A component of travel expenses are the costs of hotel accommodation. The employee is required to provide supporting documents for the cost of these services. This can be an invoice, a cash receipt, or sometimes just a receipt for the PKO. But which document will satisfy the tax authorities? And what if, for example, breakfast is included in the bill? You will find answers to these and other questions in the article.

The company is obliged to reimburse the employee for expenses incurred during a business trip for the cost of renting living quarters (Article 168 of the Labor Code of the Russian Federation, clause 11 of the Regulations on Business Travel, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). But to do this, the employee must confirm his expenses with a document.

Hotel account

What document will confirm payment for hotel accommodation so that the company does not have any claims from the Federal Tax Service during the inspection?

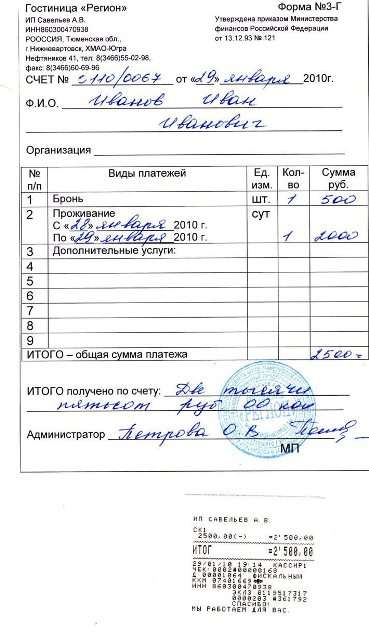

If the hotel does not use cash register equipment, then in this case it is obliged to draw up a strict reporting form, the form of which it develops independently (Letter of the Ministry of Finance of the Russian Federation dated February 25, 2015 No. 03-07-11/9440). In this case, the name of this document can be anything (receipt, hotel check, invoice, voucher, etc.). Let us recall that until December 1, 2008, hotels used form No. 3-G as a strict reporting form, approved by Order of the Ministry of Finance of Russia dated December 13, 1993 No. 121. But now this form is not used, and, as officials explain, this document cannot used as a BSO (Letters of the Ministry of Finance of Russia dated January 19, 2009 No. 03-01-15/1-11, dated August 7, 2009 No. 03-01-15/8-400).

Currently, each hotel is developing its own strict reporting form. At the same time, it must take into account certain requirements imposed by law for the registration of BSO. If at least one requirement is not met, the document cannot be classified as a BSO. Accordingly, a company whose employee brings such a document from a business trip may have problems taking into account living expenses and deducting VAT on these expenses. What are these requirements?

Firstly, the strict reporting form must contain the mandatory details, the list of which is established in paragraph 3 of the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment (approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359). Such details include, in particular, the name of the document, six-digit number and series, the name of the organization providing services, its location and tax identification number, and seal.

Secondly, a simple computer cannot be used to generate strict reporting forms. The fact is that the document form must be printed or generated using automated systems (clause 4 of the Regulations approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359). The automated system must be protected from unauthorized access, identify/record and store all transactions with the document form for at least 5 years. Also, when filling out a document form and issuing a document by an automated system, a unique number and series of its form are saved. The same conclusions are presented in Letters of the Ministry of Finance of the Russian Federation dated May 5, 2014 No. 03-01-15/20962, dated November 7, 2008 No. 03-01-15/11-353.

If an employee brings back a “hotel” bill from a business trip that does not meet these requirements, and the company took into account the living expenses on such an account when taxing profits, then if claims arise from the Federal Tax Service, it has a chance to defend its expenses in court (Resolution of the Federal Antimonopoly Service of the North-West district dated November 1, 2010 in case No. A52-3413/2009).

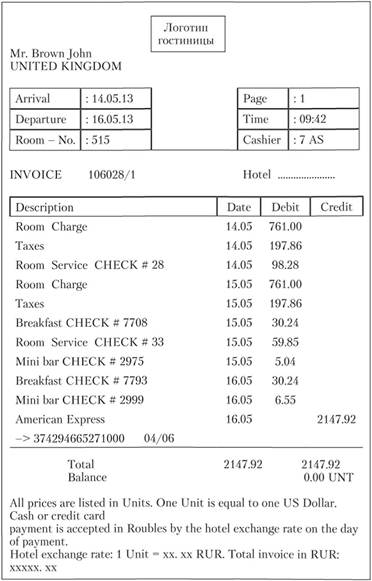

The second option is that the hotel uses cash register systems. Accordingly, the BSO may no longer be issued, and the document confirming payment for accommodation will be a cash receipt. Usually it is accompanied by a document (usually an invoice) that contains complete information about the residence of a particular person.

But what if a seconded employee, instead of a check or BSO, brought a receipt to the cash receipt order?

In such a situation, the company may have problems during verification. Tax authorities may recognize such expenses as unlawfully taken into account when taxing profits, but in court the company has a chance to challenge the claims of the Federal Tax Service (Resolution of the Federal Antimonopoly Service of the North-Western District dated February 10, 2009 in case No. A56-27225/2007).

In addition, additional personal income tax and insurance premiums are likely to be charged on the amount of compensation for “hotel” expenses based on the receipt for the PKO. In practice, some inspectors believe that compensation for hotel expenses confirmed by such a receipt constitutes the employee’s income. One such case was considered by the Federal Antimonopoly Service of the Moscow District in Resolution No. KA-A40/4142-09 dated May 25, 2009. True, there was talk about the calculation of unified social tax and personal income tax. The court did not agree with the controllers and declared the additional accrual unlawful, pointing out that the expenses for hotel accommodation were confirmed by other documents. In this situation, receipts for cash receipt orders, which are official documents confirming the receipt of money by the seller, were attached to the advance reports. The absence of a cash register receipt, in the presence of other supporting documents, cannot be unconditional evidence of misuse of funds by accountable persons and their receipt of payments subject to unified social tax and personal income tax. Thus, the FAS concluded that the funds issued to employees on account were not their income, since they were used in the interests of the company.

A similar conclusion is also contained in the resolutions of the Federal Antimonopoly Service of the West Siberian District dated April 13, 2009 No. F04-1948/2009 (4045-A75-49), and the Moscow District Federal Antimonopoly Service dated February 29, 2008 No. KA-A40/14043-07.

It should be noted that on October 9, 2015, the Government of the Russian Federation No. 1085 approved new Rules for the provision of hotel services. It is noteworthy that they indicate the hotel’s obligation to issue the consumer a cash receipt or a document drawn up on a strict reporting form. We hope that with the release of new rules, hotels will become more responsible in the preparation of documents and will stop issuing documents that do not comply with the law.

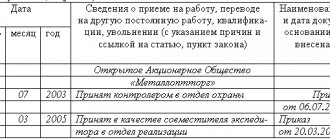

Documents for a business trip in 2020: sending an employee on a trip

Any business trip begins with the execution of an administrative document - an order. If you use unified forms, compose it according to the form:

- T-9, if you are sending one person;

- T-9a, if several.

You will find both forms in this article. A sample business trip order can be downloaded here.

Based on the order, issue an advance to the employee. Its amount should cover the daily allowance for all days of the trip, as well as approximate expenses that the employee will have during the trip. To issue money, draw up a cash order.

In general, no further documents will be required for a business trip at this stage. Thus, travel certificates and official assignments are no longer needed for a long time. But there may be nuances.

If, for example, an employee leaves, returns from a business trip, or is on the road on a weekend or holiday, or while on a business trip, he will work on such days (and this is not provided for by his regular schedule), you must obtain written consent from the employee to work on a day off and issue an appropriate order. If the business traveler will be on vacation on a weekend or holiday, these papers will not be needed.

For more details, see: “How is a business trip paid on a day off (nuances)?”

One-day business trips and part-time business trips are processed according to the same rules. There are no documentary features for them. Just keep in mind that employees are not entitled to daily allowances for one-day business trips. But there is still a way to pay them for such expenses.

See: “How is a one-day business trip paid?”

The Guide from ConsultantPlus will help you prepare other documents for business trips. If you do not already have access to this legal system, a full access trial is available for free.

No residence documents

What if the employee did not bring a check, a BSO, or a receipt for the PKO from the hotel?

If an employee loses documents, you can request a certificate from the hotel confirming the fact of residence of a specific person in this hotel. Specialists from the Federal Tax Service of the Russian Federation for Moscow do not see any obstacles to accounting for “hotel” expenses on the basis of such a certificate (Letter No. 16-15/084374 dated August 26, 2014). However, the capital's tax authorities specify that a certificate from the hotel must contain details of the services provided and confirm payment for the employee's stay. And the company, in turn, must have other documents establishing the period of stay of the posted employee in the place where the hotel is located. However, there are risks that local tax authorities will not be satisfied with such a certificate. Therefore, companies must be prepared for disputes with inspectors. We believe that in court the company will be able to challenge the claims that have arisen from the Federal Tax Service, because documents indirectly confirming expenses should also be taken into account (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Documents for hotel services may be missing for another reason. Companies where business trips, especially to the same area, are quite frequent, can rent apartments for these purposes. In this case, the company itself pays for the rent of the apartment, and the employee is not reimbursed for living expenses. The question arises: can an organization take into account the costs of renting apartments when taxing profits? Yes maybe. But, as officials explain, only for the period of actual residence of workers in it (Letters of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/178, dated January 25, 2006 No. 03-03-04/1/58). Specialists from the Federal Tax Service of Russia for Moscow also agreed with this in Letter dated April 16, 2010 No. 16-15/ [email protected]

That is, if the rental agreement for an apartment is concluded for six months, and the total period of business trips of all employees who take turns living in it is 5.5 months, then the inspectors will consider the rent for the remaining half a month to be an unreasonable expense for the company in tax terms.

Who cannot be sent on a business trip

Under normal conditions, the management of a business entity has the right not to ask the wishes of an employee when sending him on a business trip, since it will be the fulfillment of his direct job responsibilities.

However, the law establishes several categories for whom business trips are either completely prohibited or require prior written consent.

There is a ban on sending the following employees on business trips:

- A woman who is expecting a child;

- Workers who are minors at the time of travel. However, this prohibition does not apply if these employees have creative professions (actors, journalists, singers, etc.) or are professional athletes.

- Employees who perform labor duties on the basis of an apprenticeship contract.

Important: these employees are prohibited from being sent on business trips, even if they give written consent to this.

The following employees are required to obtain their written consent to be sent on a business trip:

- Women who have small children. Also included in this category are the only parents of children under three years of age;

- Single workers if their children are under five years old;

- Employees who have children with disabilities in their family;

- Workers who care for sick members of their family;

- Employees who have a disability and if their travel on a business trip will disrupt the recovery program.

For all these categories, before completing documents for a business trip, you must obtain written consent for this. In addition, the form must indicate that these employees are aware of their right to refuse the trip.

Attention: a rather complex case is the official trip of an internal part-time worker. The law does not prohibit sending such workers on trips. At the same time, there is no certainty about how exactly to mark this employee in the report card at the second place of work.

The law prohibits granting him unpaid leave or basic leave for such a period. It is optimal to provide him with additional paid leave for the specified period in the second place.

Breakfast is included in the bill

Almost every hotel has a restaurant, cafe or dining room where guests can be offered breakfast.

So, if the cost of food is indicated separately in the hotel bill, then keep in mind that it is better not to include these costs for the organization in “tax” expenses. This follows from subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. It says that expenses may include employee costs for paying for additional services provided in hotels (with the exception of service in bars and restaurants, in the room, and use of recreational and health facilities). It is noteworthy that if the hotel is not a restaurant or cafe, but a dining room, then formally the specified restriction can be ignored. This, of course, is risky, but one organization managed to prove the legitimacy of including the cost of breakfast in the dining room in “profitable expenses”. An example of this is the Resolution of the Federal Antimonopoly Service of the West Siberian District dated November 17, 2010 in case No. A45-26455/2009. Since the tax authorities did not prove that food services were provided to employees in a restaurant or bar, the court considered it legitimate to recognize expenses for breakfast in tax accounting. And, accordingly, VAT on the cost of the “canteen” breakfast is deductible.

In another case, you can see an unusual interpretation of service costs in bars and restaurants. The Ninth Arbitration Court of Appeal in Resolution No. 09AP-19562/2012 dated 03.08.2012 in case No. A40-112186/11-20-455 considered that the costs of service in bars and restaurants imply leaving tips and other forms of service, but not expenses for food. Accordingly, the court concludes, the company has the right to recognize as expenses the cost of food for a business trip employee in a restaurant.

But, unfortunately, local inspectors are not so loyal. Therefore, in order to avoid tax risks, a company may not take into account the cost of breakfast when taxing profits.

In addition to income tax, risks arise in terms of personal income tax and insurance premiums. In practice, inspectors add additional charges to the cost of breakfast reflected in the hotel bill. Moreover, there are official clarifications from the Ministry of Finance of the Russian Federation - Letter dated October 14, 2009 No. 03-04-06-01/263. It says that if the cost of food is separately allocated in the invoice, then the employee receives income in kind. After all, compensation for the cost of food is not reimbursement for the costs of renting residential premises, which are exempt from taxation. Therefore, personal income tax and unified social tax must be charged on the cost of food (at the time of this letter, companies paid unified social tax instead of insurance premiums).

What does arbitration practice tell us on this issue? The position of the courts is contradictory. For example, in the Resolution of the Federal Antimonopoly Service of the Ural District dated April 28, 2007 No. F09-3004/07-S2 in case No. A71-6947/06, the court supported the company. And in the Resolution of the Federal Antimonopoly Service of the Volga Region dated July 14, 2009 in case No. A65-27027/2007, the court accepted the arguments of the Federal Tax Service.

What should you do if the hotel bill includes breakfast, but its cost is not indicated as a separate amount? This situation is not so rare, and for companies that record expenses on the basis of such an account, it is fraught with tax risks. In practice, tax authorities either allocate the cost of breakfast by calculation, or completely exclude the entire amount from “profitable expenses.” Neither option is legal. And the organization can challenge the actions of the tax authorities in court. For example, the Federal Antimonopoly Service of the North-Western District, in its Resolution dated March 14, 2008 in case No. A56-17471/2007, declared illegal the actions of tax officials to exclude from “profitable expenses” the cost of breakfast, determined by calculation.

Tax authorities can also charge personal income tax on the cost of breakfast found by calculation. However, in court, the company will be able to prove the absence of an obligation to calculate and pay this tax (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 3, 2008 in case No. A31-8961/2006-15).

But the inspectors are unlikely to dare to charge insurance premiums, since there are official clarifications according to which insurance premiums are not charged on the cost of accommodation of a posted worker in a hotel, the price of the room in which includes the cost of breakfast (Letters of the Ministry of Health and Social Development of the Russian Federation dated 05.08.2010 No. 2519-19, FSS RF dated November 17, 2011 No. 14-03-11/08-13985).

Travel payment procedure

The price for renting employees' living quarters or paying for a hotel room is taken into account in other expenses. You must have the appropriate document - price and length of stay, date of preparation, signature and position. In different cases, inspectors impose optional conditions.

Usually there are no hotels in the Unified State Register of Legal Entities. Tax officers look to see if the hotel’s TIN is in the Unified State Register of legal entities.

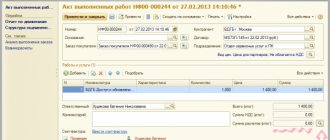

In the advance report, you must provide all the papers that confirm the expenses of the business trip. We are also talking about checks from the hotel. After approval by the employer and transfer to the accounting department, you will receive your funds in your hands. If the amount turns out to be less than you expected, coordinate this with your employer. He must provide a complete accounting statement of the settlement.

Other hotel services

In addition to the cost of accommodation itself, the company sometimes has to pay for a number of additional services.

One of these services is room reservation. As noted earlier, according to subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, employee expenses for additional services provided in hotels (excluding service in bars, restaurants and in the room, use of recreational and health facilities) are also subject to reimbursement. The financial department believes that booking a room is an additional service provided by hotel complex enterprises. This means that the costs of booking hotel rooms for business travelers can be taken into account when taxing profits. Of course, provided that such expenses are documented (by a cash register receipt or a strict reporting form). The corresponding clarifications are given in the Letter of the Ministry of Finance dated March 10, 2011 No. 03-03-06/1/131.

The company will also be able to take into account the costs of dry cleaning when taxing profits. But only, as officials say, if he can justify the production focus and economic feasibility of such expenses (Letter of the Ministry of Finance of Russia dated May 23, 2013 No. 03-03-06/1/18308). This will not be difficult to do if the purpose of a business trip is, say, meeting people, business negotiations, etc. events where it is important for an employee to look good. Although previously officials were against taking into account dry cleaning expenses when taxing profits (Letter of the Ministry of Finance of the Russian Federation dated July 3, 2006 No. 03-03-04/2/170).

Documents confirming hotel accommodation

Tourists who have visited a city, or people who have come on a visit or on a business trip, need rest, so they are thinking about staying in a hotel. But not everyone knows that it is necessary to prepare any documents confirming hotel accommodation, except for standard registration procedures, which consist of presenting a passport and printing out the reservation, which most often has an electronic form. In addition to all this, you must fill out a hotel guest form.

How to make money on a business trip?

Buy hotel receipts!

Reporting documents for business travelers, official hotel receipt for accommodation.

But for people who have arrived on a business trip and are deciding the affairs of a company or enterprise, the correct execution of documents is very important, because, having returned to their city, they must, no later than three days later, draw up and bring to the accounting department of their enterprise a calculation that what expenses did you incur while on a business trip?

Documents confirming living expenses

If the company does not have a responsible employee who organizes business trips, then the person going on a business trip must independently look for a suitable hotel, book a room and pay for it. And in order to return the money spent on hotel accommodation, the employee presents to the accountant documents confirming his stay at the hotel, which indicates the date of arrival and departure from the hotel.

If the hotel uses cash register equipment, the people living in it are given a cash receipt, to which is attached a document with information about the residents. It is imperative to check the date of arrival at the hotel and check-out from it - the dates must correspond to those indicated on the transport receipts.

If the hotel does not use a cash register, then its representatives draw up strict reporting forms in a form that is developed individually for each hotel. And these forms are called differently: hotel checks, vouchers, receipts.

A document confirming hotel accommodation

It doesn’t matter what the document is called, the main thing is that it indicates the following:

- What is the name of the document?

- His six-digit number.

- Series.

- What is the name of the organization providing the service?

- Address of the organization.

- TIN.

- At the bottom of the form there must be a seal of the organization responsible for issuing it.

Another important point is that plain paper should not be used to produce the form, and the information should not be printed on a printer.

Limit and exceeding it

Some companies, in order to spend money economically, may set a limit on expenses for hotel accommodation for their employees during business trips.

This raises the question: if an employee exceeds this limit, but at the same time submits a hotel bill for the full cost of accommodation, should the company withhold personal income tax from the employee? No, you shouldn't. The fact is that compensation payments established by law, related, in particular, to the reimbursement of travel expenses (clause 3 of Article 217 of the Tax Code of the Russian Federation) are not subject to personal income tax. Paragraph ten of paragraph 3 of Article 217 of the Tax Code of the Russian Federation stipulates that the income of a posted worker does not include actually incurred and documented expenses for renting residential premises.

Thus, if there is a written statement from the employee indicating the reasons for the overspending and the employer’s decision to reimburse the full cost of accommodation, then the entire amount of documented expenses for accommodation on a business trip is exempt from personal income tax, even if it exceeds the limit established by the company. Such clarifications were given by the Ministry of Finance of the Russian Federation in Letter dated 07/04/12 No. 03-04-06/6-204.

In addition, the entire amount of compensation for the employee’s expenses for hiring premises at the place of business trip can be taken into account for profit tax purposes. Let us explain why. Based on Article 168 of the Labor Code of the Russian Federation, the employer is obliged to reimburse the posted worker for his expenses, in particular, for the rental of living quarters. Expenses for business trips, in particular, for renting living quarters, are considered other expenses associated with production and sales (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation). At the same time, the Tax Code of the Russian Federation does not have an obligation to determine the limit on “hotel” expenses. Thus, the entire amount of compensation for such expenses can be taken into account when taxing profits in full. The above Letter from the Ministry of Finance of the Russian Federation contains the same conclusion.

Payment for accommodation on a business trip in a budget organization

If an employee of a state non-profit organization, which is financed from a certain level of budget, is sent to another region for official purposes, then the procedure for confirming expenses will be similar to that of any commercial organization. The difference in the procedure is the indication of another source of funding for the business trip.

Similar articles

- Advance report for business trip 2021 sample

- Standard daily travel expenses in 2021

- Advance report on business trip 2016-2017 (sample)

- Amount of travel expenses in 2021 per diem

- Memo for a business trip sample 2018

VAT deduction: conditions

VAT paid as part of the cost of hotel accommodation can be deducted by the organization.

However, officials put forward a condition: in order to deduct VAT, it is necessary, firstly, to have an invoice issued on the BSO, and secondly, to indicate the amount of VAT on the invoice (Letter of the Ministry of Finance of the Russian Federation dated February 25, 2015 No. 03-07-11/9440). They draw such conclusions on the basis of paragraph 18 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. It actually says that for hotel services, BSOs are registered in the purchase book with the allocated tax amount. If the hotel issued an invoice and cash receipt instead of the BSO, then VAT deduction can also be applied, as stated in Letter of the Ministry of Finance of the Russian Federation dated 04/03/2013 No. 03-07-11/10861. But if the accommodation invoice is issued on a free form, VAT deduction is not possible, even if there is a cash receipt with the allocated tax amount. This is what the Russian Ministry of Finance thinks (Letter dated December 23, 2009 No. 03-07-11/323).

Thus, when checking, tax authorities will look at documents from hotels, including to ensure that they separately indicate the amount of VAT. The presence in the document of the wording “including VAT” does not, according to fiscal officials, give the right to a deduction. Although in court, companies can prove the legality of the deduction in this situation. There are positive examples in arbitration practice (Resolution of the Federal Antimonopoly Service of the Ural District dated April 2, 2008 No. F09-2063/08-S2).

Hotel documents for business travelers

Therefore, he must take care of his place of residence. In this case, it is necessary to stay in an area of the city from where it would be convenient to resolve all service issues. The best option in this case is a hotel. What documents should a hotel issue to business travelers to confirm that they are at the hotel at a certain time? As a rule, this is an invoice for payment of accommodation. The hotel invoice for the advance report is a Form 3d containing specific information:

- hotel details;

- name, date, number of the form;

- details of the client staying at the hotel, indicating the exact length of stay;

- full cost calculation – confirmation of hotel accommodation expenses on a business trip;

- signature of the responsible person and seal of the hotel.

For accounting purposes, upon return, the employee must provide documents from the hotel confirming accommodation; for the advance report, a cash receipt will also be needed. It is this check, issued after full payment, that will serve as confirmation of the employee’s expenses that he needs to reimburse. A hotel invoice without a cashier's receipt is not a document confirming accommodation. This document may also indicate the cost of all additional services provided to the employee during his stay at the hotel. However, payment for telephone calls, the cost of breakfasts or lunches, parking or travel will be reimbursed to the employee only if this is provided for in the contract or with the personal consent of the head of the company. To do this, you will need to draw up an advance report and a travel certificate for the Republic of Belarus. Hotel document flow for reporting For the normal operation of any hotel within the framework of the law, streamlined paperwork in the hotel is necessary. All work at the hotel is based on providing specific services to clients. To eliminate possible conflicts in relationships with clients, all services must be recorded in strict reporting documents at the hotel. Depending on the type of business activity of the hotel, the list of these forms may differ. Each hotel can provide receipts and documents confirming hotel accommodation on a business trip in two options:

- organization registration documents;

- internal organizational documents of the hotel.

Internal organizational forms also include documents confirming expenses for hotels, accommodation and additional services. This documentation must meet the design requirements of the hotel's location. After all, these are the documents that are needed for hotel accommodation for the accounting department of an employee’s enterprise, so that all expenses are reimbursed to him. How do they prepare documents at the hotel? Such documentation can be primary and secondary. The primary includes strict reporting forms. Checks must be with cash registers officially registered with the tax authorities. The receipt from the hotel for the report is the most important, it displays the length of stay at the hotel, the cost of additional services, name, etc. Secondary documentation consists of various forms, the form of which can be established by the hotel management itself. The main purpose of checks from a hotel Mostly people arriving in the city on a business trip live in hotels. However, some people prefer to live in private rented apartments, without thinking that later they will need to confirm travel expenses when preparing an advance report. Making a check yourself in this case is not very easy, since the form has certain features. Such a document usually consists of a cash receipt from the hotel and Form 3d. The form must include the name of the hotel, the TIN of the service provider, the signatures of the responsible persons and the seal of the establishment. A paper hotel receipt for a business trip is mainly in demand among employees of state-owned enterprises. After arrival, you must submit an advance report for travel expenses to the accounting department, an example of which is available in each organization. This report will be confirmed by a check from the hotel, on the basis of which the employee will be reimbursed for all expenses for accommodation and hotel services. That is why providing documents from the hotel for business travelers 2016-2017 is a matter of first importance. Commercial companies may use different reporting schemes. Some people pre-allocate a certain amount of money to an employee going on a business trip, which includes expenses for accommodation, breakfast, transportation, etc. However, there are times when the 2016-2017 travel expense report expires, and the employee cannot find receipts from the hotel. Therefore, by agreement with the management, a company employee can use the services of companies that prepare documents for the hotel report, confirming payment for accommodation services. An official receipt and check from the hotel for a business trip can only be issued by hotel employees. But if you lose official forms, you can contact companies specializing in the sale of checks. For a small fee, these companies offer authentic reporting documents for business travelers to buy. While on a business trip, the employee must take care of subsequent reimbursement of all related expenses. Therefore, you should clarify in advance what documents the hotel provides for your stay. In addition, you need to check with your company’s accounting department whether the hotel account is a strict reporting form. Some companies may require additional forms. This must be confirmed in advance in order to be able to request them at your hotel.

Bookmark the link.

Payment by credit cards (Payment by CreditCard)

In hotels that accept credit card payments through POS terminals and use a pre-authorization system (deferred payment), the cashier, when making the final payment to the client, uses the “ Off-line Sales”

(

off-line sale).

To do this, he needs a client's pre-authorization check, prepared in advance upon arrival (during the clarification of solvency issues). By pressing a certain button, the cashier calls the offline mode. You must then enter your credit card number (either from a magnetic stripe, by swiping the card over a magnetic reader, or manually using the credit card number found on your pre-authorization receipt).

After entering the total amount for the account, the cashier enters the pre-authorization code (it is also indicated on the pre-authorization receipt). After a certain command to the POS terminal, the device begins to print a receipt identical to the “Sale” receipt, but with the mark “Offline sale”. This check, consisting of two copies (white and yellow) and providing a copy effect, is given to the client for signature.

The balance of the “frozen” money (if any) is instantly returned to the client’s account.

In this case, the cashier hands the client one copy of the general invoice prepared on the computer; one copy of the check signed by the client, issued by the POS terminal; all invoices due to the client for the provision of additional paid services. In Fig. 41 shows an example of an invoice in English.

For his reporting, the cashier retains: a second copy of the general invoice prepared on a computer; sign-

Puc.

41. Sample invoice for room accommodation (in English)

submitted by the client second copy of the receipt issued by POS

termipal; all client invoices for the provision of additional paid services in duplicate.

Working with credit cards requires a lot of responsibility, attention, vigilance and professionalism from the cashier.

According to the Federal Law of the Russian Federation dated May 22, 2003 No. 54 “On the use of cash register equipment when making cash payments and (or) payments using payment cards” by all organizations and individual entrepreneurs in cases of selling goods, performing work or providing services without fail cash register equipment included in the State Register is used.

Organizations (except for credit institutions) and individual entrepreneurs using cash register equipment are obliged to:

- • register cash register equipment with the tax authorities;

- • when making cash payments and (or) payments using payment cards, use serviceable cash register equipment, sealed in the prescribed manner, registered with the tax authorities and ensuring proper accounting of funds during settlements (recording of settlement transactions on the control tape and in the fiscal memory);

- • issue to buyers (clients) when making cash payments and (or) payments using payment cards at the time of payment, cash register receipts printed by cash register equipment;

- • ensure the maintenance and storage in the prescribed manner of documentation related to the acquisition and registration, commissioning and use of cash register equipment, as well as provide tax officials carrying out inspections with unimpeded access to the relevant cash register equipment, and provide them with the specified documentation;

- • during the initial registration and re-registration of cash register equipment, enter information into the fiscal memory of cash register equipment and replace fiscal memory drives with the participation of representatives of tax authorities.

Payment for additional services

If incidental services provided by the hotel (meals, long-distance telephone calls, laundry, etc.) are included in the bill as a separate line, the company will not be able to include them in expenses associated with accommodation. The cost of food is paid from the daily allowance, the amount of which is determined by the employer.

When choosing the Key Element Hotel for accommodation on a business trip, guests are guaranteed to receive a package of supporting documents. Book a room for a day or a longer period by filling out the order form on our website!

Menu

The issue of paying housing to employees is currently relevant. Some organizations hire foreign workers, others hire out-of-town specialists. Let's consider the procedure for accounting for expenses in such a situation.

Let’s say an employer invites a nonresident employee to join the organization to work as an executive director. There was a preliminary agreement to move to another location, but the employment contract did not provide for reimbursement of relocation expenses for the employee and his family. According to Art. 169 of the Labor Code of the Russian Federation, when an employee moves, by prior agreement with the employer, to work in another area, he is required to compensate for:

- Expenses for moving the employee, his family members and transporting property (except for cases where the employer provides the employee with appropriate means of transportation);

- Expenses for settling into a new place of residence;

- The specific amounts of reimbursement of expenses are determined by agreement of the parties to the employment contract.

In this case, the employee could not claim compensation for all expenses for moving his family, transporting luggage, and expenses for settling into a new place of residence.

Another situation. When drawing up an employment contract, it includes a condition that the organization pay for an apartment for the employee and his family to live in. It was indicated that the employee and his family members would be provided with an apartment rented at the expense of the organization.

Based on the employment contract and Art. 255 of the Tax Code of the Russian Federation, the accountant included the entire amount of expenses in the tax return for the purpose of calculating income tax. However, the employment contract does not indicate that payment for an employee’s housing is the employee’s monthly salary; it can also be made as a social benefit. Therefore, problems may arise when recognizing expenses for income tax purposes.

But what if the contract specifies a condition regarding payment for housing as monthly wages?

Based on Art. 255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees provided for by the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

In accordance with paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, labor costs for the purposes of Chapter 25 of the Tax Code of the Russian Federation include, in particular, other types of expenses incurred in favor of the employee, provided for by the employment contract and (or) collective agreement.

According to paragraph 1 of Art. 236 of the Tax Code of the Russian Federation, payments in favor of individuals under labor and civil law contracts, the subject of which is the performance of work or provision of services, are subject to UST taxation.

During 2005-2007 The position of the Russian Ministry of Finance regarding the issue of calculating taxes when paying for housing provided to an employee has changed.

Letters from the Ministry of Finance of Russia dated March 3, 2006 No. 03-05-02-04/24, dated December 26, 2005 No. 03-03-04/1/446 indicated that the cost of paying for housing of employees in accordance with concluded labor contracts contracts that are a form of remuneration for employees, confirmed by primary documents, can be recognized for the purpose of calculating income tax, the unified social tax should be calculated taking into account clause 3 of Art. 236 Tax Code of the Russian Federation. Then in letters of the Ministry of Finance of Russia dated 02.22.07 No. 03-03-06/1/115, dated 08.08.07 No. 03-03-06/2/149, dated 12.18.07 No. 03-03- 06/1/874 it is recommended to recognize in tax accounting only 20% of housing costs as labor costs. This is justified by the fact that, according to Art. 131 of the Labor Code of the Russian Federation, the share of wages paid in non-monetary form cannot exceed 20% of the accrued monthly wage. Hence the conclusion: for the purpose of calculating income tax, labor costs paid in non-monetary form should be recognized in accordance with Art. 131 of the Labor Code of the Russian Federation, which defines forms of remuneration. Apparently, it was intended that the rest of the payments be recognized as social payments. In addition, it was noted that this payment cannot be classified as compensation and should be included in the tax base for calculating the unified social tax, but taking into account clause 3 of Art. 238 of the Tax Code of the Russian Federation, according to which payments not recognized for the purpose of calculating income tax may not be included in the tax base for calculating the unified social tax (letter of the Ministry of Finance of Russia dated December 18, 2007, No. 03-03-06/1/874, dated July 20. 07 No. 03-04-06-01/255).

The concept of “form of remuneration” is used as arguments for such conclusions. But can form replace the content of the concept of “wages”?

Basic concepts and definitions of remuneration are given in Art. 129 Labor Code of the Russian Federation. Wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Apparently, in Art. 131 of the Labor Code of the Russian Federation determines the specific amount of non-monetary payment for the purpose of resolving labor disputes. Thus, in the resolution of the plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 (as amended on December 28, 2006), in order to resolve labor disputes, it was indicated that it was necessary to comply with the procedure for paying wages in non-monetary form, limiting such transactions to 20%.

Position of the tax authorities in the period 2007-2008. also changed.

In letters from the Federal Tax Service of Russia in Moscow dated March 14, 2007 No. 20-08/ [email protected] , dated April 16, 2007 No. 20-12/035156, dated January 18, 2007 No. 21-11/ [email protected] b, dated March 2, 2006, No. 20-12/16112с indicates that housing costs are of a social nature and cannot be recognized for the purpose of calculating income tax as expenses not directly related to wages.

In the letter of the Department of Tax Administration for Moscow dated November 26, 2007 No. 21-08/ [email protected] it is noted that the legislation of the Russian Federation does not provide for payment of rent for premises for the accommodation of employees of foreign missions. Accordingly, these expenses are not subject to the provisions of paragraphs. 2 p. 1 art. 238 of the Tax Code of the Russian Federation and such expenses are included in the tax base under the Unified Social Tax on the basis of clause 1 of Art. 237 Tax Code of the Russian Federation.

The opinion of the tax authorities changed in January 2008, they agreed with the position expressed in letters of the Ministry of Finance of Russia dated 8.08.07 No. 03-03-06/2/149, dated 18.12.07 No. 03-03-06/ 1/874. Thus, in the letter of the Federal Tax Service of Russia for Moscow dated January 11, 2008 No. 21-08/ [email protected] it is stated: based on Art. 131 of the Labor Code of the Russian Federation, which allows payment in non-monetary form in the amount of no more than 20% of the accrued monthly salary, expenses for remuneration of employees in the form of payment for accommodation in a rented apartment, if such a form of remuneration is provided for by labor and (or) collective agreements, with subject to their documentary confirmation, they can be taken into account when calculating the tax base for income tax as part of labor costs in an amount not exceeding 20% of the amount of wages.

Of course, such a radical change in guidance puts conscientious taxpayers in a quandary. The situation requires its logical conclusion.

It should be noted that in arbitration practice there is no conclusion that for the purpose of calculating income tax, only 20% of the specified labor costs can be recognized. In the resolution of the Federal Antimonopoly Service of the Federal Antimonopoly Service dated December 6, 2006 No. F03-A51/06-2/4410, it was recognized as legitimate to include as expenses when calculating income tax the taxpayer’s expenses for paying for the accommodation of foreign workers in a hotel, as well as for paying for services for the protection of their property, since this was a condition of employment contracts. In the resolution of the Federal Antimonopoly Service of the North-West District dated November 2, 2007 No. A56-47663/2006, the court agreed with the position of the organization, whose accountant reduced taxable profit by the amount of the enterprise’s expenses for paying for the accommodation of its general director and the unified social tax calculated from the amount of payment for accommodation, and also presented to deduct input VAT from the cost of housing rental services.

N. Korolkevich, Lead Auditor of JSC “Gorislavtsev and K. Audit”

Rules for calculating accommodation fees

According to the “Rules for the provision of hotel services in the Russian Federation”, payment for accommodation is made in accordance with a single checkout time - 12 noon of the current day, local time. Accommodation fees begin to be calculated from 12 noon on the date the guest checked in, regardless of the actual hour of check-in.

For stays of less than a day, the fee is charged for the whole day, regardless of the check-out time.

If check-out is delayed by no more than six hours after check-out time (from 12.00 to 17.59), an hourly rate will be charged; if check-out is delayed between 18.00 and 23.59, a half-day fee will be charged. If departure is delayed by more than twelve hours, the fee will be charged per day.

According to the “Rules for the provision of hotel services in the Russian Federation,” the Contractor must ensure the provision of benefits to categories of persons entitled to receive benefits in accordance with current legislation. The list of categories of persons entitled to receive benefits, as well as the list of benefits provided during the provision of services, must be posted in the reception service premises in a convenient place for viewing.

Explanations for examples of calculating accommodation fees:

1. According to the “Rules for the provision of hotel services in the Russian Federation”, if a guest stays in a hotel for less than a day, payment is made for the whole day.

2. The guest begins to pay for accommodation from 12 noon on January 1, since according to the “Rules for the provision of hotel services in the Russian Federation” payment calculation begins from 12 noon (single check-out time) regardless of the guest’s check-in time. Payment is due by 12 noon on January 3rd. In this case, the guest must pay for two days.

3. Payment starts at 12:00 on January 1 and is made until 12:00 on January 3 + hourly payment for 3 hours (from 12 to 15:00), since the guest checks out between 12:00 and 18:00.

4. The room is paid from 12:00 on January 1 and ends at 24:00 on January 3, since the guest checks out between 18:00 and 24:00. During this period, payment is charged for half a day. In this case, the guest must pay for 2.5 days.

5. Payment for accommodation is made from 12 noon on January 1 to 12 noon on January 3. The guest checks out between 0 and 12 noon on January 3, so payment is charged for a full day.

In some cases, an extra bed or folding bed may be added to the room. This happens when there are no rooms in the hotel or if tourists want to stay in one room, but the hotel does not have available multi-bed rooms. An extra bed is also provided for a child if the guest so desires. Payment for an additional bed is made in the amount of 80% of the main bed in a standard room and 100% in a higher category room.

Payment for hotel services

Before a business trip, it is advisable to find out what documents certifying accommodation are issued by the hotel. You should check with your organization's accounting department whether the hotel invoice will be considered a strict reporting form. Some companies require additional documents.

The Key Element Hotel in Moscow provides documents for business travelers confirming the duration of their stay and the cost of hotel accommodation:

- cash receipt;

- check;

- act of residence;

- copy of OGRN;

- copy of TIN;

- a copy of the notice of transition to a simplified taxation system.

Both the posted employee and the employer can make the payment. The Key Element Hotel has several payment methods to choose from:

- cash at the hotel (upon check-in);

- by bank card (Visa or MasterCard);

- non-cash transfer.

Documents from the hotel are proof of expenses and are issued for business travelers in accordance with established rules. In the absence of documents, it is impossible to verify the fact of staying at the hotel and the reasonableness of the costs.

For government employees, a paper hotel receipt is often required. In commercial companies, reporting schemes may be different. When paying by bank transfer, the hotel issues an invoice with VAT included.