Each subordinate has the right to dismiss on his own initiative. Terminating an employment contract for this reason is a very reliable method of dismissal. But, although the procedure is quite simple, the law regulates a special procedure for voluntary dismissal, which must be observed in 2018.

Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question

free of charge To solve your problem, call: You can also get a free consultation online.

At the request of the employee

According to labor law, termination of a working relationship can occur either at the initiative of the organization’s management or at the request of the employee. The employee is not obliged to explain the reason for his desire to quit, but he must warn him in advance. The employer cannot ignore the employee’s application and is obliged to fire him within the prescribed period.

Often, employers force an employee to write a statement of his own free will in order to calculate the minimum amount of compensation. If an employee is aware of his rights, he is more likely to defend his financial capabilities.

Working off

At the legislative level, the maximum working period is set at 14 days, but it is not mandatory if the employer wants to shorten or remove the period. Dismissal without work is possible in a number of cases:

- if the employer agrees to release immediately;

- if there are various nuances in the employment contract, including when filling positions;

- upon additional conclusion of an agreement;

- if there are good reasons that are supported by documentation.

Important! If there are disciplinary sanctions or various violations, but the employee quits of his own free will, then the employer can completely cancel the work.

It is worth considering that the duration of work is provided for by law, so the employer does not have the right to retain the employee longer than the required period.

We are writing a letter of resignation of our own free will.

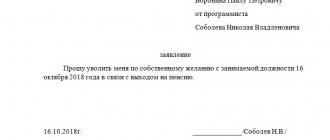

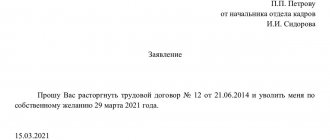

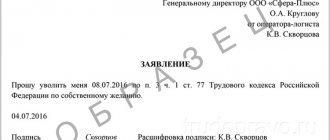

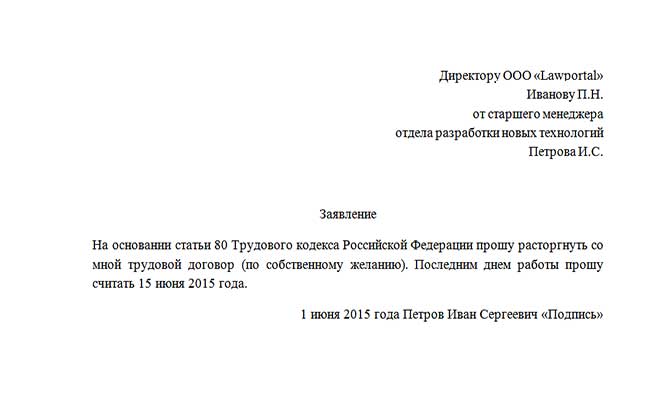

The dismissal process is carried out only if there is a written application from the employee, handwritten or printed. The application is completed in a standard way: in the upper right corner the name of the institution, position and full name of the manager are indicated, below the employee’s details. In the center, “Application” is written in large letters, and below is the text of the application, which must contain such expressions as dismiss, terminate the employment relationship or terminate the employment contract. Under the text on the right is the employee’s signature and its transcript, and also indicates the date the document was compiled.

Dismissal during vacation at one's own request: filing an application, working out, maternity leave

An application is submitted to the head of the personnel department, directly to the manager or his secretary. It is also possible to send by registered mail. If the employee is financially responsible, he must attach to the document an inventory of the property that is in his possession.

Sample letter of resignation at one's own request

Salary is withheld after dismissal - what to do

As we have already said, all payments to the employee are made on the last day of his work. If this does not happen, and the management “feeds breakfast” to the former employee, you should go to court. Before this, it is recommended to send a written claim demanding that all due payments be made. If the complaint remains unanswered, the case is referred to court.

A claim for recovery of wages is drawn up according to the rules of Art. 131 Code of Civil Procedure of the Russian Federation. The statement states:

- name of the court (the claim is filed in the district court at the location of the defendant company or its division in which the plaintiff worked);

- name of the defendant, his legal address (unit address);

- bank details, company contact numbers;

- Full name of the first manager;

- Full name, address, passport details of the plaintiff;

- a brief description of the circumstances of the case.

Download a sample statement of claim for recovery of wages after dismissal

Claims for the recovery of wages are not subject to state duty and are considered by the courts within 2 months after filing the claim (Part 1 of Article 154 of the Code of Civil Procedure of the Russian Federation).

Submission deadlines

The standard processing time for an application is 2 weeks, but it may vary at individual enterprises. So, according to the labor code, for those hired on a probationary period or under a short-term agreement for 2 months, as well as seasonal workers, the period is 3 days. For the CEO - 30.

Dismissal may occur earlier if both parties agree to this decision. Find out what documents are needed upon dismissal.

Work upon dismissal at one's own request

In some cases, management may require mandatory work, which is included in the established standards. Some categories of citizens may resign without working off in the event of voluntary dismissal in 2021:

- employee of retirement age;

- citizens who have completed a competitive selection for a vacant position in a municipal, regional and other public entity;

- persons enrolled in full-time studies at secondary technical or higher educational institutions;

- employees whose rights were violated by the organization's management.

Dismissal without working during vacation

According to the Labor Code of the Russian Federation, employees who have unused vacation days can replace the work required by current legislation for these days or demand compensation for unused vacation. It is best to first coordinate this decision with the higher management of the enterprise. However, even without a personal agreement, the organization does not have the right to not allow an employee to go on vacation and oblige him to work for two weeks, or refuse to dismiss him at the end of the vacation.

If an employee simply does not want to work at a particular enterprise any longer, he can choose a dismissal period that includes a large number of days off. For example, for those who are on a probationary period, dismissal without further work within three days is provided. You can submit an application on Friday if the employee works on the 5/2 system. And from Monday, demand actual payment and dismissal.

The procedure for dismissal at will

Adjustments in the legislative regulation of the dismissal process occur regularly; as a rule, they are insignificant. In 2018, voluntary dismissal has the following sequence:

- writing a statement indicating the date of termination of work and the grounds for its completion;

- submitting an application to management and its approval;

- signing the dismissal order;

- completion of the remaining term;

- accrual of benefits upon dismissal at one's own request;

- receipt of documents and due payments;

- checking the correctness of payment of compensation upon dismissal of one's own free will;

- termination of relations with the organization.

All procedures are regulated by law. First of all, this is the Labor Code of the Russian Federation, articles 80, 81, 71, 280, 127, 77, 64. Articles devoted to payments to an employee upon dismissal - 84 and 140.

What documents are given to an employee upon dismissal?

Upon dismissal, regardless of its grounds, the employer must provide the dismissed person with the following documents:

- work book;

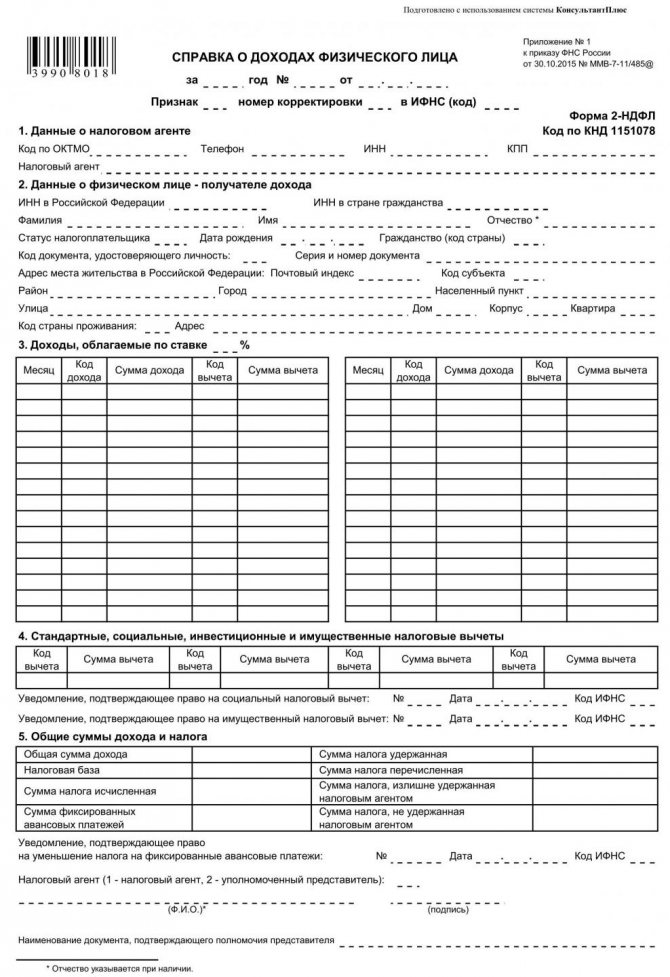

- certificate form 2NDFL;

- certificate of average earnings for the last three months;

- Form 182H certificate of salary for the last two years before dismissal or the entire actually worked period, if it is less than two years;

- extracts from reporting on insurance premiums: SZV-STAZH forms;

- forms SZV-M;

Issuance of a work book

A work book with a record of dismissal is issued to the employee on the last working day.

To confirm the fact of its issuance, the dismissed person must sign his personal card and work record book.

Pages of the work book with a record of voluntary dismissal due to retirement

If an employee was absent from the workplace on the last working day, for example, fell ill and because of this it turned out to be impossible to issue him a work book on time, the employer must send him a written notice to his home address about the need to pick up the work book with an offer, as an alternative, to give consent to it. forwarding by mail.

When a work book is sent by mail, confirmation of its issuance is an inventory of the attachments in the postal item.

Issuance of 2NDFL certificate

The 2NDFL certificate is issued by a tax agent, including the employer, and confirms the income of the taxpayer (in the case of an employment relationship, an employee) and the amount of tax paid on this income.

This document will be useful in the following situations:

- for the tax inspectorate, in particular, when processing tax deductions that are provided through the Federal Tax Service;

- to confirm income when applying for a loan to a bank;

- to confirm income and deductions from them from the new employer.

At a new job, a 2NDFL certificate will be useful when the employee needs:

- calculate sick leave pay;

- apply for a standard tax deduction, including for children;

- accrue other compensation or provide benefits.

There may be other situations when this certificate may be useful. Therefore, it would be optimal for the person being fired to receive it immediately. And if he knows that he will need it more than once, for example, both at a new employer and at the tax office, then he has the right to immediately request the required number of copies or take several certificates covering different billing periods. It must be taken into account that the new employer is interested in income and taxes for the current year, the bank only needs the previous three months or six months, the tax office, if the certificate is included in the set of documents for providing a deduction, the calendar year for which the deduction is provided is important. If there was a change of job in such a year or there were parallel sources of income subject to personal income tax, certificates are provided from all tax agents.

A sample will help you draw up a 2NDFL certificate.

Blank form 2NDFL

A special case is a situation where a taxpayer has received the right to a tax deduction for the purchase of housing and sells it through an employer, receiving all accrued income without deducting tax from it. After dismissal, a document from the tax office confirming the right to deduction and transferred to the accounting department at the place of work must be issued to the new employer. To do this, a complete set of documents is submitted to the Federal Tax Service, including 2NDFL certificates from all tax agents.

2NDFL certificates for employees and the tax authority (video)

Issuance of a certificate of average earnings for the last three months

A certificate of average earnings for the last three months will be useful to the dismissed person if he plans to register with the employment center. A specific region may have its own form for such a certificate. It is better to clarify this point with your employment center before dismissal. To do this, you need to go there, inform them that you are about to be fired, and ask for a certificate form, which you can then give to the employer.

It is better for the employee to take the current form of salary certificate for the last three months from the employment center where he wants to register

This is especially true if the dismissal is related to the liquidation of the organization: after this process is completely completed, there will be no one to request a certificate from.

Even if the employee does not plan to become officially unemployed, it does not hurt to take a certificate. It cannot be excluded that it will be useful later when assigning a pension as additional confirmation of length of service and earnings.

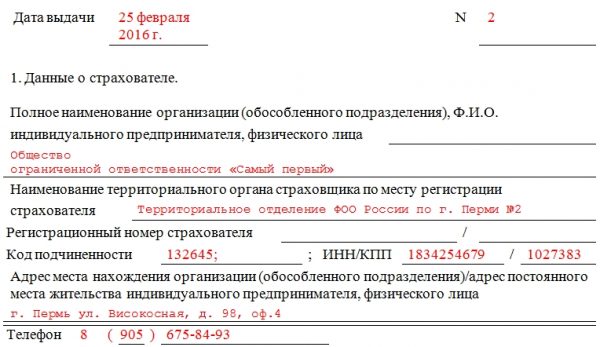

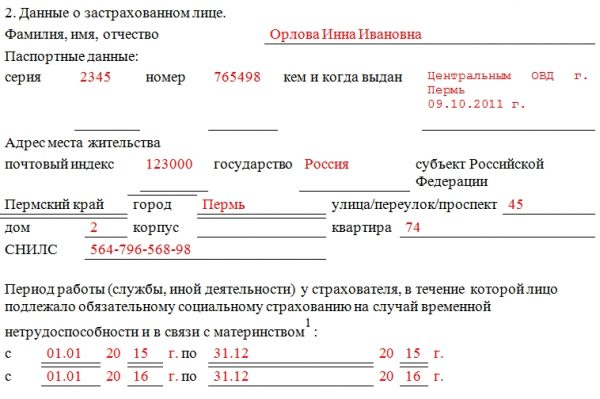

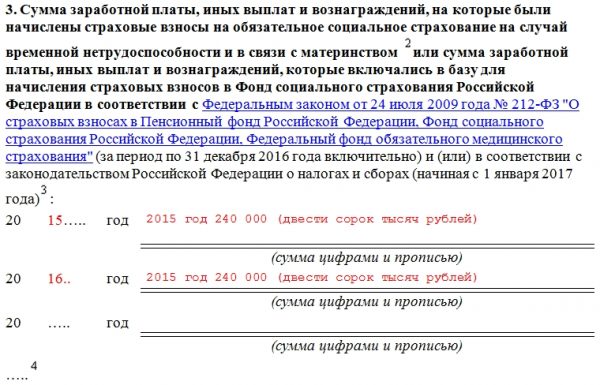

Issuance of certificate form 182Н about salary for the last two years

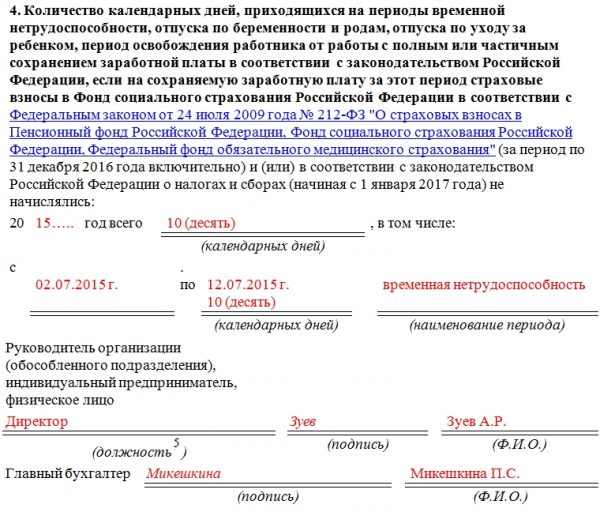

Since 2013, certificate 182N has replaced the certificate of form 4H and serves to confirm the employee’s income for which social insurance contributions were calculated. It also reflects periods for which contributions were not accrued: when the employee was sick, on maternity leave or child care.

This certificate will be needed when calculating sick leave and payments during maternity leave or child care, for assigning a pension and various social benefits through social security.

Since 2013, instead of the 4H form, 182H has been used

During the 2008 crisis, the author of these lines was laid off while working in the Moscow branch of a company whose head office was located in St. Petersburg. The salary certificate issued to me upon dismissal was drawn up by St. Petersburg specialists from the head office according to the standards adopted in the Northern capital, and was not suitable for the Moscow employment center. I had to take their form from the employment center and take it to the office, and then wait for the certificate that was needed to be sent from St. Petersburg. But there were no more problems with her.

Photo gallery: sample of filling out a certificate in form 182Н

Sample of filling out certificate 182Н, part 1

Sample of filling out certificate 182Н, part 2

Sample of filling out certificate 182Н, part 3

Sample of filling out certificate 182Н, part 4

Issuance of an extract from personalized accounting information

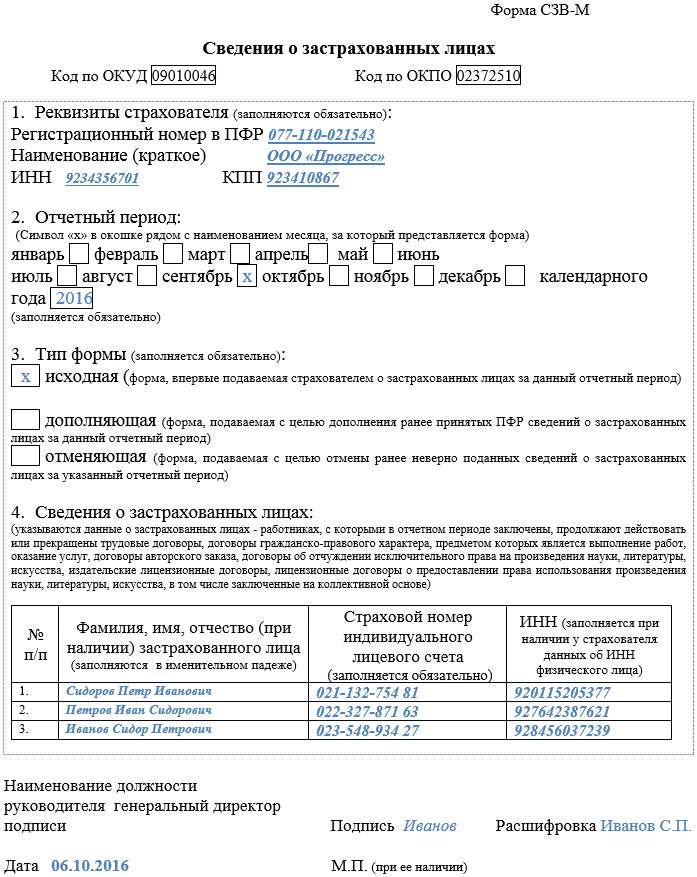

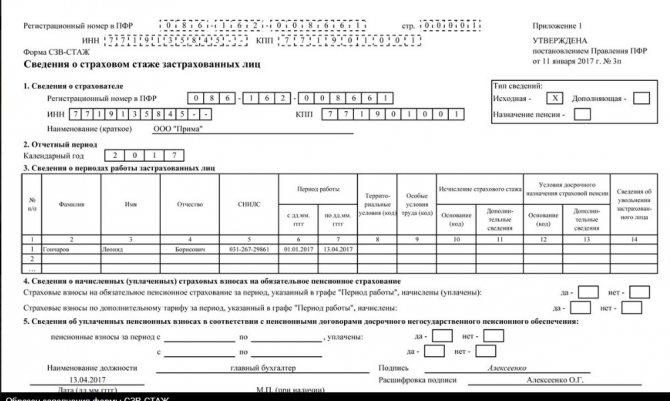

An extract from the SZV-STAZH and SZV-M forms reflects the insurance experience received from a particular employer and the amount of contributions to the Pension Fund made for him.

Since these documents represent a group reporting form, extracts are made for the employee, which contain personal information about him.

The SZV-M form covers the last month of work, but at the employee’s request it can be extended to any other period up to the entire time actually worked for the employer. But with a caveat: since this form appeared in 2021, it cannot cover earlier periods.

Sample of filling out the SZV-M form

The SZV-STAGE form is issued for the period from the beginning of the current year to the day of dismissal, and if the employee was hired in the current year - from the date of his employment. You can request it earlier, but not earlier than 2021, in which it was introduced. For periods of work until 2021, the dismissed person is provided with certificates in the form RSV-1.

Sample of filling out the SZV-STAZH form

Extracts from personalized accounting information are also received by those who cooperate with organizations under civil law contracts. In this case, the documents are issued on the day the contract ends.

Return of a medical record

If an employee presented or issued a medical record upon joining the staff, on the day of dismissal the employer is obliged to return this document to him.

Issuance of educational documents

The situation is similar with educational documents if they were kept by the employer. Diplomas of professional education remain in the employee’s hands; the employer only gets acquainted with them and makes copies. But with regard to certificates of completion of various additional education programs, courses, trainings, etc., especially those paid for by the employer, this practice is allowed.

Education documents stored by the employer are issued to the employee upon dismissal

There are cases when the employer, upon dismissal, did not give the employee documents on qualifications obtained at the expense of the company: completion of courses for forklift drivers in a supermarket, tourism instructors at a tourist center, etc. This practice is illegal, and the employee has the right to apply to the court to protect his interests , prosecutor's office and labor inspectorate.

Issuance of other documents upon request of the employee

Both upon dismissal and at any other time, including several years after leaving the organization, an employee has the right to demand copies or extracts from any internal documents containing his personal data. If such a document refers only to a specific employee, a copy is made. When his colleagues are mentioned in the document of interest, an extract is issued that contains data only about the employee who requested it.

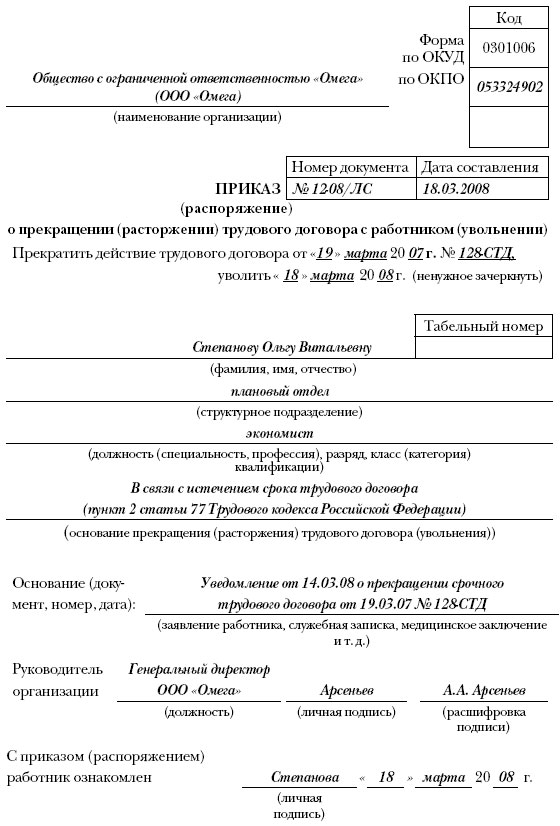

The dismissal order is one of the documents that the employer is obliged to issue to the employee upon request.

The most frequently requested documents are:

- copies of orders on hiring, dismissal, transfer to another position or to another structural unit;

- salary certificates for different periods;

- copies of orders on salary changes;

- extracts from reports to the Pension Fund and Social Insurance Fund.

When leaving, it is better to take as much as possible from the employer all documents confirming work, career growth, if any, salary, taxes paid and contributions to extra-budgetary funds. They may be useful when applying for a future pension if the personalized accounting information suddenly turns out to be incomplete.

In 2021, the third most important documents confirming work and insurance experience for pensions are considered to be archival certificates of work and salary. However, there is no guarantee that data on a specific employer, which has long ceased to exist, is available in the required archive. The author of these lines recently encountered such a problem. For additional confirmation of information about my work in 2001, I turned to the archives of the city of Moscow. And in due time I received a reply from there that they had no information about such an organization, and they didn’t know where they might be.

Issuing recommendations upon dismissal

The employer’s obligation to issue a recommendation to a dismissed employee is not provided for by law in 2021. The employer himself can take such an obligation and reflect it in the employment contract if he wishes, but he is not obliged to do so.

An employer is not required by law to provide recommendations upon dismissal, but can do so if it wishes.

But even if there is no such clause in the employment contract, the situation is not hopeless. You can agree on this in any situation. And if the head of the organization himself does not want to give a recommendation (for example, he is offended that the employee is leaving him), any other managerial employee can do this: your immediate boss or the deputy head supervising your department. The main thing is to just ask him to leave personal, and not corporate, coordinates under the document. After all, the recommender can also change jobs at any time, and those to whom you subsequently present the recommendation will most likely want to contact him personally to confirm it.

Of all my places of work, only one had the employer’s obligation to provide me with recommendations at any time in Russian, and, if desired, in English, in the employment contract. It was a project in which foreign investors participated. In other cases, I took recommendations, whenever possible, from the first person of the organization, and if it was difficult to reach him, from his deputies or my immediate supervisors. So, when leaving my next job, the editor-in-chief, offended by me because I wanted to quit, didn’t even want to hear about the recommendation, but his deputy, with whom I was and remain on friendly terms, gave it without any problems and more than once confirmed.

Deadlines for issuing documents upon dismissal

The legal requirement for issuance on the last working day applies not only to the work book, but also to all other documents that the employee must receive upon dismissal.

If an employee takes a vacation with subsequent dismissal or does not go to work on the last working day for other reasons, for example, the date of dismissal falls on a weekend or a day off, documents are issued on the last day when he actually goes to work.

In a situation where it turned out to be impossible to do this due to reasons beyond the employer’s control, for example, the employee unexpectedly fell ill or decided to miss his last working day, all required documents must be issued within three days after the employee submits the relevant application.

If the employee is not sure that he will receive the documents on time, it makes sense for him to play it safe: ask the employer’s representative to make a mark of acceptance on the second copy of the application or send it by mail with a return receipt and a list of attachments.

Is it possible to withdraw an application?

Even a correctly completed resignation letter can be withdrawn by an employee at his own request. He needs to formalize this within the two-week period used for working out. At the same time, management cannot refuse an employee without compelling reasons. Such reasons could be:

- hiring for this position disabled people or citizens of other preferential categories;

- if there is a replacement, which was issued by an external transfer, and the new employee has already started working.

In other cases, the revocation of the application is made in writing, indicating the same data as in the application for dismissal.

Step-by-step instructions for dismissal

Application for voluntary resignation

An employee can initiate termination of the contract, for which he needs to notify the administration of the enterprise with a letter of resignation.

He composes it himself in free form, either by hand or using a computer. Many business entities have pre-developed templates for such statements. The employee needs to write down all the necessary information according to the sample, substituting his personal data.

At the same time, he must clearly indicate the date of his dismissal. If it is not included in the application, management will consider that the two-week period of work will begin from the next day.

Even if the application is drawn up on a computer, it must contain the employee’s personal signature, made by hand.

Then it is advisable for the employee to contact the head of his department so that he can endorse this application. But this is optional.

The completed form is then sent to management. The director makes a decision and issues a resolution on the application.

In accordance with internal policy, after receiving an application, a bypass sheet may be issued, according to which the employee must collect all signatures confirming the closure of his relations within the enterprise in connection with the dismissal.

Issuance of an order for dismissal at one's own request

Based on the received application, the personnel service issues a dismissal order. Rosstat has provided a special form T-8 for this purpose. The company can also use a form developed independently.

In the dismissal document, you must enter personal information about the employee, the reason for the termination of the employment contract, and the date. There must be a link to the relevant article of the Labor Code of the Russian Federation (clause 3, article 77).

There are no specific deadlines for issuing an order, but it definitely needs to be issued on the last day. If you rush and do it in advance, you may have to cancel it if the person leaving changes his mind and withdraws the application.

Next, the director must sign this order, after which the employee familiarizes himself with the order.

Attention! In accordance with the law, termination of a contract can occur by granting leave with further dismissal. In this case, an order for leave and termination of the contract is issued. It is allowed to combine them into one document.

Calculation of final salaries and compensations

Based on the signed order, a note of calculation is drawn up for the dismissed employee and transferred by the HR department to the accounting department.

Upon termination of the contract, the employee is entitled to the amount of the remaining unpaid salary, compensation for unused vacation, if any, and other amounts due in accordance with the concluded employment contract.

According to the rules, payment to the employee must be made on his last day of work. If the company issues salaries through bank cards, then the deadline is set on the next working day.

When terminating a contract using vacation first, all payments are made on the final day of work before vacation. In this case, most likely there will be no compensation for vacation, since the employee uses it before his dismissal.

Registration of labor upon dismissal

In addition to the calculation, on the final day of work the resigning employee must also be given his or her work record, which must include notes about the dismissal.

Entries in it are made only on the basis of signed orders. In this case, the details of this order must be indicated here. The notice of dismissal is endorsed by the manager or responsible person and the employee himself.

In addition, due to the fact that this employee’s record book belongs to the BSO, the employee must sign for it in the work record book.

When an employee for some reason does not pick up his work document, he needs to send a letter with a request to dispose of this document - come to receive it or agree to send the work document by a valuable letter with notification.

Mark in the employee’s personal card

Dismissal of one's own free will also requires entering information about this in other documents. So it is necessary to make an appropriate entry in the employee’s personal card, drawn up in the T-2 form. It must indicate the date and reason why the employee left the company.

In this case, it is necessary that the employee signs this document. Next, the card is transferred to his personal file and stored in the company.

Final payment – when will it be received?

Compensation payments to a resigning employee are paid according to the terms written in the application. The proposal to make payments upon voluntary dismissal 2021 at the same time when all other employees receive salaries is not legal. Funds may be paid at a different time when:

- the employee quit immediately after his vacation, since payment of vacation pay and payslips is issued simultaneously on the last day of work;

- During the working period, the employee was on sick leave. In this case, payments are made the next day after presentation of sick leave;

- the employee did not show up at the place of work within the specified period, then payment is made the next day after receipt of the claim for compensation payments.

Terms of service

Without working off

The law stipulates several situations in which an employee can quit without working, that is, he does not have to work the required two weeks. But to obtain this privilege, you must provide copies of supporting documents.

Such situations include:

- The employee's spouse is transferred to another place of work in another city or country. To confirm, you must provide a copy of the summons certificate; The employee is enrolled in an educational institution as a full-time student (a copy of the order is provided);

- The employee retires. The right to resign without service is granted only once. If in the future the pensioner gets a job and quits again, he will have to work the established 2 weeks.

- The company's administration violates working conditions - for example, wages are not paid on time.

On probation

If an employee is employed on a probationary period, then during the probationary period a simplified dismissal procedure applies to him. While on probation, he must notify of his desire not 14 days in advance, as is generally required, but only 3 days in advance.

He can also agree with the administration on immediate dismissal without working out the required period. However, in this case, it is necessary to obtain explicit consent and, if possible, complete all necessary documents.

Otherwise, failure to appear will be regarded as absenteeism with possible dismissal under the article. If the probationary period has passed, the employee must work 14 days on a general basis.

Attention: also during the probationary period, the employer has the right to dismiss the employee due to low performance. In this case, no work is required at all.

With working out

The Labor Code establishes that upon dismissal on a general basis, this action can be carried out with 14 days of service (Article 80 of the Labor Code of the Russian Federation). This period is given to the administration to complete all necessary documents, as well as to find a replacement for the resigning employee.

If an employee carries out activities under a fixed-term agreement with a period of up to 2 months, then the mandatory service time is 3 days. For management personnel, which includes the manager and his deputies, the chief accountant, etc., the service period is 1 month.

Dismissal without mandatory service is not prohibited, but this decision must be made by the head of the company. He may allow you not to work at all, or reduce this number of days.

Important: if an employee does not want to work the established time, and after filing an application does not appear at work on his own initiative, then he is violating the current Labor Code. In this situation, the administration can issue him dismissal under the article for absenteeism.

Will management face fines?

If compensation payments were not made on time or in sufficient volume, the resigned employee has the right to appeal to the Labor Inspectorate with a complaint and demand additional compensation for moral and material damage. This requirement is regulated by Article 236 of the Labor Code, and the amount is 1/150 of the Central Bank rate in force at the time, it is summed up for each day of delay.

In addition, the organization will be required to pay a fine, the amount of which can reach 50 thousand rubles, and a penalty of up to 20 thousand rubles will be imposed on the head of the enterprise.

How to confirm the fact that documents have been issued to a dismissed employee

By taking care in time to confirm that he has issued the required documents to the employee in full and on time, the employer insures himself against possible problems in the future. If the dismissed person then accuses him of failure to issue certain papers, it will not be difficult to prove the inconsistency of these claims.

Since the law does not contain strict requirements for the confirmation procedure, several options are allowed:

- All documents, except for the work book, for which the already discussed procedure for confirming issue is provided, are drawn up in two copies; on the second, which remains with the employer, the dismissed person makes a note of receipt, affixes a date and signature.

- If an enterprise keeps a journal for issuing documentation, all documents are entered into it, and the employee signs for each one.

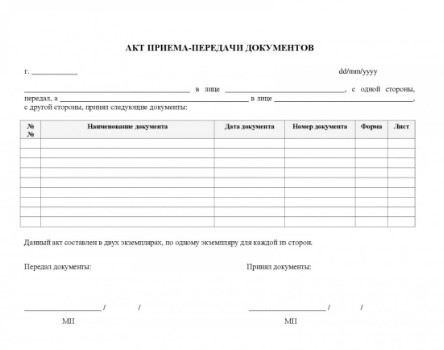

- An act of acceptance and transfer of documents () is drawn up, which lists all the certificates received by the employee. The act is sealed with the signatures of the employee and employer. The act is drawn up and signed in two copies, one remains with the employer.

Sample act of acceptance and transfer of documents

- The employee writes a receipt for receipt of documents, where they are all listed (download a standard sample). In some companies it is customary to draw up both a deed and a receipt.

- An inventory of the issued documents is compiled, the employee puts a mark of receipt and date on it and signs.

What payments are due upon voluntary dismissal?

Payments accrued to a resigning employee consist of several parts:

- salary taking into account the period of service;

- compensation for unused vacation based on the number of days that have passed since the last vacation or the date of employment;

- bonuses and allowances in accordance with the regulations of the organization or higher authorities.

An employee is not entitled to severance pay upon dismissal of his own free will, but can be paid by agreement with management.

Interesting facts about voluntary dismissal

- When leaving work at his own request, an employee can register with the nearest Employment Center and receive benefits over the next 6 months, although it will be minimal;

- Pressure from management and an attempt to force an employee to write a statement of his own free will are illegal. Thus, some managers try to save money in order to make fewer compensation payments. In such a situation, contacting the labor inspectorate will help, however, it is advisable that the employee has some evidence in his hands. Ideally, if written.

- Documents are issued and compensation is paid on the day of dismissal. If the work book was not received on this day, the employee has the right to sue and receive financial compensation for the delay.

Reasons for dismissing an employee on his own initiative

Any citizen can resign from his official place of work of his own free will. The employer cannot interfere with the implementation of his intentions. An employee may always have many reasons for dismissal, due to the circumstances in his life. They could be:

- personal reasons, for example, moving to live in another place, inability to continue working at the request of the spouse, etc.;

- reasons related to the work itself: dissatisfaction with wages, remoteness of the place of work from home, unfavorable environment in the team, poor relations with management, and others;

- circumstances that arise unexpectedly in a citizen’s life that force him to resign, for example, an urgent move due to a spouse’s long business trip, enrollment in a university or secondary educational institution, or conscription for military service.

Expert commentary

Platonov Alexander

Lawyer

The decision to resign does not imply the immediate release of the employee from his duties. The law provides for a dismissal procedure initiated by the employee himself. It must be observed for any reason for his leaving his place of work.