What is a TIN?

In order to account for the income of individuals and legal entities, as well as tax deductions from this income, taxpayers are identified by a digital code. It is mandatory and necessary in many life situations. For example, it is impossible for a citizen to pay a salary or benefits without filling out the TIN.

TIN is a taxpayer identification number indicated in all tax registers. For an individual, it consists of 12 digits, the combination of which allows you to determine in which region and tax authority he is registered, his serial number in the database. The last two digits are a check number to check the previous parameters.

The number is assigned upon initial tax registration:

- at the place of residence or stay;

- at the location of the property (real estate or vehicle) - if there is no place of residence or stay within the Russian Federation.

The assignment and issuance of a TIN certificate is carried out on the basis of a written application from a citizen.

Features of receiving

When the original TIN is somehow lost, you are allowed to purchase a duplicate using the following methods:

- Personal appeal to the tax authorities. You will need: an application written in free form with a request for a duplicate, a passport or other document establishing individuality, a document confirming the registration of place of residence, a receipt for paid state duty in the amount of 300 rubles.

- Contacting the tax authorities through a representative. In this case, the representative must present the following: a statement written in free form with a request for a duplicate; passport or other identification document; a document confirming registration of place of residence; a receipt for payment of the state duty in the amount of 300 rubles; a document that confirms the authority of the representative.

- Mailing. Documents that must be sent by mail to the tax authorities: an application written in free form with a request for a duplicate; passport or other identification document; document confirming residence registration; a receipt for payment of the state duty in the amount of 300 rubles.

TIN restoration

To reproduce a lost certificate, you need to visit the tax authorities with an application, passport and a receipt for paid state duty (300 rubles). The TIN is issued at the end of 5 days after the application. If you need it as soon as possible, the amount will be 400 rubles.

Many people are interested in the question of whether it is possible to restore a certificate via the Internet. In fact, it is not possible to carry out the entire procedure online; you can only pay the state fee.

If you absolutely need to find out the TIN number, but there is no certificate, then this can be done on the official website of the Federal Tax Service, for this you only need to enter your passport data.

Replacing TIN

The taxpayer identification number is not changed in cases of change of residence and surname.

Only the certificate of registration with the tax authorities changes.

If you change your place of residence, subordinate to another tax authority, you must replace the document.

The following documents are needed:

- Passport or other identification document.

- A document that confirms your place of residence.

- For an individual, you need a tax registration certificate.

- A copy of a document indicating that deregistration from the previous place of residence occurred.

Therefore, it is important to know:

- The TIN provided to an individual by the tax authority does not need to be replaced in case of a change of location.

- When replacing a surname or other individual data, a new TIN is obtained completely free of charge.

- Purchasing a TIN in the event of a change of name or other personal data is a purely voluntary process.

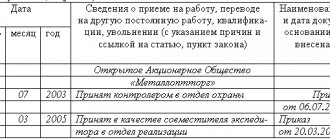

Upon subsequent receipt of the certificate, the identification number remains unchanged as when it was first issued, only some information about the taxpayer changes.

Obtaining a TIN for a child

As you know, a passport is obtained upon reaching 14 years of age. At this age, a child may need a TIN, for example, when applying for a job. The application process is the same for adult citizens. If the child is under 14 years old, his parents must obtain the certificate.

To do this, they should go to the tax department with the following documents:

- Completed application.

- Passport and its copy.

- Child's birth certificate with a copy.

A TIN is not at all necessary for a child, but if you receive it, you can easily issue a deed of gift for him or rewrite an inheritance, as well as receive various benefits when purchasing vouchers for resort examinations.

But there are some points when purchasing: registration of the child at the place of location, a birth certificate certified by a notary, the child must be recorded in the passport, any relative can pick up the TIN with a power of attorney.

Obtaining a TIN for a foreign individual

Persons who are not permanently staying or working in the country can acquire such a certificate. To do this, they also need to contact the tax authority at their location with a completed application, passport and document that confirms registration on the territory of the Russian Federation.

If the TIN has already been received, but the certificate itself has not yet been received, then the number can be determined online. To do this, you need to visit the website of the Federal Tax Service and select the “Find out your TIN” section. After this, you should enter your last name, first name and patronymic, as well as date of birth and passport data (series, number, date of issue).

The number will be displayed on the monitor screen.

Where can I get a TIN?

You can apply for a TIN in one of the following convenient ways:

- Personally contact the tax authority at your place of residence. A citizen can prepare the necessary documents, their copies and come to the inspection, where they will receive an application form in the “2-2 Accounting” form, fill it out and submit it for inspection. You can also submit your completed application in advance (fill out sample).

- Fill out an electronic application on the official website of the Federal Tax Service. Users registered on the State Services portal or who have received a registration card on the Federal Tax Service website have the right to fill out an electronic form on the official website of the tax service. For this purpose, it has organized a special online service.

All fields of the form are sequentially filled in and the application is sent for consideration to the department. Messages about the completion of processing stages will be sent to the e-mail specified in the taxpayer’s personal account.

- Send documents by registered mail. When sending documents by Russian Post, copies must be notarized and carefully fill out application 2-2 Accounting. It is recommended to enclose them in a registered letter with acknowledgment of receipt, accompanied by an inventory.

- Contact the MFC in person. Multifunctional centers provide a wide range of government services. This amount includes the issuance of a TIN. MFC specialists will accept the necessary documents, submit them to the tax office for processing and issue the citizen with a completed certificate.

Design methods

How to request a TIN? The production time for such a document depends slightly on how exactly the citizen prepares the paper.

You can submit a request:

- personally;

- through the Internet;

- with the help of a representative.

In addition, the application is sent to the authorized bodies:

- by mail;

- remotely;

- by directly contacting the registration services.

How exactly to act, everyone decides for themselves. It is only worth noting that in the case of an independent visit to the authorized bodies, you will have to wait less for the readiness of the tax registration certificate than with postal items.

Addresses and telephone numbers of the Federal Tax Service in the city of Volgograd

You can get advice and submit an application at the following department addresses.

Inspectorate of the Federal Tax Service of Russia for the Dzerzhinsky district of Volgograd

? Volgograd, st. 51st Gvardeiskaya, 38 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ?

Inspectorate of the Federal Tax Service of Russia for the Central District of Volgograd

? Volgograd, st. 7th Gvardeiskaya, 12 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? +

MIFNS of Russia No. 3 for the Volgograd region

? Kamyshin, st. Korolenko, 18 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? + 7 (84457) 9-64-75, + 7 (84457) 9-63-35, +7 (84457) 9-63-45

MIFNS of Russia No. 4 for the Volgograd region

? r.p. Srednyaya Akhtuba, st. Lenina, 38 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? +7 (84479) 5-14-52

MIFNS of Russia No. 5 for the Volgograd region

? r.p. Gorodishche, st. Chuikova, 2 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? 8-(84468) 3-53-74

MIFNS of Russia No. 6 for the Volgograd region

? Mikhailovka, st. Michurina, 17a Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? +7 (84463) 2-37-33, +7 (84463) 2-12-38, +7 (84463) 2-67-97

MIFNS of Russia No. 7 for the Volgograd region

? Uryupinsk, Lenin Ave., 83 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? +7 (84442) 4-29-24

MIFNS of Russia No. 8 for the Volgograd region

? r.p. Svetly Yar, st. Sports, 16 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ? +7 (84477) 6-33-75

MIFNS of Russia No. 9 for the Volgograd region

? Volgograd, pr. im. Lenina, 67, and Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ?

MIFNS of Russia No. 10 for the Volgograd region

? Volgograd, st. Bogdanova, 2 Mon, Wed: from 09:00 to 18:00 Tue, Thu: from 09:00 to 20:00 Fri: from 09:00 to 16:45 ?

How to find out your TIN

You can find out your TIN by applying with your passport to any tax authority in Volgograd.

You can also find out the TIN via the Internet on the website of the Federal Tax Service of Russia (www.nalog.ru) or on the Unified Portal of Government Services (www.gosuslugi.ru) through the online service “Find out your TIN”. To do this, simply fill out a request form for registration and assignment of a TIN. If you are registered with the tax authorities with a TIN, your TIN will appear in the result line.

At your request, any tax authority serving citizens can add a TIN mark to your passport as a citizen of the Russian Federation.

Addresses and telephone numbers of the MFC in Volgograd

It is recommended to make an appointment at the MFC in advance. This will reduce the time you wait in line and submitting documents will ultimately take no more than 10 minutes.

You can get advice by calling the single telephone number of the Volgograd MFC

+7 (800) 511-86-74

and submit an application to the following department addresses:

? st. them. Militsionera Bukhantseva, 20 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? pr. im. Marshal of the Soviet Union G.K. Zhukova, 125 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? st. 64th Army, 71d Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? st. Brestskaya, 19 "A" Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? st. them. Bazhova, 11 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? st. Bohunskaya, 12 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? st. Daugavskaya, 4 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? pr. im. Lenina, 211 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? st. Komsomolskaya, 10 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

? Volzhsky, Lenin Ave., 19 Mon-Fri : from 09:00 to 20:00 Sat : from 09:00 to 15:00

Use the map to find the phone number and address you need.

Conclusion

To summarize the above, we can highlight several main points in obtaining a taxpayer identification number:

- Required when officially applying for a job.

- The acquisition is a voluntary procedure.

- When you change your last name or other personal data, only the certificate form changes, the code remains unchanged.

- To receive it in person, you should visit the Federal Tax Service department at your place of residence.

- You can find out your number on the official website of the Federal Tax Service.

- Does not need to be replaced when moving to a new place of residence.

- You can purchase it in person or through an authorized person certified by a notary.

- You can get it for free.

- When registering for a child, in addition to all documents, you will need a copy of the birth certificate.

So, TIN is as important a document for a citizen of the Russian Federation as the others, which is assigned once and for life. Although the procedure for compensation in case of loss is quite simple, you should not treat it irresponsibly, since a taxpayer identification number may be needed at any time.

Deadlines for obtaining TIN

The tax authority has five working days to check the received documents, register (make changes) and issue a certificate. The processing status of an electronic application (submitted using the service on the official website of the Federal Tax Service) can be tracked in your personal account or by messages received by email.

The issuance period is extended by two working days if the application is submitted through the MFC. This is caused by the need to deliver documents to the tax authority and back.

If the TIN is issued to a foreign citizen by an organization or individual entrepreneur making payments in his favor, the registration period increases to 15 calendar days.

Obtaining a TIN Certificate from the tax office or MFC

A completed TIN certificate can be obtained from the tax office:

- who accepted the application from the citizen in person;

- at the place of registration, if the application was submitted through the Federal Tax Service website.

If the applicant submitted documents through the MFC, then on the appointed date he must appear for a certificate at the same address.

Multifunctional centers

The MFC is a kind of intermediary between the state and the population. With the help of such organizations, citizens can obtain various services and documents in one place, without visiting authorized services. Very comfortably!

True, turning to such centers is not always beneficial. Especially if the document needs to be completed urgently. How much is the TIN made through the MFC? By law, the period is 3-5 days, in practice you have to wait longer.

On average, it takes about two weeks to produce a tax ID, sometimes even more. In any case, a visit to the MFC slows down the procedure, albeit slightly. This is due to the fact that multifunctional centers first accept an application from a citizen and then forward it to the Federal Tax Service. This takes time.

Loss is not a cause for concern

The TIN certificate indicates a special number that will remain unchanged throughout life, even in the event of a change in surname, place of residence, registration or status.

How to obtain a TIN certificate if you already have a number? Of course, using the Internet. Many working Muscovites have an electronic signature. This simplifies the task; it becomes possible to receive documents using registered letters, without personal presence on site. The disadvantage of this method is that it is impossible to restore a document if it is lost.

For the first time, this certificate is issued free of charge, and in case of repeated application - 300 rubles. When restoring it, you should pay attention that not a photocopy should be issued, but a duplicate, which will be completely identical to the original certificate.

It happens that officially working citizens have never personally contacted the tax service regarding the assignment of a TIN. At the time of employment, this number is automatically assigned to them by the tax service.

The number of a specific person in the system can be found on the Federal Tax Service website. If the TIN is registered, but there is no paper confirmation, then you need to contact the inspectorate to obtain it. Representatives of tax authorities must respond to the appeal within 5 days.

As a result of using the Internet version, the procedure for obtaining a TIN is greatly simplified and queues at tax offices are significantly reduced.

How to get a TIN if you already have a number, through State Services

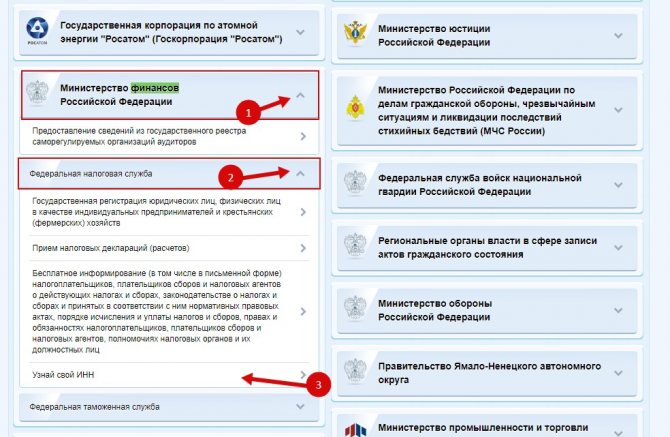

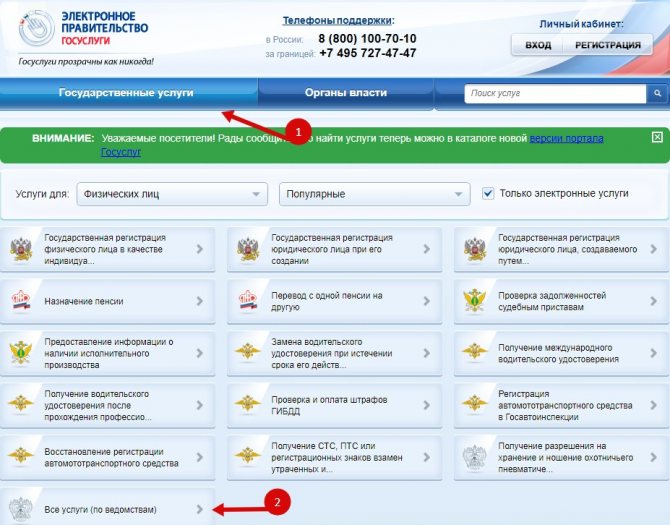

Let's look at how to obtain a TIN certificate if you already have the number (i.e., re-obtaining it). You need to log in to your personal State Services account (if the account has not been created before, you need to go through the registration procedure). Next, on the main page of the site, open the “ Public Services” . The page will refresh and display a list of all services, where you need to select “ All services” .

Then click on the arrow “ Ministry of Finance of the Russian Federation” => “ Federal Tax Service” and “ Find out your TIN” .