What is insurance experience

Companies and individual entrepreneurs must pay insurance premiums for their employees (individual entrepreneurs also for themselves). By transferring payments to the budget, they become insurers for individuals. This obligation is established, in particular, by the Federal Law of December 15, 2001 No. 167-FZ and the Federal Law of December 29, 2006 No. 255-FZ. Insurers are also arbitration managers, notaries, lawyers, etc. (Article 6 No. 167-FZ, Article 2.1 No. 255-FZ). Individual individuals can pay insurance premiums at their own discretion, for example, self-employed citizens (Article 29 No. 167-FZ).

The insurance period is the sum of the periods during which contributions for the relevant type of insurance were sent to the budget, and other periods listed in legislative acts. The insurance length indicator is important for determining the amount of the following payments to a citizen:

- old age insurance pension;

- benefits for temporary disability (sick leave) and maternity benefits.

Practical example of performing calculations

In accordance with the rules for calculating length of service, approved by Order of the Ministry of Health and Social Development of Russia No. 91 and 255 of the Federal Law, the following periods influence the calculation of length of service and assignment of payments:

- Employment under an employment contract;

- Civil and municipal service;

- Individual entrepreneurship;

- Completion of military service, including under a contract;

- Maternity leave, as well as child care leave until the child is 1.5 years old;

- A period of unemployment with the receipt of appropriate benefits;

- Time spent traveling to a new duty station;

- Detention and serving sentences by persons who have been unlawfully subjected to criminal prosecution or repression;

- For spouses of military personnel or civil servants - the time spent accompanying them to their new duty station (in general, no more than 5 years);

- Caring for a family member who is unable to work due to age or disability.

When calculating length of service for sick leave or upon retirement, in addition to the days actually worked, the following are taken into account:

- Official holidays and weekends;

- Forced absenteeism;

- Time of paid public works;

- The period of retention of the employee’s place during vacation, maternity leave, etc.;

- Time off.

There are some exceptions to the general rules. When calculating length of service online, you can also include those types of work that are not included in the work book, but entail insurance contributions to the Pension Fund. For example, the author received a fee for his creative activity and paid a fee on it. Then the total length of service will include the period for which the insurance deduction was made. The same applies to members of public associations and farms.

It is necessary to enter data into the online calculator taking into account the requirements of 255-FZ. It is important to remember the following rules:

- The law does not have retroactive effect, therefore, if, according to previously existing standards, some period of work was recognized as insurance, then it can also be counted.

- Maternity and child care benefits are calculated based on average earnings over the past year.

- The total length of service includes labor activity on the territory of the Russian Federation, with the exception of cases where a citizen has the right to receive a pension under the law of another country and these norms do not contradict Russian legislation

- If several working periods are identical, then the more profitable one is taken into account when receiving a pension.

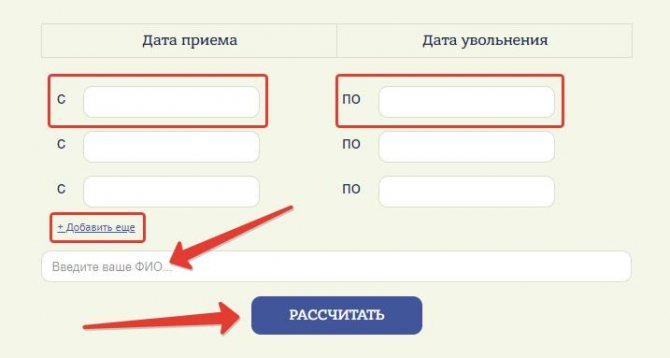

Using the online work experience calculator is easy and convenient. The main thing is to remember the rules discussed above and have labor documents before your eyes. First, fill in the columns for the dates of hiring and dismissal (strictly as in the work book). Activities equivalent to work are also included (maternity leave, caring for an elderly relative, individual entrepreneur, etc.). To add a new calculation period, click “Add experience”.

Benefits of the calculator:

- Convenience;

- Intuitive interface;

- Does not require special knowledge;

- Helps to quickly and automatically calculate the length of service.

A correctly calculated insurance period of activity allows you to receive guaranteed payments during the period of incapacity in the amount for which the citizen has the right to claim. Large organizations have special accounting programs, and at home it’s easy to calculate length of service using an online calculator.

To carry out the calculation you need to know only two indicators:

- start date of the working period;

- its end date.

There are rarely examples where a citizen works in one workplace all his life. Therefore, to carry out calculations, it is necessary to know the time intervals for a citizen’s employment at all places of his work. All this data can be seen in the employee’s work book, in column No. 2 “Date”. When applying for a job, it indicates the date of registration of employment, and when transferring to another job or upon dismissal, the date of transfer or termination of employment with a specific employer.

When calculating work experience, there are some nuances that must be taken into account:

- if the document indicates only the year of hiring or dismissal, then the date July 1 of the corresponding year is taken for calculation;

- if the day of the month is not specified, then the 15th day of the corresponding month is taken;

- if a calendar month or year is worked in full by an employee, then when calculating, there is no need to divide by 30 days or 12 months.

- date of hire. Information can be entered manually in the format: “day/month/year” or use the pop-up calendar window by selecting the desired date;

- date of dismissal from this place of employment.

If there were several places of work, then this data must also be entered into the electronic form. As you enter the initial data in the form, new windows for entering dates will appear.

After all the data has been entered, the final result of calculations separately for each period of employment in days and the final result for the total insurance period in whole years and months will appear at the bottom of the calculator form.

Let's take this situation as an example: gr. Ivanova got a job at the statistics department on September 3, 1990, and quit to care for her child on November 10, 1997. Some time later, on July 1, 1999, she got a job at Priz LLC, where she works to this day.

Let's enter all the initial data into the fields of the electronic form of the calculator and get the output data: gr. Ivanova has worked in the statistics department for 2625 days, at her last place of work - 6581 days. The final insurance period as of July 7, 2017 is 25 years and 2 months.

More information can be obtained by asking questions in the comments to the article.

In order to calculate the insurance period manually, you must:

- Convert every 30 days to 1 month.

- 12 months is equivalent to one year.

- The years add up.

Important!

The date of dismissal of the employee must be included in the insurance period.

You can calculate your work experience manually yourself.

The procedure is carried out based on the data of the citizen’s work book.

- Through an Internet program. Here on our website you need to find an experience calculator. Next, you should enter the data specified in the work book into the program:

- service in the Air Force;

- maternity leave;

- amount of children;

- a period of time during which a citizen did not work, but was registered with the employment service and received unemployment benefits;

- time of moving to work in another area;

- social work activity

- and so on.

All periods should be reflected in the form of the pension experience calculator.

Calculation of the length of service on a preferential pension can also be done using a calculator.

As for independent calculations, all working periods should first be written down, then, using a calendar, count the number of years, months and days in each period. Add up the resulting time intervals. This process is quite complex and lengthy, while the online service only asks you to enter dates. There is no need to calculate or summarize anything here.

Daily benefits during an employee's illness or traumatic injury, as well as while caring for an unhealthy family member, may be:

- when working from 6 months to 5 years, 60% of average earnings;

- when working for 5 - 8 years, 80% of average earnings;

- when working for more than 8 years, 100% of average earnings.

When working for more than 6 months, maternity benefits will be calculated as 100% of the average salary.

In the event of an accident at a production enterprise or an occupational disease, the Social Insurance Fund benefit will be calculated from 100% of the average salary, without considering work output.

How to determine the insurance period for calculating sick leave if the employee worked for different employers

An employee worked in one organization for 4 years 10 months 15 days, and in another - 1 month 15 days. How to determine the insurance period for the purpose of calculating temporary disability benefits? The answer to this question is contained in the letter of the FSS of the Russian Federation dated January 16, 2018 No. 02-09-14/17-04-31319.

The methodology for calculating the insurance period for determining the amount of benefits is given in paragraph 21 of the Rules for calculating and confirming the insurance period (approved by order of the Ministry of Health and Social Development of Russia dated 02/06/07 No. 91). This paragraph states: the calculation of periods of work (service, activity) is carried out in calendar order based on full months (30 days) and a full year (12 months). In this case, every 30 days are converted into full months, and every 12 months of these periods are converted into full years.

Therefore, if an employee worked for one employer for 4 years, 10 months and 15 days, and for the second - 1 month and 15 days, then periods of less than 30 calendar days must be summed up and converted into a full month. Thus, in the described situation, the employee’s insurance experience is 5 full years.

The periods include:

- Work according to an employment contract and part-time. Even in periods where the employee did not work. Such periods include maternity leave, child care leave, and so on.

- Passage of civil or municipal service.

- Completion of military service.

- Conducting other activities subject to mandatory insurance payments.

Insurance experience for pension insurance

From birth, an individual has an individual account opened in the Pension Fund. This account records all pension insurance payments made by the employer or other person, including the citizen himself. The period during which contributions to the Pension Fund were paid will constitute the main part of the insurance period when calculating the pension.

Important!

There is a limit on the amount of insurance coverage from which an individual has the right to receive an old-age insurance pension. Until 2015, the condition for receiving a pension was a five-year insurance period. By 2024, the length of service required to receive a pension will be 15 years (Article 8 of Federal Law No. 400-FZ dated December 28, 2013 “On Insurance Pensions”). The transition period to increase the minimum insurance period is currently ongoing:

| Year of pension assignment | Minimum insurance period |

| 2020 | 11 years |

| 2021 | 12 years |

| 2022 | 13 years |

| 2023 | 14 years |

| 2024 and later | 15 years |

The pension due to a citizen is calculated on the basis of the individual pension coefficient. Its value, in turn, depends on the insurance period.

The rules for calculating the insurance period for the purposes of pension insurance are established by Federal Law No. 400-FZ “On Insurance Pensions”, as well as the Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions.” An employee’s insurance period includes not only work activity, but also other periods of life. The full list is specified in Article 12 of Federal Law No. 400-FZ. Let us give some examples of them:

- military service;

- periods of being on sick leave and receiving appropriate benefits;

- period of receiving unemployment benefits;

- the period of care of one of the parents for the child until he reaches one and a half years old (no more than six years in total);

- length of stay in custody or in places of detention of persons brought to criminal liability without justification, etc.

It is necessary to take into account that such periods cannot be included in the insurance period if before or after them no insurance contributions were paid to the Pension Fund for the individual.

An employee can work part-time. In this case, insurance premiums will be paid by each policyholder. However, only one of the periods can be included in the insurance period. The period for calculating the insurance period is taken based on the individual’s application.

If a citizen worked abroad, and this period was taken into account when determining a pension in another country, such a period is not included in the insurance period.

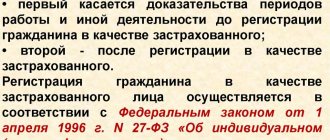

How to confirm other periods included in the length of service

A number of periods are taken into account for which contributions are not deducted, but the periods themselves are taken into account in the insurance period. How can I confirm them? Thanks to the legislator - answers to such questions exist:

- Military and other equivalent service - information from the military ID, certificates from the military registration and enlistment office, military unit, papers from the archive, work books. The offset occurs based on the actual duration of the period, without preferential calculations.

- Period of absence due to illness - documents from the employer or the Social Insurance Fund regarding the time of payment of sickness benefits.

- Time to care for a child up to 1.5 years old - birth documents, certificate of cohabitation, etc.

- Time registered with the employment service - a certificate from this organization.

- Time spent in custody - documents that need to be obtained at the FSIN institution.

- Caring for a disabled person of 1 year, a disabled child, a person over 80 years old - with the help of papers recording the fact and duration of disability - an ITU extract, and to confirm age - a passport, birth certificate.

- Spouses of diplomatic representatives during their stay outside the Russian Federation - with the help of certificates from the institutions that sent the employee to work.

- Spouses of military contractors who serve in places where there is no opportunity for employment confirm the period:

- until 01/01/2009 - certificates from military units, military registration and enlistment offices;

- after 01.01.2009 - certificates from the military unit, military registration and enlistment offices and certificates from the employment service.

- In case of service outside the state - only a certificate from the military unit or military registration and enlistment office.

Thus, the article provides an answer to the question: how to calculate length of service using a work book (the calculator and the rules for working with it are discussed above), and also provides a list of periods included in the calculation.

Social insurance experience

The periods of payment of social insurance contributions form the main part of the insurance period taken into account when calculating benefits:

- Maternity benefit.

If a woman’s work experience is less than six months, the amount of the monthly benefit cannot be more than the minimum wage (Article 11 of the Federal Law of December 29, 2006 No. 255-FZ), which from 2021 is 12,130 rubles. If the period worked is greater than or equal to one half a year, payments will be calculated based on 100% of average earnings.

- Temporary disability benefit.

Depending on the length of the insurance period, the amount of benefits is determined:

- up to 5 years of experience - the benefit is determined as 60% of average earnings;

- experience from 5 to 8 years - 80% of average earnings;

- 8 years of experience or more - 100% of average earnings.

When calculating sick leave payments, there is also a limitation of 6 months of insurance experience: less than this period, benefits are accrued in an amount not exceeding the minimum wage.

The procedure for calculating length of service for determining maternity benefits and sick leave is established by Art. 16 of the Federal Law of December 29, 2006 No. 255-FZ and Order of the Ministry of Health and Social Development of Russia of February 6, 2007 No. 91. The period of contribution includes the periods of deduction of contributions, as well as other periods listed in Part I of the Order.

Unlike pension insurance, with social insurance the length of service does not include periods of work under the GPC. There are other discrepancies between these types of insurance experience. For example, social insurance does not take into account periods of official unemployment, unjustified detention, etc.

What types of experience exist?

An ignorant person may think that there is only one type of work experience - general. This is wrong. In fact, experience is divided into several types:

- Actually the total work experience. Here it is necessary to count all periods of a person’s work, including under contract agreements and employment contracts. It is calculated based on the contracts in hand and entries in the work book;

- Special experience. Here we consider work that was carried out in special conditions (for example, in hazardous industries, in the north, etc.);

- Continuous experience. The main distinguishing feature of this type of work experience is the total period of work in one or several organizations without interruption. However, since 2007 it is not taken into account when calculating payments for temporary disability;

- Insurance experience. It is this type of experience that is taken to calculate sick leave. It includes all periods of work with mandatory insurance transfers, as well as civil service and military service.

What is the difference between insurance experience and labor experience?

The term “work experience” is used quite rarely in current practice. Until 2002, it was used to calculate pension payments. Its main difference from the insurance period is the absence of connection with the payment of insurance contributions to the Pension Fund. The amount of work experience depends only on work activity, i.e., the period reflected in the work book of an individual. Nowadays, length of service is used to determine a citizen’s length of service in the period before January 1, 2002, the period of work in difficult climatic conditions, when determining benefits and allowances, and in some other cases.

The length of service may differ in the number of years from the insurance period. For example, a citizen worked under an employment contract for 5 years. After his dismissal, he operated as an individual entrepreneur for 2 years, and after that, for three years he worked under a GPC agreement, also with the payment of insurance premiums. In this case, the individual’s work experience will be equal to only 5 years - the time of official employment. And the insurance period will be 5 + 2 + 3 = 10 years - the period during which contributions were received into the budget.

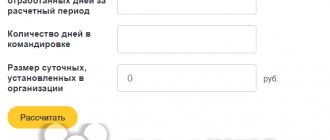

Calculator for calculating length of service for sick leave

We have developed a calculator for you to make it easier to calculate your insurance work history.

Using it, you can accurately calculate your length of service in years, months and days. You can calculate both the total amount of the period worked and the amount of time devoted to service at one place of work. If you need to find out the size of your current pension, use our

online pension calculator

.

Young people need this because in the first years of work, sick leave is paid 100% only if the person has worked for a total of more than 8 years in a Russian company.

The calculator is very easy to use. To do this, you need a work record book or you can enter the data from memory (then it may turn out to be inaccurate).

All the features of our work experience calculator

The work book states:

- the name of the company you worked for;

- day of hiring;

- date of dismissal.

This data is necessary for calculation. The data is entered in the format DD.MM.YYYY. Rounding by year occurs as follows: every 12 months are counted for the year, every 30 days for the month.

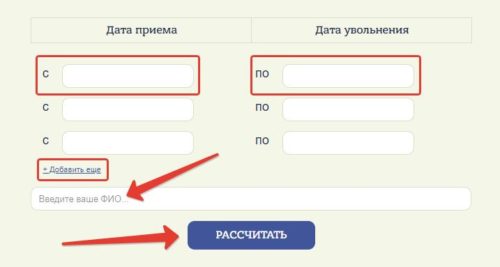

The date of hire should be entered in the left line, and the date of separation from service in the right line. Data must be entered on the days of actual hiring and dismissal from work. There are often situations when these dates differ from the actual ones.

You can provide personal information for convenience. This way you can calculate the length of service of several people without getting confused. We suggest that you take a screenshot of the page and then the calculation will not have to be done again in the future.

If you have worked in more than 4 places, you can add as many additional as you need. For this purpose there is a button “Add more”. It is located between the first column with the date of employment and the line for the full name.

If you made a mistake in filling out the data, you can delete the incorrect ones. There is a cross next to each window for entering dates. Click on it and the data will be erased. In this way, you can delete data from one window or several in a row.

There is a special program for calculating length of service using a work book - these are so-called online calculators. They serve to calculate the duration of activity, taking into account the time of incapacity for work according to the work book. You must enter data carefully to avoid calculation errors.

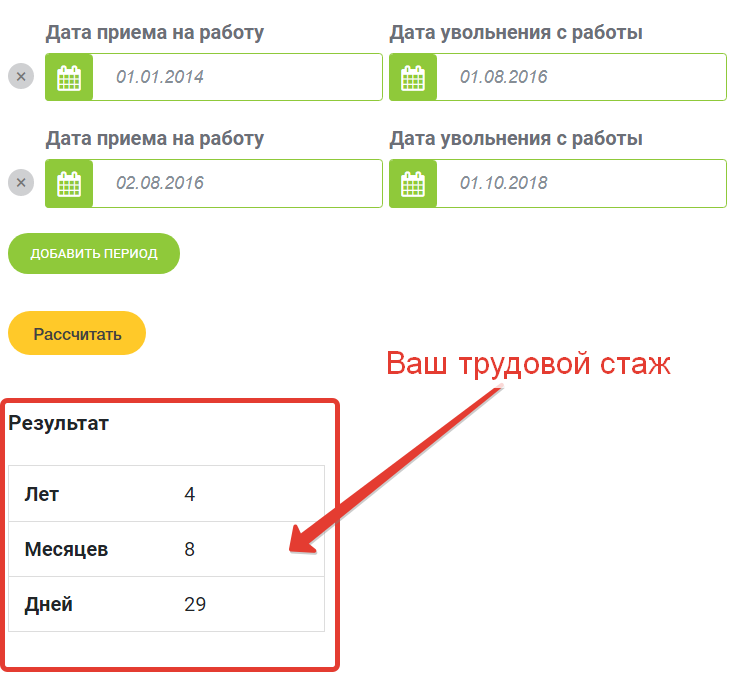

Let's look at step by step how to use our online work history calculator.

Step 1. In the “Date of hire” field, from the drop-down calendar, select (in accordance with the work book data) the required date, month, year.

Step 2. In the “Date of dismissal from work” field, select the required date, month, year from the drop-down calendar.

Step 3. If you work for more than one employer, or have other time to be included in the calculation, select the “Add period” field.

Step 4. From the drop-down calendar, again select the desired dates in the “Date of hiring” and “Date of leaving work” fields (which periods should be included in the calculation are listed below).

Step 5. Click the "Calculate" field.

In the “Result” position you will see the total of the calculation in years, months and days. The values calculated by the work record calculator can be copied and saved.

When calculating, you must follow the following algorithm:

- We count full (from January 1 to December 31) calendar years.

- We count full (from the 1st to the last day) calendar months that are not included in full calendar years.

- We count days that are not included in full calendar months and years.

- Every 30 days we convert to months. The remaining number of days less than 30 is discarded.

- Every 12 months we convert to years.

As a result, we obtain a value that must be taken into account when determining disability benefits. Please note that when calculating, you must take into account the days before the onset of disability. The first day of incapacity for work is not included in the calculation (Letter of the Social Insurance Fund dated December 9, 2016 No. 02-09-14/15-02-24113).

To make the calculation easier, it is convenient to use the online insurance period calculator for sick leave.

Why is it important to correctly calculate your insurance period?

Incorrect calculation of length of service may result in claims from authorized bodies. Thus, the period of an employee’s work in the organization is reflected in the SZV-STAZH form, submitted annually to the Pension Fund of Russia. For providing false information, the employing company is subject to a fine of 500 rubles. for each insured employee. In addition, a fine is provided for officials - from 300 to 500 rubles.

As for length of service for social insurance purposes, the amount of benefits depends on it. Consequently, distortion of the duration of an individual’s work may lead to an error in calculations. As a result, the amount claimed for reimbursement from the Social Insurance Fund will be incorrect. If an incorrect length of service inflates the benefit amount, an arrears in insurance premiums will appear when the error is discovered. Arrears, in turn, entail the obligation to pay fines and penalties to the budget. Also, if the insurance period is incorrectly indicated in the PVSO register in the regions participating in the Direct Payments project, then the regional branch of the Social Insurance Fund will incorrectly calculate the amount of the benefit.

Calculating length of service for sick leave: main points

As mentioned above, to calculate sick leave payments, you need to take into account only those periods of the employee’s work for which payments were made to the relevant insurance funds. In particular, the periods of work for:

- contract agreements;

- work book;

- employment contracts;

- individual entrepreneurship;

- public service.

In addition, when calculating the insurance period, contract service in the army and compulsory military service cannot be excluded.

An example of calculating length of service (according to a work book):

- We take all periods of work according to labor dates, starting from hiring to dismissal;

- we add them up, counting days, months and years separately;

- Now we need to convert days into months, and months into years.

For example, the amount of insurance experience according to the work book turned out to be 8 years 14 months 35 days. We convert months into years, we get: 1 year and two months, we do the same with days, as a result we have: 1 month 5 days. Now we add everything up and have the following result: 8 years 1 year 2 months 1 month 5 days = 9 years 3 months and 5 days.

For your information! There is no need to include time spent studying at a university or other professional educational institutions in the calculation of sick pay.

When calculating length of service, only those periods of work are taken into account when the employer contributed all due payments to extra-budgetary funds for the employee.

Attention! If at the same time an employee worked in two places at once, then to calculate the length of service for sick leave you need to take only one of them.

Why is it important to know the total insurance experience? The fact is that the percentage of payment from the salary of a sick employee directly depends on it.

How to calculate the insurance period if an employee refuses a paper work book

What if in 2021 an employee submits an application asking to provide information about his work activities electronically? In this case, you need to give the employee his paper work record book and inform him that now he is responsible for its safety. There is a slight change in the article of the Labor Code: the number of documents that an employee presents when applying for a job includes not only a work book, but “and/or information about work activity.” The same changes are expected in Order of the Ministry of Health and Social Development No. 91, which determines how and on the basis of what documents the insurance period is calculated. Let us remind you that an employee can receive information about his work activity from the employer (there will be information only about the last place of work), as well as in the multifunctional center, the Pension Fund and in his personal account on the government services website. The employer, in turn, will receive this information only from the hands of the person applying for the job. After the calculations are completed and the insurance period is entered into the personal T-2 card, the documents are returned to the employee. Information on labor activity as part of the new SZV-TD reporting will also be included in the procedure for forming the insurance period for the assignment of benefits.

How to use the work experience calculator?

On the certificate of incapacity for work, the insurance period is reflected in the section “To be filled out by the employer.”

An employer may be faced with a situation in which:

- no workbook;

- the work book is available, but there are no records in it for any periods of the person’s work;

- erroneous or incorrect information has been entered.

In the listed cases, in order to calculate the length of service correctly and confirm the period, you need a written work agreement. It must be drawn up in accordance with the laws in force at that time;

- collective farmer's workbook;

- certificate provided by the employer (or government agencies);

- extracts from orders;

- extracts from personal accounts;

- salary slip.