Labor Code of the Russian Federation on part-time work

The terms “rate” or “0.5 rate” do not appear in the Labor Code of the Russian Federation. In practice, the rate is usually called the normal working time - no more than 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation).

Everything that is less than the specified norm (including work at 0.5 times the rate) is designated in the Labor Code of the Russian Federation as part-time work (ILO Convention No. 175 of June 24, 1994 “On Part-Time Work”, Art. 93 Labor Code of the Russian Federation, letters of Rostrud dated 06/08/2007 No. 1619-6, dated 06/24/2009 No. 1819-6-1).

general information

A working citizen of the Russian Federation, on average, must work at least 40 hours a week.

For some categories of workers (minors, disabled people, etc.) other labor standards have been established. But for most workers, 40 hours is far from the limit, so additional time is paid as overtime. However, overtime also has its limitations. So, for example, a person cannot work longer than 4 hours for 2 days in a row. The total duration of additional hours of work per year should not exceed 120 hours. It is not difficult to calculate that the working week can increase by a maximum of 16 hours.

Often employees need to reduce the time they spend at work due to certain personal circumstances. The law allows employees to enjoy this benefit. But the agreement between him and his immediate supervisor must be documented.

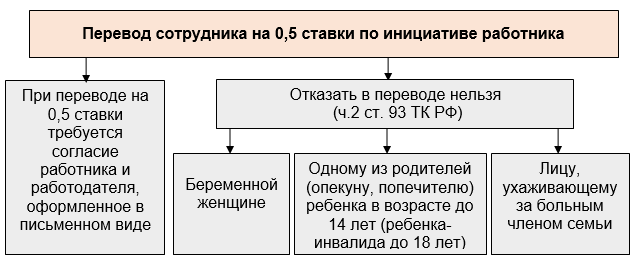

The employer can either refuse or allow this rate to be reduced. He has no right to refuse only when the request is voiced by a pregnant employee, an employee with a young child, etc. If an employee has other reasons for reducing working hours, then the resolution of the issue remains at the discretion of the manager.

When can you transfer an employee to 0.5 rates?

Such a transfer is acceptable upon entry to work or at any time during the period of employment. When transferring to 0.5 rates, not everything depends on the employer and employee - labor legislation imposes certain restrictions:

- establishes categories of employees for whom the employer cannot refuse a request for transfer to part-time (Part 2 of Article 93 of the Labor Code of the Russian Federation);

- stipulates the conditions and circumstances of the legal transfer of employees to part-time work at the initiative of the employer (Article 74 of the Labor Code of the Russian Federation).

According to labor legislation, transferring an employee to part-time work is possible:

- At the initiative of the employee

In addition, the employer does not have the right to refuse to change the essential terms of the employment contract to an employee who submits a medical report and an application for light work in connection with pregnancy (Part 1 of Article 254 of the Labor Code of the Russian Federation).

- At the initiative of the employer

If one of the conditions is not met, unilaterally transferring employees to part-time status (without their written consent) will be illegal.

The criteria for mass layoffs are determined in industry and (or) territorial tariff agreements or according to Government Decree No. 99 of 02/05/1993 (based on the number of workers laid off due to the liquidation of enterprises or a reduction in the number or staff of employees for a certain calendar period).

For how long can a part-time transfer be possible?

Here it all depends on who initiated the transfer of the employee to 0.5 rates:

- The initiator of the transfer is the employee himself

The period of work in this mode can be any, including indefinite (part 1 of article 93 of the Labor Code of the Russian Federation).

There is one exception in relation to employees transferred at a personal request to 0.5 rates and belonging to the category of employees who cannot be denied this. The period of their work in part-time mode is limited to the period of preferential circumstances (Part 2 of Article 93 of the Labor Code of the Russian Federation).

The employer may agree to such employees a longer period of part-time work, although it is not obligated to do so. Such employees have the right to abandon the established regime ahead of schedule, and the employer cannot prevent them from doing so - since according to the Labor Code of the Russian Federation, the employer’s consent to the establishment of a special regime is not required, it means that it is not necessary to cancel it (Part 2 of Article 57, Art. 72, part 1 of article 93 of the Labor Code of the Russian Federation).

- The initiator of the transfer is the employer

If the employer unilaterally transferred workers to part-time to prevent mass layoffs, the period of work in this mode cannot exceed 6 months (Part 5 of Article 74 of the Labor Code of the Russian Federation).

Within this six-month period, a specific length of working time (week, day, shift) must be established. After this period, employees must be transferred to the previous regime. Cancellation of the part-time work regime before the expiration of the period for which it was established is carried out taking into account the opinion of the trade union.

Salary and vacation under the new work schedule

Part-time work does not limit the employee’s rights. He can still count (Part 4 of Article 93 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor dated October 25, 2018 No. 14-2/OOG-8519):

- for annual paid leave, the duration of which does not change due to a decrease in hours worked;

- calculation of length of service in the usual manner and full compliance with other labor rights.

The salary for part-time work is calculated in proportion to the time worked or depending on the amount of work performed (Part 3 of Article 93 of the Labor Code of the Russian Federation). The salary in such a situation is calculated according to the rule - if an employee works part-time, then it is assumed that he works half the normal working time.

Example. The salary of the accountant of Progress LLC Tomilina N. E. is 32,000 rubles. Since July 2021, at her personal request, expressed in the application, the employee has been transferred to part-time work at 0.5 times the rate.

From now on, her monthly salary will be:

32,000 rub. x 4 hours /8 o'clock = 16,000 rub.

or

32,000 rub. x 0.5 bet = 16,000 rub.

The introduction of a part-time working regime does not entail changes in the staffing table in terms of the initially established salaries.

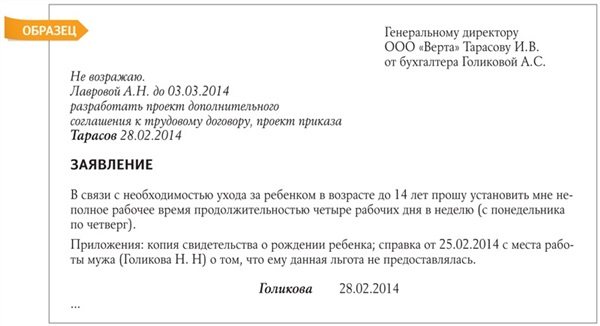

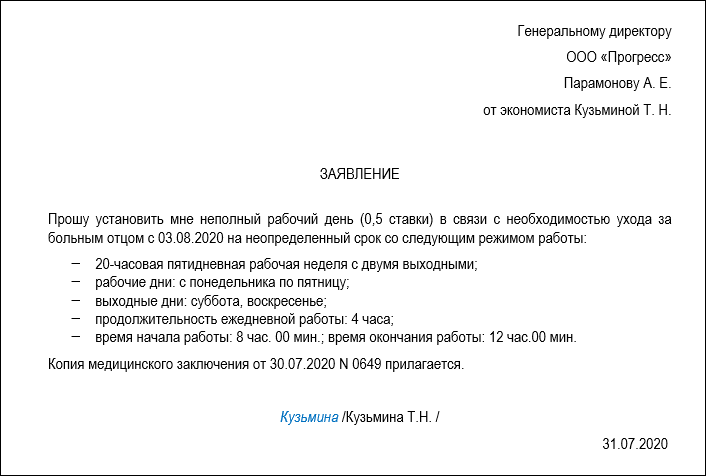

Statement

To register part-time work on the initiative of a subordinate, his application is required. The form of the document is not established by law, so you can use a suitable sample from the personnel department. An application for transfer to part-time work must contain the following points:

- the length of the period when a person needs part-time work or a week;

- type of shortened working hours;

- the date from which the new schedule will operate.

The application must be drawn up in two copies. One document remains with the employer, and he signs the second and gives it to the employee. If an employee does not have documents proving a serious reason for reducing working hours, then the manager is obliged to warn him of a possible refusal. The employer also has the right to officially request this document.

We arrange a transfer of 0.5 rates at the request of the employee

For personnel records management, transferring an employee to part-time work is a change in the terms of the employment contract previously determined by the parties.

How to formalize such a personnel event depends on who initiated the transfer. If an employee makes such a request to the employer, the following documents are usually needed to document the transfer:

- Written statement from the employee.

The law does not require a written form of the application, but if something happens it will confirm the fact of the employee’s personal request for a transfer to 0.5 rates and the absence of coercion on the part of the employer.

- Additional agreement to the employment contract according to the provisions of Art. 72 Labor Code of the Russian Federation.

Draw it up in two copies in any form indicating the working hours (at 0.5 times the rate), the period for which part-time working hours are introduced, the procedure for remuneration and the date of entry into force of the changes.

For what to write in the text of the agreement, see the example:

Since the employee transferred to part-time will work no more than 4 hours a day, he may not be provided with a lunch break (Part 2 of Article 57, Part 1 of Article 100, Part 1 of Article 108 of the Labor Code of the Russian Federation).

- An order to transfer an employee to 0.5 rates (it is advisable to issue, but not necessary).

Salary

In the case of reduced working hours, the employee must understand that his earnings will suffer as a result. In other words, it will be equal to either the amount of time worked or the amount of work completed. But these are the only restrictions that await an employee working part-time.

Let's say Sokolova P.L. as a manager with a standard 40-hour work week, she received a monthly salary of 45 thousand rubles. In connection with caring for a sick relative, she was transferred to a shortened day. Now, instead of 8 hours a day, she works only 6.

What salary can she receive, suppose, for October, which has 21 working days? To calculate, you need to divide 45 thousand rubles by 40 hours, and then multiply by 30. 45,000 / 40 * 30 = 33,750 rubles. This will be the salary of P.L. Sokolova. for October with part-time work. If there is a need to calculate the average salary, then it is carried out in a standard manner and taking into account payment when the entire norm is met.

The employer does not have the right to shorten the vacation of a subordinate by compensating for his shortened working week with rest days. This also applies to sick leave, which the employer is obliged to provide according to all the rules. There are also no restrictions related to insurance premiums, length of service, etc.

What documents should I prepare if the initiator of the transfer is the employer?

Let us recall that the part-time regime can be introduced by the employer solely under the circumstances provided for in Art. 74 Labor Code of the Russian Federation.

The package of documents will be as follows:

- Employees should be given written notices no later than 2 months before the introduction of the new regime (Part 2 of Article 74 of the Labor Code of the Russian Federation).

- If the employee agrees, enter into an additional agreement with him or her to the employment contract. In case of disagreement, the employment contract is terminated after 2 months due to a reduction in the number or staff (part 6 of article 74, clause 2 of part 1 of article 81 of the Labor Code of the Russian Federation).

- Issue an order on the introduction of part-time working hours, in which you specify from what date and for what period the regime will be introduced, for which employees, as well as other nuances that will help HR officers to correctly formalize the change in labor relations, and the accounting department to pay employees.

Don’t forget to also send a notification to the employment service (we’ll talk about this later).

Employment service notification

The employer is obliged to notify the employment service in writing about the introduction of a part-time working regime, including when transferring employees to 0.5 wages, within 3 working days after the decision is made to carry out the relevant measures (Clause 2 of Article 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”).

Such information is mandatory if the transfer of employees to 0.5 rates is established at the initiative of the employer - in accordance with Art. 74 Labor Code of the Russian Federation.

The form of notification for such situations is not officially established, that is, it is arbitrary. The main thing is that the notification makes it clear who submitted it and when the decision was made to introduce part-time working hours.

If the employee himself asked the employer for a part-time transfer and received his consent, there is no need to notify the employment service (Rostrud Letter No. 1329-6-1 dated May 17, 2011).

Order

If the parties have agreed to reduce working hours, then the employer must issue an order to transfer the subordinate to a new schedule. In the event that the boss will reduce the work time of an already employed employee, the order is drawn up in free form. The compiler only needs to adhere to the rules of office work and indicate basic information.

If an order to transfer to part-time work on the initiative of a subordinate is issued upon his employment, then the employer uses a special T-1 form.

Note to the employer

Transferring an employee to 0.5 rate may raise many questions. We answered some of them in our material. We will briefly discuss other possible nuances below:

Personnel and organizational issues

| Question | Answer | Rationale |

| Is it necessary to make an entry in the work book about transferring an employee to 0.5 rates? | No | Such an entry is not provided for by the rules for maintaining a work book (Part 4 of Article 66 of the Labor Code of the Russian Federation, clause 4 of the Rules for maintaining and storing work books, approved by Government Resolution No. 225 of April 16, 2003) |

| Is the transfer of a part-time employee reflected in SZV-TD ? | No | Such a personnel event as transferring an employee to part-time work is not included in the list of events reflected in the SZV-TD (Procedure for filling out the SZV-TD, approved by Resolution of the Board of the Pension Fund of December 25, 2019 No. 730p) |

| When transferring employees to 0.5 rates, is it necessary to make changes to the working hours in the PVTR ? | Yes | If you change the working hours for the organization as a whole or for a structural unit (Part 1 of Article 100 of the Labor Code of the Russian Federation) |

| No | If the changes are caused by the personal request of individual employees and are introduced temporarily | |

| Can an employer introduce part-time work due to difficult financial situation ? | No | Such a translation will be illegal, as it contradicts Art. 74 Labor Code of the Russian Federation. Payment to employees for the time when they were deprived of the opportunity to work should be made as for downtime due to the fault of the employer, and paid in the amount of at least 2/3 of the average salary of the employee (Article 72.2 of the Labor Code of the Russian Federation) |

Salary nuances

| Question | Answer and link to the normative act |

| How to calculate insurance premiums at reduced rates if an employee transferred to part-time work is 0.5 times less than the minimum wage? | In order to apply the reduced rates of insurance premiums established by Law No. 102-FZ dated April 1, 2020, the total amount of payments to the employee for the month is taken into account, which exceeds the minimum wage, regardless of the rate at which the employee works |

| How to calculate the average salary for an employee transferred to 0.5 rates? | Average earnings are calculated according to the general rule - the average daily earnings are used, calculated by dividing the amount of wages actually accrued for days worked in the billing period (including bonuses and remunerations) by the number of days actually worked during this period. The average earnings of an employee are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to (clause 9 of the Regulations, approved by Government Decree No. 922 of December 24, 2007) |

| How to pay an employee transferred to 0.5 rates beyond the duration of his working day ? | For an employee transferred to 0.5 rates, such work will be considered overtime, which must be paid at one and a half or double times (Article 152 of the Labor Code of the Russian Federation) |

What to do when applying for a part-time job

Part-time hiring is similar to “regular” hiring. Features - in the execution of the employment contract and employment order. So, let us remind you that upon admission you, in particular, need:

• organize a medical examination (mandatory preliminary), if it is provided for by law for the job for which the employee is hired (Article 69 of the Labor Code of the Russian Federation). The law does not provide for exceptions if the employee is hired on a part-time basis;

• request the required documents from the employee. These include, in particular, a passport, a work record book (if it is maintained and the employee previously worked) and (or) information about work activity (except for the case when an employment contract is concluded for the first time), military registration documents. If necessary, you can ask the employee to write an application for part-time work. See additional Review;

• familiarize the employee with the internal labor regulations, other local regulations that are related to his work, as well as the collective agreement (if any). This must be done under the signature of the employee and before he signs the employment contract (Part 2 of Article 22, Part 3 of Article 68 of the Labor Code of the Russian Federation);

• draw up an employment contract;

• issue an order for employment;

• make a record of employment in the work book (if it is kept) (part 4 of article 66 of the Labor Code of the Russian Federation, clause 4 of the Rules for maintaining and storing work books). The procedure is the same as for full-time employment (special features are not provided for by regulation). Therefore, there is no need to enter information that the employee is working part-time;

• reflect information about hiring in information about labor activity (Parts 1, 2, Article 66.1 of the Labor Code of the Russian Federation).

There is no need to enter information about part-time work.

Submit information about your work activity to the Pension Fund of the Russian Federation at the place of your registration (Parts 1, 2 of Article 66.1 of the Labor Code of the Russian Federation, paragraphs 1, 2.4 - 2.6 of Article 11 of the Personalized Accounting Law). They are presented in the form SZV-TD.

The procedure for filling it out was approved by Resolution of the Pension Fund Board of December 25, 2019 N 730p.

Please note that the deadline for submitting the SZV-TD form has been changed until December 31, 2021.

In particular, when hiring from April 1 to April 27, 2020, the SZV-TD form is submitted to the Pension Fund no later than April 28, 2021, and if the employee was hired after April 27, 2021, no later than the next working day after the day of publication of the corresponding order (instruction), other decisions or documents confirming the formalization of the labor relationship. This follows from paragraph 2 of Art. 2 of the Law on Personalized Accounting, paragraphs. “a”, “c” clause 1, clause 3 of the Decree of the Government of the Russian Federation of April 26, 2020 N 590;

• issue a personal employee card. Do this as usual. So, if you use the unified form N T-2, fill out section. I - III. There is no need to reflect the condition of part-time work on your personal card. For employees who have refused to maintain a work record book or are getting a job for the first time after 12/31/2020, we recommend issuing a personal card based on information about their work activity;

• notify the former employer (employer) of the employee if the latter previously held a position in the state or municipal service, taking into account the conditions and requirements of Part 3 of Art. 64.1 Labor Code of the Russian Federation.

Let's sum it up

Transfer of a part-time employee:

- possible at the request of the employee or at the initiative of the employer (in cases specified by law);

- does not affect the duration of the next vacation, calculation of the employee’s length of service and other labor rights of the employee;

- paid in proportion to the time worked or depending on the amount of work performed;

- requires the execution of an additional agreement to the employment contract with the employee, as well as other personnel and administrative documents.