Absence from work: designation on the report card

According to paragraph 6 of Art. 81 of the Labor Code of the Russian Federation, absenteeism is the absence of an employee from the workplace for more than 4 hours in a row (or throughout the entire working day) without good reason. Even for a one-time violation of this kind, the employer has the right to dismiss the negligent employee, and in the best case, reprimand or reprimand him. At the same time, it is important that the necessary procedure for registering absenteeism is followed in accordance with labor legislation.

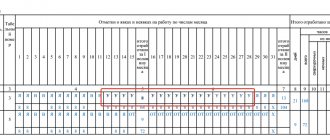

The timesheet (usually the T-12 or T-13 form is used) reflects the time actually worked by each employee, as well as periods of absence from work for various reasons (illness, vacation, business trip, etc.). For each such reason, its own designations are provided - alphabetic or digital. So, for absenteeism the designation “PR” or the digital code “24” is used.

In the case where the employee is absent and does not make himself known for four or more hours, there is no need to rush to put it down. It is possible that after some time, the reason for absence will become clear, which management will consider valid. For example, when an employee, upon leaving home, was “stuck” for several hours in the elevator due to its breakdown, and could not reach the employer by phone, because... There is often no mobile connection. Such “force majeure” may well be confirmed by documented certificates from the relevant utility and repair services.

In the meantime, the circumstances of the absence are unknown, it must be marked on the report card with the symbol “NN” (or “30”), which means failure to appear for unknown reasons. If later the employee presents, for example, sick leave for the missed days, this code should be corrected to the temporary disability code - “B” or “19”.

Thus, before entering absenteeism on the report card, you need to obtain confirmation that the absence was due to an unexcused reason, and the employee provided an appropriate explanation (or refused to explain what the report was drawn up).

If the absenteeism did not last a full working day or shift, the report card indicates both the absenteeism and partial attendance at work. For example, 5 hours of absenteeism in the morning without a valid reason, after which the employee reported to his workplace, will be indicated in the corresponding cells of the timesheet as “PR/I”, and hours of absence and actual work - “5 / 3”.

How is forced absence paid?

For each day of absenteeism through no fault of the employee, compensation equal to the average salary of the employee per shift is accrued. First, the accountant must determine the average salary of the employee.

ATTENTION! The rules for calculating average income are set out in Article 139 of the Labor Code of the Russian Federation. They are also recorded in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

Calculation of payments to an employee during VP

How will the average employee income be calculated in this case? When calculating, the following sources of the worker’s earnings are taken into account:

- Salary.

- Premium.

- Various surcharges.

- Allowances.

ATTENTION! The calculations do not take into account benefit payments and contributions to the pension fund. That is, before determining official earnings, they must be subtracted from the employee’s income.

To determine average income, you must first calculate the employee's total income since the beginning of the year. For example, on February 1 he received 31,700 thousand. From this amount, standard charges to the funds are deducted, amounting to 1,700 rubles. The resulting amount must be divided by the number of days from the beginning of the year. It turns out 1,000 rubles. This is the employee's daily income.

IMPORTANT! When calculating, only the official salary of the employee is taken into account. For example, if a worker officially received only 8,000 rubles, but his unofficial salary was 100,000 rubles, calculations will be made based on the official 8,000 rubles. That is why it is beneficial for an employee to have a “white” salary.

What's next?

The average daily wage of a person is multiplied by the number of days of temporary work. For example, absenteeism due to the fault of the employer was 30 days. The average daily salary is 1,000 rubles. The amount of payments in this case will be 30,000 rubles.

Are payments subject to personal income tax?

Payments for the WP period can be considered a regular salary. Therefore, they will be taxed at the standard rate of 13%.

What do you mean by truancy?

It happens that employees do not come to work or leave the workplace without permission. If there are no valid reasons for absence from the workplace, then this is considered absenteeism (subparagraph “a”, paragraph 6, part 1, article 81 of the Labor Code of the Russian Federation). So, for example, absenteeism is absence from work:

- throughout the entire working day (shift), regardless of its duration;

- more than four consecutive hours during a work day or shift.

Absenteeism is a gross violation of labor discipline, which is punishable by dismissal. Moreover, you can fire an employee even for a single fact of absenteeism (“Dismissal for absenteeism: sample order for 2017”).

An exception to this rule is absenteeism during pregnancy. A pregnant woman cannot be fired on this basis under any circumstances (“Absenteeism by pregnant women” https://blogkadrovika.ru/proguly-beremennoj/).

Let us remind you that the following situations are considered absenteeism:

- the employee went on vacation without permission or used his available days off without permission from the employer;

- the employee did not warn the employer about his voluntary dismissal.

How is the duration of forced absence determined?

It is extremely important to determine the duration of the VP, since in order to calculate compensation you need to know the time frame for which accruals occur. The period of absenteeism is the time between the date of dismissal (the first forced absence from work) and the date of the decision of the legal structure (court).

Example 1

On May 15, 2021, the person was illegally fired under the article “absenteeism.” He immediately filed a claim in court to restore his rights. On June 15, a court ruling came into force, according to which the employer is obliged to remove the illegal in this case wording of dismissal from the work book, and also reinstate the employee in his position. The period of forced absence in this case is a month. The employer must pay compensation for all these days.

Symbols in the time sheet in 2021

The report card can use alphabetic or numeric codes to indicate a particular event, for example, attendance at work has the letter I or 01 in digital expression, absenteeism - PR or 24, additional days off without pay - NV or 28.

You can find the required code using the table.

Timesheet codes (2020) - a complete list of alphabetic and numeric characters - are contained on the first page of Form T-12.

| Code | ||

| alphabetic | digital | |

| Duration of work during the day | I | 01 |

| Duration of work at night | N | 02 |

| Duration of work on weekends and non-working holidays | RV | 03 |

| Overtime duration | WITH | 04 |

| Duration of work on a rotational basis | VM | 05 |

| Business trip | TO | 06 |

| Advanced training without work | PC | 07 |

| Advanced training with a break from work in another area | PM | 08 |

| Annual basic paid leave | FROM | 09 |

| Annual additional paid leave | OD | 10 |

| Additional leave in connection with training while maintaining average earnings for employees combining work with training | U | 11 |

| Reduced working hours for on-the-job trainees with partial pay retention | UV | 12 |

| Additional leave in connection with training without pay | UD | 13 |

| Maternity leave (leave in connection with the adoption of a newborn child) | R | 14 |

| Parental leave until the child reaches the age of three | coolant | 15 |

| Unpaid leave granted to an employee with the permission of the employer | BEFORE | 16 |

| Leave without pay under the conditions provided for by the current legislation of the Russian Federation | OZ | 17 |

| Additional annual leave without pay | DB | 18 |

| Temporary disability (except for cases provided for by code “T”) with the assignment of benefits in accordance with the law | B | 19 |

| Temporary disability without benefits in cases provided for by law | T | 20 |

| Reduced working hours versus normal working hours in cases provided for by law | Champions League | 21 |

| Time of forced absence in the event of dismissal, transfer to another job or suspension from work being declared illegal, with reinstatement to the previous job | PV | 22 |

| Absenteeism while performing state or public duties in accordance with the law | G | 23 |

| Absenteeism (absence from the workplace without good reason for the time established by law) | ETC | 24 |

| Duration of part-time work at the initiative of the employer in cases provided for by law | NS | 25 |

| Weekends (weekly vacation) and non-working holidays | IN | 26 |

| Additional days off (paid) | OB | 27 |

| Additional days off (without pay) | NV | 28 |

| Strike (under conditions and in the manner prescribed by law) | ZB | 29 |

| Absences for unknown reasons (until the circumstances are clarified) | NN | 30 |

| Downtime caused by the employer | RP | 31 |

| Downtime due to reasons beyond the control of the employer and employee | NP | 32 |

| Downtime due to employee fault | VP | 33 |

| Suspension from work (preclusion from work) with payment (benefits) in accordance with the law | BUT | 34 |

| Suspension from work (preclusion from work) for reasons provided for by law, without accrual of wages | NB | 35 |

| Time of suspension of work in case of delay in payment of wages | NZ | 36 |

unified form T-12

It should be noted that the unified form T-12 can be used in any organization, regardless of the form of ownership, except for budgetary institutions.

In budgetary institutions, an accounting form is used, approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n, which uses other digital and letter designations in the working time sheet.

Payments for forced absence and “salary” taxes

Personal income tax. According to the general rule established in paragraph 1 of Art.

210 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, all income of the taxpayer that he received both in cash and in kind or the right to dispose of which he acquired is taken into account. According to the official position of the Ministry of Finance, the amount of average earnings due to an employee during forced absence is subject to personal income tax in accordance with the generally established procedure. This is due to the fact that the list of income exempt from taxation is given in Art. 217 of the Tax Code of the Russian Federation, and income in the form of average earnings during forced absence is not named in the specified list (letters of the Ministry of Finance of the Russian Federation dated July 24, 2014 No. 03-04-05/36473, dated April 13, 2012 No. 03-04-05/3-502 , Federal Tax Service of the Russian Federation dated 04.04.2006 No. 04‑1‑04/190). Support controllers and arbitrators (decrees of the Federal Antimonopoly Service of the Moscow Region dated 04/26/2007, 05/04/2007 No. KA-A40/3164-07 in case No. A40-70555/06-4-304, FAS SZO dated 07/06/2006 No. A56-53997/2005) .

There is another point of view. The fact is that in Art. 394 of the Labor Code of the Russian Federation, payment for forced absence made to an employee in the form of average earnings is defined as compensation. Taking into account this norm, the Department of Tax Administration for Moscow, in Letter No. 28-11/12809 dated February 27, 2004, concluded that compensation in the form of payment to an employee of average earnings during forced absence refers to compensation established by the legislation of the Russian Federation and is subject to clause 3 Art. 217 Tax Code of the Russian Federation. The FAS MO came to the same conclusion in Resolution No. KA-A40/11341-08 dated December 8, 2008 in case No. A40-6313/08-33-28.

However, in practice it is better to be guided by later explanations of officials.

The situation is different in a situation where, along with the payment of average earnings for the period of forced absence, the employee receives compensation for moral damage awarded by the court. The amount of compensation for moral damage caused to an individual paid by court decision is a compensation payment provided for in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, and, therefore, is not subject to taxation (Letter of the Federal Tax Service for Moscow dated March 17, 2011 No. 20-14/3/ [email protected] ).

For your information

If compensation for moral damage is not carried out on the basis of a court decision, these payments are not recognized as compensation payments falling under clause 3 of Art. 217 of the Tax Code of the Russian Federation , and are subject to personal income tax in the prescribed manner.

In what order is personal income tax withheld when paying average earnings during forced absence? According to para. 1 clause 4 art. 226 of the Tax Code of the Russian Federation, the tax agent withholds the amount of personal income tax directly from the taxpayer’s income upon actual payment.

In practice, there are often situations when the writ of execution determines the amount of payment by court decision without taking into account the personal income tax to be withheld. By virtue of clause 2 of Art. 13 of the Code of Civil Procedure of the Russian Federation, a court decision providing for the obligation of an organization to pay an individual a certain amount of money is subject to mandatory execution. In this case, the organization must pay the amount indicated in the writ of execution, without withholding personal income tax (Letter of the Federal Tax Service for Moscow dated October 7, 2009 No. 20-14/3/ [email protected] ).

The Ministry of Finance in Letter dated 04/07/2014 No. 03‑04‑06/15507 noted: the debtor organization has the opportunity to draw the court’s attention to the need to take into account the requirements of tax legislation when determining the amounts payable. If, when making a decision, the court does not separate the amounts payable to an individual and withheld from him, the tax agent is not able to withhold personal income tax from payments made to the taxpayer by court decision. At the same time, the tax agent must withhold tax when making other payments to the taxpayer. In the absence of such payments before the end of the tax period, the tax agent in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation is obliged to inform the taxpayer and the tax authority at the place of registration about the impossibility of withholding tax and its amount (Letter of the Ministry of Finance of the Russian Federation dated November 2, 2015 No. 03-04-05/62860).

How are tax deductions applied when calculating personal income tax on the amount of average earnings paid to an employee by a court decision in connection with his dismissal being declared illegal? These payments are not remuneration for the performance of job duties. The Ministry of Finance in Letter No. 03-04-05/24633 dated June 28, 2013 explained that when income is received in cash, the date of actual receipt of income is defined as the day of payment of income, including its transfer to the taxpayer’s bank accounts (clause 1, paragraph. 1 Article 223 of the Tax Code of the Russian Federation). This means that deductions can only be provided from January 1 of the tax period in which payment for forced absence is made.

Insurance premiums. In Letter No. 02-07-05/35315[2], the Ministry of Finance noted that payments made to an employee in the amount of average earnings during forced absence are subject to insurance contributions, since they are not included in the list of payments exempt from taxation (Article 9 Federal Law No. 212-FZ[3]). In this case, the object of taxation of insurance premiums will arise at the time of accrual of wages, regardless of the date of its actual receipt by the employee and the period for which it was accrued (Articles 11, 15 of Federal Law No. 212-FZ).

When should insurance premiums be calculated? The calculation of insurance premiums from the amount of payments due to the employee is carried out simultaneously with the calculation of compensation in the amount of average earnings for the period of forced absence on the date of reinstatement of the employee to his position by a court decision when the dismissal order is canceled.

By the way, on the issue of calculating insurance premiums, arbitrators also agree with controllers (Resolution of the FAS ZSO dated December 20, 2013 No. A45-20740/2012).

For your information

Since the provisions of Art. 9 of Federal Law No. 212-FZ regarding compensation payments upon dismissal are similar to Art. 422 “Amounts not subject to insurance premiums” of the Tax Code of the Russian Federation, after the above law ceases to be in effect and Ch. 34 of the Tax Code of the Russian Federation, the position of the Ministry of Finance on the issue of calculating insurance premiums should not change.

Truancy

Absenteeism may become one of the grounds for terminating an employment agreement at the request of the employer.

Absenteeism is the absence of an employee from his assigned place without a satisfactory reason for 4 or more hours in a row during one day (shift). Nothing depends on the length of the shift (the employee skipped working hours). The boss can define the following points as absenteeism:

- When an employee who has signed an employment contract (term unspecified) leaves his workplace without satisfactory reason, without notifying the employer of termination of the agreement, before the expiration of the 2 week notice period;

- When an employee who has signed a contract (fixed term) leaves the position without any valid reason before the expiration of the contract or before the expiration of the warning period for early termination;

- Self-management of days off, as well as arbitrary assignment of vacation.

These norms may seem to be clearly defined and extremely transparent. However, employers, and often the courts, even today find themselves at a dead end when studying such cases and determining whether a particular situation constitutes truancy. As a result, judges' verdicts often turn out to be incorrect and hasty.

Reflection of payments in accounting

Data in accounting, according to the Letter of the Ministry of Finance dated June 17, 2021, must be entered simultaneously with the elimination of the offense against the employee. For example, if an illegal dismissal occurs, the accountant enters information simultaneously with the employee’s reinstatement and the order for his dismissal is cancelled. Payments for the period of forced absence and accrued insurance premiums can be included in expenses in the general manner.

Example 2

The employee was illegally fired in February. He went to court to restore his rights. The court upheld his claim and ordered the employer to pay 110,000 rubles for the period of temporary detention. The employee was reinstated and received funds in full. As of the date of compensation:

- The employee does not have the right to a standard personal income tax deduction.

- The amount of compensation does not exceed the maximum amount accepted for calculating insurance premiums.

The accountant makes the following entries:

- DT20 (25, 26, 44) KT70. Explanation: calculation of average earnings. Amount: 110,000 rubles.

- DT20 (25, 26, 44) KT69. Explanation: calculation of insurance premiums. Amount: 33,220 rubles (110,000 * 30.2%).

- DT70 KT50. Explanation: payment of compensation to an employee. Amount: 110,000 rubles.

- DT70 KT68. Explanation: personal income tax withholding. Amount: 14,300 rubles (110,000 * 13%).

This is the standard procedure for recording information in accounting.

TIN code

We set the TIN code until the reason why the employee is not in his assigned place is clarified. Direct evidence of absenteeism in the time sheet is marked “NN” or “30”. They are able to guarantee the employer a positive outcome of the trial.

It is worth mentioning that the court does not focus on the type of report card. She is not interested in whether the employer uses an individual form, Form No. T-12 or No. T-13. It is important that he regularly notes work time and controls accounting. In fact, the form of the report card itself does not affect working rights (determined by the Moscow Regional Court).

Corrective accounting sheet

When employee absenteeism has been identified, you need to draw up a corrective report card. Then, if disputes arise, the boss will be able to easily prove the fact that he was not at work. Certain standards must be adhered to:

Mark absenteeism correctly

It is important, when a person stops regularly appearing at the workplace, not to miss the designations “NN” or “30”. These encodings indicate the fact that the employee was absent due to unknown circumstances. They can also be used if you are late or leave before the end of your shift. Then you can charge less money for shortcomings. But do not forget to mark the hours that were worked.

Accounting for weekends

Even during absenteeism, weekends determined by a person’s individual schedule must be marked with the coding “B” or “26”. The employee cannot appear on these days; they are considered non-working days. In one of the trials, the court negatively assessed the report card, which included only “NN”. The fact is that in recording the time of other employees, everything was filled out in accordance with established standards.

Who should keep track of working hours and who should be responsible for it?

If the organization is small, one person can keep time records.

If the structure of the enterprise is significant, it is advisable to appoint a responsible person in each division.

All responsible persons, regardless of their number, are appointed by orders for the main activities in order to avoid various kinds of misunderstandings.

Responsibility for the completeness and correctness of filling out the timesheet lies with the person authorized by the order.

The head of the department is responsible for the timely submission of timesheets to the accounting department.

The employer is responsible for everyone.