Human labor is not free - this provision in one form or another is enshrined in the fundamental documents of all civilized states. The need for career growth and moral satisfaction from the work done are important, but in the first place for most people is ensuring their own material needs.

Delay of wages is a direct violation of labor laws with all the ensuing consequences. If it is impossible to resolve the problem peacefully, the only option left is to file a claim in court.

The main criterion when filing a claim for debt collection is the fact that wages have been accrued. If the accrual is made, the claim is considered in the order of writ proceedings, otherwise - in general.

Legal basis

According to Russian legislation, monthly remuneration to an employee has a certain established threshold.

It must be equal to or exceed the minimum wage (minimum wage). Cash is issued twice a month. Payment dates are set by the employer and are the same for all employees. When hiring, these nuances must be discussed. Labor disputes that arise can be resolved by going to court. A claim can be filed no later than 180 days after the violation of the worker’s rights.

Where to file claims for unpaid wages

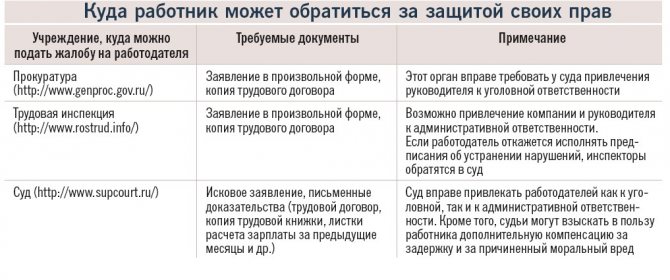

Employees go to court to file a claim for unpaid wages in the following cases:

- the employer delays wages or does not pay them in full;

- due dismissal payments have not been received;

- the employee was deprived of his bonus or fined.

If an employee has violated his labor duties, the employer has the right to deprive him of his bonus or reduce its size in accordance with the bonus regulations. And you are unlikely to want to start a lawsuit over several days of delay in payment of wages. But if your organization constantly violates established payment deadlines or tries not to pay employees extra, this is a compelling argument for going to court.

When filing claims for recovery of wages, citizens can choose the jurisdiction at their own discretion. Send it (a sample statement of claim to the court for non-payment of wages can be found in our article) to the district court at your place of residence or at the location of the enterprise.

When an employee files a claim for recovery of wages, no state duty is charged. For drawing up a statement of claim, a lawyer will charge from 1,000 to 3,000 rubles. The participation of a lawyer in a court hearing costs at least 5,000 rubles per day.

Which court should I go to?

Cases for the collection of arrears of wages are considered by district courts at the place of registration of the legal entity - the defendant, meaning the legal address of the employer.

The plaintiff has the opportunity to simplify his task and apply to the court for a court order. This can be done if the amount of the claim does not exceed 60 thousand rubles, and the defendant does not deny his guilt and is ready to compensate for unpaid wages, as well as other payments claimed by the plaintiff.

In this case, the case will be heard by a magistrate, and the parties will not be required to appear in court. The court will issue an order to collect the debt from the defendant, which is automatically a writ of execution and is transferred to the bailiffs for enforcement of the decision.

If the plaintiff knows that the employer has funds to pay wages, but spends them at his discretion for other purposes, then this method of solving the problem will be the most effective.

State duty

When the court considers labor disputes, employees are exempt from paying state fees and other legal expenses. If the court decision is positive for the plaintiff, all legal costs are levied on the employer.

Statute of limitations

The statute of limitations is the period during which an employee has the right to file a claim in court to collect back wages.

The permissible time limits for filing a lawsuit in labor disputes are determined by Article 392 of the Labor Code of the Russian Federation. So:

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- Within 30 days, an employee can file a claim for recovery of wages if he was fired without paying the due (worked) wages;

- Within 30-90 days, an employee can file due to non-payment of wages in accordance with the approved schedule for receiving wages, untimely payment due to which (for example) the citizen was late in repaying a loan, payment of wages in the wrong amount, etc. d.;

Within 3 months, an employee can file a claim not only for late receipt of wages, but also for any other reason related to the infringement of his labor rights. What to do if the statute of limitations has already expired? Despite the fact that the exact deadlines for filing claims of this nature are specified in the Labor Code of the Russian Federation, an employee can go to court even after the required deadlines have expired.

This is also important to know:

How is money collected under a contract?

He can do this on the basis of the Civil Code, according to which an employee whose rights have been violated can file a lawsuit for non-payment of wages for 3 years.

A claim for recovery of wages must be filed exclusively in the district court.

Nuances

The labor activity of any citizen of the Russian Federation working in a domestic company must be rewarded. This is determined not only by the Labor Code of the Russian Federation, but also by the employment contract concluded with the employee, which contains information about the amount of salary and the conditions under which the subject can apply for additional funds.

It is an offense to delay payment of money earned by staff. If an attempt at reconciliation with the manager fails, employees must seek protection of their interests in court.

The main criterion for considering a claim demanding the recovery of earnings is the fact that funds have been accrued. If accrual was made, the statement of claim will be considered in the order of writ proceedings, if the salary was not even accrued - in the general manner.

It is also important to comply with the statute of limitations, according to which the injured party has a maximum of 1 (one) calendar year from the date of discovery of the offense to file the document in question with the court.

The subject is provided with 1 year to go to court, even if the employment contract was canceled or the salary was accrued but not actually paid. This is due to the fact that the offense took place when the professional relationship was still officially confirmed.

If the subject resigns, he is entitled not only to a salary, but also to severance pay with all additional amounts stipulated by law, as well as specified in the individual agreement. The employer will also be required to compensate these funds if the basic salary is delayed.

The claim is filed with the district (or, due to its absence, with the city) justice body, territorially corresponding to the location of the employing company. Important: you should focus on the main office of the organization if there are several structural divisions.

We invite you to familiarize yourself with: Sample order to remove an employee from work

When drawing up a claim, all requirements necessary for this procedure must be taken into account. One of the main ones is the indication of all the details that are provided for by the Code of Civil Procedure of the Russian Federation (Article 131). The sample application assumes that it contains several parts.

Applications and state fees

To the claim in accordance with the requirements of Art. 132 of the Code of Civil Procedure of the Russian Federation, you must attach a copy of it and copies of the annexes (for the defendant), a calculation of the claims (both the salary itself and interest, if the claim contains a demand for their recovery), as well as copies of other documents that confirm the plaintiff’s arguments. A specific list of documents for the convenience of readers is indicated in the sample statement of claim for delayed wages. Please note that it may differ depending on the actual situation.

Important! As for the state duty, due to the requirements of Art. 393 of the Labor Code of the Russian Federation, the employee is exempt from incurring legal costs; accordingly, they do not need to pay them.

Introduction

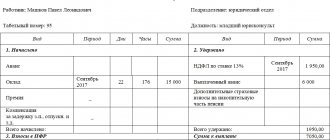

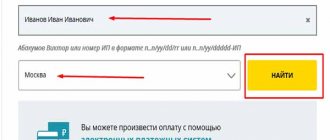

The court filing paper should begin by mentioning all parties to the proceeding. The application form for the collection of arrears of wages should indicate:

- Full name and official address of the judicial authority to which this document is sent.

- Full name and actual address of the applicant.

- Information about the defendant. This includes the TIN, the name of the organization or the full name of the head (in the case of an individual entrepreneur), and the legal form. You will also need the full legal and actual addresses of the enterprise. If the employer is a legal entity, a checkpoint is also prescribed.

- The amount of monetary penalty that the plaintiff imposes on the defendant.

Please note: the application for wage recovery must be completed correctly. The first two words must be written in words. The words “about the collection of wages” are written in lowercase letters and marked with brackets.

When is it easier to collect wages?

The situation is more complicated when you have an employment contract in your hands, which states the amount of the monthly salary, but does not indicate the amount of the bonus and additional payments (percentage of sales, payment for additional work, etc.). In this case, the task is complicated by the subject of proving exactly how much the employer owes you for salary payments, for how long and on what your calculation will be based.

When collecting wages, the court proceeds primarily from documentary evidence. The testimony of witnesses in this category of cases regarding the amount of wages is not used by the court as a means of proof, please keep this in mind.

A very difficult situation is when an employment contract has not been concluded with you and the payments made to you by the employer are not indicated anywhere. In this situation, in addition to having to prove that you had an employment relationship with the employer, you will also have to prove what your average monthly salary is.

Therefore, it is extremely important that you have an employment contract.

Description of the claim

This part should explain the reasons for writing the application. The presentation of all information should be concise, but sufficiently clear and understandable. The following information is indicated:

- Data on the interaction between the employer and the employee (date of employment and dismissal, if the latter took place, as well as the position held. It would not be amiss to indicate all labor transfers and work movements).

- The amount of the established remuneration for the applicant based on the concluded employment agreement (or other similar papers, if any).

- The period of time for which an employee's salary was not paid.

- Data on other ways of influencing the employer (written demands, etc.).

- Calculation of existing salary arrears.

We suggest you read: If your education does not correspond to your position

An employer's debt for an employee's salary may consist not only of actual unpaid money.

According to the Labor Code of the Russian Federation (Article 236), a statement of claim for the recovery of wages will bring the plaintiff monetary compensation. The amount of the additional payment (as a percentage) is at least 1/300 of the refinancing rate of the Central Bank of the Russian Federation of the total debt. In this case, the employer is obliged to compensate for each day of delay in funds.

Based on Art. 21 and Art. 22 of the Labor Code of the Russian Federation, a worker has the right to recover from management compensation for damages caused to him as a result of the delay in moral damages. The amount of compensation is directly related to the employment agreement concluded between the parties. Sometimes the amount of compensation payment is set by a judicial authority.

Separately about moral damage

There are no moral damage calculators, since assessing one’s own mental suffering is entirely the prerogative of the plaintiff. No one prohibits the plaintiff from requesting any amount as compensation for moral damage, including one hundred or more million rubles.

Another thing is that such a requirement will not be satisfied by the court in any case. Moral damage will be compensated, but the amount will correspond to the court’s assessment of damage. Therefore, one should be guided by the rule of excess of actual damage.

In this case, the presence of moral damage must be confirmed independently. Confirmation options may be:

- certificate confirming that the second spouse is on parental leave;

- an extract from the medical card in case someone from the family fell ill during the salary delay;

- certificate of salary of the second spouse if this salary does not provide a living wage for each family member, etc.

How to apply

Write the application by hand or type it on a computer. Attach to it copies of the documents you refer to in support of your claims:

- employment contract;

- The order of acceptance to work;

- wage regulations;

- orders, instructions of the employer;

- salary certificates.

The employer is obliged to issue copies of documents upon written application within three days. If the papers are not provided, the court will request them at your request.

In order for the statement of claim to be accepted and no questions arise regarding it, it must be drawn up correctly. Let's take a closer look at a sample application to the court for non-payment of wages.

The structure of this document can be divided into three parts.

Part 1. Introductory. It contains information about the participants in the process:

- full name of the judicial authority;

- location of the court;

- plaintiff's details - full name, address of residence, tax identification number;

- details of the defendant - full name, address, checkpoint;

- amount of debt.

Part 2. Main. In this part you need to set out the reasons for going to court. In this case you need to indicate:

- date of hire;

- date of dismissal (if any);

- a period for which there is no payment of wages;

- documents confirming pre-trial proceedings;

- documents confirming the amount of wages;

- also indicate the amount of debt.

Part 3. Final. In this part you need to describe your requirements for the defendant. You can also specify:

- the amount of wages owed;

- amount spent on legal costs.

All documents necessary for consideration of the claim will need to be attached to the application.

What documents will be needed

A prerequisite for winning in court is a worthy evidence base that will confirm the rightness of the plaintiff and sway the court on his side.

Therefore, it is necessary to collect documents in advance that will serve as evidence of the employer’s illegal actions:

- An employment contract is the main document when hiring; it must indicate the amount and terms of payment of wages. In such situations, the importance and significance of the employment contract are visible especially clearly; it is the main witness of the labor relationship and mutual obligations of the employee and the employer;

- a copy of the order for employment, as well as transfers to other positions, if any;

- a certificate from the accounting department about the average earnings of the plaintiff, including bonuses, one-time payments, additional payments to the basic salary;

- a document confirming the absence or discrepancy of wage payments for the period specified in the statement of claim. This could be a bank statement if the salary is credited to a bank card;

- certificate of existence and amount of wage arrears;

- It would not be superfluous to record the testimony of witnesses and also provide them to the court;

- a certificate confirming the damage suffered, moral damage, if the plaintiff claims compensation.

This is also important to know:

Debt collection under a service agreement

Primary requirements

A claim for recovery of wages upon dismissal is submitted to the court with the following documents:

- A copy of the claim for the defendant

- The order of acceptance to work

- Employment contract

- Orders on bonuses, payment terms if available

- Certificate of average earnings

- Certificate of accrual of payments in favor of the employee

The listed documents are submitted in copies, the originals are presented to the court during the hearing.

In order for a claim to the court for non-payment of money from the employer to be accepted, it is not enough to fill out the form correctly and calculate the debt from the company. It is necessary to study what documents are needed:

- an additional copy of the application intended for the defendant;

- contractual relations expressed on paper and all existing additional agreements thereto;

- written confirmation that the subordinate has taken up his duties (order of appointment to the position);

- documents on the basis of which the employee was awarded a bonus and/or in which the terms of monetary payments were discussed (there may also be orders from the manager), if the employee has them;

- documents in which the average salary for several months will be calculated;

- documents confirming that accruals of unpaid wages have been made;

- other documents that, in the plaintiff’s opinion, may be required during the proceedings.

All of the above documents must be copied and attached to the claim. And the originals will be needed only during the consideration of the claim in court. If the plaintiff has several demands on the defendant (for example, to establish the fact of an employment relationship or to reinstate him to his previous position), additional documents may be needed.

A photocopy of payment of the state fee is not required. Labor legislation obliges the judicial authorities to collect state fees from the defendant. Within two months, the judge must study all the materials of the case, listen to witnesses, and establish the truth. As a result, the decision is made either in favor of the plaintiff or in favor of the defendant.

Working without an employment contract

Expert opinion

Egorov Viktor Tarasovich

Lawyer with 10 years of experience. Specialization: family law. Recognized legal expert.

The law equally protects all workers, including those working without an employment contract. Simply, when filing a claim, in addition to the fact of delayed wages, you will also need to prove the fact of the existence of an employment relationship with the employer.

Evidence can include any evidence, for example:

- photographs of the workplace;

- witness's testimonies;

- printouts of telephone conversations;

- exchange of electronic messages;

- employee signatures on pay slips, etc.

Written, photo, audio, video and other evidence is attached to the statement of claim. If the fact of the existence of an employment relationship is supposed to be proven through testimony, then the statement of claim should indicate this and draw up a list of witnesses to be summoned to court.

Limitation periods

For this category of case, there are special statutes of limitations for protecting rights, which are three months from the date of dismissal.

Having established the fact of violation of the deadline for paying wages, the court will exact compensation from the defendant for each day of delay. Interest is calculated based on the key rate of the Central Bank. At the request of the employee, the court may also seek compensation for moral damage caused to the plaintiff by the illegal actions of the employer.

The statement of claim for recovery of wages 2021 has one more feature - the statute of limitations for labor disputes over wages and other monetary payments has been extended and is now 1 year. The decision to collect wages for three months in favor of the employee is subject to immediate execution, and the rest - after the decision enters into legal force.

Is it necessary to write a complaint?

To a certain extent, all attempts to peacefully resolve a labor dispute are a waste of time. The fact is that a delay in payment of wages is not always the employer’s malicious intent. As a rule, delays are explained by completely objective reasons, especially in times of crisis.

At the same time, the employer himself is fully aware that he is violating the law, which means that no claims or appeals to the labor dispute commission can change the situation, since the decisions of these authorities are not binding even if an administrative fine is imposed on the head of the enterprise.

In any case, wages will begin to be paid when there is money in the payroll fund.

At the same time, the enterprise may well have money in other funds, but the employer has no right to transfer it to the payroll fund. But a bailiff has the right to do this, who, in pursuance of a court decision, can withdraw money from the employer’s current account and transfer it to the employee.

Thus, if the delay in payment has been going on for a long time, and there is no chance of promptly replenishing the company’s accounts, there is simply no point in trying to peacefully resolve the dispute. It is necessary to file a claim in court, especially since:

- claims for labor disputes are not paid with state duty;

- Along with wages, you can ask the court to recover from the employer a penalty for the delay.

What to do if you worked unofficially

Those working without a formal employment contract (unofficially) often encounter employers’ reluctance to pay wages. Is it possible in such cases to protect your rights and collect arrears of wages from the organization’s managers? Of course you can.

First of all, you need to contact the labor inspectorate at the location of the organization with a complaint. In order for the complaint to be justified, it is necessary to prepare documents confirming the fact of work at the enterprise. These could be printouts of telephone conversations, documents signed by the manager and employee, and witness statements.

After collecting evidence, we file the complaint itself. As an example, you can take our example of a claim for the recovery of wages. After submitting all the necessary documents, we wait for a decision.

As a rule, a complaint to the labor inspectorate is considered within 30 days. If the inspector's decision does not suit you, you need to go to court.

Recommendations for an employee if he needs to collect a salary debt from his employer

When filing a claim to recover back wages, there are several important things to keep in mind. The first of them is that the state fee for filing a claim is not paid.

Second point. If the salary is accrued according to documents, but not paid, you should take a different route. It involves filing not a lawsuit, but an application for a court order. The magistrate can also accept it for his proceedings.

Regardless of whether a claim or documents are filed for a court order, the author of the appeal (employee) has the right to choose the court where to apply. This may also be the authority at the place of residence of the plaintiff.

Below we will provide a few more practical recommendations that will help a citizen defend his labor rights. That's their essence.

- In court, you can recover not only wages, but also related payments provided for by labor legislation and the collective agreement adopted by the organization. For example, this applies to severance pay, compensation for lost vacation

- You need to be prepared for the fact that the trial, including an appeal from the employer, may take several months. Therefore, you can first notify the competent authorities of a violation of your own labor rights by writing a complaint to the prosecutor’s office against the employer.

- The claim may also include a claim for penalties due to untimely payment of wages. It is 1/150 of the Central Bank key rate for each day of delay (Article 236 of the Labor Code of the Russian Federation).

- Additionally, you can raise the question of material damage, its existence, the size must be justified.

This is also important to know:

How is lost profit recovered under a supply agreement?

But you should also remember about the timing of going to court. They amount to one year from the date on which the settlement date came. Therefore, you need to have a clear understanding of the company’s existing employee payment dates.