Bonus options

Remuneration for each specific employer can be formed from several components (Article 129 of the Labor Code of the Russian Federation):

- the salary itself, intended to pay for the work duties performed;

- additional payments to compensate for work under certain working conditions;

- incentive payments aimed at encouraging labor achievements.

The composition of the applied remuneration system is fixed in a special internal regulatory act of the employer (regulations on remuneration or collective agreement). In the same document or in a separate one, called the provision on bonuses (or on incentive payments), the rules for the appointment and payment of bonuses are written down (Article 135 of the Labor Code of the Russian Federation). For individual employees whose bonuses are awarded on an individual basis, these rules can be included in their employment contracts.

When incentive payments are included in the remuneration system, they are regular in nature and are paid at certain intervals for certain indicators. These include, for example, monthly, quarterly, annual bonuses, to which an employee is entitled if:

- the employer has achieved certain financial indicators that make it possible to pay bonuses;

- the employee has fulfilled all the conditions under which he can qualify for a bonus;

- there are no reasons to deprive an employee of the opportunity to receive a bonus.

At the same time, the remuneration system may also provide for the payment of one-time bonuses, which will be associated with certain irregular events. These may include events both related to achievements in work activity and not related to it. The latter include, for example, bonuses for anniversaries and holidays.

ConsultantPlus experts explained what types of incentives are provided for employees and how to properly arrange such payments:

Get trial access to the K+ system and upgrade to the Ready Solution for free.

If a one-time bonus is not provided for by the wage system, this will serve as a reason for the employer not to take it into account in costs, but to include it in other expenses that cannot be taken into account in the income tax base. But for the employee it will still be included in his income and will be subject to personal income tax and insurance contributions on a general basis.

To learn how one-time bonuses are taken into account when calculating average earnings, read the article “Are bonuses taken into account when calculating vacation pay?”

Sample submission on bonuses for employees

What should be indicated in the document in question? As such, there is no generally accepted form approved by legislative acts. But some data must be present the award submission

The general structure of the award submission is as follows:

| As a general rule, the name of the company - employer is written at the top (not always). Below in the upper right corner is: • addressee (full name and position of the head of the company); • from whom does [the bonus proposal] come from (full name + position). |

| Next, the bonus submission contains the details of the awarded person, indicating his position and the structural unit to which he is assigned. They also note the type of encouragement and motive - what exactly the employee needs to be rewarded for. |

| At the very bottom, the document is signed by the responsible person. For example, the employee’s immediate supervisor. Just below, on the left, is the date. |

So, the submission for the award must include:

- organization data;

- surname, initials and position of the person being promoted;

- form and motives of encouragement;

- management signature.

The latter can be considered, for example:

- outstanding labor achievements;

- introduction of new methods and technologies into the work process;

- exceeding the set plan;

- memorable dates (anniversaries, professional holidays).

In addition, the document may contain characteristics of the employee: a description of his work or even personal qualities. In addition, HR officers can provide information about the employee’s absence of fines and penalties and about his length of service.

Also see “Drafting a petition for employee bonuses: sample.”

When do you need a memo about nominating an employee for a bonus?

Regular bonuses provided for by the wage system do not require the execution of any additional documents to consider the issue of bonuses to an employee. The procedure for assigning and paying such bonuses is already provided for by the internal regulations on bonuses.

But for one-time, irregularly issued bonuses, it is necessary to clarify a number of indicators that are essential for bonuses:

- reasons for payment;

- circle of persons awarded;

- the period to which the bonus will relate;

- forms of bonuses;

- premium size.

The right to make the final decision on the payment of bonuses - both regular and irregular - still remains with the head of the organization. Only in the first case does he approve the results of the distribution of the bonus fund, and in the second must he make a decision on payment or non-payment of the bonus.

More details about award calculations can be found here.

How to submit a nomination for an award: sample

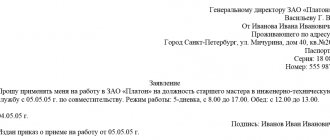

A proposal for a bonus, which can also be called a request for a bonus or a memo for a proposal for a bonus, is drawn up in any form and can be issued to several employees at once. The presentation is usually made by the head of the department in which the employee works. But it can also be submitted by another person. For example, an employee of the HR department.

The submission is addressed to the head of the organization who makes the decision to pay the bonus. It must indicate the position and full name of the person submitting this document.

The main part of the submission outlines the essence of the appeal: in connection with what, to whom (position and full name), for what period, in what form and to what extent it is proposed to award a bonus. Additionally, the following may be listed here:

- characteristics of the employee’s business qualities;

- indication of additional incentive motives;

- information about work experience with this employer;

- a note from the HR department about the absence of labor violations.

In the final part, the submission must contain the signature of the person submitting this document, with a transcript of the signature. The date of compilation is required.

A sample memo on nomination for an award can be seen on our website.

Papers for promotion (presentation and order)

Published in the issue: Personnel of the enterprise No. 1 / 2002

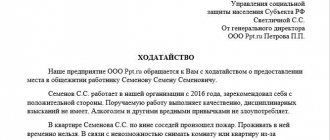

Submission for promotion

A proposal to promote an employee is drawn up by the head of the structural unit in which the employee works. A proposal addressed to the head of the enterprise can be made by the head of the personnel department, the personnel manager (for example, to reward employees for conscientious and long-term work at the enterprise, in connection with an anniversary, etc.).

The form can be arbitrary - the legislation does not yet provide for any strict requirements. You can also use the forms provided in the magazine.

The submission is signed by the head of the structural unit and endorsed by the personnel officer. Visas approved by the trade union body must also be submitted.

The head of the enterprise to whom the proposal is sent puts his resolution.

The nomination for promotion is kept in the employee’s personal file.

Order (instruction) on incentives for employee(s)

The draft order for incentives is drawn up by an employee of the personnel department or personnel service based on the resolution of the head of the enterprise on the presentation of the head of the structural unit, agreed upon in the prescribed manner.

The project is drawn up according to the unified form T-1 or T-11 (recommended format - A4).

When preparing the project, remember that you can enter additional details (for example, sources of bonuses, names of people responsible for organizing special events, etc.). This right is provided for by the resolution of the State Statistics Committee of Russia dated March 24, 1999. However, at the same time, all details of the unified primary forms of accounting documentation approved by the State Statistics Committee of Russia must remain unchanged (including code, form number, document name). Removing individual details from forms is not allowed. An exception is provided for those cases when incentives other than monetary rewards (bonuses) are issued. In this case, you can remove the attribute “in the amount of rubles” from the form. - cop."

When producing blank products based on unified forms of primary accounting documentation, it is allowed to make changes in terms of expanding and narrowing columns and lines, taking into account the significance of indicators, including additional lines (including free ones) and loose leaves for ease of placement and processing of the necessary information.

The prepared draft order is submitted for signature to the head of the enterprise or another authorized person.

The order is endorsed by those officials whose responsibilities include the endorsement of orders for personnel.

Encouraged employees familiarize themselves with the order against signature.

The number of copies of the order is determined by the instructions for office work at the enterprise. As a rule, there are two of them - one for the documentation service, the second is filed in a personal file. If this is a consolidated order to encourage employees, an extract from the order is included in everyone’s personal file. If the order is for incentives in the form of a bonus, then a third copy is drawn up - for the accounting department. The shelf life of incentive orders is 75 years.

Unified form No. T-11

Results

Drawing up a memo on nomination for a bonus will be required if it is necessary to pay a one-time bonus of an irregular nature, both within the remuneration system and assigned outside this system. The submission addressed to the head of the organization indicates the circle of persons receiving bonuses and provides the values of the indicators necessary for assigning the bonus (reason, period, form and size).

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Types of possible incentives

Article 191 of the Labor Code of the Russian Federation describes the following types of incentives for the workforce:

- issuance of certificates for work merits;

- announcement of gratitude from the company management;

- ceremonial awarding with a gift;

- petition for awarding the title of best employee of the month, year;

- transfer of bonus money.

Also see “Types of bonuses and rewards: making a choice.”

In addition, the organization itself may provide other types of cash bonuses. It is possible that then it would also be appropriate to submit a presentation for a bonus, a sample of which can be seen below.

The availability of incentives not mentioned above may be enshrined in a collective agreement or internal regulations. Also, the relevant aspects of incentives may contain internal rules for remuneration and bonuses.

However, the employer needs to remember that regular bonuses are awarded without a separate submission for the bonus (memo or petition from the manager). Since such payments are considered part of the salary. This should be indicated in one of the company documents. For example, the provision on bonuses.

Also see “Local regulations from 2021: changes to the Labor Code of the Russian Federation”.