What is simple

The Labor Code defines it as a temporary suspension of labor processes in an organization for reasons of an economic, technological, technical or organizational nature. The legislator does not establish a list of possible reasons, but any event that objectively prevents the continuation of work activity is the following reason:

- disaster;

- issuance of regulations that prevent the continuation of activities;

- lack of necessary materials;

- equipment breakdown.

There are reasons:

- due to the fault of the employer;

- independent of the parties;

- due to the fault of employees.

An important feature is the temporary nature of the stop: when the reasons are eliminated, work will continue.

How to record on a timesheet

To reflect this period, codes “RP” or “31” are provided. They are suitable if activities have been suspended for 1 or several days. If a person did not work for several hours during a shift, then additional lines can be entered into the timesheet. For example, due to a machine breakdown, a foreman worked only 4 hours out of 8. In this case, the following is written on the report card:

- the first line is the code “I” (“01”);

- second line - number 4;

- third line - code “RP” (“31”);

- the fourth line is the number 4.

If the suspension of activity is due to the fault of the employee, other codes are used - “VP” (“33”), and if the reasons for the downtime are objective - “NP” (32).

How to announce the start

Since the reasons are different, the documents initiating its introduction are also different. For example, if it is impossible to continue working because the equipment has broken down, the employee supervising work on the equipment sends a report to his superiors about what happened. This informs him about the need to enter a downtime. The memo is preceded by an act by which employees working with equipment record the breakdown and the impossibility of continuing their work. Regardless of the reason for the suspension, an order is issued to declare downtime. The report will become the basis for issuing the order and is attached to it.

Within three days from the moment of stopping work, the organization is obliged to notify the employment service about the suspension and the reasons - this rule is established by clause 2 of Art. 25 of Law No. 1032-1 of April 19, 1991. The form of notification should be clarified with the employment service located at the location of the employer. Notice is required if the employer stops production in whole or in large part. If work is stopped only for certain employees, there is no need to notify the employment office.

Algorithm for registering downtime due to the fault of the employer

Unfavorable situations leading to the inability to continue work as normal entail losses for the employer. Therefore, management has the right to reduce the amounts allocated for employee compensation. The main rule is to properly arrange production downtime. The algorithm is as follows:

- Upon receipt of verbal or written notification of the occurrence of conditions that stop the production process, management should make a decision to declare a shutdown as soon as possible.

- Then the culprits are identified. These could be employees of the company, the employer himself, or force majeure circumstances beyond the control of the parties.

- Downtime periods are determined. If it is impossible to designate a specific period, an indefinite suspension of production is declared.

- The issue of the presence of employees affected by downtime at the enterprise is being resolved.

- A written order is issued, which records all the above points. It is advisable to specify in the document the new form and amount of remuneration.

- Familiarize the entire workforce or part of the employees left without work with the order.

- Offer released employees a transfer to other available positions for the period of downtime while maintaining the average wage. According to Art. 72.2 of the Labor Code of the Russian Federation, employees can be transferred to vacant positions not lower than their current qualifications without their consent for a period of no more than 1 month. Transfer to a lower position is permissible only with the written consent of the worker.

- Notify the employment service about the situation that has arisen at the enterprise. According to paragraph 2 of Art. 25 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” No. 1032-1. This must be done if the enterprise temporarily ceases to function fully. Being late is fraught with a fine of up to 5 thousand rubles. Art. speaks about this. 19.7 Code of Administrative Offenses of the Russian Federation.

- Record downtime on time sheets. Code of envy depending on the situation: RP or 31 - it is the employer’s fault.

The more competent the paperwork is, the more money the company will be able to save on wages. If employees were not notified, but simply allocated less funds, this is a direct violation of the law. Also, furloughed employees cannot be required to perform work duties during downtime, even if they are actually present at work.

How to create an order

The suspension order is drawn up in the form approved by the organization. There is no legally established or recommended form.

The document includes information:

- justification for stopping work. Specify one of four reasons: economic, technological, technical or organizational in nature, without being more specific;

- moment of beginning;

- end moment. If it is difficult to determine the exact moment, write “until the causes are eliminated”;

- a list of employees or departments to which the order applies;

- payment order;

- It is permissible to indicate whether employees go to work during a specified period or can stay at home. The period is working time, so personnel must be at their workplaces. Absence without permission is equivalent to truancy. But if there is no need for employees to be present, the organization has the right to separately indicate in the order that employees are not required to be at the workplace during this period.

The employees who are affected by the order familiarize themselves with it by signing it.

So difficult and simple

The financial crisis has led to the suspension of the activities of some enterprises, causing downtime in organizations. In this situation, accountants need to pay employees for the downtime period, take these amounts into account for tax purposes and prepare the necessary documents. We will help you do it right. Please note that this article does not deal with downtime caused by the employee.

Payment for downtime Downtime is a temporary suspension of work for reasons of an economic, technological, technical or organizational nature <1>.

Moreover, we can talk about suspending the work of both one employee (for example, in case of a breakdown of the machine at which he works), as well as a unit (workshop, department, branch) and even the organization as a whole. Attention! A collective or labor agreement may provide for a higher rate of payment for downtime than is provided for by the Labor Code of the Russian Federation <3>.

Downtime can be caused by any external (for example, short supply of components by a counterparty) or internal (equipment damage, etc.) factors. Downtime is paid to any employee, including part-time workers <2>. An employer can have only one reason not to pay for downtime - if it is established that the employee is at fault for causing downtime. Downtime is paid in the amount established by the collective or labor agreement, but not lower than the amount established by the Labor Code of the Russian Federation <3>. According to the Labor Code of the Russian Federation, the minimum amount of payment for downtime is determined as follows <4>: if downtime arose due to the fault of the employer:

Note. The average salary must be calculated according to the Regulations on the specifics of the procedure for calculating the average salary <5>. Let us remind you that in this case all types of payments provided for by the remuneration system are taken into account <6>. When determining the average earnings of an employee with a summarized accounting of working hours, it is necessary to determine the average hourly earnings and multiply it by the number of working hours according to the employee’s schedule in the period subject to payment;

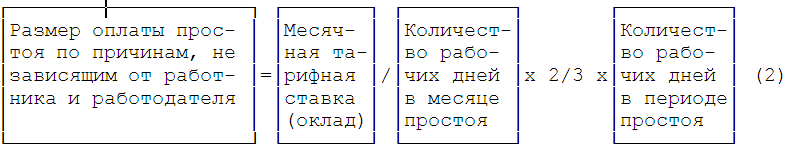

if downtime arose for reasons beyond the control of the employee and the employer: or with a monthly tariff rate (salary):

or at a daily rate:

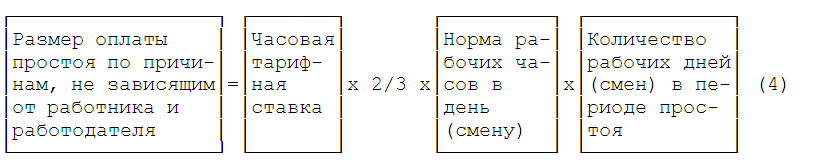

or at an hourly rate:

Sometimes it is difficult to understand whether downtime occurred due to the fault of the employer or for reasons beyond his control. If in such a situation we consider the downtime to have arisen for reasons beyond the control of the employer and the employee, and pay for it based on the employee’s tariff rate (salary), then there is a possibility that the labor inspectorate will not agree with this approach and will fine the employer <7> plus demand additional payment employees up to 2/3 of average earnings.

WARN YOUR MANAGER Even during an economic crisis, the reasons for downtime can be different. It is often difficult to determine whether downtime occurred due to the fault of the employer or for reasons beyond his control. In such cases, it is advisable to pay downtime in the amount of 2/3 of the tariff rate (salary). If the employee does not agree with this and goes to court, then the court will determine the presence or absence of the employer’s guilt.

On the other hand, if in this situation you pay for the downtime as having arisen through the fault of the employer (that is, based on the employee’s average earnings), then a conflict may arise with the tax authorities, who will consider it unreasonable to expense the difference between the amounts actually paid and the amounts to be paid during downtime. for reasons beyond the employer's control. Therefore, in such cases, you need to independently assess the possible consequences and decide on the amount of payment for the downtime period.

FROM AUTHENTIC SOURCES

KOVIAZINA NINA ZAURBEKOVNA - Head of the Department of Labor Relations and Remuneration of the Department of Labor Relations of the Ministry of Health and Social Development of Russia “The Labor Code of the Russian Federation separately identifies downtime due to the fault of the employer and for reasons beyond the control of the employee and the employer. But in practice, determining whose fault a downtime occurred can sometimes be quite difficult. In case of disagreement, the decision remains with the court. In my opinion, in a situation where the organization was let down by suppliers, it is not the employer’s fault, which means it is not his fault for the downtime. The employer is not to blame if he was unable to obtain a sufficient number of orders, although he tried to do so. Therefore, the downtime is not his fault either. Especially in times of crisis. So in both examples given, downtime is paid in the amount of 2/3 of the tariff rate (salary).”

Note. Please note that when calculating average earnings, the employee’s idle time and the amounts accrued during this time are excluded from the calculation period. <8>.

Registration of downtime

Since the amount of payment for downtime depends on the reason for its occurrence <9>, each case of downtime must be documented, establishing the cause of downtime. This is also necessary to account for expenses for profit tax purposes <10>. The Labor Code of the Russian Federation does not contain mandatory requirements for the content of documentation drawn up during downtime. Therefore, the employer must decide for himself how best to do this. In any case, the head of the organization needs to issue an order for downtime. Based on this document, as well as the working time sheet, the accountant will have to charge the employee payment for downtime.

“We are currently experiencing difficulties in production due to a lack of orders. The management has not yet started laying off workers, we are formalizing downtime. The director allows employees not to go to work during this time. We specifically indicate this in the downtime order. There is still no sense in their release. Otherwise, maybe they’ll earn extra money somewhere during this time.” Lydia, personnel officer, Orel

There is no unified form of order for downtime.

It usually records the start time of the downtime and its reason, and the duration of the downtime (if it can be determined at the time the order is issued). The order must indicate which employees (divisions) are idle. Also, if at the time of issuing the order about downtime it is already known whose fault it occurred, then this fact must be reflected in the order. The order can also indicate the amount of amounts paid to “idle” employees. A period of downtime is not a time of rest <11>, and “idle” employees must be ready to begin work as soon as the downtime ends. At the same time, during long downtimes, there is often no need for employees to go to work, since management knows that it will not be possible to eliminate the cause of the downtime in the near future. In this case, the head of the organization may, in a downtime order, allow employees not to go to work. If there was no special instruction in this regard, then employees must report to their workplaces during their working hours. However, in the downtime order, it is better to directly indicate the need for “idle” workers to be present at the workplace. This will allow you to subsequently avoid conflicts with them on this issue (for example, if the employee states that he received verbal permission from management to be absent from work during downtime). WARN YOUR MANAGER The order for downtime must indicate whose fault it arose, if this is known at the time the order was issued. Then you will know exactly how much you need to pay employees for the downtime period <12>.

FROM AUTHENTIC SOURCES

NINA ZAURBEKOVNA KOVIAZINA, Ministry of Health and Social Development of Russia “Recently, we have often been asked the question of whether an employee must be present at the workplace during downtime, especially if the downtime is protracted and it is known in advance that it will last several months. Employers complain that if employees are not at work at this time, tax inspectors refuse to recognize the costs of paying such employees for downtime. The possibility of an accident with an employee at home during downtime was even cited as reasons for the refusal: “It can’t be paid as an accident at work!” Allowing employees to remain away from work during downtime is in the best interests of both the employee and the employer. After all, then the employer does not have to bear the costs associated with workers staying at their workplaces, in particular, paying for electricity. And, in my opinion, if the decision on downtime states that the employee may not be present at the workplace, there are no violations.”

The “idle” employee must be familiarized with the contents of the order against signature. Here is a sample order for downtime that arose in connection with the forced suspension of production in the organization.

Limited Liability Company "Teremok"

ORDER N 2

02/06/2009 Moscow

Oh simple

Due to the failure of workshop No. 3 to complete the work due to the lack of profiled timber before its delivery

I ORDER:

1. From February 6, 2009, declare downtime for the following workers: Ilya Petrovich Korostelev (carpenter), Stepan Vasilyevich Sviridenko (carpenter), Veniamin Glebovich Kravtsov (loader). 2. The specified persons remain at their workplaces during working hours until the causes of downtime are eliminated or until they are temporarily transferred to another job with their consent. 3. Chief accountant L.D. Klyueva ensure: 1) familiarization of employees with this Order against signature; 2) payment for downtime in the amount of two-thirds of the employees’ salary, calculated in proportion to the downtime.

General Director __________________ V.I. Plushenko

Notification of the employment authority

Since January 1, 2009, employers are required to notify employment authorities of the suspension of production. This must be done within 3 working days after the decision to suspend production is made <13>.

Attention! Since January 2009, employers have been required to notify employment authorities of the suspension of production.

Liability for the employer’s failure to fulfill the obligation to notify the employment authority about the suspension of production is not directly established. However, it is not excluded that the employer may be held administratively liable for failure to submit or untimely submission to a state body (official) of information (information), the submission of which is provided for by law, which entails the imposition of a fine: - on the organization in the amount of 3,000 to 5,000 rubles; — per manager in the amount of 300 to 500 rubles. <14> Current legislation does not contain requirements for the content of such a notice. Therefore, notification to the employment authority can be issued in any form, for example, as follows.

Teremok LLC

Moscow, st. Snezhnaya, Head, 43, building 1, Employment Center tel.: 111-11-11 Eastern Administrative District of Moscow Ref. N 13 dated 02/06/2009

NOTIFICATION

I hereby inform about the suspension of production and the occurrence of downtime from 02/06/2009 for an indefinite period for 3 workers: a carpenter (1 person), a carpenter (1 person), a loader (1 person).

General Director __________________ V.I. Plushenko

Reflection of the downtime period in the timesheet

The downtime period must be taken into account in the report card according to the unified form N T-12 or T-13 <15>. In this case, in column 4 of form N T-13 or columns 4, 6 of page 2 of form N T-12 of the timesheet, an alphabetic or numeric downtime code is reflected. Please note that, depending on the reasons for the downtime, the following code is entered in the timesheet: <or> “RP” or “31” (in case of downtime due to the fault of the employer); <or> “NP” or “32” (for downtime for reasons beyond the control of the employee and the employer). Under the code you need to indicate the duration of the downtime. And if the downtime did not last the entire working day, but only part of it, then additional columns are entered into the timesheet in order to reflect how much time the employee worked and how much he was idle.

Transferring an employee to another job during downtime

In the event of forced downtime at the employer, caused by a reduction in production volumes during the financial crisis, the employee can be temporarily transferred to another job only with his consent. The fact is that the right to transfer an idle employee without his consent to another job with the same employer is possible only if the following three conditions are simultaneously met <16>: - the duration of the transfer is up to a month; - downtime caused by emergency circumstances (natural or man-made disaster, industrial accident, industrial accident, fire, flood and any other exceptional case that threatens the life or normal living conditions of the entire population or part of it); - the employee is transferred to a job that does not require lower qualifications. Accordingly, an employee’s refusal to transfer in other situations is not a violation of labor discipline and cannot lead to disciplinary action against the employee <17>. A transfer during downtime, as in all other cases of transfer from the same employer, is formalized by a transfer order in Form N T-5 or T-5a <18>. The employee must be familiarized with the transfer order, and here you can obtain his consent to the transfer.

“As I understand it, during downtime it is necessary to pay sick leave to employees. Indeed, according to Law N 255-FZ, benefits are not assigned for periods of release of an employee from work and for unpaid periods of suspension from work. And downtime according to the Labor Code is interpreted as a temporary suspension of work and does not apply to cases of release from work or suspension from work.” Olga, accountant, Moscow

The time worked by the transferred employee is taken into account in the usual manner.

Therefore, there are no special features in filling out the timesheet in this case. Please note that an employee temporarily transferred during downtime must be paid according to the work performed, but not less than the average earnings for the previous job <19>. Payment for the period of temporary disability of an employee during downtime

If an employee falls ill during the downtime period, then instead of paying for the downtime, he needs to be paid temporary disability benefits based on the sick leave certificate he submitted. To determine the amount of temporary disability benefits in such a situation, the accountant needs <20>: 1) determine the amount of temporary disability benefits that the employee would receive under normal circumstances.

Attention! The maximum amount of temporary disability benefits in 2009 is 18,720 rubles. for a full calendar month <21>.

Moreover, when calculating the amount for sick leave, the average earnings must be determined according to the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance <22>; 2) determine what amount would be due to the employee when paying for downtime; 3) compare the amounts received; 4) pay the employee the lesser amount received.

Note. There is a point of view according to which benefits for the period of inactivity are not paid. It is based on attributing downtime to periods of employee release from work, for which benefits are not assigned, which is an error <23>. The Federal Social Insurance Fund of the Russian Federation must compensate for this benefit in the usual manner .

Taxation of payments during downtime

Income tax

Payment for downtime is taken into account for profit tax purposes as part of non-operating expenses <24>. Previously, tax authorities did not always agree with this <25>. However, the courts, as a rule, took the side of taxpayers, and the correctness of this position was confirmed by the Presidium of the Supreme Arbitration Court of the Russian Federation. He pointed out that the employer's losses associated with paying for downtime do not depend on his will, and therefore cannot be considered as economically unjustified. The financial department <26> adheres to the same point of view. Note that some courts do not link the economic justification of expenses with the presence or absence of workers at work during downtime <27>.

Personal income tax and “salary taxes”

Payment for idle periods to employees is subject to personal income tax, since it is not a non-taxable compensation payment <28>. Payments to employees for downtime are subject to: - UST <29>; — insurance contributions for pension insurance <30>; — insurance premiums for “accident” insurance <31>.

* * * So, when downtime occurs in an organization, it needs to be documented. This will give the accountant the opportunity to correctly pay employees for the downtime period and include these amounts as expenses for income tax purposes. In addition, do not forget to promptly notify the employment authorities about the suspension of production. These actions will allow you to avoid claims from regulatory authorities.

——————————- <1> Art. 72.2 Labor Code of the Russian Federation <2> articles 157, 287 Labor Code of the Russian Federation <3> art. 9 Labor Code of the Russian Federation <4> Art. 157 Labor Code of the Russian Federation <5> approved. Decree of the Government of the Russian Federation of December 24, 2007 N 922 <6> Art. 139 Labor Code of the Russian Federation; clause 2 of the Regulations on the specifics of the procedure for calculating average wages, approved. Decree of the Government of the Russian Federation of December 24, 2007 N 922 (hereinafter referred to as Regulation N 922) <7> Art. 5.27 Code of Administrative Offenses of the Russian Federation <8> art. 139 Labor Code of the Russian Federation; subp. “c” clause 5 of Regulations No. 922 <9> art. 157 Labor Code of the Russian Federation <10> clause 1 art. 252 of the Tax Code of the Russian Federation <11> articles 106, 107 of the Labor Code of the Russian Federation <12> art. 157 Labor Code of the Russian Federation <13> clause 2 art. 1, Art. 3 of the Federal Law of December 25, 2008 N 287-FZ <14> Art. 19.7 Code of Administrative Offenses of the Russian Federation <15> approved. Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1 <16> Art. 72.2 Labor Code of the Russian Federation <17> Art. 192 Labor Code of the Russian Federation <18> approved. Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1 <19> Art. 72.2 Labor Code of the Russian Federation <20> art. 7 Federal Law of December 29, 2006 N 255-FZ <21> subp. 1 clause 1 art. 8 of the Federal Law of November 25, 2008 N 216-FZ <22> approved. By Decree of the Government of the Russian Federation of June 15, 2007 N 375 <23> Art. 9 of Law N 255-FZ <24> paragraphs. 3, 4 p. 2 art. 265 Tax Code of the Russian Federation <25> clause 1 art. 252 of the Tax Code of the Russian Federation <26> Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 19, 2005 N 13591/04; Letter of the Ministry of Finance of Russia dated October 15, 2008 N 03-03-06/4/71 <27> Resolution of the Federal Antimonopoly Service of the Russian Federation dated January 16, 2008 N A11-1995/2007-K2-20/123 <28> subp. 6 clause 1 art. 208, paragraph 1, art. 210, paragraph 3 of Art. 217 Tax Code of the Russian Federation; Articles 164, 165 of the Labor Code of the Russian Federation <29> Art. 236 Tax Code of the Russian Federation; clause 2 of Letter of the Ministry of Finance of Russia dated July 12, 2005 N 03-05-02-04/135; Resolution of the Federal Antimonopoly Service UO dated September 25, 2007 N F09-7081/07-C2; FAS VVO dated January 16, 2008 N A11-1995/2007-K2-20/123; FAS NWO dated 09/05/2008 N A05-11430/2007 <30> clause 2 art. 10 Federal Law of December 15, 2001 N 167-FZ <31> clause 3 of the Rules, approved. Decree of the Government of the Russian Federation dated March 2, 2000 N 184

The material was first published in the magazine “Glavnaya Kniga” N 02, 2009

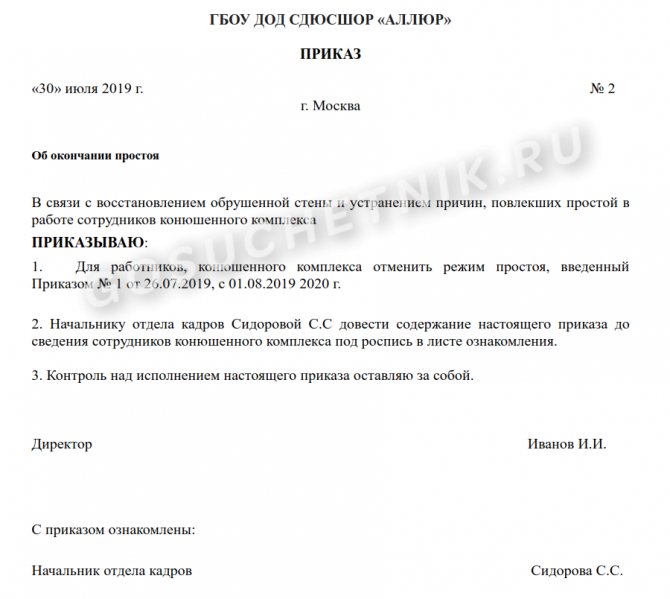

How to draw up an order to end downtime

There is no approved recommended form of termination order, therefore the employer has the right to proceed from the forms of internal documents adopted by him.

The document should indicate:

- details of the document that declared the suspension;

- the reasons for the introduction and an indication that production activities are being resumed;

- return to work date;

- list of employees returning to work.

All employees called to work are notified and introduced to the document for signature.

What does the employee do?

Some workers tend to simplify the situation in the event of an unexpected interruption in work. Whatever the reason for the downtime and no matter how long it lasts (half a day or six months), the employee is obliged to be present on site every day, at the hours established by the employment contract. And although the code does not directly say this, it does not include these hours during the period of legal rest (Article 107 of the Labor Code). In this situation, the conclusion should be drawn: what is not permitted is prohibited.

To be fair, it is worth saying that the employer can mention the obligation to be present at work in the order. There he has the right to both force him to stay in place and allow him to stay at home all this time. The fact that the order does not indicate the need to be present on the territory of the enterprise will not be a permission to miss work. In the event of unauthorized leaving of the workplace or missing days as a result of unfounded conclusions, the employee should not be surprised that he will become a candidate for dismissal for absenteeism, Art. 81 TK.

The need to be present at production during forced downtime due to the fault of the employer may be dictated by:

- the likelihood of emergency situations occurring, then the team on site will be able to quickly eliminate all negative consequences or prevent them altogether;

- the possibility that the reasons for the downtime will disappear suddenly (for example, the electricity supply will be connected), and therefore the time for the start of the resumption of work cannot be predicted;

- the employer is simply not inclined to pay employees the average for their absence from work.

All employees, even if they do not have the opportunity to perform their job functions, must remain on the territory of the enterprise or its structural unit; they will be able to leave the workplace only if such relief is fixed in the downtime order or collective agreement.

How to pay

The issue of payment is regulated by Article 157 of the Labor Code of the Russian Federation. The amount depends on whose fault the work stopped:

- if through the fault of the employer, the employee is paid two-thirds of his average salary. For the calculation, all payments that an employee receives are taken into account, including the tariff rate, bonuses, and allowances;

- if no party is to blame for the suspension of work, the payment is 2/3 of the employee’s tariff rate or salary, without any allowances - such remuneration is lower than if the employer is at fault;

- stoppages caused by the team are not subject to payment.

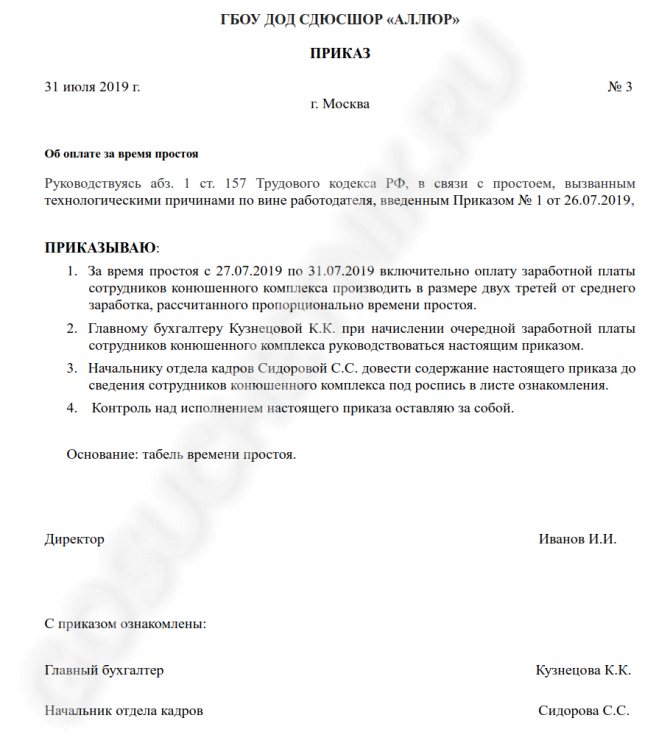

The issue of payment can be resolved by order to introduce downtime or by a separate order.

Dismissal during downtime: features, compensation

Prolonged downtime and a decrease in earnings may suggest looking for a new job. In this case, you can quit in two ways:

- at your own request (Article 80 of the Labor Code of the Russian Federation);

- by agreement of the parties (Article 78 of the Labor Code of the Russian Federation).

Most often, employers accommodate employees halfway and formalize their dismissal on the day the application is submitted.

Regardless of the article of the Labor Code of the Russian Federation, according to which the employment relationship between the parties is annulled, the procedure for settlements with an employee is similar. He is entitled to:

- the rest of the salary for the time actually worked;

- compensation for unused vacation;

- other payments provided for by law and collective agreement.

How to make a payment order

In free form according to the rules adopted in the organization. Reflect the points:

- details of the document confirming the start of the suspension;

- payment procedure: is it calculated from average earnings or from the tariff rate;

- how it is calculated: for example, together with the next salary;

- list of employees who are affected by the payment order.

Each of the employees whose interests are affected by the document gets acquainted with it and signs it.

How to write a statement about forced downtime due to the fault of the employer

Petitions do not have a form established by law, therefore, when drawing up, you should adhere to the general rules of office work. It states:

- FULL NAME. head of the organization;

- description of the current situation;

- date of suspension of work;

- reasons and alleged culprits;

- signature and date of the applicant.

The Labor Code of the Russian Federation does not oblige workers to notify the manager in writing about the start of downtime. The preparation of such a document is more necessary to protect the employee himself. This is especially true if continued work creates a danger to human life and health.