The relationship between the employer and the subordinate is regulated by the provisions of labor legislation, which clearly defines the rules and requirements for conducting, including the procedure for canceling an employment contract. Each employer is obliged to complete the necessary documentation before the person leaves the organization, as well as settle accounts with him, paying the due payments on the day of dismissal. However, unfortunately, not all employers strictly comply with the requirements of the legislator; some, caring about their own financial situation, shy away from providing their subordinates with the required funds. Failure to pay compensation upon dismissal is a serious violation of the norms of the Labor Code of the Russian Federation and the labor rights of employees, which threatens the employer with administrative liability.

On the day of termination of the employment contract, the employee must be accrued:

- Earnings for the last period of time worked;

- Financial compensation for a vacation period that a person did not have time to use (or did not fully use).

As a rule, the first type of payment is always transferred, since receiving earnings is the basis of the relationship between the employer and the subordinate. The second type of payment may be hidden from an inexperienced and legally uneducated employee. We will talk about the specifics of paying compensation, as well as the consequences of withholding it below.

Procedure for payment of compensation upon dismissal

The most difficult stage of completing cooperation with the employer is the actual adoption of such a decision by the employee, after which the person must:

- Fill out and submit to your boss an application for the upcoming termination of the employment agreement;

- If the manager responds approvingly, his signature is affixed to the document, and the application is transferred to the accounting department;

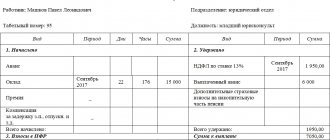

- The accountant’s task is to carry out the necessary calculations to establish the total amount due to be transferred to the person on the day of dismissal. To calculate the size of the mat. compensation for vacation , the specialist needs to establish the number of available non-vacation days, which will be paid to the employee;

- Based on the citizen’s application, HR department specialists or the boss himself develop and issue an Order to cancel the person’s employment contract. In addition, personnel officers are responsible for making an appropriate entry in the employee’s work book;

- On the last working day, the resigning citizen receives his work document, as well as the full amount of money, including compensation for unused vacation.

Payment terms upon dismissal

Based on Art. 140 of the Labor Code of the Russian Federation, enterprise managers are obliged to fully pay resigning employees on the last day of work, regardless of the reason and initiator of termination of the employment contract. If the dismissing employee is absent from the workplace for any reason on that day, full payment must be made no later than the day following the day the relevant demands are presented.

Full payment means payment of all funds due to the employee by law:

- salary for the period worked;

- severance pay if staff is being reduced;

- compensation for all unused vacations.

The resigning person is also given certificates of earnings and the status of his personal account in the Pension Fund, reflecting the amount of money transferred for his length of service in the organization.

Violation of the requirement for timely payment threatens the manager with liability under Part 6 of Article 5.27 of the Criminal Code of the Russian Federation. If this violation is systematic and most of the employees do not receive payments, if there is evidence of a crime, they may be charged under 145.1 of the Criminal Code of the Russian Federation.

Important! In a single case, the maximum penalty that an employer faces is administrative liability. Also, the dismissed person can recover through the court or voluntarily a penalty in the amount of 1/150 of the current refinancing rate of the Central Bank of the Russian Federation for each day of delay (Article 236 of the Labor Code of the Russian Federation).

Responsibility of the employer for non-payment of compensation for vacation

In order to understand in advance what amount of accruals should be expected, each worker should study the norms of labor legislation, as well as independently calculate the amount of future payment for vacation in order to eliminate accounting errors. If the employer and the chief accountant deliberately withhold compensation for vacation pay, then, according to the Law, they face the following sanctions:

- Financial liability of the head of the organization, which involves the payment of a penalty for each day of delay in accruals due upon dismissal. The amount of such a penalty is 1/150 of the Central Bank refinancing rate for each day of delay;

- Administrative responsibility, to which both the head of the company and the organization as a whole can be involved. Thus, the amount of fines is:

- 1-5 thousand rubles for representatives of management or for individual entrepreneurs;

- Suspension of the functioning of the company for no more than 3 months – for individual entrepreneurs;

- 30-50 thousand rubles or suspension of activities for no more than 3 months - for legal entities. persons

If an employer is found to have violated the provisions of the Labor Code of the Russian Federation not for the first time, the official may be suspended from his position for a period of up to three years.

- Officials who, not for the first time, for their own selfish purposes, violate labor laws and do not pay their subordinates financial benefits, including obscenities, are brought to criminal liability. vacation pay compensation for two or more months. Such violators face:

- Accrual of penalties, the amount of which can reach 120 thousand rubles;

- Prohibition from holding a current or similar position for up to five years;

- Imprisonment for no more than two years;

In the event that the employer’s unlawful acts resulted in very serious financial problems in the employee’s family, for example, due to lack of funds and the inability to pay for treatment for one of the relatives, the sick person died, then the penalty is much more serious:

- Accrual of penalties ranging from 150 thousand rubles;

- Imprisonment for 3-7 years, as well as a ban on holding office for up to three years.

How to contact the labor inspectorate: step-by-step algorithm

If there is a possibility that the director will comply with the requirements of the order and pay the money, it is easier to solve the problem with the help of the labor inspectorate.

The application procedure is as follows:

| Drawing up an application | It is necessary to indicate the start and end dates of employment, information about the employer and the essence of the problem - non-payment of compensation. |

| Submitting an application and documents | To do this, you need to come to the State Inspectorate in person or use the remote inspection service. In the latter case, you will need a digital signature and scanned copies of documentation. |

| Carrying out an inspection | Upon application, the head of the GIT appoints a responsible inspector who visits the enterprise or orders a documentary inspection. During events, the employer is obliged to provide access to all documentation. |

| Obtaining a conclusion | The applicant is notified in writing of the results of the inspection. The manager is given an order indicating the time frame for eliminating the problem. |

Expert commentary

Kamensky Yuri

Lawyer

Failure to comply with the instructions will result in liability under Art. 19.5 Code of Administrative Offenses of the Russian Federation for the employer.

Documentation

When applying to the State Labor Inspectorate, an application, an employment contract, and a passport are provided. Proof of earnings may be required. The GIT inspector has the right to request additional documentation independently after the start of the inspection.

How to calculate compensation for unused vacation period

Some employees do not have time to complete the 28 days of annual leave provided by the employer (or more, subject to the availability of an additional vacation period). Right to receive mat. Payments for the remaining weekends are provided to citizens even if there is only one day not taken off. As mentioned earlier, the employee should calculate the amount of payments in advance in order to avoid an accountant’s mistake. To do this, you can use the following algorithm:

- Determine the total amount of earnings transferred for the previous year by summing up monthly income for 12 months;

- The resulting value is divided by the number of months in a year, and then by a constant indicator of 29.3 (the value that is usually used to denote the average number of days in one month). The output is the employee’s average earnings per shift;

- The resulting value must be multiplied by the number of vacation days that the person wants to replace with a cash payment.

EXAMPLE: Citizen K’s earnings for the previous year amounted to 540,000 rubles. During the billing period, no periods of temporary disability were identified, and there were no days off. For the current year, the duration of his unused vacation period is 20 days. Thus, the amount of material compensation received will be:

540,000 / 12 / 29.3 * 20 = 30,716.7 rubles

When determining the amount of average annual earnings, it should be taken into account that the amount of annual income does not include:

- Periods of time when the employee did not actually work, but his earnings remained the same;

- Payments accrued for periods of temporary disability of a person;

- Maternity accruals;

- Periods of earning income when a person did not fulfill official obligations not through his own fault, but through the fault of the organization’s management;

- Various social charges or mat received by a person. support.

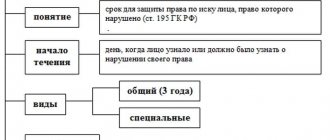

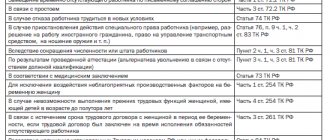

Disciplinary action: types, application, imposition, challenge

In your work life you may encounter various situations, including disciplinary action. According to Article 192 of the Labor Code of the Russian Federation, an employer may apply disciplinary sanctions to an employee who does not fulfill his duties or performs them improperly in the form of:

- reprimand;

- comments;

- dismissal from office.

In relation to certain categories of employees, other types of disciplinary liability may be used, which are provided for by federal laws, regulations on discipline, and charters. An appropriate order is issued when a decision is made to impose a penalty.

According to Part 5 of Art. 192 of the Labor Code of the Russian Federation, when choosing a measure of responsibility, the employer is obliged to take into account the circumstances that lead to violation of labor discipline, as well as the severity of the offense. Often, an employee does not agree with the disciplinary measure that was applied to him.

In this case, he can appeal the decision of management in accordance with the procedure established by law in accordance with Art. 193 Labor Code of the Russian Federation. To do this, the employee needs to file a complaint with one of the following authorities:

- Labor Dispute Commission (LCC);

- State Labor Inspectorate (SIT).

If a negative result was obtained from contacting these authorities, the employee has the right to go to court to protect his labor rights.

It is worth noting that the employee does not have to send a complaint to other authorities; he can directly appeal to the judicial authorities. To defend your interests, you need not only to know where to file a complaint, but also to know the grounds on which the penalty can be canceled.

The reasons may be:

- material - when the employee considers the punishment to be unlawful;

- procedural - when the employer violates the procedure for imposing a penalty.

In the first case, the possibility of appeal depends on the specific features of the case, and in the second, the question is whether the procedure prescribed by law was observed when applying the penalty.

According to Art. 193 of the Labor Code of the Russian Federation, if a violation of labor discipline is detected, the employer must:

- Request a written explanation from the employee. If the employee does not write an explanatory note within two working days, then a corresponding act is drawn up

- Issue an order to impose a disciplinary sanction and familiarize the employee with it against signature within 3 days from the date of publication of the document

- If the employee does not sign the order, then a corresponding act is drawn up.

One of these violations of this procedure may become grounds for appealing a disciplinary sanction. If it is impossible to resolve the issue pre-trial, the disciplinary sanction can be appealed in court.

The appeal procedure is as follows:

1. Filing a claim. According to Art. 28, 29 of the Code of Civil Procedure of the Russian Federation, it can be filed in the city and district court at the location of the organization or at the place of residence of the plaintiff.

How to calculate the amount of penalties due to non-payment of compensation upon dismissal

Penalties are considered to be penalties that accumulate from the employer every day in the absence of accrual of the required funds to employees. The size of such sanctions is 1/150 of the Central Bank refinancing rate, which in 2021 reached 7.75%.

EXAMPLE: Citizen A. resigned from the company on May 15, 2021, respectively, earnings and compensation for unused days of the vacation period should have been accrued on the same day. The head of the company neglected this requirement of the Labor Code of the Russian Federation and accrued the due funds only on May 29, 2021. The total amount of finance upon dismissal is 50,000 rubles. What is the amount of the penalty?

- To calculate the amount of the penalty, the following formula is used:

RN = SD * DP * 1/150 * 7.75%, where

RN is the amount of the penalty;

SD - the amount of debt owed to the resigned employee;

DP – number of days of payment delay.

- We get: RN = 50,000 * 14 * 1/150 * 0.0775 = 361.7 ruble

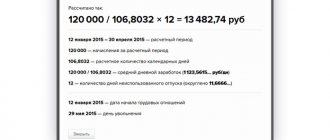

How is compensation for unused vacation calculated?

If an employee has even 1 day of unused vacation, compensation must be paid upon termination of the employment relationship. To check the correctness of the accruals, citizens can calculate everything themselves using the algorithm:

- We determine earnings for the year. To do this, we add up all salaries by month.

- We divide the average annual salary by 12 months and by 29.3 - the average number of days in a month established by Art. 139 Labor Code of the Russian Federation. This is the average daily earnings.

- We multiply the average earnings per day by the number of days of unused rest.

Let's look at a practical example:

Zinoviev O.N. works at OOO. He has 10 days of unused rest left. When dismissal in July, to calculate compensation for vacation not taken, the average annual salary for the last 12 months is first determined:

| July | 33 091,18 |

| August | 34 059,12 |

| September | 33 987,95 |

| October | 45 694,57 |

| November | 34 586,28 |

| December | 34 687,23 |

| January | 33 586,56 |

| February | 34 687,76 |

| March | 33 987,46 |

| April | 34 865,17 |

| May | 35 968,18 |

| June | 35 264,47 |

All salaries for each month are summed up. The total is 424,465.93. This number is divisible by 12:

42,465.93 / 12 = 35,372.16 rubles. – average monthly wage.

35,372.16 / 29.3 = 1,207.24 rubles. – average daily earnings.

1,207.24 x 10 = 12,072.4 rubles. – final vacation compensation.

Calculation of penalties

At the moment, the amount of the penalty has been increased and is 1/150 of the refinancing rate of the Central Bank of the Russian Federation. Previously, the value was equal to 1/300.

In 2021, the refinancing rate is 7.75% per annum. The money should be paid on February 7, but the employer transferred compensation only on March 5. The amount of debt is 45,000 rubles.

What formula is used:

SD x DP x 1/150 x 7.75%, where SD is the amount of debt, DP is the number of days of delay (27).

45,000 x 27 x 1/150 x 7.75% = 627.75 rubles. – the amount of the penalty.

What periods are not taken into account when calculating

When calculating the average salary for the year, the following periods are not taken into account:

- the time the employee maintains average earnings;

- sick leave;

- maternity leave;

- suspension of labor activity due to the fault of the employer or circumstances beyond the control of the parties.

Procedure for contacting the labor inspectorate

In order for an employee to have the opportunity to defend his own rights and interests infringed by the employer, there are several government agencies in our country where you can file a formal complaint against your boss. One of these government agencies is the Labor Inspectorate. To solve the problem that has arisen, the worker must:

- Submit a written complaint against your employer, indicating in it: the period of work in the company, personal data, and information about the boss, as well as the actual reason for the dissatisfaction: non-payment of vacation pay;

- Submit the document to government representatives. institutions through a personal visit to the Inspectorate or through the official website;

- Based on the submitted complaint, representatives of the Labor Inspectorate initiate an inspection at the enterprise, during which the head of the company is obliged to provide access to all available documentation;

- Based on the results of the inspection, a conclusion is made about existing violations. The head of the organization receives a corresponding written order, which contains specific deadlines, after which the violations must be eliminated.

The disadvantage of this method of influencing the employer is that he may not agree with the identified shortcomings specified in the order and refuse to eliminate them. The maximum penalty for the official, in this case, will be the imposition of a fine.

What to do if the employer does not pay compensation?

When faced with a situation where a manager refuses to compensate for unused vacation, it is recommended to try to get a written explanation from him. From a legal point of view, the law is on the side of the person leaving, and it is likely that the employer will refuse to enter into a dialogue.

In this case, the employee has several options:

| Complain to the labor inspectorate | Go to court |

| The disadvantage of this method is that the inspector will simply issue an order to eliminate violations within a specified time frame. It is likely that the employer will not agree to comply with the requirements of the regulation, and the maximum that he faces is administrative liability | In the claim, you can file a petition for payment of compensation along with a penalty, as well as for holding the director accountable. Claims are determined by the citizen independently |

Important! If the employee was employed unofficially, the situation becomes more complicated. First you will have to prove the fact of employment, and only after that you will have to collect all due payments from the manager.