Responsibilities of an accountant for resume

The responsibilities of an accountant are quite extensive and depend on the position held.

The mission of an accountant includes the generation of operational information about the state of affairs in the company, the calculation of financial results from operations and timely financial reporting for decision-making, as well as the timely submission of reports to control structures. Types of accounting positions that are used in enterprises:

- Assistant accountant - performs all tasks of the chief specialist in charge of accounting for the company.

- Budget accountant – pays salaries to staff and distributes the company’s budget.

- Accountant – issues sums of money to accountable employees, controls the expenditure of finances and cash discipline, and also controls debts and the correct execution of reports by company employees.

- Accountant calculator – provides calculation of the cost of manufactured products.

- Deputy chief accountant – communicates with partners, in agreement with the chief accountant, provides information on expenses, keeps records of them, and promptly calculates incoming finances.

- Accountant economist - plans and carries out accounting. Its main task is to improve the efficient functioning of the company.

Below is a general list of the functional responsibilities of accountants for possible use in a resume:

- Carrying out accounting.

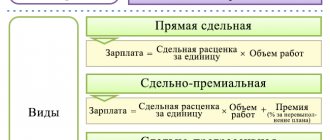

- Calculation of salaries, vacation pay, maternity pay and other accruals.

- Mutual settlements with organizations.

- Timely reporting to tax authorities.

- Issuance of powers of attorney.

- Restoring accounting from scratch.

- Issuance of receipt and expense forms.

- Document flow accounting.

- Work in programs: 1-C, Client-Bank and other software.

- Execution of cash transactions.

- Accounting for the receipt and consumption of fuel and lubricants.

- Development of budget costs.

- Work with primary documents (receipts, expenses, return invoices).

- Work with acts of completed work, reconciliation acts, etc.

- Accounting for strictly registered documents.

- Submission of reports to the tax office, as well as their preparation to various funds and the Federal Tax Service

- Carrying out accounting for organizations and individuals (SPD) with different types of functioning and methods of taxation.

- Reconciliation with counterparties.

- Extracting tax documents.

- Control over advance reports.

- Carrying out an inventory of fixed assets and other assets.

- Compliance with the company's document flow.

- Accounting for accounts receivable.

- Issuance of incoming and outgoing orders.

- Working with the cash book.

- Development of tax planning.

- Control over accountable persons.

- Filling out banking movements in 1-C.

- Making payments through “Client-Bank”.

- Depreciation calculation.

- Participation in reconciliations and settlements with organizations.

- Preparation of contracts and other agreements.

- Carrying out warehouse accounting.

- Transport cost accounting.

- Working with bank accounts and treasury accounts.

- Preparation of reports on departmental needs.

- Control of rent payments.

- Economic analysis of the efficiency of a company's functioning.

- Monitoring the correct compilation of statistical data.

- Providing daily reports on the functioning of the company.

( Video : “An accountant’s resume. How does the employer see it? The manager’s opinion.”)

What must be included in a resume for an accountant?

To get a job as an accountant, you need to prepare an advanced resume, which displays all the advantages that the job applicant has.

What do you need to show on your resume?

First, of course, the “standard block” is filled out, which all applicants know about:

– Availability of education, indicating a university or other educational institution.

Work experience, displaying the name of the position, duration of work, indicating the main responsibilities.

– Availability of professional qualifications.

– In addition to basic education, you can display the availability of certificates, for example:

- Accountant certificate.

- Certificate of the Ministry of Finance, etc.

– Ability to work with special software:

- 1-C.

- SAP or other ERP.

- ISS Consultant-Plus.

- Bank-client.

- Guarantor, etc.

– Proficiency in foreign languages.

– It is also advisable to display less obvious skills, for example:

- Specialization in one direction for over 3 years.

- Optimization and refund of tax charges.

- Successful court victories in the return of overpaid tax funds.

- Successful completion of inspections by control structures (without fines or with minor sanctions).

- Interaction with control structures.

- Timely submission of reports to the Federal Tax Service

- Participation in reconciliations.

- Participation in the submission of annual reports.

- Controlling accounts receivable.

- Experience in organizing accounting from scratch.

- You can also display how the accountant communicated with colleagues from other structural departments and the ability to resolve conflict situations.

Ability to assume key responsibilities of the Chief Financial Officer (CFO)

Ability to analyze and evaluate the financial and economic activities of a company, calculate financial indicators, forecast business development, engage in budgeting and pricing. In fact, this is the job of the CFO. But it’s no secret that today these functions are safely transferred to the shoulders of chief accountants and accountants in order to save on another TOP specialist.

Therefore, in order to be competitive and in demand, you need to go beyond the accounting functionality and learn to think on a larger scale. It’s not just about submitting reports on time, but also building the company’s financial policy. Not just evaluate decisions, but also participate in their adoption and implementation. Therefore, with 100% confidence we can say that the “accountant-finder” in one specialist is the support, right hand and confidant of the general director.

Moreover, this is also a huge plus for accountants themselves! They have full knowledge of the company’s financial situation and will certainly never encounter such an established problem as a professional conflict between accountants and financial managers.

What shouldn't be in a good resume

When filling out information about yourself in your resume, you should not describe too many of your achievements. The completed resume should be between 1-2 pages. There is no need to display unnecessary data in the form, such as:

- Personal details, indicating the exact address and passport details. It is enough to note the city of location and contact phone number.

- There is no need to provide links to social networking pages.

- You can't imagine jokes. A resume is, after all, a business essay, so humor would be clearly inappropriate in it.

How to write a resume for an accountant

Writing an accountant resume is not difficult.

But making it “alive” and attracting the attention of the company’s management, according to HR analysts, is not such an easy task. Let's try to figure out how to create an effective and attractive resume for an accountant.

The preparation for filling out this document begins with a careful study of the responsibilities in the open vacancy. Also, the applicant will need to prepare information about his activities in an accounting position, which will be of interest to the management of the company.

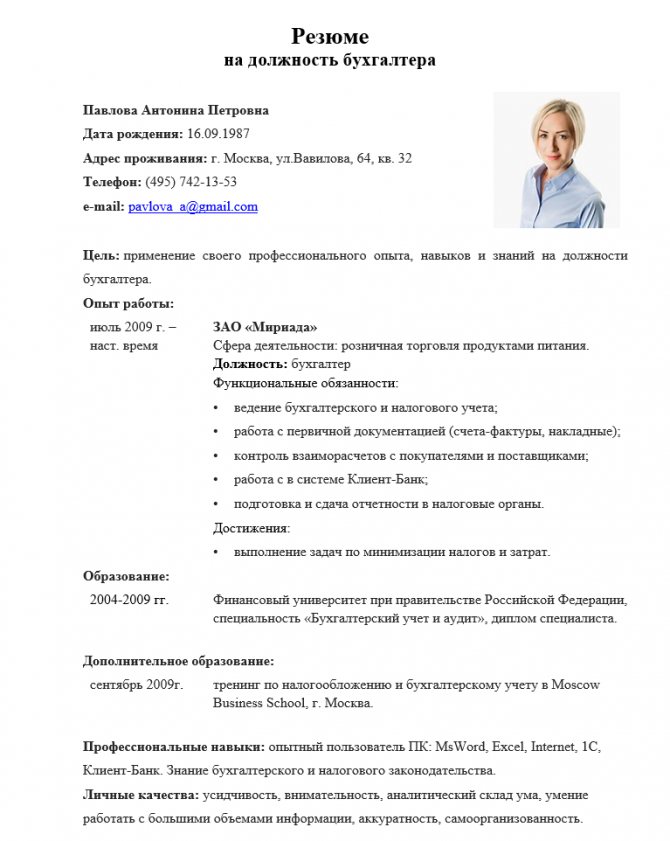

The resume form does not have a unified approved form, however, when filling it out, generally accepted rules must be followed, which allows the employer to easily read the received form. Therefore, when filling out the document, it is advisable to follow the sequence of filling out the resume shown below.

Let's look at the requirements that should be met:

- The identifying section of the document (full name, age, contact information) is displayed in the form that is noted in the identity documents.

- Next, the “goal:” of the document is displayed, displaying the desire to get a job as an accountant.

- In the “Work Experience” section, information should be displayed in reverse chronological order, indicating length of service and job responsibilities. At the same time, it is advisable to display the area of work (for example, payroll, work with accountable persons, etc.), as well as the direction of the company’s work.

- In the next section “Education” you will need to display the name of the university or other educational institution, the profession received, and the date of completion of studies.

- Data on the availability of additional education (at qualifying courses, seminars, etc.) must be displayed in chronological order.

- The “Professional skills” section will need to be devoted to a list of skills and abilities that the candidate has. This information should not be confused with the personal characteristics of the applicant.

- For this purpose, a separate section is provided, “Personal Qualities”, where you need to list the characteristic features of the applicant.

- All information in your resume must be presented concisely and thoughtfully. If there is additional information, it can be placed in the “Additional information” block. This may include the availability of recommendations and other data.

Preparing your resume doesn't end there. It is not advisable to simply send it to a potential employer. It would be better if the applicant writes a accompanying letter and attaches a completed resume to it.

The accompanying message will display:

- Additional information about the candidacy.

- Information about your interest in the advertised vacancy.

- Real offers.

The accountant's message can be displayed in the following style:

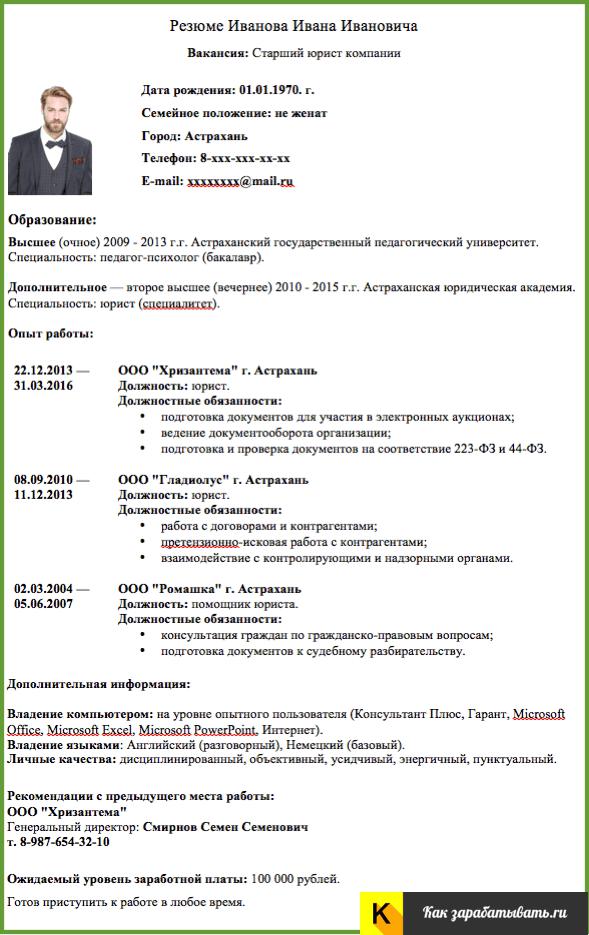

Accountant Resume Sample 2021

Candidate information

When responding to a vacancy announced by the company’s management, the applicant is required to fill out a resume and send it to the company.

The beginning of filling out the form is devoted to displaying information about the applicant for the position, indicating:

- FULL NAME. candidates for the position.

- Contact information (phone number, E-mail).

- Names of the locality where the applicant lives.

Some applicants also fill out unnecessary details in this section, for example:

- Exact address with postal code (you can only specify a locality).

- Date of birth (age may be displayed).

- Two contact numbers (it is better to display one).

- Marital status (this also need not be noted).

- There is also no need to fill out information about children.

In addition, in the next section, the author of the resume will need to display the availability of education, writing the name of the educational building and the date of its completion. You will also need to display data on additional studies (courses, seminars, retraining, etc.) At the same time, you must indicate data related to the position of an accountant. Other data will be inappropriate in this option.

Desired salary level

The applicant can display the amount of the fee on his own initiative when preparing an accompanying message along with his resume. If this information is omitted, when invited to an interview, the job applicant will still have to answer this question, since the employer will want to know what salary the applicant expects.

Of course, the size of the salary will largely depend on the level of responsibilities that will be assigned to the accountant. Therefore, this issue can be discussed at the interview.

experience

It is recommended to display work experience in the completed resume for the final 5-9 years of work. Work experience must be displayed in reverse chronological order. It is advisable to describe the duties performed in the last section of work in more detail.

Skills and abilities in a resume for an accountant

In this section you need to display the availability of skills and abilities related to the accountant vacancy. For example, the ability to draw up contracts; experience in organizing accounting from scratch, ability to work on 1-C software, etc.

That is, here you need to display what an accountant can do and there is absolutely no need to note banal characteristics:

- Responsibility;

- Determination;

- leadership skills;

- good performance;

- desire for career advancement.

These qualities need to be listed in a completely different section.

List of Basic Skills

For an accountant, when filling out skills, the following should be displayed:

- The ability to process a huge flow of information.

- Ability to work with primary documents.

- Experience in interacting with tax authorities.

The following are examples of accounting skills:

- 6 years of experience with accounting in the field of wholesale sales.

- Experience in restarting accounting from scratch.

- Successful examples of audits.

- Experience in obtaining loans for the company.

- Knowledge of legal norms on tax payments, foreign exchange transactions, knowledge of the Labor Code and Russian Federation, RAS, IFRS, INCOTERMS 2000.

- Ability to work with software (1C, Word, Excel).

Communication skills and ability to work in a team

Communication skills, leadership abilities, innovative thinking and the ability to think strategically - these qualities are critical today for accountants who aspire to a solid position and high income. In general, a financial specialist is a person who is forced to constantly interact with everyone: with the management and employees of the company, with representatives of credit institutions, with tax authorities, suppliers, investors, shareholders, etc. If he has difficulty making contact and is constantly immersed exclusively in his own responsibilities are a reason to worry.

Accounting is a separate kingdom in the company. However, in the understanding of employers, a valuable accountant is not someone who is fixated only on numbers, papers and accounting, but a person who thinks big, sees all the company’s business processes, and knows how to get along well with other team members. It is important for him to be able to make serious decisions and not be afraid to take responsibility for them. Today it is more important to be a team player, to play with others - and over time this will be given more and more importance.

List of achievements

The concept of an accountant’s achievements includes the results of work in past positions, which indicate:

- Success in achieving your professional goal.

- Reflection of economic attractiveness, as a result of the assistance of an accountant.

What is important here is not how many duties and functions the accountant performed, but what he achieved as a result of his activities.

EXAMPLE

“During the period of performance of duties as an accountant at Horns and Hooves LLC, 12 audits by tax authorities were successfully carried out.”

You can also boast about certificates, diplomas received for the results of your work, etc. - this can also be considered an achievement.

Personal qualities

( Video : “Personal qualities of a professional accountant”)

When preparing this block of a resume, it is advisable to avoid template phrases that are often used by candidates.

The following characteristics are suitable for an accountant:

- Accuracy.

- Attentiveness.

- Performance.

- Analytical mind.

- Fast learner.

- Performance.

- Responsibility.

- Perseverance.

- Honesty.

Photo

A photograph is an optional detail of the resume. Typically, a photograph is recommended for placement in a resume for representatives of vacancies that involve communication with the “outside world” on behalf of the company, as well as, for example, top models.

An accountant is busy with intradepartmental work with documents, so the appearance of an applicant for this profession is not required. However, the right headshot can have a positive impact on the employer.

A neat appearance, business style in clothes and hairstyle can indicate a lot about the applicant for the position.

For the photo, you will need to choose a not very formal, but appropriate dress code for a suit, light makeup and a neat hairstyle. The photography environment must be analyzed down to the last detail. For example, the photo can be taken in a work office.

The pose in the photograph of the applicant should be free, formal, preferably with a slight smile.

Accountant CV

An accountant is a specialist in the field of accounting. No enterprise can do without such an employee. The accountant is obliged to correctly and timely:

- To pay salary.

- Transfer taxes.

- Keep financial records

- Report to company owners and government agencies.

- Organize work with partner companies

- Monitor the financial condition of the company, etc.

As can be seen from the list of responsibilities, an accountant needs to be very responsible in filling out his resume, displaying not only information about himself, but also displaying his work experience, skills and personal qualities, which also play an important role when working in a team.

How to write a correct resume for an accountant is described in the section of this article “How to write a correct resume for an accountant.” But an accountant without work experience will have a more difficult time. We will try to talk about this in the next section.

Professional experience, innovative thinking and passion for professional development

Most employers need accounting practitioners who can quickly adapt to dynamically changing market conditions and legislative innovations. The cost of a candidate increases if he previously worked in the field of external or internal audit. But this factor is seen as an advantage, not a necessity.

Of course, work experience is important. However, today employers have slightly changed their tactics for selecting candidates for financial positions. Many of them can overlook the lack of professional experience of an accountant if he has a sparkle in his eyes and a desire to immerse himself in the work right at the interview. Today, an ambitious innovative accountant with sparkling eyes, fresh ideas and a desire for professional development is 2 times more likely to get a prestigious, highly paid job than an uninitiated conservative candidate, albeit with many years of experience.

Professional experience, as understood by management, is closely intertwined with continuous professional development. An advantage in interviews is given to those specialists who have diplomas, certificates, certificates confirming the relevance of their knowledge in the field of accounting, tax and management accounting, financial management, internal audit, etc.

How to write a resume for an accountant without work experience

Applicants for accountant vacancies must have a specialized higher education and experience in this position.

If such an applicant does not have work experience, but has a great desire to get it, you need to pay attention to knowledge and skills in your resume.

Having received an education, an accountant must know the legislative norms of the Russian Federation and specialized software. Practical training in accounting fundamentals also added to the skills. It is this listed knowledge that needs to be displayed in the relevant sections of the resume.

At the same time, you also need to focus on personal qualities that will appeal to the employer:

- Hard work.

- High learning ability.

- Responsibility.

- Attentiveness.

- And finally, a strong desire to work.

You can also give examples of active participation in the scientific activities of an educational institution, as if emphasizing personal qualities.

Note. Even if the applicant has no experience, do not skip the “Professional Skills” and “Personal Qualities” sections. It is better to show the ability to work with a PC, knowledge of the English language, and the ability to find a common language with people.

Example resume for an accountant without work experience

Cover letters as a means of increasing interest in a resume

A correctly composed cover letter is an excellent tool for attracting the attention of a personnel employee to a job applicant in any specialty. A well-written letter sometimes sticks out to a hiring manager more than the accountant's resume itself. Therefore, the applicant needs to be well aware of the basic rules for writing letters of recommendation.