Order form

Employment ch. accountant is formalized by order of the director of the company (Article 68 of the Labor Code of the Russian Federation) after signing an employment contract (TD) with him. Unified form of order for the appointment of Ch. The legislation of the Russian Federation does not establish an accountant. Each enterprise can develop the required form itself or simply fill out the order in a custom style. However, in practice, in order to publish an order on the appointment of Ch. Accountants often use the T-1 form, which was approved by the State Statistics Committee of the Russian Federation in Resolution No. 1 of 01/05/2004, but since 2013 it has become optional for use.

Regardless of the chosen form of the order for applying for the job of a chief accountant, the order must certainly display essential information, including:

- Date of publication of the order and its number.

- FULL NAME. chief accountant. Hired.

- Link to the type of TD (urgent or permanent).

- Deadlines for acceptance and transmission of accounting documents.

- Composition of the commission for the acceptance and transfer of cases.

- Signature of the head of the company.

- Signature of the newly hired chief accountant confirming familiarization with the order.

When hiring ch. The accountant director must be guided by the provisions of Article 7 of Law of the Russian Federation No. 402-ФЗ ФЗ dated December 6, 2011, which sets out the requirements for organizing accounting.

( Video : “Reception and transfer of affairs of the chief accountant.”)

Who fills out the order for the appointment of a chief accountant in 2021?

As a rule, the formation of all administrative documents is carried out by human resources specialists or secretaries (if the company is small), or, in extreme cases, by the director himself.

After filling out the order form, the administrative document is sent to the director of the company for signature.

When hiring a new chief accountant, in most cases, the transfer of accounting documents and powers from the accountant who previously occupied this vacancy is organized.

The deadlines for the transfer of cases are indicated in the order signed by the director of the company. At the same time, such deadlines are usually determined on the recommendation of the new chief accountant himself.

The new chief accountant is obliged to accept the cases and ensure verification of:

- Primary accounting documents.

- Cash register.

- Accounting for purchases and sales.

- Securities registration journal.

- Journal of issuance of powers of attorney.

- Invoice journal.

- Availability of check books from banking institutions.

- Other documents.

In fact, the transfer of cases is somewhat similar to a tax audit.

( Video : “TOP 5 tips. How to choose a chief accountant.”)

Order on the transfer of affairs upon dismissal of the chief accountant

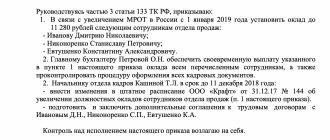

Limited Liability Company "Beta" LLC "Beta"

ORDER

24.09.2014 № 37

Moscow

On the transfer of affairs upon dismissal of the chief accountant

In connection with the dismissal of Serebryakova Yu.V. on October 10, 2014. from the position of chief accountant of Beta LLC

I ORDER:

1. Conduct the procedure for acceptance and transfer of cases and entrusted material assets no later than October 10, 2014 in accordance with the procedure approved by this order.

2. Appoint an accountant to Yudina S.V. responsible for receiving cases (documentation, material assets) from the chief accountant Serebryakova Yu.V.

3. Conduct, no later than October 10, 2014, an inventory of the organization’s cash desk entrusted to the chief accountant and document its results, and after it, transfer the cash register and cash documentation to accountant S.V. Yudina.

4. From October 10, 2014, assign the functions of cashier to accountant S.V. Yudina.

5. No later than October 10, 2014, reconcile accounts with: – the tax inspectorate and territorial bodies of extra-budgetary funds; – main debtors and creditors.

6. Chief accountant Serebryakova Yu.V. transfer the documents and material assets assigned to it, including: – accounting and other financial documentation (primary (including cash and banking) documents, accounting and tax registers, accounting and tax reporting, reporting to extra-budgetary funds, statistical bodies and others authorized departments) - according to the inventory; – official and external correspondence subject to storage and stored in the structural unit of the accounting department; – seals of Beta LLC, at the disposal of the chief accountant, according to the inventory; – carriers of electronic keys for the “client-bank” system, electronic keys for submitting reports - according to the inventory; – keys at the disposal of the chief accountant (from the safe, office); - other material assets assigned to the chief accountant - according to a separate inventory.

Draw up an act of acceptance and transfer of transferred documents and material assets.

7. Submit to me on October 10, 2014 no later than 12:00 Moscow time for approval: – act of acceptance and transfer of cases in two copies; – cash register inventory results; – results of reconciliations of calculations; – power of attorney to sign (submit) statements to accountant S.V. Yudina.

8. Until October 10, 2014, chief accountant Serebryakova Yu.V. fulfills its responsibilities for organizing and maintaining records in full.

9. Instead of the chief accountant Serebryakova Yu.V. from October 11, 2014, in the absence of a new person holding this position, the corresponding powers shall be assigned to the accountant Yudina S.V.

10. Human Resources and IT Support will follow normal termination procedures.

General Director _________________________ A.I. Petrov

The following have been familiarized with the order:

| 24.09.2014 | Yu.V. Serebryakova |

| 24.09.2014 | Yudina S.V. |

Who is appointed to the position of chief accountant?

Ch. Not every specialist can be appointed as an accountant. He must meet certain requirements. In 2021, Order No. 103n of the Ministry of Labor dated February 21, 2019 was issued, where qualification requirements were laid out for accounting workers, indicating education and work experience.

Ch. An accountant must have:

- Qualification not lower than level 6. For levels 7 and 8, higher education in a specialty or higher education plus retraining courses are required. At the same time, the experience of studying in advanced training courses must be at least 120 hours over the last 3 years, including at least 20 hours in the last year.

- Work experience in accounting for at least 5 years, with higher education, or 7 years, with secondary specialized education.

The standards provided for by the legislative norms of the Russian Federation are mandatory both for various companies, as well as for state and non-state institutions and other business entities. At the same time, for LLCs, according to letters of the Ministry of Labor No. 14-0/10/B-2553, dated 04/04/2016, No. 14-2/ОOG-6465, dated 07/06/2016, such standards are displayed in advisory form ( Article 195.3 of the Labor Code of the Russian Federation).

However, in life, when signing a TD with Ch. accountant, the manager certainly studies his level of education and work experience in his specialty. The chief accountant must have sufficient qualifications to properly account for the company's activities.

In small companies, the manager himself can perform the duties of the chief accountant.

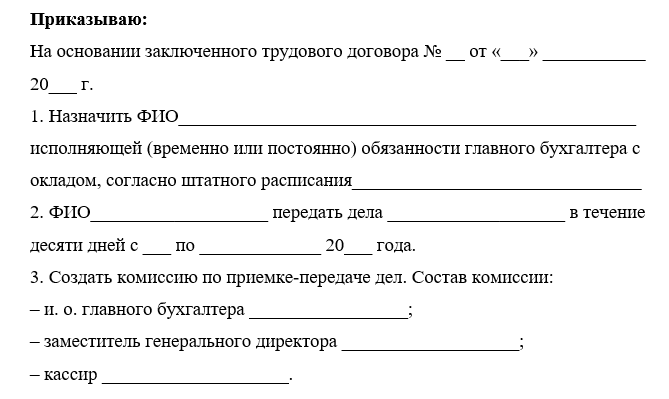

Instructions for filling out the order for the appointment of a chief accountant in 2021

As already noted, the form of the order for the appointment of the chief accountant can be free or filled out on the optional unified T-1 form. This administrative document must be drawn up correctly, since a copy of it will need to be sent to the Federal Tax Service, banking institutions and other departments.

An order, like any administrative form, must be written correctly, without errors, deletions or corrections, taking into account the rules adopted in office work.

The order must contain the following mandatory information:

- Full name of the enterprise and OKPO code. If the document is filled out on company letterhead, then this item can be skipped, since it displays all the company details.

- The name of the document, with a number assigned to it.

- Place and date of its compilation.

1) In the administrative part of the order you need to display:

- Grounds for appointment to the position of chief accountant, indicating the details of the TD.

- FULL NAME. the newly hired chief accountant, indicating the data about him provided for by internal departmental regulations or the charter of the enterprise.

- Monthly salary.

- Time of the trial period, if determined by the TD.

- The deadline for transferring cases from the old employee to the new chief accountant.

- The composition of the commission taking part in the transfer of cases, indicating the full name. its members.

2) The final part of the form includes:

- Signature of the company director with transcript.

- Signatures of the new chapter. accountant and members of the commission, indicating familiarization with the order, and the date of familiarization.

Sample act of acceptance and transfer of cases

We present to your attention a screenshot of the act of acceptance and transfer of cases.

The same document, but in .doc format, is available for download from the link at the top of this page. The execution of an acceptance certificate for personnel documentation should always accompany the change of the employee responsible for personnel records management. Despite the fact that the procedure for submitting documents to personnel departments of organizations is not defined in the legislation and, accordingly, workers do not have the obligation to draw up and sign an acceptance certificate, the documented transfer of personnel papers allows not only to record the completeness of documents at the time of replacing an employee, but also to once again systematize document flow.

The immediate execution of the document acceptance and transfer certificate must be preceded by:

- organization of a commission (optional, but highly desirable - members of the commission will be able to record the receipt and transmission of all necessary documents);

- verification of the availability, content, registration and storage form of business papers.

After checking the completeness of the documentation, an act of acceptance and transfer of personnel documents is drawn up.

Sample orders for the appointment of an accountant in an LLC

Regardless of the legal form of the company, responsibility for the correct maintenance of accounting falls on the director. Therefore, in order to partially relieve himself of such responsibility, the director issues an order on the appointment of Ch. accountant, which is a document confirming the employment of an official, with the future possession of the right to sign and full financial responsibility.

If the company uses a simplified accounting procedure, then the director has the right to perform the duties of Ch. the accountant himself, having published the corresponding order (clause 3 of article 7 of Law No. 402-FZ of December 6, 2011).

An order for the appointment of a chief accountant can be filled out on form T-1 or drawn up on letterhead, as well as on a simple sheet of A4 paper.

Below are examples of orders for the appointment of Ch. accountant.

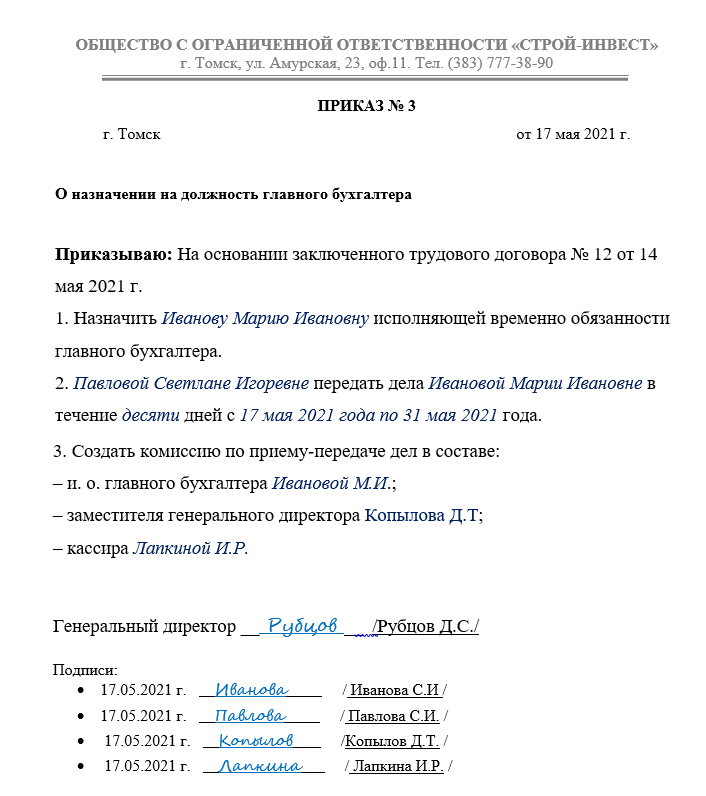

Sample order for the appointment of a chief accountant

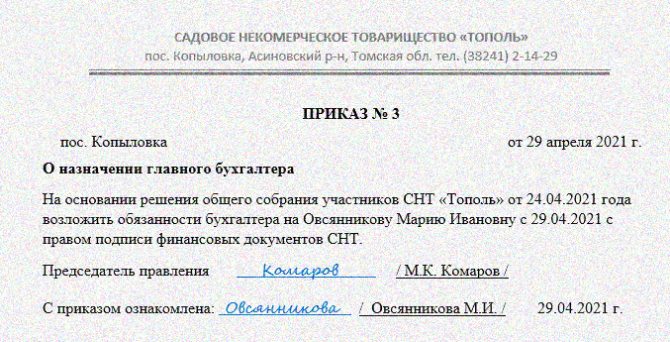

Sample order for the appointment of an accountant in SNT

Sample order for the appointment of an accountant in SNT

Download

- Sample order for the appointment of an accountant in SNT

- Sample, doc