Why do you need a vacation reserve?

The Labor Code of the Russian Federation provides all employees with the right to annual paid leave. Each employer bears mandatory expenses for:

- vacation pay;

- or monetary compensation for unused days.

Companies and individual entrepreneurs plan vacations for all employees in advance. For this purpose, a special document is drawn up - a vacation schedule. The duration of annual rest for employees is 28 calendar days, but for some categories an extended vacation period is provided (Article 115 of the Labor Code of the Russian Federation). Compensation for vacation days not used by the employee is paid upon dismissal.

Calculate the period and amount of compensation using the online calculator on our portal.

Therefore, the organization needs a reserve of money from which not only vacation pay or compensation will be paid, but also contributions to extra-budgetary funds. Such a stock is created in the current period and used in the future. For example, the creation of a reserve for vacation pay for 2021 was formed in 2021. And in the current one, employers will reserve money for 2022.

ConsultantPlus experts examined the creation and restoration of a reserve for vacation pay in tax accounting. Use these instructions for free.

to read.

Vacation reserve right or obligation?

In accounting, the formation of a vacation reserve became mandatory for all organizations with the entry into force of the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n.

Only small businesses, with the exception of issuers of publicly offered securities, as well as socially oriented non-profit organizations, may not create a reserve.

In accounting, a reserve for vacations, like a reserve for any other estimated liabilities, is created with the aim of uniformly including future expenses in the production or circulation costs of the reporting period.

With regard to tax accounting, an organization has the right to choose whether to form a reserve or not.

PBU 8/2010 does not directly indicate what exactly should be classified as estimated liabilities. The liability must be recognized as an estimate and created in accounting if certain conditions are met.

Let us briefly comment on each of the criteria to make sure that the vacation reserve is indeed an estimated liability.

Firstly, due to the provisions of labor legislation, the organization has a duty to its employees. After six months of continuous work, the employee has the right to annual paid leave, and the organization, accordingly, has the obligation to provide leave while maintaining the place of work (position) and average earnings (Article 114, Article 122 of the Labor Code of the Russian Federation). The employer cannot avoid fulfilling this obligation, otherwise he will be held accountable.

Secondly, the fulfillment of this obligation will lead to a certain outflow of funds; the organization will pay vacation pay to employees, i.e. will bear the costs.

Thirdly, the amount of this estimated liability - the reserve for vacations - can be reasonably estimated.

How exactly to evaluate this obligation is not specified in Russian accounting standards.

If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method based on accounting provisions, as well as International Financial Reporting Standards (clause 7 of PBU 1/08).

Accordingly, companies have freedom of choice regarding the reserve formation methodology. The organization must develop its own methodology and prescribe it in the accounting policy or other local act of the organization.

The approved reserve formation methodology serves as documentary evidence of the validity of the reserve assessment. This will avoid questions and disputes with regulatory authorities.

The validity of the reserve being formed is also confirmed by the calculation of upcoming vacation expenses. It can be carried out automatically in the program or calculated manually. The calculation must be made on the basis of primary documents, for example, regulations on remuneration, staffing, vacation schedules, personnel records.

The estimated liability must be recognized in the organization's accounting records in an amount that reflects the most reliable monetary estimate of the expenses necessary to settle this liability.

The principal amount of the estimated vacation liability is calculated as the product of the number of vacation days unused by all employees of the organization at the end of the quarter (according to personnel records) by the average daily earnings for the organization for the last six months.

So, what exactly needs to be written down in the accounting policy?

First, you need to decide whether you will create a reserve for each employee or for all employees as a whole. In the first case, to determine the reserve for the entire organization, we sum up the reserves for all employees.

Secondly, it is necessary to establish in the accounting policy the frequency of deductions. There are two options:

· make periodic contributions – quarterly;

· create a reserve based on the number of vacation days not taken by employees at the end of each month.

Thirdly, it is worth specifying whether, when forming a reserve, you will increase the principal amount of the estimated liability by the amount of mandatory contributions to the Social Insurance Fund of the Russian Federation, the Pension Fund of the Russian Federation, for medical insurance and for insurance against industrial accidents.

Fourthly, you need to select the period for which the average daily earnings will be calculated and what payments will be taken into account in the calculation. In our opinion, the calculation should be carried out taking into account the established methodology for calculating average earnings.

Thus, at present, the organization still has the right to develop, depending on its capabilities and needs, the most optimal methodology for itself.

The ideal option would be to form a reserve at the end of each month for all employees based on the number of rest days they earned during that month and average earnings. But this is very labor-intensive.

Now programs are being created to automate this process, but this requires additional costs.

It is possible to establish in the accounting policy for accounting purposes the creation of upcoming expenses for vacation pay in accordance with Art. 324.1 of the Tax Code of the Russian Federation.

Based on the results of the reporting period, the actual accrued amounts of vacation pay may differ from the amount of the formed reserve for a given year.

Therefore, after the expiration of the reporting period, it is necessary to conduct an inventory of the vacation reserve.

Based on the inventory results, two options are possible:

1) vacation in the current year is not fully used by the employee - the amount of the reserve for the remaining days is transferred to the next year.

2) a lack of reserve is identified - it is necessary to make additional accruals and include them in labor costs.

Clarification is made based on the number of days of unused vacation, the average daily amount of labor costs.

Nazarenko Tatyana Alexandrovna

April 2015

View “Entire list”

Who creates

Accounting regulations stipulate who is obliged to create a vacation reserve - this is the responsibility of not only government organizations, but also all legal entities. An exception is made only for organizations that maintain simplified accounting. For commercial organizations and non-profit organizations, the responsibilities are prescribed:

- in paragraph 3 of PBU 8/2010;

- Articles 4 and 5 402-FZ dated 06.12.2011.

Budgetary institutions form reserves according to the Federal Accounting Standards, approved by Order of the Ministry of Finance No. 124n dated May 30, 2018 “Reserves. Disclosure of Contingent Liabilities and Contingent Assets.”

Tax accounting of contributions to the reserve

Take into account the monthly amount of contributions to the reserve when calculating income tax as part of labor costs (clause 24 of article 255 of the Tax Code of the Russian Federation).

The moment when the amount of deductions is included in the tax base depends on whether the payments for which one or another reserve has been created are direct or indirect expenses (clause 1 of Article 318, clause 2 of Article 324.1 of the Tax Code of the Russian Federation). Organizations can independently establish in their accounting policies a list of direct costs associated with the production of goods, performance of work or provision of services (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Accordingly, the accountant has the right to make his own decision about which expenses (direct or indirect) to include contributions to the reserve. For example, the cost of creating a reserve to pay for vacations of employees directly involved in the production process can be classified as direct expenses if, according to the accounting policy, their salaries are included in direct expenses. At the same time, the accountant has the right to choose a different procedure. For example, include all contributions to the reserve as indirect expenses, regardless of whose vacation it is formed to pay for - employees involved in production, or people not directly related to the production process.

Such conclusions follow from the letter of the Ministry of Finance of Russia dated September 16, 2013 No. 03-03-06/1/38134.

Deductions to the reserve, which relate to direct expenses, should be taken into account when calculating income tax as products (works, services) are sold, in the cost of which they are taken into account (paragraph 2, clause 2, article 318 of the Tax Code of the Russian Federation). Deductions to the reserve, which relate to indirect expenses, should be taken into account when calculating income tax at the time of accrual (clause 2 of Article 318 of the Tax Code of the Russian Federation).

If an organization provides services, then direct costs, as well as indirect ones, can be taken into account at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, contributions to the reserve for future payments to employees are recognized as indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation). Therefore, take them into account when calculating income tax at the time of accrual.

If, when forming and using a reserve, accounting and tax accounting data differ, the organization is required to maintain a separate tax register. Develop its form yourself. In particular, indicate in the register:

- register name;

- accounting period;

- monthly amount of actual labor costs;

- percentage of contributions to the reserve;

- monthly amount of contributions to the reserve;

- the spent reserve amount.

The register must be signed by the accountant responsible for its maintenance.

If the accounting and tax accounting data coincide, then the costs in tax accounting can be reflected on the basis of accounting registers.

Such rules are established by Article 313 of the Tax Code of the Russian Federation.

Situation: is it possible to create a reserve of expenses for the payment of remuneration at the end of the year at the end of the tax period? The accounting policy provides for the creation of a reserve, but the amount of monthly deductions is not established.

No you can not.

The reserve for future expenses for the payment of remuneration at the end of the year is created precisely for uniform, and not for one-time accounting of such deductions. The creation of a reserve in the current tax period must be enshrined in the accounting policy for profit tax purposes. At the same time, in the accounting policy it is necessary to record not only the fact of creating a reserve, but also indicate:

- method of reserving (the procedure for calculating monthly deductions, the composition of expenses taken into account when forming the reserve, etc.);

- monthly percentage of contributions to the reserve;

- maximum annual amount of contributions to the reserve.

This procedure is established by paragraphs 1 and 6 of Article 324.1 of the Tax Code of the Russian Federation.

If, when drawing up an accounting policy, an organization does not approve all the elements necessary to calculate the reserve, the tax office may challenge the legality of the decision to create it and exclude contributions to the reserve from expenses that reduce taxable profit.

Thus, the reserve for future expenses for the payment of remuneration at the end of the year should be formed throughout the entire tax period. The possibility of one-time formation of a reserve (for example, in December) is not provided for by law. Such a possibility would contradict the purpose of creating a reserve - the uniform distribution of expenses during the tax period (clause 1, 6 of Article 324.1 of the Tax Code of the Russian Federation).

In addition, the legislation does not provide for the possibility of making changes to the procedure for creating a reserve during the year and, on this basis, starting its formation in the last month of the tax period (Article 313 of the Tax Code of the Russian Federation).

How often should you do this?

The main task is to ensure that the organization always has money to pay vacation pay and compensation. At the reporting date, the amount of money reserved is equal to the amount that would have to be paid to employees if they simultaneously went on annual vacation. The law establishes the rules for the reserve for vacation pay - in PBU 8/2010 and Order of the Ministry of Finance No. 124n, the reporting date is set at the end of the year, that is, December 31. But experts believe that the best option is to create a reserve for vacations in tax and accounting on the last day of each quarter.

Vacation reserve as an estimated liability

According to PBU 8/2010 “Estimated Liabilities”, organizations must create certain amount-weighted liabilities in their accounting accounts. That is, financial statements must contain not only data on the company’s documented obligations to contractors and third parties, but also information on planned expenses that are inevitable.

For example:

- on future vacations of employees;

- planned tax assessments;

- costs for suppliers in terms of expenses that we know for sure that they will be (for example, if a work completion certificate already exists, but has not yet been signed, so it cannot yet be recorded, although it is known for sure that the director will sign the document will be held next month).

With the advent of this information, the balance sheet becomes the most reliable, since it reflects the most realistic picture of the financial position of the enterprise. Let's take a closer look at what a reserve for vacation pay is.

Each employee, in accordance with labor legislation, is entitled to at least 28 calendar vacation days, and in a number of legally established cases this figure may be higher. Thus, for each reporting date we have vacation days that have not yet been used by employees (it is difficult to imagine an organization in which all employees took 28 vacation days at once). Accordingly, for each reporting date, there are estimated obligations of the company to employees to pay for these days and, as a result, certain obligations to funds to pay insurance premiums.

Who is responsible for reporting this information? In accordance with paragraph 3 of PBU 8/2010, all companies are required to reflect these accruals, with the exception of small enterprises (issuers of securities are not included in such exceptions), which can use a simplified method of accounting. The characteristics of such companies are specified in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Thus, if a company does not fit the definition of a small business entity, the accrual of valuation reserves becomes mandatory, and the absence of this information on the accounting accounts may be regarded as a violation of the rules for accounting for income and expenses. Responsibility for this comes on two grounds:

- for gross violation of accounting for income and expenses under Art. 120 of the Tax Code of the Russian Federation in the amount of 10,000−30,000 rubles;

- administrative liability applied to officials under Art. 15.11 Code of Administrative Offences.

If a company creates a reserve for vacation pay, it is necessary to stipulate this in the accounting policy, as well as the procedure for calculating this reserve.

Method 1: personalized calculation

If an organization decides to calculate the vacation stock for each employee, the following formula is used:

RO = K × ZP,

Where:

- RO - vacation reserve;

- K - the balance of rest days not used by the employee;

- Salary is his average daily earnings.

IMPORTANT!

In all three cases, all data is taken on the day of calculation.

You also need to determine the amount of reserve to pay insurance premiums. The formula used for this is:

Рсв = К × ЗП × С,

Where:

- RSV - reserve of expenses for insurance premiums;

- C is the rate of insurance premiums.

Having summed up both obtained values, we get the amount that is reserved to pay for the vacation.

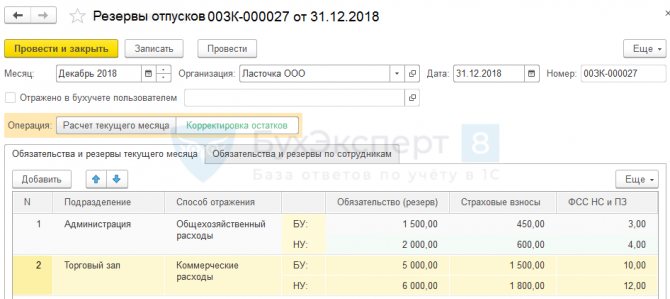

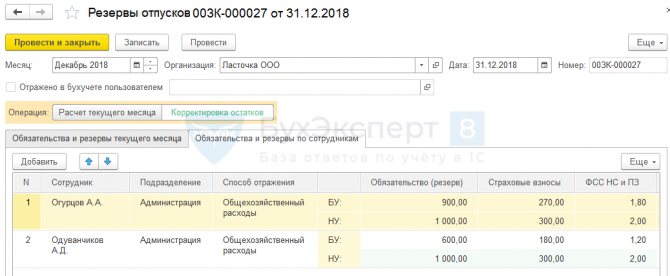

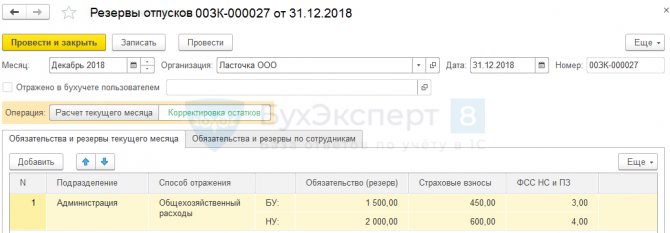

Entering balances of estimated liabilities and reserves

Entering initial balances for estimated liabilities and vacations is entered in the Vacation Reserves with the Operation set to the position Adjustment of balances :

Remainings can be deposited:

- On the tab Liabilities and reserves of the current month – in terms of divisions and methods of reflection. In the month following the entry of balances, this amount will be taken into account in calculations and distributed among employees proportionally.

- On the tab Liabilities and provisions for employees – in terms of employees and methods of reflection.

With this input method, the total data is then automatically collected on the Liabilities and reserves tab for the current month :

Calculation example using method 1

Let's give an example of calculating the reserve for vacation pay in 2021: the organization has three employees. The data on them is as follows:

- Ivanov: rest of vacation days - 5 calendar days, average daily earnings - 2000.00 rubles;

- Petrov: remaining days - 12 calendar days, average daily earnings - 1200.00 rubles;

- Sidorov: remaining days - 8 calendar days, average daily earnings - 1000.00 rubles.

First, we calculate vacation pay and contributions for each employee.

Insurance premium rates are:

- Pension Fund - 22%;

- Social Insurance Fund - 2.9%;

- FFOMS - 5.1%;

- FSS for injuries - 0.2%.

Thus, the total rate for calculation = 22 + 2.9 + 5.1 + 0.2 = 30.2%.

Calculation for Ivanov:

- Amount for reserve = 2000 rub. × 5 days = 10,000 rub.

- The total amount of contributions to the reserve for payment of basic holidays in terms of insurance premiums = 10,000 × 0.302 = 3020 rubles.

In total, Ivanov will need 10,000 + 3020 = 13,020.

Similarly, we get the figures for Petrov (RUB 18,658.20) and Sidorov (RUB 10,416).

Let's sum up the values for all employees. Total required to reserve 13,020 + 18,658.20 + 10,416 = 42,094.20.

An example of calculating and reflecting the vacation reserve in the accounting accounts

This is an example of the above method of calculating the reserve - based on average earnings. Below you will see examples for other reservation options.

Example

reflected in the accounting policy that the reserve for vacation pay is formed quarterly. To calculate wages and insurance premiums, account 44 “Distribution costs” is used; in total, the company employs 20 people. The company has no grounds for applying reduced or increased insurance premiums (the total rate of insurance premiums is 30.2%). As of March 31, the data for the quarter is as follows:

- number of days of unused vacation - 134;

- for the 1st quarter, the amount of accrued wages amounted to 678,000 rubles;

- there are 91 days in the quarter.

- Let's calculate the reserve as of 03/31/20XX:

SDZ = 678,000 / 91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 134 × 20,372.53 × 134 × 20 × 30.2% = 998,380.40 301,510.88 = RUB 1,299,891.28.

Postings:

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 998,380.40.

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 301,510.88.

- Let’s add a few more data to this example to understand how the vacation reserve is adjusted:

- as of 03/31/20XX, a reserve for vacation and insurance premiums was accrued in the amount of RUB 1,299,891.28;

- in the 2nd quarter, the amount of accrued vacation pay and insurance contributions from them amounted to 140,900 rubles;

- the number of unused vacation days at the end of the 2nd quarter is 120 days;

- wages for the 2nd quarter and the number of employees remained the same as in the previous period.

Thus, as of 06/30/20XX, the amount of the unused reserve amount is equal to 1,299,891.28 - 140,900 = 1,158,991.28 rubles.

Reserve amount as of 06/30/20XX:

SDZ = 678,000 /91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 120 × 20,372.53 × 120 × 20 × 30.2% = 894,072,270,009.74 = RUB 1,164,081.74.

Amount for contributions to the reserve as of the end of the 2nd quarter:

1,164,081.74 (calculated reserve) - 1,158,991.28 (reserve balance, balance in account 96) = 5,090.46 rubles.

If the amount of the reserve on the account. 96 exceeded the calculated amount at the end of the quarter, the reserve should have been reduced. In our case, it is necessary to make an additional accrual posting.

Postings:

Dt 44 Kt 96.01 - 5,090.46 rub.

Calculation example using method 2

Let's consider another option for creating a reserve for vacations in accounting and tax accounting with an example of calculation in 2021. Let's say that employees of an institution have accumulated 450 days of vacation, and the average daily salary is 1,500 rubles.

The additional amount will be 1500 rubles. × 450 days = 675,000.

The total rate is 30.2%, so the amount to pay insurance premiums = 675,000 × 0.302 = 203,850.

Total required to reserve 675,000 + 203,850 = 878,850.

Why are reserves created for tax purposes?

Article 25 of the Tax Code of the Russian Federation offers two options for accounting for vacation pay as part of labor costs:

- or on the basis of clause 7 (as expenses in the form of average earnings retained by employees during the vacation period provided for by the legislation of the Russian Federation);

- or on the basis of clause 24 (in the form of deductions to the reserve for the upcoming payment of vacations to employees, carried out in accordance with Article 324.1 of the Tax Code of the Russian Federation).

The creation of any reserve in tax accounting pursues the goal of uniformly including future expenses in expenses that reduce the taxable base for income tax.

For example, employees of an institution involved in income-generating activities go on vacation “unevenly” (as a rule, the number of vacationers in the summer is much higher than at other times of the year). In this case, the size of the income tax base may fluctuate significantly, and during the period of mass holidays a loss may even occur. To avoid such a situation, it is advisable to create the specified reserve.

Calculation example using method 3

Let the data for employee categories at the beginning of the year be as follows:

- for management personnel: rest of vacation days - 300 calendar days, average daily earnings - 2000.00 rubles.

- for business personnel: remaining days - 200 calendar days, average daily earnings - 1200.00 rubles.

Reserve amount = 2000 rub. × 300 days + 1200 rub. × 200 days = 840,000.

The total rate is 30.2%, therefore, the amount to pay insurance premiums = 840,000 × 0.302 = 253,680.

A total of 840,000 + 253,680 = 1,093,680 should be reserved.

Calculation (estimate) of the reserve for vacation pay for 2021

| Line number | Index | Value, rub. |

| 1 | Estimated amount of vacation pay for the year | 600 000 |

| 2 | The amount of insurance contributions from the estimated amount of vacation pay for the year (line 1 x 30.2%) | 181 200 |

| 3 | Limit amount of contributions to the reserve (line 1 + line 2) | 781 200 |

| 4 | Estimated amount of labor costs for the year | 6 000 000 |

| 5 | The amount of insurance premiums from the estimated amount of labor costs for the year (line 4 x 30.2%) | 1 812 000 |

| 6 | Estimated annual amount of labor costs including insurance premiums (line 4 + line 5) | 7 812 000 |

| 7 | Percentage of monthly contributions to the reserve ((line 3 / line 6) x 100%) | 10% |

The calculated percentage of contributions to the reserve must be multiplied monthly by the amount of actual labor costs for the month (including insurance premiums).

The result obtained will be taken into account for tax purposes in accordance with clause 24 of Art. 255 Tax Code of the Russian Federation. It is necessary to ensure that the amount of the reserve accumulated on an accrual basis since the beginning of the year does not exceed the maximum amount established in the accounting policy. If this happens, then no contributions to the reserve will be made in the next month.

Let's use the data from example 1.

In 2021, monthly contributions to the reserve will be:

| Month | Actual labor costs (excluding vacation pay), rub. | Insurance premiums, rub. (column 2 x 30.2%) | Amount of contributions to the reserve, rub. ((column 2 + column 3) x 10%) | Reserve amount at the end of the month, rub. |

| 1 | 2 | 3 | 4 | 5 |

| January | 500 000 | 151 000 | 65 100 | 65 100 |

| February | 500 000 | 151 000 | 65 100 | 130 200 |

| March | 500 000 | 151 000 | 65 100 | 195 300 |

| April | 550 000 | 166 100 | 71 610 | 266 910 |

| May | 550 000 | 166 100 | 71 610 | 338 520 |

| June | 400 000 | 120 800 | 52 080 | 390 600 |

| July | 200 000 | 60 400 | 26 040 | 416 640 |

| August | 300 000 | 90 600 | 39 060 | 455 700 |

| September | 650 000 | 196 300 | 84 630 | 540 330 |

| October | 650 000 | 196 300 | 84 630 | 624 960 |

| November | 650 000 | 196 300 | 84 630 | 709 590 |

| December | 650 000 | 196 300 | 71 610* | 781 200 |

| Total | 6 100 000 | 1 842 200 | 781 200 |

* The maximum amount of contributions to the reserve is RUB 781,200.

Contributions to the reserve in January – November amounted to 709,590 rubles, so in December they are equal to 71,610 rubles. (781,200 - 709,590). Thus, labor costs will take into account the amounts of the accrued reserve (on an accrual basis):

– for the first quarter – 195,300 rubles;

– for half a year – 390,600 rubles;

– for nine months – 540,330 rubles;

– for the year – 781,200 rubles.

In accordance with paragraph 24 of Art. 255 of the Tax Code of the Russian Federation, deductions to the reserve for future expenses for vacation pay are included in labor costs.

If the taxpayer creates a reserve, the amount of actually incurred expenses, taking into account the costs of calculating insurance premiums, must be written off against the specified reserve (see Letter of the Ministry of Finance of the Russian Federation dated April 1, 2013 No. 03-03-06/2/10401).

In other words, the institution will reduce the tax base for income tax by the amount of contributions to the reserve calculated on the basis of the estimate, and not by the amount of vacation pay accrued in fact.

So, the creation of any reserve in tax accounting pursues the goal of uniformly including upcoming costs in expenses that reduce the taxable base. Moreover, if a significant part of the vacations occur in the summer, then reserving helps to save on income tax in the first half of the year, because part of the vacation pay will be taken into account in expenses before they are actually paid.

Let's determine the benefit of creating a reserve for vacation pay by comparing the situation from example 2 with the situation when the reserve was not created, and vacation pay during the year was accrued in the amount of 600,000 rubles, including for June - 100,000 rubles, for July - 300,000 rubles, for August – 200,000 rubles.

In expenses for the purpose of calculating income tax, expenses associated with the accrual of vacation pay will be taken into account as follows (on an accrual basis):

– for the first quarter – 0 rubles;

– for half a year – 130,200 rubles. (RUB 100,000 + RUB 100,000 x 30.2%);

– for nine months – 781,200 rubles. ((RUB 300,000 + RUB 300,000 x 30.2%) + (RUB 200,000 + RUB 200,000 x 30.2%) + RUB 130,200);

– for the year – 781,200 rubles.

| Reporting (tax) period | Vacation expenses* that reduce the tax base | The difference arising between the two tax bases** (column 2 - column 3) | The difference between the amounts of advance payments at the end of the reporting (tax) period* * * (column 4 x 20%) | |

| When creating a reserve | Without creating a reserve | |||

| 1 | 2 | 3 | 4 | 5 |

| I quarter | 195 300 | 0 | 195 300 | 39 060 |

| Half year | 390 600 | 130 200 | 260 400 | 52 080 |

| Nine month | 540 330 | 781 200 | -240 870 | -48 174 |

| Year | 781 200 | 781 200 | 0 | 0 |

*Including insurance premiums.

**Here the income tax bases are compared when creating a reserve for vacation pay and without creating one. The difference is formed “within” the year, and at the end of the year it is equal to zero. This is due to the fact that in both cases, “vacation” expenses were taken into account in the same amount, only in different ways.

* * *In this case, the vacation occurred in June–August, which led to savings in the payment of advance payments for the first quarter and half of the year.

How to reflect in accounting

In budget accounting, the accrual of financial reserves and all other operations with it are reflected in special postings. We have prepared an example of how the vacation reserve is formed in a table with accounting entries for budget accounting:

| Contents of operation | accounting entry | |

| Debit | Credit | |

| Formation | ||

| For vacation pay | KRB.1.401.20.211 | KRB.1.401.60.211 |

| For insurance premiums | KRB.1.401.20.213 | KRB.1.401.60.213 |

| Accrued expenses | ||

| For vacation pay | KRB.1.401.60.211 | KRB.1.302.11.730 |

| For payment of insurance premiums | KRB.1.401.60.213 | KRB.1.303.00.730 |

| Refinement upwards (downwards using the “red reversal” method) | ||

| For vacation pay | KRB.1.401.20.211 | KRB.1.401.60.211 |

| For payment of insurance premiums | KRB.1.401.20.213 | KRB.1.401.60.213 |

Reserve in accounting and reporting

The mandatory creation of a reserve for vacation pay is recorded in the accounting policy for accounting purposes. The calculation algorithm should also be explained there.

Postings for use

The formed reserve of funds is subject to reflection in the subaccount “Reserve for vacation pay” to account 96 “Reserves for upcoming expenses”.

When it is created, a posting is generated for the credit of this subaccount for the amount of deductions. Make an accounting entry so that the subaccount balance is identical to the calculated inventory.

Let's give an example of how a vacation reserve is formed in a table with postings:

| date of creation | |

| Reflection in accounting | Operation |

| Dt 20 (26, 44) Kt 96 - reserve for vacation pay | Accrued |

| Accrual date | |

| Dt 96 Kt 70 | Vacation pay accrued from funds |

| Dt 96 Kt 69 | Holiday pay contributions accrued |

Considering that the calculation of the reserved amounts is approximate, these funds are not always enough for a year. With this option, vacation amounts should be credited to the debit of expense accounts. Identical to how salaries are calculated.