Right to vacation

Any employees who legally work on the territory of the Russian Federation have the right to annual rest (and this applies to both citizens of the Russian Federation and foreigners).

This applies to those who cooperate with organizations, institutions, enterprises, the form of ownership of which, however, does not play a role, as does the industry and type of professional activity. This also applies to those who work under a contract for an individual. How exactly is the right of employees to vacation guaranteed?

- Prohibiting the possibility of replacing annual holidays with certain monetary compensation. Exceptions are cases specified in current legislation.

- Guaranteeing that each employee is provided with a period of rest, the duration of which is influenced by a number of factors. At the same time, his place of work and salary level will be maintained.

The concept of work experience

Work experience means the total duration of work or any other socially useful activity of an employee.

Work experience is calculated for many reasons and can serve as a basis:

- when a person becomes entitled to a pension;

- for the employee to have the right to receive annual paid leave;

- if there is a need to receive benefits for temporary disability of an employee;

- in some cases, the calculation of length of service is necessary to calculate the employee’s wages.

The work book is used as the main document necessary for the correct calculation of work experience.

Basic conditions for granting leave to an employee

- Leave must be granted annually.

- In the first year of work - after at least 6 months (by agreement with the employer, earlier is possible)

- In subsequent calendar years - in any period corresponding to the vacation schedule

Exceptions to the first six months rule are:

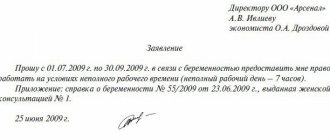

- women before and after maternity leave (as well as their husbands!),

- minors.

- who have adopted a child under 3 months.

- raising disabled children.

Before sending an employee on vacation, the accountant determines the duration of the payroll period, calculates the average daily income, and pays vacation pay to the employee.

But in practice, this simple algorithm has a number of pitfalls.

When an employee on vacation falls ill, he is forced to extend it for the period of illness. In such a situation, sick time should be excluded from the calculation period. That is, initially, when calculating vacation pay, the billing period is calculated based on the employee’s time working in the organization. And then sick days are excluded from this period.

From November 1, 2021 to October 16, 2021, while days from October 17 to October 31, 2021 should be excluded from the calculation period.

Sometimes fired employees return. But this does not mean that the calculation period can include the time that he worked before dismissal. Only those months that the employee worked after getting a new job will be taken into account. This follows from the fact that the employment contract with the employee upon dismissal is terminated and he is paid a settlement, which also contains compensation for unused vacation. This means that that time cannot be included in the calculation.

This point is also important in order to figure out how to count vacation days.

It is necessary to take into account that additional leave can be provided either together with the main one or separately from it during one working year. However, their total duration cannot exceed 59 calendar days.

In order to obtain the right to vacation at a new place of work, you must work there continuously for at least six months. However, in some cases it is possible to go on vacation earlier. Which groups of workers does this apply to?

- Disabled people.

- Minors.

- Those who work part-time.

- Women before or after maternity leave.

- Student employees for the duration of the session.

- Women who have at least two children under the age of fifteen or a disabled child.

- Employees who were issued a voucher for treatment at a sanatorium.

- Men whose wives are currently on maternity leave.

- Parents who are teachers in family-type orphanages.

As a rule, it is the management of the enterprise that participates in determining the order in which employees go on vacation. The process takes into account the personal requests of employees, production needs and existing opportunities for employee recreation. It is important to remember that schedules must be drawn up no later than January 5th of the year in question. This document can be drawn up in any form, since there is no single template established by law.

The schedule will need to fix the specific scope of the vacation (certain dates, start month and end month).

If both parties to the contract are satisfied with this situation, then the vacation can be planned in parts.

The specific period for the provision of annual leave within the limits established by the schedule is agreed upon between the employee and the employer, who is obliged to notify the employee in writing of the start date of the leave no later than two weeks before the date established by the schedule.

Only the employer can provide leave or not. This means that if the employee himself does not want to go on vacation, the boss can issue an order to grant vacation without his desire. The employee will have to obey, because failure to comply with management orders entails disciplinary liability.

However, there are some categories of employees who are given the right to go on vacation at a time convenient for these employees. These include, in particular:

- minors;

- women before or after maternity leave;

- disabled people;

- wives of military personnel;

- parents who are teachers in family-type orphanages;

- labor veterans;

- war veterans;

- women who are mothers of two or more children under 15 years of age;

- employees who have special labor services to the state;

- women raising a disabled child;

- employees who have special services to the state;

- a parent who raises children alone;

- in all other cases provided for by current legislation.

How to calculate vacation days

In order to calculate the days of vacation you are entitled to, it is not at all necessary to contact the HR department. You can totally do this yourself. To do this you need:

- find out the exact day you started working (you can look at a copy of the employment contract or ask the HR department);

- decide on the day to go on vacation;

- count the number of months from the date of hiring to the date of the planned vacation.

For each full month of work you are credited with 2.33 days of annual leave. Thus, after working for 9 months (from February to September), you are entitled to 21 days of rest (2.33 days * 9 months).

If you have a disability group or work in the field of education, then you have the right to receive additional leave. Also, “extended” leave is granted to civil servants, employees of the Ministry of Emergency Situations, employees of the prosecutor’s office, etc.

In such cases, the vacation period for each category of citizens is determined by the relevant laws, in particular, the provisions of the Labor Code of the Russian Federation. For example, employees with disabilities have the right to rest for at least 30 days during the year. This means that for each month of work, such citizens are “credited” with 2.33 days and 2.5 days of vacation.

Let's look at an example. Shuvalov S.L. – storekeeper of LLC “Farmer”, disabled group III. Shuvalov got a job at Farmer in December 2021. In July, Shuvalov took leave for 14 calendar days (07/16/18 – 07/29/18).

If weekends fall within the period of your vacation, they are included in your vacation in the general manner and reduce the amount of annual vacation “accumulated” by you during the year.

If holidays fall during your vacation, your vacation is increased by the holidays, but the total period of accrued vacation does not decrease due to the holidays.

Let's look at an example. Gavrilenko E.D., driver of Trans Service LLC, went on vacation 2 times in 2021:

- for 3 days (from 05/07/18 to 05/09/18);

- for 14 days (from 06/11/18 to 06/24/18);

- for 5 days (from 07/16/18 to 07/20/18).

Since 05/09/18 is a public holiday, Gavrilenko’s May vacation was extended by 1 day (Gavrilenko went to work on 05/11/18).

For 2021, Gavrilenko was accrued 28 days of vacation, of which he used (3 14 5). This means that Gavrilenko can rest for another 6 days before the end of the year.

By independently calculating your vacation days, you can also easily calculate the vacation pay that your employer must pay you during your vacation. To calculate you will need:

- The number of days of your vacation. To calculate, take the vacation application and count the total number of calendar days indicated in it.

- Billing period. To calculate vacation pay, you will need to determine the calculation period - 12 calendar days before the vacation. If you plan to go on vacation in September 2021, then the billing period for you will be 09/01/17 – 08/31/18.

- Annual income. Sum up the salary you received during the pay period. If you were paid bonuses, allowances, or bonuses for the previous year, then they also need to be included in the calculation.

SumOtp = AverageDaySalary * CalDnOtp,

where SumOtp is the amount that the accounting department will accrue to you in the form of vacation pay; AverageDaySalary is the average daily earnings; KolDnOtp is the number of vacation days upon application (count both working and calendar days).

We invite you to read: What taxes and fees to pay under the patent taxation system

Many people have difficulty calculating average earnings. But, I hasten to dispel your fears and doubts - everything here is extremely simple. If you have calculated your total income for the year, then calculating your average daily earnings will not be difficult for you.

Average daily earnings = Annual income / 12 / 29.3.

Let's look at an example. Shchekunov D.L., an employee of Velikan LLC, wrote an application for leave for a period of 12 days (08/13/18 – 08/24/18).

| Period | Salary, rub. | Additional payment for overtime, rub. | Bonuses for exceeding the plan, rub. | TOTAL, rub. |

| August 2017 | 18.329 | 1.423 | — | 19.752 |

| September 2017 | 18.329 | — | — | 18.329 |

| October 2017 | 18.329 | — | — | 18.329 |

| November 2017 | 18.329 | — | — | 18.329 |

| December 2017 | 18.329 | 1.423 | 2.884 | 22.636 |

| January 2019 | 19.016 | — | — | 19.016 |

| February 2019 | 19.016 | — | — | 19.016 |

| March 2019 | 19.016 | 1.541 | — | 20.557 |

| April 2019 | 19.016 | — | — | 19.016 |

| May 2019 | 19.016 | — | — | 19.016 |

| June 2019 | 19.016 | 1.541 | 2.884 | 23.441 |

| July 2019 | 19.016 | — | — | 19.016 |

| TOTAL | 236.453 | |||

RUR 236,453 / 12 / 29.3 = 672.51 rub.

RUR 672.51 * 12 days = 8,070.07 rub.

It happens that an employee does not use the provided rest. There can be many reasons for this. For example, how to calculate vacation upon dismissal? Many people are very concerned about this issue, since employers often strive to neglect the rights of the employee in this regard. It is important to know that, if the employee so desires, he can be granted leave that he did not have time to use.

How to calculate compensation for unused vacation? This depends on the employee's rate, as well as the total amount of money that would have been paid if the rest time had been used in the previously intended manner.

But what if the employee did not have time to take advantage of the vacation, and the employment contract has already expired? Such an employee can still use it, even if it exceeds the duration of the contract. And its effect is artificially extended for the entire duration of the vacation.

If an employer refuses to provide its employees with the rest required by law, this is a direct violation of the rights of company employees guaranteed by the state. There is a certain responsibility for this.

There is no statute of limitations that invalidates unused vacation time. If an employee has not had the opportunity to use his right to vacation for several years, then, if he wishes, he can do this once for all the unused time. And in the event that such an employee decides to quit, the company’s management must pay appropriate compensation.

Procedure for granting leave for incomplete periods

Even if an employee has worked for the company for less than twelve months, he has the right to go on vacation. In fact, for every day spent in service, money is awarded for future vacation. They are summed up in a special account.

As noted above, the right to paid rest appears after six months of work. But there are categories of citizens who can take vacation even earlier:

- Pregnant women going on maternity leave.

- Minor employees.

- Adoptive parents of a baby up to three months old.

- Men who have had a child.

- Part-time workers who are scheduled to rest at their main place.

According to the law, the employer can, at its discretion, release a person from the second day of employment. But with this option, calculating vacation for less than a full month does not play a role, since, in fact, the vacation is given in advance.

Key calculation data

If an employee worked continuously for a year and decided to go on vacation after twelve months, then there is no need to calculate the number of days, since it is enough to refer to the employment contract and find out how many days are allotted. It is more difficult when a person decides to exercise his right to early leave, since it is necessary to calculate how many days he managed to work.

The rules for calculating vacation for an incomplete year come down to two principles:

- The average number of vacation days per month is obtained by dividing the total by twelve. For example, 12/28=2.33.

- When calculating, all full months are taken into account, as well as those in which more than fifteen days were worked.

If a person is entitled to more vacation days than twenty-eight, then this number is divided by twelve. That is, all available days of rest are first summed up, and then the monthly average is calculated.

Algorithm for calculating rest duration

The sequence of actions when calculating the number of vacation days can be presented as follows:

- Determining how many days of rest a person is entitled to per calendar year.

- Calculation of the monthly average.

- Calculation of the number of fully worked months and days in non-integer periods.

- Multiplication of certain indicators.

There are two categories of citizens for whom the calculation is made in a different way:

- seasonal workers;

- people employed under a fixed-term contract.

It is important to know! For these population groups, for each month worked, in accordance with Article 291 of the Labor Code of the Russian Federation, two days of vacation are accrued. This rule is also stated in the employment contract.

Billing period

The standard calculation of the number of vacation days uses a twelve-month calculation period, but when the employee has not yet worked for a whole year, his entire service life is taken as a basis.

Moreover, it is important to remember about the rule associated with incomplete months. If more than fifteen days are worked, the period is taken into account in full; if less, it is completely discarded. Note that sick leave and absenteeism, that is, moments when a person was absent, are also deducted from the calculations.

Example of days calculation

In order to summarize all the rules and principles described above, let's look at an example of how to calculate vacation for less than a month and a year. Let’s say that citizen K got a job at the company on February 10, 2019 and plans to go on vacation on November 5, 2019. She is entitled to a standard rest period of twenty-eight days.

First of all, it is necessary to determine the average monthly number of days. Since the rest period is standard, the indicator will be 2.33. Next, we calculate for what periods vacation is granted:

- in February, the citizen worked twenty days - more than half, therefore, it will be taken into account;

- for the next eight months the woman worked entirely;

- in November he will be on duty for only four days - he will be discarded.

It is important to know! It turns out that the employee has the right to 21 days of rest (2.33 * 9 = 2.97). Rounding is always done in favor of the employee, and not according to the rules of arithmetic, when calculating vacation days for an incomplete month.

Vacation: number of days according to law and local regulations

Weekends falling within the vacation period are taken into account when calculating its duration and are subject to payment. Let's explain with an example. Manager Ivanov A.K. wrote an application for leave for the period from June 17 to June 23, 2021. June 22 and 23 are days off. Accordingly, the employee must be given leave for 7 days and all 7 days must be paid.

Unlike regular weekends, holidays and non-working days are not included in the duration of vacation and are not paid (Article 120 of the Labor Code of the Russian Federation). Let's go back to the example above. If Ivanov A.K. writes an application for June 6-13 - 8 calendar days, only 7 calendar days will be counted and paid for vacation. Because June 12 is a holiday (Article 112 of the Labor Code of the Russian Federation).

The specified duration of vacation - 28 calendar days - is the minimum according to the Labor Code of the Russian Federation. And the employer, on his own initiative, can establish paid leave of longer duration for his employees. The number of additionally provided paid vacation days (in addition to 28) must be specified in the collective agreement, local regulations of the organization (for example, internal labor regulations) or directly in employment contracts with employees.

It is important that the costs of paying for such additional vacation days cannot be taken into account for profit tax purposes (clause 24 of article 270 of the Tax Code of the Russian Federation). Also, personal income tax will need to be withheld from the amount of their payment and insurance premiums will be charged (clause 2 of Article 226 of the Tax Code of the Russian Federation, clause 1 of Article 420 of the Tax Code of the Russian Federation).

At the same time, certain categories of employees are required by law to be granted longer vacations. Read below about how many days of vacation they are entitled to per year.

Who has the right to apply for extended basic leave and how many days of leave should be provided to these persons is indicated in the table.

| Category of workers | Number of vacation days according to the Labor Code and other legislative acts |

| Workers under 18 years of age | 31 calendar days. Leave must be granted at any time convenient for the minor (Article 267 of the Labor Code of the Russian Federation) |

| Working disabled people with any disability group | At least 30 calendar days (Article 23 of Law No. 181-FZ dated November 24, 1995) |

| Teaching staff | 42 or 56 calendar days depending on the position held and the type of educational organization where the teacher works (Article 334 of the Labor Code of the Russian Federation, clause 3, part 5, article 47 of the Law of December 29, 2012 No. 273-FZ, Appendix to the Decree of the Government of the Russian Federation dated May 14, 2015 No. 466) |

| Researchers with an academic degree | — 48 working days for doctors of science; — 36 working days for candidates of science. The specified extended leaves are provided to scientific workers holding full-time positions in a scientific institution (organization) financed from the federal budget (Resolution of the Government of the Russian Federation of August 12, 1994 No. 949) |

| Workers working with chemical weapons | 56 or 49 calendar days depending on the group of work to which the employee’s activities are assigned. The assignment of work to the first or second group depends on the degree of their danger (Article 1, 5 of the Law of November 7, 2000 No. 136-FZ) |

| Workers of professional emergency rescue services and units | 30, 35 or 40 days, depending on the length of continuous work experience in professional emergency rescue services and units (Clause 5, Article 28 of Law No. 151-FZ of August 22, 1995) |

| Health care workers at risk of human immunodeficiency virus infection | 36 working days for employees of healthcare organizations diagnosing and treating HIV-infected people, as well as persons whose work involves materials containing the human immunodeficiency virus, taking into account additional annual leave for work in hazardous working conditions (clause 4 of the Government Decree RF dated 04/03/1996 No. 391) |

| State civil servants | 30 calendar days (Part 3 of Article 46 of the Law of July 27, 2004 No. 79-FZ) |

| Prosecutors, scientific and teaching staff of the prosecutor's office | 30 calendar days excluding travel time to the place of rest and back in the general case (clause 1 of article 41.4 of the Law of January 17, 1992 No. 2202-1). |

| Employees of the Investigative Committee serving in areas other than those with special climatic conditions | 30 calendar days excluding travel time to the place of rest and back in the general case (Part 1 of Article 25 of the Law of December 28, 2010 No. 403-FZ). |

How many days does a northerner's vacation last? Usually more than for non-northern workers. After all, “northerners”, firstly, are provided with basic annual paid leave - of standard duration or extended in the above cases. And secondly, they are granted additional leave (Article 321 of the Labor Code of the Russian Federation). For workers who work:

- in the Far North - 24 calendar days;

- in areas equated to the regions of the Far North - 16 calendar days;

- in other regions of the North, where the regional coefficient and percentage increase in wages are established - 8 calendar days (Article 14 of the Law of the Russian Federation of February 19, 1993 No. 4520-1).

By the way, both regular annual paid vacations and extended, as well as additional “northern” vacations can be provided to employees in advance (Article 122 of the Labor Code of the Russian Federation).

The calculation also takes a period of a full 12 months.

Situations also arise when an employee, before or after the weekend, took a vacation at his own expense or was sick. But even in this case, there is no need to exclude weekends from the calculation.

The vacation days calculator will easily allow you to find out how many days of vacation the employee has accumulated at one time or another.

The calculation of vacation time is made in accordance with Art. 121 of the Labor Code of the Russian Federation.

The time spent working for one employer, which gives the right to take annual leave, which will be paid, may be needed not only to directly calculate this period, but also to know how many days are subject to compensation upon dismissal.

An employee who works continuously for the same employer will be entitled to annual leave, taking into account the following periods:

- the time when he actually performed his duties;

- periods when the employee was absent from work, but his place was retained (vacation, sick leave, maternity leave, military service, etc.);

- weekends and other non-working days;

- forced absence from work due to illegal dismissal;

- suspension due to untimely completion of a medical examination (if this is not the employee’s fault);

- additional administrative leaves (no more than two weeks per calendar year).

We suggest that you familiarize yourself with: Statutory Limitations for Debt Payments

IMPORTANT! Changes were made to the legislation regarding the accrual of length of service during administrative leave:

- from 12/30/2001 to 10/05. 2006, no more than 7 days of vacation at your own expense per year were taken into account;

- from 10/06/2006 this limit increased to 14 days.

Some periods of time will not be taken into account when calculating the length of service required for leave, namely:

- employee absenteeism;

- suspension due to alcohol, drug or toxic intoxication;

- denial of permission to work due to ignorance or failure to pass safety regulations;

- the employee did not undergo a mandatory medical examination due to his own fault;

- inability to perform work according to a medical report;

- termination of a license required for work (for example, a driver’s license, a weapons permit, etc.);

- leave to care for a child over 1.5 years old.

The basis is the duration of annual leave of 28 days, unless otherwise established for special categories of employees.

In the first year of work, the minimum length of service to be able to go on vacation must be at least six months. This is not included in the calculator, just keep it in mind.

In case of dismissal, employees who have worked for at least 11 months will be able to receive 100% compensation for unused vacation days.

If an employee went on vacation before 11 months of continuous work and was then dismissed, then part of the vacation pay received in advance upon dismissal will have to be returned to him.

It is prohibited not to take annual leave for more than 2 years in a row.

It is allowed to break the vacation into parts, but one of the parts should not be shorter than 2 weeks.

An employee is required to rest 28 days per year.

You can roughly calculate it like this: for every month you work, you get the right to rest for 2.33 days.

A month is taken into account if more than 15 days are worked in it.

If the first and last month of work are not whole, the days for these months are added up (i.e., in 2 months you need to work more than 30 days).

The vacation law states that vacation pay must be paid 3 days before the start of the vacation. Since it is not indicated that the days are working days, they should be considered calendar (Article 14 of the Labor Code of the Russian Federation).

If the third day falls on a weekend or holiday, vacation pay is paid on the previous working day.

31.05.2021Reimbursement of a candidate's expenses for a COVID-19 testing position cannot be taken into account

The organization reimburses the cost of testing for COVID-19 to all persons it plans to hire. Does the organization have the right to take these expenses into account for income tax?

31.05.2021Reduced insurance premium rates: who is eligible?

Information technology companies may qualify for lower insurance premium rates. What conditions must be met for this to happen?

31.05.2021Small Business Legal Mistakes

Legal problems are among the TOP 16 reasons why startups fail, according to the analytical company CB Insights. At the same time, in Russia, many beginning entrepreneurs often make similar, from a legal point of view, mistakes. We tell you how to minimize such risks.

31.05.2021The RF Armed Forces helped the consumer receive a penalty from the violating store

The buyer decided to return the defective video card and sent a claim, but did not receive the money and filed a lawsuit. After this, the store asked the client for bank details. Having received no response, the company transferred the money to the court's deposit. For this reason, three authorities refused the buyer a penalty: if he had responded on time, the seller would have returned the money voluntarily. The Supreme Court examined the buyer’s claim more carefully and found the necessary details in it. And in addition, I discovered logical contradictions in the decisions of lower authorities (determination dated 03/09/2021 No. 46-KG20-27-K6 No. 2-5525/2019).

29.05.2021Social deduction for personal income tax for fitness: how to get it

Starting with income in 2022, you can receive a social tax deduction for personal income tax in the amount paid for physical education and health services.

28.05.2021What documents can be requested from the bank for verification?

Banks have the right to request documents from the company to verify the sources of profit. The legislation gives credit organizations the corresponding right.

28.05.2021Registering a business through a notary

A bill has been approved, according to which it is possible to open a new company or register as an individual entrepreneur through a notary.

28.05.2021Debt forgiveness by making a contribution to LLC property: what about income taxes?

The organization received a loan from a foreign founder, whose share is 49% in its authorized capital. In order to increase the company's net assets, the founder plans to forgive the debt by contributing the amount of principal and interest to additional capital. Should a Russian company pay income tax on the amount of the forgiven debt and interest under the loan agreement? The explanations of the Ministry of Finance in letter dated April 19, 2021 No. 03-03-06/1/29226 will help you understand the issue.

28.05.2021Transport tax is not paid for a “killed” car

Every year, transport tax is paid by all individuals and legal entities to whom the car is registered. The amount of tax depends on the power of the car. If the car is damaged and cannot be repaired, there is no need to pay tax. But before that, it needs to be deregistered.

28.05.2021The right to VAT deduction cannot be increased by the days the declaration is submitted

The organization was held accountable for committing a tax offense and was assessed a fine. The basis was the refusal to apply a tax deduction for VAT after the expiration of a 3-year period. But the company did not agree with this and went to court. She believed that she still had time to claim the deduction.

28.05.2021Details of creation and adjustment of doubtful provision

Doubtful debt is any debt to an organization arising in connection with the sale of goods, performance of work, or provision of services. But only if it is not repaid within the terms established by the agreement and is not secured by a pledge, surety, or bank guarantee (clause 1 of Article 266 of the Tax Code of the Russian Federation).

28.05.2021Reducing the number or staff of employees: who cannot be fired?

When reducing numbers or staff, the employer does not have the right to dismiss certain categories of employees. What specialists do they belong to?

28.05.2021Russia has been swept by a wave of “commercial” moonshine

Business Ombudsman Boris Titov proposed banning the open sale of moonshine stills in Russia. In his opinion, this can help in the fight against the underground alcohol market. Handcrafted alcoholic drinks are often made not for personal use, but for sale, Titov’s apparatus is convinced.

27.05.2021Deduction of personal income tax when selling a share in the management company of a company

If it is impossible to exempt income from the sale of an individual’s share in the charter capital of the company on the basis of clause 17.2 of Article 217 of the Tax Code of the Russian Federation, the accrued personal income tax can be reduced in the prescribed manner.

27.05.2021On vacation in 2021: calculation and payment of vacation pay. Cheat sheet for an accountant

There are no fundamental changes in the calculation of vacation pay in 2021. You just need to carefully calculate your vacation pay and not forget that there were non-working days in the billing period. Otherwise, the rules for calculating vacation pay are simple and clear.

27.05.2021Imposing disciplinary sanctions: maintaining order

The list of disciplinary sanctions applicable to an employee is limited. If you don’t want to get punished yourself, try not to go beyond it.

27.05.2021Depositing cash into the company's account through ATMs under control

Depositing cash into a company's account through an ATM is not that uncommon today.

27.05.2021How to change information about several directors in the Unified State Register of Legal Entities if they were registered before November 25, 2020

In September 2021, the JSC decided to introduce provisions into the charter stating that the management of the JSC is carried out by several directors acting jointly. The new version of the charter was registered on October 15, 2021. At the same time, the forms of registration documents in force at that time did not allow information to be entered into the Unified State Register of Legal Entities indicating that the directors were acting jointly. How to submit documents for registration of changes about several directors of a joint-stock company, given that information about them can be submitted from November 25, 2021?

27.05.2021There is not much time to adjust SZV-M

If you find an error in the SZV-M, you can avoid a fine only by submitting an adjustment yourself. This must be done before the error is detected by the Pension Fund.

27.05.2021How to fill out and submit documents for benefits if an employee was sick for only 3 days: explanations from the Social Insurance Fund

Since 2021, a mechanism for “direct” payment of benefits from the Social Insurance Fund of the Russian Federation has been in effect.

In order to assign benefits, the organization must submit a number of documents to the Fund. But in the event of an employee’s illness, the employer must still pay for the first 3 days from its own funds. What should an employer do if an employee has been sick for only 3 days, representatives of the MRO FSS told in letters dated 05/14/2021 No. 15-15/7710-9682l, dated 05/17/2021 No. 15-15/7710-10787l. 1 Next page >>

Example of defining a billing period

How to count vacation, i.e. determine its duration? Firstly, it is calculated in calendar days. In this case, the work schedule of the organization itself is not taken into account.

And if the vacation falls on a holiday, how to calculate it? Such non-working days are not taken into account in the total duration of vacation - both annual and additional. However, this does not apply to weekends. For example, many people have a question about how to count vacation days in May. After all, this month is characterized by instability of the work schedule.

So, if your vacation begins, for example, on April 30 and lasts 24 days, then you need to add as many days to the duration of vacation in calendar days as the number of holidays your company allocated to its employees as days off. Thus, you will need to go to work on May 24, and 27. The calculations are extremely simple. Now you understand well how to calculate vacation in May.

Remember that this calculation mechanism is universal. You can use it in any month if your vacation falls on a holiday. How to count, we figured out above. If you have any doubts, you can check with your HR department.

Accountant Petrova O.P. has been working at LLC Continent for four years. She wrote an application for the paid leave she was entitled to from November 6, 2021.

November 1, 2021 – October 31, 2021.

Let's determine the days excluded from Petrova's billing period:

- The vacation period at your own expense is December 12 – December 25, 2016;

- Business trip period – April 1 – April 16, 2021;

Extended leave under the Labor Code 2021: how many days

The billing period includes the 12 months preceding the upcoming month of going on official leave.

If the period for calculation is less than 12 months, then the calculation is calculated based on the time actually worked at the enterprise.

If the start of the vacation coincides with the month of employment, then the actual time worked is also taken into account.

If an employee at the place of work did not receive a salary during the 12-month billing period for official reasons, only the last months for which the salary was received are still taken as the billing period.

That is, if you were on vacation last year, this time cannot be taken into account in the billing period.

If the salary is “gray” and is given in an envelope, you are unlikely to be able to demand a correct calculation.

What is NOT included in the average daily income

- Compensations and social payments: travel, financial assistance, benefits for families with many children, money received from educational institutions.

- Bonuses that are not officially included in the remuneration system.

- Interest received from deposits or dividends from shares, loans.

Anything that is not specified in the employment contract in the Payment section is unlikely to be considered it.

1.In the case of a fully worked out billing period

This is when you have never taken sick leave, worked every day and exactly a year has passed since your previous vacation.

Average Daily Earning = Salary for the Year / (12 months * 29.3)

Salary for the Year – salary received for the full pay period

12 months – number of months in the billing period

29.3 is the average number of days in one month.

The average monthly number of calendar days is 29.3 from 2021

2. If the billing period is not fully worked out

Average Daily Earning = Salary for the Year / (KPM*29.3 ∑KNM)

KPM – the total number of months worked by the employee.

∑КНМ – the total number of calendar days in months not fully worked.

KNM = 29.3/KD * OD

CD - the total number of days in a month (for example, in January 31, and in February 28)

OD – the total number of days that were worked.

These examples will help you understand in practice how calculations occur in various situations.

- OD=30-9=21 days

- KNM=29.3/30*21=20.51 days

- Average Daily Earning = 300,000/(11*29.3 20.51) = 875.12 rubles

- Vacation pay amount=28*875.12=24,503 rubles

We calculate the average daily earnings: 264,000 / (29.3x12) = 750.85 rubles. This amount will be credited to her in two weeks: 750.85 x 14 = 10,511.9 rubles. Galina will receive in her hands: 10511.9 - (10511, 9*0.13) = 9,145.35 rub.

For those who were too lazy to read - a short video

The most important change in the calculation is that from January 1, 2021, the minimum wage became 11,280 rubles.

What does it mean?

If you go on vacation in May and your salary is less than 11,280 rubles, vacation pay will be calculated based on this figure.

Let’s assume that during the working year that began on June 3, 2013, the employee was granted unpaid leave of 25 calendar days. In this case, the end of the working year is postponed by a number of days exceeding 14, that is, by 11 calendar days; accordingly, the end day of this working year will not be 06/02/2014, but 06/13/2014.

Expert of the Legal Consulting Service GARANT

Naumchik Ivan

Reviewer of the Legal Consulting Service GARANT

Voronova Elena

All legal advice

The length of the calculation period for vacation depends primarily on how long the employee has worked for the organization. But in any case, this period cannot be more than 1 year.

For example, an employee started working for the organization more than a year ago. The billing period will then be equal to 12 months before he goes on vacation. The month is taken into account as a calendar month, complete, from the 1st to the last day.

And the period is included in the calculation as follows: from the first working day to the last day of the month that precedes the start of the vacation.

The organization also has the right to independently set the billing period. This needs to be written down in a local document of the organization, for example, in a collective agreement. For example, an employer can set a pay period of 6 months rather than 12 months. This is not prohibited by the Labor Code, but if the following condition is met: Vacation pay calculated on the basis of such a calculation period should not be less than calculated according to the general rules.

The following days should be excluded from the calculation period when:

- The employee was paid the average salary. By such days I mean periods of paid vacation, business trips (with the exception of the period of feeding a child);

- The employee was on sick leave or maternity leave;

- The employee took leave at his own expense (without pay);

- The employee took additional paid time off to care for people with disabilities;

- The employee, for reasons beyond the control of the employer or the employee himself, did not work. For example, days of power outages;

- The employee was released from work.

We invite you to read: How to draw up an order to recall an employee from vacation? Sample order

| ★ Collection and directory of all personnel documents (forms and documents in word format) purchased {amp}gt; 1200 books |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased by {amp}gt; 2000 practical courses |

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

If the company has undergone a reorganization, then the billing period should include the employee’s working time before the reorganization and the time after. This is due to the fact that the employment contract with the employee is not terminated during the reorganization. This means that his work was not interrupted; he worked and continues to work in the same organization.

Let's start with the fact that during the year you have the right to take at least 28 days of vacation. This right is guaranteed by Article 115 of the Labor Code of the Russian Federation and the employer is obliged to fulfill it.

28 days of vacation can be taken as a whole, that is, you can take 28 calendar days off continuously, or divided into parts. The vacation can be divided into parts at your request, but one of the parts should not be less than 14 calendar days.

In other words, out of 28 days, you must take 14 days of unbroken vacation, and you can divide the remaining 14 days at your discretion (for example, take 2 days as needed). This procedure for registering leave is provided for in Art. 125 Labor Code of the Russian Federation.

Basic bonuses when calculating vacation pay

In any organization there are different interpretations of bonuses, and these are:

- Bonuses awarded for long years of service at the enterprise.

- Awards received for the overall performance of the organization.

- Bonuses paid for excellent performance in production.

A monthly bonus is a payment that is transferred to an employee of an organization in addition to salary.

Such a bonus could be:

- Direct - financial assistance for child care.

- Production - calculated from the amount of wages.

The calculation of this type of bonus directly depends on the employer.

Link to online calculator: https://www.b-kontur.ru/profi/payment-holiday#_

The employer has the right to manage the types of bonuses and set them for their employees.

Awards may vary in frequency and may be:

- One-time.

- Quarterly.

- Monthly.

- Depending on the work performed per year.

In addition, the employer has every right to reward the employee in the following forms:

- Reward with a valuable gift.

- Present a certificate.

- Express gratitude for the work done.

- Nominate an employee for the title of the best in his profession.

All these types of incentives can be included in the collective agreement of the organization.

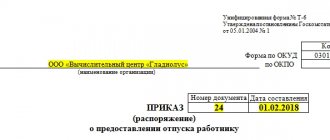

Leave order

Any types of leave must be officially formalized using a special order, which is drawn up in a special form established by law.

This document is provided to the superiors in two separate copies. One of them is provided to the HR department, and the other is given to the accounting department. It must be signed by both the immediate supervisor of a specific employee and the manager of the entire enterprise as a whole.

The order must indicate for which working year the vacation is taken and how long it is planned.

Calculation of length of service

How to calculate vacation is also influenced by how much work experience the employee has. So, it is important that at least a year has passed since the employment contract was concluded.

So, what is included in the experience?

- Firstly, the time an employee performs his direct production duties (that is, actual work). It is taken into account even in part-time conditions.

- Secondly, the period when the employee did not actually work, but the position was retained in accordance with the basic requirements of the law.

- How to calculate maternity leave? Is it included in the experience? No. This period is an exception.

- The time when the employee studied at a university while away from work.

- Some other situations that were provided for by law.

- Time spent working in hazardous or unhealthy conditions.

- Time off for work in special, difficult or dangerous conditions.

- Working hours of pregnant women who, for medical reasons, were transferred to easier work.

What does work experience include?

At the level of labor legislation, a certain list of periods is allocated, which includes length of service. Thus, in accordance with the requirements of the Labor Code, the majority of such length of service consists of the time the employee actually performs the labor functions assigned to him.

In addition, when calculating length of service, the time when the employee did not actually work, but in accordance with the requirements of the law, was assigned a place, should be taken into account.

In particular, such retention of employment is permitted in the following cases:

- when the employee is at military training;

- when an employee undergoes a medical examination4

- when employees undergo examination;

- when treating an employee associated with military registration.

Transfer of vacation

An employee’s annual vacation can be postponed to another period either at the request of the employee or due to production needs.

So, the employee directly can demand this in the following cases:

- if the employer notified the employee too late about when he would be granted leave;

- if the manager did not pay the employee on time the monetary remuneration that he should receive for the period of his vacation (at least three days before its start);

- if the employee becomes incapacitated;

- if the time has come for vacation due to pregnancy or childbirth;

- if the employee performs certain important public or government duties;

- if leave for educational activities and annual leave coincide in time.

Determining the duration of vacations

An employee does not have to use all 4 weeks of his/her allotted vacation at one time. Leave can be divided by agreement between the employee and the employer. The division of vacation into parts according to the Labor Code of the Russian Federation must be carried out in such a way that the duration of at least one of the parts is at least 14 calendar days (Article 125 of the Labor Code of the Russian Federation). If this condition is met, the duration of other parts of the vacation can be an arbitrarily small number of days, including 1 or 2 days.

Such a procedure must be carried out subject to the employee’s desire. However, one of its entire parts must last at least two weeks (counting calendar days). It doesn't have to be first. However, dividing vacation into parts is only an option and not an obligation of the employer.

How to count vacation days if an employee is called to work during this period? Such situations are not uncommon, we will talk about them further.

Additional leave

This type of leave is provided if the employee’s activities in the organization are considered harmful. Another reason for additional accrual of vacation days is irregular working hours.

The schedule and duration of such leave must be included in the organization’s collective agreement, but it cannot be less than three calendar days. Additional leave is paid, and in case of absence from such leave, each employee has a certain right to receive compensation.

How many days should you rest?

What to do if management requires an employee to come to work during his vacation? How to calculate vacation in this case?

The legislation provides for this possibility, however, it also establishes a number of conditions that must be complied with. For example, the following:

- absolute consent of the employee who is called;

- the part of the vacation that was not interrupted must be at least fourteen days;

- that part of the vacation time that was not used must be provided at any other time of the year or immediately after all the reasons for his presence at work during the vacation have been eliminated; this must be agreed upon with the employee and completely satisfy him.

So, for what reasons can an employee be called upon to continue performing his duties at the enterprise during vacation? Among them are the following:

- in order to prevent equipment downtime, accidents, damage to enterprise property or loss of life;

- in order to prevent the onset of the consequences of a natural disaster, as well as to prevent or eliminate the consequences of any industrial accident.

List of time periods that are not included in the length of service

The article of the Labor Code also includes a list of periods that should not be included in the length of service. According to this legislative act, when calculating total length of service, the following time periods should not be included:

- absence from work without good reason;

- the time of parental leave until the child reaches a certain age established by law.

Consequently, if there are certain periods of time in the year that, in accordance with legal requirements, cannot be included in the length of service, this means a reduction in the working year.

This means that at the end of the working year for which vacation is granted, it is postponed by the number of days that are not included in the length of service to obtain the right to vacation.