Changes to personal income tax The following changes are in effect from 01/01/2018. 1. Federal Law No. 335-FZ[1] introduced

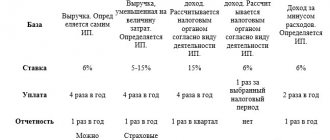

Single tax on imputed income Application of UTII in 2021 based on the basis for accrual

General and special rules In general, an employee who is hired under a fixed-term employment contract

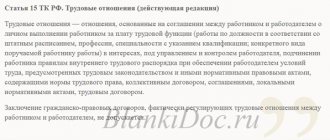

The concept of an employment contract An employment contract is an agreement between an employer and an employee. It defines

Classification of employment agreements Determination of the type of employment contracts can be made depending on the term,

Business trips are an integral part of the work activity of employees, during which they leave their

Staff reductions, including in the Ministry of Internal Affairs, imply a reduction in the number of employees for a specific

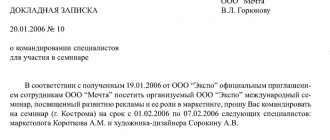

One of the most popular tasks is organizing business trips for the manager and his employees. Business travel service Search,

Definition of daily allowance Daily travel allowance is an additional expense for an employee who carries out his work

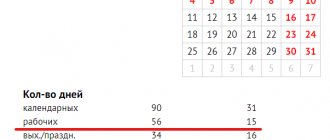

How to calculate your salary for January: Determine the number of working days in a month. Calculate the time, actually