Payment terms under loan agreements

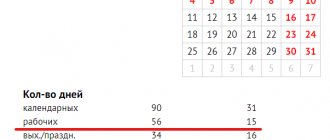

The Central Bank, in its letter dated March 27, 2021 No. IN-03-31/32, indicated that if the last day of the loan payment period falls on a non-working day, then the last date is considered such a non-working day (except Saturday and Sunday).

However, the Supreme Court pointed out that the Central Bank does not have such powers and its letters cannot be above the law. Failure to pay the payments stipulated by the contract during the period from March 30 to April 3, 2021 is not a delay in the fulfillment of obligations, and the postponement of the deadline for fulfilling an obligation to the next next business day cannot be considered as a violation of the deadlines for fulfilling obligations.

Penalty and writs of execution during the moratorium period

One of the consequences of the introduction of a moratorium is the cessation of accrual of penalties (fines and penalties) and other financial sanctions for non-fulfillment or improper fulfillment by the debtor of monetary obligations and mandatory payments for claims that arose before the introduction of the moratorium.

In addition, the introduction of a moratorium against the debtor also means that it is impossible for the creditor to obtain compulsory execution by presenting the writ of execution directly to the bank. However, it is worth considering that the moratorium applies only to the most affected sectors of the economy

8-921-903-17-16

| A fine of five times the cost of goods for each month and other changes to the law “On the Protection of Consumer Rights” |

A common practice is for a company to file zero declarations, and accordingly, no salary is paid to anyone. But an even more frequent case is when a company conducts business activities without paying a salary to the general director. Is this legal? Let's look at a few examples from judicial practice and the positions of the Pension Fund.

If activity is suspended

What to do if the company's activities are suspended? If there was no salary, then there is no need to accrue anything. Therefore, can the CEO not receive a salary? Answer: maybe. When suspending the company's activities, no additional orders are required.

But if earnings were still assigned, then additional documentation is required. For example, the general director must issue an order on leave without pay or issue an order on downtime with the preservation of part of the average earnings, in accordance with the norms of the Labor Code of the Russian Federation. But without completing additional paperwork, payments cannot be stopped.

When there are several founders in a company

As they say, there is a position of the Pension Fund, and there is a correct one. The arguments of the first are clear - if the company being inspected had economic activities, the head of the organization performed his functions, but there was no salary - therefore, contributions were not transferred, which indicates a violation of the legislation on insurance contributions. As a rule, the Pension Fund calculates insurance premiums based on a base equal to the minimum wage, taking into account the regional coefficient.

The courts do not share their point of view and base it on the rules of substantive law. So, on the basis of Art. 16, 19 of the Labor Code of the Russian Federation, labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with the said Code.

If the Pension Fund cannot prove the fact of concluding such contracts, then this indicates that the company does not have a basis for calculating insurance premiums.

The courts, taking into account the correct application of the provisions of Law No. 212-FZ on insurance premiums when considering the dispute, noted that the said Law does not contain provisions that allow management, if the payer of insurance premiums does not have a base for calculating insurance premiums, to independently determine by calculation, based on the minimum amount of labor, base for calculating insurance premiums.

Arbitration Court of the Ural District, case No. F09-5642/15

The Department's arguments regarding the actual performance of labor functions by the head of the company are often rejected by the courts, since this circumstance does not indicate payments made in favor of the individual. A possible violation of labor legislation by the company is not a basis for additional assessment of insurance premiums for compulsory pension and compulsory health insurance.

- All

- PFRZP

What to do if the pension fund makes a claim?

If Pension Funds, the Federal Tax Service and other government bodies were always right, there would be fewer lawyers.

It is necessary to appeal the requirements, otherwise, you will automatically agree with it (due to missing the appeal) and until you conclude an employment contract with the director, you will always be sent these papers.

Arbitration courts note that the territorial bodies of the Pension Fund of the Russian Federation are vested with public authority in the sphere of control over the calculation and payment of insurance contributions for compulsory pension insurance, while violation of labor legislation is not the scope of their control.

Can a director work without salary?

Auditors from the funds checked an actively operating company.

They found out that during the audited period its director performed his functions for free, that is, the director worked without salary. Inspectors consider this illegal. They added additional insurance premiums to the company based on the minimum wage (minimum wage), taking into account the regional coefficient. Shareholders, participants, beneficiaries of the company may well occupy any full-time positions in it. As a rule, directors. Since these individuals usually receive income from the company in another way (for example, in the form of dividends), they are of little interest in wages - they can easily perform their functions without it or for a nominal fee - less than the minimum wage. The employer is obliged to pay his employees in an amount not less than the minimum wage (Article 133 of the Labor Code of the Russian Federation). Violations of labor legislation threaten the company with fines of up to 50 thousand rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). But in practice, some managers, especially if they are also the owners of the company, work without salary, earning income in other ways. For example, in the form of dividends. You can defer the payment of personal income tax on dividends for a year

Loan schemes have become costly

The General Director is the sole founder. Is it possible not to conclude an employment contract?

Can. Article 273 of the Labor Code of the Russian Federation states that the provisions on labor relations between the company and the general director do not apply when the head of the organization is the only participant. Thus, the legislator has limited the right to conclude an agreement with himself.

The Tax Inspectorate, in its letter No. 16-19/ [email protected], also confirms and somewhat explains what to do in this case:

The only participant in the company in this situation, on the basis of a decision (appropriately documented), must issue an order and assume the functions of the sole executive body - director, general director, president, etc. Management activities in this case can be carried out without any conclusion contracts, including labor contracts. Consequently, the extension of labor legislation to the relations of such a participant with the organization established by him becomes meaningless.

Letter of the Federal Tax Service of Russia No. 16-19/ [email protected]

Design principles

Whether the general director can not pay himself a salary is decided by the head of the company himself. If the general director nevertheless decides to save on himself, then the situation does not require special registration. It is enough to issue an order to assign managerial responsibilities to the creator - the founder of the company. Moreover, it is not necessary to indicate wage standards in this order.

An employment agreement should not be drawn up and signed either. The director and founder as one person are not included in the timesheet and payroll, and salaries are not calculated.

Sample order on assignment of powers

When there are several founders in a company

As they say, there is a position of the Pension Fund, and there is a correct one. The arguments of the first are clear - if the company being inspected had economic activities, the head of the organization performed his functions, but there was no salary - therefore, contributions were not transferred, which indicates a violation of the legislation on insurance contributions. As a rule, the Pension Fund calculates insurance premiums based on a base equal to the minimum wage, taking into account the regional coefficient.

The courts do not share their point of view and base it on the rules of substantive law. So, on the basis of Art. 16, 19 of the Labor Code of the Russian Federation, labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with the said Code.

If the Pension Fund cannot prove the fact of concluding such contracts, then this indicates that the company does not have a basis for calculating insurance premiums.

The courts, taking into account the correct application of the provisions of Law No. 212-FZ on insurance premiums when considering the dispute, noted that the said Law does not contain provisions that allow management, if the payer of insurance premiums does not have a base for calculating insurance premiums, to independently determine by calculation, based on the minimum amount of labor, base for calculating insurance premiums.

Arbitration Court of the Ural District, case No. F09-5642/15

The Department's arguments regarding the actual performance of labor functions by the head of the company are often rejected by the courts, since this circumstance does not indicate payments made in favor of the individual. A possible violation of labor legislation by the company is not a basis for additional assessment of insurance premiums for compulsory pension and compulsory health insurance.

- All

- PFRZP

What to do if the pension fund makes a claim?

If Pension Funds, the Federal Tax Service and other government bodies were always right, there would be fewer lawyers.

It is necessary to appeal the requirements, otherwise, you will automatically agree with it (due to missing the appeal) and until you conclude an employment contract with the director, you will always be sent these papers.

Arbitration courts note that the territorial bodies of the Pension Fund of the Russian Federation are vested with public authority in the sphere of control over the calculation and payment of insurance contributions for compulsory pension insurance, while violation of labor legislation is not the scope of their control.

Director works without salary - risks

However, practice has not always worked out in favor of employers. In a number of cases, when an employee or director works without salary, the courts support additional accruals based on the minimum wage. Let's consider what situations are at risk. The first and most obvious is if employment contracts are not concluded with employees (this does not apply to the director). At the same time, based on factual data and testimony, inspectors prove the existence of labor relations (Resolution of the Federal Antimonopoly Service of the Ural District dated April 24, 2008 No. F09-2804/08-S2). The Federal Antimonopoly Service of the North-Western District indicated that Article 37 of the Constitution of the Russian Federation guarantees workers a minimum wage. Therefore, a voluntary refusal of salary does not relieve the employer of obligations both to employees and to the Pension Fund. As a result, the court upheld the additional charges (resolution dated 02/03/2000 No. A56-27006/99). The norms of the Constitution of the Russian Federation on which the decision is based have not changed. This means that, despite the age of this judicial act, it is worth considering the risk of tax authorities and insurance funds using this argument. There is a risk that controllers will reclassify part of the dividends based on the monthly minimum wage into wages subject to insurance contributions. This is exactly what they did in relation to the remuneration that the director paid himself. Despite the fact that this payment also did not apply to labor relations or civil contracts, the court considered additional charges of insurance premiums to be lawful (resolution of the Thirteenth AAS dated 04.03.13 No. A21-8666/2012). In another case, the Federal Antimonopoly Service of the North-Western District stated that the company did not prove the fact of paying dividends, and not just remuneration to the only founder-director. The court further noted that relations arising as a result of election or appointment to a position are characterized as labor relations on the basis of an employment contract (Article 16 of the Labor Code of the Russian Federation). In situations where the employee and employer are the same person, the general provisions of the Labor Code of the Russian Federation apply. On this basis, the court concluded that an employee (read - founder), who is in an employment relationship with the company, has the right to compulsory pension insurance, and the company has the obligation to pay insurance premiums in respect of him (resolution dated September 26, 2011 No. A21-3113/ 2010). Another risk: tax authorities may consider that the company in such a situation has an economic benefit (Article 41 of the Tax Code of the Russian Federation). After all, she receives work or services free of charge. This may lead to additional charges for income tax (clause 8 of Article 250 of the Tax Code of the Russian Federation). However, in the event of a dispute, the courts qualify the relations of the parties as gratuitous if the following signs are present (Article 39 of the Tax Code of the Russian Federation, Articles 423, 572 of the Civil Code of the Russian Federation): - provision of goods, work or services under a gratuitous contract is carried out by only one of the parties, while the other party has no reciprocal obligations; — the contract or legal act contains a direct and unambiguous indication of the gratuitous nature of the relationship. If the company can prove that the other party also received economic benefits, not necessarily in monetary form, then the courts will cancel additional charges. An example of this is the resolution of the Moscow AS dated 08/05/15 No. A41-56516/14, the North-Western FAS dated 04/10/14 No. A56-30538/2013, the Central District dated 03/07/13 No. A54-1171/2011.

The General Director is the sole founder. Is it possible not to conclude an employment contract?

Can. Article 273 of the Labor Code of the Russian Federation states that the provisions on labor relations between the company and the general director do not apply when the head of the organization is the only participant. Thus, the legislator has limited the right to conclude an agreement with himself.

The Tax Inspectorate, in its letter No. 16-19/ [email protected], also confirms and somewhat explains what to do in this case:

The only participant in the company in this situation, on the basis of a decision (appropriately documented), must issue an order and assume the functions of the sole executive body - director, general director, president, etc. Management activities in this case can be carried out without any conclusion contracts, including labor contracts. Consequently, the extension of labor legislation to the relations of such a participant with the organization established by him becomes meaningless.

Letter of the Federal Tax Service of Russia No. 16-19/ [email protected]

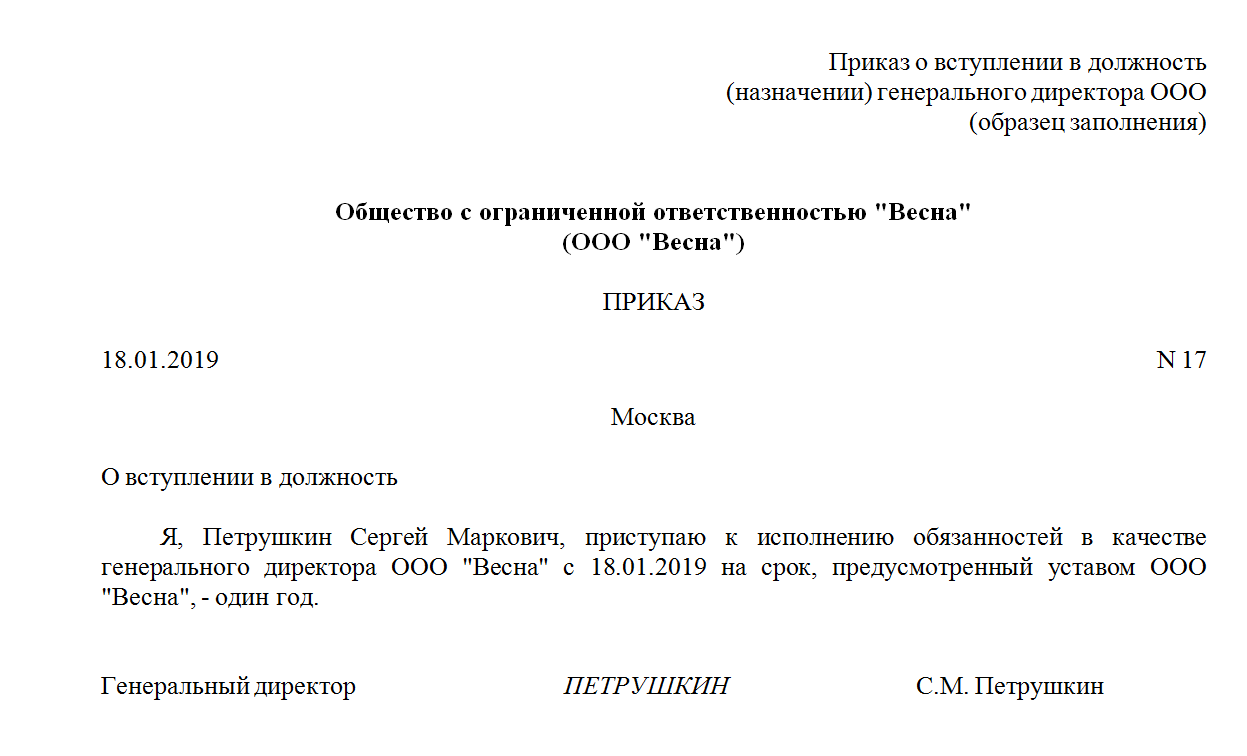

How to appoint a general

Having figured out whether the founder and director in one person can not accrue salaries, we will determine what to do if earnings still need to be accrued. For example, the general director decided to refuse charity and assign himself a reward for backbreaking work. In this case, it is necessary to issue a similar order for appointment to the position. The procedure for remuneration of the general director can be established at a general meeting of LLC participants. The decision of the founding council may be to conclude an employment contract with the general director; then an order of appointment or an order to take office is issued.

For information on how to draw up these administrative documents, read the article “Sample order for the appointment of a general director.”

Can a director be an individual entrepreneur?

Maybe. Some companies, in order to reduce the tax burden, register the director as an individual entrepreneur. After all, the manager can be assigned any amount of remuneration without additional costs.

In this case, the individual entrepreneur pays only 6% of income plus fixed payments to the Pension Fund.

However, there are cases when the tax inspectorate recognizes this action as tax evasion and charges additional taxes to the maximum. As a rule, this happens when two factors coincide simultaneously:

- the director previously worked in the organization under an employment contract, and then began to cooperate as an individual entrepreneur;

- The individual entrepreneur does not have agreements with other organizations, including those regarding the performance of managerial functions.

It is precisely the opposite that will need to be proven in court in order to cancel the decision to assess additional taxes. As a rule, if there is appropriate evidence, organizations successfully win such cases in all instances.

Why not paying a director's salary is risky

So, the director insisted, and the accountant agreed not to accrue or pay his salary.

In this case, when checking, the Federal Tax Service will definitely ask you for an explanation of why the director of the company does not receive a salary. It’s one thing if a director works in two organizations at the same time: in one he receives a salary, and in the other he does not. In this case, the probability of “unsubscribing” from the inspectors is quite high. How to justify the lack of salary for a director who has only one place of work?

In this case, nothing prevents controllers from charging additional insurance premiums to the company using the calculation method - based on the level of the minimum wage in the region. And, of course, personal income tax, penalties and fines for non-payment.