As the deadline for pension payments approaches, many future pensioners are concerned about the issue of calculating length of service, which affects the size of the pension. This article will be a useful information resource that will help improve the competence of citizens of the Russian Federation in the matter of calculating and confirming length of service. The period of insurance coverage, in addition to the size of the pension, affects and is used to calculate sick leave and when calculating the employee’s vacation. In this article we will look at the rules for calculating and confirming the length of service of employees in 2021.

What is the difference between work experience and insurance experience?

According to the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation” (Article 2), length of service is the total duration of periods of work and other activities taken into account when determining the right to certain types of pensions under state pension provision, which are counted towards the insurance period for receiving a pension provided by Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (Article 3), the insurance period is the total duration of periods of work and (or) other activities taken into account when determining the right to an insurance pension and its amount, for which insurance contributions were accrued and paid to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period.

Thus, from the definitions it follows:

| Seniority | Insurance experience |

| seniority is the length of periods of work; length of service is taken into account when determining the right to certain types of pensions; The length of service is counted towards the insurance period for receiving a pension. | insurance period – duration of periods of work; the insurance period is taken into account when determining the right to an insurance pension and its amount; During the insurance period, insurance contributions are calculated and paid to the Pension Fund of the Russian Federation. |

How is an employee's length of service calculated?

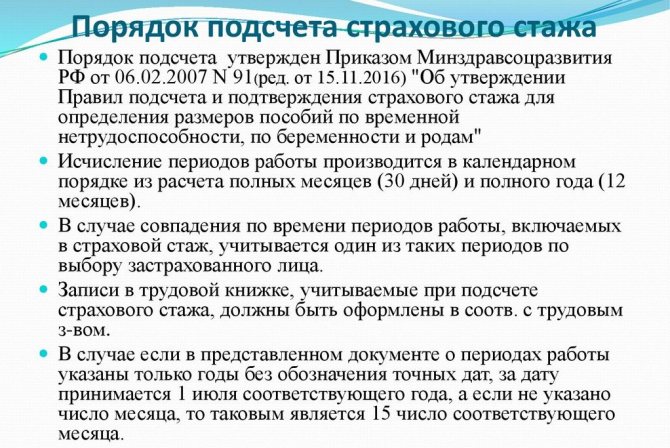

When calculating the insurance period, the calendar order is taken into account.

It should be noted that when calculating the insurance period for citizens of the Russian Federation, periods when the laws of other states influenced the establishment of pensions are not taken into account.

When calculating the insurance period, periods of work and other activities, information about the insured person posted in the Pension Fund of the Russian Federation in accordance with the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system” is used.

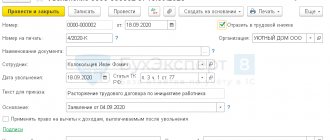

In accordance with the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions,” to calculate the length of service, it is necessary to take the information entered in the work book as a basis.

The employer is required to make entries in the work book taking into account the Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016) “On approval of the Instructions for filling out work books” (Registered with the Ministry of Justice of Russia on November 11, 2003 No. 5219).

What applies to insurance experience?

The rules for calculating and confirming insurance experience at the legal level are laid down in two documents:

- in Law No. 400-FZ of December 28, 2015;

- in Decree of the Government of the Russian Federation No. 1015 of October 2, 2014.

The term “experience” is understood as the sum of periods of work of a citizen:

- officially issued;

- for which transfers were made to the solidarity budget of the Pension Fund.

At the same time, the word “work” means any type of paid, socially useful activity. For example, creative individuals or individual entrepreneurs also work like workers in mines and factories. The main criterion for the insurance period is the payment of contributions:

- to the Pension Fund;

- to the Social Insurance Fund for Temporary Disability and Maternity (FSS).

Attention: the concept of insurance experience was introduced in Article 1 of Law No. 27-FZ of 04/01/1996.

The rules for calculating work periods are as follows:

- These are confirmed by entries in the work book (LC);

- In the absence of a Labor Code (or separate records), the period of labor can be proven with an archival certificate;

- If no documents have been preserved in the archive, then PFR specialists have the right to:

- use other documentary evidence;

- send the applicant to court to establish the fact of work.

Download for viewing and printing:

Federal Law of December 28, 2013 N 400-FZ, as amended. dated 12/19/2016 “On insurance pensions”

Decree of the Government of the Russian Federation of October 2, 2014 N 1015 (as amended on May 10, 2017) “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions”

Confirmation of length of service if there is no entry in the work book

For citizens whose work experience began before the application of individual (personalized) accounting in the compulsory pension insurance system, information about work experience can be provided by submitting the following documents containing information about work experience (Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval Rules for calculating and confirming the insurance period for establishing insurance pensions"):

- a written employment contract drawn up in accordance with labor legislation;

- a written contract of a civil law nature;

- collective farmer's work book;

- a certificate issued by the employer or the relevant state (municipal) body;

- extract from the order;

- personal account;

- salary slip.

Thus, if there is no entry in the work book, the employee can provide information about his work experience by presenting the documents specified in the normative act.

Based on the data available to the body providing pensions, the amount of the insurance pension is determined.

The procedure for confirming insurance experience

There are several ways in which you can prove past work experience. If you have supporting documents, you just need to present them to the PF employees. If they are missing, try to restore them through your former employer or through the archive.

When this fails, the following procedure for confirming the insurance period remains:

- prove your case in court;

- attract witnesses.

Judicially

You can take a case to court in the following cases:

- in the absence of supporting documents;

- the submitted papers contain errors and do not make it possible to prove the fact of work;

- the archive does not issue the necessary documents.

Article on the topic: How to calculate the insurance period and why it needs to be calculated

To file a claim, you can attract witnesses, find any documents from places of past employment and prepare confirmation of the employment relationship. If a negative decision is made, it can be appealed within ten days from the date of the decision.

The court application must indicate contact and personal information, information about the branch of the Pension Fund that does not recognize experience, a description of the problem and the reason for the appeal. The reason will be recognition of past employment. At the end you should indicate a list of all attached documents, sign and date.

Testimony

In the absence of evidence of insurance and general work experience, you can take advantage of the opportunity provided in accordance with Federal Law No. 400-FZ. They stipulate that in such a situation it makes sense to use the help of 2 or more witnesses, but only in the following cases:

- if the papers were damaged as a result of natural disasters and this can be proven;

- when personnel documents are destroyed through no fault of the employee.

IMPORTANT! This method is allowed to prove no more than half of the existing experience.

In addition, this method cannot be used to confirm special length of service not related to work. This applies to child care, military service, time of registration on the unemployment exchange and in other cases provided for by law.

In order to prove your case in this way, you need to fill out an application to the Pension Fund, which should indicate the reason for the appeal and the details of available witnesses. As an attachment, you will need to attach an archival certificate of absence of information.

What periods of an employee’s activity are taken into account when calculating length of service?

In Art. 20 of Federal Law No. 166-FZ states that if the assignment of a pension requires work experience of a certain duration, it includes periods of work and other socially useful activities that are counted in the insurance period required to receive a labor pension.

In accordance with Art. 11 and art. 12 of Federal Law No. 400-FZ of December 28, 2013, the insurance period includes the following periods:

- work periods;

- the period of military service, as well as other service equivalent to it;

- the period of receiving compulsory social insurance benefits during the period of temporary disability;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- period of receiving unemployment benefits;

- period of participation in paid public works;

- the period of relocation or resettlement in the direction of the state employment service to another area for employment;

- the period of detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

- the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144-FZ “On Operational Investigative Activities”;

- the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation.

Rules for calculating the insurance period for assigning an insurance pension

Calculation and confirmation of insurance experience is based on the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming insurance experience for the establishment of insurance pensions” (with amendments and additions).

According to this document, the calculation of the duration of periods of work, including on the basis of witness testimony, and (or) other activities and other periods is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days of periods of work and (or) other activities and other periods are converted into months, and every 12 months of these periods are converted into full years (clause 47).

Thus, when calculating length of service, all days worked are taken into account, which are gradually converted into months worked, which, in turn, are converted into years worked:

30 days = 1 month

12 months = 1 year

“Special” periods when calculating length of service

When calculating the insurance period, it is necessary to pay attention to “special” periods:

| Periods | Inclusion/non-inclusion in the insurance period |

| Periods taken into account when establishing a pension in accordance with the legislation of a foreign state | Do not turn on |

| Periods of activity of persons who independently provide themselves with work, heads and members of peasant (farm) households, members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors, periods of work for individuals (groups of individuals ) according to contracts | Included in the insurance period subject to payment of insurance premiums |

| Period of childcare by both parents | Each parent’s insurance record includes no more than 6 years of care, if they do not coincide in time or care is provided for different children. |

| The period of receiving compulsory social insurance benefits during temporary disability | Included in the insurance period regardless of the payment of mandatory payments for this period |

To quickly calculate your length of service, use: → “Calculator for calculating work experience in Excel.”

Counting Rules

The algorithm for calculating this indicator is based on the following rules:

- To determine the time of continuous work in one place, it is necessary to subtract the date of entry to the place of employment from the date of dismissal.

- The total length of service will be the sum of all periods specified in the previous paragraph.

- When calculating, each month is rounded to thirty days.

- If the number of individual days is more than thirty, they are combined into a month.

- All calculations are carried out in calendar order.

When making calculations, periods suitable for the purposes under study include:

- activities under contracts of various nature;

- different types of civil service;

- completing military duty;

- duration of illness;

- time spent caring for children, the elderly and disabled;

- staying registered in case of unemployment;

- periods of arrest if proven innocent;

- the time when the individual himself transferred mandatory contributions to the funds;

- living in a marriage with a military man in places where it is impossible to find work.

Related article: Is military service included in the insurance period?

IMPORTANT! This time will only be taken into account if the person had periods of official employment before or after it began.

To independently calculate the value in question, you can use online calculators located on Internet portals. They will calculate the total amount of experience when entering the requested information.

How to calculate the insurance period and why it needs to be calculated can be found here.

Common Questions Answered

Question No. 1. I was on maternity leave for a total of 7 years and 5 months. Is it really possible that the entire period of childcare will not be included in the insurance period?

Answer: According to the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions” (with amendments and additions), no more than 6 years of care are counted in the insurance period of each parent, if they do not coincide in time or care is provided for different children. Moreover, it is worth noting that the insurance period includes leave to care for a child until he reaches the age of 1.5 years, but in total no more than 6 years. Thus, 6 years of care will be included in the insurance period, 1 year 5 months will not.

Question No. 2. I have an entry in my work book that I was a member of a collective farm from 1992 to 1995. The Pension Fund told me that this period is not included in the length of service. Clarify please.

Answer: The fact is that having membership in a collective farm does not mean having work experience. To calculate work experience, it is necessary to have work activity, because in accordance with clause 66 of the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for the establishment of insurance pensions” (with amendments and additions), the calendar years indicated in the collective farmer’s work book, in which there were no not a single exit to work are excluded from the count.