Formation of an insurance pension

This type of pension provision in the form of an insurance pension is established for all citizens born in 1966.

Persons born in 1967 have the opportunity to choose to pay an insurance premium for an insurance pension or a funded pension.

- Having abandoned pension savings, a citizen forms only an insurance pension. Accordingly, the employer will transfer insurance payments for him to the Pension Fund in the amount of 22%, from which 16% goes to the insurance pension. These percentages are recorded on the personal account of the insured person and then recalculated (translated) into points.

- If you choose a funded pension, contributions to it will be 6%, the remaining interest will go to insurance pension payments.

In 2014-2020 The state took a kind of pause, redirecting all payments to insurance premiums. This step will reduce the PFR budget deficit for current payments to pensioners and increase the security of existing savings, because During this time, all NPFs will have to go through the corporatization procedure and will then be included by the Central Bank in the register, guaranteeing the safety of accumulated funds.

The insurance pension payment is formed from insurance contributions, guaranteed by the state and increased annually by an indexation factor.

Press about insurance, insurance companies and the insurance market

All the most important things that were reflected in the mirror of several hundred newspapers, magazines and news agencies. The section is updated throughout the working day. Follow the updates using the “Newsletter” or “Section Statistics” on the main page of the portal. To view publications that appeared on the Insurance Today website on a specific day, use the calendar on the current page. Here you can make a selection of articles from a specific publication. To select materials about insurance for several days or for any other period of time, use the “Advanced Search”. A selection by topic is also possible. The editors of the portal are not responsible for the inaccuracy, unreliability or incorrectness of the information contained in the publications, and do not make any corrections to them except for obvious typos.

| Travel Business, April 5, 2001 Question from practice — What is the difference between an insurance contract, an insurance policy, an insurance certificate and an insurance certificate? — An insurance contract is a document regulating the relationship between the insurance company (insurer), the one who pays insurance premiums (the policyholder) and the person in whose favor the insurance contract is concluded (the insured person). An insurance contract is a legal document that regulates the rights and obligations of the parties in the insurance process. The Civil Code of the Russian Federation establishes strict rules for the validity of an insurance contract. In particular, it must be in writing. The conclusion of an insurance contract is carried out on the basis of a written or oral application from the policyholder. When concluding an insurance contract, the parties (insurer and policyholder) agree on all essential terms of the contract, including: - the object of insurance (medical expenses, unforeseen expenses during the trip, inability to travel, etc.); - about the nature of the event, upon the occurrence of which the insurer’s obligation to make an insurance payment arises (acute illness, accident, theft of documents, delay or loss of luggage by the carrier, flight delay, inability to make a trip, etc.); - about the amount of the insured amount; — about the duration and territory of the agreement; — about the insured person and the beneficiary. An insurance policy, certificate, certificate and even a receipt are allowed by the Civil Code of the Russian Federation to be used as documents confirming the fact of concluding an insurance contract. They can be issued to the policyholder in exchange for an insurance contract and must comply with its essential conditions. These documents may have a standard form. Felix BERUL, head of the tourism insurance department of the Spasskie Vorota Group All press for April 5, 2001 See other materials on this topic: Insurance Law |

Types of insurance

In the Russian Federation, there are the following types of insurance pensions.

By old age

Provided to Russians who have reached the age of 60 years (female persons), 65 years (male persons). The main condition is the presence of a minimum work experience and a required number of points. It must be said that certain groups of people have the right to stop working early. This applies to those who work in hazardous conditions or in northern regions.

By disability

This pension can be received by citizens who have not reached the required age and have health problems certified by doctors. If a disabled person has no work experience, he can receive a disability pension.

Upon loss of a breadwinner

It is received by disabled dependents of a deceased person. This group of persons includes:

- sons, daughters, grandsons, granddaughters of the deceased who have not reached the age of majority;

- family members of the deceased who study at an educational institution;

- husband/wife, mother and father of the deceased who have reached the required age or have lost their source of income;

- family members of the deceased who do not work and care for his children under 14 years of age;

- family members of the deceased with the status “disabled” (disability group does not matter).

Increased rate

The fixed part of the SP may increase; this happens in cases where a person has received the right to retire, but renounces this right at the moment, when the citizen continues to work after retiring, as well as at the beginning of the year and in April.

The latest options for increasing payments are carried out on a general basis, this is done automatically, that is, in addition you do not need to write any statements or appeals to the Pension Fund. These increases occur by a certain amount, which is established by law depending on the economic situation in the country.

Who is entitled to it?

FV is an amount that is guaranteed by the state; it is paid to those who have grounds for receiving an insurance pension, but it is also necessary to pay attention to exceptions in this matter. FV is paid at the government level to the following categories of citizens:

- Recipients of old-age pensions.

- Disabled people who have the appropriate certificate.

- Persons who have lost their breadwinner and receive pensions on this basis.

This list also has exceptions, they are justified by the relevant legislative norms and are prescribed in Federal Law No. 400. As for the old-age pension, persons who have reached the age that is pensionable in accordance with the law can receive fixed payments; for men and women today this is 55 and 60 years old.

Citizens who have worked in the Far North for at least 15 years and have a total work experience of 20 and 25 years, respectively, for women and men, are also entitled to receive a fixed part of the pension. Orphans and those who have lost their breadwinner must receive such payments.

Size

There is no point in talking about a specific PF figure, since there is no need to be tied to it due to the fact that this amount can change; the relevance for today can be found in the PF; in addition, it can change for each specific citizen.

Reference! There is a category of citizens who can only count on half of the established FP.

What additional payment is added to the basic amount of compensation? If we look at approximate figures, then for 2021 it was 4,558 rubles. It can change in one direction or the other. The main indicators influencing this process are the presence and number of dependents, category of pensioner, availability of bonus coefficients.

Indexing

Indexation of the PV to the insurance pension occurs twice a year without fail. This is done automatically; the government of the country initiates this process. The first time this is carried out at the very beginning of the year, the next indexation is carried out in April.

Since 2021, this procedure for increasing the PV has been resumed, and last year this process was replaced by a one-time payment instead of the April indexation, then pensioners received 5 thousand rubles. And the first one was several times smaller when compared with previous indexations. At that time it was only 4%, but at the same time inflation in the country was over 12%.

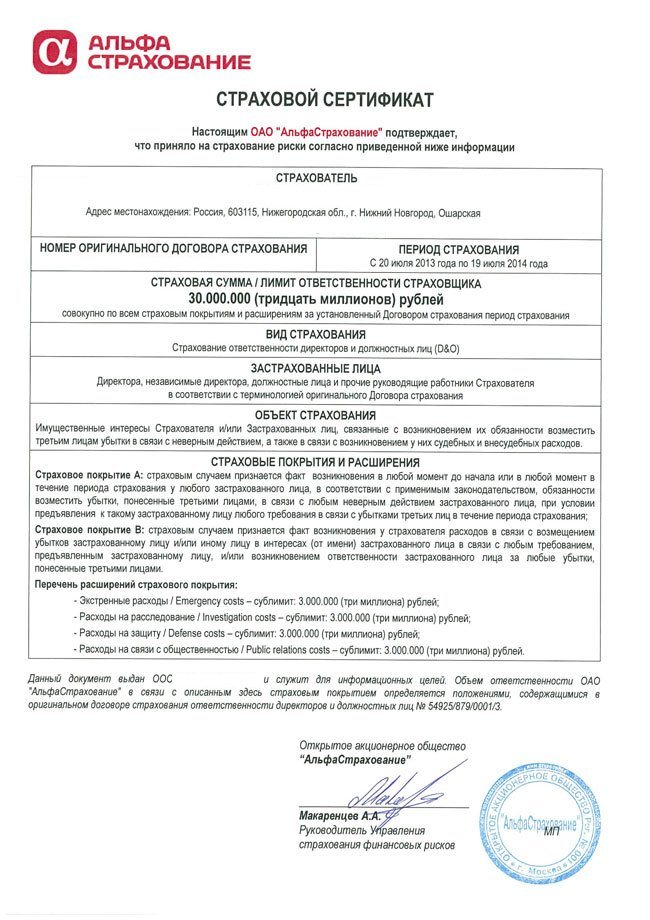

Structure of an insurance certificate

In its structure, the insurance certificate is a document executed on the company’s letterhead, which must contain the following information:

- The name of the form itself and its number.

- The name of the insurance company, its legal address, as well as details.

- FULL NAME. or the name of the policyholder and his address.

- The type of insurance that is prescribed in accordance with the concluded agreement.

- The conditions under which the insurance contract is concluded (whether a deductible applies, if so, in what proportion), and links to the rules of risk protection.

- The territory covered by the certificate received from the insurance company or broker.

- The period during which the received certificate is valid.

- The type of risks against which the object is insured.

- The amount that the insurance company undertakes to pay if an insured event occurs. If the document does not indicate the amount of payment, then the entry “Premium Agreed” must be written.

- The amount of payments that the policyholder is required to make, as well as the period during which he must do this.

- Signature and seal by the insurer. It is also possible to mark the receipt of a certificate from the policyholder.

If it is necessary to include any additional information in the document, it can be entered with the mutual consent of the parties involved in the transaction.

According to Article 941 of the Civil Code of the Russian Federation, when insuring the same type of property on the same conditions, a general policy can be used as an agreement between the insurer and the policyholder. The certificate is issued to the policyholder only after the general policy has been issued and is proof of its existence.

Example of an insurance certificate.

What is social pension

Today, pensions in the Russian Federation for older people are of several types:

- Insurance. Received by persons who have reached retirement age and have appropriate insurance experience.

- State. Paid to military personnel, WWII participants, liquidators of radiation accidents and man-made disasters, and municipal employees.

- Social. Intended for unemployed disabled people and people who do not have enough insurance coverage.

Each of them is divided into subtypes depending on the conditions necessary to obtain it. A social pension is a fixed monetary allowance allocated from the federal budget to people who, due to psychophysical development, illness, current life situation, have not worked at all or their existing work experience does not give them the opportunity to receive another type of pension.

Difference from insurance

In order to understand how social pension differs from insurance, it is necessary to identify the conditions under which the latter is allocated. Social benefits for old age in 2021 are assigned if at least one of the circumstances is not met. The main one is reaching the age limit. It is 60 for men and 55 for women, although sometimes people can retire earlier (this issue is regulated by separate regulations). Additionally, you need to have a certain pension coefficient:

- 2017 – 11,4;

- 2018 – 13,8;

- 2019 – 15.2 and. etc. in increments of 2.4 until the reading reaches 30 by 2025.

Another condition that must be met is the presence of a certain length of employment, provided that all this time deductions have been made from the worker’s salary to the Pension Fund. For 2021 this figure is 8 years, and for 2018 it will be set at 9 years. Then it will continue to increase:

- 2019 – 10;

- 2020 – 11;

- 2021 – 12;

- 2022 – 13;

- 2023 – 14;

- from 2024 – 15.

The social pension is financed from the federal budget, while the insurance pension is financed from the budget formed by the Pension Fund of the Russian Federation, which is formed from:

- insurance premiums;

- deductions from the unified social tax;

- federal budget funds;

- funds received through capitalization, etc.

Key differences between social pensions and other types of pension payments

For a certain time, there were many shortcomings in pension legislation. In 2010, all problems were eliminated, and the assignment of pensions became fair. Any citizen of the Russian Federation who is not a recipient of a labor pension has the right to receive a social pension. In this case, you must comply with certain requirements of current legislation.

Four categories of citizens have the right to receive social pensions:

- People who do not meet the requirements of current pension legislation regarding the calculation of a labor pension.

- Persons who submitted documents for the assignment of a labor pension, but withdrew them because the amount of the pension was determined for them.

- Citizens of the Russian Federation who have the right to receive a labor pension, but have not applied to the relevant authorities to calculate it.

- Pensioners are recipients of a labor pension who have refused this payment by submitting a written application approved by law to the Pension Fund authorities.

Based on current legislation, only one pension can be assigned to one citizen of the Russian Federation who meets the requirements of the Pension Fund. If a person qualifies for several categories of pension benefits, then he must decide which payment would be the best option for him.

Popular questions

It is worth considering frequently asked questions.

What is the amount of the minimum social pension?

For better clarity, information about the minimum benefit values is presented in the table.

| № | Category | Amount (RUB/month) |

| 1. | Persons with disabilities 3 groups | RUB 4,491.30 |

| 2. | Pensioners | RUB 5,283.84 |

| 3. | Persons with disabilities 2nd group | |

| 4. | Children left without a breadwinner | |

| 5. | Children who have lost both parents | RUB 10,567.73 |

| 6. | Persons with disabilities of group 1 | |

| 7. | Persons with disabilities 2nd group since childhood | |

| 8. | Disabled children or persons with disabilities of group 1 since childhood | RUB 12,681.09 |

Delivery of pensions to minor pensioners

Transfer of funds is carried out by transferring the amount to an account through a credit company or through a postal service company.

Payment delivery can be made both to the minor and to his legal representative. The pension is credited to a separate account opened by the guardian (or parent). Funds can be written off without notifying guardianship authorities and other similar organizations.

Upon reaching the age of 14, a citizen has the right to independently receive and dispose of a pension via mail.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

What are insurance pensions?

Insurance pensions in the Russian Federation are divided according to the conditions of assignment and recipients. The calculation method and the final payment amount depend on the type. There are three main groups:

- by old age;

- on disability;

- on the loss of a breadwinner.

For information: to obtain insurance coverage, you must contact your local Pension Fund office. Specialists are given ten working days to study the documents and determine the legality of the application. The pension payment is assigned from the date of application or provision of the necessary papers, but not before the right to it arises. The applicant has three months to complete the documents.

Requirements for assigning old-age insurance benefits

Any application for accrual of insurance payments must be accompanied by documents certifying the right to such. The conditions for granting an old-age pension are:

- Reaching the age limit, the criteria for which were changed from 01/01/2019:

- 60 years for women;

- 65 - for men;

- Minimum experience;

- A certain number of points.

Important: Over the next 7 years, there will be a provision for a gradual increase in the age for retirement. Download for viewing and printing:. Law No. 400-FZ, approved on December 28, 2013, contains a condition for a gradual increase in the last two indicators:

Law No. 400-FZ, approved on December 28, 2013, contains a condition for a gradual increase in the last two indicators:

| Year of application to the Pension Fund | Minimum length of service (years) | Lowest number of pension points |

| 2019 | 10 | 16,2 |

| 2020 | 11 | 18,6 |

| 2021 | 12 | 21 |

| 2022 | 13 | 23,4 |

| 2023 | 14 | 25,8 |

| 2024 | 15 | 28,2 |

| 2025 | 15 | 30 |

Attention: pension points or coefficients are determined by the amount of insurance contributions

Their total amount affects the assigned content. Important! From 2025, the point system for pension calculations will cease to exist

What will be used instead in the calculation algorithms has not yet been specified.

The point system of pension calculations will cease to exist. What will be used instead in the calculation algorithms has not yet been specified.

Disability pension

Citizens who have lost the opportunity to work and receive a salary receive social support from the state. The grounds for its provision are written down in Law No. 181-FZ of November 24, 1995. The conditions for assigning a disability pension are:

- determination of disability by medical and social examination bodies (MSE);

- the ability to confirm the insurance period (without taking into account the duration).

The new legislation does not take into account the causes of disability. In addition, social benefits are due to a citizen who, in principle, has experience. Even one day for which the employer transferred the contribution to the Pension Fund of Russia will be enough.

Attention: if a person does not have work experience, then he is assigned a social benefit. In particular, disabled children receive this

Download for viewing and printing:

Survivor's insurance pension

In order to support disabled relatives of a deceased person, they are assigned a pension. Its amount depends on the coefficient earned by the deceased. The following persons may qualify for this payment:

- Dependents who are members of the deceased's family. The main criterion is the inability to earn money on your own. Among other things, preferential grounds for receiving a pension include the fact that a young person is studying full-time and has not reached the age of 23.

- The parent or spouse of the deceased caring for his children (under 14 years of age). This group includes brothers and sisters, grandchildren and other relatives. The main criterion is the absence of an able-bodied parent living with the child.

- In some cases, a pension is assigned to a person who was not previously a dependent of the deceased. This happens when a person loses other sources of income. At the same time, the decision to assign a payment is not affected by how much time has passed since the death.

Conditions for applying for a pension in connection with the loss of a breadwinner:

- the former breadwinner has a minimum insurance period (at least one day);

- lack of evidence of a criminal act on the part of the applicant that led to the death of the breadwinner.

Important: the same type of maintenance at the expense of the Pension Fund budget is assigned in favor of a family whose breadwinner is declared missing.

Types of policies

Policies correspond to a specific insurance product. Property policies are divided into comprehensive insurance policies, real estate insurance, cargo insurance, household property insurance, goods in circulation or in storage, and so on. Personal insurance includes voluntary medical insurance, accident and life insurance policies. In voluntary types, the policy design is developed by the insurer in accordance with its brand. But in essence, they differ little from each other, since there are legal requirements regarding what sections the policy must contain.

"Boxed" policy

Today there are many combined products on the market, they are called “boxed” and involve insurance for individuals. This means that one document combines several types of insurance. One such policy can almost completely satisfy a citizen’s needs for insurance protection.

Typically, the “boxes” include property insurance (apartment, country house, residential building), protection of the policyholder himself and his family from an accident, and civil liability of the policyholder, for example, to neighbors (strait, etc.). The peculiarity of a “boxed” policy is that its insurance conditions are standardized. It is impossible to change them, because the insurance premium is calculated specifically for them.

General policy

Policyholders – legal entities – are more familiar with this type of document. It is practiced in cargo insurance (Article 941 of the Civil Code of the Russian Federation). Typically, it insures regular deliveries of equipment, goods and any other cargo. Such a policy agreement is usually concluded for a year. It stipulates all insurance conditions, the nature of the goods, conditions and type of transportation, and so on. In the future, the policyholder is only required to provide the insurer with certain documents for each shipment.

Group insurance policy

Such a policy is also issued when insuring a legal entity. As a rule, it is not the main document, but only an annex to the collective accident insurance or VHI agreement. In accident insurance, the policy contains the following information:

- name of the insured;

- number of insured employees;

- the total insurance amount under the contract;

- validity;

- insurer's liability.

In VHI, such a policy may contain a name list of insured workers assigned to one medical institution for medical care. It specifies the duration of the contract, the list of services that the insurer undertakes to pay and individual insurance amounts. A copy of the policy is usually sent to the health care facility (health care facility). However, it is not necessary for insured persons to have individual policies.

Compulsory state insurance policies

Mandatory policies have a single design standard, such as a compulsory motor liability insurance or compulsory medical insurance policy.

Today, passengers of any type of transport - air, sea or public land (including minibuses) - automatically receive insurance protection. This is an initiative enshrined at the legislative level. An insured event is considered to be an injury sustained by a passenger during a trip. The policy is a travel document - a ticket. The cost of insurance is already included in the price of travel.

Few people know that a ticket on a bus, trolleybus, tram or minibus is an opportunity to obtain insurance coverage in the event of an injury in transport. In minibus taxis, many people generally neglect it. And in vain! What does a regular ticket give? It is proof that the injured passenger was traveling on this particular bus, on this particular day and hour. Ticket numbers are recorded daily and assigned to a specific vehicle. Passengers on benefits should pay attention to this, because most often the conductor “forgets” to give them a ticket.

Similarities and differences between pensions: table

| Criterion | Insurance pension | Social pension |

| Retirement age | 60 years (men) 55 years (women) * | 65 years (men) 60 years (women) |

| Minimum experience | From 9 (upon retirement in 2021) to 15 (2024) years | Doesn't matter |

| Minimum IPC | From 13.8 (2018) to 30 (estimated - 2025) | Doesn't matter |

| Early registration | 2 years before retirement age when laid off from work (and when occupying positions that give the right to early retirement) | Not provided |

| Indexing | For a non-working pensioner - taking into account inflation | Similar, but in an amount that is usually smaller compared to an insurance pension |

| Is it paid upon employment? | Yes (in some cases with reduced indexing or without indexing) | No |

| Can it be transferred to the management of a non-state pension fund? | Yes (funded part of pension) | No |

| Size | According to the rules established by Law 400-FZ The expected average pension in 2021 is RUB 14,400. | At least the subsistence level in the region (for pensioners) If the PM in the region is federal, then in 2021 it is equal to 8078 rubles. |

* When a person lives in the Far North (applicable to both types of pensions), when performing certain types of heavy work and when working in harmful and dangerous working conditions (in the case of an insurance pension), the retirement age can be significantly reduced.

Despite the undeniability of the differences between a social pension and an insurance pension discussed above, it is fair to say that the first is intended for a situational (temporary or permanent) replacement of the second. That is, a social pension is issued, first of all, for the reason that a person does not have the right, due to a lack of experience or a lack of IPC, to apply for a regular insurance pension, while the state needs to provide him with at least some financial support in old age .

Payments to working pensioners

Citizens who have reached retirement age but continue to work retain the right to receive the insurance portion of their pension. It is prescribed in this situation according to general provisions. The only difference is that working pensioners are not entitled to annual indexation of the amount of payments. However, after retirement, their pension will be indexed in full, reaching the same amount as that of other pensioners.

Conditions of appointment

To register a payment to a working pensioner, you need to contact the territorial department of the pension fund. This can be done by personally coming to his office, or by submitting documents through the MFC, the State Services portal, or by sending by mail.

If a pensioner stops working, there is no need to notify PF employees about this. The employer is obliged to independently, within 24 hours, notify the pension authorities about this.

Types of policies

Policies correspond to a specific insurance product. Property policies are divided into comprehensive insurance policies, real estate insurance, cargo insurance, household property insurance, goods in circulation or in storage, and so on. Personal insurance includes voluntary medical insurance, accident and life insurance policies. In voluntary types, the policy design is developed by the insurer in accordance with its brand. But in essence, they differ little from each other, since there are legal requirements regarding what sections the policy must contain.

"Boxed" policy

Today there are many combined products on the market, they are called “boxed” and involve insurance for individuals. This means that one document combines several types of insurance. One such policy can almost completely satisfy a citizen’s needs for insurance protection.

Typically, the “boxes” include property insurance (apartment, country house, residential building), protection of the policyholder himself and his family from an accident, and civil liability of the policyholder, for example, to neighbors (strait, etc.). The peculiarity of a “boxed” policy is that its insurance conditions are standardized. It is impossible to change them, because the insurance premium is calculated specifically for them.

General policy

Policyholders – legal entities – are more familiar with this type of document. It is practiced in cargo insurance (Article 941 of the Civil Code of the Russian Federation). Typically, it insures regular deliveries of equipment, goods and any other cargo. Such a policy agreement is usually concluded for a year. It stipulates all insurance conditions, the nature of the goods, conditions and type of transportation, and so on. In the future, the policyholder is only required to provide the insurer with certain documents for each shipment.

Group insurance policy

Such a policy is also issued when insuring a legal entity. As a rule, it is not the main document, but only an annex to the collective accident insurance or VHI agreement. In accident insurance, the policy contains the following information:

- name of the insured;

- number of insured employees;

- the total insurance amount under the contract;

- validity;

- insurer's liability.

In VHI, such a policy may contain a name list of insured workers assigned to one medical institution for medical care. It specifies the duration of the contract, the list of services that the insurer undertakes to pay and individual insurance amounts. A copy of the policy is usually sent to the health care facility (health care facility). However, it is not necessary for insured persons to have individual policies.

Compulsory state insurance policies

Mandatory policies have a single design standard, such as a compulsory motor liability insurance or compulsory medical insurance policy.

Today, passengers of any type of transport - air, sea or public land (including minibuses) - automatically receive insurance protection. This is an initiative enshrined at the legislative level. An insured event is considered to be an injury sustained by a passenger during a trip. The policy is a travel document - a ticket. The cost of insurance is already included in the price of travel.

Few people know that a ticket on a bus, trolleybus, tram or minibus is an opportunity to obtain insurance coverage in the event of an injury in transport. In minibus taxis, many people generally neglect it. And in vain! What does a regular ticket give? It is proof that the injured passenger was traveling on this particular bus, on this particular day and hour. Ticket numbers are recorded daily and assigned to a specific vehicle. Passengers on benefits should pay attention to this, because most often the conductor “forgets” to give them a ticket.

Payment of labor pension

All types of insurance pensions are paid monthly for the current period. A pensioner can receive a pension payment personally or through a proxy. The pension established for the child is received by one of the parents or guardian. A fourteen-year-old child can receive a pension independently.

The method of delivery of pension payments is chosen by the citizen when writing an application for appointment. However, this method may be by submitting a corresponding application to the Pension Fund.

Payment of pension benefits is carried out:

- through post office institutions (at home or at the post office);

- through the bank.

Suspension and termination of payment

The following circumstances are grounds for suspending pension payments:

- failure to receive such payments within six months;

- failure of a disabled citizen to appear for the next re-examination;

- the pension recipient has reached the age of majority and has no documents confirming his full-time studies, or has completed his studies after the age of 18;

- termination of the residence permit;

- receipt of documents on the departure of a pensioner for permanent residence in a foreign state, with which an agreement has been concluded on the obligations of this state to provide pensions to our citizens;

- receipt of documents on moving for permanent residence to a foreign country with which an international treaty has not been concluded, and the absence of an application to leave Russia.

The suspension or termination of payment of the pension amount is carried out from the 1st day following the month in which such circumstances occurred.

The following circumstances are grounds for termination of pension payments:

- death of the pension recipient or recognition as missing;

- the expiration of six months from the date of suspension of payment;

- loss of the right to an assigned type of pension;

- failure by a foreign citizen or stateless person to provide a residence permit;

- refusal to receive insurance payment.

It should be remembered that a citizen is obliged to promptly notify the Pension Fund of the Russian Federation about circumstances entailing the suspension or termination of pension provision.

What is the difference between a contract and a policy?

The main difference between a certificate and a contract is that it only confirms the very fact of the existence of an insurance agreement, but does not contain all the conditions specified in it and is not an independent document. The certificate received from the insurer does not indicate the validity period of the main document; there you can only find the period of validity of protection in the event of a risk event. Also, the certificate will not be able to find the consequences that may arise if the policyholder makes insurance contributions late or does not make them at all.

In addition, the insurance contract is always signed in 2 copies (one for each party), while a policy or certificate can be issued to each beneficiary to confirm that he is the insured person. This can happen if an organization signs a collective insurance agreement, and the insurance company issues each employee of the enterprise a document confirming his insurance.

Of course, no certificate will be valid unless there is a signed contract behind it.

If we compare the concepts of a certificate and a policy, many people mistakenly identify them, believing that they are the same document. In reality this is not the case. The insurance policy itself is an agreement or an extract from it, where all the conditions are indicated. The insurance certificate is an attachment to it to confirm the existence of the policy.

Important! Another significant difference is that the policy form is stamped and signed by both parties to the transaction, while the certificate is signed only by the insurer.

Calculation of insurance pension

But if everything is clear in theory, then what about in practice? Many people who can view information about their savings on the official website of the Pension Fund begin to independently calculate their pension. And it can be done. For this, a special calculation formula is used:

P = IPK * SPK, where:

IPC is the individual coefficient discussed earlier; SPK - the value of the coefficient at the time of assignment of pension payments.

But, independently calculating the exact value of the IPC and SPK is not so simple; there are a lot of subtleties and nuances that the average citizen is unlikely to know about. In order to at least roughly estimate the size of future payments, you need to calculate

How are pensions calculated for women who are due to retire this year?

This year, women born in 1964 can begin to receive an old-age pension. This will happen legally. But there are some points about the accrual.

When a woman was born in the first half of the year, she can retire only in the second.

Women born in 1964 can retire in 2021

At the same time, we must remember the general principles. Her work experience must be at least 10 years, and she must also accumulate the required number of points.

If we talk about the minimum amount of pension that she can receive, it is calculated using an understandable formula.

SP = IPC × SPK + FV

SP - the amount of the insurance pension, which is established for each individual;

IPC is the sum of points that a woman accumulated before retirement.

SPK is the value of the individual coefficient;

FV - fixed payment towards pension.

You can calculate the pension amount using a special formula

The above calculations already take into account the 7% increase that was introduced from the beginning of 2021. But there are also cases when the amount will be less than the subsistence level. The value is set for each region separately, and if the payment does not reach it, then with the help of a social supplement it is increased. But this only happens in cases where the pensioner no longer works.

Difference between insurance and social

The main difference between insurance coverage and state coverage is the amount and calculation procedure. Insurance payments are calculated according to a rather complex scheme. Their size is influenced by:

- accumulated experience;

- wage;

- subject of the Russian Federation in which the pensioner worked;

- features of a pension account (with or without a savings component).

When calculating the state pension, neither the length of service nor the number of points matters. The main criteria for registration are reaching the appropriate age, becoming disabled, or losing a breadwinner. At the same time, a higher age is set for her when compared with the previous one.

Also, social and insurance payments differ according to:

- conditions for employment when applying for pension benefits;

- conditions for early payment processing;

- indexing conditions.

Features of insurance and social pensions can be listed in the form of 2 lists. Check them out to understand the differences between these 2 types of financial support.

Features of insurance payments

- age at which you can start receiving – 60 years (men), 55 years (women);

- the minimum required length of service is from 9 (if payments are made in 2018) to 15 (if paid in 2024) years;

- the minimum required number of pension points is from 13.8 (if payments are made in 2021) to 30 (if payments are made in 2024);

- the opportunity to become a pensioner early - 24 months before retirement age in case of layoffs and when hired for a position that gives the right to become a pensioner early;

- can it be transferred to the management of a non-state pension fund - yes;

- Are workers paid - yes.

Features of social payments from the state

- age at which registration is 65 years (men), 60 years (women);

- minimum required experience – not required;

- the minimum required number of pension points is not required;

- there is no opportunity to become a pensioner early;

- can it be transferred to the management of a non-state pension fund - no;

- Are workers paid? No.

The state pension serves as a kind of replacement for the insurance one. Payments from the state cease to be provided if a person begins to receive insurance, so you should not count on receiving 2 types of financial support at the same time.

Formation

What is the insurance part of the pension and how is it paid? After the reform, the entire population of the Russian Federation was divided into 2 groups according to date of birth. The dividing border is considered to be 1967:

- Those born before this year can only receive an insurance type of payment. Thus, the Pension Fund facilitates the system of calculation and distribution between pensioner accounts.

- Those whose date of birth falls after have a choice between 2 types of pension insurance.

Types of compulsory pension insurance.

- Insurance. The employer makes an insurance payment in the amount of 22% of the worker’s salary, 16% of which is transferred to the personal account of the future pensioner and converted into points (the current ratio is 1 point = 78.58 rubles).

- Cumulative. Insurance savings in a pension fund. Here the distribution of 22% is different: 6% goes to the NPF (non-state pension fund) or management company (management company), 10% goes to a personal account in the Pension Fund and is converted into points.

The question arises: where in both cases is another 6% transferred? This amount is a solidary tariff, that is, a fixed payment of social benefits provided for by the country's pension legislation.

Since 2014, a moratorium on the use of endowment insurance has been introduced across the country. This pause is provided for the Central Bank to check NPFs and management companies and enter them into the register. This situation will last until 2021.

Read about how insurance pensions are calculated in different situations, as well as about the specifics of payments for employees of the Ministry of Internal Affairs, Department of Internal Affairs and the Ministry of Emergency Situations, the Federal Penitentiary Service, including how calculations are carried out for employees of the Federal Penitentiary Service, military pensioners and labor veterans, in particular, about increasing their pensions and providing additional payments.

Insurance pension: what is it?

To begin with, we note that the process of reforming the pension system is not so young, and it began back in 2002. A lot has changed over the years. And the main change was that now the pension is not fully provided by the state.

At the moment, any pension payments consist of two parts:

- Storage part. All citizens who officially carried out their labor activities in the period from 2003 to 2013 have it. At the moment, all savings of citizens are frozen. And most likely they will remain so. But don’t panic, no one took the savings anywhere. And if you want to transfer your savings from the Pension Fund to the Non-State Pension Fund, then this can be done very easily. There is no moratorium on such actions. The main thing is to carefully choose a non-state pension fund. In the future, the government plans to move to a system of IPN (individual pension savings), which citizens will form independently.

Thus, it turns out that the size of the insurance pension depends on the following factors:

- From the total length of official work experience;

- From the amount of wages from which the employer made contributions to the Pension Fund;

- On the nature of the assigned pension: for disability, old age, etc.

In 2021, to receive an insurance pension, you must have at least 11 years of work experience and 18.6 points.

And here a completely logical question arises: what is the difference between labor and insurance pensions? To be honest, for the average citizen there are no fundamental differences. Until 2015, most people and even experts identified these two concepts. But after 2015, changes occurred, in particular, new federal laws were adopted that distinguished between these two concepts.

The main difference is the following: an insurance pension is assigned only if a person has enough insurance experience, and not work experience.

And here it is necessary to understand the difference between work experience and insurance experience:

- Work experience is the number of years that an employee has officially worked at the enterprise. There is a record of this fact in the work book. But such a record does not guarantee that during this period the employer paid contributions to the Pension Fund and other social funds;

- The insurance period is exclusively the length of service for which the employer transferred contributions to the Pension Fund.

Dimensions

The amount of pensions is determined by Law No. 400 of December 28, 2013. The payment consists of two amounts:

- The basic part - in 2021 it is 5334.19 rubles. (for disabled people of group 3 and recipients of survivor benefits - 50% of this amount).

- The insurance part, which is calculated by multiplying the individual coefficient and the cost of 1 accumulated point (RUB 87.24 after the last indexation in 2021).

If, upon reaching retirement age, a citizen does not receive benefits and decides to postpone it for a year or more, an increasing factor will be applied when applying. Payments to non-working pensioners are indexed annually, and working ones have the right to recalculation after they quit.

The amounts of social benefits for 2021 are shown in the table:

| Type of payment | Amount, rub. |

| Old-age pension and early pension for indigenous peoples of the north | 5283,85 |

| Survivor's pension for minors and students under 23 years of age | 5283,85 |

| Pension for the loss of a breadwinner for children left without both parents, or a single mother, as well as orphans | 10567,73 |

| Disability pension for children and disabled people since childhood 1 gr. | 12681,09 |

| Pension for disabled people 1 gr., for disabled people since childhood 2 gr. | 10567,73 |

| Disability pension for group 2 | 5283,85 |

| Disability pension for group 3 | 4491,30 |

In order to provide social support to vulnerable segments of the population, the state has established an additional payment for pensioners up to the subsistence level. From the federal budget, every month pensioners are transferred the amount of the difference between the size of the monthly minimum wage in Russia and the assigned benefit, and from the regional budget - a similar payment if the monthly wage in the region is higher than the national average.