The staffing table according to the unified form T-3 is used by companies and enterprises to organize information about the personnel structure, number of employees, salaries, allowances, etc. It is believed that every enterprise and individual entrepreneur should have such a document if it has a staff of employees. Employers and personnel often have questions related to the mandatory nature of the unified form T-3, its completion, changes made, and approval of a new staffing table.

Do companies have to have a staffing table?

Let us present two opposing points of view on this issue that exist today. The first asserts that enterprises must compile and have a SR. It is in it that the employee’s labor function and the amount of his salary are indicated, along with the employment contract. Art. 15 (explains the concept of labor relations) and Art. 57 of the Labor Code of the Russian Federation (determines the content and essence of the employment contract) define the labor function as “work according to the position in accordance with the staffing table.”

Adherents of the second point of view believe that the decision on whether an economic entity needs SR is made by the manager himself. This opinion is justified as follows:

- Fast. Goskomstat of Russia No. 1 dated January 5, 2004 established only recommended for use: unified T-3.

- Instructions for filling out work books (approved by the Post. Ministry of Labor of Russia No. 69 of October 10, 2003) indicated that records about the name of the position, profession, specialty, etc. are made “ as a rule , in accordance with the organization’s SR.”

Consequently, it is not indicated anywhere that SR is mandatory for use.

Attention! The FSS, the Pension Fund of the Russian Federation, and the Federal Tax Service agree with the first point of view. The FSS document is needed to verify the correctness of the calculation of insurance premiums, the Pension Fund of the Russian Federation - to clarify information about the length of service. Tax authorities may request SR during on-site audits.

* * *

The staffing table is a document reflecting the structure and staff of the organization. It contains the following information: a list of structural divisions, employee positions, information on official salaries and personal allowances, the total number and monthly payroll of the organization or institution. This data is necessary for the head of the organization to optimize work and more efficiently use labor and material resources. In this article we will answer some questions regarding staffing.

The staffing table (form T-3) is a personnel document, its form is approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1. This document contains a list of structural units, the names of positions, specialties, professions indicating qualifications, information on the number of staff units (Instructions on the application and completion of forms of primary accounting documentation for recording labor and its payment, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1 (hereinafter referred to as the Instructions)). In addition, the staffing table indicates the salary (tariff rate), additional payments and allowances for each position.

A budgetary institution can carry out its activities using various sources of financing, for example, subsidies for the implementation of government tasks and funds received from paid services. In this regard, remuneration for specialists for certain positions can be made either from two sources or from one of them. In practice, it is widely used to draw up two, and in some cases, three staffing schedules for each source. Is it correct? Let us note that the current legislation does not provide for the division of the staffing table into parts depending on the sources of the formation of the wage fund. As proof, we present the following arguments.

Budget institutions belong to state (municipal) institutions. The remuneration systems of such organizations are established taking into account the recommendations developed by the Russian Tripartite Commission for the Regulation of Social and Labor Relations, and the opinions of the relevant trade unions (trade union associations) and employers' associations. Thus, in accordance with paragraph 19 of the Uniform Recommendations * (1), the staffing table of an institution is approved by the head of the institution and includes all positions of employees (professions of workers) of this institution. Similar requirements are contained in clause 10 of the Regulations on the establishment of remuneration systems for employees of federal budgetary, autonomous and government institutions, approved by Decree of the Government of the Russian Federation of 05.08.2008 N 583 (hereinafter referred to as the Regulations).

Paragraph 35 of the Unified Recommendations recommends the formation of a unified staffing table in an institution, regardless of what types of economic activities the structural divisions of the institution belong to. Thus, since the current legislation does not provide for the division of the staffing table into parts depending on the sources of formation of the wage fund, the institution must draw up one staffing table for all positions, regardless of what activity the employee is engaged in.

So, we found out that the staffing table is a single document for the organization. What regulations should be followed when developing a staffing table? Let us note that in order to unify the names of professions and positions, as well as determine the scope of an employee’s labor responsibilities, the following classifiers have been adopted: – All-Russian classifier of worker professions, employee positions and tariff categories, approved by Resolution of the State Standard of the Russian Federation dated December 26, 1994 N 367 (as amended on July 18. 2007); – Qualification reference book for positions of managers, specialists and other employees, approved by Resolution of the Ministry of Labor of the Russian Federation dated 08/21/1998 N 37 (as amended on 04/29/2008); – Unified Tariff and Qualification Directory of Work and Professions of Workers (UTKS), approved by Decree of the Government of the Russian Federation of October 31, 2002 N 787 (as amended on December 20, 2003). In addition, Resolution of the Ministry of Labor of the Russian Federation dated 02/09/2004 N 9 approved the Procedure for applying the Unified Qualification Directory of Positions of Managers, Specialists and Employees, which clarifies certain issues related to the application of this directory in practice.

For reference. Let us recall that the Unified Qualification Directory of Positions of Managers, Specialists and Employees and the procedure for its application are intended for organizations regardless of their form of ownership and organizational and legal forms of activity.

When developing a staffing table, we recommend reflecting the names of positions, as well as stipulating responsibilities in employment contracts in accordance with the named classifiers, especially if the employee occupies a position for which the regulations provide for guarantees and compensation. When developing a staffing table, the question sometimes arises: how to correctly reflect the number of staffing units in this document? In accordance with the Instructions, when filling out the staffing form (form T-3), in column 4 “Number of staff units”, the number of staff units provided for in this organization, including incomplete ones, is noted. For example, if it is necessary to hire a part-time employee for the position of lawyer, in column 4 of the staffing table, you can indicate not “1”, but “0.5”. Additionally, let's talk about filling out some more lines of this form. So, in column 5 “Tariff rate (salary), etc.” The monthly salary must be indicated in ruble terms at the tariff rate (salary) depending on the remuneration system adopted by the organization in accordance with the current legislation of the Russian Federation.

Article 143 of the Labor Code of the Russian Federation, which provides for a tariff system of remuneration, provides the basis for establishing a “range” of official salaries, that is, indicating the official salary for a vacant position from the minimum to the maximum amount. When establishing salary ranges for positions of the same name, one should remember the employer’s obligation to provide employees with equal pay for work of equal value (Article 22 of the Labor Code of the Russian Federation). As Rostrud officials explained in Letter No. 1111-6-1 dated April 27, 2011, the salary amounts for positions of the same name in the staffing table should be set the same. Determining the salary of a highly qualified employee can be achieved by adding bonuses and other payments to the salary. Please note that incentive and compensation payments: additional payments and allowances of a compensatory nature, bonuses and other incentive payments are indicated in columns 6-8 of the staffing table.

Further, in practice it may be necessary to adjust the staffing table. Some positions can be added to it, and some can be removed. All changes to the staffing table are made by order (instruction) of the head of the organization or a person authorized by him to do so. However, when changing the number of staff downward, it should be taken into account that, in accordance with Art. 82 of the Labor Code of the Russian Federation when making a decision to reduce the number or staff of an organization’s employees and the possible termination of employment contracts with them by virtue of clause 2, part 1, art. 81 of the Labor Code of the Russian Federation, the employer is obliged to: - inform the elected body of the primary trade union organization about this in writing no later than two months before the start of the relevant activities, and if the decision to reduce the number or staff of employees may lead to mass layoffs of workers, not later than three months before the start of the relevant activities. The criteria for mass dismissal are determined in sectoral and (or) territorial agreements. Similar explanations are given in the Determination of the Constitutional Court of the Russian Federation dated January 15, 2008 N 201-O-P; – warn each employee personally and against receipt at least two months before dismissal (Article 180 of the Labor Code of the Russian Federation). Often in practice, situations arise when an institution changes the source of payment for an employee. For example, the position was moved to the section of positions of employees whose wages are financed from funds from income-generating activities. Should this employee be given two months' notice that such a change has been made? Is it necessary to amend the employment contract with him if the employee’s salary remains the same? In accordance with Part 2 of Art. 57 of the Labor Code of the Russian Federation, the condition of remuneration is mandatory for inclusion in an employment contract. Changing the terms of the employment contract determined by the parties, including the terms of remuneration, is allowed only by agreement of the parties, which must be in writing by virtue of Art. 72 Labor Code of the Russian Federation. At the same time, the terms of remuneration should not depend on the source of the formation of the wage fund (budgetary, extra-budgetary).

Exceptions to this rule are cases provided for in Art. 74 Labor Code of the Russian Federation. This provision gives the employer the right to unilaterally change the terms of the contract determined at its conclusion in connection with changes in organizational or technological working conditions. The employer is obliged to notify the employee in writing no later than two months in advance of the upcoming changes determined by the parties to the employment contract, as well as the reasons that necessitated the need for such changes, unless otherwise provided by the Labor Code of the Russian Federation. However, even in this case, the transition to another source of formation of the wage fund in itself is not a basis for making changes to the employment contract. In the situation under consideration, the decision made by the management of a budgetary organization to change the source of payment of wages does not affect the employee’s right to payment for work of equal qualifications. Therefore, any special notification to employees about the planned change in accordance with Art. 74 of the Labor Code of the Russian Federation is not required.

The next question that may arise in practice is related to the reduction of individual units of staff positions. Most often, the elimination of any positions is caused by insufficient funds to pay such specialists. However, the institution needs their services when certain situations arise. For example, an organization experienced an accident involving damage to its sewer systems. There is no plumber on staff. In this case, does the organization have the right to conclude a fixed-term employment contract with the specified specialist?

By virtue of Art. 58 of the Labor Code of the Russian Federation, a fixed-term employment contract is concluded when the employment relationship cannot be established for an indefinite period, taking into account the nature of the work to be done or the conditions for its implementation, namely in the cases provided for in Part 1 of Art. 59 of the Labor Code of the Russian Federation, for example: - for the duration of the duties of an absent employee, whose place of work is retained in accordance with labor legislation and other regulations containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract; – for the duration of temporary (up to two months) work; – to perform seasonal work, when, due to natural conditions, work can only be carried out during a certain period (season); – to carry out work that goes beyond the normal activities of the employer (reconstruction, installation, commissioning and other work), as well as work related to a deliberately temporary (up to one year) expansion of production or the volume of services provided; – with persons entering work in organizations created for a predetermined period or to perform a predetermined job, etc. However, for this, the organization’s staffing table must contain a unit of this profession for which the above person can be hired, otherwise payment of wages to him will be be illegal. For example, civil agreements can be concluded with persons hired to eliminate an industrial accident. For this, a number of conditions must also be met: – availability of appropriate funds under the relevant sub-article of KOSGU. Note that this also applies to contracts concluded with the condition of payment from funds received from income-generating activities. If these expenses are included in the plan of financial and economic activities of the institution, then it has the right to make them, and therefore assume obligations to pay for them; – strict compliance with the norms of the Law on the Contract System *(2).

To summarize all that has been said, we note the following: 1. The staffing table (f. T-3) is a personnel document drawn up in an approved form as a single document for the organization. 2. Positions in the staffing table must be reflected in accordance with established classifiers. 3. Salaries for positions of the same name should be set the same. The realization of the employee’s right to receive higher wages for skilled work must be fulfilled by establishing appropriate allowances and payments provided for by the remuneration system of the given institution. 4. When reducing staffing units, you should take into account the requirements of the Labor Code of the Russian Federation, in particular, warn each employee personally and against receipt at least two months before dismissal.

M. Zaripova, expert of the magazine “Budgetary Organizations: Accounting and Taxation”

“Budget organizations: accounting and taxation”, N 1, January 2015.

───────────────────────────────────────── ───────── ─────────────────────── *(1) Unified recommendations for establishing remuneration systems for employees of state and municipal institutions at the federal, regional and local levels for 2014, approved By the decision of the Russian Tripartite Commission for the Regulation of Social and Labor Relations dated December 25, 2013, protocol No. 11.

*(2) Federal Law of 04/05/2013 N 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs.”

Tags: wages, budget accounting, accounting

- 44-FZ VAT NDFL advance car alimony business marriage money children housing contract will housing plot property claim apartment benefit medicine management motivation tax taxes inheritance education clothing pensions pension payments purchase allowance bonus crime trial psychology work advertising deal family court tender labor accounting school

We greatly appreciate your comments. Thank you!

Comments for the site

Cackl e

The main tasks of staffing in the company

ShR can be useful for an economic entity by performing the following tasks:

- It describes the structure of the company, departments, divisions. By looking into it, you can immediately get an idea of the system of divisions of the company.

- It contains information about the total number of employees in the entire company, in each division, and about how many staff units there are for each position.

- Provides information about what wage system was adopted by the personnel of each department, workshop, etc.

- Sets the amounts of allowances for staff.

- Using this paper, you can easily track the number of vacant positions.

Thus, one should not diminish the importance of such a document as the HR, the organization and its personnel department, if there is one.

Validity

The company can choose the validity period of the staffing schedule independently. In most cases it is drawn up for 1 year. If the organization is small, with a small number of employees and is not actively developing, then the staffing table can function for several years. In large organizations whose staff is growing rapidly, the document is filled out annually.

If new positions appear throughout the year, the number of staff positions, vacancy names, and salaries change, then amendments and additions can be made to the document. This is done by issuing a special order (we will discuss it below) and introducing changes to the ShR.

Staffing structure and validity period

The current federal legislation does not provide direct instructions on how often the staffing schedule for the next year . However, taking into account the fact that the staffing table is a planning document, it should be assumed that it should be drawn up annually, at the end of the reporting period, along with other accounting documentation.

However, the staffing table can also be drawn up once and remain a valid document in the future.

The staffing table is drawn up on a certain date, ratified as a rule every year on January 1 and included in the work process by decree of the company's senior management; the document can be edited and corrected in the future.

There is no need to re-issue and re-approve the document for the coming year if it has been edited too insignificantly (in this situation you should only draw up a list of changes), or if no changes have been made to the schedule at all this year.

This document includes a list of structural divisions of the organization, data on the personal staff of the enterprise, the total number of staff, as well as data on financial accounting, salaries and salary increases for employees of the organization.

Is it necessary to use the T-3 form?

The staffing table in form T-3 was fixed by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1. All unified forms have ceased to be mandatory for use in work since January 2013. From this moment on, company managers received the right to work with independently created forms. It has become possible to supplement existing unified forms with new details.

In most cases, business entities use the T-3 form, since it is familiar to many accountants, experienced personnel officers, and employees of inspection departments and contains all the necessary data. And what's the point of reinventing the wheel?

Important! Management decides which forms the business entity will use, unified or developed independently. The choice must be recorded in the company’s accounting policies using a separate order to make appropriate changes there.

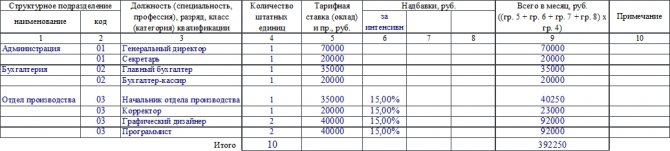

Unified form T3 - how to fill it out correctly?

Standard form No. T3 “Staffing table” is confirmed by the order of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. As a rule, this form is used when preparing the staffing table.

You can download a staffing table template in WORD format here.

Some experts in the legislative field believe that the use of this form itself should be mandatory for employers, while attempts to draw up a schedule in any form will lead to problems with accounting both within the organization and with external regulatory authorities.

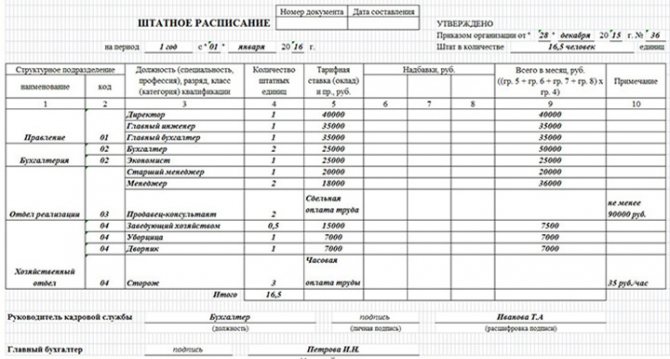

Sample store staffing table not in T-3 form.

(The picture is clickable, click to enlarge)

The question of the lack of alternative to form No. T-3 “Staffing table” arose from Article Nine of the Federal Law of November 21, 1996 No. 129-FZ. According to this article, basic accounting documentation is taken into account only if it is drawn up in accordance with the configuration of unified forms.

Only certain options and sections of documentation that are not provided for in this section can be drawn up in free form, but they must certainly include all, without exception, the details noted in Article 9 of the Law “On Accounting”.

By Federal Decree No. 835 of July 8, 1997, the creation and confirmation of albums of unified forms of basic accounting documents was imposed on the State Statistics Committee of the Russian Federation (now the Federal State Statistics Service).

From this we can conclude that if this committee has adopted one or another form or configuration, then it becomes standard without fail.

However, important information is missed here - after all, Goskomstat was given the authority to create unified forms of primary documentation. But what is such documentation?

A primary document is considered only such a document, with the help of which one or another business procedure of the company is drawn up, which finds a response in accounting.

However, the staffing table is not a document documenting any such actions. The staffing table is not used as a tool for accounting operations. That is, the employer has the right to draw up the staffing table in any form, and use the mandatory unified form only as a recommended sample.

When filling out the form in any form, a person does not violate any laws and is not subject to fines or sanctions.

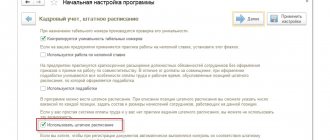

How to correctly fill out the T-3 form for a personnel employee

The staffing form consists of two parts: introductory and main (tabular). Let's look at how to fill out each of them.

Introductory part

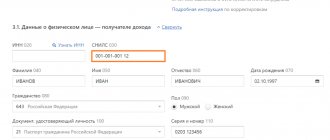

The first thing to do is indicate the name of the company. It must match the one written on the registration certificate. If the “name” contains Latin letters or words, then this should be indicated. If the registration document contains a short and full name, then any of them can be entered into the ShR.

Next they write the OKPO code, the document number and the date of its preparation. Then you should indicate the period of operation. Usually only the approval date is written, because the end date is not always known, since the schedule may be subject to change by creating a new document during the operation of the company.

Main part

This part contains a table. Let's look at how to correctly fill out each column out of 10.

Column 1. Here you need to enter the name of the structural unit. These include workshops, departments, and branches. It is more convenient to indicate divisions in a document in a hierarchical order. For example, first of all, indicate the administration, legal department, accounting, personnel department, that is, those departments that deal with general management. Next are the departments that carry out the main tasks of the enterprise, for example, production, sales department, etc. Units performing auxiliary or service tasks are listed last. For example, these are warehouses, the supply department.

Column 2. You need to enter the code of the structural unit. The number is assigned by the employer. This is usually done like this: the main department is assigned the code “01”, the departments that are part of it are assigned the codes “01.01”, “01.02”, etc. In this way, you can designate the place of a department in the overall hierarchical system of a company or enterprise.

Column 3. This contains information about the citizen’s position, rank, and qualifications. If you can choose a job title in accordance with OKPDTR (stands for the All-Russian Classifier of Worker Occupations, Employee Positions and Tariff Classes), then it is better to choose it. Since it has been operating since 1994, many professions and positions are outdated, and new ones have not been introduced.

It is imperative to select a name from this directory if the employee is entitled to any guarantees: benefits, compensation, etc. Otherwise they will not be provided.

Column 4. Here for each position you need to note the number of staff units. If the company practices part-time work, then the number is indicated in the form of decimal fractions: 0.25, 0.5, 0.75, 1.25, etc. Let's look at an example: the company has 2 designers, one full-time, the second part-time; in this case, in the ShR they write - 1.5 staff units.

In addition, vacant positions can be added to the HR. If it is planned to expand the staff, then they can be entered into the document in advance so as not to make adjustments to it in the future.

Column 5. In this field you need to indicate the tariff rate for each position, that is, the monthly salary.

Columns 6-8. This includes data on existing allowances in the organization. These may include bonuses, additional payments, incentive and incentive payments. In some cases, they can be set by the employer himself, and in some they have already been introduced by the Labor Code of the Russian Federation: various allowances for the number of years worked, for harmfulness, etc. The amount of allowances can be fixed or expressed as a percentage of the salary.

Column 9. In this column you need to note the total amount, which is calculated by adding columns five to eight for each of the personnel in specific positions.

Column 10. It indicates comments, if any. Here you can enter details of orders for personnel, etc.

The “Total” line at the end of the table should contain the total number of staffing units of the business entity and the monthly salary fund (total amount in the ninth column).

At the end, the head of the personnel department (may have a different name) and the chief accountant of the enterprise or company put their signatures. The seal is placed at the request of the management.

Still have questions about filling out the document? We will answer on the FORUM!

Extension

The legislation of the Russian Federation does not have a provision on extending the staffing table. It happens that the document has expired, but no personnel changes have occurred in the organization. What to do in this case and is it necessary to issue a new state schedule?

It should be recalled that the staffing table is a local regulatory act, and each company develops it itself, taking into account the specifics of its activities. This includes wage conditions, forms of ownership, for example, an enterprise can be commercial or non-profit, a public or private institution, etc.

On a note. Typically this document is approved for a year. If no personnel changes have occurred during this period, it can be extended. This is also done for a certain period, up to a maximum of three years.

But most often, over a certain period of time, some changes still occur, additional units are introduced or, on the contrary, unnecessary positions are removed. In this case, it is necessary to make changes to the staffing table or draw up a new document. In these cases, it is worth indicating the reason why the job changes occurred in the company. For example, when reducing staffing levels, you can indicate that the volume of work or production has been reduced, a certain type of production has been eliminated, etc.

Despite the fact that the extension of this document is provided for by law, in reality it is almost impossible to do without changes and amendments. For example, sometimes it is necessary to eliminate certain positions, this is done due to staff reductions. After deleting a position, you again have to create a new schedule.

If there is a need to reduce personnel, then the dismissed employee must be warned 2 months before the reduction (read about whether it is necessary to change the staffing table when dismissing an employee and how to do this).

How to approve the company's staffing table

The HR is put into operation by the employer with the help of an order approving the staffing table. Management can approve HR department employees, accountants, and legal department employees as responsible for developing and filling out the form. The manager himself may be responsible, especially if the enterprise does not have a large staff of employees. If work on the ShR is entrusted to a specific person, then he must be designated in the order. In addition, you can specify this task in the employment contract with him.

Remember! The dates for document approval, implementation and creation may vary. It is not forbidden to approve the staffing table even after it has been completed, but it can be put into operation much later than it has been compiled and approved.

The text of the order must contain the following information:

- name of the business entity;

- name and number of the order;

- place and date of creation of the document;

- dates of approval of the schedule, its introduction into work (here you should also note the number of staff positions and enter data on the monthly salary fund);

- Full names and positions of those persons entrusted with the preparation of the SR;

- indication of the annex to the order - the ShR itself and its details;

- signatures and positions of the manager and persons responsible for drawing up the document.

For your information! It is more convenient to introduce the staffing table from the 1st day of the month, since staff salaries are calculated monthly.

Document requirements

The law does not require any special rules regarding the staffing schedule, except that the position or profession specified in it must correspond to the positions and professions that the employer writes in the employment agreements executed with each employee.

However, practice has developed a number of recommendations that it is advisable to follow:

- It is recommended to adhere to the staffing form established by Rosstat (form T-3).

- The local act must be approved by order of the manager.

- It is allowed to draw up a staffing table on several sheets, but it is not necessary to lace and seal them with a signature and seal. You can simply fasten the sheets with a paper clip.

- In some situations, professions reflected in the staffing table must necessarily correspond to directories of professions and positions, and in addition to the name, their codes must also be reflected in the documents (For example, the presence of professions with dangerous and harmful factors).

- The presence of a company seal on the staffing table is not mandatory.

- When changing the staffing table, if they are minor, you can simply issue an order for these adjustments, and leave the staffing itself as is.

You might be interested in:

Internal labor regulations: procedure for drawing up and approval in [year]

We will draw up a sample order for approval of the staffing table

LLC "Aphrodite"

Order No. 34-OD

Sarapul

December 30, 2021

On approval of the staffing table

I ORDER:

1. Approve staffing schedule No. 3-ShR dated December 30, 2021 in the amount of 35 staff units and a monthly wage fund in the amount of 1,238,000 (one million two hundred thirty-eight thousand) rubles. 2. Introduce document No. 3-ШР dated December 30, 2021 into operation from January 1, 2021. 3. Control over the implementation of this order is entrusted to the HR manager Nikolaeva E.A.

Appendix: ShR No. 3-ShR dated December 30, 2021.

General Director: Simonov / R.O. Simonov

I have read the order:

HR Manager: Nikolaeva / E.A. Nikolaev

Extract from the staffing table

An employee may request such a document to submit it to the Social Insurance Fund, Federal Tax Service Inspectorate, Pension Fund and other institutions. In some organizations, the receipt of such an extract must be preceded by writing an application for its issuance. The manager does not have the right to refuse to issue this document to his employee, since the employee has the right to receive from the employer all information that concerns him personally.

The extract is prepared by an employee of the personnel service, certified by the employer, the head of the personnel service and the employee who compiled the document. The employee who requested the extract also signs.

The paper is not a copy of the SR; it contains only those data that are relevant to the employee who ordered it.

The document must contain only the following information:

- The name of the paper and the date of its preparation.

- Company name.

- A table with the following data: structural unit in which the employee is registered, his position, number of pieces. units, salary, allowances, monthly wage fund for this position, notes.

- Validity period of the statement.

- Signatures of the above employees.

Important! The fact that the employee was issued an extract must be noted in the journal of documents issued by the personnel department, as well as in the employee’s personal file.