What is account 20 used for in accounting?

Existing standards establish that all costs for the production of products, provision of services or performance of work until the completion of the established process are subject to reflection on account 20.

Here the accumulation of expenses associated with the main activity for which the company was created occurs. Therefore, it is called account 20 “Main production”.

All costs accumulated on this account are called work in progress. This is due to the fact that the invoice reflects them until the moment when they form the cost of the product.

This account is used in almost every enterprise, regardless of the field of activity, with the exception of trade. These can be industrial, agricultural enterprises performing construction and installation work, transport and communications, etc.

If a company creates finished products, then closing account 20 means that it is produced. For works and services, closing the 20th account implies that the entity has provided or fulfilled the obligations stipulated by the agreements.

Attention! For small businesses, a simplified accounting procedure is provided, which implies that all company expenses should be taken into account in account 20. Other accounts (23,25,26) are not applied in this case.

Accounting for information about incurred costs on account 20 is carried out on the basis of supporting documents and is used by management to manage the business entity.

Wiring Dt 90 and Kt 90, 68, 43, 99, 20 (nuances)

Dt 90 Kt 90 is the final accounting entry for closing account 90 at the end of the reporting period. To carry out the operation Dt 90 Kt 90 , you need to know the sequence of previous actions and the correct accounting entries. About them - in our article.

In what cases are entries made for debit 90 and credit 90, 68, 43, 99, 20

According to the chart of accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), account 90 is needed to generate information about the company’s income and expenses for its main type of activity, as well as to determine the financial result of its business operations. For analytical purposes, subaccounts are opened to account 90 to record revenue (90.1), cost (90.2), VAT, excise taxes and export duties (90.3, 90.4 and 90.5, respectively), and financial results (90.9).

Accounting for subaccounts of account 90 must be kept cumulatively throughout the year. Every month, the accountant compares sales revenue with cost, VAT (if necessary, excise taxes and export duties) and writes off the final financial result to account 99. At the same time, there is no balance on account 90 as of the reporting date. At the end of the year, all subaccounts of account 90 (except 90.9) will be closed with internal postings Dt 90 Kt 90 , and subaccount 90.9, in turn, will be closed on account 99.

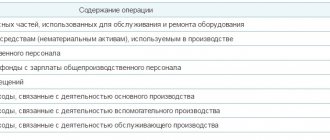

What is included in the account

Account 20 reflects all costs associated with the main activity of the company.

Therefore, the following expenses should be taken into account on the account:

- Material costs are the cost of raw materials, materials, semi-finished products, fuel and others spent on production, that is, what forms the basis of the finished product.

- Costs of services and work of third-party companies involved in the creation of the finished product.

- Remuneration of key personnel with mandatory contributions to extra-budgetary funds.

- Depreciation charges for fixed assets involved in the creation of the finished product.

- Indirect costs that are superimposed on the cost of the finished product - costs of auxiliary production, non-production, factory overhead, sales costs, etc. - they should be reflected on account 20 in the case when the accounts for their accounting are closed at the end of the reporting period.

- Other costs for the production of finished products (taxes, duties, etc.)

The first items relate to direct costs - those that are directly related to production. The cost of the above expenses accumulates while the production process is taking place, and upon its completion they are all written off from account 20 to the cost of the finished product, work, service.

Attention! If the product did not pass technical control and was recognized as a manufacturing defect, the costs of its production previously recorded on account 20 should be written off to the production defect account (usually 28).

Main production: determining the composition of costs

The production process is a technological cycle for the creation, development, and assembly of finished products at an enterprise.

The totality of all costs associated with the production and sale of finished products forms its cost. The main production can be described as follows. Organizations carrying out production activities determine the cost of manufactured products. To account for the total amounts of such expenses, account 20 is used, the transactions for which we have collected in one table. It is applied in accordance with the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000.

Primary production costs are costs that relate to the production of certain types of goods, works or services directly related to the main activity of the enterprise. Such costs can be direct or indirect.

Direct costs include the costs of purchasing raw materials and supplies involved in the manufacture of goods in a broad sense, remuneration for workers, damage from defects, depreciation, etc.

Indirect costs include costs associated with maintenance, administration and control of the production process.

It turns out that accounting account 20 for dummies is “Main production”, which reflects all production and general business costs of the organization.

At the “Main production” the following costs are taken into account:

- production of industrial and agricultural products;

- carrying out construction, installation, dismantling, geological exploration and design and survey work;

- provision of communication and transportation services;

- carrying out R&D work - research and development work;

- maintenance, operation and repair of highways, etc.

Characteristics of account 20 “main production”

Account 20, according to the current Chart of Accounts, is active, since the company’s assets are reflected on it. It has a debit balance reflecting the cost of work in progress, that is, costs that have not yet formed the cost of a product or service.

Debit turnover reflects the expenses incurred by a business entity for the production of finished products, provision of services or performance of work. The credit of the account records the cost of production written off for finished products.

The balance at the end of the reporting period is determined by summing the balance at the beginning and the turnover on the debit side of the account and subtracting from it the turnover on the credit side of the account.

Attention! Many business entities, especially those who provide services and work, have a balance of 0 at the end of the reporting period for account 20.

However, this rule does not apply to organizations engaged in production activities. For them, this indicator reflects the products launched into production.

You might be interested in:

Account 25 in accounting “general production expenses” - what is it used for, posting subaccounts

How to close a 20 account: 3 methods

At the end of the reporting period, for example a month, it is not necessary to close account 20. The debit balance in the account reflects the value of the company's work in progress. The company's accounting department needs to organize an inventory of work in progress while simultaneously checking workshops, warehouses and payroll records.

Postings for closing account 20 are generated when releasing finished products, when transferring produced material assets directly to customers, or when performing work or services.

Current accounting standards provide for three methods for closing accounting accounts 20:

- Direct method.

- Intermediate method.

- Direct sales of manufactured products.

IMPORTANT!

The company must independently determine the method of writing off costs from account 20. The decision must be documented, detailing the chosen method in the accounting policy.

Before closing account 20, the accountant must highlight the balances of work in progress. But only if there are such residues. If the production cycle does not include work in progress balances, account 20 is closed completely.

What subaccounts are used?

Analytical accounting on account 20 is usually carried out by types of products produced, services provided, work performed, divisions existing in organizations, as well as by types of costs. For example, in agriculture it is customary to open sub-accounts “Crop production”, “Livestock production”, “Industrial production” and others.

Account 20 may have the following subaccounts by type of cost:

- "Depreciation".

- "Labor costs."

- "Material costs."

- “Deductions for social needs.”

- "Other expenses."

Attention! On account 20, it is possible to keep track of costs at standard cost with a separate accounting of excess costs. Then a sub-account “Excessive costs” can be opened.

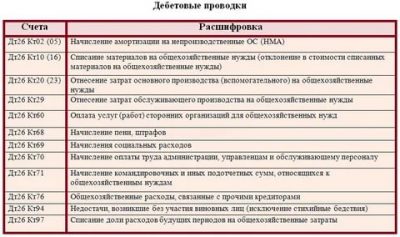

Account correspondence

Account 20 can correspond with the following accounts.

From the debit of account 20 to the credit of accounts:

- Account 02 - regarding write-off of depreciation on fixed assets;

- Account 04 - when writing off depreciation of intangible assets without using account 05;

- Account 05 - regarding depreciation of intangible assets;

- Account 10 - regarding the write-off of materials for production;

- Account 11 - regarding the write-off of fallen or slaughtered animals;

- Account 16 - regarding the write-off of deviations in the cost of materials;

- Account 19 - regarding the write-off of non-refundable VAT;

- Count 20 - for internal movements of products in production;

- Account 21 - regarding the write-off of own semi-finished products for production;

- Account 23 - regarding the write-off of auxiliary production costs to the main production;

- Account 25 – regarding the write-off of general production costs for main production;

- Account 26 – regarding the write-off of general business expenses for the main production;

- Account 28 - regarding the return to production of products with corrected defects or the write-off of irreparable defects;

- Account 40 - when using products for the needs of main production;

- Account 41 – when using purchased goods for the needs of the main production;

- Account 43 – when using main products for the needs of main production;

- Account 60 - when included in the cost of suppliers' services;

- Account 68 - regarding the inclusion of certain taxes in the cost price;

- Account 69 - regarding accrued social contributions for key workers;

- Account 70 – regarding accrued wages for main employees;

- Account 71 - write-off of accountable amounts for production needs;

- Account 75 - in terms of acceptance as a contribution to the authorized capital of unfinished products;

- Account 76 - regarding the write-off of other services;

- Account 79 - when taking into account the costs of branches or separate divisions in the cost price;

- Account 80 - when contributing to a friend’s capital with products in the work-in-progress stage;

- Account 86 - in terms of receiving as targeted financing an object with work in progress;

- Account 91 - when accepting for accounting unfinished products identified by inventory;

- Account 94 - Regarding the write-off of identified shortages and losses for production;

- Account 96 - regarding the accrual of contingent liabilities;

- Account 97 - regarding the write-off of deferred expenses for production.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 10 – regarding the return of materials from production to the warehouse;

- Account 11 - When reflecting the offspring of animals;

- Account 15 - when forming the cost of raw materials from own production;

- Count 20 – for internal movements of products in production;

- Account 21 - When reflecting semi-finished products of own production;

- Account 28 - when taking into account product defects;

- Account 40 - when posting products at planned cost;

- Account 43 - when recording products at actual cost;

- Account 45 - when writing off the cost of products, which in this case cannot be recognized in accounting;

- Account 76 - regarding the write-off of expenses due to other services;

- Account 79 - regarding the reflection of costs by structural divisions or branches;

- Account 80 - when returning a share to a friend at the expense of unfinished products;

- Account 86 - when writing off target financing funds after paying expenses;

- Account 90 - when writing off cost by direct sale;

- Account 91 - when writing off the cost of unfinished orders upon their cancellation;

- Account 94 - when identifying shortages and losses in production;

- account 99 - when writing off production costs in emergency situations.

You might be interested in:

Postings for wages and taxes: how to reflect them correctly in 2021

All the secrets of account 90: subaccounts, postings, closing

In the Chart of Accounts, account 90 “Sales” is intended to reflect transactions related to the sale of finished products, goods, and services. Accounting account 90 is complex and has a number of sub-accounts. How are transactions recorded when selling on account 90? How is account 90 closed at the end of the year? We will conduct a detailed analysis of account 90, analyze the implementation process using the example of the sale of finished products and goods, as well as accounting entries for account 90.

As mentioned above, account 90 in the accounting department has several subaccounts; below are the main subaccounts used to reflect sales.

Main subaccounts to account 90

1 – the loan reflects revenue from the sale of goods and products;

2 – the cost of what we sell is entered in debit;

3 – the debit reflects VAT accrued on sales;

9 – at the end of the month, results are summed up in this subaccount: the financial result from sales for the month is calculated, profit is recorded in debit, and loss is recorded in credit.

Let us remember that an accounting account is a two-sided table, the left side of which is called debit, and the right side is called credit. The count of 90 can be represented schematically as follows:

The main distinctive feature of this account is that it closes completely (to zero) only at the end of the year. Throughout the calendar year, a balance accumulates in each subaccount from month to month. At the end of the year, each sub-account is closed, and the total financial result for the year is calculated.

Sales of goods on account 90

First, let’s look at how, in general, sales are reflected in account 90, and what transactions need to be made.

If the sale being made is a regular activity of the enterprise, then accounting account 90 is used to reflect it (if this is a one-time sale, for example, the sale of a fixed asset, then account 91 is used, which is discussed in detail here).

Sales income is revenue; it is reflected on the credit of subaccount 1 in correspondence with the account for settlements with customers. (The topic of invoice correspondence was discussed in this article). That is, when shipping goods or products to the buyer, posting D62 K90/1 is made, which reflects the proceeds from this sale.

Sales expenses are collected in the debit of account 90.

The debit of subaccount 2 reflects the cost of goods and products sold.

In the case of the sale of goods, expenses are the costs of purchasing goods and the costs incurred during direct sale. The entry for recording the costs of purchasing goods has the form D90/2 K41, the entry for writing off sales expenses is D90/2 K44.

When selling finished products, the cost of production is written off to the debit of subaccount 2 using posting D90/2 K43.

According to the Tax Code of the Russian Federation, if an organization is a VAT payer, then value added tax must be charged on the products sold, the VAT charge is reflected by posting D90/3 K68.VAT.

Accounting entries:

Closing 90 accounts at the end of the year

During the month, all sales are reflected in this way. At the end of the month, the balance is calculated for each subaccount and the financial result for the month is displayed. How does this happen?

1. The amounts for each subaccount are added up, that is, the turnover for credit is 90/1, for debit 90/2, for debit 90/3.

2. From the total debit turnover (subaccount 2 + subaccount 3), the credit turnover (subaccount 1) is subtracted.

3. If you receive a positive number, it means there is a loss for the month, that is, expenses exceeded income. The loss is reflected by posting D99 K90/9, where account 99 “Profits and losses” is used to generate the final financial result.

4. If we receive a negative number, it means that we have a profit for the month; we reflect it by posting D90/9 K99.

Procedure for closing an account

The method by which account 20 is finally closed must be specified in the accounting policy. In addition, if this is necessary, the distribution base is indicated in the same document.

There are three ways in which you can close your account 20.

Direct method

During the billing period, the cost of production cannot be determined. In this case, products that have already left production should be accounted for at some conditional prices. After the month is closed, the cost of output is adjusted to the actual level.

When using this method, it is not possible to determine the actual cost during the billing month.

Intermediate method

When using this method, account 40 “Product Output” is used in accounting. It records the planned cost (on the credit of the account) from the actual cost (on the debit of the account). After the month is completed, the amount of deviations is proportionally written off to accounts 43 and 90.

Direct sale of manufactured products

With this option, the created products do not remain in the warehouse, but are sold immediately from production. In this situation, all production costs are immediately transferred to cost of sales account 90. Typically, service costs are closed in this way.

Postings at closing

The accounting entries in this case will be as follows:

- Dt 43 Kt 20 - adjustment to the actual cost;

- Dt 90.02 Kt 43 - reflection of deviation.

For the intermediate method, account 40 “Product Output” is used. It reflects data on the deviation of the planned value from the actual value. The debit reflects the fact, and the credit shows the plan.

Closing of account 20 is carried out after writing off the resulting deviation according to the following transactions:

- Dt 40 Kt 20 - write-off of actual cost;

- Dt 43, 90.2 Kt 40 - bringing the planned indicator to the actual one.

When directly selling released goods, works or services, all products are immediately sold, and costs are written off directly to cost, after which account 20 is closed using posting Dt 90.02 Kt 20.

Account 20 is closed depending on the chosen cost distribution method:

- the balance can only be due to work in progress;

- the direct method writes off 43, 90 accounts;

- the indirect method runs through intermediary accounts 40, 43;

- the direct implementation method debits to account 90;

- in 1C versions 8.2 and 8.3 the account is closed automatically.

In accounting, closing a month is a whole cycle of operations that must be carried out to correctly form the company’s balance sheet.

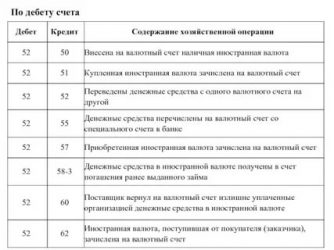

Examples of accounting entries

The following transactions can be made with this account:

| Debit | Credit | Content |

| Postings for accumulating costs | ||

| 20 | 02 | Accrued depreciation of fixed assets |

| 20 | 04 | Write-off of depreciation of intangible assets if account 05 is not used |

| 20 | 05 | Depreciation of intangible assets accrued |

| 20 | 10 | Materials and components written off for production |

| 20 | 11 | Cost of animals written off |

| 20 | 16 | Variance in materials cost written off |

| 20 | 19 | Non-refundable VAT amounts are written off to the cost price |

| 20 | 20 | Turnover within production |

| 20 | 21 | Transfer of self-made semi-finished products into production |

| 20 | 23 | The costs of auxiliary production are written off to the main production |

| 20 | 25 | The cost includes general production costs |

| 20 | 26 | The cost includes general business expenses |

| 20 | 28 | Losses from defects are written off to cost |

| 20 | 29 | Services of servicing industries are written off as main production |

| 20 | 41 | Goods for resale were used for own needs |

| 20 | 43 | Finished products were used for our own needs |

| 20 | 60 | Utilities costs written off for production |

| 20 | 68 | Taxes are written off against the cost price |

| 20 | 69 | Calculation of social contributions on the basic salary |

| 20 | 70 | Payroll for key employees |

| 20 | 71 | Amounts of accountable persons are written off for production |

| 20 | 76 | The cost includes services from other suppliers (for example, insurance) |

| 20 | 79 | The cost includes the costs of branches or separate divisions |

| 20 | 94 | Shortages and losses are written off to cost |

| 20 | 96 | The cost reflects the formation of a reserve for future expenses |

| 20 | 97 | The cost includes amounts of deferred expenses |

| Postings to write off expenses | ||

| 10 | 20 | Return of unused materials from production to warehouse |

| 11 | 20 | Increasing the number of animals due to weight gain |

| 21 | 20 | Own semi-finished products accepted for accounting |

| 28 | 20 | Main production defect reflected |

| 40 | 20 | Capitalization of finished products at planned cost |

| 43 | 20 | Capitalization of finished products at actual cost |

| 90 | 20 | Actual cost of work written off |

| 94 | 20 | Deficiencies identified in the main production are reflected |

| 99 | 20 | Writing off expenses due to an emergency |

Account 20: accounting entries

Let's look at typical accounting entries for recording operations related to core activities.

| Operation | Account debit | Account credit |

| Inventories were transferred to our own production | 20 | 10 |

| Salaries and insurance contributions of personnel directly involved in the main activities are included in the OP | 20 | 70 69 |

| Services of third-party companies are included in the costs of OP | 20 | 60 |

| Write-off of management expenses reflected | 20 | 26 |

| General production costs are written off to OP | 20 | 25 |

| Returns for reworking of finished products that were found to be defective are reflected. | 20 | 43 |

| Manufacturing defects identified prior to sale are sent for processing | 20 | 28 |

| Amounts of taxes and fees are allocated to production needs | 20 | 68 |

| Deficiencies and losses are reflected within the norms in the production process, without persons at fault | 20 | 94 |

| Downtime and claims against contractors | 20 | 76/2 |

| Semi-finished products are sent to the production process | 20 | 21 |

| The costs of auxiliary production are reflected in the OP | 20 | 23 |

| The goods were written off for the company's production needs | 20 | 41 |

| Reflects the report issued to the employee for production needs | 20 | 71 |

| The employee was compensated for costs associated with the production process (compensation for fuel and lubricants for the use of a personal car, for example) | 20 | 73 |

| Work in progress was accepted as part of targeted financing | 20 | 86 |

| Work in progress is reflected as a contribution to the authorized capital of the organization | 20 | 80 |

| Excess work in progress is taken into account | 20 | 91/1 |

| The share of deferred expenses was attributed to the OP | 20 | 96 |

Why account 20 is not closed in 1s 8.2 and 8.3 in accounting

Sometimes an accountant may have a situation when he closes account 20 in 1s 8.3, but after the operation there is a balance left on the account.

Typically, the cause of such an error is incorrect information in the accounting documents on costs.

The thing is that when closing, costs are distributed according to analytics by item groups. This means that the cost analytic attribute must be set to the same as that of the item group. The program performs the distribution within the group proportionally.

Attention! If any cost's analytics attribute does not match any of the products produced, it hangs on the account. To resolve the error, you need to open the “Analysis of subconto Item groups” report and see for which group the costs remain.

Results

Account 20 in accounting is one of the main accounts for reflecting information that is related to the production of products, performance of work, and provision of services. All applicable methods of reflecting such expenses should be provided for in the accounting policies for accounting purposes.

You can learn how to reflect expenses for main production in the balance sheet from the article “Main production in the balance sheet (nuances)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.