Subtleties of hiring people of retirement age

The main emphasis when hiring is on compliance with labor laws. They may enter into:

- Permanent contracts.

- Urgent with a clearly defined date.

- Part-time agreement.

- Contract, if a citizen plans to perform household work. The contract version is agreed upon by both parties. When hiring a pensioner, the following nuances must be observed:

- There must be a probationary period, as with the admission of other citizens. It is established by mutual agreement and this condition is indicated in the employment contract.

- A medical certificate with permission to work is required. Employers are often reluctant to hire retirees because they doubt their health will allow them to perform their duties. Therefore, a medical record will confirm your ability to work.

- There is a possibility of part-time work. There are no direct prohibitions on performing multiple duties.

- Guarantees and compensation under the employment contract remain.

- Full and part-time work available. There is an opportunity to work night shift.

A pensioner must carefully check his health and bring all the necessary certificates to the employer.

Hiring a pensioner of the Labor Code of the Russian Federation

The employment of a pensioner must be carried out in strict accordance with the provisions of the Labor Code of the Russian Federation. The law does not provide special conditions for hiring citizens who are on well-deserved rest. The entire procedure is carried out in accordance with general standards. It says that labor in Russia is free.

The Labor Code of the Russian Federation prohibits establishing any restrictions in relation to people who have reached retirement age.

As a general rule, a citizen has the right to begin working at the age of 16. In some situations, the age limit may be reduced to 14 years. At 55 and 60 years of age for women and men, respectively, a person has the right to begin receiving a pension. At the same time, the prohibition on continuing to work is not indicated in regulatory legal acts.

If an employer does not want to hire a retiree, a written refusal must be provided stating the reason. A similar rule is enshrined in. If a company does not want to work with a person because of his age, it will be considered discrimination. However, there are a number of professions for which a maximum age threshold is established.

This category of citizens has certain benefits. Thus, WWII participants and combat veterans have the right to receive additional annual leave of up to 35 working days without pay. You can use the privilege at any time.

General provisions

To more fully show why a pension certificate is actually needed, it is worth saying a few words about the pension system existing in our country.

The new model of pension provision in the Russian Federation is based on compulsory pension insurance, the essence of which is the payment of insurance pension contributions. From these contributions, certain types of pensions are subsequently formed, which are paid upon the occurrence of one of the insured events:

- reaching retirement age,

- onset of disability,

- loss of a breadwinner.

Accordingly, citizens and employers are divided into two large groups - insured persons, i.e. persons for whom premiums are paid, and policyholders who directly pay these premiums.

In order for insured persons to exercise their rights to receive a pension in the future, the Pension Fund of the Russian Federation (PFR) keeps individual records of information about each insured person (information about length of service, insurance contributions, etc.). Such accounting is carried out in accordance with Federal Law No. 27-FZ of April 1, 1996 “On individual (personalized) accounting in the compulsory pension insurance system” (hereinafter referred to as Law No. 27-FZ) and the Instructions on the procedure for maintaining individual (personalized) accounting information about insured persons for the purposes of compulsory pension insurance, approved by Decree of the Government of the Russian Federation of March 15, 1997 No. 318 (hereinafter referred to as the Instructions).

The first step of personalized accounting is the registration of citizens with the Pension Fund as insured persons, which, as a general rule, is carried out by insurers (i.e. employers). After registration, the Pension Fund of the Russian Federation opens an individual personal account for each insured person with a permanent insurance number and issues an insurance certificate of compulsory pension insurance, which indicates this insurance number.

Thus, the presence of a certificate confirms the fact that the person is already insured and an individual personal account has been opened in his name, which contains all the information necessary for subsequent pension provision. The pension certificate shall indicate:

- insurance number,

- Full Name,

- Date and place of birth,

- gender and

— date of registration in the compulsory pension insurance system.

The form of the pension certificate was approved by Resolution of the Pension Fund Board of October 21, 2002 No. 122p. The certificate is valid only upon presentation of a passport or other identification document.

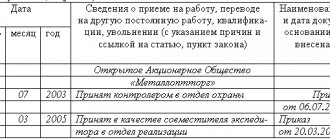

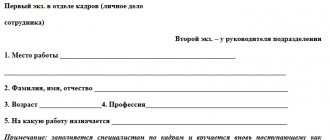

The process of hiring a pensioner

Due to the fact that age pensioners cannot be discredited, when applying for employment a person must present the same documents as other citizens who have not reached retirement age.

List of documents required for employment:

- Identification document (passport).

- Employment history.

- For people liable for military service - a military ID.

- Documents that indicate education (certificates, diplomas, certificates, etc.)

- State insurance certificate pension insurance (if available).

- As well as other documents that are provided for by the rules of the company or enterprise.

The employer has no right to require the presentation of a pension certificate.

The pensioner submits documents to the appropriate organization where he gets a job. It is important to remember that an employment contract (fixed-term or open-ended) must be concluded with any officially working citizen.

It is also possible to conclude a civil contract under which the pensioner will perform the functions of a contractor or provide services. When signing this type of agreement, the relationship between the employer and the employee is civil law, not labor, which means that the employee does not claim certain benefits that are provided for by law.

Peculiarities of registration for work of pensioners

An employer is not obliged to hire a person of retirement age if Russian legislation provides for age restrictions for certain professions or positions:

| Job title | Age limit |

| related to the management of educational institutions | 65 years for women 70 years for men |

| civil servants | Must not exceed 60 years of age |

A pensioner has the right to receive additional days of unpaid leave during work; otherwise, no specific features of the pensioner’s work process are provided. He can be given full financial responsibility, sent on a business trip, have an irregular working day established with his consent, or be instructed to do work overtime.

The pensioner continues to receive a pension - this right does not depend on the fact that the pensioner is employed. The only thing that a working person of retirement age is limited in is that his pension does not increase due to the inflationary process.

Necessary documents for hiring a pensioner

A retired employee has the same rights when applying for a job as any other person applying for this position who has not reached retirement age.

- When concluding an employment contract, he must present (Article 65 of the Labor Code of the Russian Federation): a passport or other document identifying him;

- work book;

- insurance certificate of state pension insurance (exception - loss of such a document);

- military registration documents (for pensioners liable for military service);

- document on education, qualifications or special knowledge (to be presented by a pensioner who enters a job that requires special knowledge or special training).

- Tax registration (TIN certificate if available).

In some cases (taking into account the specifics of the work), the employer may request other additional documents necessary for it.

We issue a pension certificate to a foreign citizen

Another issue that causes difficulties for employers is the issuance of pension certificates to foreign citizens.

To answer this, please refer to Art. 7 of the Federal Law of December 15, 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation”, according to which insured persons, in addition to citizens of the Russian Federation, also include foreign citizens and stateless persons permanently or temporarily residing in the territory of the Russian Federation . Thus, before registering these citizens and persons with the Pension Fund as insured (and issuing them a pension certificate based on the results of registration), it is necessary to establish the status of their residence in Russia. According to the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation,” a distinction is made between foreign citizens and stateless persons:

- permanent residents,

- temporary residents,

- temporarily staying.

For foreign citizens and stateless persons permanently residing in the Russian Federation, a document confirming such residence is a residence permit. The residence permit contains the following information: last name, first name, date and place of birth, gender, citizenship of the foreign citizen, number and date of the decision on issuance, validity period of the residence permit, name of the executive authority that issued it, and is drawn up in the form of a document established forms. A residence permit is issued to a foreign citizen for five years. Upon expiration of the residence permit, this period, at the request of a foreign citizen, can be extended for another five years. The number of extensions of the residence permit is not limited. A residence permit issued to a stateless person is also a document proving his identity.

As for foreign citizens temporarily residing in the Russian Federation, they must have a temporary residence permit. Such a permit confirms the right of a foreign citizen or stateless person to temporarily reside in the Russian Federation until receiving a residence permit. The permit is issued in the form of a mark in the identity document of a foreign citizen or stateless person, or in the form of a document of the established form issued in the Russian Federation to a stateless person who does not have a document proving his identity. The temporary residence permit is valid for three years.

Foreign citizens temporarily staying in the Russian Federation, including those carrying out work activities permitted by them, cannot be registered with the Pension Fund as insured persons and do not have the right to receive a pension certificate. A foreign citizen temporarily staying in the Russian Federation is a person who arrived in the Russian Federation on the basis of a visa or in a manner that does not require a visa, and does not have a residence permit or temporary residence permit. The period of temporary stay is determined by the period of the visa issued to him.

Let us recall that the issue of registering foreign citizens and stateless persons as insured, issuing them a pension certificate and paying insurance premiums for them remained unresolved for some time. Clarity was introduced by Federal Law No. 70-FZ of July 20, 2004, which supplemented Art. 7 of Federal Law of December 15, 2001 No. 167-FZ. Thus, since 2005, the insured persons have included foreign citizens and stateless persons not only permanently, but also temporarily residing in the Russian Federation. The procedure for registering them with the Pension Fund of the Russian Federation and issuing them a pension certificate is the same as for Russian citizens.

Citizens of Belarus have a special status, since they enjoy equal civil rights and freedoms with citizens of Russia (Article 3 of the Treaty between the Russian Federation and the Republic of Belarus on equal rights of citizens of December 25, 1998). In this regard, the registration of citizens of Belarus requires the same documents as for Russian citizens.

What agreements are drawn up during registration?

The work must be official, for which an agreement is drawn up between him and the employer. It can be presented in several varieties, which include:

- standard open-ended contract

- fixed-term agreement

- part-time contract

- contract agreement

- GPC agreement

The choice of a specific document depends on the specifics of the employee’s activities. If long-term cooperation and routine duties are planned, then it is not allowed to use a fixed-term contract.

Registration agreement

As in the classic situation, cooperation with a citizen who is on a well-deserved rest is carried out on the basis of an employment contract. If a person continues to work in the company in which he worked previously, the need to enter into an agreement in connection with reaching retirement age does not arise. If a pensioner joins a new company, one of the following agreements will be concluded:

- urgent;

- unlimited;

- part-time agreement;

- contractor;

- civil law.

The choice of type of agreement depends on the specifics of the work to be done and the agreement reached.

Features of hiring under a fixed-term employment contract

With a pensioner who gets a job, it is possible to conclude a fixed-term employment contract on a general basis. With age pensioners, such an employment contract is concluded only on the basis of mutual consent. The limitation of work under this type of contract is five years with the possibility of extension.

It is important to know that a fixed-term employment contract can be recognized by the court as indefinite if it has already been renewed several times.

Thus, this type of contract can be concluded for a short-term period - several months, to perform certain functions on a temporary basis (replacing a sick employee, etc.) or for a long time - several years, in the second case, it is possible to recognize this type of contract as indefinite , By the tribunal's decision.

Pensioners who get a job have, for the most part, the same rights as ordinary citizens, with the exception of some nuances. Remember that, based on current legislation, an employer does not have the right to discriminate against a subordinate because of his age. Such violations lead to conflicts with the Labor Commission, which strictly monitors compliance with workers' rights and laws, which can subsequently lead to serious fines or liquidation of the organization.

Civil contract

It is concluded by companies in cooperation with freelance specialists. They are represented by workers who perform a specific job or provide a service for a limited period of time.

These people are not part of the company’s staff, so after completing the task they receive a payment and search for a new place of employment. Such a contract can be concluded with older people on a general basis.

We accept an employee who has lost his pension certificate

There are cases when an applicant applying for a job already has some work experience, officially confirmed, but does not have a pension certificate due to its loss (for example, lost or damaged).

In practice, the question arises: should the employer himself take action to restore the lost pension certificate when hiring such an employee? This is especially true for those companies where there is a high staff turnover. In this case, two behavior options are possible.

Option No. 1. The applicant receives a duplicate of the pension certificate.

When hiring, the employer has the right to require the presentation of a pension certificate, and in its absence, to “send” the employee to receive a duplicate himself at the territorial office of the Pension Fund of the Russian Federation at his place of residence. So, according to para. 4 p. 5 art. 7 of Law No. 27-FZ, an insured person who does not work under an employment contract or has not entered into a civil contract for which insurance premiums are calculated, and is not registered as an insurer, is obliged to independently apply for the restoration of the certificate to the territorial office of the Pension Fund of the Russian Federation. at the place of residence.

To obtain a certificate, an employee will need to go to the territorial office of the Pension Fund of Russia during office hours with a passport, fill out a form and write an application. Within a month, the Pension Fund issues a duplicate certificate.

In order to make sure that the applicant has taken the necessary measures to obtain a pension certificate, you can ask him to bring a copy of the application for a duplicate with the incoming registration number, and then formalize an employment relationship with him or enter into a civil contract for which insurance premiums are calculated. .

Option No. 2. The employer receives a duplicate of the pension certificate.

As a rule, when the employer is interested in a given employee or there is no time to wait for the applicant to submit a copy of the application for a duplicate, the employer accepts the employee without a pension certificate. However, after the conclusion of the contract, the obligation to obtain a duplicate falls on the employer, and the employee has the right to demand that a duplicate of the lost pension certificate be issued to him.

In this case, the employer must submit an application for a duplicate to the territorial branch of the Pension Fund within two weeks. In turn, the Pension Fund of the Russian Federation makes a decision within a month to issue a duplicate or to refuse to issue it. Accordingly, if a decision is made to issue a duplicate, the employer transfers it to the employee within a week.

The issuance of a duplicate may be refused, for example, in cases where the application contains an incorrect personal account number or when the last name, first name and patronymic indicated in the application do not correspond to the information contained in the personal account.

In practice, quite often when hiring (especially when concluding civil contracts), the employer simply asks the employee for the number of his pension certificate, without bothering to obtain a duplicate. Or he uses in his work the insurance number of an already opened personal account, indicated in the decision of the Pension Fund of the Russian Federation received by him to refuse to register the employee.

But if an employee approaches the employer with an application for the issuance of a duplicate pension certificate, the employer, in accordance with current legislation, is obliged to take all prescribed actions.

Probation period for a pensioner

The Labor Code does not establish any restrictions regarding pensioners when establishing a probationary period . This means that the general rules apply (Article 70 of the Labor Code):

- the test is ordered only by consent;

- the probationary condition must be fixed in the employment contract;

- probation period - maximum 3 months (up to six months you can test the director, his deputy, the chief accountant and his deputy, the director of a branch or representative office);

- with a fixed-term contract, the maximum period is two weeks (if the contract period is up to 2 months, then no test is established at all).

Can contributions be made to the Pension Fund of the Russian Federation without an employment contract?

Here are the oddities of this forum - people who do not work in the personnel department are the first to rush to answer questions about personnel records and labor legislation, but they really want to talk. And the poor authors of topics read all sorts of garbage that these armchair experts on any topic sell to them.

Do not confuse an entry in the work book and the conclusion of an employment contract. When applying for a job, the first document that you must sign is an employment contract, on the basis of which an order for employment is then issued (which you must also sign), and only then an entry is made in the work book. Contributions to the Pension Fund are made not on the basis of an entry in the work book (you never know what can be written there), but on the basis of a concluded employment contract. Why immediately rush to the authorities? There, too, they will immediately ask you to provide some documents about employment (copies of your work book, order or employment contract); without documents there is nothing to even talk about. Imagine that you come and ask if you have been given a job in the Presidential Administration, for example))))) So start with your employer. Based on Art. 62 of the Labor Code of the Russian Federation, he is obliged to give you all certified copies of your work-related documents. And they must give you the second copy of the employment contract in the original (of course, it must first be drawn up and signed by the parties).

Working hours and working conditions

The working hours for pensioners can be flexible and depend on what job the pensioner is applying for. Full working time. Normal working hours should not exceed 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation). This applies to permanent, temporary and seasonal workers, as well as workers hired for the duration of certain work.

Pensioners are not among the persons for whom the employer is obliged to establish such a working time schedule in accordance with Part 1 of Art. 93 of the Labor Code. But this is possible at the request of a working pensioner. However, part-time working hours can also be established at the initiative of the employer.

Wages for pensioners working part-time are calculated in proportion to the time actually worked or depending on the amount of work they perform (for piecework wages)

Part-time work

Here there are no restrictions regarding pensioners either, everything is according to the rules of Article 93 of the Labor Code:

- you can establish a part-time schedule (working day or week) by agreement of the director and employee;

- the director is obliged to establish such a regime if an employee is caring for a sick family member or, according to a doctor’s opinion, he cannot work the whole day.

What deductions need to be made under a fixed-term employment contract?

Please tell me! A salesperson works in the LLC from July 26 to September 14, 2021; a fixed-term employment contract was concluded with her, because... At the same time, she is on the labor exchange. For July and August, taxes from the Social Insurance Fund, Pension Fund, and income tax were transferred to her. Is it correct? Or are these deductions made by the exchange?

When concluding a fixed-term employment contract, the employer is obliged to make the required contributions in the same way as when concluding an open-ended employment contract. The seller should have notified the employment center about applying for a job.

Work book for calculating work experience

When finding employment, a pensioner, along with other employees, is required to provide a document confirming work experience - a work book. Hiring persons who have not provided documents is a violation of the law. The exception is for persons in the category of pensioners who received a pension in the law enforcement agencies and the Armed Forces of the Russian Federation.

When serving, military personnel do not have a work book, which is issued only for civilian personnel. When employing military pensioners, they are subject to the procedure for issuing a book upon first employment. The employer is obliged:

- Provide a work record.

- Receive compensation from the employee for the cost of purchasing the form.

- Fill out the cover page for an employee who does not have civilian work experience.

- Make the first entry on the basis of a certificate of service in the RF Armed Forces or another structure.

The work book is submitted to the Pension Fund for registration of a pension and may not be with the employee at the time of employment. The employer has the right to issue a duplicate based on the certificate of experience from the pension fund. Data available upon request.

Hiring a pensioner without a work book

In a classic situation, the employer makes an entry in the employee’s work book about the beginning of interaction. In practice, a situation may arise when, for some reason, a pensioner cannot provide a document. In this situation, an employer who wants to officially record the fact of interaction with a citizen can enter into an employment contract without a work book.

The agreement will serve as evidence of work activity and experience. However, the absence of an entry in the pensioner’s work book is a violation. The need to record in a document the fact of the start of labor activity is enshrined in.

It is possible to work without making an entry only if the citizen carries out part-time activities or has entered into a GPC agreement. Information is not recorded even if cooperation is carried out with a private person. In this situation, the pensioner simply does not have the right to independently make an entry in the document, although legal relations arise in this situation.

If a person does not have a work record, there are several ways to solve the problem. They may vary depending on the reasons for which a person does not have the necessary documents. The employer can:

- Get a new work book for a pensioner if the previous one was lost.

- Request a certificate from another employer and execute a part-time contract if the document is located at the citizen’s main place of work.

- Conclude a contract or civil contract, informing the employee that sick leave and vacation will not be paid.

The decision depends on the wishes of the employer and the specifics of the current situation.

We accept an employee who has not received a pension certificate from his previous place of work

There are situations when an applicant, when applying for a job, claims that he did not receive a pension certificate at his previous place of work.

This option is possible when the employee has been registered with the Pension Fund of the Russian Federation, a personal account has been opened for him, but the certificate has not reached the employee for some reason. In this case, the employee can obtain his certificate independently by contacting the territorial branch of the Pension Fund of the Russian Federation at his place of residence. Or the employer, in the absence of a guarantee that the employee was nevertheless registered at the previous place of work, submits a questionnaire for initial registration and a list of documents to the Pension Fund, after which:

- receives a refusal to register, since an individual personal account has already been opened (and, accordingly, learns the current insurance number from the refusal), and then takes actions to obtain a duplicate certificate, or

— receives confirmation of the employee’s registration and pension certificate along with an accompanying statement.

Tax deductions

If a pensioner continues to work in retirement, contributions to the state will be required. Personal income tax in the amount of 13% will be written off from the employee’s salary. Additionally, the employer is obliged to pay insurance contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund from his own funds. Failure to pay prescribed fees is considered a violation and may result in penalties.

Paying income tax

Pensioners do not pay personal income tax on various incomes represented by social or insurance pensions, additional payments, benefits, compensation from the federal or regional budget, as well as payment for vouchers to sanatoriums or medications.

If an elderly person continues to work, then the employer pays personal income tax on his salary. Therefore, a citizen can take advantage of tax deductions, the amount of which depends on the amount spent on the purchase of housing or medicine, as well as on the amount of income tax paid by the employer for the year of work.

Payment of property tax

Pensioners can enjoy various benefits from the state or regional authorities. They receive an exemption from paying property taxes, but only for one piece of real estate. The relaxation is offered even to citizens who retired early. Even if a person continues to work, he still receives this benefit.

If a citizen has several apartments or houses, then exemption can be obtained only for one object. For others, you will have to pay property tax on a general basis.

Land tax

In 2021, by presidential decree, pensioners were included in the preferential category of the population, so they do not have to pay land tax. But this only applies to plots whose size does not exceed 6 acres. If the area of the territory exceeds this value, then for the remaining acres you will have to calculate and pay tax.

The maximum fee for pensioners is 10 thousand rubles. During the exact calculation, the cadastral value of the property is taken into account.

Transport tax

Benefits for this fee are not offered at the federal level, but may be offered by regional authorities. Only pensioners who are disabled can count on relief under federal law. They do not pay tax on cars received with the help of social security and with a power of up to 100 hp. With.

Citizens should contact the local administration of their city to obtain information about the possibility of receiving a transport tax benefit.

According to the employment contract, contributions are made to the pension fund

According to existing legislation, work in which an employment contract is concluded and the corresponding entry is made in the work book also involves a so-called social package. The social package includes the provision of paid leave, payment for sick leave and maternity leave, forced downtime, this allows the employee to be protected socially.

- The employer is obliged to notify local authorities of the fact of hiring.

- Pay taxes to the pension fund, as well as social and compulsory health insurance funds.

- If a person employed under a contract does not have a pension insurance certificate, the employer is obliged to issue one.

Medical service

Elderly citizens often require expensive medical treatment. Working pensioners can use the following services:

- free examination without waiting list

- receiving a 50% discount on medications, but they are offered only to labor veterans

- free flu vaccination

- Prosthetics and dental services are offered free of charge

To use these benefits, you must have a pensioner's certificate confirming your citizen status.

The employer did not make contributions to the Pension Fund of the Russian Federation

By the way, I’m telling you that you can also contact your employer with a written application under Article 62 of the Labor Code of the Russian Federation to be provided with certified copies of the forms submitted to the Pension Fund of the Russian Federation based on your individual data for the entire period of your work with this employer. For the entire period of your work. I'll give you a hint, because... I myself submitted this report on my employees to the Pension Fund of Russia in 2021 and 2021, then such a report is submitted for each quarter.

So, find out, not that no deductions were made, but find out whether the report was submitted based on individual data and not just the fact that it was submitted in general by the employer for his company and the employees working there, because I know that I applied, all employers do, but it is necessary to establish the fact that they did not apply specifically to you, i.e. that you worked in the black.

Dismissal of a pensioner

If a pensioner wants to complete his work activity and retire, dismissal will be carried out on a general basis. However, the employer will have to comply with a number of nuances. So, if a pensioner resigns of his own free will, he may not work for 2 weeks. This rule is enshrined in.

If the employer is the initiator of termination of the employment relationship, it must be taken into account that he does not have the right to fire a person because he has reached retirement age. This is reflected in. If a violation has occurred, the citizen can go to court. Typically, in this situation, the claims are satisfied, and the employee is reinstated at his previous place of work. If the company is liquidated, the dismissal of the pensioner is carried out on a general basis.

If a person cannot cope with his responsibilities, the employer may offer him a change of position or switch to part-time work.

Working under an employment contract, are there contributions to the pension?

When concluding an agreement in this category, the employer will not need to provide a social package to the employee or pay into some funds. Here comes another type of relationship, very similar to labor relations, but with a number of differences.

First of all, let’s determine which categories of contracts are labor contracts, concluded with the organization’s employees, and which are civil contracts, concluded with third-party individuals for the performance of work or provision of services. According to Art. 56 of the Labor Code of the Russian Federation, an employment contract is an agreement between the employer and the employee. In accordance with the employment contract, the employer undertakes to provide the employee with the scope of work for the labor function specified in this contract, to ensure working conditions provided for by labor legislation or local regulations and this employment contract.

Advantages and disadvantages of hiring without registration

Many citizens prefer informal employment. There are a number of advantages to this, but there are certain disadvantages as this option cannot be considered safe.

For a pensioner

A pensioner who is not registered as a labor pensioner will receive the same pension that was assigned to him; its amount will not be cut off. Such activities often involve a flexible schedule, thanks to which employees have the opportunity to choose a convenient time to complete their duties. Although there will be no notes in the work book, the work contract is used as evidence of the period of time worked.

But there are many more disadvantages to this employment option:

- An employee cannot count on receiving sick leave, vacation, maternity benefits, or compensation in the event of a work injury.

- Experience is not accrued, so it will be difficult to prove that you have experience at your next job.

- There are no bonuses.

- The employer may not fulfill its obligations to contribute to the pension fund and pay for health insurance.

- The pensioner must pay taxes himself from the amount received.

- It is possible to terminate an employment contract at any time, even if it has not yet expired.

- An employer can fire illegally and still not pay wages, and the employee will not be able to complain anywhere.

- The worker can be fined at any time.

Therefore, before hiring, you should weigh all the pros and cons of this option in order to avoid difficulties in the future.

For the employer

It is convenient for company owners to hire informally, as this:

- Allows you to avoid paying taxes.

- Set a salary less than the amount established by law.

- Do not pay vacation and sick pay to employees.

- Involve subordinates in any work.

- Fire people without explanation or provision of wages.

- Fail to follow safety regulations and create a safe working environment for employees.

But not everything is as good as it seems at first glance. For this the employer:

- Bears tax, criminal and administrative liability.

- Can be punished for lack of transfers to the Social Insurance Fund and the pension fund.

In addition to large fines for hiring without registration, other more serious penalties are possible.

There will be contributions to the pension fund if you get a job under an employment contract

Hello. Under an employment contract, contributions are made by the employer; under a civil law contract, you pay taxes yourself. You can find out whether your employer pays tax to the pension fund for you on the pension fund website in your personal account, or by submitting an application to the pension fund

No, under this agreement, personal income tax is paid by the “employer”, as a tax agent. Tax calculation occurs in exactly the same way as with an employment contract. Personal income tax is withheld from the amount of remuneration for individuals. person and transferred to the budget by the tax agent in accordance with Art. 226 Tax Code of the Russian Federation. Under both types of contracts, the employer or customer of services is required to pay contributions to the Pension Fund of 22% and the Federal Compulsory Medical Insurance Fund of 5.1%, from which the individual’s length of service is determined.

Nuances

Current legislation establishes a number of age restrictions for persons holding certain positions. Thus, a citizen managing an educational institution or its branch cannot be older than 65-70 years. Otherwise, the features of labor relations with persons who have reached retirement age do not differ from standard employment. The employer has the right to establish a probationary period, assign overtime work, hire a pensioner for irregular working hours and send him on a business trip.

A person on well-deserved rest has the right to continue working on a general basis. This will not result in loss of pension. However, a person must be prepared for the fact that he will have to complete all assigned tasks, regardless of age. The state provides a number of benefits, but they do not relate to the procedure for carrying out labor activities itself. Basically, pensioners can qualify for additional rest and changes in the length of the working day.

Is it necessary to renew the contract with an employee who has reached retirement age?

A pensioner is a person who receives payments for:

- old age (currently, in general, from 55 years old for women, 60 years old for men);

- disability;

- length of service;

- loss of a breadwinner.

The maximum age for work in certain positions is established for the spheres of education (Article 332 of the Labor Code), civil service (Article 25.1 of the Federal Law of July 27, 2004 N 79), heads of medical organizations (Article 350 of the Labor Code of the Russian Federation, Federal Law of July 29, 2017 N 256). This means that changing the conditions of a TD only on the basis of age (except for the specified categories) can be qualified by the court as corresponding discrimination, which is prohibited (Article 3 of the Labor Code). Therefore, re-conclusion of a TD without the consent of the employee based on his retirement age is not required. This conclusion is confirmed by the Determination of the Constitutional Court of the Russian Federation dated May 15, 2007 N 378-O-P. It states that the employer does not have the legal right to re-register a permanent TD for a fixed-term one (or terminate it), due to the employee’s retirement age and the assignment of a corresponding payment to him.

IMPORTANT! To retire in old age, in addition to reaching a certain age, you need to go through a certain procedure. Its rules are established by Order of the Ministry of Labor of Russia dated November 17, 2014 N 884n. Thus, retirement age itself, without proper paperwork, changes little for a person.

Questions - answers

Question 1: Can a pensioner apply to an employer with a request to reduce working hours?

Maybe, but the employer has the right to refuse him if he is not disabled.

Question 2: Does a pensioner have the right to work overtime and on holidays?

Yes, it has. Just like an ordinary employee.

Question 3: Should a pensioner work 2 weeks upon dismissal?

No, you shouldn't. Dismissal without service.

Procedure in a situation where the employer does not make contributions to the Pension Fund

If the employer does not make contributions to the pension fund, what should the employee do? This question comes up often, because no one is safe from an unscrupulous employer. The main thing is not to panic, but to try to defend your rights.

When an employee receives a salary, he puts his signature on the documents - this confirms that the money has been transferred and received. This is done wherever white wages are paid. The same calculation sheet indicates which taxes are withheld and in what amount. If a signature is not left anywhere, then the employee should be wary, because there is a possibility that he receives non-white wages, from which taxes are not transferred and there are no contributions to the pension fund. If an employee makes a request, the employer is obliged to provide a certificate containing the necessary information.