A writ of execution issued by the court after consideration of the case on the merits and the entry into force of the corresponding decision may be presented at the debtor’s place of work. Let us analyze in more detail the conditions for presentation, the procedure and timing of payments by the employing organization, as well as the rules for drawing up and returning enforcement documents to the claimant.

What can you do if a writ of execution has been sent to work?

Opposition to the implementation of the executive document is illegal and entails the imposition of an administrative or property penalty. Hiding obligations to pay alimony or other debts from the administration will not lead to anything good.

Over the entire period, debt will accumulate, which will have to be repaid, and on the most unfavorable terms, with payment of up to 70% of the money earned. The employee has the right to demand from the accounting department deductions in the amount determined by the court, without allowing deductions established by law.

It does not have any other ways to influence retention or change the size. Only the court can reduce the amount of payments, under certain circumstances:

- the birth of a child in the payer’s new family;

- serious illness or disability due to injury;

- job loss;

- excess of total debt obligations 70% of income. In this case, payments are reduced proportionally.

What amount are they entitled to withhold?

The amount of deductions varies according to different documents.

For alimony workers, it depends on the number of children (parents) for whom maintenance is paid: 1–25%, 2–33%, 3 or more – 50%. The exception is the formation of debt for the maintenance of minors. For the period until the resulting debt is repaid, it is allowed to withhold no more than 70% of income.

Also, up to 70% can be recovered as compensation for harm to life or health or damage caused by a crime.

Difference between alimony and regular debt

Maintenance obligations take priority over household debts arising as a result of non-payment of a loan or loan, debt or failure to fulfill contractual obligations. In the first case, they are regular.

They are not reduced without a court decision, or the will of the claimant, who completely refuses to pay. Regulated by the Family Code of the Russian Federation.

Other payments, for example, a writ of execution on a loan, are regulated by the Civil Code of the Russian Federation. They relate to the sphere of civil law relations and are not unconditional, with the exception of payments for damage to life and health.

Compensation for harm caused by a crime is also regulated by the Civil Code of the Russian Federation, and not by the Criminal Code.

Employer Responsibilities

The employer must execute the document presented and register it. If the sheet was sent by a bailiff, notify of receipt.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The accountant must make deductions and transfer them to the account specified by the collector without delay. The company's problems with a lack of funds are not grounds for delaying the payment of alimony.

Otherwise, the company is fined a large amount.

The procedure for presenting a writ of execution at the debtor’s place of work by the claimant

If the writ of execution meets the requirements established for their presentation to the employer, then the writ of execution can be brought directly to the place where the debtor carries out work and presented to the accounting department, you can also send it by mail, or entrust the presentation to your representative, providing him with the appropriate power of attorney.

Simultaneously with filing the writ of execution, you will need to write a statement; its form is free, but must contain a number of certain details:

- Full name of the claimant, his passport details;

- bank details for transferring money or indicating the address to which funds should be sent via postal order;

- if the executive document is presented by a representative, then in addition to the above information and the power of attorney, he will need to present his passport.

A sample application can be viewed here .

Sending a writ of execution to the place of work by a bailiff

In accordance with clause 1 of Article 98 of the Federal Law “On Enforcement Proceedings”, collection of wages can also be carried out on the initiative of a bailiff.

The debtor’s property status is not verified and collection under a writ of execution can be immediately carried out through the employer in the following cases:

- periodic payments are collected;

In all other cases, sending a writ of execution to the debtor’s place of work is possible only after establishing the fact that he does not have property with the help of which the debt can be collected.

To collect from an employee, the bailiff sends copies of enforcement documents to the accounting department of the organization where the debtor works; the original remains in the materials of enforcement proceedings.

Rules for processing and making payments to the claimant

When submitting a writ of execution, the debtor's employer, if the conditions provided for in Art. 9 Federal Law dated October 2, 2007 N 229-FZ, is obliged by virtue of Part 3 of Art. 99 of the specified Federal Law withhold part of the income in favor of the claimant.

Please note that the amount of withholding is clearly regulated by law and is calculated from the amount remaining after withholding personal income tax and other taxes. According to Art. 77 Federal Law of October 2, 2007 N 229-FZ, the maximum amount of withholding should not exceed 50% of the debtor’s income, for example, wages or scholarships. Part of the income is retained until the obligations are fully fulfilled and the resulting debt is repaid.

In case of collection of alimony or repayment of debt incurred as a result of causing harm, the maximum amount of recovery can be up to 70% of income. The above restrictions do not apply to accounts to which funds are transferred.

Upon receipt of a writ of execution with an application from the claimant, the employing organization (another paying income to the debtor) acts in the manner formulated in Art. 98 Federal Law dated October 2, 2007 N 229-FZ and conditionally divided into the following stages:

- retains part of the due income;

- within 3 days after the withholding, transfers or in another way specified by the collector pays him funds to repay the debt;

- ends the collection procedure upon the occurrence of one of the following events:

- repayment of the debt specified in the writ of execution in full;

- change of place of work, study, etc. (for example, dismissal or transfer to another educational institution);

- an application for completion of collection received directly from the claimant;

- on the basis of the relevant resolution of the bailiff;

- returns the writ of execution (including the original writ of execution to the claimant) with a note of execution, including the deadline for execution, the basis for completing the procedure and the amount withheld from the debtor and transferred to the claimant (in case of partial execution).

In conclusion, we note that the claimant has the right to independently choose the method and procedure for collection. Presentation of a writ of execution at the debtor’s place of work will significantly reduce the time for execution and receipt of funds. In this case, in order to repay, the debtor's income is transferred directly to the account of the claimant, bypassing the accounts of the bailiffs.

The procedure for collecting from the debtor’s earnings, the amount of deductions

Deductions are made by the company's accounting department simultaneously with payroll. Deductions are made from each payment, with the exception of those that, by virtue of Article 101 of the Federal Law “On Enforcement Proceedings,” must be paid in full. These include:

- payments related to compensation for harm to health, loss of a breadwinner;

- compensatory social payments;

- alimony;

- amounts of financial assistance paid upon the birth of children, marriage, death of loved ones, etc.;

- maternity benefits, temporary disability benefits, and child care benefits;

- some other payments that have a targeted nature and the status of targeted assistance.

If payments are regular and periodic, then the amount of deductions is established by the executive document. If the essence of the writ of execution is reduced to debt collection, then the recovery from the employee under the writ of execution cannot exceed half of the earnings.

In exceptional cases, the maximum amount may be 70% (clause 3 of Article 33 of the Law on Enforcement Proceedings).

Example

The following conclusions can be drawn on the topic under consideration:

- deductions are made from all types of earnings , exceptions are provided by law;

- the amount of deductions cannot exceed 50%, and in exceptional cases - 70%.

Dear readers, our colleague anti-collector and blogger Dmitry Guryev (Debtor Community) and I continue to discuss various topics related to debt obligations. Let's look at the topic of concern to many: “Writ of execution for the debtor’s work.”

How will the employer react? How much money will be withheld from our salary? Are bailiffs required to close enforcement proceedings? Let's figure it out together. And we remind you that the only cardinal solution to debt problems is bankruptcy of individuals in accordance with Federal Law-127!

Free initial legal consultation

The legal department of procollection.ru will review your debt situation or issue. We'll tell you what to do next.

Call - free telephone consultation:

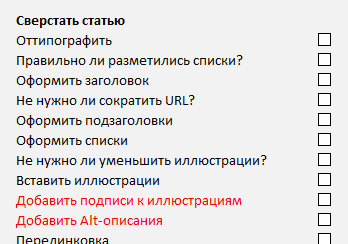

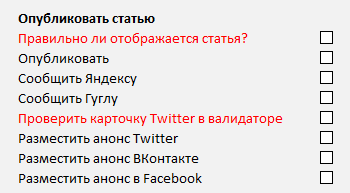

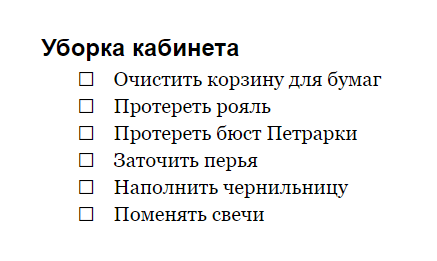

How to make your own checklist

When creating a checklist, you will have to make changes to it: add new items, swap them, group them, etc. We recommend that you first create a list of tasks in a draft, and only then design it “beautifully”.

To create a checklist, you can use the following algorithm:

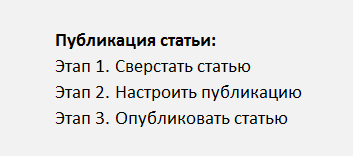

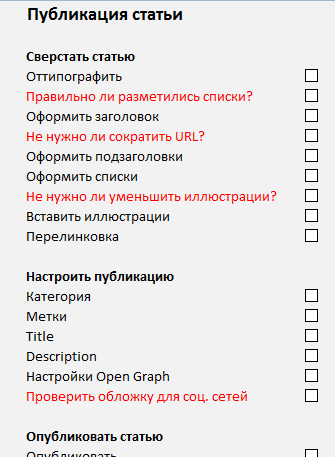

Step 1. Divide the work into main stages. They will become the skeleton of the checklist on which all other points will be “strung”.

As an example, let's create a checklist for publishing an article on a website:

Step 2. Detail. Shouldn't the stages be described in more detail? First of all, add those operations that, at least theoretically, can be forgotten.

Step 3. Handle errors. What mistakes do you usually make at each stage? Can they be prevented? If yes, add prevention tasks, and if not, timely inspection.

Step 4: Add reminders. What do you most often forget at one stage or another? What can you forget?

Step 5. Anticipate possible problems. What difficulties do you most often encounter? Where do you usually waste your time? Is it possible to avoid these problems?

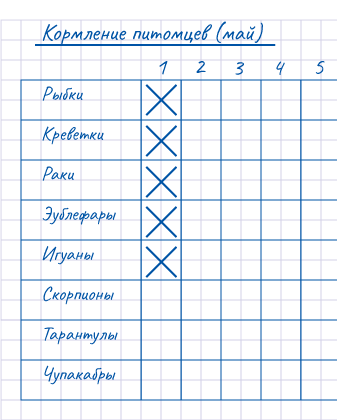

Step 6. Group tasks. If the checklist looks too overwhelming, divide it into parts and add subheadings. In our example, all this is already there:

Step 7. Check. Test the checklist on a real project. Make sure it's easy to use and that you haven't missed anything. If necessary, add new items and remove what is not useful.

Subtleties and nuances

- Keep the original checklists (you will make copies of them for work) in a separate folder where they cannot be accidentally changed or deleted. Archive each new version of the checklists: you may find it useful.

- If you plan to refer to checklists that have already been completed (for example, for accounting) or if the checklists are intended for team work, provide a header. Consider what data will be useful for searching, sharing, monitoring, or collecting statistics. Here are some options: Date

- Project name

- Category of work

- Order number

- Client name

- Names of performers and project participants

- Deadline

- Start and end time

- If while working you need to access Internet resources or folders on your computer, add active links to them directly to the checklist.

- Provide for the possibility of control if you create a checklist for your employees. Is it possible to check the completion of tasks? If not, reformulate them.

- For special important work in which mistakes cannot be made, add additional checkboxes to the checklist:

- If you need to evaluate your work efficiency, add a timing column to your checklist. Record the time it takes to complete tasks.

- Checklists can be made from ready-made blocks, and can also be combined with each other. For example, to post any materials on a corporate blog, you need to follow the same steps. Consequently, checklists for cases, interviews, reviews, etc. will have a common block - “Publication”.

What is written in the writ of execution?

Hello Dmitry. One of the recovery measures is the sending of a writ of execution by FSSP employees to the debtor’s work.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The basis for this is Federal Law 229. Many will be interested in what exactly is written on this sheet, is the exact amount of the write-off indicated? Should accountants notify management, since most people don’t want to involve their bosses in their problems?

Yes, of course, one of the enforcement actions according to the law you cited is sending a writ of execution to the debtor’s place of work.

The bailiff, having established the debtor’s place of work, sends a writ of execution to his place of work. This usually takes the form of a resolution. That is, the bailiff issues a procedural document called a resolution. This is the document the bailiff sends to the debtor.

What is the recovery amount?

That is, the bailiff does not bring out paper, but a procedural document. Surely it should contain a fixed amount that must be collected from the debtor’s salary?

No! This resolution does not indicate the exact amount, since the bailiff does not know what salary the debtor will receive in the future. Therefore, the resolution refers to percentages.

What are the recovery rates?

What interest rate are we talking about?

As practice shows, the bailiff first imposes the maximum possible amount of deduction - this is 50% of all types of earnings.

How will they react to the writ of execution at work?

Well, he sent the bailiff to work for the debtor. What's next? Will the boss find out about him?

Yes, sure! When a bailiff’s order is received at work, this document goes to the boss’s desk, who writes this document for execution to the accounting department (or financial department). And there, when calculating wages, the accountant executes the bailiff’s resolution and withholds the percentage specified in the resolution from the debtor’s wages.

Disadvantages of a writ of execution

That is, in fact, the writ of execution for work carries a big disadvantage. Is not it?

It should be noted that there are more advantages to this procedure than disadvantages. The advantages include:

- You don’t have to constantly take time off from work to pay your obligations. As you know, employers do not really like those who constantly take time off from work in order to resolve some personal issues.

- No need to wait in crazy lines. If you come to the Bank, there will be a queue; if you go to the bailiffs, there will also be a queue.

So imagine the situation: you asked to take 1 hour off, but only spent an hour and a half to two hours in line. The boss will definitely not be happy with this state of affairs.

- There is no need to pay commissions when transferring funds. If you pay through a bank, some banks charge these fees, which increases the financial burden on the debtor’s shoulders.

- There is no need to look for money by a certain date or date. Now you dictate the rules. We received our salary as we received it and paid it. It doesn’t hurt your head that the payment must be made by the 20th, and the salary is only 25 – where can you get the money to cover this hole.

With all these advantages, there is only one drawback - your salary becomes 50% less (initially).

Reducing the interest rate under a writ of execution

This is the second time you have said that at first (initially) 50%. What is the secondary interest rate?

As such, there is no secondary rate. It’s just that this amount of withholding can be reduced, and this can be done as easily as, say, canceling a court order.

And it turns out that with all the advantages, there is one small drawback - your salary is 20-17% less. That is, if you received 10 thousand rubles, now you will receive not 10 thousand rubles, but only 8 thousand rubles.

Essential? I also think that the advantages outweigh this disadvantage.

Can they be fired from work for a writ of execution?

Yes, you are talking about the positives. But you know - the human factor: the debtor trembles before being fired - should he be afraid?

It should be noted that borrowers and debtors experience fear of dismissal. Let's start with the fact that, according to the Labor Code of the Russian Federation, there are no grounds for dismissal - failure to pay one's obligations. Therefore, you cannot be fired with such a clause.

In addition, if you properly fulfill your obligations under the contract, no one will fire you. The employer doesn’t care at all who you owe or how much you owe. He does not pay this money from his own pocket - this money is yours.

But if you look at it, our whole country is in debt: some have alimony, some have an accident and payments to the insurance company for road accidents, some have non-payments for housing and communal services, some cannot cope with loans.

So don't worry about it.

Who can send a writ of execution to work?

But I wonder if only a bailiff can send a writ of execution to a debtor’s work? Or can the lender personally do the same? What about the debtor?

The creditor can himself send a writ of execution to the debtor’s place of work! Everything is exactly the same as with bailiffs. Only instead of the bailiff’s order, the original writ of execution is sent to the debtor’s place of work. And a statement from the creditor is written, in which the creditor asks to collect a certain percentage.

In addition, the debtor can personally write an application to withhold a certain amount of money from his salary. To do this, just contact the accounting department of your organization and write a corresponding application.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

In this case, there will be a voluntary recovery - which will stop the negative consequences of enforcement proceedings - seizure of property, restrictions on travel, and so on.

Practice on executive documents

For example, if bailiffs seize a debtor’s salary card through a bank, they write off the entire amount in full, and not 50% as they should. Until you write a corresponding statement, this will continue. What happens in practice with a writ of execution?

When a debtor's salary card is seized, the debtor's account is seized, on which it is not written that it is a salary card.

The writ of execution is sent to the place of work - the creditor has the right to demand 50% of the salary. After all, this is not an account on which it is not written that it is a salary account and you can play for the “fool”, they say they didn’t know, this is the debtor’s salary - here everyone knows the principles that everything cannot be taken away from the debtor.

Are all prohibitions lifted if the money goes to the bailiffs’ account?

As soon as the debtor's salary begins to flow into the bailiffs' accounts, should they stop enforcement proceedings? Are all bans lifted? And what happens if the debtor quits?

Clause 8 of Art. tells us about this. 47 of the Federal Law “On Enforcement Proceedings”, according to which it follows that when the sheet is sent to the organization to withhold periodic payments, the enforcement proceedings end.

However, in practice, bailiffs do not finish proceedings until they are confronted with an article of the relevant law. And then they begin to say that, according to some kind of instruction, it follows that termination is possible only on alimony obligations.

However, the law does not say a word about under what obligations this is possible. The law says that enforcement proceedings end.

What to do if enforcement proceedings are not completed?

So what should you do: according to the law, they should finish the production, but they don’t? What is your advice?

Demand - write a petition, if it is not satisfied - remember - you can appeal the actions of the bailiffs in court.

What happens to the writ of execution after the debtor is dismissed?

What happens to the writ of execution when the debtor is dismissed from his place of work?

When a debtor is dismissed from work, the accountant makes a calculation in which he indicates how much the debtor was accrued for the period of work with the writ of execution and how much was withheld.

Confirms this information with the numbers of the corresponding payment orders.

Draws up a certificate and sends this certificate back to the bailiff with a covering letter. Upon receipt of such documents, the bailiff resumes enforcement proceedings and begins to carry out further enforcement actions.

Parting words from Dmitry Guryev

What advice do you have for debtors on this issue? Your parting words!

Consequently, you will look for work, and you will receive money, although small, and the debt will be paid, and production will be completed.

See a more recent publication on this topic - “Employee sentenced to correctional labor: rules of deductions”

If the organization receives a writ of execution, the employer is obliged to withhold the funds specified in it from the income of the debtor employee, and the personnel department is obliged to explain to the employee why he began to receive a smaller salary. Let's look at the workflow for enforcement documents, how to calculate the amount of deductions, when it is necessary to index the collected amounts, the timing of transferring debts to collectors, who should be notified and when, liability for failure to comply with the bailiff's requirements, and much more.

In what cases is it worth working according to checklists?

Typically, checklists are used to perform tasks that consist of many individual steps. For example:

- Cleaning activities (apartment, office, workplace).

- Preparation for important events (performance, vacation, wedding, business trip).

- Regular care (for pets, equipment, cars).

- Audits and preventive inspections (machine, computer, website).

- Creation of a product (furniture, clothing, websites, articles).

- Provision of services (delivery of goods, organization of events, holding seminars).

You should think about using checklists in your work in the following cases:

- If there is a risk of forgetting about any stage.

- If errors occur frequently that could have been prevented.

- If during your work you often think about what to do next.

Checklists are also suitable for one-time events. For example, before going to the store, people often make a shopping list, and before going to the sea, a list of things they want to take with them. In fact, it's best to break down large tasks into individual steps to make them easier to complete (a process called decomposition).

But the greatest benefit comes from checklists designed for repetitive tasks. In this case, they can be constantly refined and improved, and the time spent compiling them pays off in a big way.

Enforcement proceedings

The grounds for deductions based on executive documents (which may come to the employer) are different:

- alimony obligations;

- compensation for harm caused;

- penalties for administrative offenses;

- collection of tax payments (transport tax, land tax, property tax), arrears and insurance premiums, loan debts, etc.

See the article “What you need to know about deductions from wages” magazine No. 1′ 2016

The types of executive documents are listed in Art. 12 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ).

These include, for example, writs of execution issued by courts of general jurisdiction, court orders, notarized agreements on the payment of alimony, decisions of bailiffs, decisions of the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of Russia, etc. Most often, employers are faced with the latter, when the debtor voluntarily does not want to repay the debt (on loans and obligatory payments - taxes, contributions) and enforcement proceedings have been initiated against him.

In all cases, the employer is obliged (and the employee has no right to interfere with the employer) to withhold from the salary the amounts specified in the executive documents.

Let us note that to organize the accounting of executive documents, it is best to appoint responsible persons and establish the procedure for document flow in a local regulatory act.

Rules for drawing up checklists

Before you start creating your checklists, review the guidelines below. These are not axioms, but following these rules will make your lists as convenient and effective as possible.

One point - one action. Trying to keep several operations in mind at once inevitably reduces concentration.

| No: | Yes: |

| Post the announcement on Twitter and Facebook. | Post the announcement on Twitter. |

| Post an announcement on Facebook. | |

| Sand and polish. | Sand it. |

| Polish. |

Clear and specific wording. If you have to remember every time what was meant in a particular task, then it was formulated poorly. The criterion here is this: if another person works on your checklist, will he be able to understand what you are talking about?

| No: | Yes: |

| CNC!!! | Select CNC names for all files. |

| Pixels. | Is there a transparent pixel border around the illustrations? |

| Not too much? | Is the varnish too thick? |

| Let's Mortal Kombat begin! | Start rendering. |

No details. If you are making a checklist for yourself, list only the actions themselves. Any details (which you already remember) will only distract and create “information noise.” If your checklists are intended for other people, you can briefly clarify why this or that item is needed and how to complete it.

| For myself: | For others: |

| Check the readiness of the jam. | Check the readiness of the jam. Drop it onto a dry plate: if the drop does not spread, the jam is ready. |

| Provide contact details. | Include your contact information in case journalists want to clarify anything. |

| Duplicate the content of videos with text. | Duplicate the content of the videos with text. According to statistics, only 10% of visitors open a video. |

| Check CSS syntax. | Check your CSS syntax for errors. To do this, use the jigsaw.w3.org service. |

Fighting mechanical execution. The main enemy of checklists is careless completion of tasks and automatic ticking.

If you encounter something similar, reformulate problematic tasks so as to “turn on awareness” as much as possible. To do this, use various physical actions in your formulations: write down, download, touch, say, etc. In other words, compose tasks so that their completion can be verified from the outside. The same principle is important for monitoring other people's work.

| No: | Yes: |

| Come up with five options for a title. | Write down five header options. |

| Check if all documents are in place. | Check the documents against the list. |

| Inspect everything again and make sure the room is cleaned. | Take a photo of the number. |

| Read the text. | Read the text aloud. |

Error prevention. If possible, try not just to find errors, but to prevent their occurrence.

| No: | Yes: |

| Check if the illustrations are too large. | Reduce illustrations. |

| Is the porridge burnt? | Continuously stir the porridge until cooked. |

| Is the water too hot? | Heat water to 50°C. |

Grouping of tasks. Use sections and subheadings in large checklists: this will make them more organized and understandable.

No:

Yes:

Result, not action. Very often, in checklists it is better to indicate the expected result rather than the action. This reduces the risk of careless execution.

| No: | Yes: |

| Wipe the dust. | There is no visible dust on the furniture. |

| Install social buttons on the site. | The site uses social buttons. |

| Feed the cat. | The cat is full and happy. |

Test it. If you have made a checklist for yourself, you will have to check it anyway. If the checklist is intended for other people (for example, your employees), test it before final release. Go through all the points with the performers and make sure everything goes as it should.

The organization received an executive document

Bailiffs have the right to apply various measures that do not contradict the law to implement the requirements of enforcement documents. Some regional departments of the Federal Bailiff Service (FSSP) of Russia have developed special instructions on the issues of withholding and transferring funds under enforcement documents of various categories.

- a copy of the writ of execution;

- a resolution to foreclose on the debtor's income;

- a copy of the resolution on the collection of enforcement fees 2 (if such a resolution was made);

- a copy of the resolution on the collection of an administrative fine and costs for carrying out enforcement actions (if such decisions were made);

- a memo for managers and accountants on the issues of withholding and transferring funds under executive documents.

If the writ of execution is submitted by the claimant himself, then he must attach an application indicating the details for the transfer, full name. the claimant-citizen, passport details or name of the claimant-organization, INN, OGRN, legal address (Part 2 of Article 9 of Law No. 229-FZ).

The employer's procedure will be as follows:

| The debtor employee is familiarized with the writ of execution against signature (letters of Rostrud dated March 11, 2009 No. 1147-TZ and dated December 19, 2007 No. 5204-6-0) |

| The bailiff is sent a notification of receipt of documents |

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The journal form for recording executive documents is developed independently (Example 1). When approving it, we advise you to provide not only columns for registering executive documents, but also to reflect their movement.

Conditions and procedure for filing a writ of execution by the claimant

Presentation by the claimant independently of enforcement documents within the framework of Art. 9 Federal Law dated 02.10.2007 N 229-FZ is possible only if the following conditions are met:

- the amount of claims does not exceed 100,000 rubles (as amended by Federal Law No. 539-FZ dated December 27, 2018 “On Amendments to Article 9 of the Federal Law “On Enforcement Proceedings”);

- the organization (including the employer) makes payments on a periodic basis;

- There are no restrictions on the type of income received by the debtor on foreclosure within the framework of Art. 101 Federal Law dated October 2, 2007 N 229-FZ.

If the specified conditions are met, the claimant has the right to independently submit a writ of execution to the organization paying the debtor funds. The original writ of execution must be accompanied by an application drawn up in accordance with the rules of Part 2 of Art. 9 Federal Law dated October 2, 2007 N 229-FZ and containing, in addition to the name of the organization to which it is sent, the following details:

- data of the creditor allowing him to be identified, including:

- for an individual - full name and information of an identity document (for example, series, number, by whom and when issued for a passport);

- for a legal entity - full name, legal address, INN and OGRN (for foreign organizations information about the place of registration);

- details of the account to which the income withheld from the debtor should be credited (the legislator provides the opportunity to indicate the address to which funds can be transferred, for example, in the absence of a bank account).

If the amount of recovery is subject to mandatory indexation by law, then the organization to which the writ of execution was submitted is obliged to carry it out. In this case, an appropriate order or instruction must be issued.

The refusal of the employing organization to accept enforcement documents from the claimant, subject to compliance with all the above requirements, is illegal. These persons may be forced to execute and foreclose on the debtor's income in court.

What to do if a writ of execution has been sent to work?

You have been sent a writ of execution for work. What amounts of deductions under a writ of execution are established by law.

When does a wage garnishment occur?

Cases of foreclosure of an employee’s wages are provided for by the Law “On Enforcement Proceedings”:

- writ of execution for the collection of periodic amounts, for example, alimony;

- there is no other property or it is not enough to repay the debt in full.

According to the Law “On Enforcement Proceedings”, the collection is first applied to the funds that are in the debtor’s current account.

If you receive a sheet for deductions from wages, it means that there are no other methods of collection to pay off the debt (or the bailiff - the executor did a poor job and did not find the property that you have).

The accounting department at your place of work has no right to refuse to comply with the bailiffs' demands. She is obliged immediately after receiving the writ of execution from the bailiff to begin withholding funds from your salary.

Withholding will continue until the entire amount of the debt is repaid

How much money can be withheld from wages under a writ of execution?

The maximum limit on writs of execution established by law is 50 or 70%. percent. When and how the percentage of deduction based on a writ of execution from wages is determined.

One writ of execution does not require any special calculation difficulties.

And if the employee has 2 or more writs of execution, or the employee has a debt under the writ of execution and a debt to the organization itself.

Why are checklists needed?

Checklists help:

- Don't forget anything. They will promptly remind you to send the invoice to the client or change the file format.

- Avoid mistakes. Mistakes made during work can be added to the checklist and not repeated.

- “Unload your head.” With checklists, we don’t have to constantly remember what to do and when: we can focus on the work itself.

- Maintain self-discipline. We are less likely to be tempted to do extraneous things, to “cheat” or skip some important step.

- To save time. There is no need to re-plan the work every time: a properly compiled checklist will serve for a long time.

- Rapidly improve the process. Having learned about new techniques and techniques, we can immediately add them to our checklist and begin to put them into practice.

Child support and debt to the company

Amount of deductions: for alimony from 25 to 70%, and debt to the organization cannot be deducted, unless the employee himself does not object to this.

An organization to which an employee owes money has the right to deduct up to 20% of the salary to pay off this debt (according to the Labor Code of the Russian Federation).

The maximum amount that can be withheld is determined based on the employee’s income minus personal income tax. Moreover, deductions can be made from both salary and advance payment.

There is one limitation . The employer is obliged to withhold alimony from the employee’s income no more than once a month in accordance with the Family Code of the Russian Federation, because not alimony - monthly collections; the exact amount of the employee’s income from which alimony is withheld can only be determined at the end of the month.

No similar restrictions have been established for other penalties.

The accounting department usually sets the amount of the advance taking into account all deductions for writs of execution and other payments (for example, alimony for the maintenance of minor children is 70% of income, then an advance cannot be given in the amount of 50% of earnings).

If an employee has received a writ of execution, then the first thing to do is to withhold the debt under the writ. The maximum deduction amount depends on the type of debt.

The deduction is 70% of earnings if the writ of execution is issued for:

- compensation for damage to health;

- compensation for damage caused by the crime;

- child support for minor children.

The maximum amount of deduction for other sheets is 50%.

Information about when and how much can be withheld from your salary (from the amount of payment in hand) in accordance with the legislative acts of the Russian Federation:

- compensation for material damage and other deductions at the initiative of the employer - no more than 20%;

- alimony sheet for minor children - no more than 70%;

- other alimony – no more than 50%;

- compensation for harm to the health of another person, compensation for damage from a crime, damage due to the loss of a breadwinner (according to one or several writs of execution) - no more than 70%;

- deductions for other writs of execution, including several - no more than 50%;

- deductions at the initiative of the employee - in any amount, no restrictions are established.

An employee's debt to the organization can be collected only after deduction of amounts under writs of execution, observing the limit of 20%. For example, if, according to executive documents, 30% must be withheld from you in the current month, then they have no right to collect the debt from you to the organization this month.

This is exactly the situation with the payment of alimony. The amount of child support for one child is ¼ of income, for two - ⅓ of income, for three or more children - half of income. It turns out that if an employee pays alimony, then the organization’s debt cannot be recovered from him.

Only at the written request of an employee can any amount be withheld from his salary.

If you are asked to express your consent in writing to withhold a debt to the company, you have the right to refuse. If you agree, they can collect money according to the writ of execution, as well as retain the debt to the organization.

How to collect alimony from salary in envelopes. Consultation with lawyer Lyski Pavel

Where to create checklists

In this section we will look at several ways to create and design work checklists: from the simplest and most accessible to the complex and “advanced”. What exactly to choose depends on your goals and personal preferences.

On paper

If you have to work without a computer and smartphone, the old proven method will come to the rescue - a piece of paper and a pencil. There are three options here:

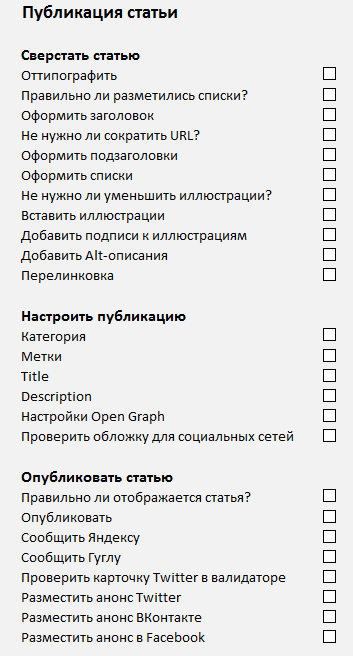

Regular list. This is the simplest, but quite workable option. You just need to write down the tasks on any piece of paper, and then cross them off as you complete them. The disadvantage of this method is that the list of tasks has to be compiled anew before each job.

List-matrix . This is a "reusable" version of a regular list. Its essence is to draw several checkboxes at once opposite each task or simply arrange the entire list in the form of a table. To create such checklists, it is better to use squared paper.

Printout. The third option is to print out a checklist already completed on the computer in advance. Life hack: if you don’t have special programs for checklists at hand, create a bulleted list in a text editor, and set white squares or circles as markers:

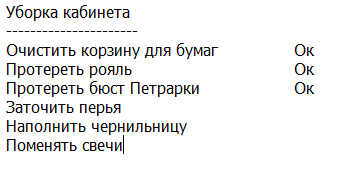

On the computer

If a computer is available, but for some reason you cannot use the Internet, pay attention to the following options:

Plain text file. If you do not attach importance to the appearance of the checklist, you can create it in absolutely any text editor (for example, Notepad). Make a list of tasks, and after completing them, delete them or mark them with the word “OK”.

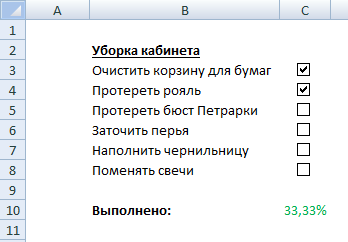

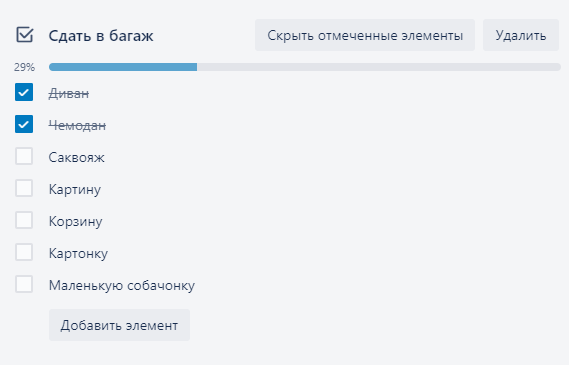

Spreadsheets. A more advanced option is a table in Excel or LibreOffice Calc. If desired, such checklists can even be made interactive: add real checkboxes, calculate the percentage of work completed, progress bars, etc.

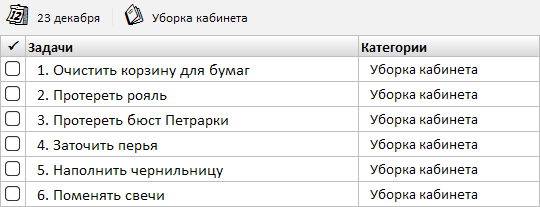

Organizer programs . Such programs already have interactive task lists, from which you can easily make checklists. Create a separate category in your organizer (folder, project, etc.) and place a list of tasks in it. To keep them in order, they need to be renumbered and arranged alphabetically.

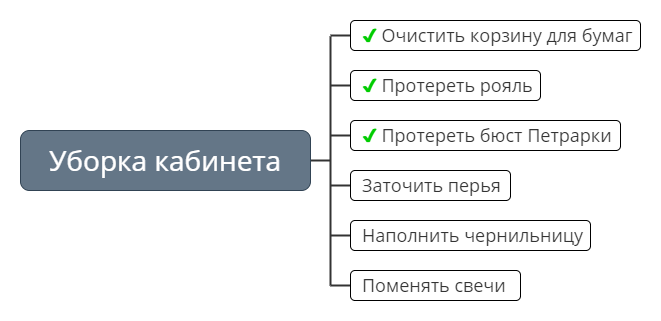

Mental maps. Checklists can also be presented in the form of mental maps (using xMind, Freemind and other similar programs). Such lists look very clear.

In the Internet

With the Internet, there are even more opportunities to create checklists. We list just a few options.

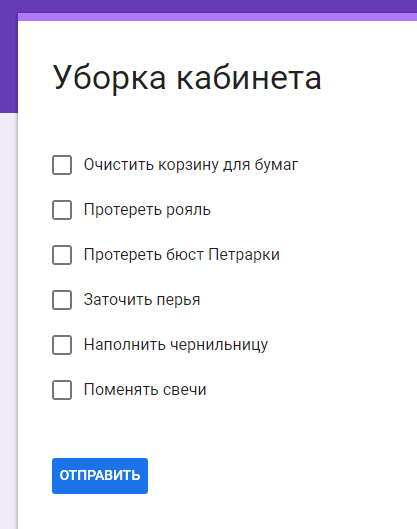

Google Forms . A very simple, convenient and eye-pleasing option. Checklists created in Google Forms can be opened using a special link from any device, and the results of filling them out can be collected in a separate spreadsheet.

Maxdone . This online organizer allows you to attach checklists to any task. Maxdone not only has a web version, but also versions for smartphones, so your lists will always be at your fingertips.

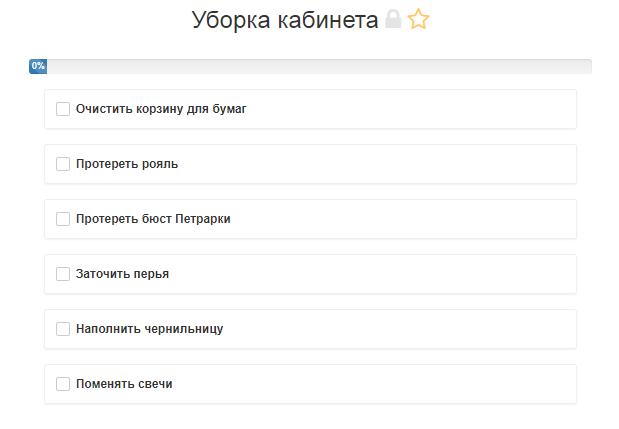

Checklists.expert. This is probably the most famous service in RuNet for working with checklists. There is a simple visual designer, the ability to create private and public checklists, and the ability to print and download them in PDF format.

Evernote and Google Keep . Designed for creating and storing notes, but you can also insert your own checklists into these notes. It’s difficult to say how convenient they are, but if you already use these services, you should probably consider this option.

Checklist in Evernote Checklist in Google Keep

Trello . This popular project management service is great for working with checklists. Creating them is very easy: just copy and paste a list, for example, from a spreadsheet, into a card. The checklists themselves can use Markdown markup and links to other Trello cards.

All of the options listed above are intended more for individual work or small teams. As for large companies, here checklists are most often implemented within various CRM systems (Bitrix24, Megaplan, etc.), where control, accounting, and collaboration are already well thought out. Please refer to your specific CRM help sheet or support for details.

Alimony and other deductions in one line

Executive documents have a certain order.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

First of all, they collect : alimony, compensation for damage to health, damage to persons who have lost their breadwinner, and also compensation for moral damage.

Secondly, they collect: claims related to payments to the budget (fines, taxes).

In the third place, all other claims are collected.

Debts under several enforcement documents of the same queue must be held simultaneously. The total amount of collection will be determined based on whether the total amount of monthly deductions for all sheets falls within the limit established by law.

If the amount of all monthly deductions under writs of execution is less than the limit, the debt will be collected in full.

If the amount of monthly deductions exceeds the limit, then the debts are withheld in proportion to the amount for each writ of execution.

Child support and loan debt

First, alimony must be withheld from you (the maximum limit is 70%). And only if there is enough income, they will move on to deductions on the sheets of the second stage, and similarly to the third. For them the limit is 50%.

If you have received 2 writs of execution of different priority, deductions for 2 of them should be made only after deducting the debt on the first writ.

For example, if you pay alimony, and the second writ of execution is to pay off loan debt, then alimony will be withheld from you first. The remainder of the amount that can be legally withheld from you will be used to repay the loan debt.

Consider this point. The limit of 70% deductions does not apply to writs of execution of the following queues, for which the limit remains 50%.