New edition of Art. 300 Labor Code of the Russian Federation

When working on a rotational basis, a summarized accounting of working time is established for a month, quarter or other longer period, but not more than for one year.

The accounting period covers all working time, travel time from the location of the employer or from the collection point to the place of work and back, as well as rest time falling within a given calendar period of time.

The employer is obliged to keep records of the working time and rest time of each employee working on a rotational basis, by month and for the entire accounting period.

What does a rotational work schedule mean?

Regardless of what format of work activity is used, the organization’s management has the responsibility to draw up a schedule. It is worth pointing out that a unified form of this act has not been developed; for this reason, organizations have the right to approve it. This act is reflected in local documentation, for example, in the appendices to the Regulations on work on shifts.

Provisions of Art. 301 of the Labor Code of the Russian Federation indicate the obligation of the company director to familiarize citizens with the schedule. This must be done a couple of months before work begins using the method in question. There is some judicial practice on this issue. For example, in 2015 a decision was made by a city court in one of the districts of the Khabarovsk Territory.

In it, the judge points out that the company’s management independently created a situation in which employees came to the conclusion that they needed to go on shift only after receiving a notification from the director. For this reason, in such a case, management does not have the opportunity to bring a person to disciplinary liability if he does not show up at the workplace.

The employer is responsible for approving the act in question. In this case, the opinion expressed by the employees' representative body must be taken into account. If the organization does not have one, this item is not mandatory. To create a schedule, you will need to take into account the following time intervals:

- duration of labor activity under shift conditions;

- the duration of rest, which is set between seasons;

- number of days off during the shift;

- the duration of the time period required to transport a citizen to the place of work and home. These periods cannot be included in working time. The law indicates that they are classified as rest in the off-season between work.

The execution of this act is carried out for the accounting period. For example, this is an annual period of time or six months. It is necessary to take into account that the legislator does not allow work to be carried out for a couple of shifts in a row.

To understand, you need to give a specific example. The rig operator begins work on December 5, 2021. The duration of the shift for him is three weeks, during which time only three days off are established. It turns out that for the entire period the person will work 18 days, while the duration of one shift is ten hours. The period worked will be 180 hours.

If we consider it from the point of view of normal operating mode, the standard is 120 hours. This indicates an overtime of 60 hours. Between shifts a person rests for seven and a half days. You need to pay attention to the fact that the fractional component will be credited to the citizen for a year.

The calendar year is taken into account. These periods will be added up to a full day to subsequently provide another day of rest between shifts. Formation of a graph requires the use of notation using letters:

- D – the number of days during which the person travels on duty and back;

- B – time off during the shift period.

- Rest between shifts is indicated as M.

Procedure for calculating overtime hours

Let us first examine the methodological nuances of calculating overtime.

The concept of inter-shift rest days was introduced in Art. 301 Labor Code of the Russian Federation. It says that days of inter-shift rest are provided for overtime hours on shift. But the procedure for determining overtime hours is not prescribed in the Code.

Also Art. 300 of the Labor Code of the Russian Federation contains a requirement to introduce summarized accounting for shift workers. Therefore, at first glance, it seems that when calculating overtime, it is necessary to act as for ordinary shift workers - if there are no overtimes during the accounting period, then there is no need to pay for them.

However, the procedure for recording time is also regulated by the Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 N 794/33-82 “On approval of the Basic Provisions on the shift method of organizing work.” This document is still in force in terms of provisions that do not contradict the Labor Code of the Russian Federation. Clause 4.3 of the Resolution states that days of inter-shift rest are provided due to the availability of hours of unused weekly and daily rest during the shift period. Hence, most experts and inspectors conclude that the calculation of overtime hours on a shift in order to provide days of inter-shift rest should be done not for the accounting period as a whole, but specifically for each period of the shift.

We will calculate the processing in accordance with the described procedure:

- Let's determine the number of hours worked on shift. In our example, during the shift period (from November 2, 2020 to November 16, 2020), 143 hours were worked.

- Let's determine the number of hours according to the norm of the production calendar for the period of being on shift. According to the conditions of the problem, the norm for the production calendar from November 2, 2020 to November 16, 2020 is 79 hours.

- Let's calculate the number of processing hours:

143 (hours worked during the shift) – 79 (standard hours during the shift) = 64 hours.

Let's consider possible methods for calculating in the ZUP 3 hours of overtime during shift work.

Work and rest hours

The general rule states that the duration of a shift cannot be more than one month. However, there are certain exceptions; they provide that the duration of the implementation of a labor function using this method cannot last more than three months. In every situation where there is a long shift, the company must have a separate division located in the place where the citizen works. At the same time, the company bears all the ensuing consequences, including tax.

The time periods during which employees perform their functions and rest are noted in the schedule. This act must be developed by the employer, and it must be agreed upon with the trade union.

There are also restrictions regarding the duration of work per day. This period cannot be more than 12 hours. Working hours do not include breaks provided for meals. For this reason, this period will only include the time when the person was working. However, if lunch is included in working hours, then the duration of pure work is 11 hours.

The day off is provided without taking into account the days of the week. To understand, a specific example should be given: a citizen worked as a drilling rig operator, with a shift length of four weeks and a work shift of ten hours. The company sets one day off per week.

In this situation, the day off does not necessarily fall on a standard weekend. The rules on this issue are to be reflected in the employment agreement.

Summarized working time recording

The provisions of labor legislation indicate that when using a rotational work methodology, one should use accounting of working time in total terms for a monthly period. In addition, another period can be selected, for example, a year or a quarter.

It is worth pointing out that the total working time for accounting periods should not be more than the normal number of hours defined in labor legislation. Internal regulations are aimed at regulating the accounting procedure in total terms.

In a situation where a citizen works in dangerous or harmful conditions, the period for registration cannot be more than three months. However, there may be situations when, for seasonal or technical reasons, the specified duration cannot be observed; it can be extended, but not more than for an annual period.

An increase in the specified period must be reflected in an industry-type agreement or in a collective agreement. The accounting period has the following components:

- the time the citizen is working;

- a period provided to a person for rest;

- The time allowed for traveling to the place of work or back to home should also be taken into account.

When using summarized recording of working hours on holidays or weekends, compensation is not made with other days of rest. This is in contrast to the standard labor regime. For this reason, there is no need for double the amount of payment, because this time is included in the schedule according to the standard labor time.

Providing days of inter-shift rest

Inter-shift rest days are provided according to the production calendar of a five-day working week. The duration of one day of inter-shift rest is equal to the normal working day established for the employee. In our case, employees have a 40-hour work week. This means that inter-shift rest days must be 8 hours long.

Overtime hours that are not multiples of a whole working day are accumulated during the calendar year and then provided as additional days of inter-shift rest (Article 301 of the Labor Code of the Russian Federation).

We will calculate the number of days between rotational rest that must be provided to employees in November 2021.

- Let's calculate the number of overtime hours after the end of the shift:

0 (remaining overtime hours as of November 1, 2020) + 64 (overtime hours on shift in November) = 64 hours.

- Let's calculate the number of days of inter-shift rest that can be provided to employees:

64 (overtime hours) / 8 (duration of one day of inter-shift rest) = 8 days.

Let us determine the period for providing days of inter-shift rest. Employees return from a shift on November 17, 2020 and leave for the next one on December 1, 2020. This means that they can be provided with inter-shift rest days from November 18, 2020 to November 30, 2020.

The period from November 18, 2020 to November 30, 2020 accounts for 9 days according to the production calendar. Therefore, paid days between rotational rest are working days from November 18, 2020 to November 27, 2020, and November 30, 2020 is an unpaid day off. All overtime hours (64 hours) will be used by employees in November.

In ZUP 3 we will reflect the days of inter-shift rest using the document Timesheet , in which we will indicate the Month - November 2021 and fill out the tabular part of the document. We will manually indicate the days of inter-shift rest .

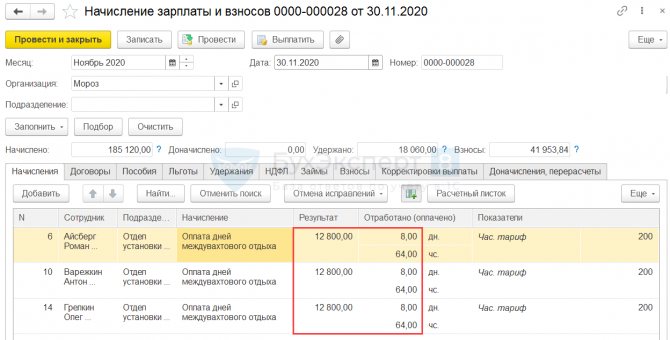

When calculating wages, payment for days of inter-shift rest for 64 hours will be automatically calculated. The payment amount will be:

- 64 hours * 200 (payment for 1 hour) = 12,800 rubles.

Features of accounting for shift work

The procedure for recording the working period and time intended for rest for a citizen who works on a rotational basis is represented by using the T-12 form. It was developed by Goskomstat in 2004.

It is important to understand how the designation of periods is made when a citizen travels from his place of work to his home and back. The legislation does not reflect rules on this matter. This indicates that an additional type designation is required. It is set by the company and may have different designations, for example, P.

The report card does not reflect numerical and alphabetic codes for the specified situation. However, it is mandatory to indicate the time while the person is on the road. For this reason, the company has the right to develop its own designation. You need to use the procedure reflected in the resolution of the above-mentioned body.

It may also happen that a citizen working according to the specified scheme has 1 day to travel to the place of fulfillment of duties. Then you will need to pay for the labor period and travel time. It is necessary to enter in the time sheet the number of hours worked by the person per day, when he works and during the following period.

It is necessary to take into account the peculiarities of entering information into the timesheet with this method of organizing work. The travel period is subject to reflection in the schedule.

Overtime work

An employee in this situation may also be required to work overtime. This is realized in a situation where an employee does not show up for a shift, then management decides to involve citizens in increased working hours. The length of the working day reflected in the schedule increases. When there is a need for a production plan, the use of work in an increased mode is also allowed.

The procedure itself does not provide for any special features compared to simply performing a job duty. This indicates the implementation of the rules reflected in Art. 99 Labor Code of the Russian Federation. This type of work includes:

- as a result of the accounting period, an increased amount of payment;

- establishment of additional rest, similar in duration to overtime work.

A situation with an increase in standards is established when a citizen works more hours than indicated in the schedule. For example, a shift consists of ten hours, but a person works 12 hours. Then a couple of hours is considered overtime.

Setting up an accrual for payment of inter-shift rest

Let's create a new accrual for payment of inter-shift rest days .

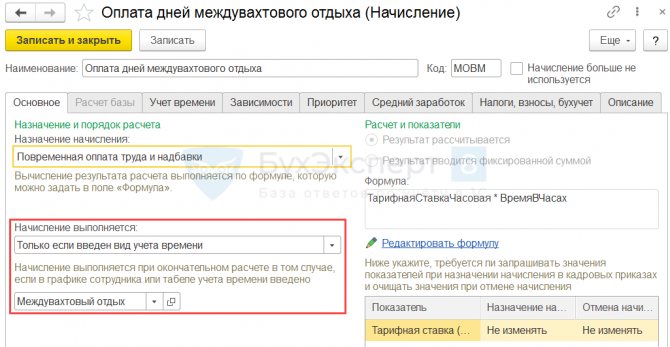

On the Main we indicate:

- purpose of accrual - Time-based wages and allowances ;

- execution method – Only if time tracking type is entered . The accrual will be calculated in the document Accrual of salaries and contributions if the employee in the month of calculation has hours according to the type of time Inter-shift rest ;

- formula. The legislation establishes the procedure for paying for days of inter-shift rest - in the amount of no less than the daily rate per day of rest. The organization may provide for an increased amount of payment, but we will proceed from the established minimum. In our case, employees have an hourly rate, so it is necessary to calculate the payment using the formula: Hourly tariff rate * Time in hours.

On the Time Tracking , note that this is an accrual for working a full shift within the normal time limits . We will indicate the type of time Inter-shift rest .

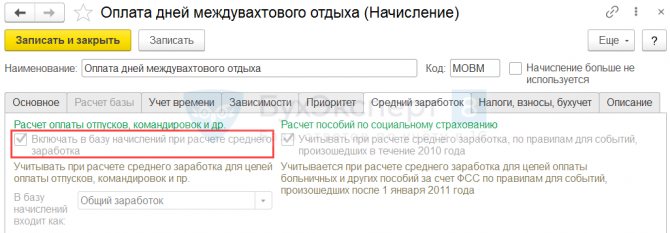

In the Average Earnings , the accrual is marked automatically as included in the calculation of the average. Settings cannot be edited.

With this setting for entering into the average, we are guided by the fact that inter-shift rest is not indicated in the list of accruals excluded from calculating the average (clause 5 of the Regulations on the specifics of the procedure for calculating average wages, approved by Government Resolution No. 922 of December 24, 2007). Days of inter-shift rest, in our opinion, cannot be classified as cases of release from work.

If you adhere to a different position and need to exclude Payment for days between shifts from the average, then in the accrual assignment you should indicate - Other accruals and payments and then on the Average earnings , reset the checkbox for inclusion in the average.

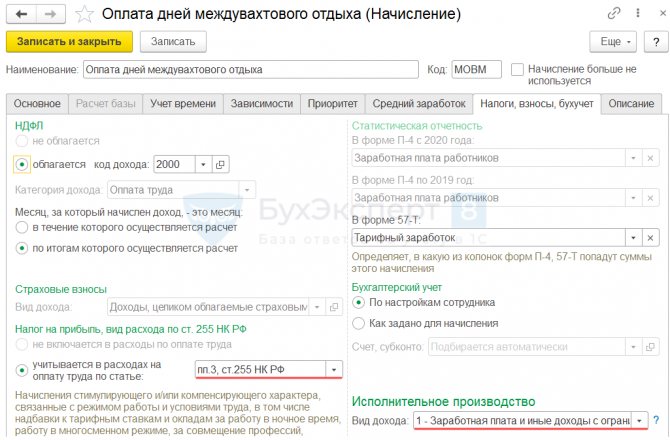

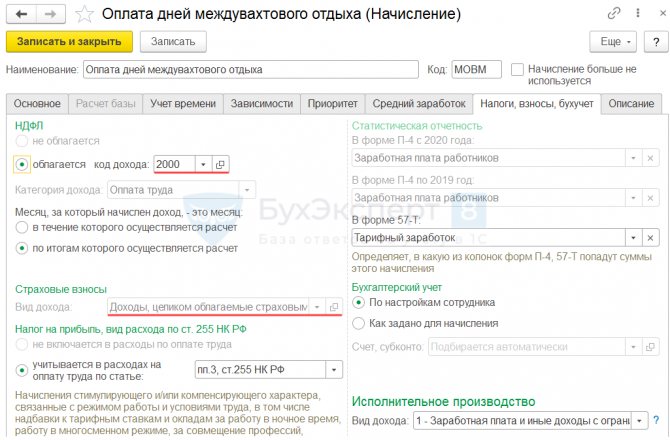

On the Taxes, contributions, accounting tab for Payment of inter-shift rest days, we will indicate that it is subject to personal income tax with income code 2000 . For the default accrual, it is established that it relates to Income that is entirely subject to insurance premiums - this suits us.

Payment for inter-shift rest days is related to the intensity of the shift workers' work schedule. Therefore, it is logical to indicate that in tax accounting it is taken into account in labor costs in accordance with clause 3 of Art. 255 Tax Code of the Russian Federation.

Also, payment is not included in the list of income that cannot be levied (Article 101 of Federal Law No. 229-FZ). Therefore, we will set the type of income of enforcement proceedings to 1 - Wages and other income with a limitation on collection .