How are expenses for additional paid vacations taken into account for income tax purposes? Is it possible to include vacation bonuses in the income tax base? What is the procedure for recognizing expenses for the purchase of vouchers for employees and their children for the purpose of calculating income tax? Is it necessary to charge insurance premiums to the cost of travel vouchers for employees, and what opinion do controllers and arbitrators have on this issue? What are the tax features of financial assistance paid for vacation? Is it necessary to withhold personal income tax and calculate contributions from the amount of payment (compensation) for the cost of travel to the place of vacation and back to workers of the Far North?

Who is entitled to a lump sum payment for vacation?

To qualify for one-time financial assistance for vacation, an employee must work for the company for at least six months.

A one-time payment for vacation can be accrued to employees of any institutions:

- commercial enterprises;

- municipal institutions;

- budgetary organizations.

In any case, the rules for assigning and paying this benefit within the enterprise should not contradict the norms of the law, the employment contract with the employee and the company’s collective agreement.

Features when going on maternity leave

Each employer is obliged to pay one-time financial assistance to an expectant mother who will go on maternity leave.

In this case, the woman in the HR department takes special maternity leave. Maternity must be paid in one amount for all days of leave that are provided for by law.

The size of the one-time payment depends on the average woman’s earnings over the last 2 years.

Important! A lump sum payment for vacation in this situation is not provided.

Example of calculating a lump sum payment for vacation

An HR employee whose salary is 49,000 rubles goes on annual leave according to the vacation schedule. According to the employment contract, he must receive a one-time vacation allowance in the amount of 35% of the salary.

- A one-time payment for vacation excluding taxes will be: 49,000 rubles. x 35% = 17,150 rub.

- Four thousand rubles are not taxed, and therefore the tax base will be: 17,150 rubles. – 4,000 rub. = 13,150 rub.

- Personal income tax and insurance premiums: 13,150 x 13% + 13,150 x 22% = 4,602 rubles. 50 kopecks

- A one-time payment for vacation will be accrued in the amount of: RUB 17,150. – 4,602 rub. 50 kopecks = 12,547 rubles 50 kopecks.

- Vacation pay taking into account this payment will be: 49,000 + 12,547.5 = 61,547 rubles 50 kopecks.

Application for a one-time payment

A one-time payment for vacation is provided for by the collective and employment agreement, and therefore, when going on vacation according to the vacation schedule, it is not necessary to submit an application for accrual of this benefit. But if the vacation is not provided according to a pre-approved schedule, an application must be submitted, indicating the full name of the enterprise, the full name of the manager and a request for payment. The application is accompanied by the required certificates indicating the need for financial support.

Required documents for registration

The employee himself does not have to provide any additional documents.

If leave is provided to an employee not according to the leave schedule, then he is required to write a separate application indicating a request for payment of a lump sum.

Based on the application, the director of the company creates an order for the assignment of payment, which must indicate the following information:

- amount for incentive;

- date of issue of the amount;

- to whom the amount is intended;

- sources from which payments will be made;

- grounds for assigning the amount.

How is a lump sum payment for vacation taxed?

A one-time payment for vacation is not recognized by law as financial assistance, despite the regularity of its appointment. This is encouragement and stimulation of the employee. The payment is made together with the calculation of vacation accruals and is subject to personal income tax. In this regard, employers, as tax agents of their employees, are obliged to withhold the required amount from accruals and pay personal income tax to the budget.

A one-time payment for vacation will not be subject to personal income tax if its amount is less than 4 thousand rubles per employee.

In order to economically justify the need to make a payment, the wage provision must contain complete information about the nature of the accrual:

- its value as a percentage of the salary or in a fixed amount;

- the required length of service to qualify for payment;

- loss of the right to an incentive payment in the event of detection of cases of violation of labor discipline.

A one-time payment for vacation is subject to inclusion in the cost of paying employees and is subject to taxation:

- Personal income tax at a rate of 13%;

- insurance contributions to the Social Insurance Fund, Compulsory Medical Insurance Fund, Pension Fund (from 2021 - to the Federal Tax Service) at a rate of 22%.

Accounting for expenses for additional paid vacations for the purpose of calculating income tax

Costs for additional paid leave provided in accordance with the requirements of the Labor Code are taken into account for corporate profit tax purposes as part of labor costs if:

- These expenses comply with the provisions of Art. 252 Tax Code of the Russian Federation;

- they are not named in Art. 270 Tax Code of the Russian Federation.

The Ministry of Finance in Letter dated April 25, 2019 No. 03-03-06/3/30287 explained that based on clause 7 of Art.

255 of the Tax Code of the Russian Federation, labor costs include, in particular, expenses in the form of average earnings retained by employees during the vacation period provided for by the legislation of the Russian Federation. At the same time, Art. 116 of the Labor Code of the Russian Federation establishes that annual additional paid leave is provided to employees:

- those employed in jobs with harmful and (or) dangerous working conditions;

- having a special nature of work;

- having irregular working hours;

- working in the Far North and equivalent areas;

- in other cases provided for by the Labor Code of the Russian Federation and other federal laws.

Yes, Art. 321 of the Labor Code of the Russian Federation establishes additional holidays lasting:

- for residents of the Far North - 24 calendar days;

- for residents of areas equated to the regions of the Far North - 16 days;

- for residents of other regions of the North, where a regional coefficient and a percentage increase in wages are established - 8 days.

Please note that some categories of workers are entitled by law to an extended period of paid rest:

- minor workers (under 18 years of age) - 31 days (Article 267 of the Labor Code of the Russian Federation);

- disabled people of all groups - 30 days;

- for teachers and lecturers - 42 or 56 calendar days, depending on the position held by the teaching staff and the type of educational institution;

- for employees of the defense and chemical industries - from 30 to 40 days, depending on the length of continuous service;

- for medical workers who are at risk of contracting AIDS – 36 days.

Article 116 of the Labor Code of the Russian Federation allows for the establishment of extended vacations for employees at the initiative of the employer.

Such a decision must be spelled out in the company’s local regulations (collective agreement, internal labor regulations), and employment contracts. If the employer provides additional leave, it must be paid. However, unlike the main paid leave and additional leaves established in accordance with the Labor Code of the Russian Federation, such expenses cannot be recognized for profit tax purposes.

Note:

In paragraph 24 of Art. 270 of the Tax Code of the Russian Federation directly states that expenses for the purposes of taxing the profits of organizations cannot take into account the costs of paying for additional vacations provided under a collective agreement (in excess of those provided for by current legislation) to employees, including women raising children. At the same time, insurance premiums for additional vacations paid at the initiative of the employer are assessed on a general basis.

So, if additional leaves are provided in accordance with the requirements of labor legislation, the costs of paying them are taken into account as part of labor costs. If an organization, on its own initiative, pays for additional vacations on the basis of a collective agreement, it cannot take these amounts into account in income tax expenses. Therefore, an organization must clearly distinguish whether it has an obligation to provide and pay for additional leave.

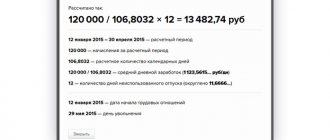

Example

An employee was granted leave from 06/01/2019 lasting 35 calendar days, including:

- 28 calendar days - annual basic paid leave;

- 7 calendar days - additional leave in accordance with the collective agreement, provided to employees with two or more children.

Let’s assume that the amount of payments for the billing period (from 06/01/2018 to 05/31/2019) amounted to 815,000 rubles; there were no excluded periods.

How much vacation pay can be recognized when taxing profits?

The average daily earnings of an employee will be 2317.97 rubles. (RUB 815,000 / 12 months / 29.3 days).

The amount of vacation pay due to the employee will be equal to:

- for the main vacation - 64903.16 rubles. (RUB 2,317.97 x 28 cal. days);

- for additional leave - 16225.79 rubles. (RUB 2,317.97 x 7 cal. days).

When taxing profits, you can take into account the amount of 64,903.16 rubles.

Explanations from controllers on the issue of recognition of payments for additional vacations when calculating income tax are also presented in letters from the Ministry of Finance:

- dated December 17, 2018 No. 03-03-06/3/91574 “On accounting for income tax purposes of expenses for paying additional leaves to employees”;

- dated November 22, 2018 No. 03-03-07/84407 “On accounting for vacation pay for income tax purposes.”

For information

On issues of application of the labor legislation of the Russian Federation (in particular, on the issue of the obligation to provide annual additional paid leave to certain categories of workers), the Ministry of Finance in Letter dated 04/17/2019 No. 03-03-07/27331 recommended that employers contact the Ministry of Labor for clarification, since on the basis of clause 1 of the Regulations on the Ministry of Labor and Social Protection of the Russian Federation, approved by Decree of the Government of the Russian Federation of June 19, 2012 No. 610, this department is the federal executive body that carries out the functions of developing and implementing state policy and legal regulation, including number in the world of work.

How is a lump sum payment calculated for vacation upon subsequent dismissal?

An employee who has announced his resignation from the company does not lose the right to annual paid leave. He can exercise his right in two ways:

- Rest for the prescribed amount of time and then quit.

- Receive compensation for the vacation that he did not have time to take, and quit his job.

The employer can provide the employee with partial leave and compensate the rest in cash. The conditions for obtaining the right to leave before dismissal are:

- concluding an employment contract when applying for a job;

- termination of an employment contract on personal initiative or in agreement with the employer;

- the end of a fixed-term employment contract when the employer does not want to renew it;

- the employee’s desire to leave work when it is his turn for annual paid leave;

- absence of violations of labor discipline that led to dismissal;

- submitting a resignation letter within the prescribed period.

All money due to the employee, including vacation pay, must be paid within three calendar days before the start of the vacation, and the final payment is made on the last working day before the vacation.

When dismissal is agreed with the employer, the application must be drawn up separately, and the process of dismissal and obtaining the right to rest is agreed with management. In other situations, vacation can be combined with the dismissal procedure. Upon leaving work, the employee will receive:

- vacation pay;

- wage debt for past working periods;

- settlement money for the previous month of performance of official duties;

- compensation amount for vacations that the employee did not take.

Payment for a travel package for an employee

Income tax. The Ministry of Finance in Letter No. 03-03-06/1/4054 dated January 25, 2019 clarified the issue of the possibility of taking into account, for the purpose of calculating income tax, expenses for the purchase of vouchers for employees and their children through an agent who enters into contracts for the purchase of a tourism product. Officials indicated that the costs of paying for the above-mentioned services will be taken into account when forming the tax base if such an agreement is concluded in accordance with the norms of the legislation of the Russian Federation.

Note:

A tourist product should be understood as a set of transportation and accommodation services provided for a total price (regardless of the inclusion in the total price of the cost of excursion services and (or) other services) under an agreement on the sale of a tourist product (Article 1 of the Federal Law of November 24. 1996 No. 132-FZ “On the fundamentals of tourism activities in the Russian Federation” (hereinafter referred to as Federal Law No. 132-FZ)).

Let us remind you that from 01/01/2019, in accordance with clause 24.2 of Art. 255 of the Tax Code of the Russian Federation, taxpayers are given the right to include in labor costs for tax purposes the costs incurred by the employer to pay for services for organizing tourism and recreation in the territory of the Russian Federation under an agreement (agreements) on the sale of a tourism product concluded (concluded) by the employer with a tour operator (travel agent) in favor of employees (members of their families).

Note:

For the purpose of applying clause 24.2 of Art. 255 of the Tax Code of the Russian Federation, members of an employee’s family include the employee’s spouse, his parents, children (including adopted ones) under the age of 18, wards under the age of 18, as well as the employee’s children (including adopted ones) under the age of 24 years old, full-time students in an educational organization, former wards (after termination of guardianship or trusteeship) under the age of 24 years, full-time students in an educational organization.

Thus, the costs of paying for the above-mentioned services provided to the employee and the relevant members of his family will be taken into account when forming the corporate income tax base only on the basis of an agreement on the sale of a tourism product concluded by the employer with a tour operator or travel agent.

At the same time, the costs of paying for similar services, if they are provided on the basis of contracts concluded by the employer directly with the providers of these services (hotels, carriers, excursion guides (guides), etc.), cannot be included in the composition of labor costs by virtue of p. 24.2 art. 255 Tax Code of the Russian Federation. The explanations of the Ministry of Finance on this issue can be found in the letters:

- dated January 24, 2019 No. 03-03-06/1/3880 “On income tax, insurance premiums, personal income tax when purchasing tourist vouchers for employees (members of their families), as well as on personal income tax when purchasing vouchers for sanatorium and resort treatment for them ";

- dated 07/02/2018 No. 03-03-20/45524 “On accounting for income tax purposes of expenses for payment for services for organizing tourism and recreation under an agreement on the sale of a tourism product to employees and members of their families from 01/01/2019”;

- dated 05.23.2018 No. 03-03-05/34637 “On accounting for income tax purposes of expenses for payment of services for organizing tourism and recreation in the Russian Federation for family members of employees from 01.01.2019.”

Insurance premiums. In Letter No. 03-04-05/32077 dated April 30, 2019, the Ministry of Finance expressed the opinion that the employer is obliged to accrue contributions on the cost of travel packages paid for employees. To justify their position, officials cited the following provisions of the Tax Code:

- based on paragraphs. 1 clause 1 art. 420 of the Tax Code of the Russian Federation, the object of taxation of insurance contributions for organizations is payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, in particular, within the framework of labor relations;

- according to paragraph 1 of Art. 421 of the Tax Code of the Russian Federation, the base for calculating insurance premiums for organizations is determined at the end of each calendar month as the amount of payments and other remunerations provided for in paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, accrued separately in relation to each individual from the beginning of the billing period on an accrual basis, with the exception of the amounts specified in Art. 422 Tax Code of the Russian Federation;

- list of payments to individuals not subject to insurance premiums, given in Art. 422 of the Tax Code of the Russian Federation is exhaustive.

The Ministry of Finance drew attention to the fact that the organization’s expenses for paying the cost of tourist trips for employees are not included in the list of amounts not subject to contribution, named in Art.

422 of the Tax Code of the Russian Federation, therefore, such amounts of expenses should be subject to insurance contributions in the generally established manner. Controllers have already expressed a similar opinion:

- in the Letter of the Federal Tax Service of the Russian Federation dated September 14, 2017 No. BS-4-11/ [email protected] “On insurance premiums from the payment of sanatorium and resort vouchers for employees engaged in work with harmful (hazardous) factors, and compensation for the maintenance of their children in a preschool institution ";

- in letters of the Ministry of Finance of the Russian Federation dated 04/12/2018 No. 03-15-06/24316, dated 03/21/2017 No. 03-15-06/16239.

However, the arbitrators classify the payment for the cost of vouchers as social benefits and allow insurance premiums not to be calculated from it (see the decisions of the Supreme Court of the Russian Federation dated 01.02.2019 No. F01-6795/2018 in case No. A11-8130/2018, the Supreme Court of the Russian Federation dated 02.27.2019 No. F02 -310/2019 in case No. A33-7165/2018, AS TsO dated December 25, 2018 No. F10-5583/2018 in case No. A48-1566/2018 (Decree of the RF Armed Forces dated May 6, 2019 No. 310ES19-4593 refused to transfer the case for revision) etc.).

For your information,

the concept of social payment was defined in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 14, 2013 No. 17744/12 in case No. A62-1345/2012, which formulated its main features:

- such payment is provided for by the collective agreement;

- it is not remuneration or remuneration for work, or an incentive payment;

- it does not depend on the qualifications of workers, the complexity, quality and conditions of their work.

Judicial practice developed before the transfer of the function of administering insurance premiums to the tax authorities, but the essence of the rules has not changed, so you can focus on it at the present time.

At the same time, given the position of the controllers, the organization will have to prove its case in court. Personal income tax. According to paragraph 9 of Art. 217 of the Tax Code of the Russian Federation are not subject to personal income tax:

- the amount of full or partial compensation (payment) by employers to their employees and (or) members of their families, former employees who resigned due to retirement due to disability or old age, disabled people not working in this organization, the cost of purchased vouchers, on the basis of which the indicated persons are provided with services by sanatorium-resort and health-improving organizations;

- the amount of full or partial compensation (payment) for the cost of vouchers for children under the age of 16, on the basis of which these persons are provided with services by sanatorium-resort and health-improving organizations.

This paragraph contains a number of conditions under which exemption from personal income tax is possible:

- vouchers are not tourist;

- organizations providing sanatorium-resort and health-improving services are located on the territory of the Russian Federation;

- expenses for compensation (payment) for the cost of vouchers in accordance with the Tax Code of the Russian Federation are not included in the expenses taken into account when determining the tax base for corporate income tax.

In Letter dated January 24, 2019 No. 03-03-06/1/3880, the Ministry of Finance clarified that, according to Art. 1 of Federal Law No. 132FZ, tourism is temporary trips (travels) of citizens of the Russian Federation, foreign citizens and stateless persons from their permanent place of residence, in particular, for medical, health and recreational purposes. Taking into account the above, the cost of vouchers recognized as tourist according to Federal Law No. 132FZ, the provisions of clause 9 of Art. 217 of the Tax Code of the Russian Federation does not apply and amounts of compensation (payment) for the cost of such vouchers are subject to personal income tax in the prescribed manner.

For information

Amounts of compensation (payment) by an organization for the cost of vouchers for individuals, with the exception of tourists, on the basis of which they are provided with services by sanatorium-resort and health-improving organizations located on the territory of the Russian Federation, are exempt from personal income tax under clause 9 of Art. 217 of the Tax Code of the Russian Federation only if the conditions set out in this paragraph are met.

Earlier clarification that the cost of vouchers to children's health camps on the territory of the Russian Federation for children under 16 years of age, which is paid at the expense of the organization and the costs of payment for which are not taken into account for profit tax purposes, is not subject to personal income tax on the basis of clause 9 of Art. .

217 of the Tax Code of the Russian Federation, were presented in the Letter of the Ministry of Finance of the Russian Federation dated 01.08.2017 No. 03-04-06/48824. Also, the position of the Ministry of Finance on the issue of taxation of the amount of payment (compensation) for the cost of vouchers for employees and members of their families is set out in letters dated 04/30/2019 No. 03-04-05/32077, dated 02/22/2019 No. 03-04-05/11747, dated 01/15/2019 No. 03-04-06/1107.

What documents are prepared for the payment of one-time assistance for vacation?

The employee himself does not have to submit any documents to provide him with financial assistance for his vacation - he just has to have the right to it. If vacation is granted outside the vacation schedule, then the employee writes an application for accrual of payment.

The main document is the Order of the head of the company, to which the accounting employee who makes the payment is subordinate. The order must include the following information:

- specific payment amount;

- date of accrual of funds;

- who is the recipient of the funds;

- where does the funding come from (company profit, budget, trade union, salary fund);

- On what basis is the payment of money made (document details must be specified).

View a sample order for calculating a lump sum payment for vacation

Common mistakes

Error: The employee worked at the company for 5 months, after which he took leave. He demands a lump sum payment in addition to vacation pay.

Comment: Employees who have worked for less than six months are not entitled to a lump sum payment for vacation.

Error: The employee regularly violated labor discipline, for which he was fired without having time to take advantage of his annual paid leave. Upon receiving compensation for unused vacation, he demanded an additional lump sum payment for vacation.

Comment: A one-time vacation allowance is an incentive payment for excellent work, therefore violations of labor discipline deprive the employee of the right to receive it.

In relation to state and municipal employees

All employees of budgetary and municipal organizations, as well as employees of commercial firms, have the right to annual leave in seven payments. At the same time, the rules of the institution itself must spell out the rules for calculating and paying lump sum benefits for employee vacations.

Important! The main basis for calculating payments is the availability of a sufficient amount of funds in the employer’s accounts to pay one-time incentives to employees for vacation. That is, the enterprise must have a satisfactory financial condition and have profit in its accounts.

Municipal authorities may issue orders for the payment of such incentives to employees for vacation; this must be stated in their Charter. The amount is transferred to employees once a year, which does not depend on the duration of the vacation.

Federal employees have the right to annual leave on a general basis. In this case, the amount of vacation pay is doubled from the salary level. The possibility of receiving additional vacation payments in the form of a lump sum is provided in each region in accordance with local legislation. Funds are paid 10 days before the start of the vacation. In the absence of payments, the civil servant has the right to postpone his vacation until the payments become due.

Answers to common questions about how a lump sum payment for vacation is calculated

Question No. 1: What to do if the director of the company does not have the right or does not want to pay a lump sum allowance for vacation?

Answer: In such a situation, it is necessary to convene a special commission consisting of at least 3 people (director, accountant and chairman of the trade union), which will hold a meeting and draw up an act on the payment of funds.

Question No. 2: Is it possible to claim a one-time vacation allowance if an employee is employed without signing an employment contract?

Answer: In such a situation, any incentive payments are awarded at the discretion of the employer, and the law cannot protect the employee, since there are no legal grounds for employment, personal income tax is not paid on income, as well as insurance contributions.

https://youtu.be/eKVsZm5mnD4

What should you pay attention to?

Every employer must monitor all changes in the country's labor and tax code.

First of all, the employer must pay attention to the following mandatory points:

- who should actually receive a fixed lump sum of holiday payments and who is not eligible for this incentive;

- what is the maximum and minimum lump sum of vacation payments that can be assigned to an employee;

- how many times a year an employee has the right to demand a lump sum of payments for vacation;

- when the amount should be transferred - before, during or after the vacation;

- how to correctly display these amounts in reporting;

- How is this payment taxed?

These issues should be controlled not only by the director of the company, but also by the chief accountant.

The HR employee responsible for vacation planning is also involved in this process.