From the article you will learn:

In practice, there are often cases when an unscrupulous employer refuses to pay an employee wages and other funds due to him upon dismissal. In such situations, former employees of the organization can expect that one day the employer will settle with them or, conversely, contact the Labor Inspectorate to protect their rights. Let's take a closer look at how to write a complaint to the labor inspectorate about non-payment of compensation upon dismissal.

How to write a statement correctly

complaints to the Labor Inspectorate about non-payment of compensation after dismissal free of charge in word format

Important! In order to file a complaint with the labor inspectorate, you must write a statement containing the following information:

- full address of GIT. You need to send an appeal to the unit that is located geographically in the service area of the enterprise,

- position and full name of the inspector to whom the complaint is intended,

- employer's address and details.

Before writing a complaint, you need to study the legislation. It is necessary to correctly name the violations; the appeal must contain references to the norms of labor legislation that were violated. Depending on the issue the appeal concerns, additional documents may be required.

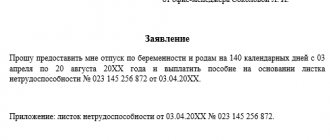

For example, if a pregnant woman files a complaint with the labor inspectorate. Her appeal is related to the refusal to transfer her to easier work. In this case, documents confirming the duration and presence of pregnancy will be required.

Responsibilities of the employer in the event of an accident.

The appeal should consist of three parts:

- the beginning, which indicates the details of the parties,

- central - it describes the essence of the appeal,

- the final part, which should contain the applicant’s requirement and offer options for solving the problem.

In the header, it is important to correctly indicate the details of the organization against which the complaint is being filed, as well as the contact details of the applicant.

In the central part of the complaint, it is necessary to indicate the applicant’s position and the start date of work at the enterprise. It is imperative to describe what results the employee’s appeal to the employer to solve the problem brought.

In the final part, the applicant must indicate possible ways to solve the problem.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

They may be as follows:

- bring the organization to administrative responsibility,

- if a crime is discovered during an inspection, put forward demands for the transfer of information to law enforcement agencies,

- It is imperative to demand that the situation be corrected: for example, to issue funds, reinstate in the workplace, arrange the workplace in accordance with the standards.

The application must be dated and signed by the applicant at the end.

ATTENTION! Look at the completed sample complaint to the Labor Inspectorate about non-payment of compensation after dismissal:

Procedure in case of refusal to pay a settlement

The employee is given the opportunity to apply to several authorities at once that resolve labor disputes. You can visit these authorities with a complaint simultaneously or one by one. However, it should be noted that some of them have a time limit for circulation.

The dismissed person can file a complaint:

- directly to the head of the enterprise;

- to the trade union body (if there is one);

- to the labor inspectorate;

- to the prosecutor's office;

- to the city or district court.

The rules for contacting each of the above authorities are different.

Employer

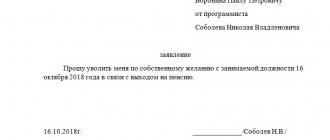

Situations where the settlement is not paid in full or management avoids paying it altogether are common. In this case, the dismissed person must submit a statement to the head of the organization or company in which he previously worked.

The application must be drawn up in two forms. One copy remains with the employee, the second is transferred to management. Such a document can later be used as evidence in court, so it is necessary to affix the stamp of the secretary, head of the personnel department or director of the organization on its receipt.

If management refuses to mark receipt of the application, it should be sent by registered mail through the postal authority.

The General Director is obliged to respond to the request within the minimum possible time. In the absence of any action on the part of the employer, the employee can only apply to government agencies that protect the rights of workers.

Trade union

In enterprises with a large number of employees, trade unions can be created. Such associations consist of workers, and their main task is to protect the interests and rights of people working in the organization. In the event of disputes and conflicts with the employer, the trade union bodies provide significant assistance to the employees.

A quitter who is not paid must submit to the trade union chairman all documentation related to the fact of work activity and dismissal, as well as a written request for assistance in resolving the dispute.

However, trade unions are not created at all enterprises, so workers are given the opportunity to immediately contact government inspectors, skipping the stage of pre-trial settlement.

State Labor Inspectorate

In practice, the most effective way to achieve payment of the settlement is to contact the labor inspectorate. In this case, you should act quickly enough, since in the event of further appeal to the court, deadlines must be observed.

When contacting an inspector, a written complaint is submitted to the office or reception office of the inspectorate. The reception staff issues a receipt confirming receipt of the document. The complaint will be considered within a month from the date of its registration and transfer to the inspector. An official appeal is considered to be the filing of a complaint. Personal communication with the inspector is regarded as a consultation only.

Information included in the complaint:

- To whom it is addressed (name of inspection).

- Personal data of the applicant (passport, registration, telephone number, Email).

- The essence of the conflict with the employer:

- employer's name;

- his details;

- information about the manager (full name, position);

- the amount of the unpaid settlement;

- what payments are included in it;

- for what period;

- attempts to peacefully resolve the problem (if any).

- Submission time.

- Applicant's signature.

- Applications.

You can attach an additional package of documentation to your complaint confirming the facts noted in the appeal:

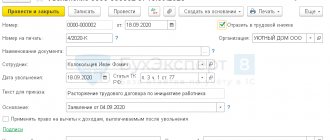

- copies of orders on hiring and dismissal of an employee;

- a copy of the employment document with notes from the HR department;

- a letter sent to management with a note of acceptance.

You can contact the inspection in person, through the post office or through the Internet resource “State Services”.

After conducting an inspection and identifying violations, the inspector issues an order addressed to the employer. The order states the requirement to correct violations within a certain time frame. In addition, administrative sanctions are imposed on unscrupulous management, as well as the obligation to pay compensation (in percentage) for late payments. The dismissed person is sent a response to his complaint.

Prosecutor's office

The principle of contacting the Prosecutor's Office of the Russian Federation is no different from filing a complaint with the inspectorate. An employee who has not received settlement funds prepares the same complaint, with the same information. Responses to requests occur within a month.

The only difference between the further actions of the inspectorate and the prosecutor's office is the methods of punishing the unscrupulous employer. If the inspector can only impose administrative sanctions on the management, then the prosecutor’s office also has the right to bring the employer to criminal liability, depending on the period of non-payment of the settlement.

Often representatives of both authorities conduct simultaneous inspections. Therefore, it is advisable to file a complaint with two authorities at once for a more thorough consideration of the dispute.

At the same time, neither the prosecutor's office nor the inspectorate can oblige the employer to pay a salary to the dismissed person. Their task is to issue an order to eliminate violations, as well as impose sanctions on the employer.

Court

Appeal to the court occurs urgently.

In accordance with Art. 392 of the Labor Code of the Russian Federation, a dismissed person can appeal to the judicial authorities only within 3 months from the date of refusal to transfer the payment, that is, the day of dismissal or demand for payment (if absent from work). The district court to which the application is filed may restore the time limit for the application only if there are compelling circumstances. In some cases, a valid reason is considered to be missing a deadline due to the expectation of fulfilling the instructions of the inspectorate or prosecutor's office.

You can submit to the court:

- application for the issuance of an order - almost always an order is issued in favor of the employee, however, if the employer objects, the matter will have to be resolved in a lawsuit;

- a lawsuit is a longer and more complex process, but the verdict can only be challenged on appeal.

The court order is issued within a couple of weeks; the presence of the employee and the employer is not required. After such a verdict is made, the employee receives a writ of execution, with which he can apply to the bailiff service.

If a previously dismissed employee contacted the prosecutor’s office, the initiator of the process may be the prosecutor who conducted the inspection. The official submits to the judicial authority all the documentation collected during the inspection along with the claim.

When applying independently, you must draw up a standard application containing the following information:

- The name of the addressee is the district court in the territory where the employer is located.

- Information about the applicant (passport, registration, telephone number, Email).

- Employer details.

- Information about the manager (full name, position).

- A detailed description of the essence of the conflict (reasons for refusal to pay).

- Amount of unpaid severance pay.

- For what period?

- Results of appeals to other authorities.

- Links to the provisions of the Labor Code (Articles: 352, 353, 381 and 382).

- Submission day.

- Applicant's signature.

- Applications.

For this category of litigation, payment of state fees is not provided. The case is considered in the standard manner within a month.

What payments can you expect upon dismissal?

The legislation strictly establishes the terms and amounts of payments that must be transferred to the employee upon dismissal. When an employee resigns, funds must be paid to him on the day of dismissal or on the day of application in certain cases. All required payments are enshrined in Article 140 of the Labor Code of the Russian Federation.

Remember! The employer is obliged to give the employee upon dismissal:

- wages for all days worked,

- compensation for unused vacation,

- severance pay.

If the employment contract contains a clause on the payment of bonus 13, it must be issued on the day of dismissal.

When should salaries be paid?

Article 140 of the Labor Code determines the day on which wages must be paid after dismissal. Salary and all payments due to the employee are paid on the day of dismissal. This day is the date specified in the order. Payments cannot be made later.

The only exception would be the situation when the employee was not present on the day of dismissal. In this case, the employer must pay wages no later than the next day after the employee submits a request for full payment. The employee must send this request in writing through the office. It is important to make sure that it is registered.

In this case, the employer will have to respond in writing. If difficulties arise, the date of application will be indicated in the official document, therefore, the employer will not be able to set the date at his own discretion.

Deadlines for contacting the Labor Inspectorate after dismissal for non-payment of wages

The possibility of contacting the labor inspectorate is limited to 3 months, starting from the day the employee learned of the violation. For disputes regarding dismissal, the period is 1 month from the date of receipt of documents (Article 386 of the Labor Code of the Russian Federation).

If you are late to go to court (a period of 1 month is given), the employee can safely write a statement to the labor inspectorate against the employer about the legal violation that has occurred. Even if there are legal proceedings in the case, the State Tax Inspectorate can also conduct an investigation.

Watch the video. The Labor Inspectorate calls for complaints about delayed wages:

How the Labor Inspectorate can help

The functions of the state labor inspectorate include:

- conduct scheduled and unscheduled inspections of organizations and enterprises,

- put forward demands on organizations to eliminate the violations found,

- impose penalties,

- consider statements from employees regarding violations of rights in the field of labor legislation,

- suspend the operation of the institution until the violations are completely eliminated,

- suspend employees from performing their job duties.

Also, the labor inspectorate can submit an application to the internal affairs authorities to inspect the organization if there is criminal liability.

Can an employer force you to work overtime?

What to do if the employer has not concluded an employment contract with the employee, read here.

How to extend sick leave, read the link: https://novocom.org/dokumenty/zayavleniya/kak-prodlit-otpusk-po-bolnichnomu-listu.html

Results of the complaint consideration

A standard complaint, both paper and electronic, is reviewed within 30 days. During this time, the State Tax Inspectorate will verify the facts stated in the appeal and make a decision on them.

The results could be:

- Sending an order to the employer to eliminate the identified violations within a specific period, that is, he will be officially obliged to make a settlement with the employee.

- Sending materials to law enforcement agencies if there are grounds for conducting an inspection in order to initiate a criminal case.

- Bringing the employer to administrative liability for violation of labor laws.

If the employer does not comply with the order and does not make the calculation, he may be punished with an administrative fine. Compliance with the prescription is monitored by the GIT independently.

If payment of the settlement is impossible for some reason (the employer does not want to pay, there is no money, bankruptcy, liquidation), the issue of collection is resolved in court. In this case, the inspection of the State Tax Inspectorate and the participation of its representative in the trial will be strong arguments in favor of satisfying the claim.

Is it possible to complain to the State Tax Inspectorate anonymously?

Many workers do not contact the labor inspectorate because they are afraid of being fired later. In this regard, most of them are interested in whether it is possible to file a complaint anonymously, without providing their personal data.

In accordance with the law, the labor inspectorate may not consider anonymous complaints. But at the same time, when sending a complaint about violations by the employer, the applicant can demand that this complaint be kept confidential.

To do this, you must write in the text of the application “during the inspection, I ask you not to disclose information about me as an applicant to the employer.”

If the application is submitted electronically, a confidentiality mark may be placed on the form.

Results of the appeal to Rostrud

After receiving a complaint from an employee, labor inspectors conduct an inspection, which determines the absence or presence of violations of workers’ rights, as well as the extent of these violations. Based on the results of the inspection, a report is drawn up.

Attention! If violations are found, the following measures may be taken against the employer:

- criminal proceedings,

- issuing orders and applying administrative measures.

The applicant must be sent a written response containing all the results of the inspection.

The document must indicate:

- facts of violations that were revealed during the commission,

- measures taken by the labor inspectorate,

- algorithm of actions of the applicant to restore his rights.

If the applicant does not agree with the results of the labor inspection, he has the right to submit a written complaint to the head of the labor inspection unit, as well as file a claim in court.

When sending a complaint to the labor inspectorate, the employee must understand that after the inspection the employer will have a period to eliminate the violation. If the order is not followed, the employer faces trial and fines. And after that a new deadline will be set for eliminating violations.

If the inspection reveals that there are no violations, the applicant will not face any consequences.

The Russian Federation provides a large number of ways to protect the rights of citizens, and they must be able to use them.

Rights and obligations of an employee under the Labor Code of the Russian Federation.

Application deadline

All complaints must be submitted within three months from the date of violation of the employee’s rights. It is worth noting that the limitation period in labor court is similar.

If the employee could not know about the violation of his rights due to objective reasons (he was undergoing treatment in a sanatorium or on vacation abroad, a long business trip, etc.), then he needs to provide the appropriate documents to extend the statute of limitations.

What does an employer face for delaying salary payments?

It is not profitable for the employer to withhold wages for the following reasons:

- the employer faces financial liability under Article 236 of the Labor Code of the Russian Federation. It involves payment of additional compensation at the Central Bank rate of 1/150 for each day of delay. Calculator for calculating interest for late wages (Article 236 of the Labor Code of the Russian Federation) here,

- if an employee files a complaint, the organization’s administration faces administrative liability in the form of a fine for officials from 10 to 20 thousand rubles,

- If wages are delayed for more than three months, the employer faces criminal penalties.

Thus, delays in wages can lead to a real prison sentence for the enterprise administration.

Watch the video. Responsibility for non-payment of wages:

Sample of writing a statement to the employer about non-payment of payment upon dismissal

You quit your job and your employer didn’t pay you your severance pay? Such cases have become more frequent, especially recently - see frequently published problems on this topic on our website: here, here, here, here and here, and many others.

In this algorithm, we would like to consider the most difficult option, when the employee was not officially registered and did not receive payment upon dismissal. It is in this situation that employees most often get lost and don’t know what to do, because... it turns out that they did not work in this organization, because labor relations were not formalized, as required by the Labor Code of the Russian Federation. In this case, it will be necessary to prove the very fact of work and the fact that the due payments were not received.

Evidence of the employee's work in the organization:

- Let's start with the fact that, taking into account the requirements of Article 67 of the Labor Code of the Russian Federation, an employment contract that is not drawn up in writing is considered concluded if the employee began work with the knowledge or on behalf of the employer or his representative. It is on this basis that we need to act.

- You can always bring witnesses, but witnesses alone may not be enough in court. Witnesses can be both your colleagues and clients with whom you contacted on behalf of the employer.

- Proof of the existence of an employment relationship may be your telephone calls to the employer (officials), and from them to you (for example, in the form of a printout of these telephone calls).

- Documents in which you left your signatures, or documents that you filled out entirely in your own hand.

- Announcements of vacancies for your position on the Internet, newspapers, magazines. Moreover, very often the employer in such advertisements indicates the actual wage, and not the one indicated in the staffing table, if it is divided into “white” and “black” parts. This will come in handy when the employee is trying to prove the real amount of his salary. You can take screenshots from advertisements on the Internet, and it is advisable to purchase newspapers and magazines.

- It will also help to have a permit system at the entrance to the building where you worked, as well as the presence of video cameras. Or, for example, handing over your offices to the security console of the police, if you did this, then accordingly you transferred your data to the police, i.e. your last name.

- Recording a conversation on a voice recorder with your immediate supervisor or other employer official can also be useful. Although it must be taken into account that such a recording may not be accepted in court as evidence, because its use has some subtleties. But still, sometimes judges can take it into account, especially if it is confirmed by a printout of telephone conversations.

This list can be supplemented, everything will depend on the situation and how the judicial practice on this issue develops.

Next, we bring to your attention the signs by which regulatory authorities identify organizations that pay “gray” and “black” wages. When drawing up a conversation with the employer, they will help an employee who has not received a payout upon dismissal to be more confident and convincing, especially since these signs were collected by specialists from the Federal Tax Service of the Russian Federation:

- the employment contract provides for the minimum possible salary;

- from the 2-NDFL certificate from the previous place of work it clearly follows that the employee came on less favorable financial terms;

- management salaries according to official statements are lower than the earnings of ordinary employees;

- reduction of official salaries of all employees;

- part-time employment;

- large amounts of money are accountable to the organization’s employees;

- vacancy announcements indicating wages significantly higher than the official salary;

- unmotivated “transfer” of some employees who previously worked on staff to the status of individual entrepreneurs;

- differences in the level of officially established wages and the amounts of wages indicated by the employer in certificates for issuing a bank loan, certificates for obtaining a visa.

Methods of proving that an employee worked for a given employer, and the signs that identify organizations paying “gray” and “black” wages, are presented in this Algorithm in case the employee still has to go to court.

The main document that is proposed in this Algorithm is a sample of writing a statement to the employer about non-payment of compensation upon dismissal. This document should help resolve this situation at the stage of negotiations with the employer in pre-trial proceedings.

This application must be sent to the employer by registered mail with acknowledgment of receipt and a list of the contents.

“I, full name, worked at “…” (indicate the name of the employer’s organization and its organizational and legal form of ownership (LLC, individual entrepreneur, OJSC, etc.) for the position “..." with “___” _______________ 20__ by "___" ______________ 20___

Upon dismissal, the employer did not issue a paycheck, which is a violation of Art. 84.1, 127, 136, 140 Labor Code of the Russian Federation.

I remind you that in accordance with Art. 67 of the Labor Code of the Russian Federation, an employment contract that is not formalized in writing is considered concluded if the employee began work with the knowledge or on behalf of the employer or his representative.

However, I would like to (a) resolve this situation peacefully and receive payment upon dismissal without official registration for work. If the settlement is not issued to me, I will be forced to (a) contact the appropriate authorities, which as a result may lead to undesirable consequences for the organization, because the employer not only did not pay the dismissal payment and did not formalize the employment relationship properly, but also underestimated the tax base for wages and the base for calculating insurance contributions to the Pension Fund of the Russian Federation, which also resulted in the fact that the relevant reports were not submitted to the Tax Inspectorate and Pension Fund.

For violation of labor legislation, the employer bears administrative liability under Art. 5.27 Code of Administrative Offenses of the Russian Federation parts 1 and 2.

Criminal liability under Art. 145.1 of the Criminal Code of the Russian Federation for non-payment of wages, pensions, scholarships, benefits and other payments.

Criminal liability for understating the tax base and non-payment or incomplete payment of taxes under Art. 199 of the Criminal Code of the Russian Federation, and administrative liability under Art. 122 of the Tax Code of the Russian Federation.

Article 47 of the Federal Law of the Russian Federation dated July 24, 2009 No. 212-FZ provides for liability for non-payment or incomplete payment of insurance premiums to the Pension Fund as a result of understating the base for calculating insurance premiums, other incorrect calculation of insurance premiums or other unlawful actions (inaction) of insurance premium payers in the form of a fine in the amount of 20 percent of the unpaid amount of insurance premiums. And if these acts were committed intentionally, they will entail a fine in the amount of 40 percent of the unpaid amount of insurance premiums.

The corresponding settlement amount must be paid to me no later than the next day after receipt of this letter, or no later than the next day after the notification of delivery of this application is returned to my address.”

If, nevertheless, this letter does not bring the desired result, then you will have to contact the following authorities: the prosecutor’s office, the police and the court, using a list of evidence of work with this employer, as well as signs of the presence of “gray” and “black” wages.

Together we make the world a fairer place.

The “Tak-Tak-Tak” website was created so that we can help each other. You can help too by supporting the project

Mandatory information.

The Foundation for Assistance to the Development of Mass Communications and Legal Education “Tak-Tak-Tak” is included in the Register of NPOs performing the function of a foreign agent. We are obliged to post this comment in compliance with the requirements of existing legislation, but we declare that we consider the decision of the Ministry of Justice to be unfounded and are challenging it in court.

Write a comment

You must be logged in to post a comment.