General procedure for making changes to LNA

Any local regulation requires periodic amendments.

The reasons for this are varied. The most common reasons for making amendments are errors in the document, changes in legislation, and internal reform of rules in the organization. For example, changes to the wage regulations may be required in connection with the establishment of different dates for payment of wages. The legislation does not establish the procedure for making adjustments to the LNA. Let's look at how to make changes to the organization's regulations.

You can make adjustments to existing acts in one of two ways:

- issue an order or order to make adjustments;

- draw up the LNA in a new version and approve it.

The employer himself chooses which way to do this. If the amendments are single, for example, only the salary payment dates change, then it is more convenient to make adjustments by order.

If there are many adjustments, then it will be more rational to approve the act in a new edition.

. .

Tabular part of the position

In the structure of the position from the example considered, all additional payments, compensations and bonuses are placed in separate tabular sections. This is not necessary - the text form of presentation can also be used. In this case, this method of structuring information was used for the purpose of clarity and ease of perception.

For information about what payments form the remuneration system, read the article “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

The “Additional payments” table contains a list of those salary supplements that are applied by the employer. For example, these could be additional payments related to overtime work, for night work or the employee’s work on a holiday, and other additional payments.

For each type of additional payment, the corresponding interest rates are indicated in the table. For example, for night work the surcharge is 40% of the hourly rate (for hourly workers). The necessary explanatory data is indicated in a separate column of the table (it may be called “Note”). For example, for additional payment for night work, this column shows the period considered night: from 22:00 to 6:00.

The structure of the “Compensation” table is similar to that described above. The listed compensations (for example, for harmful and dangerous working conditions, upon dismissal, reduction, etc.) are supplemented with the corresponding amount or calculation algorithm.

The “Additions” table is present in the regulations only if this type of monetary supplement to the employer’s salary exists. An example is the bonus for length of service. In this case, it is necessary to explain in detail for what period what amount of the premium is due. For example, for work experience from 4 to 7 years, the salary increase will be 12%, from 7 to 10 - 15%, and over 10 years - 18% of the accrued salary.

The remaining tables are filled in the same way.

You can see and download a sample regulation on remuneration and bonuses for employees - 2020 (current for 2021) on our website using the link below:

Changes to position

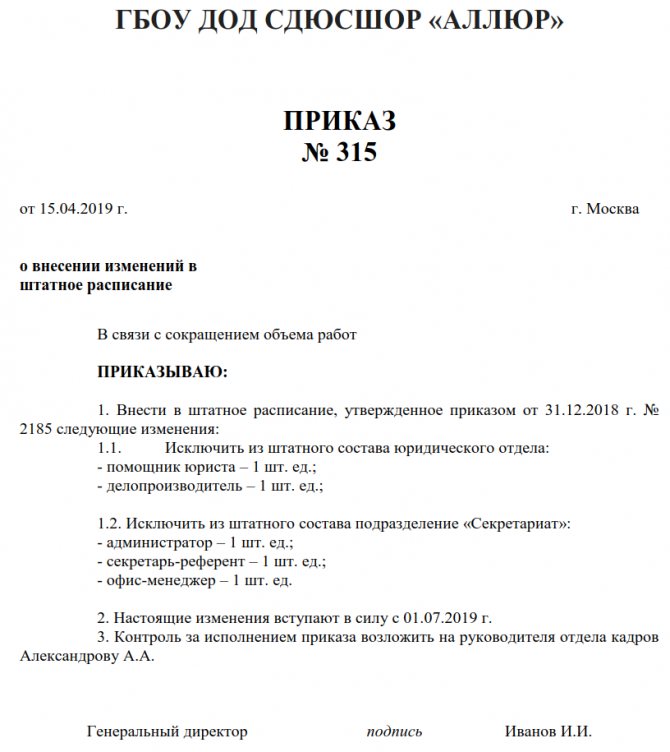

The document on making corrections to the LNA must contain:

- justification for the amendments made;

- list of adjustments made;

- the date from which the document comes into force.

Since changes are being made to the provisions relating to the regulation of labor relations, and if the LNA was adopted taking into account the opinion of the representative body of workers (trade union), then adjustments to it can only be made taking into account the opinion of this body (Article 372 of the Labor Code of the Russian Federation).

Is it necessary to review the wage regulations every year?

The wage regulations can be approved by the employer once and be valid without a time limit (indefinitely). The legislation does not establish any specifics for the validity period of such a document.

The need for an annual review of the regulations may arise in cases where the employer is developing new types of activities involving workers of various professions, for which a revision or addition of existing SOT and incentive payments is necessary, or working conditions are changing.

The employer and employees are interested in keeping their internal local acts up to date and must promptly initiate their revision, including the provisions under consideration.

We will tell you what to indicate in the order approving the wage regulations here.

The procedure for making changes to the wage regulations

Is it possible to make changes to the wage regulations? Yes, you can. This document is subject to change at the discretion of the organization's management.

How to correctly make changes to the salary regulations

Corrections to the salary document must be executed in the same way as the original document itself was approved. If this regulation was approved by a decree or order, then a corresponding decree or order is issued to make corrections.

An order to change the wage regulations is issued in the same way as any order to adjust the LNA. It must indicate the reasons for the changes being made, list the corrections being made, and set the start date for the order.

If the regulations were approved by using the stamp “Approved”, then corrections should be made to them by issuing the provisions in a new edition.

Since it is much easier to formalize changes to the regulations by order in the case of single corrections, employers often use this option.

Is it possible not to draw up a wage regulation and can they be punished for this?

The wage regulations are one of the employer’s internal documents.

It is necessary not only to describe the applied system of calculation and remuneration for labor, but also to consolidate the system of material incentives and rewards for employees in the organization. This provision justifies the legality of including salary costs in tax expenses. Its absence sharply reduces the chances of proving to tax authorities the legality of reducing the tax base for income tax or the simplified tax system for bonuses, additional payments, compensation and other similar payments.

Find out whether the employer is obliged to pay a bonus by following the link.

Given these advantages of the provision, taxpayers in most cases spare no time and effort in developing it.

You can do without such a document only in one case - if all the terms of remuneration are described in employment contracts with employees or in a collective agreement, or all employees of the company work under conditions that exclude any deviations from the usual (do not work overtime, at night and on holidays ). In this case, there is no need to draw up a separate provision.

The legislation of our country does not contain an unconditional requirement to develop and apply wage regulations for each employer. There are no requirements for the form, type and content of this document. Therefore, there will be no punishment for the arbitrary form of the provision or its absence as a separate document.

And if changes are made to working conditions, disputes may arise with both employees and workers. Find out how to correctly approve the wage regulations and avoid claims from a consultation with an expert from the Ministry of Labor. To do this, go through a quick registration in the ConsultantPlus system and get trial access for free.

What to pay attention to

A wage regulation is a legal regulation that establishes rules for remuneration of workers. Therefore, all amendments to it are made in accordance with labor legislation. If this regulation is an annex to the collective agreement, amendments to it are made in accordance with Art. 44 of the Labor Code of the Russian Federation - taking into account the opinion of the employee representative. If the regulations are a separate document, then corrections are made to it in accordance with Art. 372 of the Labor Code of the Russian Federation - taking into account the opinion of the trade union organization. That is, the employer, in any case, must notify the other party about the amendments being made and obtain consent to this or draw up a protocol of disagreements for their further resolution.

Any amendments made to the LNA must not change the position of employees for the worse, compared to legislative norms, and must comply with current legislation. At the same time, it is possible to improve any conditions. For example, changes to the wage regulations can be made to increase the amount of additional payment for night work (according to the Labor Code of the Russian Federation - 20%, and the LNA can establish an additional payment of 50%).

Any adjustment made to the LNA must be informed to employees against signature (Article 22 of the Labor Code of the Russian Federation).

Main sections of the regulations on remuneration and bonuses for employees

The regulations on wages and bonuses for employees may include, for example, the following sections:

- general terms and definitions;

- description of the current form and wage system in the company;

- terms and forms of salary payment;

- employer's liability for delayed wages;

- duration of the provision;

- “Additional payments” table;

- “Compensation” table;

- table "Allowances";

- “Premiums” table;

- table “Other employee benefits”.

The general section provides a link to the regulatory documents in accordance with which this provision was developed. Then a decoding of the basic concepts and terms used in the provision is given, so that any employee, when reading it, would not have difficulty understanding the contents of the document. The same section indicates who this provision applies to (employees under an employment contract, part-time workers, etc.).

The second section is devoted to a description of the wage system (WRS) adopted by the employer (time-based, piece-rate, etc.). If different SOTs are provided for different categories of workers and employees, a description of all applicable systems is given.

The section intended to describe the terms and forms of salary payment indicates the dates for the payment to employees of their earned remuneration (advance payment and final payment). You cannot limit yourself to a one-time payment of salary income.

See also “Advance payment – what percentage of salary?” .

IMPORTANT! Remuneration for labor must be paid at least 2 times a month (Part 6 of Article 136 of the Labor Code of the Russian Federation, letter of Rostrud dated May 30, 2012 No. PG/4067-6-1). Violators of this requirement may face administrative liability under clause 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (fine from 30,000 to 50,000 rubles for a company, from 10,000 to 20,000 rubles for its officials and from 1,000 to 5,000 rubles for individual entrepreneurs). Also keep in mind that the payment period must be determined by a specific date; you cannot create a “fork” of dates.

However, paying wages more than 2 times a month will not violate any norms. Read more about this in the material “Salaries can be paid more than twice a month .

The same section reveals the form of remuneration: in cash through a cash register or by transfer to employees’ bank cards, as well as the percentage of possible payment of part of salary income in kind.

A separate paragraph reflects information related to the employer’s responsibility for delayed wages.

IMPORTANT! The employer's financial liability for delayed wages is provided for in Art. 236 of the Labor Code of the Russian Federation, which sets the minimum interest rate (not lower than 1/150 of the refinancing rate of the Central Bank of the Russian Federation from amounts not paid on time for each day of delay).

The regulations may establish an increased amount of compensation.

The main text part of the provision ends with a final section, which indicates the period of its validity and other necessary conditions.

Do I need to notify employees?

Corrections to the wage regulations must occur in accordance with the procedure established by law:

- if the amendments concern the terms of the employment contract, the consent of the employees is required (Article 72 of the Labor Code of the Russian Federation);

- if corrections are made due to organizational or technological changes in the employee’s working conditions, the employer makes them unilaterally, warning the employees in writing 2 months in advance (Article 74 of the Labor Code of the Russian Federation).

If the amendments to the regulations do not concern the mandatory terms of the employment contract, for example, the positions of the persons mentioned in the document have been renamed, then the consent of the employees to these amendments is not necessary.

Additions to the wage regulations are drawn up in the same manner.

Regulations on remuneration and bonuses for employees: is it necessary to combine

Since there are no legal requirements on this issue, in different companies you can find a variety of options for drawing up internal documents related to the calculation and payment of wages to employees.

For example, the regulations on wages are drawn up as a separate document, and the conditions for bonuses are prescribed in another local act - the regulations on bonuses and material incentives for employees. It is possible to provide for other salary provisions: on wage indexing, summarized recording of working hours, etc.

Some employers are limited to approving only one document - a collective agreement, which stipulates all the necessary aspects of the salary policy.

Read about the purpose and features of a collective agreement in the material “Collective agreement as a form of social partnership.”

The decision on whether to prescribe all the necessary salary nuances in one document or formalize each significant issue in separate provisions remains with the management of the company or the employer-individual entrepreneur. If a decision is made to combine the issues of the payment system and the features of bonuses in a single provision, it is necessary to spell out all the nuances in this document as scrupulously as possible.

To learn about what bonuses and rewards can be for employees, read the article “What are the types of bonuses and rewards for employees?” .

Validity period of the wage regulation

- 1. This provision applies to relations between Company employees from June 1, 2005. until December 31, 2005

- 2. Upon expiration of the period specified in clause 4.1. The position is subject to extension or revision based on the results of the employee’s certification and evaluation of the performance of the structural unit. Before the expiration of the period specified in clause 4.1., the provision may be revised:

4.4. A planned review of the “Regulations on the remuneration system” and the staffing table occurs in the Company once every 6 months. Reporting dates are January 1 and July 1 of each year.

4.5. When reviewing the amount of remuneration, the following factors are taken into account:

External factors:

- Official data on inflation rates from Goskomstat;

- Data from independent organizations and centers;

- Results of a study of changes in the labor market carried out by personnel department employees.

Results

Regulations on wages are necessary for both employees and the employer. With the help of this internal document, it is easier for the taxpayer to defend to the tax authorities the validity of reducing the tax base for income tax or the simplified tax system for various salary payments. And employees will be confident that they will not be deceived when calculating their salaries and they will be able to receive legal bonuses and compensation (including through legal proceedings).

This document does not have a legally established form; each employer has its own form.

Its validity period is set by the employer independently. The provision may be revised as necessary or remain in effect indefinitely. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.