Changes for 2021

The reform of insurance premiums introduced changes regarding daily allowances in excess of the norm.

In view of the established innovations, the company is obliged to pay tax on personal income along with insurance premiums, provided that the daily allowance limit approved by law is exceeded. Tax adjustments were introduced in accordance with the following fact. Now the Federal Tax Service is responsible for insurance payments, except for those related to injury.

All transfers that relate to insurance must now be entered not into the Social Insurance Fund, but into the Tax Inspectorate.

According to this change, enterprises must document travel expenses for workers both in Russia and abroad, in accordance with the Tax Code of the Russian Federation.

This year, additions were introduced to Article 422 of the Tax Code of the Russian Federation, which can be found in the second paragraph of this law, which talks about excess daily allowances.

There are no changes to tax deductions from daily allowances this year; they are also subject to personal income tax. But in addition to these tax contributions, organizations must now make contributions to the Social Insurance Fund, excluding payments of any size related to employee injuries.

The amount of standards for daily payments to the Federal Tax Service is not regulated, that is, each enterprise can set its own amount of compensation for the time spent on a business trip.

The tax authority sets only limited amounts of refunds, which are not subject to taxes. If this cost is exceeded, the company is obliged to pay personal income tax on excess daily compensation, along with tax contributions to the Pension Fund of Russia, as well as for health insurance.

Most companies approve their amounts of travel reimbursements that exceed the legal standards from which insurance payments are transferred.

What to look for in 2019

In 2021, accountants need to be more attentive to excess daily allowances: insurance premiums will have to be charged on them. And the main thing here is not to get confused. After all, earlier, in 2016 and earlier, any amount of daily allowance was free from contributions. The main guarantee was that their maximum values were specified:

- in a collective agreement;

- regulations on business trips or other internal acts.

However, in 2021, insurance premiums from daily allowances in excess of the norm will have to be paid to the treasury. At the same time, the daily allowance standards remained at the same level (clause 2 of Article 422 of the Tax Code of the Russian Federation):

- for business trips in Russia – up to 700 rubles;

- for foreign business trips – up to 2.5 thousand rubles.

Thus, daily allowances in 2021 are subject to insurance premiums if they exceed these values.

According to the law, daily allowances are additional costs in connection with staying in a place other than your permanent residence (see 168 of the Labor Code of the Russian Federation).

As you can see, legislators have equated the daily allowance standards that have long been in effect in relation to income tax. Therefore, from the specified norm of the head of the Tax Code of the Russian Federation on insurance premiums, a direct reference is given to the third paragraph of Article 217 of the Tax Code of the Russian Federation.

Also see “Excess Per Diem Rules.”

How to pay insurance premiums

For 2021, a mandatory tax requirement has been introduced for all excess daily payments.

In accordance with the established standards of Article 424 of the Tax Code of the Russian Federation, the dates of payment and accrual of compensation to an employee for a business trip must coincide. When a worker receives a daily allowance in excess of the norm, an advance report is approved on the same day. Consequently, reimbursements made by the employer for travel expenses exceeding the limit are included in the insurance payments system for the same calendar month when the official’s advance report is approved.

If the daily allowance does not exceed the norms established by law, then they are not subject to insurance contributions.

Following the recommendations for calculating travel allowances specified in regulations will help eliminate claims against the company that may come from the Pension Fund, the Tax Service and the Social Insurance Fund.

Insurance premiums are deducted from the employee's additional expenses for living outside the home, as well as those that exceed the approved standards. But this condition applies to business trips lasting more than 24 hours.

What daily allowances should be considered as issued in excess of the norm?

What rules determine the division of daily allowances incurred during business trips into those that are exempt from the calculation of contributions for them and those that form the basis for calculating insurance premiums for daily allowances in 2018?

In terms of establishing this boundary, clause 2 of Art. 422 of the Tax Code of the Russian Federation refers to clause 3 of Art. 217 of the Tax Code of the Russian Federation, i.e. to the same restrictions that apply to resolve the issue of taxation of daily allowances on the income of individuals. In the text of paragraph 3 of Art. 217 of the Tax Code of the Russian Federation specifies 2 values of daily allowance, if exceeded, the obligation to withhold personal income tax from an employee who has been on a business trip arises:

- 700 rub. — per day of a business trip in the Russian Federation;

- 2,500 rub. - per day of stay on a business trip abroad.

Starting from 2021, these same values will have to be used in relation to the issue of calculating insurance premiums subject to the provisions of the Tax Code of the Russian Federation.

Daily allowances issued for business trips abroad can be paid in foreign currency. In this case, they will require their conversion at the exchange rate into rubles. On what day should such a recalculation be made in order to establish whether the daily allowance limit has been exceeded and to determine the base from which insurance premiums will be calculated? It should be carried out on the date on which the amount of excess daily allowance is accrued in favor of an employee who has been on a business trip (letter of the Ministry of Finance of Russia dated March 16, 2017 No. 03-15-06/15230), i.e. on the day such expenses as daily allowance are recognized . The day of recognition of such expenses will be the date corresponding to the day of approval of the advance report on the business trip (subclause 5 of clause 7 of Article 272 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated March 21, 2011 No. KE-4-3/4408).

Keep in mind that for the purpose of withholding personal income tax, daily currency allowances must be recalculated to another date. More details about this can be found in the material “And again - about personal income tax on daily allowances in foreign currency .

Thus, from 2021, not only the income tax of individuals should be withheld from the amount of excess daily allowance, but also insurance premiums for pension, medical and social insurance (OPS, compulsory medical insurance and compulsory social insurance (in terms of disability and maternity insurance)) should be charged. If the payer of contributions does not have the right to use reduced tariffs for them, then until the maximum value of the bases for contributions is reached, he will have to accrue an amount of insurance premiums amounting to 30% of the amount of excess of the current limit for the amount of excess daily allowance (including 22% for compulsory insurance). , 5.1% for compulsory medical insurance and 2.9% for compulsory social insurance).

Reflection in RSV-1

All legal entities, including individual entrepreneurs, should send to the Pension Fund branch, in addition to their own personal information, a document in the form of a certificate drawn up in accordance with the RSV-1 form.

This form is a report containing information regarding accrued or paid insurance transfers. It stores a lot of data that is necessarily transmitted to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Line 201, located in the RSV-1 form in subsection 2.1, displays the amount of payments and compensations that are not subject to insurance transfers for compulsory pension insurance.

All managers of enterprises and entrepreneurs with any tax regimes need to study all the main provisions and information regarding the certificate drawn up in the RSV-1 form.

Are excess daily allowances subject to “unfortunate” contributions?

However, in addition to the contributions transferred to the jurisdiction of the tax service, there is another type of contribution - for injury insurance (the so-called accident contributions). The rules for their calculation are regulated by the law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ, which has not been affected by the changes that have occurred since 2021 with all other insurance contributions.

Text of paragraph 2 of Art. 20.2 of Law No. 125-FZ made it possible not to charge “unfortunate” daily allowance contributions until 2021, and in 2017-2018, payers of these contributions still have the right not to charge them on daily allowances issued for the time spent on business trips both in the territory of the Russian Federation , and abroad. And this exemption is not dependent on the amount of daily allowance.

Thus, there is no need to pay injury insurance premiums for excess daily allowance in 2021.

Check that Form 4-FSS is filled out correctly using a checklist developed by our experts.

Accounting procedure

The calculation of personal income tax is accompanied by standardization of the amount of daily payments. Tax-free amounts include:

- one day of travel for work in the Russian Federation (700 rubles);

- business trip abroad (2500 rubles).

If the amount of this compensation is higher than the specified standards, then personal income tax is withheld.

When a business reimburses an employee's daily allowance in excess of the allowance, the employee has taxable income. It is recognized regarding the last day of the month, when the advance report sent by the employee returning from a work trip is approved.

Personal income tax is withheld for the next payments made to the official, including wages. Personal income tax must be transferred on the first working day, following the listed income payments to the employee. This rule corresponds to Article 226 of the Tax Code of the Russian Federation.

Daily allowances that exceed the standards are paid to the employee in accordance with the established law. In addition to such payments, the employer is obliged to reimburse the employee for the following expenses related to the work trip:

- for transport, the type of which is determined by the general director of the company;

- to pay for housing in another city;

- additional personal needs for living outside the place of residence.

Compensation for other expenses is covered by the employee’s daily allowance provided by the head of the enterprise. At the same time, it is envisaged that their amount will be increased by decision of the employer.

It should be remembered that daily allowances above the norm are subject to tax. Failure to comply with this rule may result in legal proceedings.

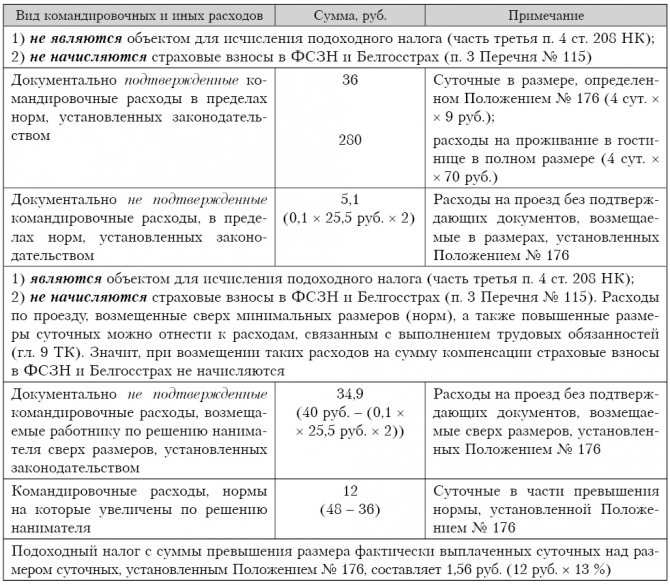

Situation. The employee is sent on a business trip from May 20 to May 23, 2021.

An employee of the organization (Vitebsk) was sent on a business trip to Minsk. According to the order of the employer, he departs on a business trip on May 20, 2021 and arrives from it on May 23, 2021. The employee was paid by bank transfer for accommodation in a single hotel room for 4 days in the amount of 280 rubles. (4 days × 70 rub.). After returning from a business trip, the employee did not provide travel documents because he lost his tickets.

Travel expenses are determined in the following amounts:

1) travel expenses without supporting documents in both directions are reimbursed by the employer to the employee in the amount of 40 rubles. (this amount of compensation is determined by the organization’s regulations on the posting of employees);

2) expenses for hotel accommodation for 4 days – 280 rubles;

3) daily allowance for 4 days - in the amount of 48 rubles. (the regulations on the secondment of workers determine the amount of daily allowance in the Republic of Belarus at 12 rubles per day).

Among the listed expenses there are expenses incurred both within and in excess of the norms established by law.

How to correctly calculate “salary” taxes on the listed travel expenses?

The employer has the right to reimburse certain expenses in excess of the norms established by law

During business trips, the employer is obliged to issue an advance and reimburse the employee for the following travel expenses:

1) on travel to and from the place of business travel;

2) for renting residential premises;

3) for living outside the place of residence (daily allowance);

4) other expenses incurred by the employee with the permission or knowledge of the employer (Article 95 of the Labor Code of the Republic of Belarus; hereinafter referred to as the Labor Code).

The employer may establish additional labor and other guarantees for employees in comparison with labor legislation (Article 7 of the Labor Code). Thus, in the LNLA (in the business trip order, in the regulations on business trips, etc.), the employer has the right to establish compensation for employees for certain expenses in excess of the limits determined by law.

Reimbursement of travel expenses

If a posted employee does not have travel documents (tickets) to the place of business trip and (or) back, travel expenses are reimbursed in the amount of 0.1 basic value (BV) in each direction (clause 13 of the Regulations on the procedure and amount of reimbursement of expenses, guarantees and compensation during business trips, approved by Resolution of the Council of Ministers of the Republic of Belarus dated March 19, 2019 No. 176; hereinafter referred to as Regulation No. 176).

The size of the BV from January 1, 2021 is 25.5 rubles. (clause 1 of the resolution of the Council of Ministers of the Republic of Belarus dated December 27, 2018 No. 956). Consequently, the amount of travel expenses to the place of business trip and back is 5.1 rubles. (0.1 × 25.5 rub. × 2). The employee was reimbursed 40 rubles, which means 34.9 rubles. (40 – 5.1) – these are travel expenses in excess of the norm.

Expenses for renting residential premises

Expenses for renting accommodation during a business trip within the Republic of Belarus are reimbursed from the date of arrival at the place of business trip to the date of departure from it in the amounts established in Appendix 1 to Regulation No. 176, without submitting supporting documents.

If the costs of renting residential premises exceed the amounts established in Appendix 1 to Regulation No. 176, the tenant reimburses these costs on the basis of supporting documents, but not more than the cost of a single room in a hotel accommodation (clause 15 of Regulation No. 176).

Since the employer provided the employee with housing on a business trip, having previously paid for accommodation by bank transfer, one should be guided by clause 17 of Regulation No. 176: when paying for residential premises, the employee’s expenses for renting residential premises are not reimbursed.

Thus, actually incurred and documented expenses for renting residential premises are taken into account at the rate of 70 rubles. per day in the total amount of 280 rubles. for all days of the business trip. In this case, the costs of renting residential premises are considered to be calculated within the limits defined by Regulation No. 176.

Daily allowance

When traveling within the Republic of Belarus, the daily allowance of a posted employee for the entire time spent on a business trip, including the time spent on the road, is reimbursed in the amounts established in Appendix 1 to Regulation No. 176, namely 9 rubles. per day (clause 20 of Regulation No. 176).

Since the employer has established increased daily allowances, then 36 rubles. daily allowances for 4 days of business trip were paid by the employer within the framework of Regulation No. 176, and the excess amount was 12 rubles. (48 – 36) – in excess of the standards established by Regulation No. 176.

Income tax

When the employer pays the payer for expenses on business trips both on the territory of the Republic of Belarus and abroad, the following are exempt from income tax:

1) daily allowances paid within the limits established by Annexes 1 and 2 to Regulation No. 176;

2) actually incurred and documented expenses for travel to and from the place of business travel, and for the rental of living quarters. If the payer fails to provide documents confirming payment of these expenses, the amounts of such payment are exempt from income tax within the limits of the norms (amounts) established by Regulation No. 176;

3) other expenses for business trips made with the permission or knowledge of the organization recognized as the place of the main work (service) of the payer, paid or reimbursed in accordance with Regulation No. 176 (part three of clause 4 of article 208 of the Tax Code of the Republic of Belarus; hereinafter referred to as the Tax Code ).

For reference: the same taxation procedure applies to the listed payments made:

– members of the management body of the organization in connection with their performance of the functions of members;

– payers not at the place of main work (service, study), incl. when they perform work (render services) under civil contracts, if such payments are provided for in these contracts.

The date of actual receipt of income in the case of taxable income is the day the employee draws up an advance report on the amounts spent on a business trip (subclause 1.6, clause 1, article 213 of the Tax Code). As a general rule, the organization as a tax agent is obliged to withhold the calculated amount of income tax directly from the payer’s income upon actual payment. An exception is income in the form of wages for the first half of the month, bonuses and payment of expenses for business trips in excess of the established amounts. The calculated income tax is withheld from any funds paid by the tax agent to the payer (clause 4 of Article 216 of the Tax Code).

Insurance premiums to the Social Security Fund and Belgosstrakh

Travel expenses are compensation to employees for costs associated with the performance of their job duties, which is provided for in Chapter. 9 TK. Consequently, contributions to the Social Security Fund and Belgosstrakh are not accrued not only for travel expenses reimbursed by the employer within the limits of the norms, but also when the employee is reimbursed for travel expenses in excess of the norms established by law, as well as for other expenses associated with the business trip, provided that they are supported by documents ( according to explanations from FSZN employees). The reasons are as follows:

1) an object for calculating mandatory insurance contributions to the Social Security Fund for employers and working citizens - payments of all types in cash and (or) in kind, accrued in favor of working citizens on all grounds, regardless of sources of financing, including remuneration under civil contracts, except provided for by List No. 115*, but not higher than 5 times the average salary of workers in the republic for the month preceding the month for which mandatory insurance contributions are paid, unless otherwise established by the President of the Republic of Belarus (Article 2 of the Law of the Republic of Belarus dated February 29, 1996 No. 138-XIII “On mandatory insurance contributions to the budget of the state extra-budgetary fund for social protection of the population of the Republic of Belarus”);

____________________

* List of payments for which contributions for state social insurance are not charged, including professional pension insurance, to the budget of the state extra-budgetary fund for social protection of the population of the Republic of Belarus and for compulsory insurance against industrial accidents and occupational diseases to the Belarusian Republican Unitary Insurance Enterprise “Belgosstrakh”, approved by Resolution of the Council of Ministers of the Republic of Belarus dated January 25, 1999 No. 115 (hereinafter referred to as List No. 115).

2) the object for calculating insurance premiums in Belgosstrakh - payments of all types accrued in favor of persons subject to compulsory insurance against industrial accidents and occupational diseases, on all grounds, regardless of sources of financing, except for payments provided for in List No. 115 (clause 2 Regulations on the procedure for paying insurance premiums to the insurer for compulsory insurance against industrial accidents and occupational diseases, approved by Resolution of the Council of Ministers of the Republic of Belarus dated October 10, 2003 No. 1297);

3) in paragraph 3 of List No. 115, compensation is named in order to reimburse employees for the costs associated with the performance of their labor duties, provided for in Chapter. 9 TK.

Let's summarize what has been said in the table: