In practice, organizations have developed various remuneration systems. One of them is time-based bonus, which is a remuneration for work based on actual time worked and bonus amounts based on the results of work performed. Wages are often tied to the minimum wage, which is the basis for calculations subject to the condition of not violating labor laws. The source of remuneration and bonuses is the wage fund.

Let's consider how calculations are made using this wage system.

Regulatory regulation of bonuses for employees

Section VI. The Labor Code of the Russian Federation is dedicated to wages

Part 3 art. 37 of the Constitution of the Russian Federation guarantees the right to remuneration of an employee without discrimination and not lower than the minimum wage

Local regulations regarding wage and bonus systems: Employment contract, Collective agreement, Regulations on wages, Regulations on bonuses, etc.

The size of the bonus can be set as a fixed amount or as a percentage of the rate (salary). The bonus is paid if the employee fulfills (or exceeds) the production task.

Deputy Director of the Department of Education and Human Resources of the Russian Ministry of Health Nina Kovyazina

Time-based salary in Belarus: how it is calculated, pros and cons

1prof.by looked into what factors the salary of a time-based employee depends on, and what dangers there are for the employer.

Let us recall that all forms of remuneration can be divided into two large groups: piecework and time-based. The first option is suitable for traditional industries that involve manual labor. The second option can be used in any enterprise, especially in a high-tech one. By the way, time wages are considered one of the most effective ways to evaluate human labor.

A time-based form of remuneration is a wage calculation option based on the principle that the amount of wages depends on the amount of working time, hours worked.

This form of payment owes its popularity to scientific and technological progress. Due to the division of labor and deepening specializations, increasing requirements for the qualifications of workers, it has become increasingly difficult to isolate the work of an individual from the overall results. Then time-based payment comes to the rescue: more time spent, more earned.

Advantages of time-based payment

This form of payment has several advantages. This system facilitates the administration process. Managers just need to install access systems or keep a working time log. It is the time spent at the workplace that will be the key factor for calculating wages.

When employees are not focused on quantitative indicators, they can comply with all regulations, do scrupulous work and follow all standards. This factor is very important for production, where a high degree of concentration and decent product quality are required.

Another plus is the absence of competition between employees and the tension that occurs with piecework payment.

Also, with time-based payment, workers have more motivation to improve their skills, because this factor determines how much their working time will cost.

Disadvantages of time-based payment

Unscrupulous workers can use the existing system and receive money only for being present at the workplace. As a rule, they lack incentives to work efficiently and cannot quickly influence their earnings.

With this payment format, dissatisfaction within the team may grow: some work more, while others work less, but everyone’s salary is the same.

In addition, such employees may lose interest in their work and forget about the consumer of goods, which can be detrimental to the organization as a whole.

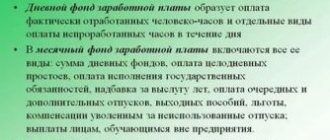

Types of time-based payment

A simple form of payment is calculated based on the hours worked by the employee at a certain rate and in accordance with qualifications. Divided into hourly, daily and monthly forms of payment.

Time-based bonus - calculated according to the tariff, like a simple form of payment, but it involves the accrual of a bonus for meeting production targets. This method allows you to increase employee motivation.

Mixed - an employee’s salary depends on the results of his department or the enterprise as a whole. In this case, earnings may vary depending on the implementation of the plan.

Daria Zimak, official website of the Federation of Trade Unions of Belarus

The basis for establishing a time-based bonus system

The employee receives wages and bonuses based on the following documents:

- Labor Code of the Russian Federation

- Employment contract

- Collective agreement

- Wage regulations

- Regulations on bonuses

- Report card

- Staffing table or tariff schedule

At the same time, the provisions established by local acts may be changed based on the following characteristics:

- organizational or technological changes in working conditions

- reflection of these conditions in the additional agreement

- impossibility of maintaining the existing terms of the contract on the basis of their change

Important! The deterioration of the financial situation or the difficult economic situation are not grounds for making changes to the basic provisions of salary payment.

Subject of the agreement

1.1. Under this employment contract, the Employee undertakes to fulfill the duties of his profession/position [indicate work by position in accordance with the staffing table, profession, specialty indicating qualifications; specific type of work entrusted to the employee] at [place of work, and in the case where the employee is hired to work in a branch, representative office or other separate structural unit of the organization located in another locality, the place of work indicating the separate structural unit and its location], and The Employer undertakes to provide the Employee with the necessary working conditions provided for by labor legislation, as well as timely and full payment of wages.

1.2. Work under this agreement is the main place of work for the Employee.

1.3. Working conditions in the workplace in terms of the degree of harmfulness and (or) danger are [optimal (class 1)/ permissible (class 2)/ harmful (specify the class and subclass of harmfulness)/ dangerous (class 4)].

1.4. The probationary period for hiring is [specify the period]./The employee is hired without a probationary period.

1.5. The employment contract is concluded for an indefinite period.

1.6. The employee must begin work on [day, month, year].

back to contents

Minimum wage as a basis for determining wages

The minimum wage is used to regulate the amount of wages, which should be less than this indicator, provided that the employee has worked the full time limit and fulfilled the plan requirement.

The size of the minimum wage is reflected in Federal Law No. 82-FZ of June 19, 2000 and is necessarily indexed annually.

Art. 133 of the Labor Code of the Russian Federation establishes the minimum wage in force in the country.

| date | Minimum wage, rub. per month |

| 01.01.2021 | 9489 |

| 01.05.2021 | 11163 |

| 01.01.2021 | in the amount of the subsistence minimum |

If the cost of living for the 2nd quarter turns out to be lower, then the minimum wage remains at the amount established on January 1. The minimum wage for the constituent entities of the Russian Federation cannot be lower than the minimum wage. If its size for the constituent entities of the Russian Federation is not established, then the minimum wage is used. If a regional coefficient is established in the region, then the minimum wage increases by this percentage.

When should an employer apply time-bonus payment?

Similar to the usual “time work”, the method of organizing salary payments discussed above is established, as a rule, in cases where the organization does not have a direct possibility of correlating labor results with the time spent on work. Simply put, when for some reason rationing is impossible.

A similar situation can be observed today in a variety of professional fields! For example, in management, education or in many production processes. The accrual regime we are considering today is convenient in that it allows employees to receive additional funds along with their basic salary, which is undoubtedly extremely important in the current economic situation in the country.

Lawyer's Note

However, the employer also benefits. After all, such additional payments motivate employees and significantly increase work efficiency!

It should also be noted that this system is understandable to employees and easy to calculate, which makes it possible to strengthen the relationship between employees and employers, as well as make them more “transparent”.

ARTICLE RECOMMENDED FOR YOU:

Nanny without work experience - how to get a job?

Since the organization’s employees are interested in receiving additional cash payments, work becomes coordinated and efficient, which is often lost with an exclusively fixed salary amount. And including in the list of conditions for receiving a bonus, for example, a clause on the careful use of equipment, allows the employer to save money on thrifty employees, to whom he pays an amount less than the cost of new equipment or for regular maintenance.

Time-bonus wage system

When establishing this system, wages must be calculated in the same way as a simple time-based system and, in addition to it, the employee must be given a bonus.

The calculation for a simple time-based system is based on the type of rate or salary that is set for the employee:

- hourly

- daytime

- monthly salary

At the established hourly rate, the number of hours worked is paid:

Salary = Number of hours worked * Hourly rate

At the established hourly rate, the number of days worked is paid:

Salary = Number of days worked * Daily rate

With a set monthly salary, the salary is paid regardless of the number of working days in the month.

An employee who has not worked for a full month at the established monthly salary will receive a salary calculated according to the formula:

Salary = Employee salary * Number of days worked / Number of working days in a month

The size of the bonus at an enterprise can be set as a fixed amount or as a percentage. The condition for paying a bonus is that the employee fulfills or exceeds the production task.

Working time and rest time

4.1. The employee is assigned [a five-day work week with two days off/a six-day work week with one day off/a work week with days off on a sliding schedule/a part-time work week].

4.2. The duration of daily work/part-time work is [value] hours.

4.3. The start and end times of work, the time of the break and its duration [in the case of providing days off on a sliding schedule - alternating working and non-working days] are established by the internal labor regulations.

4.4. The employee is assigned an irregular working day.

4.5. The employee is granted annual basic paid leave of [value] calendar days.

4.6. The employee is granted annual additional paid leave of [value] calendar days [indicate the basis for granting additional leave; for an irregular working day cannot be less than three calendar days].

4.7. For family reasons and other valid reasons, the Employee, upon his written application, may be granted leave without pay, the duration of which is determined by agreement between the Employee and the Employer.

back to contents

An example of salary calculation for a time-based bonus system

The employee did not work for a full month

Alpha and Omega LLC has established a time-bonus wage system. Monthly salary of worker V.I. Biktimerova – 25,000 rubles. The bonus amount is 10% of the salary, calculated monthly, as established by the Regulations on Bonuses. From August 13 to August 26, 2021, Biktimerov was on vacation. 13 working days were worked in August.

Total working days in August 2021 – 23.

Biktimerov’s salary for August 2021 is calculated as follows:

25,000 rub. * 13 days / 22 days = 14772.73 rub.

Biktimerov Prize for August 2021:

25,000 rub. * 10% = 2500 rub.

2500 rub. * 13 days / 22 days = 1477.27 rub.

The calculation for August is:

RUB 14,772.73 + 1477.27 rub. = 16250.00 rub.

Main features of the time-based bonus payroll system in 2021

Regardless of the type, each “time schedule” contains an accrual of earnings for the period that was the working period for each employee of the employing organization. Therefore, as a rule, remembering the nuances, many lawyers immediately cite the example of situations with additional payments added to the main quantitative indicator, which depends directly on the salary, that is, the employee’s working rate.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

The time-bonus salary system is one of the ways to remunerate employees, according to which employees receive additional money above the basic rate and only if the terms of such payment are agreed upon with their superiors. Simply put, the very existence of time-based bonus payment must be justified by the conditions and their achievement by employees.

Unlike the common conventional “time-based” system, which depends only on the indicators of time worked by employees, the time-based bonus system directly depends on the following additional factors:

- Quality of work;

- the amount of work performed.

ARTICLE RECOMMENDED FOR YOU:

Russian Railways: working conditions, employment, tests

Example of payroll entries

The manufacturing enterprise produces food products (baked goods) and sells them to wholesale and retail customers. Salary accruals are reflected by the following entries:

| Operation | Debit | Credit |

| Salaries accrued to main production workers | 20 | 70 |

| Salaries accrued to auxiliary production workers | 23 | 70 |

| Salaries accrued to service personnel | 25 | 70 |

| Salaries accrued to management personnel | 26 | 70 |

| Salary accrued from the reserve for future payments | 96 | 70 |

| Workers' wages were accrued based on capital expenditures | 08 | 70 |

| Workers' wages are accrued from the organization's net profit | 99 | 70 |

| Workers' wages were accrued using targeted funding | 86 | 70 |

| Personal income tax withheld | 70 | 68 personal income tax subaccount |

| Personal income tax withheld from a person who is not an employee of the organization | 76 | 68 personal income tax subaccount |

Responsibility for the employer for late payment of wages

| Responsibility (type) | Normative act | Punishment |

| Material | Art. 236 Labor Code of the Russian Federation | If payment deadlines are violated, the employer is obliged to pay them with interest. The minimum amount of compensation according to the Labor Code of the Russian Federation is calculated: B = salary debt * x% / 150 * Days of delay |

| Administrative | Part 6, 7 Art. 5.27 Code of Administrative Offenses of the Russian Federation | warning or fine in the amount of: – 10,000 – 20,000 rub. – for officials – 1000 – 5000 rub. – for individual entrepreneurs – 30,000 – 50,000 rub. - for legal entities. |

| Criminal | Part 1, Art. 2 145.1 of the Criminal Code of the Russian Federation | In case of non-payment of salary for more than 3 months: – fine up to 120,000 rubles. or in the amount of salary or other income of the convicted person for a period of up to 1 year – deprivation of the right to hold positions or carry out activities for up to 1 year – forced labor for up to 2 years – imprisonment for up to 1 year |

Error when generating local acts

Payments of incentive benefits, which include bonuses, are established by local regulations in accordance with the Labor Code of the Russian Federation. These local acts should not worsen the situation of workers under current legislation.

The local act should indicate:

- list of positions subject to bonuses

- bonus amounts

- frequency of bonuses

- payment terms

- methodology for calculating bonuses of each type

- grounds for bonuses

- conditions for reducing the amount of the premium or not paying it

Bonuses should be awarded based on the results of work, the achievement of indicators based on the results of assessing these indicators.

Bonus rules

The main thing is to clearly state all the rules related to bonuses. Documentary approval of these rules is an equally important aspect. Local documents must contain the following information:

- payment periods, types of transfers;

- a list of persons who are entitled to increased payments;

- indicators upon achievement of which additional payments become available to the employee.

Be sure to describe the reasons why premiums are reduced or even deprived of increased transfers. Separately indicate the procedure according to which an employee challenges decisions made when necessary.

The use of a time-based bonus system is associated with the following features:

- If the calculation is carried out as a percentage, regional coefficients are taken into account.

- A fixed amount involves payment in proportion to the time worked.

- Salary, or actual earnings taking into account increases, is the main support when making calculations.

- The basis for transferring bonuses can be the results of both an individual and the entire department.

- The frequency allows the choice of different periods - a year or a quarter, a month, or other periods of time.

- Payments must be regular in any case.

What the bonuses will be and when the payments will arrive depends on the efforts made to achieve the result. Management can choose different conditions on the basis of which results are determined:

- compliance of products and services with a certain level of quality;

- managers and clients do not complain about work;

- Not only are deadlines met, the schedule is ahead of schedule;

- sales reached planned levels;

- plan overfulfilment.

The subject of litigation most often are issues related to a reduction in the size of bonuses, or their absence. For example, when an employee commits disciplinary offenses, or the company fails to achieve certain financial indicators.

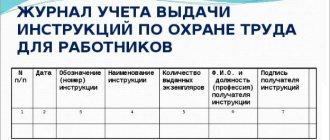

That’s why it’s so important to fully develop bonus terms from the very beginning. All employees are familiarized with local regulations under their personal signature.

The minimum wage is used if the salary is below this indicator. Although the employee fulfills all the conditions associated with working a particular time. No. 82 Federal Law of 2000 fully describes what such remuneration should be.

Answers to common questions

Question No. 1 : If the employer, through no fault of his own, did not pay wages to employees (revocation of the bank’s license). Could there be any consequences for the employer?

Answer : As a result of the revocation of the license, the bank cannot transfer funds to its clients. But the employer bears financial responsibility (Article 236 of the Labor Code of the Russian Federation), even though the employer is not to blame and he will have to pay compensation for each day of delay in payments at his own expense. The employee may also claim compensation for moral damages and may also have his work suspended. To avoid consequences, the employer needs to pay wages to employees from any means.

Question No. 2 : Can an employer deprive a bonus due to disciplinary action against an employee?

Answer : Not entitled, but the imposition of a disciplinary sanction provided for by law may be grounds for non-payment of bonuses (Part 1 of Article 192 of the Labor Code of the Russian Federation - for failure to fulfill duties). Thus, the employer can, by local act, prescribe the grounds for non-awarding a bonus, for example, bringing to disciplinary liability in the time period for which the bonus is paid.

What are the indicators for employee bonuses in 2021?

Using this system of calculating salaries for employees, the employer guarantees a salary/tariff share of the amount of money in an amount proportional to the amount spent on additional work.

At the same time, the second, bonus share of the salary completely depends on the efforts and efforts of the employee himself, which affect the quality of the work done. This part of the salary is not a mandatory payment, since its very availability depends on the conditions and requirements for bonus payments to employees established in the relevant documents of the employing organization.

Such conditions for receiving bonuses may include:

- overfulfillment by the employee of the work plan established by the employer;

- absence of complaints, as well as violations and complaints to superiors;

- achievement by an employee or group of employees (for example, a certain department or workshop) of an established quantitative indicator;

- compliance with established quality criteria for manufactured products.

It is worth noting that strict adherence to the regulated conditions must be carried out during a certain period established by the employer, the end of which subsequently serves as the result for remuneration payments. As a rule, a period of 30 days (calendar month) is used as such a period, but the legislator does not prohibit the employer from changing (reducing or, conversely, increasing) the duration of such a period !

At the same time, the occurrence of the established conditions is considered a mandatory basis for the start of accrual of the promised bonus, because this amount is part of the salary security. Thus, if the employer expresses his refusal to make the payments (bonuses) discussed above, the employee or group of employees has the right to seek appropriate legal assistance and receive their earned money!