- 7791

- 30 May 2021, 08:22

- taxesmoneyBelarusinteresting to know

Photo: onliner.by

Tax deductions allow you to reduce the amount of income tax and thereby increase your salary. An employee often finds out about this by accident or too late, because it would hardly occur to anyone to look into the Tax Code in their spare time (unless you are fighting insomnia with the help of this fascinating treatise). Together with tax consultant and manager Olga Fedorova , Onliner.by explains what amounts we are talking about and who can claim them.

What are tax deductions and how to get them?

This is a fixed amount that is not subject to income tax (remember, its size in Belarus is 13%). Income tax deductions are available in some cases. This may be paid education, the presence of children, construction or purchase of housing and other cases specified in Articles 209-212 of the Tax Code. You can receive a deduction for those who have all the supporting documents (their list is given there).

There are several types of tax deductions: standard, social, property. Standard deductions include a deduction for a low amount of income, deductions for children under 18 years of age and dependents, social deductions for education and insurance, and property deductions for the purchase (construction) of housing.

If specialists will definitely notice your failure to pay taxes and demand an explanation, then with deductions everything is a little different. To receive a standard deduction, you need to provide the necessary documents, but for a social deduction you will need not only documents, but also an application indicating from what period and how you want to receive the deduction.

It is important to understand that an income tax deduction can only be obtained from earnings on which income tax is calculated. That is, deductions from wages are possible, but from child benefits – not.

How to receive a refund and list of documents

- To receive the amount of previously paid personal income tax, you need to collect a set of documentation and submit it to the Federal Tax Service in person, by mail or online:

- personal income tax certificate 2; here you can add other documents on income, if any were in the tax period, for example, from renting out housing;

- title papers – purchase and sale agreement, mortgage, treatment, etc.;

- checks, receipts, etc.;

- certificate of interest payment - in case of repayment of the mortgage;

- passport;

- agreement on the distribution of property deductions - if there are several homeowners;

- application for compensation in free form;

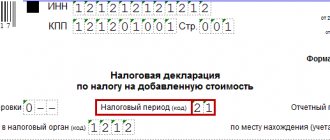

- declaration 3 personal income tax.

If your salary is not higher than 761 rubles before taxes

For people with low incomes, there is a standard tax deduction - a fixed amount of 126 rubles. If your full-time salary is less than 761 rubles, then 126 rubles of it will not be taxed. Let's say you receive 600 rubles before taxes. Without it, it will take 78 rubles to pay income tax from your salary, and with it - 61.6 rubles ((600 - 126) × 13%). Savings - approximately 197 rubles per year.

Deduction for the construction or purchase of housing

This deduction is provided to those who have registered in the queue for improvement of housing conditions and buy or build housing while in such a queue. From the amount you spent on it, you will get 13% income tax back. And it doesn’t matter whether you bought an apartment on preferential or general terms. If you are in line to improve your living conditions, you have the right to a deduction. But the property deduction can only be received once.

“For several years now I have been receiving a tax deduction in connection with the purchase of an apartment,” says Victor. — I was registered as in need of improved housing conditions, but I found out about the deductions by chance from the Internet. Now he is exempt from paying income tax until the amount of money earned exceeds the cost of the purchased apartment. I figured that with my salary this period could last more than 10 years.

How is the deduction amount determined? Let's say you receive 1000 rubles monthly. Buying an apartment cost you 150,000 rubles. This means that for 150 months you will not be charged income tax - 13%. The savings will be approximately this: for a month 130 rubles, for a year - 1560, for 12.5 years - 19,500. This is a very approximate calculation - provided that income does not change and other deductions are not taken into account.

If you took out a loan to purchase or build a home, then a deduction will be provided for both the amount you spent from your own funds and the amount transferred by the bank. If you have repaid part of the loan, you must immediately submit supporting documents to the accounting department. So gradually, 13% of the entire cost of housing will be returned to you. The exception is payment of increased interest and fines for late loan payments.

Both spouses can receive such a deduction, and if you work several jobs, you have the right to a deduction from the salary for each of them. For those who are in line and have started building a house, there is a huge list of reasons for which you can receive a deduction (developing a house project, installing gas, heating, etc.).

“I get a deduction for housing construction at the cost of my nerves,” Victor shares his impressions. — The most absurd thing is that you have to prove your right to deduction for every little thing. I have accumulated a ton of papers after correspondence with tax authorities at various levels - from local to regional. They themselves do not know what is eligible for a deduction and what is not; they themselves refute what was written earlier in the response of another department. And I have to prove that a deduction is due, for example, for the delivery and unloading of building materials, for cables, for film, etc. They are very afraid to give an extra deduction and refuse everything they can. They don’t even know how to Google the name from the receipt and make sure that it is a building material. They spoil the checks themselves by storing them on the windowsill in the sun, and then they don’t give a deduction because the check is faded and nothing is visible on it. And so it has been for several years.

How can you ensure that receiving a deduction for housing construction does not turn into hassle for you, exhausting correspondence with the tax office and extra gray hair on your head?

“The situation is standard, unfortunately,” explains the tax consultant. — In such cases, you must immediately ask the sellers not only for a check, but also a copy of the check, make copies of the received documents for yourself and apply for a deduction not for each amount, but, for example, for a certain period. That is, we collect documents for three months, provide them, and receive a deduction for the next period.

Probable reasons for refusal to receive a deduction

Violation of the document flow procedure or lack of evidence of expenses leads to a refusal to provide a deduction. Common cases include:

- Application for benefits in the absence of taxable income during the year.

- Lack of originals provided to the Federal Tax Service upon request during the inspection period.

- Submitting an application to refuse to apply a deduction in favor of a spouse if the absence of the right to a deduction is documented, for example, in the presence of a separation agreement or when inheriting property. Knowledge of legal regulations guarantees the prevention of denial of deductions.

We invite you to read: Organizational property tax in 2019-2020: rate, calculation, reporting - Buhonline

Deduction for those who have children and other dependents

Deductions for children will be calculated automatically (upon providing documents) if they are under 18 years old. All other dependents require additional documents. For example, a dependent is considered to be your wife (husband) on maternity leave, an elderly mother or grandmother whom you are caring for, or a child over 18 years of age who is receiving their first education after school (full-time education). This also includes your mother, who is officially on leave to care for your child.

For each minor child or dependent there is a fixed deduction of 37 rubles. If you are raising children alone or have several of them, then the deduction will be larger - 70 rubles for each. If a child has a group I or II disability, 177 rubles per month will not be taxed.

— Both parents can receive deductions for children at the same time. And it doesn’t matter whether the parents are officially married, if this particular father is indicated on the birth certificate, he can receive a deduction for the child,” says the consultant.

Tax deduction on maternity leave

A woman can claim a tax deduction during maternity leave if during this time she has any officially registered income, with the exception of child care benefits.

These include:

- Earnings received from renting out real estate.

- Profit received from business activities subject to personal income tax deductions.

If a woman had taxable income in the same year in which she went on maternity leave, she also receives the right to apply for a deduction.

When buying an apartment

If the apartment was purchased while the woman was on maternity leave, then in order to receive the deduction she will have to wait a little before going to work.

However, if you purchased real estate while the expectant mother was still working, you can receive part of the deductible funds for the current year.

Example: Ivanova A.A. bought an apartment in March 2015, and she went on maternity leave in September 2015. In this situation, it is possible to return the money within a few months.

Read about receiving a tax deduction for shared property between spouses. What is the deadline for filing a tax deduction application? See here.

Return through spouse

Although a woman without official income during maternity leave cannot exercise her right to a refund, she can transfer it to her spouse. In this case, the couple is required to draw up a corresponding application. On its basis, the spouse can receive a deduction in full while his wife is on maternity leave. This is the easiest option for receiving money.

The specified application for transfer of rights can be drawn up only once. This paper must indicate the share in which the deduction is distributed between the spouses.

For example, if you indicate a ratio of 100% in favor of the husband and 0% in favor of the wife, the spouse will receive the full amount of the deduction. However, it will no longer be possible to change the shares in the future.

Deduction for training

A deduction can also be provided for education by yourself or your children. But only if several conditions are met: this is your (or your child’s) first education after school and must be full-time. If the training is free, you will receive a fixed tax deduction of 37 rubles; if it is paid, you will receive a deduction in the amount of tuition fees (without retaking tests and other expenses).

“When I studied at the university and paid for my studies, I didn’t know anything about tax deductions,” says Artem. “Then I wanted to get a deduction, but for a long time they sent me from office to office and demanded a certificate of completion of my studies. But I dropped out of university after the third year. Although this shouldn’t seem to prevent me from getting a tax deduction. As a result, they never gave me a deduction.

You or your child are entitled to such a deduction, but only for studying in Belarus. There is no deduction for studying at a foreign university.

“In practice, I came across an interesting situation,” says Olga Fedorova. — The son of one of the clients studied at paid departments in two Belarusian universities at the same time. In one - in the fourth year, in the other - in the first. It turned out that the deduction must be accrued for the entire amount of expenses (that is, for studying at two universities) until the moment of receiving the first higher education.

The legislative framework

The right to return personal income tax on income is enshrined in the Tax Code of the Russian Federation: in Articles 218-221. Certain nuances of the procedure are contained in letters and other legal acts of the Ministry of Finance and the Federal Tax Service of Russia. I will mention some later in the article.

Maternity leave is provided on the basis of Article 37 of the Constitution of Russia, Article 255 of the Labor Code of the Russian Federation, Federal Laws No. 255-FZ of December 29, 2006 on social insurance in the case of BIR and maternity and No. 81-FZ of May 19, 1995 on state benefits for citizens with children .

Important! You can receive a tax deduction on maternity leave after contacting your Federal Tax Service with a package of documentation and a completed 3rd personal income tax return. There are different options for contacting the inspectorate, incl. remotely.

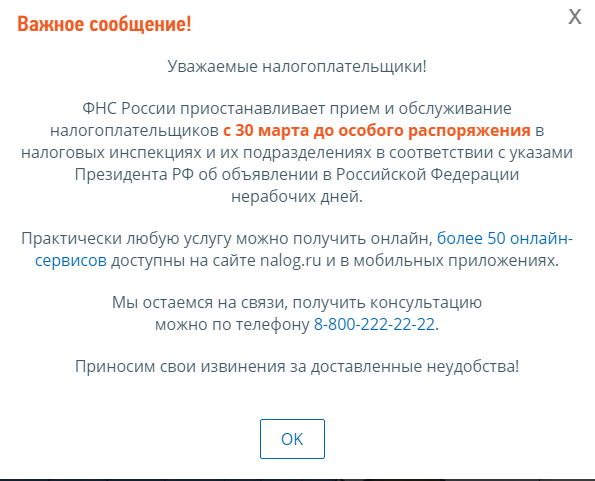

The remote method of interaction between individuals and the Federal Tax Service is relevant in quarantine conditions amid the spread of coronavirus infection and is being actively developed by the website of the Federal Tax Service of Russia.

Note! As of May 1, 2021, all inspections of the Federal Tax Service have suspended the reception and service of citizens in operating rooms and offices of department branches.

If you have taken out insurance

Anyone who has entered into a voluntary life insurance agreement, opened a pension savings account, or taken out voluntary health insurance for themselves or a close relative can also receive a deduction. But this must be insurance from a Belarusian company and for a period of three years.

— If your salary is more than the insurance amount, the entire tax deduction can be applied for a month. If your monthly income is 1,000 rubles, and insurance costs 3,000 rubles, then the deduction will apply for three months,” explains the consultant.

There are restrictions here: no more than 3,890 rubles can be exempted from tax per year.

— I learned from a friend about tax deductions for voluntary life insurance and took out such insurance for my son. He’s my truck driver, you never know what can happen,” says Elena Stepanovna. — Now I get deductions from my job. True, I was sure that the entire insurance amount would be refunded from taxes, but it turned out that only 13%.

Registration procedure

Personal income tax is paid upon receipt of the notice, but in most cases this responsibility is assumed by the employer's accounting department. Transfers are made from the company's account, which are later deducted from the employees' salaries.

You can receive a property deduction either through the tax authority or through your employer. More often, individuals apply to the Federal Tax Service on their own, because this way the process happens much faster. There is no statute of limitations for tax deductions for purchased housing, so a person himself determines when it is more profitable for him to apply for its registration.

To return taxable personal income tax, you must submit documents in accordance with the requirements of the tax authority and the specific situation. The declaration indicates the amount of income received during the year and taxes paid. Based on the results of the audit, a notification about the decision of the Federal Tax Service is issued within 30 days, and after another 10 days the money is transferred to the taxpayer’s account.

I didn’t know about deductions, is it possible to fix it?

If for some reason you were not accrued deductions, this is considered an overpayment of tax and the amount of the deduction must be returned. But this is permissible if no more than five years - this is the statute of limitations.

“I found out that I could get a tax deduction for education many years after graduation, when there was no one to blame,” says Alice. — While studying full-time, I worked as a bartender to pay for my own education. Of course, it was a shame that no one said anything. The irony is that I studied to be a lawyer.

That is, if your child graduated from a university three years ago, you can still get deductions. Even if not for five years of study, but only for the period that falls within five years from the date of writing the application.

Can I receive several deductions at once?

If suddenly you are the happy owner of a wife on maternity leave and three small children, you pay 200 rubles a month on a loan and at the same time you are trying to get your first higher education for 50 rubles a month, then all deductions can be taken into account for your salary. We count the savings. Let's say you receive 1000 rubles. Without deductions, you would pay income tax of 130 rubles, and with deductions you would be charged just over 65 rubles (13% × (1000 – (70 × 3) – 37 – 200 – 50)).

Second example. If your wife is on maternity leave with two children, they will not deduct tax on the amount of 177 rubles (37 + (70 × 2)). If you receive less than 761 rubles, another 126 rubles are added to the deduction amount.

When does right arise?

Income tax refunds are provided to all working citizens of the Russian Federation once in their lifetime. When completing a purchase and sale transaction, a person automatically becomes a potential owner of the opportunity to return 13% of the amount spent.

After changes occurred in the Tax Code, the maximum refund amount became equal to 260 thousand rubles - this is 13% of 2,000,000 rubles. You can use the refund immediately, at the end of the current year, or after several years.

What if I am unemployed or an individual entrepreneur?

If you are unemployed, you cannot receive any deductions. No income means no income tax deduction. But that’s why it’s a law, to have a thousand exceptions.

— If you have a loan and the purchase of subsidized housing, and you went on maternity leave, there is simply nothing to charge a deduction for. Then the husband can receive it if he writes an application to the tax office, says Olga Fedorova. — If you worked in the last five years and had the right to a deduction, but did not provide documents or did not know about it, the deduction amounts can still be returned.

An individual entrepreneur can also receive all these deductions, but only if they work with the payment of income tax (simplified tax or single tax will not work). But for self-employed workers there are many nuances that do not apply to hired workers.

Features of claiming deductions when using different methods

Depending on the chosen method of claiming a deduction, there are differences in design.

| Method of receiving a deduction | To the Federal Tax Service in person | To the Federal Tax Service by contacting the government services website | From the employer (tax agent) |

| Filing a 3-NDFL declaration | Required, on paper | Required, electronically | On required |

| Statement | Required, included in the package of documents | Required, generated after verification | Required by the Federal Tax Service to receive notification and to the employer |

| Desk inspection | Carried out, period limited to 3 months | Carried out, period limited to 3 months | Not carried out, document verification is carried out within 1 month |

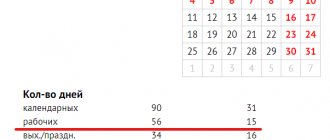

| Deadline for receiving the deduction | The amount of overpaid tax is transferred to the account within a month after verification if an application is submitted | The amount is transferred to the person within a month after verification and generation of the application in electronic form | The deduction is provided in the current period of income receipt |

We invite you to familiarize yourself with: Sample lease agreement for industrial premises

The declaration for obtaining the deduction is submitted at any time after the end of the annual tax period. Within 3 years, you can apply for a recalculation of the tax base and a refund of overpaid tax. After 3 years there is no tax refund.

Where do such amounts come from - 761 rubles in salary?

If you look closely, the typical tax deduction amount is a lumpy number that is not tied to a base amount or some other fixed amount. Where does it come from?

“I personally don’t see any logic in the amounts,” the consultant laughs. — Not all amounts in tax legislation are divided by the base amount. For example, the previous minimum wage was 388.42 rubles; individual entrepreneurs under contracts from individuals can receive a maximum of 7,521 rubles. Why - no one knows.

*The article shows simplified cases. To know for sure whether you are entitled to a deduction, contact your accounting department or tax office.