19.07.2019

0

7043

4 min.

One of the social guarantees of the Russian state is compensation for a period of temporary disability due to illness. The source of financing for this payment is the social insurance fund, to which the employer makes contributions for all of its employees. The benefit is provided upon presentation of a certificate from a medical institution.

Basic Concepts

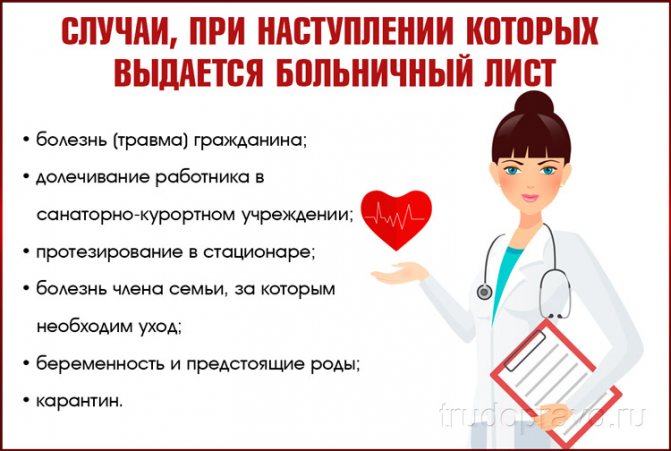

A sick leave certificate is a document issued by licensed medical institutions, which indicates the period of temporary incapacity for work of a person. The form has a unified form approved by the Ministry of Health and Social Development. In 2021, an electronic form of the document will also be acceptable. The grounds for issuing a sheet include:

- injury or illness of the employee himself;

- restorative procedures, aftercare;

- illness of one of the family members who requires care;

- pregnancy and childbirth.

Filling out the form is the responsibility of employees of medical institutions, and control over the correct formation of the document is exercised by the employer. His interest is based on the fact that management pays compensation from its own funds and then requests them from the Social Insurance Fund. Errors and inaccuracies in the form will lead to refusal from the fund.

The amount of payment is determined by several parameters:

- average salary;

- insurance experience;

- number of days of incapacity.

It is important to know! The employer calculates the payment based on the provided certificate, which indicates the third point and his information about salary and length of service. If an employee brings data from previous or other places of work about his earnings, then the accounting department must recalculate the amount.

How to properly recalculate sick leave

Since money is paid based on the slip, it is important that all details in this section are filled out correctly.

If the patient’s last name, first name, patronymic, place of work are written incorrectly, or the doctor’s seal or signature is missing, then such a sheet must be returned to the employee. If there are errors in this section, then such a sick leave certificate is considered damaged and instead a duplicate is issued at the medical institution (Procedure approved). In this case, in the new form, o should be entered in the “duplicate” line, and in the “Date of issue” line, the date of issue of the new form (duplicate) certificate of incapacity for work should be indicated (Procedure approved). The main violations due to which employees of the Federal Social Insurance Fund of Russia may not accept sick leave benefits for credit are listed in the Guidelines approved by.

Reasons for recalculating sick leave after payment

The accounting department of an enterprise calculates sick leave based on the data it has. Along with this, they may be incomplete, for example, if a person works part-time or has recently joined a specific company. Considering that the basis is the average daily income for the last two years, it is beneficial for the employee to provide information from previous employers.

Reasons for recalculation

There are several grounds for recalculating already paid temporary disability benefits. These include:

- The emergence of new information about the employee’s earnings, for example, receiving certificates of income from previous places of work.

- Detection of facts of employee dishonesty - provision of knowingly false information about sick leave or salary.

- Errors in calculations made by an accountant.

If management has doubts regarding the authenticity of the submitted documents, then an authorized employee has the right to submit a request to the Social Insurance Fund in order to clarify the information.

Regulations

The regulatory act governing the rules for recalculating sick leave is Article 15, Article 255 of the Federal Law. Let's consider several provisions of the document:

- You can apply for benefits within three years after your right to it arises. If the payment did not take place due to the fault of the employer, the period is not limited.

- Excessively transferred funds due to the fault of the accounting department will not be recovered from the person.

- If inaccurate information about income or sick leave is discovered, leading to an overpayment, the employer has the right to write off up to twenty percent of wages as debt.

All of the above aspects apply to both temporary disability benefits and payments in connection with pregnancy and childbirth.

Billing period

In accordance with Article 14, Article 255 of the Federal Law, the calculation period for calculating sick leave benefits is two calendar years. Moreover, all 730 days are taken into account, without excluding weekends, holidays and other periods.

It is important to know! The period counts from the day the illness or other event subject to insurance began (the need to care for a relative, prosthetics, pregnancy, and so on). If a person had no income or it was less than the minimum wage, then the basis for calculation will be the minimum wage established in the region of residence.

An employee who was on maternity leave in the previous two years has the right to change the calculation period to the one when she worked. You cannot take any years, but only those preceding the insured event associated with the birth of a baby.

The need for a salary certificate

In order to legally recalculate the amount of compensation for the period of incapacity for work, you must provide your current employer with a certificate in Form 182H. It is issued to citizens in two cases:

- upon dismissal;

- former employees upon written request.

The employee has the right to receive the document for three years; it is during this period that he has the right to apply for disability benefits, which will take into account income from his previous place of work.

It is required to provide either the original certificate or a certified copy of the document (notarized or by the employer himself). Sick leave will be recalculated even if compensation has already been transferred. Based on the information received, the accountant will be able to determine the difference and transfer it to the employee.

If, for objective reasons, an employee cannot obtain a certificate from his former employer, then he submits a request to the Pension Fund for information about his income. This procedure takes more time, but is used in practice. As a rule, this is done if the company where the person worked is liquidated or located in another region.

Information from a former employer

The basis for calculating benefits for LVN is the presence of two documents:

- LVN;

- salary papers for the past 2 years.

This is important to know: personal income tax for direct payments of sick leave

The paper, which records the amount of income at the previous company (hereinafter referred to as the Certificate), is an important basis for determining the amount of payment in case of disability.

Yes, Art. 13 of Federal Law No. 255-FZ establishes several rules for calculating sick leave funds:

- compensation is paid at the current place of work;

- if a person is employed in several organizations, then payments are made to each of them in full in accordance with the general calculation rules.

If within two years before the benefit was calculated, the employee was employed in several companies, then the amounts are paid from the funds of the current company based on the salary that the person received over a two-year period (they are displayed in the Certificate).

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The form of the paper must comply with the rules established by law. Order of the Ministry of Labor of the Russian Federation dated 2013, as amended 2021 No. 182 n, establishes the form of the certificate and the procedure for its issuance.

Since the legislator has established a unified form, the employer does not have the right to draw up the paper at his own discretion. For convenience, the person responsible for issuing the Certificate in the organization always has a template at hand.

The employee who deals with this issue may be a specialist:

- from accounting;

- from the HR department.

Therefore, if necessary, an employee should contact these departments of the enterprise to obtain a Certificate.

Recalculation procedure

The recalculation of sick leave on the basis of new certificates from previous places of work is of interest to the employee himself, so the initiative should come from him. This is done in two steps:

- Obtaining data from previous employers in documentary form.

- Submitting an application in free form with attached certificates.

Based on the received materials, the accounting department, firstly, checks the accuracy of the information, secondly, makes a recalculation, and thirdly, submits a request to the Social Insurance Fund.

The money is transferred to the employee within fifteen days with the next salary or advance payment. As noted above, if an employee cannot obtain a certificate from a previous employer, then he asks management to make a request to the Pension Fund. Based on data from the Pension Fund, additional payments are calculated and sick leave from the previous period is recalculated.

Recalculation procedure

If circumstances arise that have already been described above, the employer can independently change the calculations for previous years.

This is important to know: How sick leave is paid after surgery

The employee has the right to submit an application for adjustment of the deduction amount. The application is written to the director of the enterprise or the head of a structural unit. It is compiled in free form.

There is no single template for writing a paper in the legislative norms, but an employee can ask the HR or accounting department about the availability of a template.

In order for the requirements to be satisfied, the applicant must attach the following documents to the application:

- Certificate from a medical institution.

- A document of the established form from the former employer.

If the documents are drawn up in violation of the law, the employer has the right to reject the application.

If everything is in order, the employer will not be able to refuse, since the scales are tipped in favor of the subordinate. The law in this case clearly protects the rights of the employee: if there is evidence for an increase in payments, and the citizen has substantiated the demands, then his application must be granted.

The statement is drawn up according to the rules that are usually used in business communication. Therefore, the petition states:

- details of the enterprise, full name of the manager, applicant;

- name of the paper;

- request for changes in the billing period;

- number and signature;

- Help is also included.

There is no statutory time limit for satisfying the applicant's demands, but it must comply with the rules of reasonableness of time. This means that once the request has been received and a decision has been made, the application must be processed.

The requirement must be complied with immediately. This will allow you to avoid misunderstandings with the employee and fines from the state labor inspectorate or the Fund.

The benefit during illness is accrued to the employee on the nearest date of payment of earnings, part 8 of Art. 13, part 1 art. 15 Federal Law No. 255-FZ. If there is a delay in payments, the employee is entitled to additional compensation provided for in Art. 236 Labor Code of the Russian Federation.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

As for changing the amount of benefits from the Social Insurance Fund, the application procedure is similar to that outlined. An application is also written addressed to the head of the Fund and the payment document corrected by the employer is attached along with a certificate of incapacity for work and a Certificate.

Following the above recommendations, difficulties with re-registration of the payroll period should not arise, since conscientious employers usually do not prevent their subordinates from exercising this right.

Recalculation of sick leave is permitted provided that an error was made in the initial calculation of the amount due to the employee.

Statute of limitations for recalculating incorrectly accrued sick leave

However, then, to calculate the benefit, a certificate(s) of the employee’s earnings from other employers or a duly certified copy of it is required (Part 7.1, Article 13 of Law No. 255-FZ). What if such certificates are not provided? In this case, the provisions of Part 2.1 of Art. 15 of the Law of December 29, 2006 N 255-FZ stipulates that if an employee does not have the necessary certificates on the day of his application for benefits, the benefit is assigned on the basis of the information and documents presented and available to the employer. That is, if an employee presents sick leave for payment, the benefit must be calculated based on the information available to the employer himself - there is no waiting for the employee to bring a certificate about the income he received from the previous employer(s), subject to insurance contributions necessity.

Statute of limitations for recalculating incorrectly accrued sick leave

- Reason for recalculating benefits

- Recalculation examples

As a general rule, temporary disability benefits are calculated based on the employee’s earnings for the two years preceding the onset of illness. The relevant information is “collected”, including in certificates of his earnings during the billing period, issued to him by other employers. If such benefits are not provided at the time the benefit is assigned, the benefit is calculated based on the information available to the employer.

Subsequently, when the employee reports them, the benefit will have to be recalculated... The conditions, amounts and procedure for paying benefits for temporary disability are regulated by Law No. 255-FZ of December 29, 2006 (hereinafter referred to as Law No. 255-FZ). In accordance with Part.

How many days can you pay for one newsletter per year?

Sick leave - paid for the entire period of illness, but there are exceptions. What are they? When caring for a sick child, the doctor must issue a sick leave certificate for the entire period of outpatient or inpatient treatment. In this case, temporary disability benefits are paid only for a period that in a calendar year the total period does not exceed: 90 calendar days - for caring for a child under 7 years of age who has a disease included in the special List *; 60 calendar days - for caring a child under 7 years of age in all other cases; 120 calendar days - for caring for a sick disabled child under 18 years of age (clause

5 of Federal Law No. 255-FZ of December 29, 2006). Note: This limitation applies to the number of sick days per year per child.

Recalculation of “sick leave”: causes and consequences (Baraznenok N.)

In case of loss of ability to work due to illness or injury of the employee himself, “sick leave” benefits are paid (clause 1, part 2, article 3 of Law N 255-FZ): - for the first 3 days of temporary disability - at the expense of the employer; - starting from the 4th day of temporary disability - at the expense of the Social Insurance Fund.

Vote:

- for the first 3 days of temporary disability - at the expense of the employer;

- starting from the 4th day of temporary disability - at the expense of the Social Insurance Fund.

In other remaining cases, sick leave benefits are paid in full from the Social Insurance Fund directly from the 1st day of temporary disability (Part 3 of Article 3 of Law No. 255-FZ). The main document that serves as the basis for the assignment and payment of temporary disability benefits is a properly executed sick leave (Part 5, Article 13 of Law No. 255-FZ). Meanwhile, in some cases, benefits are paid taking into account the earnings received by the employee in the pay period and from other employers.

Today, since many have had to change jobs over the past couple of years, this has become, one might say, a common occurrence.