the penalty for May is carried out in two stages - from May 16 to 31 and from June 1 to 20. The following values apply :

- For the first stage – 16 days and the key rate of 8.5%;

- For the second stage – 20 days and a key rate of 9%.

The results obtained are summarized. The end result is a penalty for May.

Let's find out whether compensation for delayed wages is subject to insurance premiums by reading a special article prepared by the editors of our website.

Compensation calculator for late wages

You must calculate and pay compensation at the request of the employee for whom you have delayed wages, vacation pay, benefits and other payments directly related to the performance of job duties (hereinafter referred to as wages).

If you do not do this, the employee may complain to the labor inspectorate (or to the court), which will not only oblige you to pay compensation, but also fine you. Organization – for 30,000–50,000 rubles. and its manager - by 1000–5000 rubles. Compensation is accrued from the day following the last day of the established salary payment period until the day of actual payment (Article 236 of the Labor Code of the Russian Federation).

You must calculate and pay compensation at the request of the employee for whom you have delayed wages, vacation pay, benefits and other payments directly related to the performance of job duties (hereinafter referred to as wages). If you do not do this, the employee may complain to the labor inspectorate (or to the court), which will not only oblige you to pay compensation, but also fine you. Organization – for 30,000–50,000 rubles. and its manager - by 1000–5000 rubles.

Compensation is accrued from the day following the last day of the established salary payment period until the day of actual payment (Article 236 of the Labor Code of the Russian Federation).

We suggest you read: How to stop accruing interest on a credit card*Women's joys

Violation of the Code’s requirement for timely and full payment to an employee of wages and other amounts due to him is a violation of labor legislation, liability for which is provided not only by Article 142, but also by Article 362 of the Labor Code of the Russian Federation

The legislative framework

Wages are an integral component of labor relations. Article 136 of the Labor Code of the Russian Federation prescribes its payment at least once every 15 calendar days. The employer and employee, when concluding an agreement, fix the dates when the first must give money to the second. In addition, the deadlines are indicated in the company’s local documents, for example, internal labor regulations or regulations on remuneration.

If management violates the deadlines, it is liable under Article 236 of the Labor Code of the Russian Federation. It does not matter whether the boss is to blame for the incident or whether the funds were not transferred for reasons beyond his control.

Compensation for salary delays in 2021 is 1/150 of the Central Bank key rate as of the current date for each day of delay. In fact, the company pays for the use of other people's funds, since it holds them without reason.

This amount is not subject to personal income tax.

How to calculate compensation for delayed wages

Example

The head of the organization and his deputies may be held accountable at the request of the representative body of workers. The employer is obliged to consider the application of this body about the violation by the head of the organization, his deputies of laws and other regulatory legal acts on labor, the terms of the collective agreement, agreement and report the results of the consideration to the representative body of workers.

If the facts of violations are confirmed, the employer is obliged to apply disciplinary action to the head of the organization, his deputies, up to and including dismissal (Article 195 of the Labor Code of the Russian Federation). An employment contract with the head of the organization can be terminated, in addition to the grounds provided for by the Code, and on other grounds provided for employment contract (Article 278 of the Labor Code). These may include violation of the law on wages.

The head of the organization bears full financial responsibility for direct actual damage caused to the organization. That is, the employer (owner) can recover the amount of damage caused from the head of the organization.

a) in case of violation of the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, pay them with interest (monetary compensation) for each day of delay, starting from the next day after the established payment deadline until the day of actual payment, inclusive (Art. 236).

For each day of delay in salary, the organization is obliged to pay the employee compensation amounting to at least 1/150 of the refinancing rate of the Central Bank of the Russian Federation of the payment amount (Article 236 of the Labor Code of the Russian Federation).

The accrual of interest in connection with late payment of wages does not exclude the employee’s right to indexation of the amounts of delayed wages due to their depreciation due to inflation!

b) compensate the employee for the earnings he did not receive in all cases of illegal deprivation of his opportunity to work, in particular when he suspends work in case of delay in payment of wages, since continuation of work in case of violation of the established deadlines for payment of wages or payment of it not in full is considered forced work that is prohibited by law;

c) compensate in cash in the amounts determined by agreement of the parties to the employment contract for moral damage caused to the employee by unlawful actions or inaction of the employer.

In accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation, company officials can be fined from 1,000 to 5,000 rubles, and the organization itself - from 30,000 to 50,000 rubles.

If repeated violations are detected, the head of the enterprise faces disqualification for a period of one to three years.

During this period, they cannot hold leadership positions in the executive body of a legal entity, join the board of directors or carry out entrepreneurial activities in managing the company.

Note: More than 50% of violations for which this type of punishment is imposed are related to wages.

Administrative liability can only be brought to court.

When identifying an employer’s debt to pay wages, regardless of how long ago it was formed, state labor inspectors issue orders to repay it within a period of no more than a month. In this case, payments must be made to both working and dismissed employees, regardless of the date of separation. The inspectorate keeps records of wage inspections and their results, as well as a register of employers who have violated labor laws and have been brought to administrative liability. Information about violating managers is sent to the prosecutor's office. The latter can bring criminal charges for non-payment of wages.

We suggest you read: Issuing an invitation for a foreigner to Russia in Novorossiysk - the cost and timing of issuing an invitation

Article 145.1 of the Criminal Code of the Russian Federation. Non-payment of wages, pensions, scholarships, benefits and other payments

1. Failure to pay wages, pensions, scholarships, allowances and other payments established by law for more than two months, committed by the head of an organization, an employer - an individual out of mercenary or other personal interest - is punishable by a fine in the amount of up to 120,000 rubles or in the amount of wages or other income of the convicted person for a period of up to one year, or by deprivation of the right to hold certain positions or engage in certain activities for a term of up to five years, or by imprisonment for a term of up to two years.

2. The same act, which entailed grave consequences, is punishable by a fine in the amount of 100,000 to 500,000 rubles or in the amount of the wages or other income of the convicted person for a period of one to three years, or by imprisonment for a term of three to seven years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years or without it.

According to Article 122 of the Tax Code of the Russian Federation, non-payment or incomplete payment of social tax amounts, as well as on the income of individuals as a result of an understatement of the tax base, other incorrect calculation of the budget obligation or other unlawful actions (inaction) entail a fine of 20% of the unpaid tax amounts.

If these actions are performed intentionally, the fine will increase to 40% of the non-payment amount.

If an organization paid taxes late, it will have to pay a penalty to the budget for each calendar day of delay, starting from the day following the payment date established by law. According to Article 75 of the Tax Code, penalties are calculated at 1/150 of the current key rate of the Central Bank.

Similar liability measures are prescribed for cases of non-payment or delay in payment of contributions for compulsory pension insurance and against industrial accidents and occupational diseases.

In accounting, take this payment into account in other expenses (clause 11 of PBU 10/99). The accrual of compensation is not related to calculations of wages, so reflect it on account 73 “Settlements with personnel for other operations” (Instructions for the chart of accounts).

Debit 91-2 Credit 73 – compensation for delayed wages has been accrued.

Compensation is calculated on the day the salary is paid. Only at this moment can the amount of expenditure be accurately determined, and, accordingly, the requirements of paragraph 16 of PBU 10/99 will be met.

The employer is obliged to pay, but does not pay

Calculating compensation due to an employee is sometimes purely academic, especially when the employer is in financial trouble. That is, the employer knows that he owes, but is not going to or cannot pay the debt.

In this case, the employee has only one option - to court.

You can draw up a statement of claim yourself using tips from the Internet. The requirements of the statement of claim should include:

1. collection of net wage arrears;

2. collection of compensation based on calculator calculations;

3. recovery of moral damages (optional, if desired).

It is very important not to miss the statute of limitations, which for these categories of claims is shortened and is only three months. Article 392 of the Labor Code of the Russian Federation determines the beginning of the limitation period from the moment when the employee learned about the fact of the delay.

As a rule, the employee learns about the fact of a delay in payment on the day when the payment should have taken place according to schedule. However, there are exceptional cases when information is received late, for example, in the case of an employee’s illness, due to which he could not call work, could not clarify whether the money was transferred to the salary card, and did not contact any of his colleagues.

The delay in payment of severance pay begins to be calculated from the moment the employee was given the work book. In connection with the transition to electronic work books planned by the Government of the Russian Federation, perhaps we should expect changes in the Labor Code regarding the calculation of the delay in payments upon dismissal.

Advice! Remember that your employer is not going to play the role of a lamb in court. It is possible that he will try to prove that you missed the deadline for filing a claim. It's not that difficult to do. For example, provide testimony that the sick employee was notified of the delay in salary personally by the chief accountant. Therefore, it is best not to delay going to court, especially since labor disputes are not subject to state duty.

Workers have the right to suspend work

The resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 indicates that when resolving disputes related to late payment of wages, the courts should keep in mind that, by virtue of Art. 142 of the Code, an employee has the right to suspend work, provided that the delay in payment of wages was more than 15 days and the employee notified the employer in writing about the suspension of work.

It is necessary to take into account that, based on this norm, suspension of work is allowed not only in cases where a delay in payment of wages for a period of more than 15 days was due to the fault of the employer, but also in the absence of such.

Since Art. 142 of the Labor Code of the Russian Federation does not oblige the employee who suspended work to be present at his workplace during the period of time for which his work was suspended, and also taking into account that by virtue of Part 3 of Art. 4 of the Code, violation of established deadlines for payment of wages or payment of wages not in full is considered forced labor; he has the right not to go to work until the delayed amount is paid to him. (clause 57 of the Resolution)

Consequences of missing a deadline

If the statute of limitations is missed, the case will not be considered and the judge will make a decision to reject the claim without examining the circumstances of the case.

Therefore, if it happens that you missed the deadline out of laziness or ignorance of the law, then before filing a claim in court, take care of several things:

1. Think about how you can motivate missing a deadline. To extend the period, the reason must be valid - illness, caring for a sick family member, funeral, wedding, administrative arrest, etc. But the reason will have to be confirmed. As an option, think about your chronic illnesses, run to the doctor, tell him that you have been feeling bad for two months now, but you have been patient, and let him write it all down in your chart. 2. Indicate in the statement of claim that you are asking to reinstate the missed deadline for a valid reason. 3. Attach to the claim documents confirming valid reasons for missing the deadline. Perhaps the court will believe you.

If you could not come up with a good reason, then there will be little chance of winning the case. However, you can still file a claim. And at the same time hope that the employer will not come to court and the decision will be made in his absence or that the employer will simply admit your claim.