Due to illness

Characteristics of account 68 Organizations and entrepreneurs, based on the results of their economic activities, must share part of their

Rates and calculation procedure The tax period for calculating insurance premiums is the calendar year. Accrued

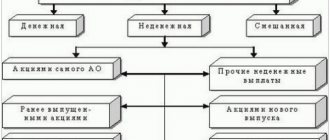

Profit distribution The amount that a JSC or LLC can allocate for distribution between participants or

It is difficult to imagine today an enterprise that from time to time, and sometimes regularly, in connection

The procedure for paying sick leave is regulated in detail by law. But sometimes employers have difficulties with

Today, the job description is an optional document, but employers, as a rule, continue to use it

You found a good vacancy, submitted your resume and received an invitation to an interview. To communicate with

Conditions for incentives for work The incentive method is considered one of the most effective ways to ensure labor

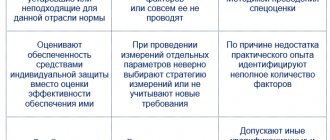

What is a special assessment of working conditions? This is a set of measures, the purpose of which is to establish the presence

To investigate an accident, the employer (his representative) shall immediately form a commission consisting of at least