For some categories of workers, the Labor Code provides for the opportunity to submit an application to the employer for travel payment. These cases do not apply to travel expenses: in accordance with Art. 168 of the Labor Code of the Russian Federation, the obligation to reimburse travel expenses lies with each employer, regardless of the organizational and legal form. We will talk about how to draw up an application for payment of travel in special cases.

When and who pays for travel, how to draw up a document in the name of the employer - the answers to these questions can be found below.

:

Application for travel payment

To whom and when is travel to the holiday destination paid?

According to Article 325 of the Labor Code of the Russian Federation, employers are obliged to compensate the employee’s travel expenses to the place of rest and back if the following conditions are met:

- the company where the citizen works operates in the Far North or in areas equivalent to them - the list of such areas was established by the Council of Ministers of the USSR dated November 10, 1967 No. 1029 and anyone can familiarize themselves with it;

- You can count on receiving compensation no more than once every 24 months;

- the place of rest must be located on the territory of the Russian Federation.

The basis for reimbursement of travel expenses arises simultaneously with the right to another vacation.

The following types of expenses are reimbursed:

- for travel in any vehicle except a taxi;

- for places in the luggage compartment, while the weight of luggage should not exceed 30 kg;

- for travel and luggage of family members who do not work, that is, compensation can be received for a child and other dependents.

The rules for issuing funds as reimbursement for travel expenses on vacation and back for citizens working in the Far North and in places equivalent to them are approved by Decree of the Government of the Russian Federation of June 12, 2008 No. 455.

The procedure for receiving travel compensation is established by the company's regulatory documents, drawn up taking into account current legislation. Reimbursement is carried out based on the employee’s application.

Expert opinion

Irina Vasilyeva

Civil law expert

A citizen can receive payment only at his main place of employment. Compensation is not provided for part-time work.

Proving the amount of compensation in a dispute with an employer

Courts accept the following documents as evidence of travel expenses:

- receipts (cheques), sales receipts from gas stations for the purchase of fuel;

- certificates from bus stations about the distance of the shortest route by road to the vacation spot and back;

- certificates from bus stations and convoys about the standard fuel consumption for vehicles in which the employee traveled on vacation;

- evidence of the employee’s presence in the chosen place of rest (certificates from local authorities: village council, administration of the Moscow Region, information on registration in hotels and boarding houses).

Unilateral cancellation by order of the employer or other document of payment of compensation or fixation of a certain amount of such compensation (lower than the possible actual costs of the employee) is considered by the courts as a violation of labor legislation (section 6 of the Review of the practice of consideration by the courts..., approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014).

How to calculate the amount of monetary compensation?

To calculate the amount of payments, the employee gives the employer the purchased tickets or paid reservation. The amount must correspond to travel expenses. After returning, the vacationer is required to provide boarding passes or other documents confirming presence on this flight.

If an employee’s expenses for travel and baggage transportation differ from the compensation received, the employer must reimburse the difference in future payments.

In the event that a citizen, due to certain circumstances, was unable to provide documents certifying the amount of expenses for tickets, then compensation is paid according to certain rules, depending on the type of transport:

- railway – according to the tariff of a reserved seat carriage;

- airplane - according to economy class tariffs;

- water - according to the tariff plan of cabins: X category sea vessel, III group river vessel;

- by car - at the bus fare.

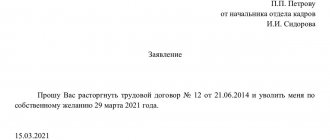

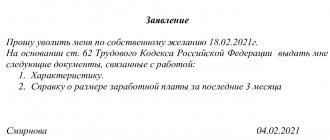

Writing example

A sample application for leave with travel expenses looks like this:

from the chief accountant L.V. Mironova

Statement

On reimbursement of travel expenses to a place of rest (health) and back

Vacation place: Republic of Crimea, city of Yalta.

Route to the vacation spot and back: Murmansk – Moscow – Simferopol – Yalta – Simferopol – Moscow – Murmansk.

- plane ticket Murmansk-Moscow 06/01/2019;

- boarding pass for the Murmansk-Moscow flight;

- plane ticket Moscow-Simferopol 06/01/2019;

- boarding pass for the Moscow-Simferopol flight;

- bus ticket Simferopol-Yalta 06/01/2019;

- bus ticket Yalta-Simferopol 06/14/2019;

- plane ticket Simferopol-Moscow 06/14/2019;

- boarding pass for the Simferopol-Moscow flight;

- plane ticket Moscow-Murmansk 06/14/2019;

- boarding pass for the Moscow-Murmansk flight;

- cash receipt dated June 14, 2019.

Only on the basis of a correctly drawn up application for payment of travel to and from the holiday destination, as well as provided reporting documents, the employer will compensate the employee’s expenses for tickets. Without travel documents and other similar coupons, money will be refused.

How to write an application correctly?

An application for payment for travel on vacation is drawn up in free form, but the document must reflect the following information:

- personal data of the manager and position held;

- personal data of the employee and position held;

- the essence of the statement;

- holiday dates and route;

- personal data of non-working family members, whose travel expenses also need to be reimbursed;

- list of attached documents proving the amount of expenses.

At the end of the form, the applicant puts his signature and the date of compilation.

The application is provided to the employer in advance, since, according to current legislation, money for travel is issued at the time of calculation of vacation pay and no later than 3 days before the employee begins his vacation.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

How to apply for travel payment

The document is drawn up after confirmation of actual expenses incurred. The employee must take care of the availability of not only the tickets themselves, but also receipts and other financial documents.

For students of universities and educational institutions of secondary vocational education, they will additionally need to submit a certificate of completion of training, preferably a certificate of challenge. In such cases, payment for travel is the responsibility of the employer once a year, not more often. If local regulations do not establish additional travel compensation.

An application for travel payment in cases where such a benefit is directly provided for by the legislation of the Russian Federation must be satisfied by transfer to a bank card or issuing cash, otherwise you can file a complaint with the labor inspectorate or the prosecutor's office.

Clarifying questions on the topic

Application for a written refusal to pay for travel.

Submit an application for payment of travel using this sample. Ask for an acceptance mark on your copy of the application. This will be proof of your application. A written refusal can only be given at the request of the organization's administration.

Can I get money if I provide an electronic printout from Russian Railways?

Officially issued travel documents on letterhead are usually required. In addition, you can take supporting documents from the RJD after the trip. You need to look at the payment regulations in force in your organization; perhaps you have a different procedure.

If the company pays for preferential holidays as the cheapest reserved seat. And I get to my place of study on a company train (which is more expensive). How will my employer pay for my travel?

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Your organization must have an approved regulation that describes all issues of payment for travel, including when using train travel. Without studying this document, it is impossible to say anything concrete right now.

Good afternoon According to Art. 173 of the Labor Code of the Russian Federation, the employer must pay me for travel to my dream of study. But when we go on preferential holidays, payment is made as the cheapest reserved seat ticket. I travel to my place of study on a branded train (i.e. more expensive). How do I have to pay for travel to my place of study?

Study the fare regulations. In such cases, as a rule, a certificate of the cost of travel is attached to the tickets, according to which expenses are paid.

What documents do we need to provide if we return from vacation in my husband’s personal car? And secondly: is it possible to write an application to pay for travel after vacation?

There will be no payment without an application, so you must write an application. Collect receipts from gas stations on your way home from vacation. At home, submit them to the accounting department at your place of work + a certificate from the transport company about the distance and fuel consumption to your vacation spot. Your organization may require additional documents.

Hello! I live in a city located in the Far North and similar areas. Question: Will I be paid for reduced travel by car if the car is not my property? There is a power of attorney for the right to drive a vehicle from the owner; I am included in the MTPL insurance policy as a second driver.

Additionally, draw up an agreement for the free use of the car for this period, although in judicial practice a power of attorney for the right to drive is accepted as evidence of personal use of the vehicle.

How should an application for compensation of expenses for preferential leave (travel within the territory of the Russian Federation) be drawn up?

About the regions of the Far North

The list of regions of the Far North and equivalent areas was approved by Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12.

Please note that compensation is due to employees who actually work in the Far North and equivalent areas. The address of the employer's location, if it differs from the place of actual business and is not “northern”, does not matter for the purposes of providing compensation. The above means that, for example, if an organization registered in Moscow has a separate division in the Murmansk region, then employees of such a separate division are entitled to travel compensation.

This is important to know: How to properly fill out a vacation application: sample 2021

By the way, shift workers who only work, but do not live in the regions of the Far North and equivalent areas, are not entitled to compensation for travel on vacation (clause 4 of the Constitutional Court Resolution No. 2-P dated 02/09/2012).

Business trip and travel expenses

To begin with, you should distinguish between the concept of travel expenses and travel expenses.

A business trip is a trip by an employee by order of a manager to carry out work (fulfill a job assignment) in a place other than his permanent workplace.

Payment of travel expenses lies with the employer in accordance with Article 168 of the Labor Code of the Russian Federation, and this responsibility does not depend on the presence of a clause on payment of travel expenses in the local regulatory acts of the enterprise; this is a guarantee provided by law to the employee, as the most vulnerable party to the labor relationship.

The organization's local regulations may also stipulate additional compensation for its employees. These norms are enshrined, for example, in the Internal Labor Regulations. In any case, when hiring, the employer is obliged to familiarize the employee with the local regulations in force in the organization.

In addition to internal documents, the employee’s right to demand from the employer payment for travel to the place of vacation and back is regulated by the Labor Code of the Russian Federation, namely Article 325.

According to this article, the following have the right to pay for travel to and from their vacation destination, as well as to pay for baggage transportation:

- once every two years - employees of organizations located in the Far North and equivalent areas. Compensation is provided when going on regular annual leave and concerns only expenses within the Russian Federation;

- in accordance with the deadlines established by individual regulations - employees of the internal affairs department, civil services and other institutions.

In addition, athletes and coaches are paid for travel to and from the team meeting place, as well as expenses incurred in connection with participation in sporting events as part of these teams.

Bachelor's and master's students, as well as those studying a specialty by correspondence, have the right, subject to successful training, to pay for travel to and from their place of study. This right is regulated by Art.

173 and 174 of the Labor Code of the Russian Federation. For workers receiving secondary vocational education, a 50% reimbursement of travel costs is provided.

This can also be done by writing a statement.

An employer may provide other benefits for its employees, related, for example, to length of service at a particular enterprise.

In addition, there are also benefits for disabled workers, but their travel is paid for by social security authorities.

How is the road paid?

Vacation travel in the Far North within Russia is paid. If a northerner decides to spend his free time abroad, he is paid for travel to a border post with another state. To receive the required compensation, the employee provides tickets, travel passes and documentary evidence of the trip to the organization’s settlement department. The cost of expenses is reimbursed regardless of the type of transport, with the exception of taxi. Train, bus, plane, sea transport, ferry are included in the list. Ticket prices are 100% reimbursed once every two years.

Example:

An employee of the Northern Metal Production Company went on vacation to Sochi for the first time in two years with his unemployed wife and minor son. Upon returning from vacation, the employee wrote an application for compensation payments, and provided the family’s round-trip tickets to the accounting department as proof of travel. Calculations have been made, the amount of expenses to the worker is reimbursed in full, equal to the cost of all tickets. The employee will have his next opportunity in two years.