The labor legislation in force in the Russian Federation includes an obligation for employers to notify employees of all types of deductions that were made from wages at the time of payment.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

To do this, he must serve a written notice called a payslip.

How to properly organize the execution of this document so as not to break the law? To do this, the head of the enterprise must issue an order to approve the pay slip, a sample of which is given below.

Why is it needed?

The obligation to issue a salary statement manually when paying it is assigned to the head of the organization in Article 136 of the Labor Code of the Russian Federation.

The text of this regulatory act establishes a procedure for bringing to the attention of workers information about accruals and deductions on their labor income.

Thus, the administration of the enterprise provides a written explanation to each worker about what components his wages were calculated from for a specific period of his work and indicates on what grounds the deductions were made.

The total in the document shows the amount of money that the employee should receive after carrying out all accounting transactions.

After the adoption of Federal Law No. 35-FZ of April 23, 2012, the list of accruals and deductions included in the salary statement was expanded.

Federal Law of April 23, 2012 N 35-FZ

Now you need to reflect the following points in separate lines:

- accrual of monetary compensation in case of violation of salary payment deadlines;

- funds paid during vacation;

- the amount of settlement payable upon dismissal of an employee;

- other monetary payments accrued to the employee.

Please note that handing over pay slips to the work team is not a right, but an employer’s responsibility.

Moreover, he must issue notifications when paying funds not only to permanent employees of the organization’s workforce, but also to part-time workers and workers temporarily hired to perform production tasks.

Workers must receive a payroll statement in all cases, both when funds are credited to a bank account or card, and when paid by other legal means.

Currently, there is no unified form of this document approved for all enterprises. Its type must be put into effect by a separate regulatory act for the organization - this is why an order is needed.

The form itself for the statement of accrual and deductions for wages is developed in accordance with the capabilities of the existing program used for accounting.

What percentage of the salary is the advance? You can find the amount of the fine for non-payment of wages here.

When to issue a payslip

Don't know when pay slips are issued? It is provided to the employee regardless of the salary payment option: upon the accrual and transfer of wages to the employee’s card or at the time the employee receives the monthly cash remuneration in hand. Settlements are received by both main employees and employees working under civil contracts, to whom the employer also pays wages.

The document is issued only at the time of final payment; the form does not need to be provided on the day of advance payment in the organization or when transferring vacation pay. When directly transmitting calculations, the accountant must comply with the principle of confidentiality.

The fact that an employee has received a pay slip can be confirmed in the following ways:

- develop a detachable part of the document in which the employee will sign the form, thereby certifying the fact of receipt;

- keep a log of the issuance and receipt of pay slips.

Order on approval of the pay slip form

The formal form of the payroll sheet is developed by each employer independently and approved by order. order approving the form of the pay slip, it is suitable for both budgetary institutions and commercial and non-profit organizations.

How to fill out

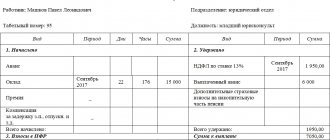

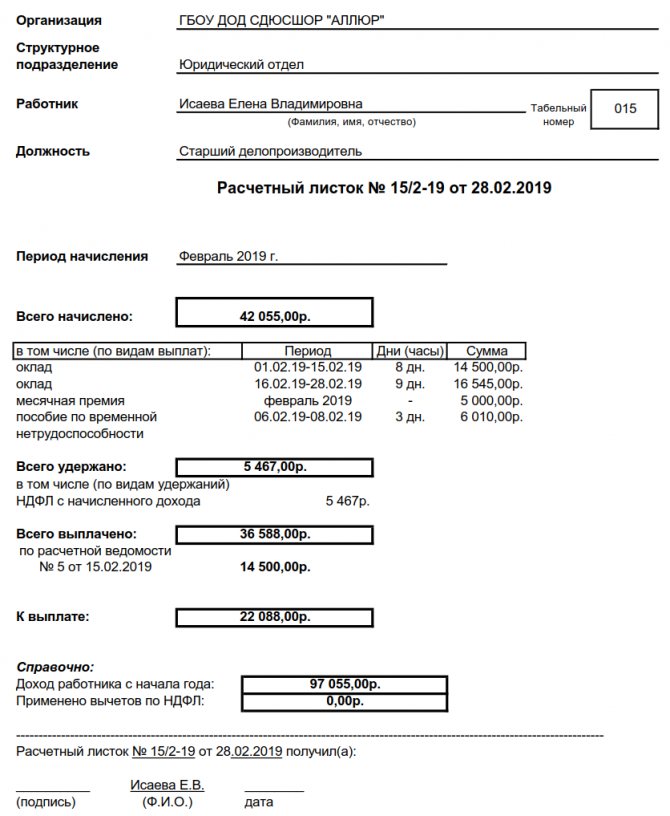

The payroll form for employees must be filled out according to the rules. The following information must be displayed on the payslip:

- name of the organization and information about the unit;

- FULL NAME. employee;

- his personnel number;

- month for which accruals and deductions are made;

- the total amount of time worked for the month;

- accrued amount without taxes and other deductions;

- composition of wages.

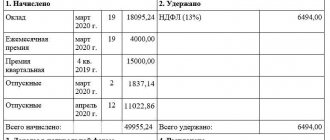

The payslip itself consists of several sections:

- Total accrued. This block reflects information about all accruals made to the employee during the reporting period, that is, the entire composition of the salary is indicated. In addition to salary, this includes compensation, incentive and bonus payments, benefits, sick leave, vacation pay, work on holidays and weekends, calculation and compensation upon dismissal. The procedure for calculating income is also indicated here, and the days and hours worked for which you need to pay are written down.

- Total withheld. This block records all deductions made by the employer: personal income tax and insurance contributions, trade union dues and deductions under writs of execution (alimony).

- Total paid. The block is intended to reflect previously paid amounts for the reporting period (advance payment, vacation pay, etc.).

- To payoff. This section of the payslip specifies the total amount to be transferred (issued). It also reflects the employer's or employee's salary debt. At the end of the document, reference information is indicated - total income since the beginning of the year and applied deductions to personal income tax.

The pay slip is issued after the actual closing and payment of wages, so data on all amounts accrued during the month is entered into it. It specifies fines, compensation, incentives and bonus payments, overtime and work on weekends.

If the salary in an institution is calculated using specialized programs, then payslips are generated automatically in electronic form, based on data on accruals and payments made. The accountant can only print out the form and provide it to the employees for signature.

Sample salary slip in Excel

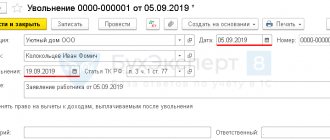

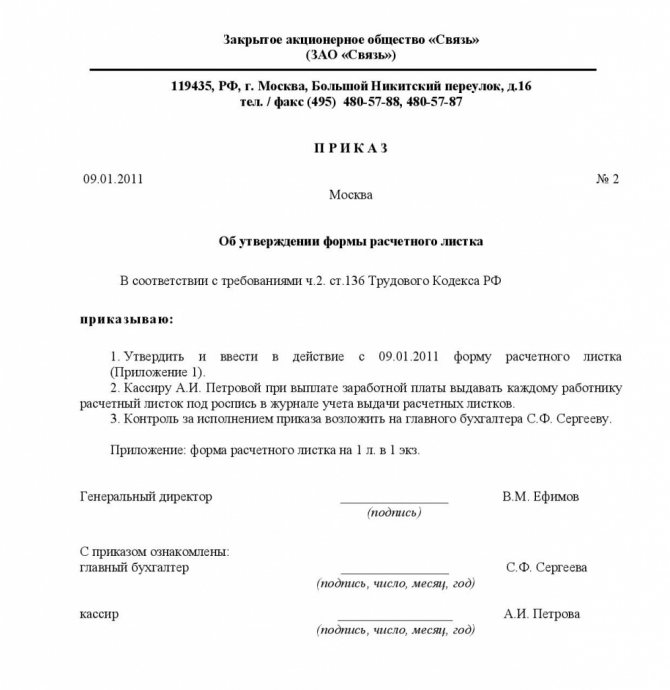

How to issue an order to approve the form of a payslip?

To approve the use of the payslip form at the enterprise, the manager signs the appropriate order or instruction, which conveniently delineates the exercise of powers among employees.

For example, a specific employee from the accounting department may be given the responsibility to hand over notices to the workers of the enterprise on certain days.

What information should be in the document?

The following information must be included in the salary schedule:

- last name, first name, patronymic of the worker;

- Personnel Number;

- calendar period of work subject to wage calculation;

- number of days or hours worked;

- what is the amount of salary and all additional components of income calculated from?

- all types and amounts of deductions from earned money;

- the remaining amount given to the employee.

The employee's income, which consists of many different accruals (overtime, compensation for harm, work on holidays, allowances, etc.) must be listed on separate lines.

If the enterprise has a social package, then the payment in kind is also recorded on the payslip.

All amounts collected are reflected in separate lines:

- penalties and alimony awarded by writs of execution;

- taxes to budget funds (personal income tax, social insurance, pension contributions, etc.)

- deduction to trade union bodies;

- advance payment that was not worked out or unspent on a business trip;

- excess funds previously erroneously accrued by the accountant and paid.

Each type of deduction and income must be reflected separately, and combining even two similar data into one number will be considered erroneous information.

Sample pay slip and order

Here you can download a free example of a payslip form.

An example of drawing up an order with attached forms: An example of drawing up an order to approve the form of a pay slip

Sample order:

With whom should the form be approved?

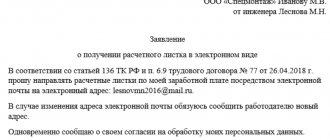

The procedure set out in Article 372 of the Labor Code of the Russian Federation contains an algorithm of actions for approving and putting into effect a pay slip. It also includes coordination of its form with workers through the trade union body or persons protecting the interests of full-time employees.

In organizations where there is an elected committee of this organization or representatives from the workforce, the management administration must necessarily agree on the future version of the pay slip.

Actions must be performed in the following sequence:

- The sample is sent to the trade union committee.

- Members of the trade union organization must study and provide a response in writing to the head of the enterprise within 5 days from the date of receipt of the leaflet form. It may contain an adjustment to the form, justified by a reasoned reference.

- After agreeing on the form of the pay slip, an order is issued for its approval.

The document includes a note on approval indicating the following: “Agreed with the trade union organization or the opinion of the representatives of the workers’ collective has been taken into account, protocol No. …”.

In the absence of such a public body or defenders acting in the interests of the employees of the enterprise, the following note is included in the extract: “At the time of approval of the pay slip form, a committee of workers’ representatives has not been created.”

One of the options for approval in the absence of any bodies from the labor collective could be to discuss the form with employees at a conference specially convened for this purpose.

Find out everything about making changes to the vacation schedule. You will find a sample calculation note on granting leave to an employee in this article.

How is vacation pay calculated? About this - here.

Payroll slip: what should an employer know and do?

Issuance of pay slip

Employer when paying wages

is obliged to issue each employee a monthly pay slip indicating the components of the wages due to him for the corresponding period, the amount of deductions from wages, as well as the total amount of wages to be paid (part one of Article 80 of the Labor Code).

Document:

Labor Code of the Republic of Belarus (hereinafter referred to as the Labor Code).

Violation:

as we see from the norms of the current legislation, the employees’ complaint is justified and the employer, indeed, violates the deadlines for issuing pay slips, issuing them to employees a week after the payment of wages. The payslip must be issued to employees upon actual payment of wages.

The procedure for approving the pay slip form

The form of the pay slip is approved by the employer (part two of Article 80 of the Labor Code).

Violation: the use in an organization of a pay slip form not approved by the employer is a violation of labor legislation.

How to eliminate these violations?

1. Approve the form of the payslip.

2. Ensure that pay slips are issued to employees on payday.

Currently, in every institution, employees' salaries are usually calculated using a software product (1C: Enterprise, Galaktika, etc.). Therefore, it is advisable to approve the form of the payslip that your accounting program prints.

According to the author, the form of the payslip that is valid in the institution and the timing of its issuance can be approved by order of the manager, for example, according to the following sample:

Sample order for approval of the payslip form

Organization "ХХХХХ"

ORDER

date

No.

XXX

Minsk

On approval of the settlement form

leaflet and timing of its issuance

In accordance with Article 80 of the Labor Code of the Republic of Belarus

I ORDER:

1. Approve the form of the pay slip contained in the appendix to the order.

2. Use the approved payslip form from the date.

3. Appoint a payroll accountant, full name, to be responsible for issuing pay slips to employees, and in case of his absence (illness, leave of absence and other reasons) – chief accountant, full name.

4. Persons responsible for issuing pay slips should ensure their issuance on the day of payment of wages.

Head Signature

FULL NAME.

We have read the order: Signature

FULL NAME.

date

Signature

FULL NAME.

date

An order for approval of the payslip form can be found

here .

Examples were selected using the “Example Selection Service”

Ekaterina Pilkevich, accountant-auditor

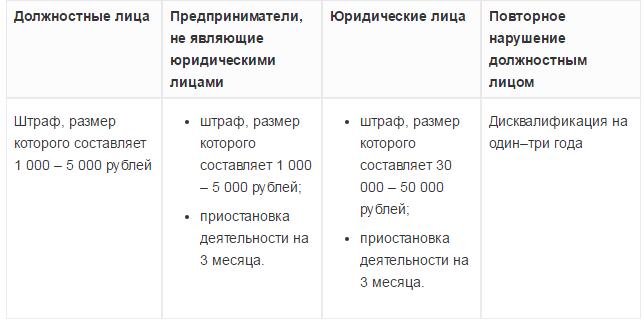

Is it possible not to publish the document?

An order or instruction to approve the form of a pay slip is one of the confirming documents of compliance with the labor legislation of the Russian Federation.

For failure to issue this type of notice, management may be held accountable. Failure to comply with the law provides for several types of punishments and fines.

It is still better for the manager to take care in advance of approving and issuing the pay slip form in order to avoid such troubles in his work.

Document role

The value of a payslip cannot be overestimated - it allows an enterprise employee to understand exactly what his salary is formed from, and also, in some cases, to see in a timely manner the inconsistencies between the calculation of wages and the terms of a specific employment contract or legal requirements. If such facts are identified, an employee can turn to the company’s accounting department for clarification of controversial or unclear issues, and if it comes to a conflict, then go to the labor inspectorate or court to restore justice.

Duty or right

Some employers neglect to generate payslips, confident that they have the right to do without them. This is fundamentally wrong - the legislation of the Russian Federation obliges every employer to notify subordinates about the components of their wages.

For whom is it necessary to make a payslip?

A payslip must be made for all employees without exception - those who work on staff, part-time workers, temporary employees, seasonal workers, etc.

When should you create a document?

The payslip must be made several days before salary payments, but it can also be issued in advance or on the day the salary is paid. At the same time, it should be remembered that usually the payment of salaries is divided into two stages, two weeks apart - so the pay slip should be provided to employees on the day they receive their “graduation”, when all the necessary amounts have already been calculated.

It must be said that the payslip concerns only wages, so there is no need to create it for issuing, for example, vacation pay.

When resigning, it is mandatory to provide a payslip (it is given to the resigning person on his last working day along with his salary).

Do I need to make payslips if my salary is transferred to a card?

The payslip must be drawn up regardless of how the money earned is issued - in cash at the organization's cash desk or on a card. The same applies to the issuance of wages to an employee’s authorized representative - if the representative provides a notarized power of attorney, the employer is obliged to give him both the payslip and all the money due to the principal.

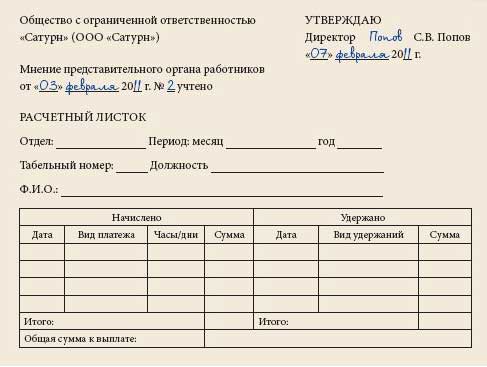

In what other ways is affirmation possible?

There is another way to approve a payslip without a special order. For this purpose, a special approval stamp is affixed to the document, which is personally signed by the head of the enterprise.

It must include the following information:

- The word “APPROVED” is entered first.

- The next line contains the position of the person approving the payslip.

- A dash is placed next to or below for signature and the surname with the initials of this responsible employee is indicated.

- The date of approval is indicated on a separate line.

- The calendar date for the approval of the payslip is entered on the stamp manually.

An example of a pay slip form approved without an order:

Should employees be familiarized with the order and the approved form?

After issuing an order to approve the payslip, it must be familiarized with signature by the persons who are responsible for its implementation.

The remaining members of the enterprise's work team also need to be notified of its acceptance. It is imperative to draw up a list of employees who must confirm with their signature that they have been informed of the order.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Salary