Grounds for bonuses to the general director

The CEO is an employee, like all other employees of the organization. The difference from others lies in the special procedure for his appointment and removal from office, as well as his job responsibilities. In this regard, he, like others, has the right to apply for a bonus based on the results of his work.

Labor Code of the Russian Federation in Art. 135 determines that systems for remuneration of employees and their bonuses can be established by the employer in local acts of the enterprise, agreements or collective agreement. Also in the Labor Code there is Art. 57, which contains a clause stating that the conditions for assigning incentive payments must be included in the employment contract. In practice, an employment contract usually includes a reference to the bonus clause, rather than describing the entire procedure.

Thus, the general director has no right to arbitrarily assign a bonus to himself, nor does he have the right to determine its size. This can only be done by his employer by issuing a decision, order or signing the minutes of the general meeting (executive body of the company), if we are talking about a one-time bonus. The basis for assigning a bonus to the general director is an administrative act of the employer (executive body). The initiators of issuing such an act may be, in particular:

- general meeting;

- Board of Directors;

- a collegial executive body with a different name, depending on the charter of a particular organization;

- sole executive body.

Note: if the director is the sole founder of the company, that is, both the employee and the employer, he can decide to pay himself a bonus.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for bonuses under special regimes

Organizations that pay a single tax on the difference between income and expenses can include premiums in costs that reduce the tax base for the single tax (subclause 6, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

However, this is only possible if two conditions are simultaneously met:

- payment of the bonus is provided for by the labor (collective) agreement;

- bonuses are awarded for labor performance.

Include the amount of bonuses in expenses at the time of their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Do not include the amount of non-production bonuses as expenses.

If an organization pays a single tax on income, the amount of the premium does not reduce the tax base (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

UTII If an organization applies UTII, the calculation and payment of bonuses to the manager will not affect the calculation of the single tax. UTII payers calculate tax based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

General UTII system. Bonuses accrued to the manager for achieving specific indicators are attributed to expenses for the type of activity to which they relate. If a bonus is paid for the overall results of the organization’s work, it must be distributed (clause 9 of article 274, clause 7 of article 346.26 of the Tax Code of the Russian Federation).

How to draw up a regulation on bonuses for the general director?

Bonuses for the general director must be carried out according to the rules established by the legislator. However, the regulations do not cover this issue in detail, so the employer needs to develop a local act that will include a provision on bonuses for the general director (the provision can be either an independent document or be part of the salary regulation).

At the same time, the development of a local act on the appointment of a bonus relates to the rights, and not the responsibilities, of the employer. As a rule, regulations are issued if the enterprise has a bonus system, since in the case of a one-time remuneration payment, an order from the executive body of the company is sufficient.

Since the legislator has not developed a standard form for bonus regulations, the employer draws up an act in any form. It is recommended to reflect the following points in the document:

- general rules for awarding bonuses;

- performance indicators, the fulfillment/non-fulfilment of which leads to the assignment of a bonus or deprives it;

- bonus procedure;

- frequency of payments.

How to fill out a bonus application: 9 basic elements

Attention

Instruction 1 A proposal for a one-time bonus is written by the head of the structural unit in which the rewarded employee works. If your organization does not have a strict submission form, format it as a report or memo.

In the upper right corner of a sheet of standard A4 format, write the full name of the position, surname and initials of the manager. For example: “To the director of LLC “Honest Business” I.I. Ivanov.”

Then state your position, initials and surname: “Head of the Marketing Department S.V. Petrova.” 3 Print the title of the document on the left 2-3 lines below the organization details if you are using letterhead, or 1-2 lines below the last line of the “header”.

Info

ORDER.” Under the title, briefly indicate the contents of the order (on bonuses to the employee) and the reasons for its issuance. 2 In the main part of the order, describe in full the grounds for the decision on incentives. Next, after the word “I order,” indicate the last name, first name and patronymic of the employee being awarded, his position and structural unit of the enterprise. A separate paragraph should determine the type of incentive (bonus, valuable gift, etc.) and the amount (amount in words and figures).

An order may also be placed here for the accounting department regarding the attribution of the specified amounts to the payroll fund or other source of financing. In addition, at the end of the main part of the order, indicate the document that served as the basis for issuing this order (a proposal to encourage the employee from his immediate supervisor or the general Regulations on bonuses adopted in the organization).

He constantly strives for self-development and improving his level of qualifications. This year, Sergeev successfully coped with his job responsibilities, repeatedly carried out additional assignments from his manager, and participated in the public life of the organization.

Sergeev has no violations of labor discipline or other criticisms. I ask you to pay S.S. Sergeev a cash bonus.” 5 When the idea of a bonus comes “from below”, from the immediate supervisor, and higher management needs to be convinced of this, list specific facts confirming the employee’s significant personal contribution.

Important

Describe in detail all the benefits that the organization received as a result of the specialist’s activities. Also, make a guess about the size of the bonus.

Let's start with the fact that the CEO, of course, has the right to receive a bonus, if there are grounds for this. In this article, the general director is understood as any person who performs the functions of the sole executive body of the organization - general director, director, president, etc. The head of the organization himself does not have the right to reward himself. His employer is the founders of the company, who enter into an employment contract with the director.

The procedure for bonuses is not defined by the Labor Code, however, the Labor Code of the Russian Federation allows you to regulate the procedure at the local level, in each specific company. The procedure for rewarding a director can be established both in the employment contract with him and in the local acts of the company, collective agreements and agreements.

Any incentives for the general director are paid exclusively with the consent of the founders or their authorized persons.

Bonus payment for the general director - a sample order for this can be downloaded from the link in the article. Let's consider how bonuses are calculated and paid to the general director.

order on bonuses for the general director CONTENTS OF THE ARTICLE:

- 1 CEO Award – Reasons

- 2 Regulations on bonuses for the General Director

- 3 Decision on bonuses for the general director

- 4 Bonus for the general director - how to apply? Order on bonuses for the general director - sample

- 5 How to pay a bonus to a director?

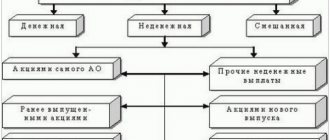

Bonus for the general director - grounds The general director is the same employee of the organization as ordinary employees, however, his leadership status determines some features in the bonus procedure. Payment accounting How to reflect bonuses to a manager in accounting depends on the sources from which bonuses are paid:

- due to expenses for ordinary activities;

- at the expense of other expenses.

Write off the production bonus accrued to the manager as expenses for ordinary activities (clause 5 and 8 of PBU 10/99). Reflect its accrual by posting: DEBIT 26 (44) CREDIT 70 – bonus accrued to the director of the organization. Non-production bonuses (for anniversaries, holidays, etc.) in accounting are classified as other expenses (clause 11 of PBU 10/99): DEBIT 91 subaccount “Other expenses” CREDIT 70 - bonus accrued at the expense of other expenses.

Decision on bonuses for the general director

A bonus to the general director can be assigned only on the basis of a decision of the founder or meeting of founders, who are his employers. As a rule, such a decision is made at a meeting and included in the minutes. The decision is usually a document drawn up on the organization’s letterhead, where the secretary of the meeting records the following information:

- The total number of persons present, indicating the competence/incompetence of the meeting, as well as full name, position name and passport details of the meeting chairman and secretary.

- Agenda. Here we can talk about assigning a bonus to the general director or other persons.

- Indication of the amount of the bonus and the period for its payment.

- Voting results.

- Signatures of the founders, the secretary of the meeting.

All minutes of meetings must be kept by an authorized person. The text of the decision is brought to the attention of those interested after the protocol is drawn up.

Income tax

When calculating income tax, take into account bonuses as part of labor costs if bonuses are paid for production indicators stipulated by the employment contract, and the source of their payment is not net profit (clause 2 of Article 255, clauses 1 and 21 of Article 270 of the Tax Code RF). Similar recommendations are given in letters of the Ministry of Finance of Russia dated November 30, 2009 No. 03-03-06/4/101, dated November 21, 2008 No. 03-03-06/4/85, Federal Tax Service of Russia dated August 20, 2014 No. SA-4-3/16606, dated May 20, 2010 No. ShS-37-3/1977. Despite the fact that these letters are addressed to state unitary enterprises, the conclusions of officials can also be applied by commercial organizations.

Executive bonuses are indirect expenses. Therefore, if an organization calculates income tax using the accrual method, these costs are fully attributed to the expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

When using the cash method, take into account the costs upon payment of the premium (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Bonuses and remunerations that are accrued to the director in excess of the amounts provided for in the employment contract cannot be taken into account for taxation (Clause 21, Article 270 of the Tax Code of the Russian Federation). Bonuses that are not related to the manager’s performance of his job duties (for example, bonuses for holidays, anniversaries) also do not reduce the tax base for income tax. Such payments do not meet the criterion of economic justification of costs (clause 1 of Article 252 of the Tax Code of the Russian Federation). A similar position is contained in the letter of the Ministry of Finance of Russia dated January 20, 2005 No. 03-05-02-04/5 and confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the Ural District dated January 11, 2006 No. F09-5989/05-S7 ).

For accounting for bonuses paid out of net profit, see How to register and record payment of bonuses out of net profit.

Order on bonuses for the general director, sample

The order to assign a bonus is issued based on the decision of the founders and signed by the employer. If the founder and director are the same person, then he personally signs this order.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

A sample order for director bonuses can be developed at the enterprise, and it must include the following information:

- Full name and position of the employee who is entitled to remuneration.

- Reasons for the award.

- Grounds for assigning a bonus.

- Amount and terms of payment.

The order is printed on the organization’s letterhead. For convenience, the legislator proposes to use form T-11 for these purposes, which was approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms...”.

A completed bonus order may look something like this:

LLC "Zauralsky Stone"

Order

About bonuses to Ianishchev T.V.

№ 32

11.02.2016

Based on clause 23 of the Regulations on bonuses for Zauralsky Stone LLC and taking into account the achieved indicators based on the results of January 2016, I order:

- To assign a bonus of 50% of salary to the General Director of Zauralsky Stone LLC T.V. Ianishchev.

- The chief accountant must accrue payments until February 20, 2016.

- Control over the execution of the order is entrusted to the chief accountant Dorofeeva A.V.

(Signature, date)

Is it possible to pay a monthly bonus to the General Director by stipulating this in the employment contract?

Personal income tax and insurance contributions Regardless of what taxation system the organization uses, calculate personal income tax from bonuses to the manager (clause 1 of article 210 of the Tax Code of the Russian Federation). For the amount of premiums, also add contributions for insurance against accidents and occupational diseases (Art.

- Entrust the calculation of the bonus to the accountant of Zakoved LLC, A.A. Petrov.

- Control over the execution of the order shall be entrusted to the accountant of Zakoved LLC, A.A. Petrova.

- Founders: Sidorov G.G. /Sidorov/, Evstaviev A.A. /Evstafiev/ The order has been reviewed by: Ivanov A.A. /Ivanov/ 12.12.2017 Petrov A.A. /Petrov/ 12.12.2017 How to pay a bonus to the director? After preparing the above documents, they are transferred to the accounting department for execution. It is recommended that the order reflect the deadlines for calculating bonuses. They can also be enshrined in the Regulations on Bonuses. In this case, there is no need to additionally specify them in the order.

You can transfer the bonus either to the employee’s card or hand it out. Depending on this, the accountant fills out various forms of statements.The bonus can be accrued at any time, since the provisions of Part 6 of Art. 136 of the Labor Code of the Russian Federation does not apply to bonuses.

How to pay a bonus to a director?

After all the documents necessary for the appointment and payment of bonuses have been prepared by authorized persons, they are transferred to the accounting department for accrual. As a rule, the decision on appointment or order specifies the timing of the transfer of funds to the employee. In case of late payment, the employee through whose fault this occurred will be held liable. If there are no such deadlines, the payment of the bonus can be made simultaneously with the payment of wages. Depending on the form in which the bonus is given (cash or in kind), the reward is given to the employee against his signature or transferred to a salary card.

Thus, the procedure for bonuses to the general director can be specified both in the bonus regulations in force at the enterprise and specified in the employment contract of the employee. For payment, the minutes of the general meeting of founders and the decision of the sole founder are drawn up, after which an order for bonuses is issued.

Criteria for evaluation

The answer for what a director can receive a bonus is found in the Regulations on bonuses for employees of the company, a collective agreement or other local act. There is no need to decipher them in the contract, you just need to provide a link to the internal document (letters of the Ministry of Finance of Russia dated February 26, 2010 No. 03-03-06/1/92, dated February 5, 2008 No. 03-03-06/1/ 81). The director may be assigned the following types of bonuses based on:

- minutes of the general meeting of shareholders of the organization;

- decisions of the board of directors or supervisory board;

- decisions of the sole shareholder of the organization.

Lawyers' opinion

The taxpayer's position in this case looks weak. Tax inspectors, on the contrary, present quite weighty arguments. In particular, they compare data on the wage fund of the company’s employees with the amounts of bonuses payable to the general and executive directors, who were not directly involved in gold mining.

In order for a bonus to reduce taxable profit, it must be unambiguously stimulating, aimed at increasing the economic indicators of the taxpayer. Tax authorities challenge the legality of accounting for bonuses in the following cases:

- the premium is paid although the taxpayer is operating at a loss;

- local regulations do not provide clear criteria for the payment of bonuses, and the actual implementation of indicators is not assessed;

- bonuses are paid to employees who are also members of the company.

At the same time, the size of the bonus itself does not indicate the taxpayer’s dishonesty if management works effectively and the ratio of management expenses and income allows the bonus to be paid without damage to the company.

In practice, the acceptable size of the bonus at the end of the year is considered to be from three monthly salaries to an annual one.