Report of the cashier-operator according to the KM-7 form

This document reflects data for each specific cash register.

The KM-7 form includes information about meter readings at the beginning and end of a certain time period, as well as about the total revenue received from this cash register.

https://www.youtube.com/watch?v=ytpressru

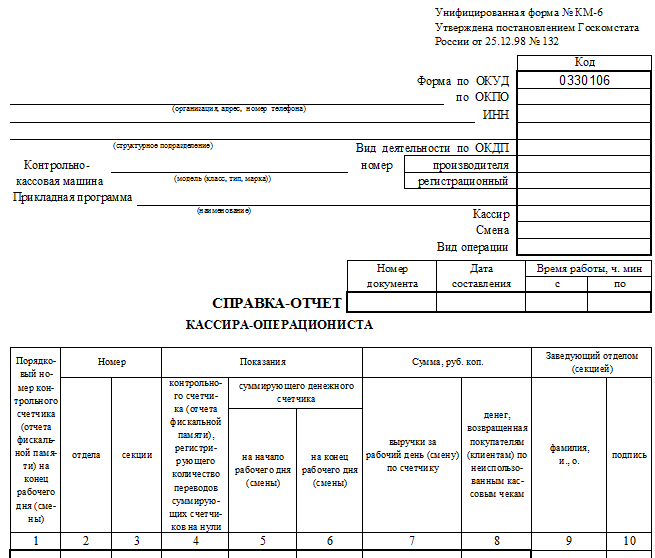

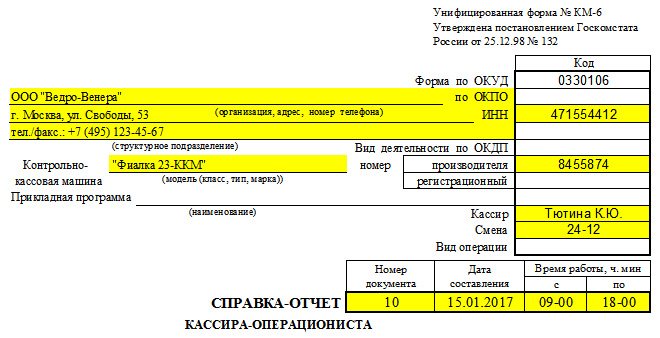

The cashier-operator's certificate-report has several characteristic features:

- the KM-6 form, approved by the State Statistics Committee of the Russian Federation in 1998, is unified;

- errors when filling out, as well as deviations from the generally accepted format, may result in a fine during the work of inspection bodies;

- KM-6 must be filled out daily (or at the end of each shift), and simultaneous filling out of certificates for 2 or more days/shifts is not allowed;

- The document must be submitted simultaneously with the proceeds - either to the chief cashier of the company or to the bank;

- The certificate must be kept for exactly 5 years, after which it loses its value.

Important! Column 4 is filled in only when using outdated cash register equipment. If modern devices have been installed in the organization over the past 12 years, then this section should be left blank.

Cashier-operator journal for online cash register

The cashier-operator's journal is an optional form of filling out according to the letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-20 / [email protected] Because the data that was previously recorded in the journal is now sent to the Federal Tax Service online.

Why do you need a cashier-operator’s journal and who should have it?

The cashier-operator's journal is needed for the online cash register to take into account the receipt and expenditure of cash. Despite the fact that since July 2017 it is optional, it will be useful for internal accounting.

The log is kept by an employee who serves customers using cash registers. The document is kept by the manager or chief accountant.

If you still decide to conduct it, then read the instructions below.

How and when to fill out the cashier-operator log

Companies and entrepreneurs decide for themselves what rules to use to fill out the journal. But they must definitely follow the template from Resolution No. 132.

The description of the KM-4 register states that the cashier-operator's book is maintained by the cashier every day. The entry is made in the journal using a ballpoint or blue ink pen.

If you are correcting a record, be sure to obtain a visa from your boss or chief accountant.

Until July 1, 2021, maintaining a cashier-operator journal for an online cash register required: firmware, numbering and registration with the tax office. Now registration is not needed, and numbering and lacing is carried out at the request of the individual entrepreneur and organization.

The requirements for maintaining KM-4 oblige the cashier to fill out the journal after removing the Z-report.

Step-by-step algorithm for filling the PKO

Account cash warrant

According to Directive No. 3210-U, an expense cash order is issued when cash is issued from the cash register. You cannot make corrections to a completed form.

Step-by-step algorithm for filling out RKO

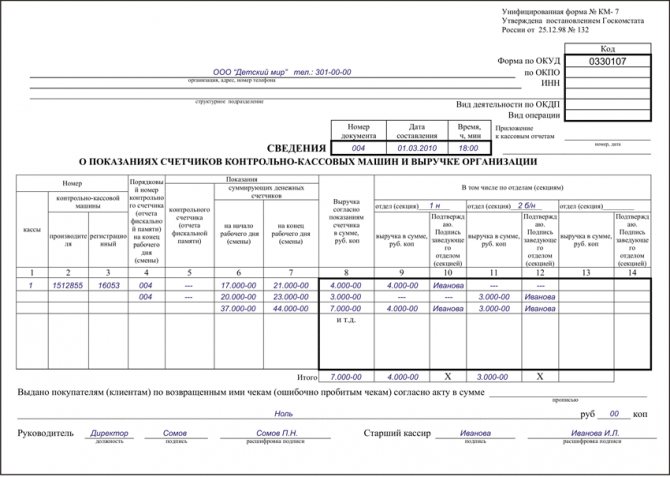

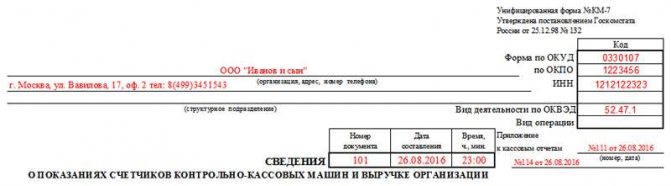

Form KM-7. Information about counter readings of cash register machines and the organization’s revenue

The information is compiled by the responsible person (cashier) in one copy daily at the end of the work shift, and together with the cashier-operator’s report, with cash receipts and debit orders, is submitted to the accounting department. Form KM-7 is unified and approved by the State Statistics Committee of Russia dated December 25, 1998 No. 132 .

The “header” of the form indicates the name, address and telephone numbers of the organization, as well as the structural unit, if the report concerns it; organization code according to OKPO, INN, type of activity code. The numbers of the cashier-operator's reports for that day, the number, date and time of drawing up the KM-7 form itself are also indicated.

The tabular section states:

- cash register number (assigned by the organization itself);

- KKM serial number

- cash register number assigned to the cash register upon registration with the tax office;

- Z-report number for the beginning and end of the shift;

- Column 5 is not necessary to fill in, because With modern cash registers, counter readings do not reset to zero

- meter readings at the beginning of the work shift;

- meter readings at the end of the work shift;

- all meter revenue for a work shift, including refunds on unused checks;

- revenue data by departments (sections); The amount of revenue received is entered and the signature of the responsible person for each department is affixed.

At the end of the table, the total of all revenue and separately by section is summed up.

If there were refunds on unused or erroneously punched checks, this figure is indicated in words below the table.

The completed KM-7 form is certified by the senior cashier and the head of the enterprise with their signatures.

KKM7 is manufactured with a lifting capacity of up to 16.0 tons and a console reach of up to 12 meters in various designs. The jib crane is installed on a pre-prepared foundation with installed anchor bolts, or it is mounted on an existing concrete surface with a special system of chemical anchors.

Every day at the end of the working day, the cashier must fill out a number of documents; if the organization has several cash registers, then one of the mandatory reports is Information on the readings of cash register counters, form KM-7. This form is a summary report that reflects data on all available cash registers.

To fill out a summary report on the results of information from cash register counters and the gross income of the enterprise for the past working day, a document called Information on the readings taken from cash register counters and the establishment's revenue in the KM-7 form is used.

This information becomes an addition to the certificate-report of the cashier-operator KM-6 for the real day. OKUD form code 0330107.

The senior cashier fills out the KM-6 form and daily, together with acts, certificates-reports of cashiers-operators, receipt and expense orders, is transferred to the accounting department before the beginning of the next day.

Form KM-7, according to the counter data at the beginning and at the end of the work shift for a separate cash register, contains the calculation of revenue. Accounting is made of its distribution by departments and sections. The heads of these departments verify all data with signatures.

The necessary table is compiled, at the end of it the totals of the information from all cash register counters and all the total revenue of the enterprise are compiled, with its distribution among departments.

If during the work of the shift there was a fact of return, and a certain amount of money was returned to the client on the basis of the provided check, then a special regulatory act is drawn up, which indicates the returned amount of cash, and it is signed by the head and chief cashier of the institution. This amount ultimately reduces the total revenue.

https://www.youtube.com/watch?v=upload

Method of entering information into the KM-7 form

When filling out the KM-7 form, a certain order is taken into account.

Initially, the details of the organization are filled out in the form for information about KKM meter readings. Forms are entered according to the general Russian classifier of management documentation and the classifier of institutions and organizations.

Each form has an individual serial number. Numbering starts from the beginning of the year, indicating the date and real time.

1 – enter KKM No.;

2 – enter the serial number of the KKM;

3 – registration number of the cash register;

4 – enter the number at the end of the control meter shift;

5 – information from the meter is recorded;

6 – contains a statement of the summing cash counter at the beginning of the shift;

7 – information about the summing cash counter at the end of working hours is recorded;

8 – the amount of profit minus the returned funds is fixed;

9, 11, 13 – information about profits by sections is entered;

10, 12, 14 – signatures of the relevant departments are affixed.

Another cash document that must be filled out on a daily basis is the cashier-operator’s journal KM-4.

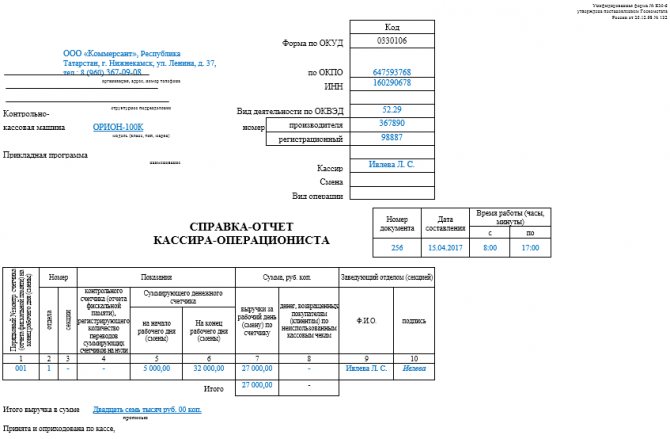

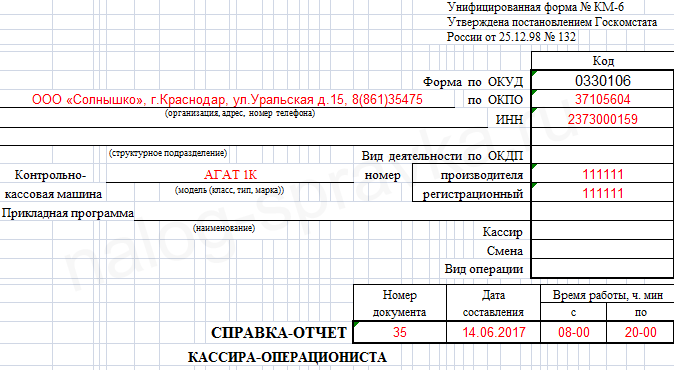

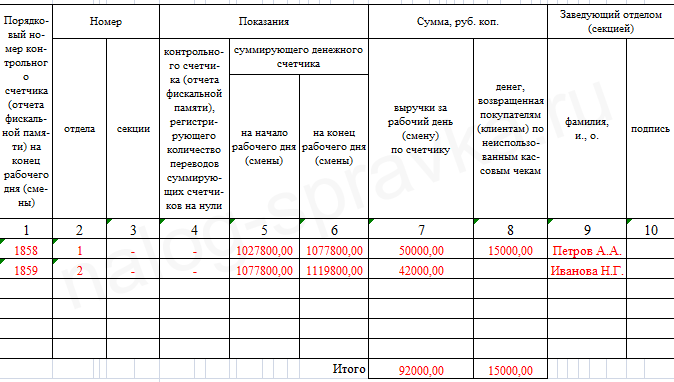

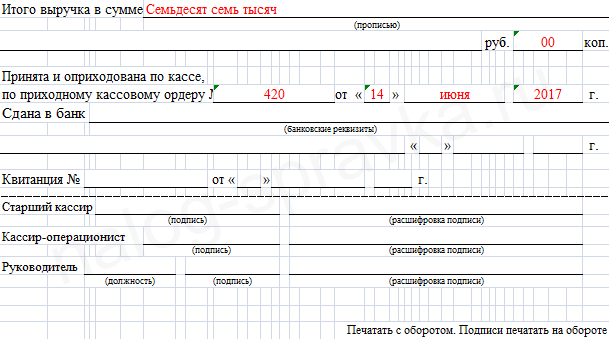

Fill out the KM-6 form

The report in form KM-6 is drawn up in 1 copy. After displaying information about the company (name and telephone number, KPO, INN) and indicating the used cash register model (name, serial and registration number), it shows the revenue for the shift according to the summing counters at the beginning and end of the working day.

In addition, to fill out the KM-6 form, you need to know the amount of cash returned to customers (when returning goods), and for incorrectly punched checks, so that the final amount of cash according to the report reflects the actual cash revenue received by the company for the shift. This report must be signed by the senior cashier and the company manager.

You can find KM-6 forms on our website:

A sample will help you fill out the KM-6 form, which can also be downloaded on our website:

Rules of conduct

One of the norms for maintaining a report is its daily (at the end of the shift) execution.

The cashier signs his autograph on it and hands over the form, along with all proceeds, to the senior (chief) cashier or directly to the head of the company.

If the organization is small (one or two cash desks), then all the money is handed over to the collector of the credit institution.

Instructions for filling out the KM-6 form

The cashier-operator's certificate-report is filled out daily in a single copy. A legally developed form - form KM-6, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132

Cap part

Information about the organization or individual entrepreneur

- Name - must correspond to that specified in the constituent documents (in practice, an abbreviated name is most often used, but only if it is specified in the documentation). An individual entrepreneur indicates his full last name, first name, and patronymic (in accordance with registration documents with the Federal Tax Service).

- Address: as a rule, the legal address is indicated for organizations and the address of residence for individual entrepreneurs; telephone.

- Structural unit (if available)

OKPO code

This is the main code of organizations and individual entrepreneurs in statistical bodies (can be found by TIN on the official website of Rosstat). An empty field will not be a blunder.

OKDP code

OKDP is a classifier of products by type of economic activity. Lost force, OKPD 2 is used instead.

Codes can be determined depending on the type of product: on the websites of the Ministry of Economic Development of the Russian Federation, Rosstat (https://www.gks.ru/metod/classifiers.html) or do not fill in this field.

Cash register

Here you can find information about the cash register model, the manufacturer's number (serial number of the cash register indicated in the documentation) and the registration number indicated in the registration card of the cash register with the Federal Tax Service.

Attention! The list of cash registers approved for use from 2021 is presented on the official website of the tax service (https://www.nalog.ru/rn77/related_activities/registries/reestrkkt/).

Enter the cashier's last name and initials. If the certificate is compiled in sections with different cashiers, the field may remain empty.

Below is the number and date of the document, working hours

Tabular part

1 column

The number of the Z-report taken for the current day (shift) is entered - displayed on the report itself. This column coincides with column 4 of the cashier-operator’s journal.

2nd and 3rd column

If KKM provides for the division of Z-reports into various departments, these columns display the numbers of departments and sections (optional). If division by department is not provided, then a dash is added.

4 column

The report form is outdated; there is no need to fill out this column (a dash is placed).

5 column

The sum of all punched cash register checks for the entire period of its operation is displayed (cumulative result of activity). In the X- and Z-report, the cumulative total can be displayed with the following names:

- GROSS TOTAL;

- CUMULATIVE SALES TOTAL;

- NI.

Something to keep in mind! The amount can be taken from column 6 of the cashier-operator's journal, the X-report of the current day's cash register or the Z-report of the previous day's cash register.

6th column

Results of activity at the end of the current day (shift): data from the Z-report of the current day or column 9 of the cashier-operator’s journal (cumulative total).

7 column

The revenue received for the shift is displayed (the sum of all punched checks minus any refunds made). The data in the column coincides with column 10 of the cashier-operator's journal.

8 column

The total result of refunds made to customers and erroneously issued checks. The information is displayed in the KM-3 act. All receipts for which the refund was made are attached to the act. The data in the column coincides with column 15 of the KM-4 journal

9th and 10th column

Last name and initials of the head of the department. If there is no position of manager, the full name of the cashier is given. And also the signature of the specified person.

Data after the table

After filling out all the columns of the table, the total amount of revenue received (minus returns) in rubles and kopecks is entered in words.

Based on the completed journal of the cashier-operator, the cashier draws up a certificate-report KM-6, transfers this form to the senior cashier (chief accountant, manager) simultaneously with the proceeds from the cash receipt order (the report includes the PKO number and the date of preparation).

In small companies, a cashier-operator or an individual entrepreneur who combines all positions independently transfers the received proceeds to collectors at the bank. In the certificate-report, a note is made about the transfer of funds (bank account details, date, receipt number).

Reverse side of the report: accepting the cash received for the shift (day) according to the PQS and posting the cash received for the shift (day), the responsible persons sign on the reverse side of the certificate: senior cashier, cashier-operator, company management or individual entrepreneur (if combining positions, the same signature is placed several times) .

The prepared certificate-report of the cashier-operator is the basis for filling out a general statement of cash register counter readings and company revenue (according to the KM-7 form).

Sample of filling out a certificate-report of a cashier-operator (form KM-6)

Here is a sample, KM-6 can be found further down the page.

How to fill out cash reports KM-6, KM-7 when replacing EKLZ

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

There should not be any difficulties in filling out the KM-7 form, the main thing is to be careful. In order for you to have all the necessary data on hand, you need to know the information from the operator’s reports. Each report has its own number and date. The following rules must be taken into account when filling out the document:

- The name of the organization, TIN, address, as well as the location of the unit, if any, are indicated.

- The date must be specified, with the time specified in minutes.

- A serial number, which is indicated in accordance with continuous numbering.

- It is necessary to give information about the cashiers' report numbers, along with the dates. The combined form must also be indicated.

- KKM numbers and other distinctive features, of which there may be several, are indicated. All this is indicated on the reverse side.

- There must be information about the control counter reports, information about the fiscal memory report, where you need to indicate its number. All this is entered in the appropriate columns. Counter data is indicated both at the beginning of the day and at the end.

- Total revenue per shift, which needs to be broken down by department.

- If there is an amount that was returned due to some circumstances to buyers, this must be recorded in a separate line in words.

- Everything is certified by the senior cashier, where it is necessary to decipher the surname. The completed form must be attached to the KM-6 report.

https://www.youtube.com/watch?v=ytaboutru

Now, using special computer programs, you can obtain all the necessary information related to meter readings. Most organizations must have a document called a “certificate-report of the cashier of the operator.” Such a document will most likely be required if the retail outlet has a registered cash register with fiscal memory. All the necessary information is taken from this document, and it is on its basis that the necessary document can be drawn up.

The header must contain the details of the company. In this case, the name may be incomplete, and the structural unit may not be indicated. The numbering of the form is established by the enterprise. It maintains end-to-end order even after changing the calendar year, i.e. if on December 31 it was KM-7 No. 342, then on January 1 it will be No. 343, and not No. 1, as one might assume.

KM-7 hat

The KM-7 header can be said to be filled in in a standard way. The organization's data, name, address, and all its digital characteristics are entered:

- The table must include cash register numbers, which are entered in columns 2 and 3.

- The value for column 2 can be clarified in the vehicle passports, and 3 - in documents from the tax office regarding the registration of cash register equipment.

- Column 4 contains the report number Z. Entrepreneurs are familiar with such cases when, after removing this report, they had to open the cash register again and carry out transactions. If this happens, in the fourth column we indicate the number of the last Z report.

- Revenue for the day (columns 8-14) is posted by sections. If the department has more than 3 sections, several forms must be filled out.

- In boxes 10, 12 and 14, section leaders will need to sign to confirm that the information entered is correct.

If the enterprise does not have departments, columns 9-14 remain blank.

At the bottom of the form, fill in the amount of returns on checks for the day, including those that were entered by mistake. Enter the number in words, without duplicating it with numbers. Only the amount that buyers received in cash is entered in the field. Cashless returns are not taken into account.

We remind you that the KM-7 form is submitted in a single copy per day. If during the inspection the tax inspector discovers the absence of a document, fines will be imposed on the company and the responsible person.

View more:

- Form 1 6 accounting General provisions on structural divisions Domestic civil legislation establishes the right of every Russian company to have and create...

- Article 126 of the Tax Code of the Russian Federation Is it often punished under paragraph 1 of Art. 126 Tax Code of the Russian Federation?P. 1 tbsp. 126 Tax Code of the Russian Federation...

- UTII form 3 In what cases to submitBefore considering the nuances of filling out, you need to understand when such an application will be needed. According to…

- Form OS 14 What are the features of the practical use of the act in form OS-14 Act OS-14 draws up the 1st stage of inclusion of equipment in ...

1 – enter KKM No.;

In cases where an organization operates several cash registers at once, then a unified KM-7 form is required. This form helps to compile a consolidated report on information about the income of a legal entity from all cash registers used. Moreover, the report is drawn up for the current day of the organization’s work.

The senior cashier prepares one copy of the KM-7 form and, together with other reporting documents, sends it to the accounting department at the end of the work shift. Form KM-7 indicates information for each cash register at the beginning of the work shift and at its end. The amount of revenue is certified by the signature of the head of each department.

The organization's total revenue is entered in a special field on the KM-7 form. The information specified in the document makes it possible to evaluate the efficiency of the enterprise. The distribution of funds among departments of the organization also occurs based on the daily reporting table. Indications from cash registers must be signed by the senior cashier, as well as the head of the organization.

As a sample of filling out KM-7, the completed form is presented below.

At the end of the table, the meter readings of all cash registers and the total revenue of the organization are summed up with its distribution by departments (sections). According to the acts, the total amount of money issued to buyers (clients) based on the cash receipts returned by them is indicated, by which the total revenue of the organization is reduced. The information is signed by the head and senior cashier of the organization.

Maria Machaikina, expert of the BSS "System Glavbukh".

Answer approved by Alexander Rodionov,

Deputy Head of the BSS Hotline "System Glavbukh".

Personal advice on accounting and taxes

The best answers from tax, accounting and legal experts. Answers from tax, accounting and legal experts.

The first line of the report should contain the name, address (legal or actual - it doesn’t matter, the main thing is that it is the same in all reports) and telephone number of the enterprise. If there is a separate division, then its name must also be indicated.

If the KM-6 form is filled out by an individual entrepreneur, then he must indicate all the necessary information in the same order. This is a common mistake - many individual entrepreneurs believe that they can deviate from the unified form, because they work for themselves. The document must indicate the name, registration number and number of the CCP manufacturer.

Important! If the proceeds are not handed over to the company’s chief cashier, but to the bank, then this must be noted in the report.

The completed document must be given to the chief cashier, if the company has one. The chief cashier passes the certificate report to the general director or accountant. If there is no such cashier, then the cashier-operator gives the document directly to the accountant or director. The certificate must be kept for 5 years.

Important! Individual entrepreneurs, as a rule, are triune. An individual entrepreneur is his own cashier-operator, accountant and manager. Therefore, he gives the document directly to the bank.

This question is ambiguous. On the one hand, no one is fined for the absence of a certificate-report. Many enterprises simply do not require it, and individual entrepreneurs most often do without it. But if the check reveals the absence of such certificates, then this will be considered an “aggravating circumstance.” The manager will have problems, and naturally he will blame the cashier-operator who did not fill out the KM-6 form.

https://www.youtube.com/watch?v=https:tv.youtube.com

Newbie cashiers sometimes make the ridiculous mistake of entering their own TIN instead of the company’s TIN. Of course this is wrong. The identification number must always belong to the company.

Columns 5 and 6 of the main table should not be confused. Column 5 contains the GROSS TOTAL of the X-report, and column 6 - the GROSS TOTAL of the Z-report. It can't be the other way around. This mistake is often made due to inattention.

Other errors are due to inattention when entering numerical values. For example, you can confuse the date or make a mistake when entering the amount. Such errors are unacceptable, so the cashier should check everything properly.

Important! If there are typos in the KM-6 form itself, then no one will punish the cashier for them. A fine can only be issued for errors in the information that the cashier-operator personally entered.

At the beginning of the working day, the cashier servicing the cash register enters into the KM-7 form data on the name of the organization, its address, tax identification number, telephone number. The KKM model is also indicated, for which information is filled out in the KM-7 form, not only the name of the model is written, but also the passport number, the number received when registering the KKT with the tax office.

The cashier responsible for conducting operations with this cash register and filling out information on the KM-7 form must write his full name and the exact wording of the position. This cashier is responsible for the information provided and for all transactions carried out in the cash register for the specified period. The duration and time of the work shift are also prescribed at the top of the KM-7 form. The document is assigned a number and the date of completion is written.

The table displays data on cash registers for a work shift; the following data should be entered into it:

- number of the fiscal report at the end of the working day;

- information about cash meter readings at the beginning and end of the work shift;

- daily revenue as the difference in meter readings;

- distribution of revenue by departments (if any);

- information about checks returned by customers, as well as incorrectly entered ones;

- signature of the senior cashier and the head of the organization.

Form KM-7. Information about KKM meter readings and the organization’s revenue. How to fill it out correctly

KKM7 is manufactured with a lifting capacity of up to 16.0 tons and a console reach of up to 12 meters in various designs. The jib crane is installed on a pre-prepared foundation with installed anchor bolts, or it is mounted on an existing concrete surface with a special system of chemical anchors. The angle of rotation of the console for this crane is 360°. At the customer's request, the crane can be equipped with various options and safety systems. As a lifting mechanism, it is possible to use manual or electric hoists of Bulgarian, German or Russian production.

| Boom rotation: | frequency drive |

| Operating mode according to GOST: | 2K |

| Execution: | OPI, PBI, VZI |

| Climatic performance: | U3 |

| Ambient temperature: | -40°С/ 40°С |

| Power circuit: | 380 V, 50 Hz |

| Control circuit: | 42 V |

| Console rotation angle, degrees: | 360 |