The CEO is also a person and periodically has the right to go on vacation. During this period, you should not leave the company headless; it is wiser to transfer the managerial powers to another employee. This collection tells you how to do it correctly. It is also advisable to do this because the general director being on vacation is not a reason to stop the inspection, extend the official period, and so on. This is illustrated with examples from judicial practice. But if the general director still wants to retain the reins of management while on vacation, then at the beginning of the selection he will find an explanation why he has every right to do so.

The CEO can work while on vacation if he wants

As a rule, if a CEO goes on vacation, it is to relax, not to work.

Therefore, he temporarily delegates authority to his deputy or another employee. At the same time, situations are possible when the manager wants to work while on vacation. Let's say he will have time to do work, but he doesn't want to trust the company to anyone else, even for a couple of weeks.

Then the question arises: does the CEO have the right to work on vacation? Will he have the right to remotely give instructions to his subordinates, and will the documents signed by him during his annual leave have legal force?

The Labor Code states that annual leave is one of the types of rest time during which the employee is free from performing work duties and which he can use at his own discretion (Articles 106, 107, 114).

It would seem that the performance of labor duties is excluded by this norm, but this is not so.

The term "free" means freed. Freed from what? Obviously, since it is impossible to be exempt from rights, they are usually deprived of duties, but this is not the case.

This means that any employee, including the general director, is not obliged to work on vacation and the owners of the company cannot force him to do so.

Further in this norm it is written that the employee can use vacation time at his own discretion. Can you extend your discretion to work?

Why not? After all, this norm does not contain a ban on working on vacation. But he could. For example, weekends and non-working holidays are also a type of rest, but in relation to them the code directly states that working on these days is prohibited. An employee can be engaged to work during this time only with his written consent and only if it is necessary to perform unforeseen work (Article 113).

Conclusion: the CEO can work while on vacation.

Another argument in favor of this: working during a period of release from service for a certain period of rest is the same as working during a lunch break.

It is also a type of recreation; in relation to it, the code also does not contain a prohibition to work (Article 108). It is hardly possible to imagine that someone would demand that a document signed by the director during lunch be declared void. Nonsense. The situation is similar with vacations. Argument three: this conclusion is confirmed by the courts. In their opinion, the current legislation does not provide for a ban on an employee performing his official duties while he is on regular leave (Resolution of the Federal Antimonopoly Service of the Moscow District dated May 24, 2010 No. KA-A41/5089-10, Determination of the St. Petersburg City Court dated May 2. 2012 No. 33-6076/2012, Appeal ruling of the Supreme Court of the Republic of Sakha (Yakutia) dated January 14, 2015 No. 33-4778/2014).

Moreover, the judges believe that while on vacation, the powers of the general director are retained even if an acting officer is appointed. Therefore, the signing of a transaction by the manager during this period is not grounds for declaring it invalid (resolutions of the Arbitration Courts of the Moscow District dated October 4, 2017 No. F05-12743/2017, Volga District dated January 14, 2010 No. A12-6003/2009, North Caucasus District dated January 12 .2010 No. A32-408/2009).

Summary: the fact that the head of the company is on vacation does not deprive him of the rights and powers to act on behalf of the company, to represent its interests in all matters determined by law. Any documents signed on behalf of the company by the director have full legal force.

But if he still wants to delegate his powers...

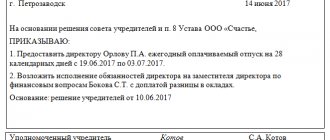

Actions of the HR department

If the director is on vacation and there is no one to sign documents, orders of dismissal, hiring of employees, business trips, vacations, sick leave, etc., then the work of the personnel department is completely paralyzed. Signing contracts and concluding important transactions will become impossible, the financial well-being and the entire production process of the company will be at risk.

There are reliable options for transferring authority when a director goes on leave. There is no need to leave the company unattended. A wise manager, when going on vacation, should leave his deputy a reminder about the deadlines for submitting reports, paying taxes, payments under contracts, and also leave the phone numbers of clients, customers and business partners.

The transfer of powers of the general director is formalized by order

The head of the LLC, going on vacation, issued an order “On the temporary performance of duties,” assigning his duties to another employee.

One of the two participants in the company, who has a 50 percent share in the authorized capital, did not agree with the order. In his opinion, the competence to appoint a manager, both permanent and temporary, belongs only to the general meeting of company participants. This is stated in Art. 40 of the LLC Law.

Motivating in this way, the founder demanded that the court declare the said order invalid.

However, the court refused.

The arbitrators made it clear that no one disputes the right of the general meeting of participants to appoint a sole executive body. At the same time, the authority to appoint a temporary deputy may be granted to the general director by the charter of the LLC.

In this case, the company’s charter states that the powers of the general director of the company include, among other things, the issuance of orders on the appointment of company employees to positions, on their transfer and dismissal. Thus, the charter provides that for the period of his temporary absence (including during vacation), the general director appoints an acting director. Such an appointment is formalized by order.

Consequently, by issuing the contested order, the general director acted within his competence and lawfully gave another employee the right to exercise the powers of the sole executive body of the company. This decision does not violate the requirements of the LLC law.

Resolution of the Federal Antimonopoly Service of the Volga Region dated July 2, 2013 No. A12-25625/2012

Editor's note:

However, one order will not be enough to delegate all the powers of a manager. It gives the acting general director only the labor rights of a boss. To carry out transactions, a power of attorney is still required. This is emphasized in judicial practice: judges write that from the content of the order, according to which the director assigned the duties of the general director to the acting director, it does not follow that the latter was vested with the authority to carry out transactions on behalf of the company (Resolution of the Arbitration Court of the Central Vacation dated 02.02.2015 No. F10-4918/14).

Results

All executives on vacation must first ensure that they are disturbed only as a last resort. And for this it is necessary to take into account the following points:

- If the director has a deputy, he performs all duties. It is necessary not only to consolidate these conditions in the employment agreement, but also to issue a corresponding order.

- If there is no deputy, you can choose a suitable employee from the staff. If such a person is found, then a combination of positions is formalized. An acting employee is a temporary employee who does not have the right to apply for the position assigned to him.

- You can invite an outside specialist. It will cost more, but you don’t have to worry about the state of affairs at the company.

- For all persons replacing the boss, an appropriate power of attorney should be prepared.

- If the head of an enterprise, going on vacation, has not found a person capable of taking on his responsibility, he has the right to sign certain documents. This is the boss's right, although he will have to interrupt his vacation.

- In the case when the boss draws up documents, transferring his powers to another person during his absence, this is a violation of the law. Such documents are disputed in court, which leads to the termination of agreements and large losses. For the violator, such actions may result in dismissal or penalties.

The transfer of powers is also formalized by a power of attorney

The general director of the OJSC issued another employee with a notarized power of attorney to exercise his powers, including the right to sign accounting and other reporting documents on behalf of the company as required by current legislation.

The shareholders filed a lawsuit to declare this power of attorney invalid. They referred to the fact that it, as a unilateral transaction made by the company, is invalid on the grounds specified in Art. 173, 174 of the Civil Code of the Russian Federation, since it was committed without the consent of the legal entity and to the detriment of the interests of society. There were also circumstances that indicated unfair joint actions of the representative and the general director to the detriment of the interests of society.

However, the court rejected the claim, deciding that the issuance of a power of attorney by an unauthorized person was not proven, as well as a violation of the rights of shareholders by issuing the controversial power of attorney.

Resolution of the Arbitration Court of the Central District dated January 15, 2018 No. F10-5609/2017

Editor's note:

To be fair, we note that the courts do not have a consensus on whether the general director has the right to issue a power of attorney to the acting person without receiving permission from the general meeting of participants or shareholders. Some judges still believe that such permission is necessary and without it the power of attorney is invalid (Resolution of the Arbitration Court of the Moscow District dated January 17, 2019 No. F05-22748/2018).

To avoid disagreements, it is necessary to specify in the company's charter who exactly has the authority to appoint an acting general director during his next vacation - the general director or the general meeting of participants (shareholders).

Claims from the tax authorities

A potential risk is also associated with mismatched signatures on documentation. Control services always closely monitor reporting. If it contains the signature of the director, who was supposed to be on vacation during this period, this may be regarded as official forgery. This, in turn, is a criminal offense for which similar liability is imposed.

This once again indicates that if a manager goes on vacation, he should delegate authority to a deputy. This procedure eliminates the risk of possible claims from the tax service or various commercial risks.

Going on vacation for the director of an enterprise is a procedure that is clearly regulated by labor law. At the same time, the question often arises as to whether the manager, while on vacation, can sign official documents or perform other operations. In general, this is not prohibited, but such actions are associated with certain risks. In accordance with the law, when going on vacation, duties should be transferred to another employee who performs the functions of a deputy.

Did you like the article? Share with friends:

The CEO being on vacation is not a reason not to allow inspectors into the office

Representatives of the Federal Accreditation Agency visited the company for an unscheduled on-site inspection.

The organization was a testing laboratory, and in relation to it this government agency was authorized to carry out control measures. However, the company’s employees refused to allow department officials to enter their territory, blocked their access to the premises and did not allow them to familiarize themselves with the required documents.

They motivated their actions by the fact that the general director was on vacation. In his absence, no one else is authorized to represent the interests of the organization during the audit.

The inspectors did not agree with this argument and drew up a protocol against the organization under Part 2 of Art. 19.4.1 Code of Administrative Offenses of the Russian Federation for obstructing an inspection. The judge imposed a fine of 30 thousand rubles.

The company challenged it, but to no avail.

The courts rejected the argument about the director’s leave, pointing out that in violation of the requirements of Part 5 of Art. 12 of Law No. 294-FZ, the company did not fulfill its obligations and did not provide officials of the regulatory body with the opportunity to conduct an inspection.

Resolution of the Moscow City Court dated March 11, 2019 No. 4a-363/2019

Editor's note:

The courts agree on this and emphasize that the main thing is that the company is promptly and properly notified of the date, time and place of the inspection. In this case, she is obliged to provide the opportunity for it to be carried out, including ensuring that either the manager or any other person authorized by him is present on site (decrees of the Samara Regional Court dated 06/05/2017 No. 4a-529/2017, Moscow City Court dated 19.09 .2016 No. 4a-4800/2016, court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated August 27, 2014 No. 4-a-409/2014).

What is the difference between VRIO and IO

Before deciding on the difference between these two concepts, it is necessary to give them a detailed definition:

| Acting | A form of temporary replacement of an employee, when the employee is assigned specific powers, for which he is charged the difference between salaries, according to the staffing table of the actual and main position. But he performs the duties assigned to him only during the vacation, illness or business trip of the main employee and upon his return he begins his immediate duties. |

| AND ABOUT | A form in which positions are combined and an employee of the enterprise performs the duties assigned to him until another person is appointed to the vacant position. The employee is not released from performing his direct functions, and the combination is not marked in the work book. When the main employee returns, he again moves to his main place of work. |

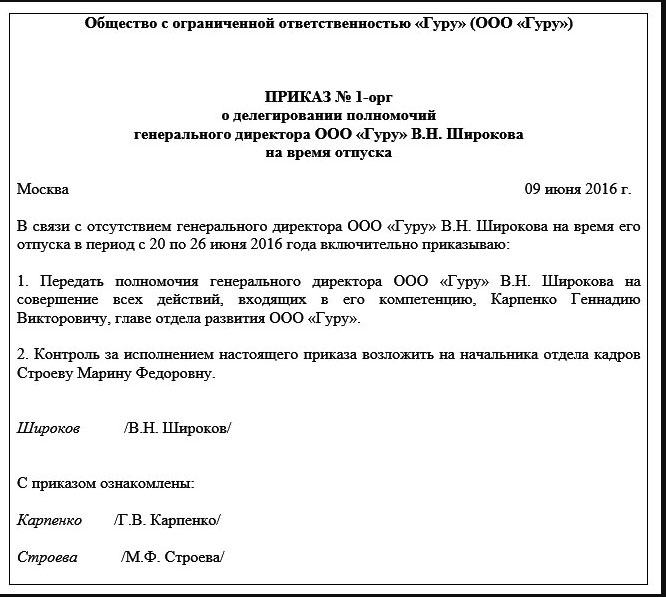

Sample order on transfer of powers

The CEO being on vacation is not a reason to extend the period for appeal

The general director of the company, as an official, was fined under Art.

15.19 of the Code of Administrative Offenses of the Russian Federation for violation of legal requirements relating to the presentation and disclosure of information on financial markets. From the date of delivery or receipt of a copy of the decision, he had 10 days to appeal (30.3 of the Code).

However, he missed this deadline and filed a complaint later. At the same time, his lawyer, who filed a complaint with the court, asked that the reason for missing the deadline be recognized as valid - the general director and the lawyer were on vacation.

The judges refused. They decided that being on vacation does not indicate the impossibility of timely exercise by a person brought to administrative responsibility of the right to appeal a decision in a case of an administrative offense.

There is no other evidence confirming the validity of the reasons for missing the deadline for appeal provided by law.

Thus, the general director had no objective obstacles to filing a complaint in a timely manner.

Resolution of the Supreme Court of the Russian Federation dated March 6, 2019 No. 78-AD19-3

Editor's note:

This is a typical position of judges. They do not recognize the CEO's vacation as a valid reason for missing a deadline. In particular, because such a position is set out in paragraph 10 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 11, 2012 No. 29 (resolution of the Arbitration Courts of the Moscow District dated February 28, 2018 No. F05-2450/2018, Volga District dated September 23, 2015 No. F06- 580/2015, East Siberian District dated 08/31/2011 No. A78-7255/2010).

Manager's business trip

As noted above, a business trip for the director of an enterprise must not only meet all the standards for business trips for an ordinary employee, but also:

- have a goal according to which the business trip is justified and meets the needs for the development or activities of the company;

- be properly formalized in accordance with the requirements of the law and the rules of the organization;

- meet the goal.

Directors

In order for the director of an organization to go on a business trip, it is necessary to develop a clearly defined goal for such a labor action. Moreover, according to the Regulations, the purpose of the manager’s business trip is to perform actions related to the performance of official duties, which are aimed at improving and developing the organization.

Purposes that a director’s business trip may pursue:

- development or opening of a new project that is closely related to the current activity of the organization or is partially related, but is a subsidiary organization;

- conducting an inspection at an existing branch of the company to eliminate suspicions or violations discovered there;

- holding business meetings with potential partners or investors for the development of the organization, preparing presentations and presenting them to such persons;

- opening new branches of the company in other cities both in Russia and abroad, etc.

Often, goals are not reflected in the organization's charters, as they are constantly changing.

The purposes of business trips must be reflected in the order for sending on a business trip, or in a memo, which must be drawn up in order to record the work activities of the manager.

Budget organization

In the case of arranging a business trip for the director of a budget organization, a number of difficulties may arise, since for such a boss it is necessary to prepare not only a standard package of documents, but also to reflect the funds through which the business trip is carried out and travel allowances are paid.

At the same time, before a manager goes on a business trip, it is very important to register the person acting in the duties of the management.

In this case, it is necessary to transfer the director’s powers, as well as to grant the person performing his duties partial rights in relation to other employees during the director’s business trip.

In particular, such persons must, for example, accept explanatory notes from employees, memos, respond to them and perform other actions that are necessary for the normal operation of the organization despite the absence of management.

Requirements

According to Russian law, any business trip must be:

- appropriately designed and aimed at fulfilling the necessary instructions for the development of the organization;

- not related to the implementation of business trips at a permanent workplace;

- limited by a fixed period for the execution of the order or purpose of the trip.

Requirements for activities on business trips can be supplemented by the organization’s management, however, these rules and requirements are the most general and must be followed regardless of the hierarchy of the organization’s employee.

Read more: How to exchange an apartment if it is not privatized

The duration of a business trip for a company director is not limited by law and is set by management independently, while the legislator notes that the duration of a business trip must be “reasonable”, but does not provide any specific figures.

It is noted that the period is set to the extent necessary to fulfill the purpose of the trip or official assignment.

Are you interested in tracking working hours while on a business trip? See here.

The CEO being on vacation is not a reason to delay execution of the order

The Federal Service for Financial Markets issued a fine of 500 thousand rubles to the company for failure to comply with a previously issued order.

Considering this resolution illegal, the company appealed to the arbitration court.

As one of the arguments in favor of canceling it, the company pointed out that it was impossible to fulfill the order on time due to the absence of the general director - he was on vacation at that time.

The court rejected this argument, since this circumstance is of an internal organizational nature for the company.

At the same time, another argument worked: the administrative body committed a significant violation of the order and procedure for holding the company accountable - based on the results of the consideration of the case, it announced only the operative part of the resolution, but issued it in full two days later and another five days later sent the resolution to the company.

This is a violation of Part 1 of Art. 29.11 of the Code of Administrative Offenses of the Russian Federation, by virtue of which the resolution is announced immediately upon completion of the consideration of the case.

The norms of the code do not provide for the possibility of announcing only the operative part of the resolution and subsequently making it in full. This conclusion corresponds to the legal position set out in paragraph 29 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 24, 2005 No. 5.

Consequently, such a procedural action as “announcing the operative part of the resolution” and “making the resolution in full” is a significant and irreparable violation, leading to the impossibility of determining the exact date of the resolution.

In accordance with paragraph 4 of Part 1 of Art. 30.7 of the Code of Administrative Offenses of the Russian Federation, this serves as a basis for canceling the decision in the case.

Resolution of the Federal Antimonopoly Service of the Moscow District dated May 12, 2014 No. F05-2992/14

The director is a worker like the rest

The head of the organization, like all other employees, has the right to annual paid leave (Article 274 of the Labor Code of the Russian Federation). The fact is that managers are fully covered by labor legislation. The duration of a director's vacation must be at least 28 calendar days.

The sequence of staff vacations is established by the vacation schedule. This document is approved by the head of the organization, taking into account the opinion of the trade union organization, and is mandatory for both the employer and the employees (Parts 1, 2 of Article 123 of the Labor Code of the Russian Federation).

For more information, see “Vacation Schedule 2021: Smart Form in Excel.”

Despite the fact that the manager is on vacation, the company continues to operate. In this regard, the participation of the CEO may be required if an important issue is being resolved. Can a director on vacation sign financial documents?

Let us clarify that vacation is granted specifically for the working year, which, in general, is an annual period starting from the moment of employment. Obviously, the length of service for the purposes of calculating vacation depends specifically on the employee’s working year, and not the calendar year. The fact is that the dates of employment in the organization are different for all employees, and it would be illogical to be tied to the calendar year when calculating the length of service that gives the right to leave.

For more information, see “Granting leave: calendar or working year.”

The general director being on vacation is a reason to cancel the protocol and resolution

The FMS fined the company 400 thousand rubles for violating migration norms (Part 4 of Article 18.9 of the Administrative Code of the Russian Federation).

The organization appealed to the court with a demand to declare the decision illegal and cancel it, since on the day the protocol was drawn up, the general director was on vacation. The company sent a message about this to the FMS, further explaining that he did not leave a power of attorney for anyone. But officials ignored this message.

The judges supported the company and canceled the fine, deciding that the prosecution procedure was violated, since the protocol was drawn up in the absence of a legal representative of the company.

As justification, the judges referred to the provisions of Art. 28.2 of the Code of Administrative Offenses of the Russian Federation, which requires the participation of a legal representative of a legal entity in drawing up a protocol, as well as clause 24 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 2, 2004 No. 10, which instructs government agencies to take sufficient measures to notify the person against whom a case of an administrative offense has been initiated, or his legal representative on drawing up a protocol in order to ensure the opportunity to exercise the rights provided for in Art. 28.2 Code of Administrative Offenses of the Russian Federation.

The arbitrators emphasized that since the general director of the company, due to being on vacation, was not notified of the preparation of the protocol, he did not have the opportunity to issue a power of attorney to represent the interests of the company to any other employee of the company.

Resolution of the Federal Antimonopoly Service of the Moscow District dated April 20, 2011 No. KA-A40/3167-11

Editor's note:

This decision was made before the release of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 11, 2012 No. 29, mentioned in a note to one of the previous reviews, which called the CEO’s leave a purely organizational problem of the company itself. Perhaps that is why in this case the judges still sided with the company. Although there is one more argument that is significant: the Resolution of the FAS of the Moscow District concerns the Code of Administrative Offenses of the Russian Federation, while the Resolution of the Plenum of the Supreme Court of the Russian Federation explains the norms of the Arbitration Procedure Code of the Russian Federation. [/box]

Founder's business trip

There are situations when it is necessary to send the founder on a business trip. More precisely, the trip must be registered as a business trip, because the founder is traveling on company business, and the expenses must be taken into account as travel expenses. But he is not an employee of the company, so he cannot be sent on a business trip (Article 166 of the Labor Code of the Russian Federation) and money cannot be given on account. If this rule is neglected, the tax office may have questions.

Read more: Which court considers deprivation of parental rights?

To arrange a business trip for the founder (and at the same time write off expenses in tax accounting, not withhold personal income tax and receive a VAT deduction), you can use three methods.

Employment contract

The first way is to conclude a fixed-term employment contract with the founder and hire him for a position (for example, assistant director) with a minimum salary. Then you can arrange a business trip according to all the rules: with payment for accommodation and daily allowance.

Important! The employment contract must specify the responsibilities related to the business trip: participation in negotiations, preparation for concluding transactions, etc. The salary in this case should not be lower than the minimum wage.

Civil contract

The second way is to conclude a civil law agreement for each “business trip”. Such an agreement must specify specific tasks: what it must do, what result it must obtain.

The contract can be of two types: provision of services and assignments (it is concluded if it is necessary to sign any documents during the trip; a power of attorney is also drawn up for the right to sign documents on behalf of the company).

If a GPA is concluded, the company must reimburse the founder for the costs of this trip or buy tickets, pay for accommodation, etc. In the first case, personal income tax and insurance premiums are not charged for compensation of costs; this amount is included in the tax expenses of the organization. All expenses must be confirmed by the primary source; VAT cannot be deducted, because Only the founder will appear in the documents.

If the company itself pays for travel and accommodation, then VAT deduction will be possible, because documents will be issued in the name of the company.

Cash for the trip is not issued on account, but simply from the cash register as funds necessary for the implementation of the GAP. The cash receipt order must indicate the date and number of this agreement.

Without an agreement

There is no need to conclude any agreements if the trip is related to a transaction, the conclusion of which requires the presence and approval of the founder. There are types of transactions that a director cannot enter into independently:

- large (these are transactions with property worth more than 25% of the value of the enterprise’s property);

- with interest;

- which are stated in the LLC charter as requiring approval.

If the reason for the trip is one of these transactions, then the Federal Tax Service will not doubt the justification of the costs of the trip (Article 252 of the Tax Code of the Russian Federation). Typically, such expenses are considered as other or non-operating expenses.

Since the funds were not used to pay the founder’s personal expenses, but to pay the company’s expenses, payment of personal income tax and insurance premiums is not required. VAT can be deducted.

It’s not just ordinary employees who go on business trips: some situations require the personal presence of the company’s CEO. What nuances exist when preparing documents and who should sign them? We analyze in detail all questions about the director’s business trip.

The procedure for sending employees on business trips is regulated by the Labor Code of the Russian Federation (in particular, Article 166, which defines a business trip) and the Regulations on the specifics of sending employees on business trips, which was approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749.

According to the Labor Code of the Russian Federation, a business trip is a trip by an employee on behalf of the employer for the purpose of fulfilling this assignment outside the place of permanent work. The general director is the same employee as other employees; he simply represents the employer in relations with other employees. If the general director is also the founder of the company, the situation is somewhat different; we’ll talk about it separately.

Registration of a business trip for the General Director: necessary documents

When arranging a business trip, directors use the same forms as when sending any other employees on a business trip. The registration procedure is also standard; the following documents are required:

- Form T-10a - official assignment for sending on a business trip, as well as a report on its implementation. The director sends himself on a business trip.

- Form T-9 - a business trip order issued on the basis of a job assignment.

- An order for the temporary replacement of a manager is issued in parallel with the order for a business trip.

- Form T-10 - travel certificate confirming the fact of being on a business trip and its duration. Contains personal data of the traveler, purpose of the trip, time stamps of arrival at the destination and return. It must be submitted to the accounting department along with the expense report.

Who signs the director's business trip order?

All documents - orders for your business trip, travel certificate and official assignment - must be signed by the person specified in the statutory documentation and authorized to draw up and endorse local orders. Most often it is the director himself.

The General Director draws up all documents in his name and signs everything himself. This algorithm of actions is fully confirmed by the letter of Rostrud No. 1143-TZ dated March 11, 2009. The text states that the manager has the right to sign any orders, even if they concern him.

An important difference between a director’s business trip and a regular employee’s trip is the need to transfer management of the company to someone during the director’s absence. Most often, responsibilities are transferred to the deputy general director. If he is not present or is also on a business trip, the director may delegate his duties to another employee. Most often, this is one of the persons specified in the organization’s statutory documentation: the head of the human resources department, the head of a division or department, or the chief accountant. But in general, the director can delegate his powers to any employee. The main thing is that this employee gives written consent.

When consent is received, an order for temporary transfer of authority is issued. It reflects the duration and prerequisites for the substitution and clarifies the powers, as well as indicating information about payment for temporary substitution if it is not part of the job responsibilities of the subordinate.

Read more: Tenants are asked to make temporary registration

In addition, the deputy must be given a power of attorney to conduct business. And so that the deputy can sign not only local documents, but also financial ones, the director must provide the bank that services the company with a card signed by his deputy.

If the CEO is also a founder, the situation is somewhat more complicated. In this case, you need to check whether an employment contract has been concluded with the director. Experts do not give a clear answer to the question of whether this can and should be done.

If the agreement is concluded, the founder and director can be sent on a business trip without any problems by completing the usual set of documents that we discussed above.

If there is no agreement, then in order to arrange a business trip for the founder and at the same time write off expenses in tax accounting, not withhold personal income tax and receive a VAT deduction, you can use three methods.

- Conclude a fixed-term employment contract and hire the founder for a position with a minimum salary. Then the business trip can be arranged according to all the rules.

It is important to remember that the salary should not be lower than the minimum wage. The employment contract must specify the responsibilities that relate to the business trip.

- Conclude a civil contract.

Such an agreement can be concluded for each business trip. It spells out specific tasks: what needs to be done and what result to get.

If the trip is related to a transaction, the conclusion of which requires the presence and approval of the founder (especially large, with an interest, or stated in the charter as requiring approval), you can send him on a business trip without a contract. In this case, the Federal Tax Service will not doubt the justification of the travel costs.

A manager's business trip has long become an important part of the performance of official duties for superiors. Sometimes it is necessary to monitor the work process at any branch of the organization, give appropriate instructions and orders, and for this purpose a business trip is arranged.

The CEO cannot be fired while he is on vacation

During the period when the head of the organization is on vacation or is temporarily incapacitated, the employment contract with him cannot be terminated under clause 2 of Art.

278 of the Labor Code of the Russian Federation (in connection with the adoption by an authorized body of a legal entity or the owner of the organization’s property, or a person (body) authorized by the owner of a decision on the early termination of an employment contract). Rationale: the dismissal of the head of an organization in connection with the adoption by an authorized body of a legal entity or the owner of the organization’s property, or a person (body) authorized by the owner of a decision on the early termination of an employment contract is essentially a dismissal at the initiative of the employer.

Article 3 of the code prohibits restricting anyone’s labor rights and freedoms depending on their official position.

Chapter 43 of the Labor Code, which regulates the peculiarities of the work of the head of an organization, does not contain rules that deprive him of the guarantee established by Part 3 of Art. 81 of the Labor Code of the Russian Federation, in the form of a general ban on the dismissal of an employee at the initiative of the employer during a period of temporary incapacity for work and while on vacation (except in the case of liquidation of an organization or termination of activities by an individual employer).

Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2

“On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”

Editor's note:

This position was cited in the letter of Rostrud dated 09/05/2006 No. 1333-6.

general information

All employees without exception have the right to annual paid leave. This also applies to the head of the enterprise. He can issue it 6 months after taking office. But Article 122 of the Labor Code of the Russian Federation states that the director has the right to take days off earlier than the specified period by agreement of the parties.

He must be informed about the start of his vacation 2 weeks in advance. As for the paperwork, it depends on many factors. For example, from who specifically in the organization is responsible for providing vacations to managers. If this is the responsibility of the company founders, then minutes of the general meeting must be drawn up.

In some cases (when the boss is an employee), he is required to write an application addressed to the owner, shareholders, etc. Naturally, if the manager is a co-founder of the company, there is no need to draw up an application.

An order drawn up in any form is also issued. The unified form of the T-9 document cannot be used in this case, since it must be signed by the manager. If the director provides vacations to the bosses at the company, then he arranges his vacation independently.

Help: the manager is recalled from vacation in the same way. It is drawn up by the founders or himself.

Payments and reimbursements

Any employee, including the head of the enterprise, is entitled to the following payments:

- travel allowances – payment of funds for all days spent on a business trip;

- average daily earnings during absence from work due to a business trip;

- daily allowance, which is the amount paid daily for accommodation;

- reimbursement of personal expenses, if any, during the business trip.

Food and accommodation

Food and accommodation on a business trip is one of the most important issues, so it is so important to take care of it in advance.

As a rule, food and accommodation for a business traveler, including management, is provided on a daily basis, which will be discussed below.

It is believed that daily allowances are issued so that a posted worker can afford decent food and accommodation on a business trip, while, as practice shows, the cost of food outside the permanent place of work increases significantly and therefore daily allowances should be at a good level.

Also, to confirm the cost of services provided, in particular hotels and meals there, you must ask for a receipt, and also collect all receipts to attach them to the trip report.

As practice shows, additional costs incurred are paid by the organization quite quickly if there is strong evidence.

Daily allowance

According to the law, daily allowances are payments of funds to a business traveler before going on a trip so that he has the opportunity to fulfill any personal needs of the body.

In this case, daily allowances are paid for all days spent on a business trip, including holidays and weekends.

By personal car

A business trip in a personal car also requires reimbursement of expenses incurred by the employee.

In order for the organization to be able to reimburse the spent funds to the business traveler, he must provide:

- documents indicating a job assignment or purpose;

- receipts from gas stations, hotels and food places;

- other documentary evidence of expenses incurred.

Very often, for the use of a personal car for the purpose of operating an enterprise, an employee is paid a fixed amount of compensation, thanks to which he will be able, if necessary, to repair the vehicle or maintain it in good condition. These actions are fixed in an agreement between the business traveler and the legal entity.

The same actions apply to the head of the enterprise. An agreement is concluded according to which a certain amount of money will be paid to him for the use of a personal car for the development of the enterprise, in particular for business trips.