The GIT inspection plan is annually posted on the websites of the territorial bodies of Rostrud. Regardless of whether your organization is included in these lists or not, we recommend that you check yourself for errors in maintaining personnel records and put your documents in order. We’ll tell you how best to do this in the article.

Let us remind you that there are two types of inspections - scheduled and unscheduled.

Lists of organizations included in scheduled inspections of the State Tax Inspectorate are available on the website of the territorial branches of Rostrud (inspections of other departments can be tracked on the website of the Prosecutor General's Office). The employer is notified of the scheduled inspection by the labor inspectorate no later than three days before the start of the inspection (Clause 12, Article 9 of Federal Law No. 294-FZ of December 26, 2008).

Unscheduled inspections are carried out in cases established by clause 10 of the “Regulations on federal state supervision of compliance with labor legislation and other regulatory legal acts containing labor law norms” (approved by Decree of the Government of the Russian Federation of September 1, 2012 N 875). For example, if there are complaints from employees, or information appears in the media about the organization violating labor laws. The employer is notified of an unscheduled inspection no later than 24 hours in advance. But in a situation where an inspection occurs, for example, based on a complaint from an employee, the employer may not be notified and he will learn about the inspection upon the arrival of the inspector.

Only now, before the New Year, “Clerk” is selling three online courses for the price of one . Learn how to protect yourself from all types of audits in the online course package “Protection: tax audits, labor audits, contracts.” This package will teach you how to defend yourself against claims:

- tax officials

- OBEP

- labor inspectors

- counterparties

Scheduled checks

The inspection plan will be published on the website of the State Tax Inspectorate of the region until November 10 of the year preceding the year of inspection (clause 41 of the Regulations).

Previously, this was done until December 1st. This gives employers more time to prepare. The Regulations enshrine the principle of a risk-based approach when conducting inspections, introduced back in 2017. Those enterprises that the system classifies as low risk are not routinely inspected. If the risk is high, the company will be included in the inspection plan every two years, significant - every three years, medium - maximum once every five years, moderate - no more than once every six years.

The company will be reminded about a scheduled inspection at least three working days in advance. The inspector will provide the employer with a copy of the order or order to begin the inspection by any available means.

Unscheduled inspections

Note:

The State Tax Inspectorate conducted 136.9 thousand inspections in 2021; 92.7 percent of them are unscheduled. Violations were found in 91.9 thousand inspections. Based on the results, the inspectors assigned 3 billion 251 million rubles. fines.

The reason for an unscheduled inspection may be a complaint from an employee about a violation of his rights, as well as other information received by the state labor inspectorate containing information about existing violations of labor legislation.

The most likely reason for an unscheduled inspection is to obtain information about the emergence of a threat of harm to the life and health of citizens (clause 90 of the Regulations), and these include cases when the employer:

— does not conduct a special assessment of working conditions;

— does not provide paid vacations;- does not pay wages in full or part thereof;

— violates the work and rest regime of the enterprise’s employees;

— does not provide workers with protective equipment;

— does not provide guarantees or compensation for work in hazardous working conditions;

- does not formalize or improperly formalizes labor relations;

— allows employees to work who have not undergone instructions, medical examination, training, etc.

As you can see, there are plenty of reasons to conduct an unscheduled inspection, if only there is a desire.

Note. The inspector does not notify the company about an inspection based on a report of a threat to life and health (clause 98 of the Regulations). The Regulations established that a citizen’s request to terminate the consideration of his application is not a basis for terminating an unscheduled inspection (clause 29 of the Regulations). Thus, if an employee who complained to the State Tax Inspectorate resolves the issue with the employer and withdraws the complaint, this will not affect the inspection.

Checklists and HR audit

Since 2021, labor inspectors, when conducting scheduled inspections, use checklists approved by Order of Rostrud dated November 10, 2017 N 655. The subject of a scheduled inspection of employers is limited to the list of questions included in the checklist (checklist) on a specific topic.

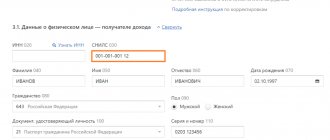

In the general part of the checklist, the name of the organization, type of activity and risk category are filled in, followed by a list of questions, the answers to which indicate compliance or non-compliance with labor law standards in the organization. Therefore, employers can use such checklists to self-check compliance with regulations regarding labor law.

To prepare for an inspection by a labor inspectorate or conduct a scheduled personnel audit, the State Labor Inspectorate recommends that employers organize an internal control system. The procedures for conducting such control are discussed in the “Methodological recommendations for voluntary internal control (self-control) of compliance with labor legislation and other regulatory legal acts containing labor law norms” (Letter of Rostrud dated 03/07/2018 N 837-TZ).

Rostrud recommends ensuring internal control by:

- Creation of a special service and/or appointment of an internal controller - if the organization employs more than 250 people.

The official responsible for carrying out the preliminary check (self-check) of compliance with the requirements of labor legislation and other regulatory legal acts must have a higher education (legal or economic), have experience in personnel work and have knowledge of labor legislation.

When carrying out control, the department recommends using checklists (using the “Electronic Inspector” service or by printing out checklists yourself, for example, from the Reference information in the ConsultantPlus System “Forms of checklists (lists of checklists)”).

- If the organization employs less than 250 people, the creation of an internal control service is not necessary. It is enough to appoint a person responsible for checking compliance with labor legislation requirements. You can also pass the self-test using checklists or the Electronic Inspector service.

For self-checking, you can use the system of electronic services “Onlineinspektsiya.rf”, which was created to prevent violations in the labor sphere, increase the awareness of employers and citizens on issues of labor legislation. Currently, 12 free services are available to users, including 200 self-test sheets by the Electronic Inspector. Users can familiarize themselves not only with the basic requirements of legislation in the field of labor law, but also with possible violations, as well as with the sanctions established for these violations in accordance with the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation.

Based on the results of the inspection, the user of the Electronic Inspector service can print out an inspection report, inspection history, or recommendations for eliminating violations (including instructions, templates and sample documents).

Currently, Electronic Inspector is operating in pilot mode. In this regard, the identification of violations of labor legislation during an inspection using this service does not lead to the inclusion of the organization in the State Labor Inspectorate inspection plan. In addition, for now, such a check can be carried out anonymously - the service allows the possibility of specifying a “conditional company name”.

The service development plans provide that Rostrud will carry out activities to confirm the results of self-tests. And upon confirmation, the employer will receive a certificate of compliance with the established self-test procedure.

Rostrud recommends conducting internal control annually. The results of the audit should be drawn up in the form of a document that will reflect the content of the event (date, period under review, name of the internal control measure), identified violations, recommendations for eliminating violations. It is also advisable to monitor the implementation of recommendations to eliminate identified violations.

It is important to remember that the inspection of the State Tax Inspectorate is not limited to specific periods of the documents being inspected, and therefore the controller can request documents for any period of activity. The scope of the requested documents is limited only by the length of time the employer retains documents related to the employment relationship and their need for the inspector in accordance with the purposes of the inspection.

The storage periods for individual documents relating to labor relations are established by sections 7 and 8 of the “List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods” (Appendix to the Order of the Ministry of Culture of the Russian Federation dated 08/25/2010 N 558).

When analyzing an organization’s personnel records, it should also be remembered that the mandatory availability of certain documents is not always directly established by the Labor Code of the Russian Federation, but may be determined by a combination of several labor legislation norms.

In general, personnel documentation can be divided into:

- General documents. These include, in particular, the employer’s local regulations (internal labor regulations, regulations on remuneration, protection of personal data of employees, labor protection instructions, etc.);

- Individual documents. These are documents related to a specific employee (in particular, employment contracts, additional agreements to them, orders for hiring and dismissal, vacations, disciplinary sanctions, personal cards, etc.);

- Documents that perform an accounting or recording function (time sheets, staffing tables, vacation schedules, etc.);

- Payment documents (payroll statements, calculations of average earnings when granting leave, dismissal, etc.). In addition to compliance with labor law standards, the provisions of the legislation on tax and accounting are also applicable to them (in particular, on compliance with the list of mandatory details of the primary document, Article 9 of the Federal Law of December 6, 2011 N 402-FZ).

Depending on the type of documents, you can set the frequency of monitoring their availability and correctness of execution. Thus, mandatory personal identification documents of a general nature require less frequent verification than documents for a specific employee. At the same time, accounting and settlement documents, with proper organization of internal control, can be checked not on a continuous basis, but on a selective basis.

When planning verification procedures with limited resources (labor, time, etc.), we recommend taking into account not only the volume of documentation to be verified, but also the severity of sanctions for relevant violations.

We also remind you that the statute of limitations for bringing to administrative responsibility for violations of labor legislation (including violations of labor protection requirements) is one year from the date of the violation (Article 4.5, paragraph 6 of Part 1 of Article 24.5 of the Code of Administrative Offenses of the Russian Federation).

Conditions for stopping the check

Clause 27 of the Regulations indicated cases when an inspection cannot be carried out, and the one started must be terminated.

In particular, it was stipulated that the inspection would be terminated if gross violations were committed during its organization and conduct. For example, if the company was notified of a scheduled inspection one day in advance. This is a gross violation that needs to be brought to the attention of the State Tax Inspectorate (clause 53 of the Regulations). If the inspector does not stop the inspection, its results will be invalid (Article 20 of Law No. 294-FZ).

The check will also be stopped if, after it began, the anonymity of the appeal that was the reason for the check was revealed, or it was determined that the appeal contained deliberately false information (clause 27 of the Regulations, Article 10 of Law No. 294-FZ).

Note. The initiator of termination of the inspection may be the employer. Therefore, if during the inspection you become aware of gross violations on the part of the inspector, deliberately false information in the application or other circumstances listed in clauses 27 and 104 of the Regulations, send a statement to the State Tax Inspectorate demanding that the inspection be stopped.

Results

Planned control activities of the State Labor Inspectorate are aimed at identifying and suppressing violations of labor legislation and bringing those responsible to justice. The audit can be devoted to both general institutions of labor law and specific ones. It is impossible to know in advance which documents the supervisory authority will be interested in. The employer is recommended to review the inspection plan annually to meet inspectors fully prepared.

Sources:

- Labor Code of the Russian Federation

- Law “On the Protection of Rights...” dated December 26, 2008 No. 294-FZ

- order of Rosarkhiv dated December 20, 2019 N 236

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documents that the inspector will request during the inspection

The Regulations contain an exhaustive list of documents that the State Tax Inspectorate may request.

There was no such list in the previous regulations. The list is extensive: the documents are not named in a closed list, but are divided into groups. For example, documents confirming compliance with mandatory requirements in terms of labor protection and salary indexation. Among other things, the inspector may ask to see the employer’s requests for increases in consumer prices for goods and services (clause 13 of the Regulations). The appearance of such a closed, albeit broad, list is useful for employers. If during the inspection the inspector requests a document that does not belong to the groups from clause 13 of the Regulations, then the employer is not obliged to provide such a document. In this case, you must send a reasoned response to the State Tax Inspectorate, in which you refer to the fact that the requested document is not in the exhaustive list of documents that can be requested from the employer.

The inspector receives the documents specified in clause 14 of the Regulations from other departments as part of interdepartmental information interaction. The inspector has no right to demand these documents from employers (clause 8 of the Regulations).

Check period

The inspection period for a regular company cannot be more than 20 working days, for a small enterprise - 50 hours per year, for a micro-enterprise - 15 hours per year. If a company operates on the territory of several constituent entities of the Russian Federation, the inspection period is set separately for each branch, representative office or separate division. The Regulations clarified that in general the period cannot exceed 60 working days (clauses 24, 62). There was no similar rule in the previous regulations, but it is enshrined in Part 4 of Art. 13 of Law No. 294-FZ.

Note. The inspection can be extended only if it is necessary in connection with complex, lengthy studies, tests, examinations and investigations. If such circumstances exist, the inspection period may be increased by a maximum of 20 working days, and in relation to small enterprises - by no more than 50 hours, micro-enterprises - by no more than 15 hours (clause 24 of the Regulations). The maximum 20-day period for conducting an unscheduled inspection cannot be extended (clause 107 of the Regulations).

Checking act

If the person being inspected agrees to interact electronically, the inspection report can be sent to him in the form of an electronic document signed with an enhanced qualified electronic signature.

But the inspector does not have the right to send an inspection report by simple mail (clauses 78, 81 of the Regulations). In general, the Regulations regulate the issues of drawing up an act in detail. In particular, it is stated that the identified violations must be set out in detail, with reference to the articles and paragraphs of the acts, the requirements of which, in the opinion of the State Tax Inspectorate, have been violated. The results of the inspection must be confirmed by documents, explanations, checklists and other evidence stored in the file along with the report (clauses 69, 70, 72, 74 of the Regulations). They also explained how the inspector should issue an order to eliminate violations. It should indicate in detail the violations that need to be corrected, and references to specific acts.

Note. If the inspector does not hand over the inspection report to the employer, he will violate the requirements of Part 4 of Art. 16 of Law No. 294-FZ. The results of the inspection in this case are subject to cancellation based on the application of the legal entity (Article 20 of Law No. 294-FZ).

Recommendation:

Before the inspector arrives, complete a self-test. Use the questions from the checklists, as well as the Electronic Inspector service. Rostrud claims that this service saved companies 11 billion 125 million rubles. This is the amount of fines that employers avoided if they corrected the violations identified by the Electronic Inspector.

How to celebrate GIT in 2021?

None of the inspectors has unlimited powers.

Depending on the type of inspection performed, the set of rights of inspectors varies.

In accordance with the generally accepted rule, 3 strict restrictions are established when carrying out any inspection activities:

- The work of inspectors is limited to the scope of checklists. Inspectors do not have the right to demand more information than is provided

- If the audit concerns a certain area of personnel records, then it is unlawful to demand additional information

- Inspectors do not have the authority to take away original documents of the organization

In addition, you need to remember that ordinary employees are not subject to liability for detected violations. Only the head of the organization and executive executives can be involved in it .

Based on the experience of conducting numerous inspections, we can create a list of the most common violations that employers commit in their activities. Among them:

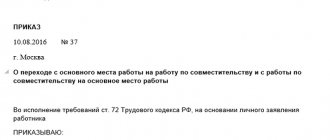

- Incorrect drafting of employment contracts, work without employment

- Errors in the preparation and maintenance of work books

- Errors in payment of wages, late wages

- Lack of internal company documents that regulate personnel issues

- Violations in the field of labor protection

- Violations when working with beneficiaries and foreigners

The mistakes are often of the same type, probably made for reasons of economy, at a time of lack of funds or low qualifications of personnel officers.

Question

The employee decided to write a complaint against his employer. However, he does not want to reveal his identity. Is it possible to submit an anonymous application?

An employee has the right to initiate an investigation of his employer without disclosing his last name. However, in the application you will need to indicate all the data, but ask the inspectors not to disclose information about the applicant. In this case, confidentiality will be maintained and the employer will not know who filed the complaint. The labor inspectorate does not accept or consider anonymous applications.

Error

When hiring new employees, the company uses a standard employment contract. During the inspection, the labor inspectorate discovered that the document did not contain a clause on compensation provided for workers. This is a violation of Article 57 of the Labor Code of the Russian Federation, since it determines what information the contract must contain. Changes to the document will need to be made in any case, but a fine will most likely not be avoided.

Businesses are subject to numerous inspections by various regulatory authorities, and the labor inspectorate also does not stand aside. There are serious fines for violations of labor laws. It is in the employer’s interests to keep personnel issues under control and to correctly maintain personnel records.

Heads of employing organizations should understand what to prepare for during inspections by the State Labor Inspectorate (SLI), what rights and responsibilities SLI inspectors have, based on the following legislative acts:

- Labor Code of the Russian Federation (especially articles 353 and 356).

- Code of the Russian Federation on Administrative Offences.

- Federal Law No. 294-FZ of December 26, 2008, taking into account the amendments made to it by Law No. 277-FZ of July 3, 2016.

- By-laws, in particular, Decrees of the Government of the Russian Federation No. 875 of 09/01/2012, No. 177 of 02/13/2017, No. 1080 of 09/08/2017 and Order of the Ministry of Labor No. 354n of 10/30/2012.