General approach

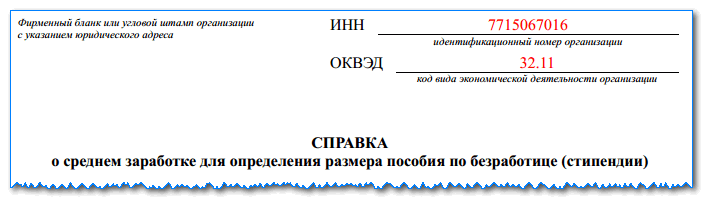

It is advisable to complete the certificate in question in one of 2 ways:

- On company letterhead.

- Place a corner stamp of the company indicating the legal address.

Here is the most important thing that needs to be reflected in the certificate of average earnings for the employment center in 2021:

- TIN and OKVED of the employer;

- FULL NAME. a former employee who requested a certificate;

- legal name of the enterprise;

- the entire period of work of the former employee;

- the amount of calculated average earnings for the last 3 months (in numbers and in words);

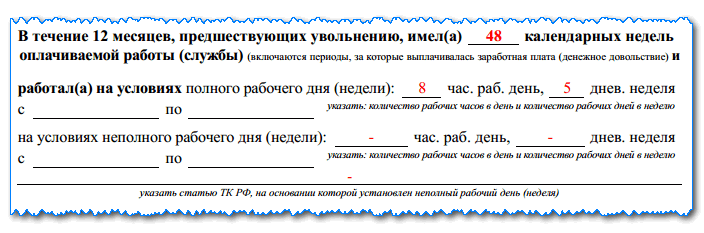

- number of calendar weeks of paid work 12 months before dismissal;

- the number of working hours per day and working days per week on a full-time basis, indicating dates;

- the number of working hours per day and working days per week on a part-time basis, indicating dates;

- article of the Labor Code of the Russian Federation, on the basis of which part-time work is established;

- periods excluded from the calculation (dates and reasons for exclusion);

- the basis for issuing the certificate (indicate the employee’s personal account, pay slips, etc.);

- FULL NAME. and signatures of the head of the organization and the chief accountant;

- date of issue of the certificate;

- phone number to contact the company.

New report form to the employment center from October 1, 2021

Each employment center develops its own report form. In addition, the report form is presented by Rostrud in letter 858-PR dated July 25, 2021. Regardless of which form the company fills out, it provides the following information:

- name of the company, its tax identification number and checkpoint;

- average number of employees;

- data on male and female employees born in 1959 and 1964. respectively.

No personal information is provided in this report. You will only need to indicate the number of employees of pre-retirement age working in the company, as well as the number of dismissed workers (including those who were dismissed at the initiative of the employer). If there are no such employees, then you need to submit a zero report (

Calculation procedure

The procedure for calculating the average wage for unemployment benefits was approved by the Ministry of Labor in a separate document, and is reflected in the Appendix to the Resolution of the Ministry of Labor of the Russian Federation No. 62 of August 12, 2003. It is in many ways similar to the scheme for calculating travel allowances, vacation pay and other payments calculated taking into account average earnings, but still has some differences.

This is important to know: Notice of job reduction: sample 2021

Thus, for the employment service, average earnings are calculated for the last 3 months of work preceding the month of dismissal (as opposed to 12 months taken into account in other cases). The calculation includes all types of payments provided for by the remuneration system, incl. it includes (clause 2 of the Procedure):

salary (including those paid in kind),

various coefficients, bonuses and additional payments (regional, under special working conditions, for length of service, combining positions, etc.),

bonuses, remunerations, including annual and one-time ones for length of service,

royalties, royalties (to employees of creative organizations, media),

other employee benefits accepted by the company.

The periods specified in clause 4 of the Procedure are not included in the calculation, including the time when:

the employee retained his average salary,

the employee was paid benefits (sick leave or maternity leave),

the employee was idle due to the fault of the employer (or for other reasons beyond the control of the parties),

additional paid days off were used to care for a disabled child,

the employee could not work due to the strike, although he did not participate in it,

the employee was released from work (with or without preservation of earnings),

When working on a rotational basis, time off was provided for overtime, as well as in other cases provided for by law.

If the employee did not have accrued earnings in the billing period, or the entire period consists of excluded days, the previous three-month period in which the accruals were taken is taken for the calculation. When there was no earnings in previous periods, the average earnings are calculated from the actual salary for the days worked in the month in which the employee was fired.

First, the employee’s average daily earnings are determined by dividing the amount of payments by the days worked in the billing period. The result obtained is multiplied by the average monthly number of working days in the same period. The result will be the average earnings for 3 months, reflected in the certificate.

Submitting labor safety reports

| Name | Submission deadlines | Normative base |

| Form No. 1-T (Working conditions) | January 20th | Appendix 2 to the order of Rosstat dated August 6, 2021 No. 485 |

| Form No. 7 – injuries | January 25 (annually) | Order of Rosstat dated June 21, 2021 No. 417 |

| Form 4-FSS | No later than the 20th day of the calendar month following the reporting period. In electronic form – no later than the 25th day of the calendar month following the reporting period (I quarter, half year, nine months, year) | Order of the FSS of Russia dated September 26, 2021 No. 381 |

| Report on the use of insurance contributions for compulsory social insurance | Quarterly along with form 4-FSS | Appendix 1 to the letter of the FSS of Russia dated February 20, 2021 No. 02-09-11/16-05-3685 |

Help for determining unemployment benefits: filling out

Filling out the informative part of the certificate is standard; the document indicates:

name of the organization and period of work in it;

the amount of average earnings received for the last three months of work before the month of dismissal (indicated in numbers and words);

length of the working day and working week;

details and signatures of the manager and chief accountant responsible for drawing up the certificate;

date of completion of the document and contact information.

The lower part of the certificate is reserved for completion by the employment service authority.

An example of a certificate for unemployment benefits and calculation of average monthly earnings

Let's calculate Starovoytov's average daily earnings:

You can always view the full texts of regulatory documents in the current edition in ConsultantPlus.

An employee dismissed for any reason needs time to find employment. During the period of job search, he has the right to contact the Employment Service and register. To assign and pay a citizen who is officially unemployed, you will need to provide a certificate of average earnings.

When is it issued?

An employee has the right to receive such a certificate upon application. It is not included in the mandatory package of documents that are issued on the last day of work. The employer’s responsibility is to formalize it and issue it to the citizen within three days from the date of receipt of the application (Article 62 of the Labor Code).

This is important to know: Certificate of acceptance of transfer of services provided: sample 2021

The opportunity to order it from an employee arises:

- at the time of dismissal;

- during the period of service before dismissal (upon application, a certificate will be issued on the day of dismissal);

- at any time after dismissal.

An application for the issuance of a document does not have a strictly established form. It is issued randomly in the name of the head of the organization with a request to issue a certificate of average earnings for submission to the employment service authority.

What regulates the procedure for issuing and the form of the certificate?

In accordance with paragraph 2 of Article 3 of the Law of the Russian Federation No. 1032-1 of April 19, 1991 (as amended on December 11, 2018) “On Employment in the Russian Federation”, a certificate of average monthly wages for the three full months preceding dismissal is one of the mandatory documents provided to obtain unemployed status. This certificate is used to determine the amount of unemployment benefits, which is calculated by the employment center where the fired person is registered.

The certificate is issued by the employer at the request of the dismissed employee. No legislative norm contains a direct indication of the period during which the employer issues a certificate of earnings for unemployment benefits. However, part 4 of Art. 84.1 of the Labor Code of the Russian Federation establishes the employer’s obligation to issue to the dismissed employee on the day of dismissal, in addition to the work book, “work-related documents,” which, according to the rule of Art. Labor Code of the Russian Federation, can also include a certificate for unemployment benefits (it is also a certificate of the average monthly salary for the last three full months of work). When a former employee who was dismissed earlier applies to the employer for the issuance of such a certificate, Part 1 of Article 62 of the Labor Code of the Russian Federation comes into force, according to which the document is provided upon a written application within three working days from the date of its submission.

For what period is the information provided?

The main value in the certificate is the average amount of income paid to the employee over the last three months of work in the organization. The rules for its calculation are given in the appendix to the Resolution of the Ministry of Labor and Social Development dated August 12, 2003 No. 62 (hereinafter referred to as the Rules).

The calculation period for establishing average earnings is 3 full calendar months that the citizen worked before dismissal.

For example, if an employee is dismissed on May 17, 2020, the certificate must contain information about earnings for the period from February 1 to April 30.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

To calculate the average value of remuneration amounts, all payments that were made by the employer during the specified period are taken into account. This includes:

- wages in cash or in kind;

- all types of allowances and additional payments that were established and accrued to the employee;

- bonuses and other remuneration.

Days and amounts accrued for them are excluded from the three-month period if the employee did not work for the following reasons:

- being on a business trip, vacation, etc.;

- illness or maternity leave (being on a certificate of incapacity for work and receiving appropriate benefits);

- being on additional paid leave related to caring for a disabled child;

- downtime due to the fault of the employer or other reasons beyond the control of the employee;

- days of rest or time off granted for overtime in accordance with the law;

- days of release from work with pay (full or partial) or without pay;

- the period of the strike, when the employee did not participate in it, but the situation prevented him from carrying out labor functions.

What if there were no salaries or days worked during the last three months? In accordance with paragraph 5 of the Rules, average earnings must be calculated from the amounts of income for the previous estimated time period.

For example, an employee was fired on 06/05/2020. From 01.03 to 30.05, i.e. He was on sick leave for all three months of the billing period. Then the average earnings will be calculated for the previous 3 months - from 12/01/2018 to 02/31/2020.

The situation with the lack of actual earnings in the billing period and before it is explained in paragraph 6 of the Rules. In this case, the amount of earnings actually received by the employee for the days worked in the month of dismissal is determined.

What items must be completed in the certificate?

The certificate form was recommended by the Ministry of Labor in letter No. 16-5/B-421 dated August 15, 2016. However, the text of the document contains a clarification that if the certificate is not issued in the specified form, but contains all the necessary details, there are no grounds for refusing to accept it.

Therefore, it is important to comply with the conditions for the availability of the necessary information and follow the rules for filling it out.

The certificate for the employment service must be filled out on the organization's letterhead or A4 sheet, where the employer's stamp with its full name is affixed in the upper left corner. The document must contain the following information:

- TIN of the employer who issued the certificate;

- OKVED organization;

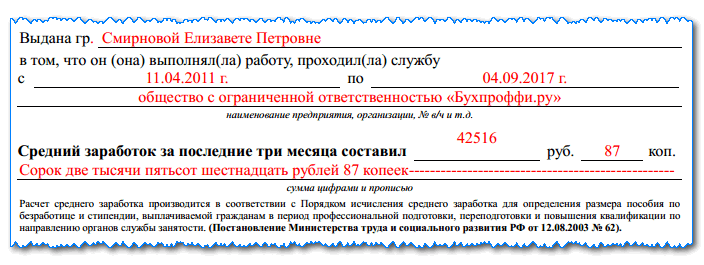

- Full name of the citizen at whose request the certificate is issued;

- the period of work of the citizen in this organization (start and end date);

- full name of the company or full name of the individual entrepreneur;

- working conditions are filled in in the corresponding lines of a full or part-time working day or week (number of hours of the working day and days of the working week);

- if the employee worked part-time or a week, the article of labor legislation on the basis of which such work mode was applied should be clarified below;

- average earnings based on the last three calendar months of work in numbers and words;

- documents that served as the basis for calculating average earnings (employee personal accounts and other payment documents);

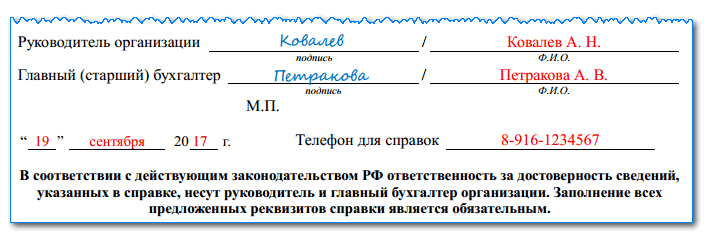

- signatures of the head of the company and the chief accountant with a transcript;

- date of completion and contact telephone number;

- seal of the organization (if available).

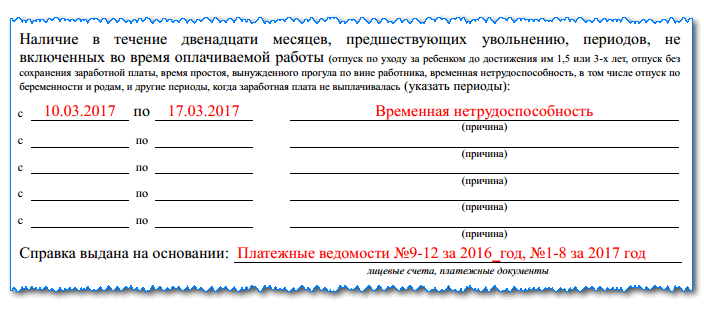

If there are periods that were not taken into account in the calculation, they must be listed in the certificate, indicating the beginning, end and reason for not being included.

This is important to know: Retirement length: minimum work experience in Russia for calculating a pension in 2021

Certificate of average earnings for the employment center: how to fill it out correctly

When an employment contract with an employee is terminated, he may not immediately find a job, but register with the employment service at his place of residence. To carry out this procedure, this government agency will require the collection of a certain package of documents, among which a special place is occupied by a certificate of average earnings for the employment center.

In what cases do you need a certificate of average earnings?

These amounts will be paid to the former employee of this service within a specified period, during which a new job will be found for him.

At the same time, a person can register without this certificate, since it is not part of the documents required for this procedure. But if the dismissed employee does not provide it, the benefit will be calculated according to the minimum amount in accordance with the rules of law. This rule is enshrined in employment legislation.

At what point should a certificate be issued?

A certificate of average earnings for determining unemployment benefits is not part of the mandatory documents that the administration must draw up at the time of termination of an employment contract with an employee.

It is drawn up when a fired or resigning person receives a request for the head of the company. According to the law, the accounting department is obliged to draw up this document within three days from the date of submission of the application for the generation of this form.

Except for the case when he asked to give it away while still an employee of the company. In this case, it is drawn up and transferred to the person being dismissed on the last day of work of this person.

For what period should information be provided (for how many months)

The Employment Law regulates that a certificate of average earnings for an employment center must be drawn up for three full months preceding the date of dismissal of the employee.

This norm distinguishes this process of determining average earnings from calculations according to the general rule. For example, if you quit on September 18, the payroll period is taken from June 1 to September 1.

From this time, the accountant must exclude the following periods:

- Vacation time, when his place of work was retained and vacation pay was paid;

- Periods of incapacity;

- Downtime that occurred through no fault of the employee;

- Time off;

- The time of child care provided to the employee additionally, for which payment was made;

- The period of a strike when the dismissed person did not take part in it, but because of it could not work;

- The time when the employee did not work with payment of wages in whole or in part.

- Periods when the employee used his time off.

Certificate of average earnings for the employment center form 2021 sample

Help for the employment center 2021 free form of the Ministry of Labor in Word format.

Certificate form for the employment center about average earnings for Moscow in Word format.

Download a sample of filling out a certificate for an employment center using the Ministry of Labor form in Pdf format.

Download a sample of filling out a certificate for an employment center using the Moscow form in Pdf format.

Certificate of average earnings to the employment center sample filling out 2021

There are two types of this certificate. There is an official form that was developed and put into effect by the Ministry of Labor in 2016. Let's look at how to fill it out correctly. It should be noted that there are no official rules for drawing up a certificate.

Sample of filling out a certificate for an employment center according to the Ministry of Labor form

In the upper right corner you need to put a stamp with the company details. Opposite it on the left are the TIN and OKVED codes. The latter is placed without text decoding.

In the column “Issued by card.” full name must be indicated. the employee for whom the document is being filled out. After this, the dates defining the beginning and end of the period of work at the enterprise are entered in columns “From” and “To”. The full name of the company or full name is written under them. entrepreneur.

Next, the accountant determines the average earnings for the previous 3 months, and enters the result into the certificate, first in numbers and then in words.

Next, you need to indicate in numbers the number of weeks during which he worked for the company over the past 12 months.

Next, columns are displayed where you need to indicate the number of hours per day and the number of days per week during which the employee performed duties on a full-time and short-time basis. If the work was carried out part-time, then in the column below you need to write down the article of the Labor Code that served as the basis for determining such a schedule.

Next comes a block graph of 7 pieces (we had 5 pieces - they reduced it because it didn’t fit), in which you need to enter periods for the last 12 months during which the employee did not receive wages (this could be vacation without pay, sick leave, idle time etc.). The information is indicated in the following form: the start and end dates of this period, as well as its name.

In the column “Certificate issued on the basis” information about the documents on the basis of which the filling was made is recorded.

The certificate must be signed by the director and chief accountant, with a transcript of their signatures, after which the date of registration of the certificate and a contact telephone number for clarification of information are indicated below.

If any of the lines is not used (for example, in conditions of a short day he did not perform labor duties), a dash is placed in these columns.

In addition, each of the subjects of the country has the right to develop and implement its own certificate form. In this case, most often regional authorities require the provision of certificates in their own form. Typically, this option is simpler and contains fewer required fields for entering data.

What will happen to the employer for failure to issue a certificate?

Refusal to issue a former employee with a certificate for the employment service is an unlawful act for the employer. Therefore, a citizen has the right to contact the supervisory authorities with a corresponding complaint. You can submit it to the state labor inspectorate, the prosecutor's office, or both bodies at once.

Then the employer’s actions will be subject to verification and punishment in accordance with the provisions of paragraph 1 of Art. 5.27 Code of Administrative Offences. This is a warning or fines in the amount of:

- to an official 1-5 thousand rubles.

Taking into account the legislative innovations in 2021 regarding the increase in unemployment benefits by virtually doubling, there will be a tendency towards an increase in those wishing to “relax” at the expense of the stock exchange. The desire to receive the maximum possible payments will add more work to accountants in terms of how to calculate the average earnings for an employment center without offending the former employee and without falling into the category of fines.

Answers to common questions

Question: If our company hasn’t received a notification from the employment center about submitting a new report, then we don’t need to submit it?

Answer: Not really. The fact is that the company may simply not reach this notification. Therefore, even if the company does not and has not previously had men and women with the required years of birth, it would be useful to call the employment center and clarify the information.

Question: Do I need to submit a zero vacancy report?

Answer: No, if there are no available jobs, then there is no need to submit information. However, if the employer has found an employee, then the employment center must be notified about this.