Order on the appointment of the general director as chief accountant

Article current as of: August 2021

The manager must organize accounting and storage of documents. He can independently conduct accounting if the organization is a small or medium-sized enterprise.

At the same time, the manager cannot take over accounting if:

- or the organization’s financial statements are subject to mandatory audit (for example, created as a joint stock company);

- or the organization is created in the form:

— housing/housing-construction or credit cooperative;

— bar association, law bureau or chamber of lawyers;

Small and medium-sized businesses

These include organizations that meet the following conditions:

- the average number of employees for the previous year did not exceed:

– from 100 to 250 people – for medium-sized enterprises,

– up to 100 inclusive – for small businesses.

In this case, all employees are taken into account, including those working under civil contracts or part-time, as well as in separate departments;

- Revenue for the previous year excluding VAT did not exceed:

— 2 billion rubles. – for medium-sized enterprises;

— 800 million rubles. – for small businesses;

- the requirements for the structure of the authorized (share) capital of a legal entity are met:

— the total share of participation of municipalities, constituent entities of the Russian Federation, the Russian Federation, public and religious organizations, charitable and other foundations is no more than 25%;

- companies that are not classified as small and medium-sized businesses, as well as foreign companies, own in total no more than 49% of the authorized capital of the company.

Simplified methods of accounting and reporting

Small businesses in which the manager independently keeps records can use simplified accounting methods and prepare simplified financial statements. A list of such methods is given in Information of the Ministry of Finance of Russia N PZ-3/2015 On a simplified accounting and financial reporting system.

Director and chief accountant in one person 2021 order

Then the manager will keep accounting records as part of the manager’s labor function.

If the staffing table includes the position of chief accountant, then, taking over the accounting, he combines the position of manager and chief accountant on the basis of an additional agreement to the employment contract, for which he receives an additional payment established by this agreement in Art. 60.2 Labor Code of the Russian Federation ".

Let us note that if the director took over accounting only during the absence of the chief accountant, then on the day he returns to work, these duties of the director will cease automatically, without filing any additional papers.

"Subscription" details

Bank card with sample signatures. If the manager initially personally conducts accounting, then only his autograph appears in the “First signature” field on the card.

The accounting policy must include one of the following options:

- Make a responsible company employee or chief accountant responsible for storing and maintaining accounting records.

- Draw up an agreement for accounting by a third-party organization or specialist.

- Take charge of accounting to the general director.

In case of temporary disability or absence of the chief accountant, two forms of labor organization are possible:

- temporary substitution;

- performance of duties.

When temporarily replaced, the employee must be relieved of his duties at his main place of work. He is paid the difference between the chief accountant's salary and the actual salary.

While performing duties, the employee is not released from his main job. He is paid a percentage of his salary for additional duties.

Sample order for the appointment of a chief accountant

Limited Liability Company "Romashka"

Moscow city "___" _________ _____ g.

Due to the absence of the position of chief accountant in the staffing table, I assign the responsibilities of chief accountant to myself.

General Director / Ivanov I.

the main text of the order must begin with a description of the documents that served as the basis for its preparation;

- you should indicate the date the director assumed the position, as well as the name of the organization he will lead;

- the order will need to describe all working conditions.

If the need arises to appoint a chief accountant, then these actions can be combined in one order for the appointment of the general director and accountant as one person .

Do you want to learn how to do your own accounting for an individual entrepreneur? Detailed guidance can be found here .

If the CEO is reappointed

In case of reappointment of the general director of the LLC, an order of appointment must be drawn up, signed, and applied to the Unified State Register of Legal Entities within 3 days.

Since the CEO (or simply director, president, manager, etc.

), is an employee, and not the owner of the company (and even if he is at the same time), in order for him to take office, an order of appointment must be issued.

The most interesting thing is that the LLC participant (chairman of the meeting, if there are several of them) appoints the director to the position (and enters into an employment contract with him). But at the same time, the director draws up and signs the order for appointment to the position “for himself.”

Powers of the CEO in the organization

The powers of the general director, or, as he is called in the Federal Law “On LLC”, the sole executive body of the company, are prescribed in the mentioned Law.

Namely, Article 40, Part.

Source: https://urist-parnas.ru/drugoe/prikaz-o-naznachenii-generalnogo-direktora-glavnym-buhgalterom.html

You can put yourself in charge by order

- maintaining, storing, tracking the movement of work books and other documentation related to personnel;

- drawing up a vacation schedule, shift schedule, time sheet taking into account working hours, etc.;

- transfer of responsibility from one employee to another or a group of people due to vacation, long-term illness or other reasons;

- responsibilities to ensure uninterrupted supply of the enterprise with necessary materials, raw materials, equipment, etc.

The following briefly describes the essence of the order and for what purposes it was created. Then, lower in the center of the line, write the word “I order” and put a colon. Body of the order The second part of the document contains more detailed information. All workers who are responsible for compliance with certain production conditions are included here. In particular, the type of responsibility is indicated, as well as their full surnames, first names and patronymics (first and patronymic names can be entered with initials). A separate paragraph must also indicate the persons who, in the absence of responsible employees at the workplace, will replace them. The last paragraph should indicate a complete list of documents that employees must follow to fulfill the requirements for monitoring the area of responsibility. Finally, the order must be signed by the manager, as well as the seal of the organization.

Order on the performance of duties of the chief accountant by the director

Every company must have a chief accountant. He deals with financial affairs, accounting for all income and expenses.

But what if the company is very small and there is no money to hire a specialist? Or did the chief accountant go on a long vacation? In some cases, the director of a company can appoint himself as the chief accountant.

To do this, an order is drawn up to appoint oneself as chief accountant. In addition, it is recommended to draw up an additional agreement to the general director’s employment contract.

In what cases can a director simultaneously be a chief accountant?

The general director of a small business or micro-business can simultaneously be the chief accountant if these conditions are met:

- The company's staff does not exceed 100 employees.

- The annual turnover is no more than 800 million rubles.

- The share of capital owned by other legal entities is no more than 49%.

These restrictions exist to prevent tax evasion by large businesses. The chief accountant is one of the main employees of the company. Therefore, he is appointed by the first order of a newly registered organization. Based on order No. 1, other orders and documents will be signed.

[2]

Sample order No. 1

LLC "Red Book"

On the appointment of the general director and chief accountant

June 1, 2021

General Director Bely A.L. (signature)

Temporary reassignment of the chief accountant

You can appoint yourself as chief accountant either on a permanent or short-term basis. The second option is relevant in these cases:

- The specialist went on long vacation/sick leave.

- The employee was fired, and a new specialist has not yet been found.

- Other employees cannot replace an absent employee.

To temporarily appoint yourself as chief accountant, you also need to draw up an order. It must contain these provisions:

- The period during which the chief accountant assumes the functions of the chief accountant.

- The reason for the absence of the main specialist.

The rest of the order is drawn up in a standard form.

Sample on the temporary appointment of a chief accountant

On the temporary performance of duties of the chief accountant

July 24, 2021

In connection with the dismissal of the chief accountant D.D. Petrov. and the lack of a replacement specialist

1. Assign the duties of the chief accountant to himself, the general director of Gorodovoy R.R., until the hiring of a new chief accountant. 2. The order comes into force on August 1, 2021.

General Director Gorodovoy R.R. (signature)

FOR YOUR INFORMATION! When appointing yourself as chief accountant, you need not only to issue an order, but also to perform a number of other procedures. In particular, it makes sense to make changes to the bank account card.

It bears the signatures of the chief accountant and the general director. However, if a position is occupied by one specialist, only one of his signatures is required.

The exception is when another person has received the right to sign on the basis of a power of attorney.

We correctly draw up an order for the appointment of a chief accountant to the position - sample for downloading

The chief accountant is a management position; such an employee must be appointed by order of the director.

The order determines the start date of work in the position, as well as the procedure for payment and the specifics of the work.

In general, the document must be drawn up in accordance with the terms of the employment contract concluded with the employee hired for the position of chief accountant. The order is drawn up at the beginning of employment and must be approved by the manager. The chief accountant reports exclusively to the manager and is the second person after the director at the enterprise.

[3]

To appoint a person as chief accountant, you need to make sure that he has the necessary specialized skills, abilities, experience, and in some cases, education. You can be appointed chief accountant if you have a specialized higher education or have at least three years of work experience.

In addition to the employment contract, an employee of this position usually signs an agreement on full financial responsibility.

The order appoints not only the chief accountant of the LLC, but also the director of the company (executive, general), as well as his deputies.

Often in small companies, the director combines the position of chief accountant; in this case, one sample order is drawn up to appoint a manager and chief accountant in one person; an example of such an administrative document can be downloaded below.

Sample for the chief accountant of LLC

The form is not standard and is compiled with the inclusion of standard details for administrative documents:

- the place of drawing up the order is indicated - locality, name of the LLC;

- enter the date of preparation of the order;

- indicate the title of the document, and also explain what the form is about - appointment to a position;

- the reasons for this appointment, references to regulatory clauses requiring appointment by order (Articles 57, 59, 68, 70, 145 of the Labor Code of the Russian Federation may be indicated);

- an order to appoint a specific person as the chief accountant of the LLC (his full name, date of birth and other necessary information are written);

- the period for which a given person will perform his duties - relevant if a person is appointed to a position for a limited period;

- the procedure for remuneration according to the staffing table;

- order to conclude an employment contract with a citizen;

- if necessary, indicate the duration of the test if it is established;

- if full liability to the employer is provided, then this point is indicated;

- an order to the head of the personnel department (or other specialist responsible for personnel) to familiarize the appointed person with the contents of the order;

- manager's signature;

- study visas for responsible persons.

If the chief accountant and the manager are one person, then this point is explained in the document; in this case, the administrative document is signed by the founder of the LLC.

We also propose an order for the appointment of a director of an LLC.

registration

Sample order for the appointment of chief accountant of an LLC - download.

Sample on the appointment of a director and chief accountant in one person - download.

Get instructions on how to solve your specific problem. Call now:

+7 — Moscow — CALL

+7 — St. Petersburg — CALL

+7 ext.849 — Other regions — CALL

Koloskov Dmitry · 09.10.2019 2019-09-10

Assigning the duties of chief accountant to the general director is not such a rare procedure. This often happens at the time of opening an enterprise, when the staffing table has not yet been approved, but the obligation arises to submit reporting forms to the Federal Tax Service, Social Insurance Fund or Pension Fund of the Russian Federation, and activities have not yet begun.

How to assign the duties of a chief accountant to a director - sample order

Source: https://business-doc.ru/prikaz-o-vypolnenii-obyazannostej-glavnogo-buhgaltera-direktorom/

Who can be appointed chief accountant

However, no manager in his right mind would entrust the position of chief accountant to a person who does not have in-depth knowledge in the field of accounting and tax law, as well as experience in his specialty. Therefore, you can set the necessary requirements for a candidate for this position yourself, based on the specifics of your organization. Just don’t forget to indicate these qualification requirements in the job description of the chief accountant - this, among other things, will make it possible to reject candidates for this position who do not have the necessary skills.

Order for the director to assign the duties of chief accountant - in 2020

Russian legislation provides that every legal entity has the right to have a chief accountant in the company. However, such a right is not an obligation for all structures and, unless prohibited by law, the director can serve as the company’s chief accountant.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

This is possible not only in those moments when such an employee is temporarily absent, but also in the case when he is not present at all.

This circumstance may be due to the fact that such a position is not provided for in the staffing table. In this case, the functions of the chief accountant are assigned to the general director, who is fully responsible for maintaining the organization’s accounting records, filing reports, paying taxes and wages to employees, etc.

There is no single form of order that must be used when preparing a document on the transfer of responsibilities from the chief accountant to the director.

However, there is certain information that must be included in the order without fail, for example, the details and name of the company, the reasons for drawing up the paper with reference to legal norms and the signature of the director under the document.

Assignment of duties of the chief accountant during vacation

To temporarily perform such work, a deputy chief accountant or financial director is usually appointed. If these specialists are not available, another person is appointed (usually the responsibilities are transferred to the accountant).

By the way, the manager can prescribe it in the internal rules in advance. Then there will be no need to additionally issue an assignment order.

Otherwise, the procedure for assigning the responsibilities of the chief accountant during vacation or sick leave involves registration (see table):

| Personnel decision | Its essence |

| Position filling | The employee temporarily does not perform his job duties, but is exclusively engaged in the work of an absent colleague |

| Combination of positions | In addition to his duties, the specialist performs the duties of a chief accountant |

Please note: both options require a corresponding surcharge.

Also see “How to register a replacement during sick leave.”

You will need to do the following:

- Conclude an additional agreement with the person temporarily performing the duties of the absent employee. It is attached to the employment contract, which establishes an additional payment for replacement.

- Draw up an order appointing a responsible person. The rights and responsibilities of the chief accountant are transferred to him.

- Issue a power of attorney to the responsible person confirming the authority to act on behalf of the chief accountant before other persons and authorities.

- Issue a new card at the bank, where the right of second signature is transferred to the deputy of the absent employee (necessary when the manager does not have the opportunity to sign financial documents).

, please select a piece of text and press Ctrl+Enter.

Imposed recommendations How a director can avoid risks Assigning the duties of a chief accountant to an accountant and other employees Responsibility of a controlling person

A bank card with sample signatures and seal imprints is the most common reason for issuing an order to assign the duties of chief accountant to the director. Moreover, some banks themselves develop a sample of such an order. However, in addition to accounting by the director himself, there are other options.

Popular:

- Disability pension 2nd group of the Ministry of Internal Affairs Information of the Ministry of Internal Affairs of Russia dated March 18, 2021 “On current changes in the legal regulation of social guarantees for employees of internal affairs bodies who have suffered health damage in connection with the performance of official […]

- Order of the Ministry of Internal Affairs of Russia 495 dsp dated 29042018 instructions Order of the Ministry of Internal Affairs of the Russian Federation 495 dated 29042018 Order of the Ministry of Internal Affairs of the Russian Federation and the Federal Tax Service dated June 30, 2009 N 495/MM-7-2-347 “On approval of the procedure for interaction between internal affairs bodies and tax authorities on prevention , identification and […]

Source: https://cz-kch.ru/materialnaya-otvetstvennost/prikaz-o-naznachenii-glavnogo-buhgaltera-ooo.html

How to create an order

The legislation does not establish any special form or sample order for the appointment of an accountant. However, unlike documents for the admission of other specialists, they often have to be submitted to banks, the tax office and other institutions, so questions sometimes arise regarding its execution.

An order to appoint this employee is issued upon hiring and concluding an employment contract. Like the others, it should contain:

- date and serial number of the order;

- full name of the organization;

- FULL NAME. the appointed person;

- date of appointment to the position of chief accountant (if different from the date of publication of the document);

- manager's signature;

- personal signature of the employee confirming familiarization.

The order can also reflect the issues of establishing a probationary period, imposing full financial responsibility and granting the right to sign financial documents.

Order for appointment to the position of chief accountant form and sample 2019

There is no standard form for such an order; it is filled out according to a specific case. First of all, the HR employee or manager must take into account the purpose of the document, which may be:

- Confirmation of the status of the company's chief accountant when submitting documents to government organizations, banks, etc.

- Determining the list of cases and documents that the resigning chief accountant must transfer to the new one, as well as the period within which the transfer must take place.

- Familiarize the hired employee with his responsibilities.

If a commission has been formed for the acceptance and delivery of cases, its name must be indicated in the order (it may include employees of the accounting department and other departments, as well as third parties). In addition, an appendix to the order draws up a work schedule for the commission.

Also, when drawing up the document, the possible need to involve third parties in the process of transferring cases (representatives of outsourcing or audit companies or an independent auditor, consultants, representatives of higher organizations, etc.) is taken into account.

When formalizing a working relationship with a new chief accountant, the company issues two orders at once: on appointment to a position and on hiring. An entry is made in the work book based on the employment order.

How is the procedure regulated?

The legislation establishes that accounting is organized by the head of the organization. Article 7 of Federal Law No. 402-FZ dated December 6, 2011 establishes that the head of an organization is obliged to entrust accounting to the chief accountant or to conduct it independently. However, in some organizations, such as credit institutions, the presence of a chief accountant is mandatory.

Qualification requirements have been established for the chief accountant (clause 4 of Federal Law 402-FZ), which means that every chief accountant, regardless of the form of ownership of the enterprise (commercial or state), is subject to the professional standard, which is approved by Order of the Ministry of Labor dated December 22, 2014 No. 1061n .

Read more about the specifics of using the accountant’s professional standard

How to issue an order for the appointment of an accountant

There is no standardized form for such an order. If you do not have a company letterhead, you can use a blank sheet, indicating the details of the organization on it.

The document must contain:

- full and exact name of the organization;

- the place where the document was drawn up and signed;

- date and order number;

- surname, name, patronymic of the appointed person in full (here you can also indicate the date of birth and other information provided for by the charter of the Company or internal documents of the employer);

- employer's order on the appointment of a chief accountant;

- date of entry into position of the employee;

- signatures of the company manager and the new employee.

►Change the instructions for personnel records management. Yours is outdated

This is sufficient if the order is issued to confirm the status of the responsible person when he provides financial documents to various organizations. If the document is drawn up to transfer powers and affairs to the new chief accountant, it is also necessary to include in it:

- full last name, first name and patronymic of the employee transferring the case;

- the period within which it is planned to submit and accept documentation and work files (its maximum duration established by the Labor Code of the Russian Federation is two weeks);

- list of transferred cases;

- type of control over the transfer of cases and the list of persons involved in the process (including representatives of higher organizations and auditors).

It is also possible to draw up an order to determine job functions, and the document may reflect:

- the nature of the performance of duties - temporary or permanent;

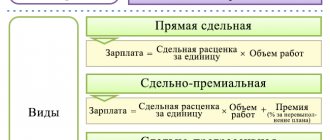

- amount of remuneration (salary, according to the terms of the employment contract, or piecework);

- the duration of the probationary period, if established (for the chief accountant should not exceed six months);

- the period for which the employment contract is concluded;

- information about the financial responsibility assigned to the employee, necessarily with the date of its occurrence;

- a key list of established job functions outlined in the contract.

It is important that the content of the clauses of the order does not diverge from the content of all other documents drawn up in this case (employment contract, etc.).

Sample order for the appointment of an accountant

Obviously, the above document should not cause any difficulties in filling out and can be used as a sample order for the appointment of the chief accountant of an LLC or any other organization. When designing it, you need to pay attention to the following nuances:

- The following must be included in the Order:

- date, since it will begin the person’s personal responsibility for maintaining accounting records in your organization;

- Full name of the person who will be the future chief accountant or who is assigned accounting responsibilities;

- full and exact name of the legal entity;

- personal signature of familiarization of the individual appointed to the position.

- In line 2, you can indicate not a salary, but a piece-rate payment option.

- Lines 4 and 6 are filled in if appropriate services are available at the enterprise

- Lines 3 and 4 are filled in as needed.

- Line 5 must be filled in with the date.

Any organization can write this document in free text form, indicating in it the data that relates to the specifics of its work. the order should not contradict other documents, including those that need to be drawn up for the final employment of the chief accountant.

Enter the site

In order to ensure healthy and safe working conditions, the availability and maintenance of production equipment, fire extinguishing equipment and timely monitoring of compliance with labor protection legislation

1. Organizational work on labor protection, industrial sanitation and fire safety is entrusted to the acting labor protection engineer (if there is an engineer, then even better) ___________ 2. Management and control over the organization of work and the state of labor protection, production culture, fire safety is entrusted to position and full name 3. The above mentioned fulfill their labor protection responsibilities set out in the “Regulations on the organization of work on labor protection of the enterprise” and be guided in their daily work by the current “Rules for training in safe methods and techniques of work, conducting briefings and testing knowledge on safety issues labor", "General fire safety rules of the Republic of Belarus for industrial enterprises" in PPB RB 1.01.-94, job descriptions, regulatory documents and instructions of the head of the enterprise. 4. Submit the order to the responsible persons against signature.

We recommend reading: How to correctly draw up an employment contract for the 05th rate

Checking records when accepting cases

The deed has been signed, all documents are available.

What else should the new chief accountant do? Of course, he is only responsible for his own work. But in order to avoid trouble in the event of a tax audit, it is better to play it safe and check how records were kept before. The new chief accountant can do this himself or ask to hire an audit firm. If the company does not have money for an audit, and the accountant does not have enough time to check everything himself, a random audit is carried out. First of all, you should pay attention to the calculation of taxes. Especially for taxes for which the tax period is a calendar year. The fact is that mistakes made by the former accountant will entail a distortion of the tax base already during the period when the new chief accountant will work.

The new chief accountant arrived in the middle of the year

Let's look at the main taxes paid by an organization that applies the general taxation regime.

VAT . In accordance with Article 163 of the Tax Code of the Russian Federation, the tax period for VAT is a month (for organizations with monthly revenue excluding VAT no more than 2 million rubles - a quarter).

Thus, if a company has a tax period of one month, it is necessary to check the business transactions reflected in the accounting records and relating to both the calculation of VAT and tax deductions for it for the last month. In addition, it is necessary to check the availability and correct completion of issued and received invoices, their registration journal, purchase and sales books.

If the tax period is a quarter, the verification mechanism is the same, but the period is longer. However, if a company has relatively small revenue (less than 2 million rubles per month), we can assume that it does not have many business transactions, as well as documents. It is advisable to check the purchase books and invoices received from suppliers since the beginning of the year.

UST . Article 240 of the Tax Code of the Russian Federation specifies the tax period - a calendar year. What does this mean? If a new chief accountant comes in the middle of the year, he will have to file a tax return under the Unified Social Tax both for his period and for the period when he has not yet worked. Therefore, you need to check transactions related to the calculation and payment of this tax not only for the last month, but also from the beginning of the year. In addition, the accrued UST is one of the types of expenses taken into account when calculating income tax. Therefore, errors in the calculation of UST will be double, that is, they will lead to a distortion of the tax base for income tax.

Property tax . The tax period for this tax is a calendar year (Article 379 of the Tax Code of the Russian Federation). The new chief accountant will have to check how it was accrued from the beginning of the year. True, it is not as difficult as with previous taxes. It is enough to check how the residual value of fixed assets is determined, the average annual value of all fixed assets and the tax itself is calculated.

income tax . As a rule, it is with this tax that most errors are associated. The tax period for income tax is a calendar year (clause 1 of Article 285 of the Tax Code of the Russian Federation). The new chief accountant will have to check all supporting documents, tax registers, as well as accounting of business transactions related to income, expenses and tax charges for the period from the beginning of the year. Documents related to expenses should be examined especially carefully. After all, in the absence of at least one necessary document, it will be considered that the tax base is unlawfully underestimated. After the audit, tax sanctions may follow.

We recommend that you pay attention to business transactions related to the application of PBU 18/02. If the amounts of income tax calculated in the declaration correspond to the amounts reflected in the accounting records, taking into account deferred tax assets and liabilities, then the likelihood of errors in tax accounting is minimal.

If the organization applies the simplified tax system , then the new chief accountant, who arrived in the middle of the year, must review all entries in the Book of Income and Expenses from the beginning of the year. He checks whether income is correctly determined, how expenses are classified as expenses, whether there are supporting documents, etc. Let us recall that the tax period for tax paid under the simplified tax system is also a calendar year (clause 1 of Article 346.19 of the Tax Code of the Russian Federation).

Unlike the chief accountant of an organization under general regime, the new chief accountant of an organization whose activities fall under UTII will not have to check so much. The amount of accrued UTII does not depend on real income and expenses, so you only need to look at the calculation of physical indicators. The tax period is a quarter. Consequently, the new accountant will be responsible for accruing UTII from the beginning of the quarter for which they have not yet reported.

The new chief accountant arrived at the beginning of the year

Let's assume that the previous chief accountant has already calculated all taxes for last year and submitted all reports.

Then the new chief accountant, who comes to work at the beginning of the year, starts the year anew. He does not need to check the accounting and calculation of taxes for the previous year. If taxes for last year have not yet been calculated, the reports are not ready and have not been submitted, the new accountant acts in the same way as if he came in the middle of the year. It is necessary to study everything done by the previous chief accountant, not for part of the year, but for the entire previous year.