In what cases is a notification letter written?

Chapter 11 of Federal Law-229 provides for the obligation of the employer or persons paying wages to the debtor under a writ of execution to withhold part of the funds to pay off the debt. The basis for this is a writ of execution or a court order, which can be transferred to an organization (IP) either by the collector (recipient of alimony) or by the bailiff.

In this case, the obligation to send a letter to the bailiffs about the dismissal of an employee or a change of place of work or residence, Part 5 of Art. 95 FZ-229 is assigned to the debtor. It is he who must notify the collector or bailiff of new circumstances.

In practice this does not always happen. Moreover, a significant portion of debtors avoid payments in every possible way and do not comply with notification requirements. Because of this, the legislator duplicated the requirement to dismiss the debtor, imposing this obligation not only on the citizen-debtor, but also on the employer. A similar obligation is provided for in Part 3 of Art. 98 FZ-229.

Failure by the employer to comply with the requirement to return the writ of execution and notify the bailiff and the claimant about the dismissal of his alimony employee entails administrative liability under Part 1 of Art. 17.14 Code of Administrative Offenses of the Russian Federation.

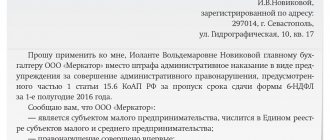

Sample notice to the bailiff

A sample letter to bailiffs regarding the dismissal of an employee can be found on the Internet. Since there is no legally approved form, the letter can be drawn up in any form.

The document must be signed not only by the general director, but also by the chief accountant. If the organization's seal is available, you must also provide its imprint. Copies of all documents transferred to the employee must be kept in the organization’s archives.

They may be useful in the event of a compliance audit.

A sample notice to bailiffs about the dismissal of an employee is available.

What happens to the document if an employee is fired?

A writ of execution is one of the types of enforcement documents; it is issued on the basis of a decision, ruling or court order. It contains data from the operative part:

- name of the judicial authority;

- case number;

- dates of the decision, issuance of the sheet, entry into force;

- the demands presented to the defendant (in this case, he is the employee);

- an excerpt from the decision (the text must strictly coincide with the court’s conclusions about the satisfaction of the claim in full or in part, and contain information about the procedure and amounts to be recovered);

- details of the parties to the case (full name, date and place of birth, registration address - details of an individual, full name of the organization, TIN, date of registration - details of a legal entity);

- document number and series.

A writ of execution is issued only by the court on the basis of an application for the issuance of this document. It can be sent to the bailiff department or handed over to the claimant, his representative by proxy, so that he can present it to the debtor’s employer for execution.

It is also necessary to provide an application containing the data of the claimant and, necessarily, bank details for transferring deductions.

Once the employer has received a writ of execution, you need to:

- notify the bailiff of receipt of the document (if notification was sent);

- register the writ of execution in a special journal for registration of such documents;

- ensure its safety.

upon dismissal of an employee, the employer is obliged to return the writ of execution with notes on what basis the execution was terminated, during what period it was carried out, and what amounts were collected.

This must be done no later than the working day following the day of dismissal. Within the same period, it is necessary to notify the bailiffs and the collector about the dismissal of the debtor, indicating the amount of deductions made.

When do you need to return the writ of execution to the bailiffs?

Article 46 of Federal Law No. 229 provides for the procedure for returning a writ of execution to bailiffs. According to the law, the employer is obliged to return the writ of execution to the bailiff service in the following cases:

- dismissal of the debtor from his place of work;

- death of the defendant;

- full satisfaction of claims;

- inability to locate the defendant;

- termination of collections based on the request of the plaintiff (recipient of funds).

Below we will describe in detail the procedure for returning a writ of execution for each of the above cases.

How to fill out a writ of execution when dismissing a debtor employee

When dismissing a debtor employee, you must make a special mark on the writ of execution (a copy of it received from the bailiff). To do this, on the reverse side of the writ of execution, in a special line, indicate the following (clause 2, part 4, part 4.1, article 98 of the Law on Enforcement Proceedings):

- execution was completed due to the debtor changing his place of work;

- the amount collected.

If you have the original writ of execution received from the claimant, additionally indicate the period during which the writ of execution was in your possession (clause 1, part 4.1, article 98 of the Law on Enforcement Proceedings).

This mark must be certified by the seal of your organization (if any) and the signature of an accountant, which follows, in particular, from the Letter of the FSSP of Russia dated June 25, 2012 N 12/01-15257.

On execution from 01/09/2019 to 04/05/2019. Executed in the amount of 90,000 (ninety thousand rubles) 35 kopecks. The execution was completed due to the debtor changing his place of work.

Is it necessary to keep a copy of the writ of execution closed upon dismissal of an employee?

No, such a requirement is not established by law, but we recommend doing so.

This way, in particular, you can confirm the legality of deductions from the wages of a dismissed employee in the event of claims on his part. If the dispute goes to court, you will have proof of the legality of your actions and will not have to ask the court for confirmation that the deductions were made according to a writ of execution.

We recommend keeping a copy of this document for at least two years. We believe that this period is optimal, since the employee has a year to go to court to collect wages (Part 2 of Article 392 of the Labor Code of the Russian Federation). In this case, the court may extend this period in accordance with Part 4 of Art. 392 Labor Code of the Russian Federation.

Where should the execution paper be returned?

When an employee quits, the employer is obliged to:

- notify the bailiffs that collection of amounts under the writ of execution is impossible;

- return the sheet to the bailiff department.

The writ of execution must be returned along with the application and a copy of the dismissal order. The application shall indicate:

- the amount of penalties made;

- the reason why further penalties are impossible (in this case, it is the dismissal of the employee);

- information about the debtor’s new place of work, if such information is available.

How to return a writ of execution if the employee’s whereabouts are unknown

If the employer cannot fulfill the requirements for recovery on the basis of a writ of execution due to the inability to establish the whereabouts of the employee, then the representative of the organization must immediately notify the bailiff service about this. To do this, the employer fills out an application (the form can be downloaded here ⇒ Application for the return of the writ of execution) and submits it to the FSSP along with the writ of execution.

The period during which the employer is obliged to notify the FSSP is not provided for by law in this case. However, in order to avoid claims from controllers, it is recommended to fill out an application and return the writ of execution no later than 3 days from the moment the employer discovered the impossibility of establishing the whereabouts of the employee.

When and how to return the writ of execution upon dismissal of a debtor employee?

Return the writ of execution (a copy of it) to the person from whom you received it. That is, the claimant needs to return the original writ of execution received from him, and the copy received from him to the bailiff. This must be done no later than the day following the day the employee is dismissed. Such conclusions follow from clause 2, part 4, part 4.1 of Art. 98 of the Law.

You can return this document in any way, the main thing is to record the date and the fact of return. For example, you can send by mail a valuable letter with a list of the attachment, indicating in it the details of the returned writ of execution. With this method of sending, a copy of the inventory, certified by a postal employee, is returned to you, which means you will have confirmation of the return of the document.

You can also invite the claimant to your place and hand over the writ of execution to him personally, or hand over a copy of the writ of execution to the branch of the FSSP of Russia, where the bailiff who sent you this document works.

In such a situation, we recommend that you draw up a free-form inventory of the acceptance and transfer of the document and ask the claimant to put in it: his signature on receipt of the writ of execution, and the employee of the Federal Bailiff Service of Russia - a note on receipt of a copy of the writ of execution.

How and within what time period is the document sent to the bailiffs?

The writ of execution must be returned to the bailiff service within three working days from the date of dismissal of the employee.

Code of Administrative Offenses of the Russian Federation in Art. 17.14, part 4, provides for a fine for a legal entity employer in the amount of 50,000 to 100,000 rubles for late notification, its absence, as well as for the loss and non-return of the writ of execution. The fine for the director or head of the HR department personally is from 15,000 to 20,000 rubles.

On the back of the writ of execution, the employer states the grounds that were the reason for termination of execution, the amount withheld and transferred to the claimant under this writ.

It roughly looks like this: “Alimony in the amount of 50,000 rubles. withheld and transferred to the claimant in full. The remaining amount is 17,000 rubles. was not withheld due to the dismissal of an employee. There is no information about the employee’s new place of work.”

It is necessary to indicate the numbers of payment orders and the dates of transfer of funds. The record is certified by the signature of the chief accountant and the seal of the organization.

Who and in what cases must notify the bailiffs about the debtor’s dismissal?

The most common case is when the bailiff is informed about the dismissal of the alimony debtor. In addition to alimony, there are other cases, in other cases, when it is necessary to file an appeal for the collection of wages and repayment of debts. In these situations, a special resolution must be sent to the debtor's employer.

An employer can dismiss a debtor for various reasons, and when this happens, it is necessary to send a notification to the FSSP within three days that this has happened.

The nuances of dismissing an alimony debtor

First of all, it is important to say that paying child support is the responsibility of the parent who does not live with his child. Such an employee is considered a child support provider only if there is a corresponding court decision.

A peaceful resolution of this issue completely relieves management from the obligation to withhold alimony payments, as well as to warn anyone about the employee’s dismissal.

If the employer wishes to dismiss the alimony worker, in this case it is necessary to consider specific circumstances:

- there are no obstacles to dismissal by agreement of the parties;

- if the employer wants to fire the alimony worker, having alimony rights is not a privilege over other personnel;

- when an employee wants to pay at will, no one can prohibit him from doing so. The only caveat is that management may oblige the employee to undergo a 2-week training period.

The main thing in any of the above cases is to carry out the dismissal procedure correctly. In this case, the employer will be able to avoid fines, as well as other possible misunderstandings.

What to send to bailiffs when terminating an employment contract with an alimony provider

The procedure for collecting alimony payments is regulated not only by Art. 98 of the law on enforcement proceedings, but also Ch. 17 of the Family Code of the Russian Federation (hereinafter referred to as the Code). By virtue of Art. 109 of the Code, the employer must withhold funds on the basis of:

- alimony payment agreement certified by a notary;

- IL.

Read about the rules for calculating alimony in our article “Calculation of alimony from wages.”

More complete information on the topic can be found in ConsultantPlus. Full and free access to the system for 2 days.

Clause 1 Art. 111 of the Code establishes the employer’s obligation to inform the bailiff and the person receiving alimony payments about the termination of the employment contract with the alimony-paying employee. The question often arises about what else to send to the bailiffs when dismissing the alimony worker?

The answer to this question is contained in clause 4.1 of Art. 98 of the law on enforcement proceedings. No later than the next day after the dismissal of the alimony employee, the IL must be returned to the bailiff indicating the amount collected.

The notarial agreement submitted by the recipient of the alimony must be returned to this person with a note about the period the agreement was in this organization and the amount of money paid.

How to inform the recipient of alimony and the bailiff about the dismissal of the alimony worker

Compose a notice of dismissal of an employee who is obligated to pay alimony in any form, since there is no normatively established one. Please include your full name. the employee, information that he has been fired and, if you know, his new place of work and place of residence (Clause 1 of Article 111 of the RF IC). We also recommend that you indicate the details of the writ of execution on the basis of which alimony was collected from the employee, and if you do not know the new place of work (residence) of the dismissed employee, make a reservation about this.

Attention: there is an opinion that in such a message it is necessary to indicate the basis for dismissal (article). We recommend not to do this, since this goes beyond the scope of paragraph 1 of Art. 111 IC RF. This means that it can be regarded as a violation of the procedure for processing personal data and entail, for example, administrative liability under Part 2 of Art. 13.11 Code of Administrative Offenses of the Russian Federation.

In accordance with paragraph 1 of Art. 111 of the Family Code of the Russian Federation, we inform about the dismissal of Yuri Pavlovich Krikunov (dismissal order dated 04/05/2019 N 131-k), from whose wages alimony for minor children was collected on the basis of the Supreme Court writ of execution N 111367485, issued by the magistrate of court district N 156 r- on Khoroshevo-Mnevniki in Moscow.

New place of work and place of residence of Krikunov Yu.P. unknown.

Such a message must be sent directly to the recipient of the alimony within three days after the day the alimony provider is dismissed. And if the bailiff sent you a copy of the writ of execution, then also to him - that is, there may be two addressees. Such conclusions follow from paragraph 1 of Art. 111 RF IC, part 4.1 art. 98 of the Law on Enforcement Proceedings.

The recommendations for sending this message are the same as for returning the writ of execution - it doesn’t matter in what way, it is important to record the date and fact of sending.

Risks associated with the dismissal of a debtor employee

In this case, in particular, the following risks are possible:

- administrative liability under Part 3 of Art. 17.14 of the Code of Administrative Offenses of the Russian Federation for the loss or untimely sending of a writ of execution - for an organization this is a fine of 50,000 to 100,000 rubles;

- administrative liability under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation for failure to inform (untimely communication) upon dismissal of an employee who pays alimony to the bailiff about his new place of work (residence) (if they are known to you), taking into account clause 1 of Art. 111 of the RF IC - for an organization this is a fine of 3,000 to 5,000 rubles.

Attention: there is an opinion that for failure to send the specified message, the bailiff faces liability under Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation, and not under Art. 19.7 Code of Administrative Offenses of the Russian Federation. However, Part 3 of Art. 17.14 of the Code of Administrative Offenses of the Russian Federation does not provide for liability for this. This means, in our opinion, you can challenge the prosecution if you are held accountable under this rule.

Contradictions in the timing of notification of the dismissal of an employee and the return of the writ of execution for alimony

Notification of the dismissal of an employee to the bailiffs by virtue of clause 1 of Art. 111 of the Code must be sent within 3 days from the date of termination of the employment contract with the alimony provider, while the IL must be returned to the bailiff no later than the next day after termination of the contract. At first glance, it seems that there are no contradictions, since we are talking about 2 different actions.

However, on the other hand, by virtue of sub. 2 clause 4 art. 98 of the Law on Enforcement Proceedings, a change of place of work is grounds for termination of the execution of the executive document; therefore, when returning the IL, it is necessary to indicate the reason for this action. Therefore, in order to avoid claims from the bailiff, it is recommended to send the notice of termination of the employment contract and the writ of execution for alimony upon dismissal of the employee to the bailiff at the same time. This must be done the next day after the termination of the employment contract with the employee.

Failure to fulfill the obligation to notify the bailiff of the debtor's dismissal entails administrative liability under Art. 19.7 of the Code of the Russian Federation on Administrative Offenses (CAO). Those found guilty face a warning or a fine of up to RUB 5,000.

Untimely return of IL is punishable by a fine (clause 3 of Article 17.14 of the Administrative Code):

- 15,000–20,000 rub. for entrepreneurs and directors of organizations;

- 50,000–100,000 rub. for organizations.

What to do with a writ of execution that arrived after the dismissal of an employee

When the organization receives a writ of execution (copy) after the dismissal of an employee, the employer must return it to the sender (bailiff or claimant) no later than the day following the day of receipt, and also send a notice of the impossibility of collecting funds in connection with the dismissal of the employee.

A writ of execution on the collection of periodic payments, on the collection of funds not exceeding 100 thousand rubles in the amount, can be sent to the organization or other person paying the debtor wages, pensions, scholarships and other periodic payments, directly by the collector (Part 1 Article 9 of Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ)).

The bailiff forecloses on the wages and other income of the debtor-citizen in the following cases (Part 1 of Article 98 of Law No. 229-FZ):

– execution of enforcement documents containing requirements for the collection of periodic payments;

– collection of an amount not exceeding 10 thousand rubles;

– lack or insufficiency of the debtor’s funds and other property to fulfill the requirements of the writ of execution in full.

What deadlines do you need to meet?

The notice period after dismissal may vary. Depends on the nature of the obligations for which the debt was collected. For general property obligations, no deadline has been established. In Part 4 of Art. 98 FZ-229 there is only an indication that the ID is subject to immediate return.

More precisely, the terms of return are established in relation to debtors from whom alimony is being collected. The return period for IL is established by Part 1 of Art. 111 of the Family Code - no later than 3 days from the date of dismissal.

Notifying the bailiff that the employee does not work at the place where the writ of execution was received

If the debtor is not employed in any way by the company to whose address the writ of execution was sent, you need to draw up a response for the bailiff and send it along with all the documents received from the bailiff. The response to the bailiff must contain information about the debtor such as:

- FULL NAME;

- previous position;

- date of preparation and number of the writ of execution.

It is also necessary to indicate the address of the organization to which the response is sent.

Return of the claim with a covering letter

It is possible that an organization has received a writ of execution against an employee who has already resigned. In this case, it is necessary to return the writ of execution to the bailiffs, attaching a cover letter in any form. It must contain information about the basis for the debtor’s dismissal (with reference to the order), information about the amounts of deductions and the collection period.

The letter is signed by the chief accountant and general director of the organization; if there is a seal of the organization, its imprint is affixed. It is best to record such (if there is one), and also keep documentary evidence of the return (a list of attachments if the document was sent by registered mail).

The procedure for dismissing an employee against whom penalties were imposed under a writ of execution is quite complex and requires maximum care and professionalism of the accountant and the organization’s personnel. We hope that the detailed description will help you not to encounter difficulties and make mistakes when working.

Return of the writ of execution to the bailiffs after fulfillment of the requirements

In general, the return of the writ of execution to the bailiffs is made upon the defendant’s fulfillment of all the requirements stipulated by the writ of execution. Let's consider typical cases:

- The defendant repaid the amount owed. Let us assume that, on the basis of a writ of execution, the employer made penalties for compensation for damage caused, while the amount of compensation in the document is indicated in a fixed monetary amount. In this case, the organization returns the writ of execution upon full repayment of the debt.

- The collection period has been terminated . In general, the employer withholds child support until the child turns 18 years old. If the text of the writ of execution contains this wording of the retention order, then upon the child’s 18th birthday, the plaintiff’s demands are considered fulfilled, which means the employer can return the writ of execution to the bailiff.

Letter to representatives of the FSSP stating that the debtor resigned

In accordance with sub. 2 clause 4.1 in case of dismissal of the debtor, the employer is obliged to send to the bailiff:

- a copy of the writ of execution with a note indicating the reason for the end of execution of the document;

- and the amount that was withheld for the entire time the employee worked in a particular organization.

Thus, the covering letter to the bailiffs is an official document that is sent to the FSSP after the termination of the employment contract with the debtor, complete with a writ of execution. An order for the dismissal of a specific employee must also be attached here.

In case of failure to comply with the notification procedure, the employer may be fined:

- for citizens - from 2,000 to 2,500 rubles;

- for officials - director, head of the personnel department - from 15,000 to 20,000 rubles;

- for legal entities - from 50,000 to 100,000 rubles.

Such amounts are specified in Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation.

When is it compiled?

A covering letter to bailiffs is drawn up upon the dismissal of an employee from whose wages deductions were made on the basis of a writ of execution. It could be:

- payment of alimony;

- repayment of debt to the bank;

- compensation for damage caused to another person;

- fines;

- other types of deductions.

In this case, the main reason for sending a covering letter, including the papers attached to it, is the termination of the execution of the writ of execution. It is also worth emphasizing that the bailiffs must be notified of this event not only when the debtor is dismissed, but also in a number of other situations (for example, when transferring money in full, in connection with the filing of an application by the debtor, etc.).

What is the purpose of writing a letter?

The responsibilities of each employer include tracking all citizens working in its production and are required to make regular cash deductions based on the following documents:

- Performance list.

- Court order.

- Notarized agreement on payments (most often these are alimony benefits).

The accounting department of the enterprise where such an employee is registered is obliged to regularly withhold from the income received from work a certain amount, which is indicated in the documents provided.

If the employment contract between the employer and the employee from whom the money is withheld is terminated, then the employer is required to respond to the bailiff’s decision that the person no longer works at this enterprise.

If the employer has received a notice with a court decision to open enforcement proceedings against any of the employees, then its further steps should be as follows:

- If a notice was attached to the writ of execution from the bailiff, then you should report on its receipt. The message can be composed in any form.

- It is advisable to register the received document in a special journal and appoint a person who will be responsible for its storage, since the loss of such papers is fraught with a fine.

Return of the document is also provided in the following situations:

- If the employee for whom it was written was long dismissed at the time of receipt. In this case, it is necessary to attach a covering letter - a response to the bailiff stating that the debtor does not work in this organization.

- All monetary obligations stated in the sheet have been fulfilled.

Notification of the debtor about the dismissal of the debtor

In the legislative framework of the Russian Federation there is no mention of the form of notification to the debt collector that the executor of the court decision no longer works in this organization, which means you can write a letter in a free conversational form. You need to indicate for what reasons payments from the salary of a former employee of the company will not be transferred to the account of the debtor and information known to you about the current location and employment of the debtor. You can also add formal data such as the number of the writ of execution, etc.

Example letter:

“Dear Petrov Petr Petrovich, the accounting department of the Organization LLC organization informs you that citizen Ivan Ivanovich Ivanov is no longer our employee, and therefore payments to repay the debt will no longer be transferred for you from the organization’s account. At the moment, we know that Ivan Ivanovich is officially employed at, where you can contact with questions that interest you.”

Documentation for returning writs of execution

If there are grounds for terminating the collection procedure from the debtor, then you need to collect a whole set of documents, which cannot be avoided. They are sent through postal services, the main addressee being the relevant government service. Its employees are always ready to explain how to answer the bailiffs that the debtor does not work for the organization.

Departure is carried out for:

An application from the employer is drawn up using a free form. There is no regulated form, therefore the option of using letterhead is allowed. The appeal includes all contact information that, if necessary, will help contact interested participants in the process.

The employer can report a new job if it is known for sure. Such information is also included in the covering letter to the bailiffs upon dismissal of the debtor.

How to write correctly?

The current legislation does not have any requirements or rules for writing a cover letter to bailiffs. There is also no single example of such a document.

It is drawn up in any form on A4 paper. It can be prepared on the letterhead of an organization acting as an employer.

The standard structure of a cover letter for the dismissal of a debtor is represented by the following points:

- “Head” of the document - here the details of the employing company (name, location) and information about the addressee are indicated, that is, the full name of the territorial branch of the FSSP and its address.

- Registration data - the number and date of registration of the letter in the company’s outgoing correspondence.

- Title of the document - the following wording can be used here: “Notice of dismissal of the alimony payer.”

- Content part — this section should consistently contain the following information:

- Full name of the debtor;

- the position he held in the organization;

- details of the writ of execution on the basis of which deductions from wages were made (number and date, name of the judicial authority);

- reason for dismissal;

- the day until which the deductions were made, and a note indicating the absence of uncollected debt;

- message about the return of the writ of execution.

- At the end of the document there must be signatures (of the manager and chief accountant), as well as the seal of the organization.

How to send a message?

The notice is printed on a computer on company letterhead (if available). Sheet format A-4.

The legislation does not establish specific forms of such a document.

However, the notification must contain the following information:

Notification header:

- on whose behalf the document is written;

- to whose address the notification is sent;

- Company name;

- title of the document and what it is about.

Contents include:

- FULL NAME. and data of the debtor;

- the fact of dismissal of an employee with a specific date (specify the reasons);

- details of the writ of execution and the date of its execution;

- the period during which deductions were made from the employee;

- if there is debt, then the reasons for its occurrence;

- list of attached documentation.

The final part of the document includes: signatures of the chief accountant and the head of the company, seal, date of preparation.

In addition to the notification the following is attached:

- writ of execution with a note about the amounts withheld and transferred to the recipient;

- a copy of the dismissal order;

- if information about the employee’s new place of work is known.

The structure of the document may be different, the main thing is to reflect all the necessary information about who the debtor is, what amounts are withheld from him and the amount of the remaining debt.

Based on this data, the bailiff will issue the following writ of execution for the new employing organization.

The notice is an official document. Therefore, it is not allowed to make mistakes or typos, or to indicate false information.

Methods for sending a writ of execution and notification

The current legislation does not contain instructions on specific ways to fulfill the employer’s obligation to return the writ of execution (copy). Accordingly, you can return this document in any way, recording the date and the fact of return.

The employer can return the writ of execution (copy) together with the notice by mail, sending them by registered mail with return receipt requested to the addressee. In this case, an inventory of documents must be compiled at the post office, which is certified by the date the letter was sent (clause 6.1.1.1 of the Procedure for the acceptance and delivery of internal registered mail (edition No. 2), approved by Order of the Federal State Unitary Enterprise “Russian Post” dated 03/07/2019 No. 98- P).

In addition, the employer can return the writ of execution personally to the claimant or submit a copy of the writ of execution to the branch of the Federal Bailiff Service of Russia, where the bailiff who sent this document to the employer works. In this case, you should draw up a free-form inventory of the acceptance and transfer of documents and ask the claimant to put a signature in it indicating receipt of the writ of execution, and the bailiff to mark the receipt of a copy of the writ of execution.

If the organization keeps a log of writs of execution, then it is necessary to record in writing the fact of the return of the writ of execution. The journal form for recording executive documents is developed by the employer independently.

The obligation to notify will be considered fulfilled if the addressee does not receive the correspondence due to reasons beyond the control of the sender.

Note!

For untimely dispatch of a writ of execution, the employing organization and its official may be brought to administrative liability under Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation.

Notice deadlines

If the employee is a debtor for alimony, the Family Code stipulates that the employer is obliged to notify the bailiffs within a period not exceeding three working days from the date of dismissal. Weekends and holidays for sending letters are not taken into account in this case.

For other types of obligations, federal legislation does not establish clear time limits for sending a letter to the bailiff department about the dismissal of an employee. However, Part 4 of Article 98 of Law No. 229-FZ requires the employer to immediately notify the FSSP of the dismissal of the debtor employee. When dismissing a debtor, lawyers recommend sending a letter to the bailiffs either on the same day or immediately the next day after the order is issued.

What to do with a writ of execution in accounting?

Sometimes it happens that the debtor has not been an employee of the organization for quite a long time, but the bailiff does not have the necessary information and still sends a writ of execution to the legal address of the former employer with a request to withdraw some part of the salary of the executor of the judgment. In this case, there is no need to worry, because the organization and its employees will not suffer any financial losses if they send a response to the bailiff’s request in a timely manner and return all received documents.

Subsequent proceedings with documents, a decision that the person does not work and the search for ways to collect the debt is already the job of the bailiffs. But you will greatly help the investigation if in your answer you also indicate information known to you about the current or last place of employment of the debtor known to you.

If an employee is still employed in this company, but for some reason does not receive wages, the executive officer should also be notified about this. An administrative penalty for failure to prepare a response may be a monetary fine.

How to write a cover letter correctly?

The document must contain an introductory, as well as a main and final part.

The introduction should contain the following information:

- details of the enterprise;

- contacting a specific bailiff department;

- contacting the alimony recipient (full name, address, zip code);

- date of signing and document number (indicated in the registration documentation);

- name of the paper.

The main part should be logical and reasoned.

The introduction of the main part of the letter should contain the following data:

- for what reason is the letter sent - dismissal in a specific case;

- reference to a document that obliges the subordinate to pay alimony;

- link to the letter from the bailiffs (to explain the issue that prompted the writing of the letter).

After this, the employee’s full name, his position, as well as the grounds on which alimony is paid, the reasons and date of dismissal, the date of final payment, and the place of residence of the alimony holder are indicated. It is also necessary to indicate information that the writ of execution is sent to the bailiff for further collection of alimony.

What to do if a collection order has been received?

If the organization receives a resolution to collect debt from one of the employees, the procedure will be as follows:

- First of all, the document must be registered in a special journal (according to the internal procedure established at a particular enterprise).

- Then the employer must fill out a notice of receipt of the writ of execution (tear-off spine to) and send it to the bailiff.

- Next, the employee must be familiarized with the contents of the writ of execution against signature.

- A duly registered resolution is transferred to the accounting department for deductions.

- In the future, the executive document must be stored in the organization’s safe as a strict reporting form.

In accordance with clause 3, the employer is obliged to transfer the deductions made in favor of the claimant within 3 days (from the date of payment of wages to the employee).

What should be sent to the FSSP if the alimony worker quit his job?

In Art. 111 of the RF IC states that the employer must send a notification to the FSSP. This must be done within 3 days from the date of dismissal of the alimony employee. The notification that must be sent to the FSSP is drawn up in an application form (drawn up according to the sample).

The document specifies the following mandatory details:

- title of the notification;

- document details (number and date);

- indicate that payments were made by the employer before dismissal;

- header (it indicates who the sender and recipient are);

- list of attachments (copy of dismissal order, writ of execution);

- detailed information on dismissal: who was fired, as well as under what article, what is known about the new place of work;

- signature of the head of the organization and transcript.

After the notification is drawn up, it is certified by the company’s seal. The notice to the former spouse is drawn up in the same form.

Expert opinion

Irina Vasilyeva

Civil law expert

There is no point in delaying sending the document, since if the rules are violated, the employer will be fined up to 100 thousand rubles.

Reply and return of the decision

As noted above, if an employee from whose wages were deducted quits, then the bailiffs must be notified of this circumstance. The employer must prepare a written response containing information about the reason for the debtor's departure and the total amount that was withheld at the particular workplace.

The certificate of dismissal for bailiffs must also be accompanied by a previously received resolution and order to terminate the employment contract with a specific employee.

Thus, notifying representatives of the FSSP about the fact of termination of employment relations with the debtor (as part of enforcement proceedings) is the responsibility of the employer, enshrined at the legislative level. If this requirement is ignored, the organization may face unpleasant consequences in the form of an administrative fine of up to 100,000 rubles.