Hello! In this article we will talk about “white” wages.

Today you will learn:

- What does white salary consist of?

- What signs indicate an official salary and what are its advantages;

- Why is it beneficial to use black and gray earnings in labor relations?

In labor legislation there is not and will not be any other salary other than the official one. Theoretically, in an ideal society, all accrued earnings should be reflected in accounting documents and, therefore, taxes should be paid on the entire amount to the state treasury. But in practice, that is, in real life, the ideal scheme is violated, and along with the phenomena of illegal wages, the concepts of white, gray and black wages entered the colloquial language and took root.

A little about salary in general

Wages are remuneration for an employee’s labor expressed in monetary form.

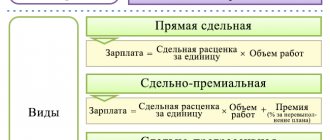

Its level depends on the complexity and amount of work, conditions, and qualifications of the performer. If work is paid based on a time period, the salary is time-based. If it is possible to keep track of the work performed, piecework payment is often used.

Salary is a broad and collective concept; it consists of several points that may differ in different organizations. But in general, salary refers to the total amount that the performer receives after deducting all taxes. All items can be easily tracked in the payslip, or “settlement”, which is issued to the employee every month.

Complaint to the Federal Tax Service and the Labor Inspectorate

You can write a complaint about the payment of black wages in free form, but to speed up the consideration of the application it is better to use a template.

You can submit in three simple ways:

- contact the Federal Tax Service or TI in person: come to the office and submit a completed application

- send via a form on the official website of one of the services

- send a message by mail: registered letter to the address of the territorial office of the service

The processing time for an application is usually 30 days.

What does white wages consist of?

White salary means official. What does it include? Let's consider.

| Wage component | Peculiarities |

| Salary | Appears in the employment contract and order. It is for this amount that the employee “sells” his labor to the employer. This amount is a lower threshold, but guaranteed. Depends on the level of qualifications and work experience of the person hired |

| Prize | Individual or collective - as an incentive for fulfilling bonus conditions prescribed by the company in internal documents, for example, in the regulations on remuneration |

| Income in kind | Present if the company provides the employee with housing or food free of charge. The calculation must indicate the value of such income calculated for a given employee. For what? Despite the fact that the company pays for the employee’s housing and food, he is required to pay 13% income tax on this income. |

| Sick leave | The calculation takes into account a percentage of average earnings, depending on the employee’s length of service and earnings. If the employee manages to provide sick leave, sick leave is accrued and paid in the same billing period in which he was sick |

| Vacation pay | Calculated based on average earnings for the previous 12 months. Vacation pay must be included in the calculation for the period in which the employee went on vacation |

| Compensation bonus | Additional payment for some inconveniences in work activities. For example, working at night and overtime, on public holidays |

| Incentive bonus | It is added to the salary individually for length of service, academic degree, and contribution to the company. For example, an employer can set a salary increase of a fixed amount for every six months of experience in order to “fix” experienced workers |

| Regional coefficient | Otherwise – “northern coefficient”. Legally guaranteed indexation of certain wage points for work in difficult climatic conditions. The coefficient depends on the region. For example, in the Sakhalin region, salaries are multiplied by a factor of 2.0 (the highest), and in Novosibirsk - only by 1.15 (the lowest possible) |

Legislation

By the way, according to the law, there are no “multi-colored” salaries. There is only one - official, regulated by Section VI of the Labor Code.

The employer himself sets the amount and procedure for payment, recording this in internal documents. According to the Labor Code, he must meet two conditions:

- The employee's salary must be no less than the minimum wage established by the state.

- Payments are made at least twice a month.

In addition, there is the Tax Code of the Russian Federation, which considers wages to be the income of an individual and obliges him to pay an income tax of 13-30%.

Signs of white wages

Official wages must meet the requirements stipulated by law. They represent mandatory characteristics of legal remuneration for work. It is not for nothing that the white color symbolizes the honesty and transparency of all the activities of the enterprise.

| Item characteristics | Description |

| Employment | An employee is hired officially, that is, he is on the staff. Has rights and obligations documented in the employment contract, employment order, salary regulations |

| Salary | Fully reflected in all of the above documents |

| Payment method | It is issued either in cash through the cash desk in the organization itself, or transferred to a bank card. As a rule, a large organization enters into a service agreement with a bank, and all employees are issued cards to avoid queues in the accounting department on payday. |

| Payout frequency | By law, payments must be made at least twice a month. This is an advance and the salary itself. The exact dates are set by the employer himself |

| Pay slip | All employees are given pay slips along with their salaries, where all payments are spelled out in detail and each bonus is spelled out. The sheet also shows the amount of income tax deducted. The employer is obliged to withhold income tax from salaries and pay it to the budget. The very presence of a detailed payslip indicates transparent accounting and that the organization is not hiding anything. |

| Employment history | The book is filled out in full accordance with the Labor Code: indicating the terms of work, position and reason for dismissal |

Employer's responsibility to pay salary

An employer who does not pay wages on time may be subject to the following liability:

- Disciplinary. Provided by Art. 192 of the Civil Code of the Russian Federation - implies a reprimand, reprimand or dismissal of the responsible person.

- Material. Regulated by art. 234 of the Civil Code of the Russian Federation - the employee is compensated for delayed wages.

- Administrative. Liability is provided in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation - a fine of up to 70,000 rubles is issued.

- Criminal. Arrest for up to two years is expected if intentional retention is discovered during the investigation.

Responsibility is imposed on an individual basis.

Advantages of white wages

| Item characteristics | Description |

| Security | The employee has all the supporting documents in his hands; the employer will not be able to infringe on his rights, for example, by groundlessly depriving him of payments. Employee-employer relations in the financial aspect are as transparent as possible for both parties, manipulations are kept to a minimum |

| Prospects | The “whiteness” of salaries indicates the solidity and reliability of the company. Such companies value their reputation and are aimed at long-term cooperation with both partners and employees. Therefore, you can think about a career in this organization |

| Credit history | With the active development of lending systems, the issue of income confirmation, in particular, the 2-NDFL certificate, has become acute. It lists the person’s income by month for the requested period; on the basis of this certificate, the bank makes a decision on granting a loan or mortgage. A certificate that corresponds to reality can only be issued by the accounting department of “white” employers |

| Decent pension | The official employer, among other social contributions, makes payments to the pension fund, and at its own expense. Their size directly depends on the amount of accrued wages |

| No questions from the tax authorities | All purchased goods with a white salary will be easily explained - otherwise the origin of expensive purchases will be difficult to justify |

| Guaranteed minimum wage | According to the law, the employer will not be able to pay less than the minimum approved by the state. The minimum wage differs in different regions of the Russian Federation. The federal minimum wage from January 2021 was 11,280 rubles. |

Insurance premiums for a white salary - where and how much

An employee costs the employer much more than the amount of his salary. Why? As you know, the employee pays an income tax of 13% from his salary - only the responsibility for transferring these funds to the budget lies with the employer (non-residents of the country pay a 30% income tax).

But the employer himself must transfer a certain amount for his employee to state extra-budgetary funds in addition to the amount that he has already paid to the employee as salary. It is not surprising that salaries are in fact the largest expense item for most employers.

Until 2010, there was the so-called Unified Social Tax (UST). Now the single tax has been replaced by several contributions - to the Pension Fund and social insurance funds, but the essence has not changed - only now the payments are split.

The tax rate for each deduction is calculated for all employees separately.

If we assume that the enterprise does not have the right to use reduced rates, then the employer transfers the following percentages of accrued wages to the funds:

| Fund | % deduction from salary | Example with a salary of 40,000 rubles. – deduction amount, rub. |

| Pension Fund of Russia (PFR) – insurance and savings part | 22% | 8 800 |

| Federal Compulsory Medical Insurance Fund (FFOMS) | 5,1% | 2 040 |

| Social Insurance Fund (SIF) – ability to work, maternity | 2,9% | 1 160 |

| FSS – injuries. From 0.2% to 8.5% depending on the class of professional risk | 0,2% | 80 |

| Total | 30,2% | 12 080 |

The taxable base is all the employee’s salary accruals before deduction of income tax.

However, a business may qualify for the calculation of these deductions at reduced rates, or may stop paying these taxes altogether. This is possible if the employee’s cumulative salary for the year has reached the legal limit. For each fund they are presented in their own amounts.

Legislative framework

– he does not have the right to pay wages less than the minimum wage;

– the frequency of salary payments should be once every six months.

It should be noted that the official salary represents the income of an individual. The Tax Code of the Russian Federation requires that the amount of income tax, which is 13-30%, be deducted from it. Only after this payment is withdrawn from the salary are all other deductions taken.

What are black and gray salaries

Black wages mean monetary remuneration that is not reflected in the company’s accounting records. At the same time, the employee not only has no official income, but also does not appear on the company’s staff at all.

He receives his salary in an envelope based on a verbal agreement with the employer. The use of such labor is illegal and risks administrative and, in some cases, criminal liability.

Workers on black wages are not socially protected in any way and are completely dependent on the employer. All the benefits provided for in official employment - paid sick leave, vacation, contributions to the pension fund - are lost here.

Gray wages are an intermediate option between black and white wages; they are also illegal. Its peculiarity is that a worker on a gray salary is officially employed, receives part of his salary officially, and part is given to him in person.

A common option for unscrupulous but fearful employers: they are afraid of openly breaking the law by doing dirty work, but at the same time they want to cut costs.

Differences between types of remuneration

Table 2. Main differences between all types of wages.

| View | Differences |

| White | officially enshrined in documents legal protects the rights of the employee and makes it impossible for him to deceive |

| Gray | legal and officially listed in the accounting records divided into two parts - official and black legal protection of an employee’s salary is possible, but only for the official part |

| Black | illegal is not listed in any documents, and the person is not an employee of the company protection of rights upon receipt is impossible |

The choice of one type or another should be based not only on short-term, but also on long-term benefits.